Professional Documents

Culture Documents

The Impact of External Debt On Economic Growth in Egypt 1

Uploaded by

Walaa IbrahimOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Impact of External Debt On Economic Growth in Egypt 1

Uploaded by

Walaa IbrahimCopyright:

Available Formats

Oct 2022

The Impact of External Debt on Economic

Growth in Egypt During (1990-2019)

The Impact of External Debt on Economic Growth in Egypt Page 1 of 8

Oct 2022

Contents

1. INTRODUCTION (1)........................................................................................................................... 3

2. DEFINITION OF EXTERNAL DEBT (1)..................................................................................................3

3. THE CAUSES OF THE EXTERNAL DEBT CRISIS'S ESCALATION (1)..........................................................4

3.1 Internal Factors............................................................................................................................... 4

3.2 External Factors.............................................................................................................................. 5

4. THE NEGATIVE EFFECTS OF EXTERNAL DEBT (1)..............................................................................6

4.1 Economic Effects of External Debt..................................................................................................6

4.1.1 Impact on economic growth......................................................................................................6

4.1.2 Impact on exports:.................................................................................................................... 6

4.1.3 Impact on leveraging domestic savings....................................................................................7

4.1.4 Impact on inflation.................................................................................................................... 7

4.2 Political Effects of External Debt......................................................................................................8

4.3 Social Effects of External Debt........................................................................................................8

5. EGYPT'S EXTERNAL DEBT.............................................................................................................. 9

5.1 Egypt’s External Debt Evolution (2)...................................................................................................9

5.2 Reasons Behind Egypt's Reliance on External Debt (2)..................................................................10

5.3 The External Debt Indicators......................................................................................................... 11

5.3.1 External debt to GDP ratio: (3).................................................................................................12

5.3.2 External debt to Goods and Services Exports ratio: (3)............................................................13

5.3.3 Average Percentage of External Debt Per Person (2)..............................................................14

6. CONCLUSION (2)............................................................................................................................ 14

7. REFERENCES:.............................................................................................................................. 15

List of Figures:

FIGURE 1: PERCENTAGE OF EXTERNAL DEBT TO GDP- EGYPT- BASED ON MACROTRENDS SITE...........................................12

The Impact of External Debt on Economic Growth in Egypt Page 2 of 8

Oct 2022

FIGURE 2: PERCENTAGE OF EXTERNAL DEBT TO GOOD AND SERVICES EXPORTS- EGYPT - BASED ON MACROTRENDS

SITE.............................................................................................................................................................. 13

1. INTRODUCTION E RROR: REFERENCE SOURCE NOT FOUND

The third world countries have been declining for more than twenty years despite having unlimited

natural and human resources that could elevate them to the ranks of wealthy nations and prevent the

repayment of debts, which have grown significantly, from allowing their peoples to meet the most

basic needs.

In order to impede any economic development in third world nations, religion has evolved into a

complex system of dominance and a modern tool of colonialism. The creditors frequently have more

influence over the governments of debtor nations than do the parliaments of those nations.

Management of debt is crucial for economic expansion. Stability in the macro- and micro-economies

can be facilitated by effective debt management. Due to the record-high levels of public debt at the

global level, it is now necessary to evaluate how governments' current borrowing practices will affect

their economies in the long run as well as how well they will be able to pay back the principal and

debt obligations. Creditors must also plan ahead for potential risks and modify their financing

requirements accordingly. Make sure that debt stays within a manageable range in order to promote

economic expansion.

In order to achieve economic growth to better people's lives, the issue of external debt in Egypt will

be studied in the context of Egypt's economic history from (1990–2019) in order to throw light on the

degree of its impact on economic growth.

2. DEFINITION OF EXTERNAL DEBT E RROR: REFERENCE SOURCE NOT FOUND

Throughout their development processes, most nations encounter a variety of issues that are unique

to each nation and depend on its circumstances and capacity, which brings them to the issue of

external funding. This is because of a number of factors, some of which led to its development and

others of which increased its complexity. A tool for filling the resource gap is external debt. domestic,

including those caused by a decline in the value of exports compared to the value of imports.

