Professional Documents

Culture Documents

Week 2 Tutorial Question 2 - Double Entry Solution

Uploaded by

Dragos0 ratings0% found this document useful (0 votes)

7 views2 pagesThis document contains two tutorial questions with accounting transactions. Question 9.2 lists transactions with debits and credits, such as crediting sales revenue for a customer payment and debiting purchases for goods bought from a supplier. Question 9.7 shows accounting entries over a month for a new business, including introducing assets, purchases, sales, expenses and loan payments. The question provides a chart of accounts with debit and credit amounts for each transaction dated from December 1-24.

Original Description:

Original Title

Week 2 Tutorial Question 2- Double Entry Solution

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains two tutorial questions with accounting transactions. Question 9.2 lists transactions with debits and credits, such as crediting sales revenue for a customer payment and debiting purchases for goods bought from a supplier. Question 9.7 shows accounting entries over a month for a new business, including introducing assets, purchases, sales, expenses and loan payments. The question provides a chart of accounts with debit and credit amounts for each transaction dated from December 1-24.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesWeek 2 Tutorial Question 2 - Double Entry Solution

Uploaded by

DragosThis document contains two tutorial questions with accounting transactions. Question 9.2 lists transactions with debits and credits, such as crediting sales revenue for a customer payment and debiting purchases for goods bought from a supplier. Question 9.7 shows accounting entries over a month for a new business, including introducing assets, purchases, sales, expenses and loan payments. The question provides a chart of accounts with debit and credit amounts for each transaction dated from December 1-24.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

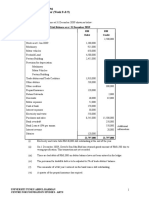

Tutorial Question solution 9.

Debit Credit

(a) Customer - Gormley Sales Revenue a/c

(b) Purchases a/c Supplier – Morgan a/c

(c) Purchases a/c Cash a/c

(d) Purchases a/c Bank a/c

(e) Cash a/c Sales Revenue a/c

(f) Customer - Earls Sales Revenue a/c

(g) Purchases a/c Supplier – McAfee

Tutorial Question 9.7

Date Transaction DEBIT ( £ ) CREDIT ( £ )

1 Dec Introduced a motor vehicle to the new business worth Motor Vehicle 8,000 Capital 8,000

£8,000

1 Dec Transferred a computer from home to the business: Computer equipment Capital 500

£500 500

1 Dec Withdrew £200 cash from her personal account to Cash 200 Capital 200

cover the cash expenses of the business

1 Dec Put a cheque in the business bank account to cover Bank 10,000 Capital 10,000

business start-up costs: £10,000

1 Dec Purchased goods for sale by cheque: £4,000 Purchases 4,000 Bank 4,000

2 Dec Bought a van using a loan from the bank: £15,000 Van 15,000 Loan 15,000

2 Dec Bought office equipment using a loan from the bank: Office furniture 5,000 Loan 5,000

£5,000

3 Dec Received cheques amounting to £5,000 for sales made Bank 5,000 Sales 5,000

4 Dec Purchased stationery for £450 Stationary expense Cash 450

450

5 Dec Purchased envelopes for £25 using cash Stationary expense 25 Cash 25

6 Dec Paid wages by cheque: £400 Wages 400 Bank 400

9 Dec Purchased goods for sale for £2,000 by cheque Purchases 2,000 Bank 2,000

10 Dec Sales lodged: £3,000 Bank 3,000 Sales 3,000

10 Dec Cash sales: £1,000 Cash 1,000 Sales 1,000

12 Dec Cash lodged: £800 Bank 800 Cash 800

14 Dec Pens purchased in cash: £20 Stationary expense 20 Cash 20

15 Dec Loan instalment transferred by direct debit (DD): Loan 1,000 Bank 1,000

£1,000

18 Dec Mary wrote a business cheque to her personal Drawings 2,000 Bank 2,000

account: £2,000

21 Dec Petrol paid by cheque: £280 Motor expenses 280 Bank 280

22 Dec Petrol for vehicles paid by cash: £40 Motor expenses 40 Cash 40

23 Dec Wages paid by cheque: £400 Wages 40 Bank 40

24 Dec Second loan instalment DD from bank: £1,000 Laon 1,000 Bank 1,000

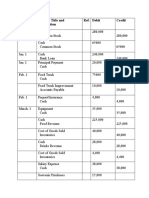

9.7

Motor vehicle a/c Capital introduced a/c

Dec 1 Cap. Int 8,000 Dec 1 MV a/c 8,000

Dec 2 Loan a/c 15,000 Dec 1 Comp equ 500

Dec 1 Cash 200

Dec 1 Bank 10,000

Computer equipment a/c Bank loan a/c

Dec 1 Cap. Int. 500 Dec 15 Bank a/c 1,000 Dec 2 MV a/c 15,000

Dec 24 Bank a/c 1,000 Dec 2 Off equip 5,000

Cash a/c Bank a/c

Dec 1 Cap. Int. 200 Dec 5 Stat. a/c 25 Dec 1 Cap. Int. 10,000 Dec 1 Purchases 4,000

