Professional Documents

Culture Documents

ch07 Lecture Notes 1

ch07 Lecture Notes 1

Uploaded by

micolleOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ch07 Lecture Notes 1

ch07 Lecture Notes 1

Uploaded by

micolleCopyright:

Available Formats

lOMoARcPSD|7156481

Ch07 - Lecture notes 1

Accountancy (De La Salle University – Dasmariñas)

Studocu is not sponsored or endorsed by any college or university

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

CHAPTER 7

PARTNERSHIP FORMATION, OPERATION,

AND CHANGE IN OWNERSHIP

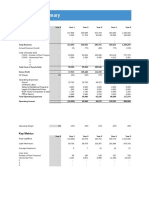

SUMMARY OF ITEMS BY TOPIC

Conceptual Computational

True- Multiple Multiple Short

False Choice Choice Problems Answer

Contrasting partnerships, 1-15 107-112 333-336

proprietorships, and

corporations

Equity theories applied to 16-21 113-115 337-338

partnerships

Articles of partnership 22-25 116-117

Initial capital 26-28 118-119 275-277 339-340

contributions

Carrying value assigned 29-30 120 169 275-276

noncash assets

Tax basis assigned 31-33 121 276

noncash assets

Market value assigned 34-36 122 277

noncash assets

Liabilities assumed by 37-40 123 170 278 341

partnership

Partnership formation, 41-47, 124-126 171-173 279-280 342-343

bonus method 49

Partnership formation, 41-44, 127-129 174-176 281-282 344-345

goodwill method 48-50

Drawing accounts 51-53 130-132 346

Sharing profits and losses 54-55 133 347

Interest on capital 56-59 134, 136 177-178, 185, 283-284, 348-349

balances portion of profit 187 288-289

and loss allocation

Salary portion of profit 60-62 135, 137 185-186 288-289 350

and loss allocation

Bonus portion of profit 63-65 138-139 179-181, 185 285-286, 351

and loss allocation 288-289

Residual ratio portion of 66-71 140-142 182-187 287-289 352-353

profit and loss allocation

Unrealized holding gains 72-74 143-144 188-205 290-295, 354-355

and losses 297

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

Changes in ownership 75-77 145 356

Admission of new partner 78-80 146-148 206-207 296-297 357-358

- no change in net assets

Admission of new partner 81-83 149-150 208-209 298-299, 359-361

- change in net assets - 302, 305,

revaluation of existing 308

assets

Admission of new partner 84-86 151-153 210-219 300-302 362-363

- bonus to existing

partners

Admission of new partner 87-89 154-155 220-230 303-305 364-365

- bonus to new partner

Admission of new partner 90-92 153, 156- 231-240 306-308 366-368

- goodwill to existing 157

partners

Admission of new partner 90, 93- 158-159 241-249 309-311 368-369

- goodwill to new partner 94

Withdrawal of partner - 95-100 160-162 250-253 312-317

revaluation of existing

assets

Withdrawal of partner - 95-97, 163-165 254-261 318-320 370-371

bonus method 101-103

Withdrawal of partner - 95-97, 166-168 262-274 321-332

goodwill method 104-106

True-False Statements

1. A partnership is an association of two or more investors to carry on as co-owners a

business for profit.

2. Only individuals are allowed to be partners in a partnership.

3. Proprietorships and partnerships are similar in that they are both easily formed.

4. Proprietorships and partnerships are different in that proprietors have unlimited legal

liability while each partner’s legal liability is limited to his/her percentage ownership in

the partnership.

5. A partner’s personal assets may be taken by creditors to pay partnership debts if the

partnership is unable to meet its obligations.

6. Partnerships are not required to prepare financial statements in accordance with

Generally Accepted Accounting Principles unless they have publicly traded debt or are

required to follow GAAP by a creditor.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

7. For a partnership to get an unqualified audit opinion, the financial records must conform

to Generally Accepted Accounting Principles.

8. Most small partnerships maintain their financial information in accordance with

Generally Accepted Accounting Principles.

9. Tax authorities basically view partnerships and proprietorships as extensions of their

owners.

10. Partnerships are not required to pay any taxes.

11. The taxable income of all partners does not necessarily sum to the net income of the

partnership.

12. The only accounting difference that must exist between partnerships and corporations is

the reporting of the ownership equity.

13. The manner in which a partnership and a corporation are formed is very similar.

14. It is generally easier to transfer ownership interest in a corporate form of business than in

a partnership.

15. A partnership legally ceases to exist each time a new partner joins the partnership or an

existing partner leaves the partnership

16. The proprietary theory of equity is based on the notion that a business entity is distinct

from the owners.

17. The entity theory of equity is based on the notion that a business entity is distinct from

the owners.

18. An individual partner’s personal responsibility for partnership debts is an example of the

entity theory of equity.

19. The dissolution of a partnership because of the admission of a new partner or withdrawal

of an existing partner is an example of the proprietary theory of equity.

20. The fact that partnerships can enter into contracts is an example of the proprietary theory

of equity.

21. Contributed assets becoming property of the partnership is an example of the entity

theory of equity.

22. The Uniform Partnership Act is the basis for partnership laws in many states.

23. A written agreement is required to form a partnership.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

24. When a partnership is formed without a written agreement, the state laws where the

partnership is formed will establish the legal relationship between partners.

25. All provisions of state partnership law must be applied when a partnership is formed.

26. Partners make contributions of equal size when forming a partnership

27. There are different ways the partnership can value noncash assets contributed to the

partnership.

28. Appraisals are not necessarily required when assigning value to noncash assets

contributed to the partnership.

29. Assigning a noncash asset the contributor’s carrying value could result in a misallocation

of gain or loss if the asset is sold.

30. An asset’s carrying value should not be considered when establishing the initial capital

accounts of partners.

31. The tax basis of contributed noncash assets must be used to determine partnership

income allocation for tax reporting purposes.

32. Partnerships are required to file an informational return (Form 1065) with the IRS

indicating the amount of partnership income allocated to each partner.

33. The income assigned to each partner for financial accounting purposes will equal the

partner’s partnership income included on the partner’s individual income tax return.

34. The market value of noncash assets contributed to the partnership may be used for

computing the partners’ taxable income.

35. A contributing partner’s capital account may be assigned the market value of noncash

assets contributed but a market value assignment is not required.

36. The market value of noncash assets contributed to a partnership is the only relevant value

when determining the partners’ beginning capital balances.

37. The assumption of a liability by the partnership with regard to a noncash asset

contributed to the partnership by a partner will affect the value assigned to the partner’s

capital account.

38. The tax basis of a noncash asset contributed to a partnership with an accompanying

liability will not change as a result of the contribution.

39. When a noncash asset is contributed to a partnership with an accompanying liability, the

book value of the asset must become the cost basis of the asset on the partnership’s

financial records.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

40. The assumption of a liability related to a noncash asset contributed to a partnership

reduces the value contributed.

41. Initial partner capital balances must equal the sum of the net assets contributed to the

partnership by the partner.

42. Initial partner capital balances are determined by agreement among the partners.

43. Only tangible assets contributed to the partnership can be considered when creating

initial capital balances.

