Professional Documents

Culture Documents

Business Law Ass

Uploaded by

tseguCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Law Ass

Uploaded by

tseguCopyright:

Available Formats

INFOLINK UNIVERSITY COLLAGE HAWASSA CAMPAUS 2020

1) Discuss the meaning and attributes of personality in comparison with non-persons?

A person, in the first instance, is a human being who is individual member of the society and it also refers

to an entity (such as a corporation) that is recognized by law as having the rights and duties of a human

being. A person is any being whom the law regards as capable of rights and duties. Any being that is so

capable is a person, whether a human being or not, and no being that is not so capable is a person, even

though he be a man. Persons are the substances of which rights and duties are the attributes. It is only in

this respect that persons possess juridical significance, and this is the exclusive point of view from which

personality receives legal recognition. Or hence, a person is a being or an entity that possesses rights and

duties or is a subject of rights and duties before the eyes of the law.

Legal personality is the legal status of one regarded by the law as a person: the legal conception (device)

by which the law regards a human being or an artificial entity as a person. It is a particular device by

which the law creates or recognizes units to which it ascribes certain powers and capacities.

Legal personality is the attribute feature of being the subject of rights and duties before the eyes of the

law. If one is the subject of rights and duties it is a person and the process is called personality.

The Attribute Features of Legal Personality

By the attribute features of legal personality we are referring to those characteristics or attributes that

distinguish beings endowed with legal personality from beings with no legal personality. Accordingly, the

following are the typical attribute features of legal personality:

The right to have a name (to be named) to be identified by it. If one is not a person s/he does not

meaningfully cause use of their name. In Ethiopia we follow a three degree naming scheme,

which is consecutively, First Name, Father’s Name and Grand Father’s name.

The ability to sue or be sued by its own name.

The ability to own and administer property, whether the property is movable or immovable;

tangible or intangible.

The ability to engage in a Juridical Act (an act to be effected by the law), such as concluding a

contract, issuing of a WILL and so on.

The obligation (duty) to be pay taxes as per the conditions prescribed by law.

2) Briefly discus the difference between violating the essential element of contract and non-

performance of contract?

A contract is any agreement enforceable by law. You should never enter into a contract without

understanding the legal responsibilities involved. Not all agreements are contracts, however. A Son’s

promise to take the garbage to the curb before his father returned home is probably not a contract.

The six elements of a contract are offer, acceptance, genuine agreement, consideration, capacity, and

legality.

To be legally complete, a contract must include all six elements. Notice that the list does not include

anything written. Not all contracts have to be in writing to be enforceable.

Business Law Page 1

INFOLINK UNIVERSITY COLLAGE HAWASSA CAMPAUS 2020

Offer: is a proposal by one party to another intended to create a legally binding agreement.

Acceptance: is the second party’s unqualified willingness to go along with the first party’s proposal.

If a valid offer is met by a valid acceptance, a contract exists.

Genuine Consent: Some circumstances, such as fraud, misrepresentation, mistake, undue influence,

and economic duress, can destroy the genuineness of an agreement.

Capacity: The fourth element is the legal ability to enter a contract. The law generally assumes that

anyone entering a contract has the capacity, but this assumption can be disputed.

Consideration: the fifth element is the exchange of things of value. The parties to the contract should

exchange things of value to one another. If not, there is no consideration in that agreement.

Legality of Object: People cannot enter into contracts to commit illegal acts. Consequently, legality

is the final element of a contract.

The word valid means legally good, meaning that a valid contract is one that is legally binding. On the

other hand, a contract that is Void has no legal effect. An agreement that is missing one of the previously

discussed elements would be void, such as any agreement to do something illegal.

When a party to a contract is able to void or cancel a contract for some legal reason, it is a Voidable

contract. It is not void in itself but may be voided by one or more of the parties. A contract between two

minors, for example, could be voidable by either of them. An unenforceable contract is one the court will

not uphold, generally because of some rule of law, such as the statute of limitations. If you wait too long

to bring a lawsuit for breach of contract, the statute of limitations may have run its course, making the

contract unenforceable.

Non-performance of a contract refers to the failure of either one or both of the parties to perform

contractual obligations in conformity with the terms of the contract and the law. It is also called breach of

a contract.

The following are the major instances of non-performance:

This failure or breach may be total - where a party totally fails to honor the terms of a contract.

It may also be partial- where a party has performed his/her obligations only partly.

It may also relate to delay in performance.

Offering performance at a place other than the place agreed up on by the parties or at a place

fixed by law also constitutes non-performance.

Delivering a thing that non-conform to the contract or

Delivering a defective thing also amount to the breach of contract.