Dec 10 Sales a/c 1,000 Dec 10 Bank a/c 800 Dec 3 Sales a/c 5,000 Dec 4 Stationery 450

Dec 14 Stat. a/c 20 Dec 10 Sales a/c 3,000 Dec 6 Wages 400

Dec 22 Mot. 40 Dec 10 Cash a/c 800 Dec 9 Purchases 2,000

Exps.

Dec 15 Loan a/c 1,000

Dec 18 Drawings 2,000

Dec 21 Motor exps 280

Dec 23 Wages 400

Dec 24 Loan a/c 1,000

Purchases a/c Office equipment a/c

Dec 1 Bank a/c 4,000 Dec 2 Loan a/c 5,000

Dec 9 Bank a/c 2,000

Sales revenue a/c Stationery a/c

Dec 3 Bank a/c 5,000 Dec 4 Bank a/c 450

Dec 10 Bank a/c 3,000 Dec 5 Cash a/c 25

Dec 10 Cash a/c 1,000 Dec 14 Cash a/c 20

Wages a/c Drawings a/c

Dec 6 Bank a/c 400 Dec 18 Bank a/c 2,000

Dec 23 Bank a/c 400

Motor expenses a/c

Dec 21 Bank a/c 280

Dec 22 Cash a/c 40

You might also like

- Solution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or LiabilitiesDocument7 pagesSolution 2.1: Indicate, by Circling The Correct Classification, Whether Each of The Following Are Assets or Liabilitiesshafqat aliNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Acc Project Phase 4Document5 pagesAcc Project Phase 4Omar KhaledNo ratings yet

- Accounting For IT Mid-Term ExamDocument2 pagesAccounting For IT Mid-Term ExamCarlo AguilarNo ratings yet

- The Schram Academy: Accounts ProjectDocument17 pagesThe Schram Academy: Accounts ProjectVarshini KNo ratings yet

- Acc ProjectDocument4 pagesAcc Projectamirulfahmi433No ratings yet

- PoultryDocument15 pagesPoultryJulliana mae MarjoneNo ratings yet

- 11.recording Business TransactionDocument17 pages11.recording Business TransactionAfrin rahman miliNo ratings yet

- F5 Bafs 2 QueDocument13 pagesF5 Bafs 2 Queouo So方No ratings yet

- Part ADocument23 pagesPart AMinh VõNo ratings yet

- GT1Fin AccDocument26 pagesGT1Fin AccZapirah Nirel LayloNo ratings yet

- Fabm Sample Exercises With Answer KeyDocument7 pagesFabm Sample Exercises With Answer KeySg Dimz100% (1)

- FA - Thanh TamDocument19 pagesFA - Thanh TamTâm Huỳnh ThanhNo ratings yet

- Enter The Following Transactions in The Books of Mary WardDocument1 pageEnter The Following Transactions in The Books of Mary WardBube KachevskaNo ratings yet

- Seat Work 03 - DingcongDocument7 pagesSeat Work 03 - DingcongJheilson S. Dingcong100% (2)

- Journal TransactionsDocument3 pagesJournal TransactionsFaye Garlitos100% (1)

- Activity Acctg 1Document4 pagesActivity Acctg 1Elmeerajh JudavarNo ratings yet

- CCP102Document12 pagesCCP102api-3849444No ratings yet

- Homework Artsy Ceramics Solutions 2Document6 pagesHomework Artsy Ceramics Solutions 2Thi Van Anh VUNo ratings yet

- Assignment 2Document13 pagesAssignment 2Lyca Mae Cubangbang100% (2)

- General LedgerDocument1 pageGeneral LedgerAlyssa GenobatinNo ratings yet

- Accounting Problem 5Document8 pagesAccounting Problem 5Carlo AniNo ratings yet

- Basic Terms in Accounts: Assets: Something That You OwnDocument46 pagesBasic Terms in Accounts: Assets: Something That You OwnLeo GladwinNo ratings yet

- Business Account WordDocument11 pagesBusiness Account Wordbiggboss 15No ratings yet

