Professional Documents

Culture Documents

Book 003

Book 003

Uploaded by

Md.Anisur Rahman0 ratings0% found this document useful (0 votes)

2 views1 pageThe document outlines the conditions for government servants in Kerala, India to join the General Provident Fund. It states that all permanent government servants must join the fund, except those who have taken a state life insurance policy where the premium exceeds the minimum contribution to the GPF. It also provides that temporary government servants who complete one year of continuous service must join the fund. The document includes these rules through references to government orders from 1966 and 1971.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines the conditions for government servants in Kerala, India to join the General Provident Fund. It states that all permanent government servants must join the fund, except those who have taken a state life insurance policy where the premium exceeds the minimum contribution to the GPF. It also provides that temporary government servants who complete one year of continuous service must join the fund. The document includes these rules through references to government orders from 1966 and 1971.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageBook 003

Book 003

Uploaded by

Md.Anisur RahmanThe document outlines the conditions for government servants in Kerala, India to join the General Provident Fund. It states that all permanent government servants must join the fund, except those who have taken a state life insurance policy where the premium exceeds the minimum contribution to the GPF. It also provides that temporary government servants who complete one year of continuous service must join the fund. The document includes these rules through references to government orders from 1966 and 1971.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

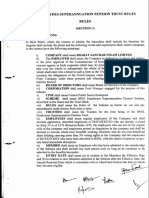

whose conditions of service are governed by the rules issued by the Governor,

shall join the Fund:

Provided that any Government servant who has insured his life in the

State Life Insurance (Official Branch) will not be required to join the Fund if he

so desires and if the monthly premium of Insurance does not fall below the

minimum rate of subscription for the General Provident Fund (Kerala) prescribed

by Government from time to time.

Provided also that if the monthly premium in respect of the State Life

Insurance (Official Branch) taken by a Government servant falls below the

minimum rate of monthly subscription to the General Provident Fund (Kerala)

prescribed by the Government from time to time, he will be required to join the

General Provident Fund (Kerala) also and the monthly subscription to the

General Provident Fund (Kerala) and the monthly premium to the State Life

Insurance (Official Branch) together shall not fall below the minimum rate of

Provident Fund subscription prescribed by Government from time to time.

(G.O (P) 619/71/Fin dated 11.10.1971)

a) All full members of any pensionable service.

b) All Probationers in any service who will be made full members of the

service on due completion of their period of probation.

c) All temporary, acting and officiating members of any service, other than

re-employed pensioners, on completion of one year’s continuous service.

d) Part time contingent employees (KPTCEPF)

e) An officer not coming under (a) or (b) or (c) or (d) above, but who has

been duly admitted to membership under rules or orders heretofore in

force.

NOTE: Temporary, acting and officiating members of any service (other than

re-employed pensioners and those provisionally appointed initially) who have not

completed one year’s continuous service may also be admitted to the Fund if they

apply for it in writing.

(G.O (P) 198/66 Fin., dated 11.5.1966)

Provided that a temporary Government Servant who is borne on an

establishment to which the Provisions of Provident Funds Scheme, 1952 framed

under the Employees, Provident Funds and Family Pension Fund Act, 1952 (19

of 1952), would have applied but for the exemption granted under section 17 of

PDF created with pdfFactory Pro trial version www.pdffactory.com

You might also like

- Product Recall ProcedureDocument3 pagesProduct Recall ProcedureEkhlasur Rahman100% (3)

- FRSRDocument38 pagesFRSRSrm me exam cell100% (1)

- Declaration NRI NRI SponsorDocument2 pagesDeclaration NRI NRI SponsorDurga Prasad NanginaNo ratings yet

- Dole Circular On Ra 7641Document4 pagesDole Circular On Ra 7641Ferdinand MacolNo ratings yet

- Chapter 04 Leave RulesDocument13 pagesChapter 04 Leave RulesPankaj K AryaNo ratings yet