44. There are two ways to consider unidentifiable intangible assets contributed to a

partnership: the bonus method and the goodwill method.

45. The bonus method of recognizing unidentifiable intangible assets contributed at a

partnership’s formation does not result in a net increase in total owners’ equity.

46. The bonus method of recognizing unidentifiable intangible assets contributed at a

partnership’s formation has to make the capital account balances for all partners equal.

47. The bonus method of recognizing unidentifiable intangible assets contributed at a

partnership’s formation will result in all of the partner’s capital accounts increasing.

48. Application of the goodwill method when forming a partnership requires partners to

agree on the amount of goodwill to be assigned to a partner(s).

49. At the date the partnership is formed, the total partner capital will be the same regardless

of whether the bonus method or the goodwill method is used to recognize unidentifiable

intangible assets.

50. Goodwill can be assigned to more than one partner at the date the partnership is formed.

51. The ability of partners to withdraw resources from the partnership is controlled

exclusively by the laws of the state where the partnership resides.

52. The articles of partnership often control the size of withdrawals partners are allowed to

make.

53. If a partnership makes a payment on behalf of a partner, a withdrawal has occurred.

54. Partnerships are required to indicate the manner in which profits and losses are to be

allocated among the partners.

55. With the exception of the residual profit and loss ratio, partners can agree to apply profit

and loss allocation components in any order.

56. The interest component of partnership profit and loss allocation rewards the partner for

labor and expertise brought into the partnership.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

57. The purpose of the interest on capital balances component of partnership profit and loss

allocation is to reward partners for contributing economic resources to the partnership.

58. The interest on capital balances component of partnership profit and loss allocation is

always based on each partner’s beginning or period capital balance.

59. The interest on capital balances component of partnership profit and loss allocation is

generally stated as a percentage of the capital balance.

60. The salary portion of the profit and loss allocation is set in the articles of partnership and

will not change over time.

61. The salary portion of the partnership profit and loss allocation is not included in the

partnership’s income statement.

62. The salary portion of the partnership profit and loss allocation is used to compensate

partners for the time and effort expected in the business.

63. Partnerships are required to have bonus clauses in the articles of partnership.

64. Bonus to partners can be based on any criteria on which the partners agree.

65. Partnership bonus arrangements must consider net income as part of the bonus

calculation.

66. A residual interest is always a component of partnership profit and loss allocation.

67. Partnership profit and loss residual percentages must be equal.

68. Partnership profit and loss residual percentages must be the same for profits as they are

for losses.

69. Partnership profit and loss residual percentages are used to allocate any remaining profit

or loss to partners after all other allocation components have been considered.

70. Partnership residual profit and loss percentages may be changed by agreement of the

partners.

71. Partnership residual profit and loss percentages do not have to be the last component

applied in the profit and loss allocation process.

72. When partnership profit and loss ratios are changed, the difference between market and

book values should be determined and allocated to partners based on the currently

existing profit and loss ratios.

73. Partnerships must revalue assets up and/or down when the profit and loss ratios are

adjusted.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

74. When an error is discovered in the financial records of a partnership, it should be

corrected immediately. Allocation of any change to capital accounts as a result of an

error correction should be based on the profit and loss ratios that existed when the error

occurred.

75. The dissolution of a partnership occurs only when the partnership is terminating

operations and going out of business.

76. One reason a change in the number of partners in a partnership through the addition or

withdrawal of a partner is important because the partners have unlimited liability.

77. A new partner in a partnership accepts unlimited liability for actions that occurred before

that partner joined the partnership.

78. The admission of a new partner into a partnership can occur without any new assets

being invested into the partnership.

79. If a new partner is going to acquire an ownership interest in a partnership directly from

another partner, the other partners do not need to approve the admission.

80. If a new partner acquires 40 percent of an existing partner’s equity in the partnership, the

new partner is also entitled to 40 percent of the existing partner’s profit and loss

allocation.

81. When a new partner is joining a partnership by making a payment to the partnership for

an amount more than book value, the partners are required to choose one of three

methods of recording the new partner’s payment in excess of book value.

82. The revaluation of assets and liabilities at the date a new partner joins the partnership, by

investing assets directly into the partnership, does not eliminate the possibility that the

partnership might need to record bonuses or goodwill as part of the admission of the new

partner.

83. The amount that assets are revalued when a new partner joins a partnership is always

shared by existing partners equally.

84. If a new partner’s capital account is created for an amount less than the value of net

assets contributed, an error has been made in the partnership’s accounting records.

85. The recognition of a bonus to existing partners at the date a new partner is admitted to a

partnership often occurs in lieu of the recognition of goodwill for the existing partners.

86. The bonus recognized by existing partners when a new partner is admitted to a

partnership is commonly shared among the existing partners based on the existing

partners’ relative profit and loss residual ratios.

87. It is possible for a new partner’s capital account to be established at an amount greater

than the market value of the identifiable assets invested.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

88. New partners are never recipients of bonuses when they join the partnership.

89. A bonus paid to a new partner results in a reduction to the capital accounts of the existing

partners in proportion to their profit and loss sharing ratios.

90. The goodwill method of admitting a new partner to a partnership results in greater total

assets than the bonus method of admitting a new partner.

91. When the goodwill method is applied to recognize the admission of a new partner and

the existing partners are responsible for the goodwill, the new partner’s capital account

will always be established equal to the amount of the contribution to the partnership.

92. The existing partners will always recognize goodwill when a new partner is admitted to

the company and the goodwill method is applied.

93. When the goodwill method is applied to recognize the admission of a new partner and

the new partner is responsible for the goodwill, the new partner’s capital account will be

established at the amount of the contribution.

94. When new partner goodwill is recognized at the date the partner joins the partnership, the

existing partners’ capital accounts do not change as a result of the new partner’s

admission

95. A partner may withdraw from a partnership at any time without notice given to the

existing partners.

96. A withdrawing partner may have his/her partnership interest acquired by an outside

investor agreed to by the remaining partners, the remaining partners, or the partnership.

97. If existing partners acquire a withdrawing partner’s equity, the existing partners must

purchase the withdrawing partner’s equity in proportion to their residual profit and loss

ratios.

98. The revaluation of assets when a partner withdraws from the partnership may be a

complete revaluation or a partial revaluation, reflecting the change in value with regard

to the withdrawing partner’s ownership interest.

99. A partnership’s assets must be revalued when a partner withdraws.

100. When a partnership’s assets are revalued at the date a partner withdraws from the

partnership, the withdrawing partner’s equity must be acquired by the partnership. It

cannot be acquired by an outside investor or the existing partners personally.

101. Withdrawing partners from a partnership may receive a bonus or pay a bonus to

remaining partners.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

102. If the assets of a partnership are revalued at the date of a partner’s withdrawal, there can

be no bonus recorded.

103. A bonus can be recorded for a retiring partner only if the partnership acquires the equity

of the partner.

104. At the date a partner withdraws from a partnership, the partners must choose to either

recognize the goodwill with respect to the withdrawing partner or they can choose to

recognize all of the partnership’s goodwill.