- CXC Principles of Accounts Past Papers May 2012Document8 pagesCXC Principles of Accounts Past Papers May 2012BrandySterlingNo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Review Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Document11 pagesReview Questions & Answers For Midterm1: BA 203 - Financial Accounting Fall 2019-2020Ulaş GüllenoğluNo ratings yet

- MerchandisingDocument11 pagesMerchandisingAIRA NHAIRE MECATE100% (1)

- Financial Accounting BMBA 140 Assignment #2 Name (First and Last Name) : Mark John AbanaDocument4 pagesFinancial Accounting BMBA 140 Assignment #2 Name (First and Last Name) : Mark John AbanaEdnalyn PascualNo ratings yet

- Accounting Revision QuestionsDocument8 pagesAccounting Revision QuestionsFranswa MateteNo ratings yet

- Andrew AngDocument3 pagesAndrew AngShane Kimberly LubatNo ratings yet

- Journal Entries Groupings AccountingDocument3 pagesJournal Entries Groupings AccountingGerlyn Mae Delantar100% (1)

- Accounting Assignment & CATDocument14 pagesAccounting Assignment & CATMargaret IrunguNo ratings yet

- Initial InvestmentDocument18 pagesInitial InvestmentLyca Mae Cubangbang100% (3)

- Introduction To Financial Accounting 7Th Edition Thomas Solutions Manual Full Chapter PDFDocument27 pagesIntroduction To Financial Accounting 7Th Edition Thomas Solutions Manual Full Chapter PDFchiliasmevenhandtzjz8j100% (9)

- Samiullah-4012, Major AssignmentDocument13 pagesSamiullah-4012, Major AssignmentSamiullahNo ratings yet

- Kay Breeze Balance SheetDocument9 pagesKay Breeze Balance Sheetdaniel whitelyNo ratings yet

- Accounts Project 1 - Puran TakDocument21 pagesAccounts Project 1 - Puran TakPURAN TAKNo ratings yet

- Preparing and Posting Journal Entries For Brooke GableDocument5 pagesPreparing and Posting Journal Entries For Brooke GableĐông Đông100% (1)

- Preparing and Posting Journal Entries For Brooke GableDocument5 pagesPreparing and Posting Journal Entries For Brooke GableĐông ĐôngNo ratings yet

- AISAE 101 - Assessment 5 - Morales Mariel MaeDocument6 pagesAISAE 101 - Assessment 5 - Morales Mariel MaeMariel Mae MoralesNo ratings yet

- Unit 2 - Accounting TemplatesDocument13 pagesUnit 2 - Accounting TemplatesHsu WaiNo ratings yet

- Acctg 1 Act 2Document6 pagesAcctg 1 Act 2Elmeerajh JudavarNo ratings yet

- Illustrative Examples - Bank Recon & PCFDocument3 pagesIllustrative Examples - Bank Recon & PCFjames patrick LaysonNo ratings yet

- Tut 4 FinanceDocument7 pagesTut 4 FinanceJordan RixNo ratings yet

- Chapter (1) The Accounting EquationDocument46 pagesChapter (1) The Accounting Equationtunlinoo.067433100% (3)

- 2010 DR CR December 1 Cash: Journal EntriesDocument14 pages2010 DR CR December 1 Cash: Journal EntriesRafe Alexis MiravillaNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- ACs Basic MechanicsDocument19 pagesACs Basic Mechanicsapi-3741610100% (1)

- Fab MDocument5 pagesFab Mzacharaya abegailNo ratings yet

- Journal Problems For AssignmentDocument2 pagesJournal Problems For AssignmentMD. Arif HossainNo ratings yet

- Accounting Assignment PDFDocument58 pagesAccounting Assignment PDFIsha_12No ratings yet

- CIA 2 FA - 2020349 Khushi NaharDocument13 pagesCIA 2 FA - 2020349 Khushi NaharKhushi naharNo ratings yet

- CCP102Document15 pagesCCP102api-3849444No ratings yet

- Steve (Till Trial Balance Fixed)Document5 pagesSteve (Till Trial Balance Fixed)A StrangerNo ratings yet

- MGMT200 Section1 Team22Document94 pagesMGMT200 Section1 Team22Joseph ToneyNo ratings yet

- Practice - Journalizing and Posting-1Document24 pagesPractice - Journalizing and Posting-1Ahmed P. FatehNo ratings yet

- Quis Seb UASDocument5 pagesQuis Seb UASHafiz FadhlanNo ratings yet

- 2011-006 Tangram People (All Ages) PDFDocument28 pages2011-006 Tangram People (All Ages) PDFKhalil BarhoumiNo ratings yet