- Uriarte vs. Court of First Instance of Negros Occ - DigestDocument3 pagesUriarte vs. Court of First Instance of Negros Occ - DigestJubelle AngeliNo ratings yet

- LTC RulesDocument33 pagesLTC RulesExam Preparation Coaching ClassesNo ratings yet

- Activity 2 GEC 102Document4 pagesActivity 2 GEC 102AserethNo ratings yet

- F.R. Without Pay Fixations PDFDocument18 pagesF.R. Without Pay Fixations PDFAPSEBAEANo ratings yet

- People v. Parel G.R. No. L-18260 (January 27, 1923)Document7 pagesPeople v. Parel G.R. No. L-18260 (January 27, 1923)D MonioNo ratings yet

- HDFCBANK SlipDocument1 pageHDFCBANK SlipShashikant Thakre67% (21)

- ContractsDocument21 pagesContractsDea Lyn BaculaNo ratings yet

- Fundamental RulesDocument86 pagesFundamental RulesRupakDas50% (4)

- M5.2 Lepanto Consolidated Mining Company v. The Lepanto Capatas UnionDocument2 pagesM5.2 Lepanto Consolidated Mining Company v. The Lepanto Capatas UnionHartel BuyuccanNo ratings yet

- Guidelines in The Reassignment of PNP Personnel Who Are Witness in Drug-Related CasesDocument1 pageGuidelines in The Reassignment of PNP Personnel Who Are Witness in Drug-Related CasescalatravaNo ratings yet

- Metropolitan Bank and Trust Company, The vs. Rosales DigestDocument2 pagesMetropolitan Bank and Trust Company, The vs. Rosales DigestCher100% (1)

- #27 Alolino V. Flores G.R. No. 198774 - April 4, 2016 DOCTRINE: An Easement Is An Encumbrance Imposed Upon An Immovable For The Benefit ofDocument4 pages#27 Alolino V. Flores G.R. No. 198774 - April 4, 2016 DOCTRINE: An Easement Is An Encumbrance Imposed Upon An Immovable For The Benefit ofBeatrice AbanNo ratings yet

- Notes On AMLADocument7 pagesNotes On AMLAIzzy Martin MaxinoNo ratings yet

- Republic Vs AlconabaDocument2 pagesRepublic Vs AlconabaGladys Bantilan100% (3)

- Authorisation PensionDocument2 pagesAuthorisation PensionAmit PatilNo ratings yet

- Employees' Provident Funds and Miscellaneous Provisions Act, 1952Document20 pagesEmployees' Provident Funds and Miscellaneous Provisions Act, 1952PrateekNo ratings yet

- CCS (Leave) RulesDocument53 pagesCCS (Leave) Rulespoojasikka196380% (5)

- WN On FRSR (Pay) Rules, 2023 (1) FBDocument11 pagesWN On FRSR (Pay) Rules, 2023 (1) FBRavi Prakash MeenaNo ratings yet

- Republic Act No. 8291Document14 pagesRepublic Act No. 8291MerabSalio-anNo ratings yet

- Revised AIS Rule Vol I Rule 03Document31 pagesRevised AIS Rule Vol I Rule 03Archana SivagamiNo ratings yet

- Revised AIS Rule Vol I Rule 13 PDFDocument209 pagesRevised AIS Rule Vol I Rule 13 PDFghazi4uNo ratings yet

- Fundamental RulesDocument18 pagesFundamental RulesrakeshNo ratings yet

- Leave 25032013 PDFDocument7 pagesLeave 25032013 PDFprasannandaNo ratings yet

- 10 - 22011993admn - PrintDocument8 pages10 - 22011993admn - PrintPraveen BabuNo ratings yet

- Public Service Updates: Pension RulesDocument45 pagesPublic Service Updates: Pension RulesAbc DefNo ratings yet

- Fundamental RulesDocument60 pagesFundamental RulesabidjeeNo ratings yet

- Foreign Service Central Govt1Document14 pagesForeign Service Central Govt1Eepod BcNo ratings yet

