Professional Documents

Culture Documents

09 Activity 1

Uploaded by

Skuksy BillieOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

09 Activity 1

Uploaded by

Skuksy BillieCopyright:

Available Formats

BM2012

NAME: SECTION: SCORE:

PRACTICE EXERCISE

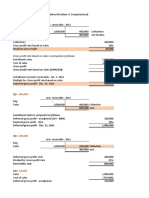

Portia Co. uses the installment method of income recognition. The entity provided the following pertinent data:

20x1 20x2 20x3

Installment sales P600,000 P750,000 P720,000

Cost of goods sold 450,000 570,000 504,000

Balance of deferred gross profit at year-end

20x1 105,000 30,000 -

20x2 108,000 18,000

20x3 144,000

REQUIRED:

1. Total balance of Installment Receivable on December 31, 20x3 ____________

Reginald Company, which began operations on January 5, 20x1, appropriately uses the install method of

revenue recognition. The following information pertains to the operations for 20x1 and 20x2:

20x1 20x2

Sales P600,000 P900,000

Collections from:

20x1 sales 200,000 100,000

20x2 sales 300,000

Accounts written off from:

20x1 sales 50,000 150,000

20x2 sales 300,000

Gross profit rates 30% 40%

REQUIRED:

2. Deferred gross profit on December 31, 20x2 ______________

3. Realized gross profit in 20x2 ______________

The following are the information related to instalment sales made by Bimbo Co.:

20X1 20X2

Sales P200,000 P320,000

Cost of Sales 160,000 224,000

Gross profit rate 20% 30%

Installment receivable, 20x1 90,000 30,000

Installment receivable, 20x2 144,000

During 20x2, Bimbo Co. has repossessed a property sold to a defaulted customer in 20x1 for P25,000. Prior

to repossession, P5,000 were collected from the buyer. The repossessed property has an estimated resale

price of P22,000. Reconditioning costs amount to P3,000. The normal profit margin is 30%.

REQUIRED:

4. Compute the gain or loss on repossession ____________

5. Compute the total realized gross profit in 20x2 ____________

6. Net income recognized in 20x2 ____________

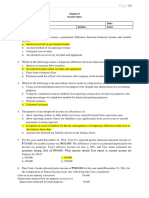

Performance Indicators Points

Correct accounts and amounts used 3

Computed final amounts are correct/balanced 2

Total 5

09 Activity 1 *Property of STI

Page 1 of 1

You might also like

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- Financial Accounting P3Document4 pagesFinancial Accounting P3amiNo ratings yet

- Investment Analysis & Portfolio ManagementDocument65 pagesInvestment Analysis & Portfolio ManagementKaran Kumar100% (1)

- Leases (Part 2) : Problem 1: True or FalseDocument23 pagesLeases (Part 2) : Problem 1: True or FalseKim Hanbin100% (1)

- Accounts of Clubs and SocietiesDocument5 pagesAccounts of Clubs and SocietiesJunaid Islam100% (1)

- Problems Revenues FR Contracts With CustomersDocument17 pagesProblems Revenues FR Contracts With CustomersJane DizonNo ratings yet

- Illustration Problem & SolutionDocument4 pagesIllustration Problem & SolutionClauie BarsNo ratings yet

- Chapter 7 - Notes - Part 1Document10 pagesChapter 7 - Notes - Part 1XienaNo ratings yet

- Quiz - Chapter 10 - Installment Sales Method - 2021 EditionDocument5 pagesQuiz - Chapter 10 - Installment Sales Method - 2021 EditionYam SondayNo ratings yet

- Module 9 - Basic Principles of Tax PlanningDocument15 pagesModule 9 - Basic Principles of Tax PlanningAlice WuNo ratings yet

- To Accrue Advertising Expense: I PXRXTDocument6 pagesTo Accrue Advertising Expense: I PXRXTShane Nayah78% (9)

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- ACC110 P3Quiz2 AnswersDocument12 pagesACC110 P3Quiz2 AnswersTricia Mae FernandezNo ratings yet

- Chapter 10Document6 pagesChapter 10Love FreddyNo ratings yet

- Notes: Name: Date: Professor: Section: ScoreDocument18 pagesNotes: Name: Date: Professor: Section: Scorefinn mertens100% (2)

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- Installment Sales Method Cost Recovery Method (Traditional)Document23 pagesInstallment Sales Method Cost Recovery Method (Traditional)yhygyugNo ratings yet

- Quiz 7: Use The Following Information For Questions 4 To 6Document9 pagesQuiz 7: Use The Following Information For Questions 4 To 6Tricia Mae Fernandez100% (2)