105. Any goodwill recognized at the date a partner withdraws from a partnership is usually

allocated to partners based on their residual profit and loss ratios.

106. Partnerships may have both a revaluation of assets and liabilities as well as goodwill

recognition at the date a partner withdraws from a partnership.

True-False Statement Solutions

1. T

2. F, Individuals, partnerships, and corporations are allowed to be partners in a partnership.

3. T

4. F, All of the general partners are liable for all the partnership’s debts.

5. T

6. T

7. F, Partnerships may receive an unqualified audit opinion when using a comprehensive

basis of accounting other that accrual such as cash, modified accrual, or the tax basis.

8. F, Most small partnerships maintain their financial information using the tax basis.

9. T

10. F, While the partnership does not pay income taxes, it is responsible for other taxes such

as payroll taxes and franchise taxes.

11. T

12. T

13. F, Partnerships and corporations are formed by two are more parties. A written

agreement is not necessary and state approval is not required for a partnership but a

corporation must file articles of incorporation with the state to attain a corporate charter.

14. T

15. T

16. F, The proprietary theory is based on the notion that the business entity is an aggregation

of the owners

17. T

18. F, This is an example of the proprietary theory of equity.

19. T

20. F, This is an example of the entity theory of equity.

21. T

22. T

23. F, While a written agreement is generally recommended when forming a partnership, it is

not required.

24. T

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

25. F, Most provisions only apply if there is no agreement among the partners with regard to

that specific issue.

26. F, Initial capital contributions are determined by agreement among the partners and do

not have to be equal in size.

27. T

28. T

29. T

30. F, Any basis (i.e., carrying value, tax basis, or market value) can be used to value

noncash assets contributed to a partnership

31. T

32. T

33. F, There are numerous differences that can cause the income assigned to partners for

accounting purposes to differ from income assigned to partners for tax purposes such as

noncash assets contributed to the partnership valued at an amount different than the

contributing partner’s tax basis

34. F, The tax basis of noncash assets contributed to the partnership must be used to

determine taxable income.

35. T

36. F, Partners should agree on the method to be used to value noncash asset contributions

when preparing the articles of partnership. A variety of bases can be used and the market

value is one of the alternatives.

37. T

38. F, The amount of the liability assumed by the partnership, excluding the contributing

partners share of that liability, will reduce the tax basis of the asset contributed.

39. F, The assumption of a liability has no impact on the valuation approach by the

partnership.

40. T

41. F, The capital balances established can be any amounts agreed by the partners.

42. T

43. F, Partners may contribute tangible and intangible assets to the partnership. It is possible

to consider both when determining initial partnership capital account balances.

44. T

45. T

46. F, The bonus method reallocates the total partnership capital among the partners’ capital

based on the agreed value of unidentifiable intangible assets contributed. Capital

accounts do not have to be the same when the process is completed.

47. F, The bonus method reallocates the total partnership capital among the partners based on

the agreed value of unidentifiable intangible assets contributed. It will always result in

one or more partner’s capital accounts decreasing while the remaining partner(s) capital

accounts increase.

48. T

49. F, The goodwill method requires an additional asset (Goodwill) to be recognized on the

balance sheet. As a result, the partners’ capital accounts will be greater in aggregate.

The bonus method results in a reallocation of capital among the partners and does not

result in a change in total partnership capital.

50. T

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

51. F, While states may have laws indicating that the partners cannot withdraw resources and

make the partnership insolvent, withdrawals are typically controlled by the articles of

partnership.

52. T,

53. T

54. F, If the partnership agreement is silent with regard to profit and loss allocation, profits

and losses are shared equally.

55. T

56. F, The interest component of partnership profit and loss allocation rewards partners for

capital contributions.

57. T

58. F, The interest on capital balances component of partnership profit and loss allocation

may be based on the beginning, ending, simple average capital balance, or weighted

average capital balance.

59. T

60. F, The salary component of the partnership profit and loss allocation would be expected

to be renegotiated periodically as the duties of the partners change.

61. T

62. T

63. F, Partnerships can offer bonuses to anyone. The choice is up to the partners. On the

other hand, there is no requirement to ever offer a bonus.

64. T

65. F, While many bonuses are based on a measure of income, it is not required. Bonus can

be based on other criteria such as market share, revenue, or average cost per unit.

66. T

67. F, Residual interests may be equal but they are not required to be equal.

68. F, While profit residual ratios and loss residual ratios are generally the same, they can

differ.

69. T

70. T

71. F, Residual profit and loss percentages are the last component of the profit and loss

allocation process applied because they are designed to allocate any remaining amount to

the partners.

72. T

73. F, There are several ways that the difference between market and book value of assets

can be addressed when the profit and loss ratios are changed. Revaluing the assets is one

of the possibilities along with maintaining a record of assets with market and book value

differences as well as directly adjusting capital accounts while leaving asset values

unchanged.

74. T

75. F, A dissolution occurs every time there is a change in relationship among the partners.

This can occur when a new partner enters the partnership or an existing partner leaves the

partnership. A dissolution occurs when the partnership is going out of business but the

termination of business is not a requirement for a dissolution.

76. T

77. F, A new partner's liability for actions that occurred before joining the partnership is

limited to the amount invested in the partnership.

78. T

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

79. F, Regardless how a new partner enters a partnership, the other partners have to approve

the admission because they must accept unlimited liability due to actions of the new

partner taken on behalf of the partnership.

80. F, There is no necessary relationship between the percentage of equity acquired and the

amount of profit or loss received. These are separate contractual issues.

81. F, There are three methods that may be used when a new partner is paying an amount

more than book value for the investment: revaluation of existing assets, bonus method,

and goodwill method. The partners do not have to choose one method. It would not be

inconsistent to revalue the assets and apply either the bonus or the goodwill method to

record the investment.

82. T

83. F, Existing partners share the difference between market value and book value equally if

that is the manner in which profits and losses are shared. If profits and losses are shared

in some other manner, then the difference between market and book values are shared in

that manner.

84. F, While it is possible that an error has been made, it is more likely that the existing

partners recognized an increase in their capital accounts via a bonus. The difference

between the amount credited to the new partner’s capital account and the amount

invested is shared by the existing partners.

85. T

86. T

87. T

88. F, New partners may receive a bonus if they bring value to the partnership in excess of

the tangible assets invested. This additional amount may be from such things as

expertise, experience, or business contacts. The bonus allocated to the new partner is

payment for these types of unidentifiable assets contributed to the partnership.

89. T

90. T

91. T

92. F, Goodwill may be recognized with regard to the existing partners but it may also be

recognized with regard to the new partner.

93. F, When goodwill is recognized with regard to the new partner, the new partner’s capital

account will be greater than the amount invested by the recognized goodwill.

94. T

95. F, The articles of partnership may include an agreement on the length of advanced notice

a partner must give before withdrawing from a partnership. Failure to provide the agreed

notice may result in the withdrawing partner being liable for damages suffered by the

partnership.

96. T

97. F, If existing partners acquire a withdrawing partner’s equity, they can divide the

purchase of that equity among themselves in any manner they choose.

98. T

99. F, Partnership assets may be revalued but they may also remain at their carrying value.

100. F, The revaluation of the partnership’s assets is unrelated to the purchase of the

withdrawing partners ownership interest in the partnership.