External debt is not regarded as a recent phenomena; rather, it is an old phenomenon that dates

back to the first half of the nineteenth century, and resorting to external borrowing was not a

phenomenon that was exclusive to third-world nations. in the 19th century.

The International Monetary Fund, the World Bank, the Organization for Economic Cooperation and

Development, and the Bank for International Settlements formed a working group in 1984 to develop

The Impact of External Debt on Economic Growth in Egypt Page 3 of 8

Oct 2022

a unified definition of external indebtedness, which was published in its annual report and is as

follows: "The total external debt on a given date is equal to the amount of the current contractual

obligations of the country.

3. THE CAUSES OF THE EXTERNAL DEBT CRISIS'S ESCALATION E RROR: REFERENCE SOURCE NOT FOUND

Developing nations attempt to use external debt to finance the public budget deficit and achieve

economic development without creating strategies that will allow them to be ready for repayment. The

external debt crisis is caused by the interruption of capital flows from the borrowing countries to the

creditors, and this interruption is caused by the borrowing countries' inability to meet their external

obligations. The majority of these nations used an industrialization strategy that focused on

developing industries producing leisure-related consumer goods that benefited high-income

individuals as well as serving the interests and goals of global foreign corporations rather than

producing goods to replace imports of necessary and productive goods.

It causes a deficit in the balance of payments of these countries, which ultimately causes their

external debts to rise and may cause a delay in their economic growth. Additionally, internal and

external factors interact to exacerbate the external debt problem. The following are those of these

factors that stand out the most:

3.1 Internal Factors

Borrowing for economic development and reform

Developing nations aspire to stay up with progress and create an infrastructure that can support the

national projects required for economic success. Poor planning, which is one of the most significant

failures of projects and consequently the inability to pay the instalments and interest of those debts, is

the main subject of this article's discussion of payment methods, which may cause a worsening of the

external debt problem.

Ineffective handling of external debt

The result is an increase in loans beyond their own needs, the lack of a long-term strategy for

borrowing from abroad, and the absence of an appropriate timetable for repaying the instalments of

these debts. Countries dither into borrowing without coordination with their competent bodies and

flounder in how to direct these funds.

The lack of available local funding alternatives

Selling bonds on the local market is a crucial tool for financing expenditure deficits, but developing

nations have trouble accumulating domestic savings since the bond market is ineffective at covering

the high rates of fiscal deficits these nations experience

The Impact of External Debt on Economic Growth in Egypt Page 4 of 8

Oct 2022

Ignorance about the agricultural industry

Agriculture plays a big role and an effective impact on the dimensions of sustainable development,

contributes significantly to the gross domestic product, and attracts investments. Imports rise as a

result of emerging nations' disregard for this sector in order to provide agricultural needs. The

industrial sector in developing countries may get the majority of their loans, as it demands enormous

resources. Whereas an increase in external indebtedness results from the issue of financing

agricultural imports and devoting a sizable portion to the industrial sector and a lack of interest in the

agricultural sector.

Deficit in the balance of payments

When industrial imports exceed exports, there is a balance of payments imbalance, which forces

countries to borrow to close the gap and attempt to restore the trade balance. This is an obvious

cause of the rise in these countries' external debt.

3.2 External Factors

LOW DEMAND FOR RAW MATERIALS WORLDWIDE

The terms of trade for the nations exporting these goods deteriorated due to the drop in raw material

prices, which worsened the balance of payments deficit and increased the propensity for external

borrowing. as a result of the decline in the value of exports of goods, in the balance of payments.

INCREASED COST OF OIL IN 1973

As a result of the rise in oil prices between 1974 and 1973, more non-oil producing countries received

net loans from international financial markets to help close their current account deficits, and starting

in 1976, their net debt to foreign banks and bond markets also rose. Its drop since 1985 has also

contributed to the worsening of the economic crisis in emerging nations, particularly in those that

produce oil, as the majority of them are burdened with substantial foreign debts. paying off her unpaid

debt service

REDUCED SUPPORT FROM DEVELOPED NATIONS

Due to their reliance on rich nations' aid, developing nations are more likely to need to borrow money

to pay back the soft loans these nations have given them.

CAPITAL FLIGHT

The crisis of developing countries' external indebtedness emerged as a result of the capital flight to

international financial centers in the form of various deposits, which left local banks short of funds.