- Installment Sales Reviewer Problems PDFDocument43 pagesInstallment Sales Reviewer Problems PDFUnnamed homosapien100% (1)

- 06 Task Performance 1Document4 pages06 Task Performance 1Bryan BristolNo ratings yet

- Installment T SalesDocument31 pagesInstallment T SalesNiki DimaanoNo ratings yet

- Module 7 InstallmentDocument12 pagesModule 7 InstallmentNiki DimaanoNo ratings yet

- InstallmentDocument10 pagesInstallmentNiki DimaanoNo ratings yet

- Ncpar Cup 2012Document18 pagesNcpar Cup 2012Allen Carambas Astro100% (2)

- Accounting PoliciesDocument8 pagesAccounting PoliciesJandyeeNo ratings yet

- Module 10Document4 pagesModule 10PaupauNo ratings yet

- Quiz Installment Sales 2Document1 pageQuiz Installment Sales 2MARJORIE BAMBALANNo ratings yet

- CH7 - DiscussionDocument8 pagesCH7 - DiscussionRichell ArtuzNo ratings yet

- P2 - Installment Sales, O2018 AUFDocument5 pagesP2 - Installment Sales, O2018 AUFedsNo ratings yet

- Installment Sales Method 1Document7 pagesInstallment Sales Method 1Roy Mitz Bautista29% (7)

- Practice QuestionsDocument19 pagesPractice QuestionsAbdul Qayyum Qayyum0% (2)

- Midterm Exam - Ac-2Document7 pagesMidterm Exam - Ac-2Lyca ArcenaNo ratings yet

- Rev 003 Midterm - Short QuizDocument2 pagesRev 003 Midterm - Short QuizJames LuoNo ratings yet

- Name: Date: Score:: Property of STIDocument2 pagesName: Date: Score:: Property of STIZeniah LouiseNo ratings yet

- Accounting For FSDocument1 pageAccounting For FSAngela ChloeNo ratings yet

- Questions - Cost of Capital and Sources of FinanceDocument3 pagesQuestions - Cost of Capital and Sources of Financepercy mapetereNo ratings yet

- Interim Financial ReportingDocument4 pagesInterim Financial Reportingbelle crisNo ratings yet

- 05 Activity 1Document1 page05 Activity 1Skuksy BillieNo ratings yet

- Template - Acctg. Major 3 Module 5 PDFDocument16 pagesTemplate - Acctg. Major 3 Module 5 PDFRia Mendez100% (2)

- Answers Installment Sales Dayag PDFDocument11 pagesAnswers Installment Sales Dayag PDFAshNor Randy100% (1)

- Intercompany TransactionsDocument5 pagesIntercompany TransactionsJessica IslaNo ratings yet

- Sol. Man. - Chapter 10 - Installment Sales Method - 2021 Edition 1Document12 pagesSol. Man. - Chapter 10 - Installment Sales Method - 2021 Edition 1amad.hannah0913No ratings yet

- Installment Sales MethodDocument11 pagesInstallment Sales MethodJanella Umieh De UngriaNo ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Q1-Review On Fa3Document4 pagesQ1-Review On Fa3Santos Gigantoca Jr.No ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- CHAPTER 12 - RR REVENUES From Contracts With Customers: Jan 02, 20x5Document13 pagesCHAPTER 12 - RR REVENUES From Contracts With Customers: Jan 02, 20x5Jane DizonNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- Assignment 6Document8 pagesAssignment 6Muhammad AdilNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- IA3 5copiesDocument6 pagesIA3 5copiesChloe CataluñaNo ratings yet

- Chapter 5 - Dayag - MCS 81-88Document4 pagesChapter 5 - Dayag - MCS 81-88Mazikeen DeckerNo ratings yet

- Chapter 10 Installment Sales AccountingDocument13 pagesChapter 10 Installment Sales AccountingFaithful FighterNo ratings yet

- Managment Accountant ACCOW, OpenT, KPP WBDocument6 pagesManagment Accountant ACCOW, OpenT, KPP WBFarahAin FainNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Chapter 17 - Teacher's Manual - Aa Part 2Document24 pagesChapter 17 - Teacher's Manual - Aa Part 2Mydel AvelinoNo ratings yet

- Chapter 2. Understanding The Income Statement A. QuestionsDocument3 pagesChapter 2. Understanding The Income Statement A. QuestionsThị Kim TrầnNo ratings yet

- 02 eLMS Activity 1Document1 page02 eLMS Activity 1Bryan BristolNo ratings yet

- 12 Activity 1Document3 pages12 Activity 1Razel AntiniolosNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Organic Growth: Cost-Effective Business Expansion from WithinFrom EverandOrganic Growth: Cost-Effective Business Expansion from WithinNo ratings yet