101. T

102. F, The revaluation of partnership assets at the time of a partner’s withdrawal has no

impact on the recognition of a bonus or goodwill.

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

103. T

104. F, While the partners can recognize either the withdrawing partner’s goodwill or the

entire partnership’s goodwill, there is no requirement to recognize any goodwill when a

partner withdraws from a partnership.

105. T

106. T

Conceptual Multiple Choice Questions

107. Which of the following is not a reason for forming a partnership?

a. Combine economic resources

b. Share managerial talent

c. Avoid complicated tax laws

d. Undertake a specific business objective

108. Which of the following business entity forms is (are) required to maintain their financial

information in accordance with Generally Accepted Accounting Principles?

a. Corporations

b. Corporation and Partnership

c. Partnership and Proprietorships

d. Corporation, Partnerships, and Proprietorships

109. Which of the following statements is not true with regard to tax issues of partnerships?

a. Partnerships are viewed as an extension of the owners

b. Partnerships are required to pay some forms of taxes

c. The IRS must be informed as to the manner partnership income is allocated to the

partners

d. All of the above are true

110. Which of the following is not a similarity that exists between proprietorships and

partnerships?

a. Neither requires approval by a state to form

b. Both can use an accounting method that does not conform to GAAP

c. Owners put the company’s income on the owner’s individual tax return

d. All of the above are similarities of proprietorships and partnerships

111. Which of the following is not an area where there are differences when comparing

partnerships and corporations?

a. The ease of formation

b. The level of owner legal liability

c. The ease of ownership transferability

d. All of the above are areas where partnerships and corporations differ

112. Which of the following is not a difference when comparing partnerships and

corporations?

a. Corporations must conform to GAAP whereas partnerships are not required to

conform to GAAP

b. Partnerships and corporations neither are required to attain state approval to form

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

c. Partners have unlimited liability while corporation shareholders generally do not

have unlimited liability

d. Corporations are required to pay income tax while partnerships are not required to

pay income taxes

113. What theory of equity is applicable for partnerships?

a. Proprietary theory

b. Entity theory

c. A mix of proprietary and entity theory

d. Partnership theory

114. Which of the following is not an example of the proprietary theory of equity?

a. Partners do not have claims to specific assets

b. Individual partners are liable for all debts of the partnership

c. A partner’s income tax includes the partner’s share of partnership net income, and

the partnership does not pay income taxes

d. Salaries of partners are viewed as distributions of income, not components of net

income

115. Which of the following is not an example of the entity theory of equity?

a. Continuity of the partnership when admission or withdrawal of partners occurs

b. A partnership can enter into contracts

c. Assets contributed to the partnership retain the existing tax basis to the partner

contributing

d Partnership creditors have priority claim to partnership assets and the creditors of

partners have priority claim to the partner’s assets in the event of liquidation

116. Which of the following statements is not true with regard to articles of partnership?

a. Written articles of partnership are not required to form a partnership

b. The Uniform Partnership Act provides a list of items that must be included in

articles of partnership

c. A written partnership agreement enables the partners to detail the agreed working

relationship among the partners

d. State law applies only if there is not agreement among the partners with regard to

that specific issue

117. When a partnership agreement is silent with regard to any aspect of a partnership

operation, who/what decides on that aspect of the partnership’s operations?

a. State law

b. Uniform Partnership Act

c. Majority vote of stockholders

d. Decision by senior partner

118. Which of the following valuation amounts is not allowed when assigning values to

noncash assets in a partnership formation?

a. Contributor’s carrying value

b. Contributor’s tax basis

c. Market (appraised) value

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

d. All of the above valuation amounts are allowed

119. Which of the following statements is correct with regard to the creation of initial capital

account balances on a partnership’s financial records?

a. The capital accounts can be created for any dollar amount agreed by all partners

b. The market value of noncash assets must be considered when creating the initial

capital balances

c. Each partner’s capital account must have a non-zero value assigned to it

d. All of the above statements are correct

120. Which of the following statements is not true with regard to assigning the carrying value

of noncash assets contributed to those assets at the date of a partnership’s formation?

a. Use of the noncash asset’s historical cost can result in the misstatement of the

partners’ capital accounts

b. Assigning the historical cost to noncash assets contributed to a partnership may

require the partnership agreement to address profit/loss distribution that will

occur when the contributed asset is sold

c. Assigning the historical cost to noncash assets contributed to a partnership will

not cause partner taxable income to differ from the partner’s share of partnership

income

d. All of the above statements are correct

121. Which of the following statements is true with regard to assigning a noncash asset

contributed to a partnership the tax basis of the contributing partner?

a. The tax basis of noncash assets contributed must be used if the partnership is a

taxable entity

b. The tax basis must be considered when determine each partner’s allocation of

taxable partnership income

c. The contributing partner’s tax basis may not be used for financial accounting

records

d. None of the above statements are true

122. Which of the following statements is not true with regard to assigning the market value

of noncash assets contributed to those assets at the date of a partnership’s formation?

a. Gains or losses would likely not be recorded if the asset were sold at the date for

partnership is formed

b. The contributing partner’s share of the partnership’s income would be adjusted by

the difference between the market value and tax basis at the date the asset is

contributed to the partnership

c. The market value is the most commonly assigned value to contributed noncash

assets

d. All of the above statements are correct

123. Which of the following statements is correct with regard to the contribution of assets and

associated liabilities to a partnership?

a. Liabilities associated with assets contributed to a partnership remain the liability

of the contributing partner

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

b. Liabilities associated with assets contributed to a partnership become the liability

of the partnership

c. Liabilities associated with assets contributed to a partnership become the liability

of both the contributing partner and the partnership

d. Assets may not be contributed to a partnership if there is a liability associated

with the asset

124. The bonus method of recognizing unidentifiable intangible asset contributions to a

partnership does which of the following?

a. It recognizes that partners may contribute more than the observable assets to the

partnership

b. It increases total partnership capital

c. Can only increase partner capital accounts

d. b and c are correct

125. This method of recognizing unidentifiable intangible assets does not result in a change to

total contributed capital.

a. Goodwill method

b. Bonus method

c. Reciprocal method

d. None of these methods will result in a change to total contributed capital

126. When can the bonus method be applied?

a. When a partnership is formed

b. When a new partner is added to the partnership

c. When an existing partner retires from the partnership

d. The bonus method can be applied in all three of the above circumstances

127. Shawn, Harris, and Derek are forming a partnership. The partners agree that Harris

should be assigned goodwill because of his knowledge of the business. Which partners’

capital accounts will have the dollar assigned dollar amounts altered due to the

recognition of the goodwill?

a. Shawn

b. Harris

c. Derek

d. All dollar amount assigned to all three partners’ capital accounts will be altered.