Moreover, an interruption of a successive delivery also amounts to non-performance.

3) Differentiate between special and general agent?

Business Law Page 2

INFOLINK UNIVERSITY COLLAGE HAWASSA CAMPAUS 2020

A general agent is a regular policy agent who is tied to selling insurance products and carriers of one

particular company.

Their main aim is to help insurance seekers to buy insurance products of their company.

A special agent is little different concept. Special agent is not to be confused with general agents as they

both have different objectives and authorities.

The concept of a special agent was felt necessary by companies in order to outperform the intense

competition in the market.

The job of a special agent is to seek people looking to buy insurance.

They have limited authorities i.e. a special agent is not authorized to sell insurance products to customers.

Their main aim is to find customers willing to buy insurance and help them to connect to the general

agent.

A general agent is the main agent for an agency with lots of agents or an agent who is the middleman

between the company and individual agents selling a product. I have never heard of a special agent in

regards to insurance only regular ordinary insurance agents. They are licensed to sell specific kinds of

insurance in a particular jurisdiction or multiple jurisdictions.

A general agent is a person authorized to transact every kind of business for his/her principal. S/he acts as

a representative of another, who has a mandate of general nature.

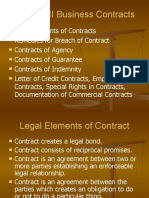

4) Explain the major distinction between companies and partnerships?

Partnership Company

Simple Organizational Structure Complex Organizational Structure

Low Startup Costs High Startup Cost

Liabilities Upon Members Liabilities of the Company

Taxation did on Individual Members Taxes did on the company and members

One cannot transfer shares One can easily transfer shares

End upon death, insanity, and insolvency of a member Can exist for a long time

Differences between Partnership and a Company

1. Structure of Partnership and a Company

One of the main differences between partnerships and companies is the formation structure. Companies

have a complex structure due to their large number of people involved in the formulation of the company.

The people forming the company include the shareholders who employ a management team to run the

company on their behalf. This means that a company has a complex organizational structure with

hierarchy a bureaucratic root in which decisions and instructions flow. On the other hand, a partnership

does not have a complex organizational structure because it involves two people combining their efforts

Business Law Page 3

INFOLINK UNIVERSITY COLLAGE HAWASSA CAMPAUS 2020

and strategies to offer goods and services to people. There are no structures in a partnership because the

owners make decisions, which influence the working of the partnership.

2. Startup Costs of Partnership and a Company

The other difference between partnerships and companies is the costs involved in the formation of these

types of businesses. Companies involve high costs of formulation due to the legal requirements that the

government puts in place to ensure that a company has met all the required fundamentals. It is important

to highlight that formulation of corporations include a lot of administration costs and complex tax

requirements. Besides, there are many employees involved in the formulation of a corporation, which

increases the cost of forming a company. This is not the same when it comes to the formulation of a

partnership. Partners are just required to register the business with state and obtain local or state business

licenses permits.

3. Liabilities of Partnership and a Company

Another difference between a company and a partnership is the issue of liability. For a partnership, the

owners of the organization are purely responsible for the liabilities of the organization. In case of the

dissolution of the partnership, the properties of the partner members will be taken to pay for the liabilities

of the partnership to pay the debts involving their company. Therefore, all the legal liabilities are

bestowed upon the partner members, which is one of the main disadvantages of a partnership. It is also

essential to note that partners include a partnership agreement, which states the percentage of the

partnership he or she owns. On the other hand, a company is a legal entity, which shields the owners of

the organization from being liable for the debts of the company. It is important to understand that owners

of the organization and other shareholders are not at risk of losing personal assets.

4. Business Taxation in Partnership and a Company

The method of taxation is another aspect that differentiates between a partnership and a company. A

partnership does not pay taxes as losses and profits are passed to the individual owners upon which they

pay the income taxes. It is worth noting that partners have to file a tax return which shows their share of

profit or loss from the partnership and other incomes upon which they are taxed. This is different from

corporations which are taxed directly by the revenue collecting body. It is worth noting that a company is

a legal entity which means that the taxes of the company cannot be passed to the individual owners of the

organization. Corporations pay both state and national taxes while shareholders pay their taxes, which are

based on salaries, bonuses, and the dividends that they receive from the profits of the company.

5. Life Time in Partnership and a Company

The life of a company and that of the partnership forms a significant difference between the two forms of

business ownership. It is important to note that the life of a company is formulated such that it can last in

its entirety. Its existence is not affected by the change of the membership or death of any of the members

of the organization. Besides, a company’s life may not be ended due to the insolvency of one of the

members. On the other hand, there are specific situations upon which the life of a partnership can come to

an end. Some of the main incidences that may lead to the end of a partnership include the death of one of

the members, insolvency, or insanity of any one of the partner.