While resources accumulated in these centers, they are now lending them to emerging nations with

pricing restrictions, and in many cases, commercial invoices are fabricated as a means of smuggling

capital.

The Impact of External Debt on Economic Growth in Egypt Page 5 of 8

Oct 2022

IMPORTED INFLATION AS WELL AS STAGFLATION

The industrialised countries' stagflationary crisis forced them to lower the rates on their soft loans to

developing nations, and the monetary and financial steps they took to address the crisis resulted in

an increase in the developing nations' dependency on private sources of financing. The unusually

high interest rates on savings deposits have contributed to the rise in loan interest rates. which

caused the burden of debt service to gradually and noticeably increase, which in turn caused several

nations to reschedule their loans. Imported inflation significantly contributes to the escalation of the

debt issue; In economic crises where developing countries tend to follow the nations from whom they

import goods and services, inflation in the prices of those imports leads to the escalation of the

external imbalance, which increases their demand for external funding.

4. THE NEGATIVE EFFECTS OF EXTERNAL DEBT E RROR: REFERENCE SOURCE NOT FOUND

External debts have a variety of effects; however, they differ from one country to another. Perhaps

the nature of the debts and the terms of payment, in addition to the state's handling of debts, account

for the disparate outcomes brought on by these loans. But in general, debts that exceed the state's

ability to control them and that they accumulate along with turn all points and effects negatively,

adding to the state's debt load.

4.1 Economic Effects of External Debt

4.1.1 Impact on economic growth

The excessive debt theory emphasizes how debt has a negative effect on growth by slowing capital

accumulation. As debt increases, investors' expectations of returns decrease because they anticipate

tax increases to pay off debts. This deters both domestic and foreign investors and reduces capital

accumulation. Due to the ambiguity surrounding which portion of the debt will be paid using the

resources of the state, investors in highly indebted countries rescind their investment decisions. A tiny

portion of the export profits will be left over for investment and economic growth if a significant portion

is needed to pay off the foreign debt.

Debt significantly impacts public spending, which includes social, health, and educational services,

which in turn negatively impacts human capital and, in turn, investment decisions and economic

growth. This is how debt indirectly affects economic growth.

4.1.2 Impact on exports:

The Impact of External Debt on Economic Growth in Egypt Page 6 of 8

Oct 2022

In reality, debt servicing is a deduction made from the loan's proceeds and principle that will later be

repaid to the creditors. As a result of this heavy load, the surplus balances of payments are put under

further strain, the foreign debt to GDP ratio rises, and the rising debt service ratio may eventually

force domestic economic sectors to transfer money from abroad. The most significant portion of these

industries will not receive investment, which will have a direct negative impact, as a result of not

saving it due to the future worry of paying off this debt.

4.1.3 Impact on leveraging domestic savings

A portion of the income is reduced by leakages that do not increase this national income to cover the

costs of debt service, which are represented by debt payments. As a result, this burden reduces

overall savings and prevents the most crucial sector of the economy, investment, from benefiting from

it. The marginal sufficiency of capital will be weakened by taking out an external loan with a high

interest rate, which will reduce the demand for capital and run counter to what is intended. With

respect to the needs of development, domestic savings, or the ability of the state to meet its

obligations abroad, will sometimes be positively impacted by an increase in interest rates, but this will

also have a negative impact on local economies.

4.1.4 Impact on inflation

Numerous studies support the notion that there is a direct link between foreign debt and the large rise

in the average level of prices in the debtor countries. Given that there are other objective variables

like structural imbalance and monetary and financial policies, the rise in these countries' external

indebtedness may therefore only partially account for the sharp rise in the general level of prices.

One of the variables that explains the phenomena of inflation is expansion. Following is the link

between inflation and external debt:

- When the process of reimbursing external debt services begins, prices often increase, particularly if

the projects that were funded by external loans are not performing to their full potential, which is often

in developing nations.

- Many studies and reports confirm that the prices of these products sometimes increased by more

than 100%, given that the supplier finds himself in a state of monopoly, which results in a decrease in

power, because most loans are conditioned on the supply of semi-manufactured or capital goods

from the lending country. acquisition of the loan.