128. This method of recognizing unidentifiable intangible assets results in a change to total

contributed capital.

a. Goodwill method

b. Bonus method

c. Reciprocal method

d. None of these methods will result in a change to total contributed capital

129. The goodwill method always results in which of the following?

a. A change in the dollar value assigned to two or more partners’ capital accounts

b. A decrease in a partner’s capital account

c. An increase in a partner’s capital account

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

d. An increase in a partner’s capital account and a decrease in at least one partners’

capital account

130. For what purpose(s) might a drawing account be used for a partnership?

a. To keep a list of business contacts made by a partner

b. To recognize a loan made to a partner

c. To recognize inventory removed from the partnership by the partner

d. None of the above ore possible uses of a drawing account

131. Which of the following is not a withdrawal that may be found in a partnership’s drawing

account?

a. Removal of cash by a partner

b. Payment of a partner’s speeding ticket by the partnership

c. Removal of inventory by a partner

d. All of the above may be found in a drawing account

132. Which of the following statements is correct with regard to drawing accounts that may be

used by a partnership?

a. Drawing accounts are closed to the partners’ capital accounts at the end of the

accounting period

b. Drawing accounts establish the amount that may be taken from the partnership by

a partner in a given time period

c. Drawing accounts are similar to Retained Earnings in a corporation

d. Drawing accounts appear on the balance sheet as a contra-equity account

133. Which of the following should not be done by the accountant with regard to partnership

profit and loss allocation?

a. Prepare an analysis of alternative methods to allocate profits and losses

b. Recommend a particular method for allocating profits and losses

c. Inform partners of different ways that profits and losses could be allocated

d. All of the above are reasonable duties of the accountant

134. What is the underlying purpose of the interest on capital balances component of

allocating partnership profits and losses?

a. Compensate partners who contribute economic resources to the partnership

b. Reward labor and expertise contributions

c. Reward for special responsibilities undertaken

d. None of the above

135. What is the underlying purpose of the salary component of allocating partnership profits

and losses?

a. Compensate partners who contribute economic resources to the partnership

b. Reward labor and expertise contributions

c. Reward for special responsibilities undertaken

d. None of the above

136. Which of the following interest component calculation bases is least susceptible to

manipulation when allocating profits and losses to partners?

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

a. Beginning capital account balance

b. Average of beginning and ending capital account balances

c. Weighted average capital account balance

d. Ending capital account balance

137. Which component of the partnership profit and loss allocation compensates partners for

the routine time and effort expended in the business?

a. Interest on capital balance

b. Bonus

c. Salary

d. Residual interest

138. Which component of the partnership profit and loss allocation is most commonly offered

to the partner who manages the business?

a. Interest on capital balance

b. Bonus

c. Salary

d. Residual interest

139. Which of the following may be a basis for determining the amount of a partner’s bonus?

a. Operating income

b. Market share

c. Average cost per unit

d. All of the three may be bases for determining the amount of a partner’s bonus

140. Which component of the partnership profit and loss allocation must be performed last?

a. Interest on capital balance

b. Bonus

c. Salary

d. Residual interest

141. Which of the following statements is true with regard to partnership residual profit and

loss ratios?

a. A partner’s residual profit ratio must be the same as the loss ratio

b. Residual profit and loss ratios can be changed by agreement

c. The residual profit and loss ratio must always be applied

d. All of the above are true statements

142. Applying the partnership residual profit and loss ratio can have which of the following

effects on a partner’s allocation of profit and/or loss?

a. Increase

b. Decrease

c. Increase or decrease

d. The residual profit and loss ratio is not used for the allocation or profit and/or loss

143. Which of the following should be done when the partnership profit and loss ratios are

changed?

a. The book and market value of assets and liabilities should be evaluated

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

b. The capital accounts should be modified to reflect the new profit and loss ratios

c. The creditors should be informed that the profit and loss ratios have been changed

d. The partners must draft new articles of partnership.

144. Which of the following is not a common way to address the difference between market

and book values of assets and liabilities when the partnership profit and loss ratios are

changed?

a. Assets and liabilities are revalued to market value

b. Assets with a difference between market and book value are sold and the profit is

distributed to partners based on existing profit and loss ratios

c. A list of differences between market value and book value are made

d. Capital accounts of the partners are altered to reflect the difference between

market and book values at the date the profit and loss ratios change

145. Which of the following occurs every time a new partner is admitted to a partnership or an

existing partner leaves the partnership?

a. Dissolution

b. Termination

c. Dissolution and termination

d. None of the above occurs

146. Which of the following forms of new partner admission will not result in a change in the

partnership’s net assets?

a. Purchase of an ownership interest directly from the partnership

b. Purchase of an ownership interest directly from an existing partner

c. Either of the above

d. Neither of the above

147. Which of the following must occur for a new partner to enter the partnership by

acquiring an ownership interest directly from an existing partner?

a. Existing partners must know the amount the new partner is paying for the

ownership interest

b. The new partner must acquire all of the current partner’s ownership interest

c. Existing partners must approve the admission of the new partner into the

partnership

d. The new partner must live in the same state as the other partners

148. Which of the following must be true when a new partner acquires an ownership interest

directly from an existing partner?

a. Capital must be assigned to the new partner

b. The new partner’s profit and loss allocation must be proportionate to the capital

account balance

c. The new partner must be allocated some amount of profit and loss

d. The existing partners must provide a list of all the partnership’s outstanding

liabilities to the new partner

149. When a new partner joins a partnership by investing assets into the partnership, what

method may be used to record the admission of the new partner?

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

a. Revaluation of existing assets

b. Recognition of goodwill

c. Application of the bonus method

d. Any of the three or a combination may be applied

150. Which of the following is a reason to not revalue partnership assets at the date a new

partner is admitted to the partnership?

a. There has been a change in ownership

b. A new legal entity exists

c. The partnership has not ceased operations

d. All three are reasons to not revalue partnership assets at the date of a new

partner’s admission

151. A bonus is recognized by existing partners at the date a new partner joins a partnership

when which of the following relationships occur?

a. The new partner’s contribution exceeds his/her percentage of total partnership

capital after the investment is made

b. The new partner’s contribution is less than his/her percentage of total partnership

capital after the investment is made

c. The new partner’s contribution is equal to his/her percentage of total partnership

capital after the investment is made

d. It is not possible to determine the answer to this question

152. Which of the following is not a criterion for recognizing a bonus to existing partners

when a new partner joins the partnership?

a. Only cash assets were contributed to the partnership by the new partner

b. The existing partners desire to not recognize goodwill on the balance sheet

c. The articles of partnership indicate that the bonus method will be used to admit

new partners

d. The new partner invests more into the partnership that his/her share of total

partnership capital after the investment is made

153. Which method of recording the admission of a new partner into a partnership potentially

results in the existing partners’ capital accounts changing in value?

a. Bonus method

b. Goodwill method

c. Either bonus method or goodwill method

d. Existing partners’ capital accounts never change when a new partner is admitted

into a partnership.