- The General Provident Fund Rules, Svt. 1981Document37 pagesThe General Provident Fund Rules, Svt. 1981Avik BanerjeeNo ratings yet

- G.O. No. 9008-F (P)Document3 pagesG.O. No. 9008-F (P)Sumit GuptaNo ratings yet

- Short Title and CommencementDocument10 pagesShort Title and CommencementRaj KrNo ratings yet

- Terms Used in The Pension Rules ExplanationDocument41 pagesTerms Used in The Pension Rules Explanationfareha riazNo ratings yet

- 13Document43 pages13Rakesh Ranjan0% (1)

- Budget Circular No. 2017-2 PDFDocument7 pagesBudget Circular No. 2017-2 PDFTesa GDNo ratings yet

- Government of Rajasthan Finance Department (Rules Division) F. 6 (5) FD (Ru Les Jaipur, Dated: Order Sub: Grant of Ad"hoc Bonus To State Government Employees For The Financial YearDocument4 pagesGovernment of Rajasthan Finance Department (Rules Division) F. 6 (5) FD (Ru Les Jaipur, Dated: Order Sub: Grant of Ad"hoc Bonus To State Government Employees For The Financial YearSurya PareekNo ratings yet

- Retirement BenefitsDocument9 pagesRetirement BenefitsSandeep SavarkarNo ratings yet

- The Payment of Gratuity Act, 1972: Prof. Priyanka NagoriDocument21 pagesThe Payment of Gratuity Act, 1972: Prof. Priyanka Nagorishilpatiwari1989No ratings yet

- Family Dependents RuleDocument3 pagesFamily Dependents RuleRMC New DelhiNo ratings yet

- MP Civil Services Leave RulesDocument17 pagesMP Civil Services Leave RulessanjaysonerNo ratings yet

- Pension RulesDocument39 pagesPension RulesSharafatAliNo ratings yet

- CENTRAL CIVIL SERVICES - Department of Personnel & TrainingDocument40 pagesCENTRAL CIVIL SERVICES - Department of Personnel & Trainingprotyai chowdhuryNo ratings yet

- The All India Services (Leave) RulesDocument29 pagesThe All India Services (Leave) RulesRenuka Prasad A100% (1)

- Pension Regulations01995 NewDocument61 pagesPension Regulations01995 Newprabha sureshNo ratings yet

- 2010fin - MS160 (1) 7 5 10Document5 pages2010fin - MS160 (1) 7 5 10SEKHAR100% (1)

- PRB Reading MaterialDocument77 pagesPRB Reading MaterialGK TiwariNo ratings yet

- UP Agrarian & Social LegislationDocument29 pagesUP Agrarian & Social LegislationJesa FormaranNo ratings yet

- GPF RulesDocument23 pagesGPF RulesMuhammad AliNo ratings yet

- 1 1 Employees PF ActDocument9 pages1 1 Employees PF ActSudha SatishNo ratings yet

- ESIC Act, RulesDocument50 pagesESIC Act, RulesmanishsoniesicinNo ratings yet

- The Prescribed Leave Rules, 1959Document6 pagesThe Prescribed Leave Rules, 1959ENGR ABRAR IMTIAZNo ratings yet

- SR L eDocument12 pagesSR L eIshtiaq AhmadNo ratings yet

- EPF ActDocument5 pagesEPF ActRajpreet kaur KadambNo ratings yet

- AIS (Leave) RulesDocument13 pagesAIS (Leave) RulesRoop KumarNo ratings yet

- Short Title, Commencement and Application. - (: 2. Definitions. - (Document15 pagesShort Title, Commencement and Application. - (: 2. Definitions. - (Mukul Lal MazumderNo ratings yet

- Leave Rules in EnglishDocument8 pagesLeave Rules in EnglishTeachersbadi Prakash VemulaNo ratings yet