- Since it results in a reduction in the supply of goods, the state's limited ability to import due to the

rising cost of servicing its external debt has the biggest influence on the growth in the prices of

essential commodities and the upkeep and renewal of its production equipment.

The Impact of External Debt on Economic Growth in Egypt Page 7 of 8

Oct 2022

4.2 Political Effects of External Debt

Even though political colonialism may have subsided, its economic form is growing more and more

powerful. The need for financial resources and monetary liquidity in these countries has been

exploited by the creditor countries and international financial organizations, who have found a clear

way to meddle in the affairs of the poor debtor countries. This opens the door for the rich to exert

control over the poor in order to enact policies that serve their interests.

The intervention has started in state affairs as a means to protect the interests of the colonial

capitalist states and their citizens abroad. The intervention is by actual pressure exerted by one or

several countries on another country, with the intent of forcing it to do an action, refrain from doing or

to desist from certain behaviours that are against the special interests of countries or their subjects.

The risk of exacerbating foreign debts does not stop at the economic and social borders, but rather

extends beyond exposing the freedom of the maker. This is one of the most significant negative

effects of foreign debt in developing countries because it worsens the extent of foreign interference in

those countries, negatively impacts political decision-making, and exposes it to more pressures. The

political choice results in increased pressure and outside involvement.

4.3 Social Effects of External Debt

Foreign debts have an impact on more than just the economic and political spheres; they also have

an impact on how people relate to one another socially, since they have an impact on

intergenerational fairness. The following generation must shoulder the costs of servicing these loans

without access to new resources, thus in order to pay for the services they require, in addition to

investing and boosting growth rates, deductions must be made from the available money. This is in

contrast to the conditions imposed on the countries borrowed by some organizations, including the

International Monetary Fund, which have strictly economic objectives and affect social aspects if

countries do not develop policies to protect those with low incomes. These conditions include harsh

financial policies on citizens to service the debt from high taxes, raising subsidies without regard to

social aspects, and the deterioration of living standards.

The Impact of External Debt on Economic Growth in Egypt Page 8 of 8

You might also like

- The Impact of External Debt On Economic Growth in Egypt 2Document9 pagesThe Impact of External Debt On Economic Growth in Egypt 2Walaa IbrahimNo ratings yet

- Ethiopia Public Debt Portfolio Analysis No 21 - 2019-20Document82 pagesEthiopia Public Debt Portfolio Analysis No 21 - 2019-20Mk FisihaNo ratings yet

- (9798400208591 - Policy Papers) Volume 2022 (2022) : Issue 019 (Apr 2022) : Making Debt Work For Development and Macroeconomic StabilityDocument32 pages(9798400208591 - Policy Papers) Volume 2022 (2022) : Issue 019 (Apr 2022) : Making Debt Work For Development and Macroeconomic StabilityA'Him Kridsada ThirasophonNo ratings yet

- Ethical Issues in International Lending': BemardsnoyDocument6 pagesEthical Issues in International Lending': Bemardsnoyটিটু হকNo ratings yet

- Debt - and Reserve-Related Indicators of External VulnerabilityDocument54 pagesDebt - and Reserve-Related Indicators of External VulnerabilityMuhammad Abubakar RiazNo ratings yet

- China's Belt and Road Initiative and It's International Consequences.From EverandChina's Belt and Road Initiative and It's International Consequences.No ratings yet

- PA00JM49Document30 pagesPA00JM49Bereket MekonnenNo ratings yet

- PPEA2021022Document15 pagesPPEA2021022Ivan LessiaNo ratings yet

- Mid SemDocument11 pagesMid SemUdeshi ShermilaNo ratings yet

- Discussion Note 3-Private Sector Creditors - Hle FFD Covid-5-25-20Document5 pagesDiscussion Note 3-Private Sector Creditors - Hle FFD Covid-5-25-20Vladimir Soria FreireNo ratings yet

- Decoding The Debt SustainabilityDocument4 pagesDecoding The Debt Sustainabilityjoy haqueNo ratings yet

- External Debt ManagementDocument55 pagesExternal Debt Managementajayajay83No ratings yet