154. A bonus recognized by a new partner at the date of admission into the partnership is

generally shared by the existing partners in what way?

a. Equally

b. In proportion to capital account balances

c. In proportion to profit and loss residual ratios

d. In proportion to salaries

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

155. Which of the following is not a criterion for recognizing a bonus to a new partner when

the new partner joins the partnership?

a. Only cash assets were contributed to the partnership by the new partner

b. The existing partners desire to not recognize goodwill on the balance sheet

c. The articles of partnership indicate that the bonus method will be used to admit

new partners

d. The new partner invests less into the partnership that his/her share of total

partnership capital after the investment is made

156. When the goodwill method of recognizing the admission of a new partner is applied and

the existing partners contribute the goodwill, which of the following will result?

a. An increase in the capital accounts of existing partners

b. A decrease in the amount invested by the new partner

c. A decrease in the partnership’s total assets

d. A new partner’s capital account less than the amount invested

157. Which of the following will occur when the existing partners contribute goodwill and a

new partner is admitted to the partnership?

a. The existing partner’s capital accounts will be decreased

b. The existing partner will receive cash from the partnership

c. The partnership’s total assets will be increased

d. The new partner will be required to reduce his/her profit and loss sharing ratio

158. Which of the following statements is false with regard to the goodwill recognized for a

new partner entering a partnership?

a. The new partner’s capital account balance will exceed the amount invested

b. The existing partners’ capital accounts will remain unchanged

c. The amount invested by the new partner will be less than his/her proportion of the

partnership’s book value before goodwill is recognized

d. The three partners will have equal capital account balances when the transaction

is completed

159. Which of the following statements presents a reason that goodwill may be recorded with

regard to a new partner at the date of that partner’s admission to the partnership?

a. The existing partnership is worth more than the appraised value of the tangible

net assets

b. The new partner has a strong desire to become a member of the partnership

c. The total value of the new partner’s contribution to the partnership is greater than

the value of the identifiable net assets contributed

d. The new partner’s residual interest in profits and losses is greater than 30 percent

160. What portion of the partnership’s assets must be revalued when a partner withdraws from

the partnership?

a. The withdrawing partner’s share must be revalued

b. All of the partnership’s assets must be revalued

c. Any or all of the partnership’s assets may be revalued but none have to be

revalued

d. Partnership assets may not be revalued when a partner withdraws

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

161. Who may acquire the ownership interest of a partner who is withdrawing from a

partnership?

a. Existing partners

b. New investor

c. The partnership

d. All of the above

162. If existing partners acquire the equity of a withdrawing partner, in what manner do they

divide the equity?

a. In any manner they choose

b. Equally

c. Proportionate to their residual profit and loss ratios

d. Existing partners are not permitted to acquire the equity of a withdrawing partner

163. Which of the following must exist to create the potential for a retiring partner to have a

bonus recognized at the date of withdrawal?

a. The retiring partner must be paid more than the book value of his equity

b. The existing partners must decide to not admit a new partner to the partnership

c. The retiring partner’s equity must be acquired by the partnership

d. All of the above are necessary for a bonus to be recognized

164. In what manner do the remaining partners share in the bonus paid to a withdrawing

partner?

a. In proportion to their residual profit and loss ratios

b. Equally

c. In proportion to their capital account balances

d. The partner with the greatest capital account is assigned the bonus

165. Which of the following statements is true with regard to a withdrawing partner?

a. A bonus must be paid to the retiring partner

b. A bonus may be paid to the retiring partner

c. A bonus must be paid to the retiring partner or to the remaining partners

d. Recognizing a bonus is not appropriate when a partner retires

166. What change occurs to continuing partners’ capital accounts when a withdrawing partner

is assigned goodwill at the date of withdrawal?

a. Continuing partners’ capital accounts decease by their profit and loss ratio

proportion of the goodwill assigned to the withdrawing partner

b. Continuing partners’ capital accounts increase

c. Continuing partners’ capital accounts do not change

d. Goodwill cannot be recognized with regard to withdrawing partners

167. What amount of goodwill can be recognized at the date a partner withdraws from a

partnership?

a. The withdrawing partner’s portion of goodwill

b. The continuing partners’ portion of goodwill

c. Goodwill may not be recognized at the date a partner withdraws

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

d. Either the withdrawing partner’s portion of goodwill or the goodwill attributable

to the entire partnership

168. Which of the following will occur when the goodwill method is used to recognize the

withdrawal of a partner?

a. The partnership must acquire the equity of the withdrawing partner

b. The withdrawing partner will be paid the book value of his/her equity after the

goodwill is recognized

c. The existing partners will divide the salary of the withdrawing partner

d. The total equity of the partnership will not change as a result of the partner’s

withdrawal

Conceptual Multiple Choice Question Difficulty and Solutions

107. easy c

108. moderate a

109. moderate d

110. easy d

111. easy d

112. moderate b

113. moderate c

114. difficult a

115. difficult c

116. moderate b

117. moderate a

118. easy d

119. moderate a

120. difficult c

121. moderate b

122. moderate d

123. easy b

124. easy a

125. easy b

126. moderate d

127. easy b

128. easy a

129. moderate c

130. easy c

131. moderate d

132. moderate a

133. easy b

134. easy a

135. easy b

136. easy c

137. easy c

138. easy b

139. moderate d

140. easy d

141. moderate b

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

142. easy c

143. moderate a

144. easy b

145. easy a

146. easy b

147. easy c

148. moderate c

149. easy d

150. moderate c

151. moderate b

152. easy a

153. easy c

154. easy c

155. easy a

156. moderate a

157. easy c

158. easy d

159. moderate c

160. easy c

161. easy d

162. moderate a

163. moderate d

164. easy a

165. easy b

166. easy c

167. easy d

168. easy b

Computational Multiple Choice Questions

169. Paul, Jeremy, and Juan are forming a partnership. Juan contributes a building having an

historical cost, accumulated depreciation, and market value of $290,000, $100,000, and

$400,000, respectively. The building is initially recorded on the partnership’s books at

Juan’s book value ($190,000). Two years later the building is sold for a $270,000 gain.

What portion of the profit or loss should be allocated to Juan?

a. $20,000

b. $230,000

c. $210,000

d. $90,000

170. Philip, Ray, and Sarah are forming a partnership. Philip contributes cash of $100,000;

Ray contributes inventory with a value of $100,000; and Sarah contributes a building

with a market value of $300,000. The partnership also assumed the $210,000 mortgage

on the building. What is the amount of capital assigned to each partner?

Philip Ray Sarah

a. $30,000 $30,000 $230,000

b. $56,000 $56,000 $174,000

c. $100,000 $100,000 $90,000

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

d. $100,000 $100,000 $300,000

171. Max, Ike, and Tony are forming a partnership. The appraised value of assets contributed

is $60,000, $80,000, and $100,000, respectively. In addition, Max and Tony agree that

Ike’s experience is worth $30,000. The partners desire to apply the bonus method where

applicable. What is the total capital recorded at the date the partnership is formed?

a. $210,000

b. $240,000

c. $270,000

d. Some other dollar amount

172. Richardson, Peterson, and Wilkerson are forming a partnership. The partners contribute

cash and noncash assets valued at $30,000, $50,000, and $25,000, respectively. The

partners choose to apply the bonus method where applicable. If the partners agree to

establish equal capital account balances when the partnership is formed, how much of a

bonus is received by Richardson?

