Professional Documents

Culture Documents

Report On Rate Cut

Uploaded by

Aman GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report On Rate Cut

Uploaded by

Aman GuptaCopyright:

Available Formats

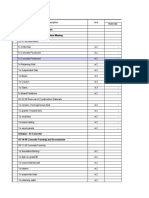

Rate cut policy and its reasons:-

The MPC unexpectedly cut the benchmark Repo rate by 25bps, from 6.50% to 6.25% on 7

February 2019 through a split vote.In an unanimous vote, the monetary policy stance was changed

to ‘neutral’ from ‘calibrated tightening’.Reasons for this cut are:-

1) Sharp downward revision to inflation forecasts from 3.2% to 2.8% forJan-Mar’19

appears to be a key trigger for this cut, whereas H1 FY20 inflation has been revised down

by 60-80 bps, to 3.2-3.4%yoy.Crude prices are more or less at similar levels as at

December review and INR is only modestly weaker (by 1.4%).

2) Weaker growth outlook is the second key trigger for the rate cut. It also pushed down

inflation forecast. The RBI believes that the output gap has opened up modestly recently, after

earlier assuming that the gap had virtually closed. With inflation forecast for CY19 well below

the 4% mid-point of target range, it was likely felt that the recent soft patch in growth should be

accommodated as part of the flexible inflation target regime.The FY20 FD estimate of 3.4% is

30 bps higher than the FRBM target, is a good sign as FD is increasing in the regular Budget.

3) Expectations of further drawdown in household inflation is one of the reasons.The results

show a sharp drawdown in not just the three month ahead inflation expectations (by 80 bps),

but even the one year ahead expectations by 130 bps.The persistently low food inflation and

recent correction in fuel prices have had a salient effect on inflation expectations.

First, it appears rather hasty on part of MPC to overlook core inflation pressures witnessed recently.

Recall core inflation ex auto fuels and housing components accelerated 10% mom sa annualized over

Oct-Dec.It was explained as One-Off phenomenon by MPC. Second, we believe RBI’s new inflation

forecasts for FY20 have been adjusted too low. We expect CPI inflation to evolve more in line with

RBI’s old forecasts than the new. Thus, Jan-Mar inflation could average a little above 3%, while

H1FY20 inflation could be 50 bps higher than RBI projections, at 3.9%.The RBI is exercising

judgement to err on lower inflation outcomes rather than higher given the public criticism for past

forecast errors. Third, The MPC considered policy settings to be tight relative to expected inflation

outcomes, which is seen undershooting 4% in CY19. Policy rate fixings should thus be considered

suitable, rather than overly restrictive. Further, the part of CPI basket that should be most sensitive to

policy fixings i.e. core has surprised higher recently. Evidently the majority in MPC has judged that

growth risks are real enough to warrant a response which could not wait for more clarity on inflation.

Signal of more Rate cuts:-

The Governor did signal that in case inflation evolves in line with forecasts, there may be scope for

more policy action. The risk then is of another 25 bps cut in April policy itself as material upside risks to

inflation may not arise in short order.

Effect on Bond Market due to Rate cut:-

The yield curve steepened and was expected this trend to continue. Substantially higher auction sizes

in H1FY20 and reduced OMO support from RBI will affect the curve and short-end may be well

supported by excess liquidity conditions. We expect OMO amounts to start tapering from March itself

with Rs 300 bn worth of purchases likely should RBI decide to pay interim dividend of Rs 280 bn.

You might also like

- Radio Drama (Rubric)Document1 pageRadio Drama (Rubric)Queenie BalitaanNo ratings yet

- Finding The Answers To The Research Questions (Qualitative) : Quarter 4 - Module 5Document39 pagesFinding The Answers To The Research Questions (Qualitative) : Quarter 4 - Module 5Jernel Raymundo80% (5)

- Desk PiDocument21 pagesDesk PiThan LwinNo ratings yet

- Inspection and Test Plan Steel Sheet Pile DriDocument6 pagesInspection and Test Plan Steel Sheet Pile DriSofda Imela100% (1)

- Monetary Policy - April 2015Document4 pagesMonetary Policy - April 2015Deepak SharmaNo ratings yet