- Perceived Effectiveness of Artificial Intelligence-Powered Calculators On The Academic Performance of Senior High School STEM Students in MathematicsDocument8 pagesPerceived Effectiveness of Artificial Intelligence-Powered Calculators On The Academic Performance of Senior High School STEM Students in MathematicsPsychology and Education: A Multidisciplinary JournalNo ratings yet

- Lovol - Fl936-Dhbo6g0131Document140 pagesLovol - Fl936-Dhbo6g0131LuzioNetoNo ratings yet

- Anichol 60 For Broilers ReferencesDocument5 pagesAnichol 60 For Broilers Referencesjimlee2jimleeNo ratings yet

- How Satisfied Are Students of Royal High School With The Lunch Services Offered by The School CanteenDocument5 pagesHow Satisfied Are Students of Royal High School With The Lunch Services Offered by The School CanteenMonique GayleNo ratings yet

- Joseph Brazier, Ltd. Et Al v. Specialty Bar Products Company - Document No. 7Document3 pagesJoseph Brazier, Ltd. Et Al v. Specialty Bar Products Company - Document No. 7Justia.comNo ratings yet

- Front PageDocument5 pagesFront PageAnas AloyodanNo ratings yet

- Article 2 - NOVEMBER - Thermage PDFDocument3 pagesArticle 2 - NOVEMBER - Thermage PDFPey EsperasNo ratings yet

- PF2 S02-10 in Burning DawnDocument31 pagesPF2 S02-10 in Burning Dawnxajos85812No ratings yet

- Service Manual: Diva Avr200 Surround Sound ReceiverDocument61 pagesService Manual: Diva Avr200 Surround Sound Receiver王军No ratings yet

- Fundamentals of Inviscid, Incompressible FlowDocument57 pagesFundamentals of Inviscid, Incompressible FlowpaariNo ratings yet

- How To Product ManualDocument250 pagesHow To Product ManualAmith M DNo ratings yet

- Definition, Classification and Diagnosis of Diabetes, Prediabetes and Metabolic SyndromeDocument6 pagesDefinition, Classification and Diagnosis of Diabetes, Prediabetes and Metabolic SyndromemandaNo ratings yet

- Tutorial ControlDocument161 pagesTutorial ControlQuangNguyenDuy100% (1)

- Cot On Theoretical and Experimental ProbabilityDocument8 pagesCot On Theoretical and Experimental ProbabilityNoemie BautistaNo ratings yet

- BS 6089 - 2010 - Assessment of Insitu Compressive TestDocument40 pagesBS 6089 - 2010 - Assessment of Insitu Compressive TestMike Chan100% (2)

- Resume - Lifestyle Medicine RDDocument1 pageResume - Lifestyle Medicine RDapi-338995106No ratings yet

- EPON OLT Operation Manual V1.2 20211102Document484 pagesEPON OLT Operation Manual V1.2 20211102MfahmifauzanNo ratings yet

- JD Pharmacy TechnologistDocument3 pagesJD Pharmacy Technologistpeter mulilaNo ratings yet

- Code For VirtualboxDocument1 pageCode For VirtualboxAnonymous 4m8ueTNo ratings yet

- Biosash Order Form Latest - 2019-9281576348996003Document3 pagesBiosash Order Form Latest - 2019-9281576348996003Amer Suhail ShareefNo ratings yet

- 2022 Grade 10 Study GuideDocument85 pages2022 Grade 10 Study Guideeskaykhan11No ratings yet

- The Lateral Trochanteric Wall Gotfried 2004 PDFDocument5 pagesThe Lateral Trochanteric Wall Gotfried 2004 PDFluis perezNo ratings yet

- 2 PassivetransportDocument8 pages2 PassivetransportFayeNo ratings yet

- C.8 SOLUTIONS (Problems I - IX)Document9 pagesC.8 SOLUTIONS (Problems I - IX)Bianca AcoymoNo ratings yet

- Answers 1Document68 pagesAnswers 1Miguel Angel HernandezNo ratings yet

- SUD Life Elite Assure PlusDocument4 pagesSUD Life Elite Assure Plussourav agarwalNo ratings yet

- Holmstrom1982 Moral Hazard in TeamsDocument18 pagesHolmstrom1982 Moral Hazard in TeamsfaqeveaNo ratings yet

- LTE Throughput Troubleshooting GuidlelineDocument15 pagesLTE Throughput Troubleshooting GuidlelineTourchianNo ratings yet