Business Law Page 4

INFOLINK UNIVERSITY COLLAGE HAWASSA CAMPAUS 2020

6. Transfer of Shares in Partnership and a Company

Lastly, shares or units of a company can easily be transferred from one person to another unless restricted

by the articles of the organization. On the other hand, a partner cannot transfer his share without the

consent of all other partners. This explains why the shares of an organization are traded on the stock

exchange while the shares of a partnership are no traded in the stock market.

Business Law Page 5

You might also like

- Elsa Business Law AssignmentDocument5 pagesElsa Business Law AssignmentAbdiNo ratings yet

- Law Business 02Document19 pagesLaw Business 02Perinnah FelixNo ratings yet

- The Role of Contracts in BusinessDocument14 pagesThe Role of Contracts in BusinessBamlak HailuNo ratings yet

- Contract and Its EsentialsDocument10 pagesContract and Its EsentialsAditya PratapNo ratings yet

- AgencyDocument8 pagesAgencyZena HabteNo ratings yet

- Legal Aspect For BusinessnitinDocument2 pagesLegal Aspect For BusinessnitinrohanNo ratings yet

- Agency Relationship and Problems of Undisclosed PrincipalDocument10 pagesAgency Relationship and Problems of Undisclosed Principalbello aminatNo ratings yet

- LAWDocument7 pagesLAWRanjini JessiNo ratings yet

- LEGAL AND REGULATORY FRAMEWORK (DBB2101) Conv - 240107 - 142210Document10 pagesLEGAL AND REGULATORY FRAMEWORK (DBB2101) Conv - 240107 - 142210Kautilya DubeyNo ratings yet

- FinalDocument6 pagesFinalKautilya DubeyNo ratings yet

- Adl 12 Business Law With Change 2013Document40 pagesAdl 12 Business Law With Change 2013emailtheodoreNo ratings yet

- Business LawDocument5 pagesBusiness Lawmikiyas hailuNo ratings yet

- RailwayDocument52 pagesRailwaymansiNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Understanding the Key Areas of Business LawDocument8 pagesUnderstanding the Key Areas of Business LawMAUANAY, MICHAELA, P.No ratings yet

- Legal Considerations For Doing BusinessDocument17 pagesLegal Considerations For Doing BusinessdidmugambiNo ratings yet

- Covenant BusDocument11 pagesCovenant BusAyodele OlorunfemiNo ratings yet

- Business and Labor LawsDocument15 pagesBusiness and Labor LawssaniaNo ratings yet

- Commercial TransactionsDocument191 pagesCommercial TransactionsDavid MunyuaNo ratings yet

- Agency Business LawDocument7 pagesAgency Business LawNAUGHTYNo ratings yet

- Companies, partnerships, sole proprietorships and LLCs explainedDocument11 pagesCompanies, partnerships, sole proprietorships and LLCs explainedsubendNo ratings yet

- Specific ContractsDocument14 pagesSpecific ContractsKaushik SutharNo ratings yet

- Essential Contract ElementsDocument22 pagesEssential Contract ElementsahmedNo ratings yet

- BLW 3103 Ahmed Abdirizak PDFDocument6 pagesBLW 3103 Ahmed Abdirizak PDFODUNDO JOEL OKWIRINo ratings yet

- Business Law-PartnershipDocument20 pagesBusiness Law-PartnershipHarah LamanilaoNo ratings yet

- Partnership An Extension of Law of AgencyDocument12 pagesPartnership An Extension of Law of Agencyhimanshu kumarNo ratings yet

- Assingment 1 by Piyush Anand A60006420098Document3 pagesAssingment 1 by Piyush Anand A60006420098Piyush AnandNo ratings yet

- L3309 - LAW OF SPECIAL CONTRACTS: AGENCY RELATIONSHIPDocument6 pagesL3309 - LAW OF SPECIAL CONTRACTS: AGENCY RELATIONSHIPDEEHNo ratings yet

- Legal and Regulatory Framework (DBB2101)Document10 pagesLegal and Regulatory Framework (DBB2101)2004singhalvasuNo ratings yet

- Termination of AgencyDocument26 pagesTermination of AgencycnlurocksNo ratings yet

- Business Law AssignmentDocument11 pagesBusiness Law AssignmentStrom spiritNo ratings yet