- Principles of Managerial Finance Brief 8th Edition Zutter Solutions ManualDocument4 pagesPrinciples of Managerial Finance Brief 8th Edition Zutter Solutions ManualBrianCoxbtqeo100% (13)

- Financial Reporting: TestbankDocument9 pagesFinancial Reporting: TestbankLaiba RazaNo ratings yet

- OM3 CH 11 Forecasting and Demand PlanningDocument30 pagesOM3 CH 11 Forecasting and Demand PlanningGeorge VilladolidNo ratings yet

- #Ent Group Assignment (G5)Document24 pages#Ent Group Assignment (G5)Pahin RamliNo ratings yet

- Third Division G. R. No. 135813 - October 25, 2001 FERNANDO SANTOS, Petitioner, v. SPOUSES ARSENIO and NIEVES REYES, Respondents. Panganiban, J.Document68 pagesThird Division G. R. No. 135813 - October 25, 2001 FERNANDO SANTOS, Petitioner, v. SPOUSES ARSENIO and NIEVES REYES, Respondents. Panganiban, J.Jan Miguel ManuelNo ratings yet

- Multiple Choice Questions 1 A Graduated Income Tax System MeansDocument2 pagesMultiple Choice Questions 1 A Graduated Income Tax System Meanstrilocksp SinghNo ratings yet

- AC2105 SG07 Presentation 5Document48 pagesAC2105 SG07 Presentation 5Kwang Yi JuinNo ratings yet

- Problems and Prospects of The Rural Women Entrepreneurs in IndiaDocument10 pagesProblems and Prospects of The Rural Women Entrepreneurs in IndiamarishhhNo ratings yet

- IAS 1 - Presentation of Financial StatementsDocument13 pagesIAS 1 - Presentation of Financial StatementsPhillipa ChihlanguNo ratings yet

- Solved The Dennis Company Reported Net Income of 50 000 On SalesDocument1 pageSolved The Dennis Company Reported Net Income of 50 000 On SalesAnbu jaromiaNo ratings yet

- Chapter 6Document14 pagesChapter 6Louie Ann CasabarNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 5 - NotesDocument4 pagesConceptual Framework and Accounting Standards - Chapter 5 - NotesKhey KheyNo ratings yet

- Blackstone 3 Q21 Supplemental Financial DataDocument20 pagesBlackstone 3 Q21 Supplemental Financial DataW.Derail McClendonNo ratings yet

- Question Bank - IV SEM BBA TAXATIONDocument54 pagesQuestion Bank - IV SEM BBA TAXATIONRisham Mohammed Ismail YUNo ratings yet

- (ASSIGNMENT 3) Eslam Mahmoud MohamedDocument4 pages(ASSIGNMENT 3) Eslam Mahmoud MohamedAmira OkashaNo ratings yet

- Illustrative Problem Worksheet ADocument6 pagesIllustrative Problem Worksheet AJoy SantosNo ratings yet

- Editable Retail Loan Application - ApplicantDocument10 pagesEditable Retail Loan Application - Applicantmadhukar sahayNo ratings yet

- Income Tax Calculator FY 2022-23 (AY 2023-24)Document3 pagesIncome Tax Calculator FY 2022-23 (AY 2023-24)Ravindra BagateNo ratings yet

- Accounting Income StatementDocument5 pagesAccounting Income StatementjaneNo ratings yet

- Endterm Paper Finmgt - FinalDocument46 pagesEndterm Paper Finmgt - FinalJenniveve ocenaNo ratings yet

- Financial Plan: A. AssumptionsDocument20 pagesFinancial Plan: A. AssumptionsNahiyan MuakhkherNo ratings yet

- Financial Accounting Libby 7th Edition Solutions ManualDocument36 pagesFinancial Accounting Libby 7th Edition Solutions Manualwalerfluster9egfh3100% (39)

- COMMISSIONER OF INTERNAL REVENUE VsDocument16 pagesCOMMISSIONER OF INTERNAL REVENUE Vsnicole MenesNo ratings yet

- Definition, Dimensions Determinants of Tourism Impacts: Learning OutcomeDocument17 pagesDefinition, Dimensions Determinants of Tourism Impacts: Learning OutcomeJUN GERONANo ratings yet

- Report Bata & Apex Shoes (Final)Document49 pagesReport Bata & Apex Shoes (Final)Abdullah Al Rafi ,141438No ratings yet

- Sweet Surprise Variety StoreDocument11 pagesSweet Surprise Variety Storebktsuna0201No ratings yet