- IN: Inflation and Shifting Policy Dynamics: EconomicsDocument5 pagesIN: Inflation and Shifting Policy Dynamics: EconomicsgirishrajsNo ratings yet

- Key Highlights:: Inflationary Pressures Overrides Downside Risks To GrowthDocument6 pagesKey Highlights:: Inflationary Pressures Overrides Downside Risks To Growthsamyak_jain_8No ratings yet

- RBI Maintains Accommodative Stance Despite Elevated InflationDocument2 pagesRBI Maintains Accommodative Stance Despite Elevated InflationspeedenquiryNo ratings yet

- Australia and New ZealandDocument11 pagesAustralia and New ZealandedgarmerchanNo ratings yet

- RBI Rate Hike to Curb InflationDocument4 pagesRBI Rate Hike to Curb InflationPranshu_Priyad_8742No ratings yet

- Assignment 3Document5 pagesAssignment 3SuprityNo ratings yet

- Monetary Policy ReviewDocument3 pagesMonetary Policy ReviewNikhil DambalNo ratings yet

- India RBI AI Apr19Document7 pagesIndia RBI AI Apr19Aman GuptaNo ratings yet

- Steps Taken By RBI To Control InflationDocument7 pagesSteps Taken By RBI To Control Inflationliyakat_khanNo ratings yet

- Monetary Policy ReviewDocument4 pagesMonetary Policy ReviewiesmcrcNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- RBI Rate Cut ExpectationsDocument4 pagesRBI Rate Cut ExpectationsDeepak SharmaNo ratings yet

- Mps Sep 2019 EngDocument2 pagesMps Sep 2019 EngAnonymous 2E1ThpuNo ratings yet

- Premia Insights Feb2020 PDFDocument6 pagesPremia Insights Feb2020 PDFMuskan mahajanNo ratings yet

- RBI Credit Policy Analysis November 2010Document8 pagesRBI Credit Policy Analysis November 2010gaurav880No ratings yet

- Rbi Bulletin Mar 2015Document110 pagesRbi Bulletin Mar 2015yogeshNo ratings yet

- BSP MonetaryPolicySummary August2022 QuizDocument2 pagesBSP MonetaryPolicySummary August2022 Quizcjpadin09No ratings yet

- RBI's growth priority risks inflation spiralDocument1 pageRBI's growth priority risks inflation spiralaryamahaNo ratings yet

- RBI Springs Surprise, Cuts Repo by 50 Bps by Dinesh Unnikrishnan & Anup RoyDocument5 pagesRBI Springs Surprise, Cuts Repo by 50 Bps by Dinesh Unnikrishnan & Anup RoymahaktripuriNo ratings yet

- Colombia Economic Outlook Update 2Q19Document52 pagesColombia Economic Outlook Update 2Q19eduardo sanchezNo ratings yet

- AUG 04 DBS Daily Breakfast SpreadDocument6 pagesAUG 04 DBS Daily Breakfast SpreadMiir ViirNo ratings yet

- CPI Inflation View: Prepare For A Downside Surprise: Treasury Research 1 October 2021Document4 pagesCPI Inflation View: Prepare For A Downside Surprise: Treasury Research 1 October 2021sharman mohiteNo ratings yet

- Macro Economic Impact Apr08Document16 pagesMacro Economic Impact Apr08shekhar somaNo ratings yet

- Fomc Pres Conf 20160615Document21 pagesFomc Pres Conf 20160615petere056No ratings yet

- Fomc Pres Conf 20141217Document23 pagesFomc Pres Conf 20141217JoseLastNo ratings yet

- Ed - 11-08-2023Document1 pageEd - 11-08-2023Avinash Chandra RanaNo ratings yet

- Nedbank Se Rentekoers-Barometer Vir Mei 2015Document4 pagesNedbank Se Rentekoers-Barometer Vir Mei 2015Netwerk24SakeNo ratings yet

- RBI MONETARY POLICY - RBI Sees Challenges Ahead in Meeting Fiscal Deficit TargetDocument1 pageRBI MONETARY POLICY - RBI Sees Challenges Ahead in Meeting Fiscal Deficit TargetPrashant MarwahaNo ratings yet

- Rbi Monetary Policy Review Further Cuts LikelyDocument6 pagesRbi Monetary Policy Review Further Cuts LikelyTaransh ANo ratings yet