- Debt Sustainability Indicators Rogerio Ossemane PDFDocument48 pagesDebt Sustainability Indicators Rogerio Ossemane PDFaakhyar_2No ratings yet

- 1211Document201 pages1211Angel CapellanNo ratings yet

- Illicit Financial Flows From Africa GFI ReportDocument44 pagesIllicit Financial Flows From Africa GFI Reportmpd20009No ratings yet

- A Growth Programme For EuropeDocument28 pagesA Growth Programme For EuropeEKAI CenterNo ratings yet

- Revisiting The Debt Sustainability Framework For Low-Income CountriesDocument70 pagesRevisiting The Debt Sustainability Framework For Low-Income CountriesJustin TalbotNo ratings yet

- México External Debt: Which Would Be Its Evolution Through Time?Document18 pagesMéxico External Debt: Which Would Be Its Evolution Through Time?vioextra1706No ratings yet

- Debt Policy StatementDocument50 pagesDebt Policy StatementMahreen EllahiNo ratings yet

- Informe de La UNCTADDocument16 pagesInforme de La UNCTADTélamNo ratings yet

- From The Great Lockdown To The Great Meltdown:: Developing Country Debt in The Time of Covid-19Document16 pagesFrom The Great Lockdown To The Great Meltdown:: Developing Country Debt in The Time of Covid-19Teymur DadashovNo ratings yet

- Informe de La UNCTADDocument16 pagesInforme de La UNCTADTélamNo ratings yet

- Deuda de Los Paises en Desarrollo en El Tiempo de Covid-19 UNCADDocument16 pagesDeuda de Los Paises en Desarrollo en El Tiempo de Covid-19 UNCADCristianMilciadesNo ratings yet

- Report of the Inter-agency Task Force on Financing for Development 2020: Financing for Sustainable Development ReportFrom EverandReport of the Inter-agency Task Force on Financing for Development 2020: Financing for Sustainable Development ReportNo ratings yet

- Course Work. Economics.Document22 pagesCourse Work. Economics.Alexandra GerasimovaNo ratings yet

- Deuda 2020Document40 pagesDeuda 2020Maria Concepcion Peralta BosoNo ratings yet

- Global Financial Development Report 2019/2020: Bank Regulation and Supervision a Decade after the Global Financial CrisisFrom EverandGlobal Financial Development Report 2019/2020: Bank Regulation and Supervision a Decade after the Global Financial CrisisRating: 5 out of 5 stars5/5 (2)

- The Level and Composition of Public Sector Debt in Emerging Market CrisesDocument35 pagesThe Level and Composition of Public Sector Debt in Emerging Market CrisesTBP_Think_TankNo ratings yet

- Final Project CompDocument81 pagesFinal Project Compshahsam17No ratings yet

- Case Study Solution: Future of World Bank and IMFDocument5 pagesCase Study Solution: Future of World Bank and IMFJithu Jose ParackalNo ratings yet

- Somalia Economic Update Impact of COVID 19 Policies To Manage The Crisis and Strengthen Economic RecoveryDocument64 pagesSomalia Economic Update Impact of COVID 19 Policies To Manage The Crisis and Strengthen Economic Recoveryabdiasis mohamed karimNo ratings yet

- Middle East and North Africa Economic Monitor October 2015: Inequality, Uprisings, and Conflict in the Arab WorldFrom EverandMiddle East and North Africa Economic Monitor October 2015: Inequality, Uprisings, and Conflict in the Arab WorldNo ratings yet

- Whose Debt Is ItDocument32 pagesWhose Debt Is ItSimranNo ratings yet

- The Effect of External Debt on Economic GrowthDocument50 pagesThe Effect of External Debt on Economic GrowthmustafaNo ratings yet

- An Empirical Investigation Into The Determi-Nants of External IndebtednessDocument17 pagesAn Empirical Investigation Into The Determi-Nants of External IndebtednessFaiza DjaouiNo ratings yet

- 04 - Vandemoortele (2009) Within-Country InequilityDocument24 pages04 - Vandemoortele (2009) Within-Country InequilityRéka NagyNo ratings yet

- Hipc WP Sovereign DebtDocument69 pagesHipc WP Sovereign DebtHenry MichealNo ratings yet