a. $15,000

b. $10,000

c. $5,000

d. Richardson does not receive a bonus

173. Richardson, Peterson, and Wilkerson are forming a partnership. The partners contribute

cash and noncash assets valued at $30,000, $50,000, and $25,000, respectively. The

partners choose to apply the bonus method where applicable. If the partners agree to

establish equal capital account balances when the partnership is formed, how much

capital is Peterson sacrificing to give a bonus to Richardson and Wilkerson?

a. $15,000

b. $10,000

c. $5,000

d. Richardson does not receive a bonus

174. Albert, Claude, and Jamie form a partnership by contributing $25,000, $70,000, and

$80,000, respectively. In addition, the partners agree that Albert should receive $20,000

of goodwill because of his special skills relevant to this business. What amount of capital

will exist for Albert when the partnership is formed?

a. $20,000

b. $25,000

c. $65,000

d. $45,000

175. Albert, Claude, and Jamie form a partnership by contributing $25,000, $70,000, and

$80,000, respectively. In addition, the partners agree that Albert should receive $20,000

of goodwill because of his special skills relevant to this business. What amount of capital

will exist for Claude when the partnership is formed?

a. $60,000

b. $65,000

c. $70,000

d. Some other amount

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

176. Chris and David are forming a partnership with contributions of $75,000 and $125,000,

respectively. In addition, they agree that they will recognize $25,000 goodwill with

regard to David’s contacts in the area. What is the total amount of capital that will exist

for the partnership immediately after it is formed?

a. $75,000

b. $125,000

c. $150,000

d. $225,000

177. Chris is a partner in a local partnership. The profit and loss sharing agreement includes

an interest allocation of 7 percent on the invested capital. The capital account of Chris

reveals that he had a beginning capital account balance of $50,000. He withdrew

$10,000 on May 1 and invested $25,000 on October 31. Rounded to the nearest dollar,

what is Chris’ weighted average capital balance?

a. $57,500

b. $51,667

c. $47,500

d. $28,333

178. Richard is a partner in a local partnership. The profit and loss sharing agreement

includes an interest allocation of 8 percent on the invested capital. Richard had a

beginning capital balance of $60,000. He invested $30,000 on March 1, withdrew

$20,000 on August 1, and invested $40,000 on December 1. Rounded to the nearest

dollar, what dollar amount is allocated to Richard as interest on capital balance if the

weighted average capital balance is used as the basis of the computation?

a. $82,500

b. $6,400

c. $80,000

d. $6,600

179. Shawn is a managing partner in a local business. Part of his profit allocation is a bonus

based on the store’s operating income. The bonus is 8 percent of operating income in

excess of $200,000 after deducting the bonus. If operating income for the year is

$250,000, what is Shawn’s bonus (rounded to the nearest dollar)?

a. $3,703

b. $40,000

c. $20,000

d. $4,000

180. James has a bonus as part of his partner profit allocation. The bonus is based on the

partnerships net income. James receives a bonus equal to 5 percent that the net income

exceeds $150,000. If the net income in the current year is $180,000, how much bonus

does James receive?

a. $30,000

b. $7,500

c. $1,500

d. $9,000

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

181. Cheryl is the manager of a local store. She is also a partner in the company and she

receives a bonus as part of the profit and loss allocation. Cheryl’s bonus is based on the

increase in revenues recorded during the period. The bonus arrangement is that Cheryl

receives 1 percent of net income for every full percentage point growth for revenues in

excess of a 5 percent revenue growth. During the most recent period, revenues grew

from $500,000 to $540,000 and net income grew from $98,000 to $120,000. How much

bonus does Cheryl receive for this period?

a. $2,000

b. $1,100

c. $6,000

d. $3,600

182. Norman, Sarah, and Taylor are partners. The partnership income for the period is

$130,000. The partnership agreement assigns salaries to the partners of $10,000,

$15,000, and $18,000, respectively. In addition, the partners have profit and loss residual

ratios of 30%, 45%, and 25%. What is the amount of profit and loss allocated to Sarah

as a result of applying the residual ratios?

a. $39,150

b. $54,150

c. $58,500

d. $51,750

183. Jim and Scott are partners who have residual profit and loss ratios of 55% and 45%,

respectively. The partnership has income of $60,000 for the current period. How much

of this income is allocated to Scott?

a. $30,000

b. $33,000

c. $14,850

d. $27,000

184. Mike and Michelle are partners in a local business. The business has a $25,000 loss this

year. How much of this loss is allocated to Mike?

a. $12,500

b. $0

c. $25,000

d. Losses cannot be allocated without residual profit and loss ratios

185. Nick, Joe, and Mike are partners. The company has $150,000 net income for the period.

How is this income divided to the partners if the following profit and loss allocation

process is followed?

Nick Joe Mike

Weighted average capital $200,000 $350,000 $180,000

Salary 25,000 15,000 35,000

Bonus .1 (NI - $100,000)

Residual profit/loss ratios .25 .45 .30

Return on invested capital 9%

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

Nick Joe Mike

a. $43,000 $46,500 $60,500

b. $45,325 $50,685 $53,990

c. $50,000 $50,000 $50,000

d. $44,075 $48,435 $57,490

186. Harriet, Bob, and Tim are partners. Income for the current year is $500,000. The profit

and loss agreement states that salaries are $35,000, $50,000, and $40,000, respectively.

In addition, the residual profit and loss ratios are 40%, 30%, and 30%, respectively.

How much of the profit is allocated to Harriet?

a. $150,000

b. $185,000

c. $162,500

d. $152,500

187. Suzanne, Thomas, and Vicky are partners. They have average capital account balances

of $200,000, $250,000, and $400,000, respectively. In addition, they have residual profit

and loss ratios of 15%, 25%, and 60%, respectively. If income for the year is $300,000

and the partners earn 8 percent return on invested capital, how much will be allocated to

Thomas?

a. $78,000

b. $100,000

c. $50,800

d. $171,200

188. Johnson and Pritchard are partners. They are changing the profit and loss ratios from the

current 60/40 to 70/30. At the date of the change, vacant land owned by the partnership

has a book value of $50,000 and a market value of $60,000. The partners choose to

prepare an itemized list of assets with market values different from book values. If the

land is sold in the future for $80,000, how much of the gain will be assigned to Johnson?

a. $21,000

b. $18,000

c. $27,000

d. $20,000

189. Johnson and Pritchard are partners. They are changing the profit and loss ratios from the

current 60/40 to 70/30. At the date of the change, vacant land owned by the partnership

has a book value of $50,000 and a market value of $60,000. The partners choose to

prepare an itemized list of assets with market values different from book values. If the

land is sold in the future for $80,000, how much of the gain will be assigned to

Pritchard?

a. $12,000

b. $10,000

c. $9,000

d. $13,000

190. Karen and Andrea are currently changing their partnership profit and loss ratios from

75/25 to 60/40. They have created a list of assets that have market and book value

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

differences. One of the assets is a building with a $300,000 market value and $200,000

book value. Two years after changing the profit and loss ratios, the building is sold for

$380,000. How much of the profit is allocated to Karen?

a. $135,000

b. $108,000

c. $123,000

d. $183,000

191. Karen and Andrea are currently changing their partnership profit and loss ratios from

75/25 to 60/40. They have created a list of assets that have market and book value

differences. One of the assets is a building with a $300,000 market value and $200,000

book value. Two years after changing the profit and loss ratios, the building is sold for