- CONTRACTDocument6 pagesCONTRACTvidhi300520No ratings yet

- I. Art. 1768 - Partnership Is A Juridical Person Separate and Distinct From Each of The Partners. ConsequencesDocument8 pagesI. Art. 1768 - Partnership Is A Juridical Person Separate and Distinct From Each of The Partners. ConsequencesChristian ViernesNo ratings yet

- FSRE 2022-23 Topic 4Document22 pagesFSRE 2022-23 Topic 4Ali Al RostamaniNo ratings yet

- Legal Aspect ExplainatiuonDocument3 pagesLegal Aspect ExplainatiuonJocelyn Mae CabreraNo ratings yet

- Week Three Student Guide: Contracts OBJECTIVE: Analyze The Elements Necessary To Form Valid ContractsDocument6 pagesWeek Three Student Guide: Contracts OBJECTIVE: Analyze The Elements Necessary To Form Valid ContractsBreanne NardecchiaNo ratings yet

- Business Law Lectures: Hussnain Manzoor VirkDocument8 pagesBusiness Law Lectures: Hussnain Manzoor VirkAhmed HussainNo ratings yet

- BL Law of ContractsDocument44 pagesBL Law of ContractsAbay BogaleNo ratings yet

- DMBA302Document7 pagesDMBA302Thrift ArmarioNo ratings yet

- BA4105 Legal Aspects of Business All Units 2 Mark Question and AnswerDocument20 pagesBA4105 Legal Aspects of Business All Units 2 Mark Question and AnswerN.Nevethan100% (1)

- Assignment Legal FrameworkDocument8 pagesAssignment Legal FrameworkBANUPRIYANo ratings yet

- Legal Environment of Business ICMR WorkbookDocument371 pagesLegal Environment of Business ICMR WorkbookSarthak Gupta100% (1)

- BusOrg - Chapter 1Document8 pagesBusOrg - Chapter 1Zyra C.No ratings yet

- BLAW4Document11 pagesBLAW43333nishNo ratings yet

- DMBA302LABDocument5 pagesDMBA302LABThrift ArmarioNo ratings yet

- Contracts Movzu 1 Ve 2Document6 pagesContracts Movzu 1 Ve 2Najafzada GunelNo ratings yet

- MRL2601Document3 pagesMRL2601yaaseen.02essofNo ratings yet

- Essays From Business LawDocument7 pagesEssays From Business LawSuad KrcićNo ratings yet

- Distance Learning CenterDocument12 pagesDistance Learning CenterYagana Ifeoma bukarNo ratings yet

- Japanese ContractDocument92 pagesJapanese ContractAnkit SibbalNo ratings yet

- I. Corporation LawDocument8 pagesI. Corporation LawaeriNo ratings yet

- Competency of The Parties To The ContractDocument8 pagesCompetency of The Parties To The ContractAnchita SrivastavaNo ratings yet

- Legal Aspects of Business END TERMDocument9 pagesLegal Aspects of Business END TERMMridulNo ratings yet

- Law of AgencyDocument8 pagesLaw of AgencyHamse Xaaji HassanNo ratings yet

- Business Associations OutlineDocument52 pagesBusiness Associations OutlinestoliknoliNo ratings yet

- Business Law 2 NotesDocument38 pagesBusiness Law 2 Noteswanjohia613No ratings yet

- 5th Lesson International Business & Contract LawDocument4 pages5th Lesson International Business & Contract Lawpetrinluca.9No ratings yet

- Agency, Trust & Partnership Reviewer - 1767-1783 (Cambri Notes)Document6 pagesAgency, Trust & Partnership Reviewer - 1767-1783 (Cambri Notes)Arvin Figueroa0% (1)

- Intro To Legal EnvironmentDocument31 pagesIntro To Legal Environmentrajeevsaha87No ratings yet

- CH ONE Ela ProposalDocument18 pagesCH ONE Ela ProposaltseguNo ratings yet

- Project Analysis and Management ChapterDocument24 pagesProject Analysis and Management ChaptertseguNo ratings yet

- Group Assignment (20%) - Project ProposalDocument21 pagesGroup Assignment (20%) - Project ProposaltseguNo ratings yet

- Group Assignment (20%) - Project ProposalDocument21 pagesGroup Assignment (20%) - Project ProposaltseguNo ratings yet

- Module 4Document17 pagesModule 4Vidal De Arce RodriguezNo ratings yet

- Module 12 BALAWREX Corporation (Merger and Consolidation Nonstock)Document52 pagesModule 12 BALAWREX Corporation (Merger and Consolidation Nonstock)Anna CharlotteNo ratings yet

- Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad AnsarDocument8 pagesEntrepreneurship Lecture No: 27 BY Ch. Shahzad Ansar Entrepreneurship Lecture No: 27 BY Ch. Shahzad Ansarskeleton1sNo ratings yet

- Marine Coatings SpecificationDocument10 pagesMarine Coatings SpecificationBarıs AtayNo ratings yet

- A Legal Guide To Contract Works and Construction Liability Insurance in Australia - PDF UnlockedDocument168 pagesA Legal Guide To Contract Works and Construction Liability Insurance in Australia - PDF Unlockedsgk9494No ratings yet

- Business Law Today Comprehensive Text and Cases Diverse Ethical Online and Global Environment Miller 10th Edition SolutionsDocument11 pagesBusiness Law Today Comprehensive Text and Cases Diverse Ethical Online and Global Environment Miller 10th Edition SolutionsPatriciaStonebwyrq100% (91)

- Civil Law Bar Exam Answers Torts and DamagesDocument26 pagesCivil Law Bar Exam Answers Torts and DamagesAmy Dela Cruz DaquioagNo ratings yet

- Notes: Shareholder Liability For Corporate Torts: A Historical PerspectiveDocument26 pagesNotes: Shareholder Liability For Corporate Torts: A Historical Perspectivevikasnehra9999No ratings yet

- MCQ For Obligations and ContractsDocument6 pagesMCQ For Obligations and ContractsMei Mei75% (4)

- Independent Contractor Agreement SummaryDocument3 pagesIndependent Contractor Agreement SummaryCenNo ratings yet

- Dwnload Full Corporate Finance European Edition 2nd Edition Hillier Solutions Manual PDFDocument35 pagesDwnload Full Corporate Finance European Edition 2nd Edition Hillier Solutions Manual PDFdesidapawangl100% (10)

- Banana Mania's SEO-Optimized TitleDocument45 pagesBanana Mania's SEO-Optimized TitleMary Ann IsananNo ratings yet

- Case 4 and 5Document2 pagesCase 4 and 5Frances AgulayNo ratings yet

- Enlistment Rules 2021Document45 pagesEnlistment Rules 2021Alphonso OmegaNo ratings yet

- Airports Cold Storage (Pty) LTD V Ebrahim SummaryDocument2 pagesAirports Cold Storage (Pty) LTD V Ebrahim SummaryCamagu NomngaNo ratings yet

- Rights and Duties of Bailor and BaileeDocument22 pagesRights and Duties of Bailor and Baileerajeshwari sivakumarNo ratings yet

- Inevitable AccidentDocument5 pagesInevitable AccidentJagadeesh PandianNo ratings yet

- Prof Ad. Intensive ReviewerDocument7 pagesProf Ad. Intensive Revieweryizhan szdNo ratings yet

- COEM 6009 Coursework Assignment For Neil BeeraspatDocument30 pagesCOEM 6009 Coursework Assignment For Neil Beeraspatneil beeraspatNo ratings yet

- VIRATA V NG WEEDocument16 pagesVIRATA V NG WEEChrissy0% (1)

- Agreement FOR Proposed Bridge Over River Ajoy: December, 2017Document187 pagesAgreement FOR Proposed Bridge Over River Ajoy: December, 2017Likhon BiswasNo ratings yet

- Kodak_Alaris_EULA_for_Drivers_and_FirmwareDocument60 pagesKodak_Alaris_EULA_for_Drivers_and_FirmwareChouiref YoucefNo ratings yet

- Entertainment contract dispute resolvedDocument7 pagesEntertainment contract dispute resolvedAlfred DanezNo ratings yet

- Company Law Unit - 1Document22 pagesCompany Law Unit - 1Anjali ShuklaNo ratings yet

- Gozinta® Force Transducer Gozinta Force Transducer: Model GZ-10Document3 pagesGozinta® Force Transducer Gozinta Force Transducer: Model GZ-10Andrés SánchezNo ratings yet

- Law On Sales - Lecture NotesDocument6 pagesLaw On Sales - Lecture NotesKyungsoo DoNo ratings yet

- Belt Frequency Meter ManualDocument28 pagesBelt Frequency Meter ManualLuisSilvaNo ratings yet

- Date: February 09, 2022 Emp Temp Code: 2011510031319 Sanjay JainDocument7 pagesDate: February 09, 2022 Emp Temp Code: 2011510031319 Sanjay JainAbul HussainNo ratings yet

- The Workmen's Compensation Act, 1923Document3 pagesThe Workmen's Compensation Act, 1923sumit nayakNo ratings yet

- Helical Gear Formulas GuideDocument4 pagesHelical Gear Formulas GuideMd. Alam HasnatNo ratings yet