- Econ 157 - Homework II. 11Document6 pagesEcon 157 - Homework II. 11BrimerNo ratings yet

- Economic Development EssayDocument15 pagesEconomic Development EssayPhúc HoàngNo ratings yet

- Global Monitoring Report 2014/2015: Ending Poverty and Sharing ProsperityFrom EverandGlobal Monitoring Report 2014/2015: Ending Poverty and Sharing ProsperityNo ratings yet

- The Sustainable Development Goals 2023 Progress Report 1689343825Document80 pagesThe Sustainable Development Goals 2023 Progress Report 1689343825Ali ShehadehNo ratings yet

- Debt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair SiddiquiDocument38 pagesDebt Management in Pakistan: Presented by Hira Wahla Saeed Ansari Atika Imtiaz Umair Siddiquiumair_siddiqui89No ratings yet

- Chapter 13Document3 pagesChapter 13Hazell DNo ratings yet

- Principles For Effective Insolvency and Creditor and Debtor RegimesDocument44 pagesPrinciples For Effective Insolvency and Creditor and Debtor Regimesrmprskgwk5No ratings yet

- Global Financial Development Report 2015/2016: Long-Term FinanceFrom EverandGlobal Financial Development Report 2015/2016: Long-Term FinanceNo ratings yet

- DPS 2015 16Document40 pagesDPS 2015 16Khizar Khan JiskaniNo ratings yet

- International Capital Flows:: Structural Reforms and Experience With The OECD Code of Liberalisation of Capital MovementsDocument22 pagesInternational Capital Flows:: Structural Reforms and Experience With The OECD Code of Liberalisation of Capital MovementsAnonymous mn1IapOQ2TNo ratings yet

- Ioscopd127 230411 154829Document123 pagesIoscopd127 230411 154829sompasongNo ratings yet

- How Should We Think About Debt Capital Markets Today? ESG’s Effect On DCMFrom EverandHow Should We Think About Debt Capital Markets Today? ESG’s Effect On DCMNo ratings yet

- Paper 1 - Ver3 - Final Debt Profile GA - AG August FINAL 2023Document28 pagesPaper 1 - Ver3 - Final Debt Profile GA - AG August FINAL 2023AlemayehugedaNo ratings yet

- Transformation of Developing Economy Debt Under Financial Capital: Effects of Financial Growth On Developing Economies Since The 1970sDocument15 pagesTransformation of Developing Economy Debt Under Financial Capital: Effects of Financial Growth On Developing Economies Since The 1970sSaumil SharmaNo ratings yet

- Foreign Aid For DevelopmentDocument24 pagesForeign Aid For DevelopmentMukund GuptaNo ratings yet

- Annual Public Debt Report 2018-2019Document55 pagesAnnual Public Debt Report 2018-2019Olympus MonsNo ratings yet

- Fe 2108 2208 0525Document34 pagesFe 2108 2208 0525Amir Ali KhanNo ratings yet

- External Debt Accumulation and Its Impact On Economic Growth in PakistanDocument17 pagesExternal Debt Accumulation and Its Impact On Economic Growth in PakistankalaNo ratings yet

- India External Debt Problem Unit-4Document12 pagesIndia External Debt Problem Unit-4VINUS DHANKHARNo ratings yet

- Two Major Issues of Fiscal Policy and Potential Harms To The EconomyDocument10 pagesTwo Major Issues of Fiscal Policy and Potential Harms To The Economysue patrickNo ratings yet

- Capital Budgeting and Economic Development in The Third World: The Case of NigeriaDocument26 pagesCapital Budgeting and Economic Development in The Third World: The Case of NigeriaAdeyeye davidNo ratings yet

- Cash Management ModelsDocument2 pagesCash Management ModelsyukesrajaNo ratings yet

- ATDC Annual Review 2018 Web PDFDocument68 pagesATDC Annual Review 2018 Web PDFPiyooshNo ratings yet

- Knowledge Managment BiaDocument18 pagesKnowledge Managment BiaAbhinav PandeyNo ratings yet