- Social Legislation (The Government Service Insurance System Act of 1997 Summary)Document7 pagesSocial Legislation (The Government Service Insurance System Act of 1997 Summary)Maestro LazaroNo ratings yet

- FORM IXA Abstract of The Minimum Wages Act, 1948Document7 pagesFORM IXA Abstract of The Minimum Wages Act, 1948Avinash Kumar PandeyNo ratings yet

- Central Civil Services (Leave Travel Concession) Rules, 1988Document7 pagesCentral Civil Services (Leave Travel Concession) Rules, 1988serekant guptaNo ratings yet

- BSNL Employees Superannuation Pension Trust Rules RulesDocument15 pagesBSNL Employees Superannuation Pension Trust Rules RulesswapanNo ratings yet

- Contractual Employess BillDocument6 pagesContractual Employess BillRupinder kaurNo ratings yet

- Ccs LTC Rules 1988Document36 pagesCcs LTC Rules 1988Upendra Pratap SinghNo ratings yet

- 1he Gazelte of India: ExtraordinaryDocument10 pages1he Gazelte of India: ExtraordinaryprasannandaNo ratings yet

- Labour Laws - Part 1 (PF)Document33 pagesLabour Laws - Part 1 (PF)samarth agrawalNo ratings yet

- The Comptroller and Auditor-General'S (Duties, Powers and Conditions of Service) Act, 1971Document14 pagesThe Comptroller and Auditor-General'S (Duties, Powers and Conditions of Service) Act, 1971Aishwarya SivaramNo ratings yet

- Yeoh Poh HongDocument17 pagesYeoh Poh HongsierraNo ratings yet

- Stronghold v. CADocument9 pagesStronghold v. CAmonagbayaniNo ratings yet

- Henry Lamb Columns in 1998Document50 pagesHenry Lamb Columns in 1998dyahshalindriNo ratings yet

- Bail Petition of Tarun TejpalDocument6 pagesBail Petition of Tarun TejpalLive LawNo ratings yet

- Petition Under Art.186-Draft.ADocument8 pagesPetition Under Art.186-Draft.AObaidullah AbidNo ratings yet

- Evaluation of Dying Declaration - Recent Judicial PerspectivesDocument6 pagesEvaluation of Dying Declaration - Recent Judicial PerspectivesRiya LalNo ratings yet

- KK Luthra Respondent PDFDocument9 pagesKK Luthra Respondent PDFSoumiki GhoshNo ratings yet

- Almagro, Samar (Western Samar)Document2 pagesAlmagro, Samar (Western Samar)SunStar Philippine NewsNo ratings yet

- Comparative Constitutional Law Project On: Comparative Study of Veto Power Exercised by President in Various CountriesDocument15 pagesComparative Constitutional Law Project On: Comparative Study of Veto Power Exercised by President in Various Countriesankit nandeNo ratings yet

- Sexual Offences EssayDocument3 pagesSexual Offences EssayElaine TanNo ratings yet

- Manafort-Kilimnik Superseding Indictment 060818Document32 pagesManafort-Kilimnik Superseding Indictment 060818Geoffrey Rowland100% (1)

- Salmorin v. ZaldivarDocument1 pageSalmorin v. ZaldivarjenizacallejaNo ratings yet

- People v. DecenaDocument7 pagesPeople v. DecenaAndrei Anne PalomarNo ratings yet

- OP19 Appendix 1: ICNDT Multilateral Agreement On Recognition of NDT Personnel CertificationDocument3 pagesOP19 Appendix 1: ICNDT Multilateral Agreement On Recognition of NDT Personnel CertificationShami MudunkotuwaNo ratings yet

- Payment of Gratuity ActDocument39 pagesPayment of Gratuity ActParul PrasadNo ratings yet

- Abi/nyu Bankruptcy and Business Reorganization WorkshopDocument97 pagesAbi/nyu Bankruptcy and Business Reorganization WorkshopszundellNo ratings yet

- People Vs NunezDocument5 pagesPeople Vs Nunezshaye587No ratings yet