$380,000. How much of the profit is allocated to Andrea?

a. $57,000

b. $45,000

c. $72,000

d. $97,000

192. Peter and Ronald are partners. They have shared profits and losses 65/35 for a number of

years. Peter has indicated that he is going to reduce his involvement in the partnership so

the profit and loss ratio is being modified to 45/55. At the date of the change in the profit

and loss ratio, the partnership own vacant land with a market value of $300,000 and a

book value of $100,000. Peter and Ronald compile a list of assets with market and book

value differences. Two years after the change in the profit and loss ratios, the land is sold

for $450,000. How much of the gain is allocated to Peter?

a. $197,500

b. $227,500

c. $157,500

d. $287,500

193. Peter and Ronald are partners. They have shared profits and losses 65/35 for a number of

years. Peter has indicated that he is going to reduce his involvement in the partnership so

the profit and loss ratio is being modified to 45/55. At the date of the change in the profit

and loss ratio, the partnership own vacant land with a market value of $300,000 and a

book value of $100,000. Peter and Ronald compile a list of assets with market and book

value differences. Two years after the change in the profit and loss ratios, the land is sold

for $450,000. How much of the gain is allocated to Ronald?

a. $122,500

b. $192,500

c. $152,500

d. $262,500

194. Jennifer and Robert are partners who are changing their profit and loss ratios from 60/40

to 45/55. At the date of the change, the partners choose to revalue assets with market

value different from book value. One asset revalued is land with a book value of

$50,000 and a market value of $120,000. Two years after the profit and loss ratio is

changed, the land is sold for $200,000. What is the amount of change to Jennifer’s

capital account at the date the land is revalued?

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

a. $72,000

b. $42,000

c. $30,000

d. $28,000

195. Jennifer and Robert are partners who are changing their profit and loss ratios from 60/40

to 45/55. At the date of the change, the partners choose to revalue assets with market

value different from book value. One asset revalued is land with a book value of

$50,000 and a market value of $120,000. Two years after the profit and loss ratio is

changed, the land is sold for $200,000. What is the amount of change to Robert’s capital

account at the date the land is revalued?

a. $72,000

b. $42,000

c. $30,000

d. $28,000

196. Jennifer and Robert are partners who are changing their profit and loss ratios from 60/40

to 45/55. At the date of the change, the partners choose to revalue assets with market

value different from book value. One asset revalued is land with a book value of

$50,000 and a market value of $120,000. Two years after the profit and loss ratio is

changed, the land is sold for $200,000. What is the amount of change to Jennifer’s

capital account at the date the land is sold?

a. $48,000

b. $67,500

c. $31,500

d. $36,000

197. Jennifer and Robert are partners who are changing their profit and loss ratios from 60/40

to 45/55. At the date of the change, the partners choose to revalue assets with market

value different from book value. One asset revalued is land with a book value of

$50,000 and a market value of $120,000. Two years after the profit and loss ratio is

changed, the land is sold for $200,000. What is the amount of change to Robert’s capital

account at the date the land is sold?

a. $44,000

b. $82,500

c. $32,000

d. $60,000

198. James and Bruce are partners. They have shared profits and losses 70/30 for several

years. The partnership profit allocation agreement is currently being modified to 60/40.

At the date of the change, the partners choose to revalue assets with market value

different from book value. One asset revalued is a building with a book value of

$370,000 and a market value of $520,000. One year after the profit and loss ratio is

changed the building is sold for $650,000. What is the amount of change to James’

capital account at the date the building is revalued?

a. $105,000

b. $91,000

c. $45,000

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

d. $39,000

199. James and Bruce are partners. They have shared profits and losses 70/30 for several

years. The partnership profit allocation agreement is currently being modified to 60/40.

At the date of the change, the partners choose to revalue assets with market value

different from book value. One asset revalued is a building with a book value of

$370,000 and a market value of $520,000. One year after the profit and loss ratio is

changed the building is sold for $650,000. What is the amount of change to Bruce’s

capital account at the date the building is revalued?

a. $105,000

b. $91,000

c. $45,000

d. $39,000

200. James and Bruce are partners. They have shared profits and losses 70/30 for several

years. The partnership profit allocation agreement is currently being modified to 60/40.

At the date of the change, the partners choose to revalue assets with market value

different from book value. One asset revalued is a building with a book value of

$370,000 and a market value of $520,000. One year after the profit and loss ratio is

changed the building is sold for $650,000. What is the amount of change to James’

capital account at the date the building is sold?

a. $91,000

b. $78,000

c. $39,000

d. $52,000

201. James and Bruce are partners. They have shared profits and losses 70/30 for several

years. The partnership profit allocation agreement is currently being modified to 60/40.

At the date of the change, the partners choose to revalue assets with market value

different from book value. One asset revalued is a building with a book value of

$370,000 and a market value of $520,000. One year after the profit and loss ratio is

changed the building is sold for $650,000. What is the amount of change to Bruce’s

capital account at the date the building is sold?

a. $91,000

b. $78,000

c. $39,000

d. $52,000

202. Theresa and Craig are partners. Their current profit and loss ratios (70/30) are being

changed to (60/40). The partners decide to adjust their capital accounts at the date of the

change in the profit and loss ratios to reflect the difference between market value and

book value of assets and liabilities. At the date of the change, land has a market value of

$250,000 and a book value of $120,000. How much will Theresa’s capital account be

adjusted at the date of the change in the profit and loss ratios?

a. $52,000 increase

b. $13,000 increase

c. $52,000 decrease

d. $13,000 decrease

Downloaded by micolle oprecio (micolle.oprecio08@gmail.com)

lOMoARcPSD|7156481

203. Theresa and Craig are partners. Their current profit and loss ratios (70/30) are being

changed to (60/40). The partners decide to adjust their capital accounts at the date of the

change in the profit and loss ratios to reflect the difference between market value and

book value of assets and liabilities. At the date of the change, land has a market value of

$250,000 and a book value of $120,000. How much will Craig’s capital account be

adjusted at the date of the change in the profit and loss ratios?

a. $52,000 increase

b. $13,000 increase

c. $52,000 decrease

d. $13,000 decrease

204. Eric and Phillip have been partners for several years. During that time they have shared

profits and losses (60/40). They are currently revising the profit and loss ratios to

(70/30). Eric and Phillip decide to adjust the capital accounts at the date of the change to

reflect the difference between market value and book value of assets and liabilities. At

the date of the change, the partnership owns a building with a book value of $350,000

and a market value of $600,000. How much will Eric’s capital account be adjusted at the

date of the change in the profit and loss ratios?

a. $25,000 increase

b. $50,000 increase

c. $25,000 decrease

d. $50,000 decrease

205. Eric and Phillip have been partners for several years. During that time they have shared

profits and losses (60/40). They are currently revising the profit and loss ratios to

(70/30). Eric and Phillip decide to adjust the capital accounts at the date of the change to

reflect the difference between market value and book value of assets and liabilities. At

the date of the change, the partnership owns a building with a book value of $350,000