- Christina Hudnall, SPHR, SHRM, Joins Impec Group As Senior Vice President of Human Resources & StaffingDocument2 pagesChristina Hudnall, SPHR, SHRM, Joins Impec Group As Senior Vice President of Human Resources & StaffingPR.comNo ratings yet

- Trade UnionDocument14 pagesTrade UnionSaurabh KhandaskarNo ratings yet

- Audit Cum Risk Compliance Officer, Provisional ResultDocument15 pagesAudit Cum Risk Compliance Officer, Provisional ResultWAQAS AHMEDNo ratings yet

- Compensation Package Offered by The Multinational Companies/Bank in Bangladesh QuestionnairesDocument6 pagesCompensation Package Offered by The Multinational Companies/Bank in Bangladesh QuestionnairesS.E ChowdhuryNo ratings yet

- 1-Delivering Quality Services of SME-Based Construction Firms in The Philippines PDFDocument6 pages1-Delivering Quality Services of SME-Based Construction Firms in The Philippines PDFjbjuanzonNo ratings yet

- Rural Marketing 260214 PDFDocument282 pagesRural Marketing 260214 PDFarulsureshNo ratings yet

- Accounting For ManagersDocument2 pagesAccounting For ManagersAnbazhagan AjaganandaneNo ratings yet

- Staffing: Why Is Staffing Essential?Document2 pagesStaffing: Why Is Staffing Essential?ARISNo ratings yet

- Financing of Textile Industry in IndiaDocument72 pagesFinancing of Textile Industry in IndiaPooja Bindal100% (1)

- IoBM Catalog 2021 2022Document205 pagesIoBM Catalog 2021 2022Yashal AlamNo ratings yet

- 2018 Coleman Tax Return PDFDocument46 pages2018 Coleman Tax Return PDFJonathan Brinton100% (1)

- BBMC 1113 Management Accounting: Distinguish Between A "Prime Cost" and A "Production Overheads Cost"Document2 pagesBBMC 1113 Management Accounting: Distinguish Between A "Prime Cost" and A "Production Overheads Cost"王宇璇No ratings yet

- Gri Content Index Template 2021Document12 pagesGri Content Index Template 2021BrototiNo ratings yet

- Blinc 360 and Ajna TechDocument14 pagesBlinc 360 and Ajna TechAlkame IncNo ratings yet

- Tutorial 7 QsDocument4 pagesTutorial 7 QsDylan Rabin PereiraNo ratings yet

- Resume of Flora BaruaDocument4 pagesResume of Flora BaruaFLORA BARUANo ratings yet

- Ing Mt940 Structured Format DescriptionDocument61 pagesIng Mt940 Structured Format DescriptionDHL123No ratings yet

- Roshini Project ReportDocument68 pagesRoshini Project ReportPavithra SaravananNo ratings yet

- Gulayan Sa Paaralan 2023 Project ProposalDocument3 pagesGulayan Sa Paaralan 2023 Project ProposalP Olarte ESNo ratings yet

- Pricing Strategy and Growth of Dmart - Project (1) UpdatedDocument17 pagesPricing Strategy and Growth of Dmart - Project (1) Updatednilesh.das22hNo ratings yet

- Compiled Report On Avery Denisson 1 PDFDocument33 pagesCompiled Report On Avery Denisson 1 PDFTashfiqur Rahman Khan 1411446630No ratings yet

- Fiib - Om - Process and Capacity AnalysisDocument9 pagesFiib - Om - Process and Capacity AnalysisCherin SamNo ratings yet

- BIS Loan Request for $200K Warehouse ExpansionDocument4 pagesBIS Loan Request for $200K Warehouse ExpansionOscar Arana50% (2)

- KFC Matrics in PakistanDocument3 pagesKFC Matrics in PakistanSuleman Iqbal BhattiNo ratings yet

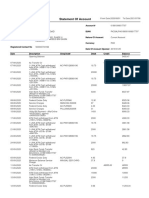

- 'Account StatementDocument11 pages'Account StatementSikander Qazi100% (2)

- Jun Freolo Figueroa STDocument3 pagesJun Freolo Figueroa STwarlitopadernaNo ratings yet

- Reliance Industries' Naphtha Swap DealDocument4 pagesReliance Industries' Naphtha Swap DealPrabha ArunNo ratings yet