- Annual ReportDocument10 pagesAnnual Reportcharu555No ratings yet

- RBI's Annual Monetary Policy Review 2008-09: Here HereDocument2 pagesRBI's Annual Monetary Policy Review 2008-09: Here HereDeepika DograNo ratings yet

- RBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFDocument5 pagesRBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFswapnaNo ratings yet

- 2011-06-02 DBS Daily Breakfast SpreadDocument7 pages2011-06-02 DBS Daily Breakfast SpreadkjlaqiNo ratings yet

- Monetary Policy July'19Document2 pagesMonetary Policy July'19Zainab AliNo ratings yet

- Monetary Policy Review: Rbi Turns More Dovish, But Keeps Key Rates On HoldDocument2 pagesMonetary Policy Review: Rbi Turns More Dovish, But Keeps Key Rates On HoldNeeraj KumarNo ratings yet

- RBI Raised Interest Rates How This Impacts You!Document5 pagesRBI Raised Interest Rates How This Impacts You!Aishwarya ShettyNo ratings yet

- Why RBI Raised Rates How This Impacts You!Document12 pagesWhy RBI Raised Rates How This Impacts You!Avinash2458No ratings yet

- South African Reserve Bank: MPC Statement 21 May 2020Document6 pagesSouth African Reserve Bank: MPC Statement 21 May 2020BusinessTechNo ratings yet

- Westpac - Fed Doves Might Have Last Word (August 2013)Document4 pagesWestpac - Fed Doves Might Have Last Word (August 2013)leithvanonselenNo ratings yet

- FOMCpresconf 20220615Document27 pagesFOMCpresconf 20220615S CNo ratings yet

- MPS Nov 2019 Eng PDFDocument2 pagesMPS Nov 2019 Eng PDF21augustNo ratings yet

- Performance of Debt Markt: An Article ReviewDocument11 pagesPerformance of Debt Markt: An Article ReviewNida SubhaniNo ratings yet

- Calibrated Normalisation: Monetary PolicyDocument4 pagesCalibrated Normalisation: Monetary Policyvikash singhNo ratings yet

- Review of Monetary Policy Statement H2'24 by EBLSLDocument7 pagesReview of Monetary Policy Statement H2'24 by EBLSLAnika Nawar ChowdhuryNo ratings yet

- Nedbank Se Rentekoers-Barometer Vir Mei 2016Document4 pagesNedbank Se Rentekoers-Barometer Vir Mei 2016Netwerk24SakeNo ratings yet

- Governor's Statement - August 6, 2020: TH TH TH THDocument13 pagesGovernor's Statement - August 6, 2020: TH TH TH THThe QuintNo ratings yet

- Hike Now, Pay LaterDocument10 pagesHike Now, Pay LaterrexNo ratings yet

- RBI Policy June 17Document3 pagesRBI Policy June 17Govind SharmaNo ratings yet

- Anatomy of 12 Rate Hikes in 19 MonthsDocument6 pagesAnatomy of 12 Rate Hikes in 19 Monthsjp6451No ratings yet

- Annual Investment Report Highlights Risks and OpportunitiesDocument22 pagesAnnual Investment Report Highlights Risks and OpportunitiesSantoshNo ratings yet

- RBI BulletinDocument118 pagesRBI Bulletintheresa.painter100% (1)

- RBI Credit Policy Trends 2001-2012Document4 pagesRBI Credit Policy Trends 2001-2012Sandeep SheshamNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- Fiscal Deficit InfoDocument12 pagesFiscal Deficit InfoSanket AiyaNo ratings yet

- Fomc Pres Conf 20230614Document26 pagesFomc Pres Conf 20230614LAKHAN TRIVEDINo ratings yet

- Hidden Spending: The Politics of Federal Credit ProgramsFrom EverandHidden Spending: The Politics of Federal Credit ProgramsNo ratings yet

- Safety Data Sheet: 1. Identification of The Substance/preparation and of The Company/undertakingDocument4 pagesSafety Data Sheet: 1. Identification of The Substance/preparation and of The Company/undertakingBalasubramanian AnanthNo ratings yet

- Tle 10 4quarterDocument2 pagesTle 10 4quarterCaryll BaylonNo ratings yet

- Chemical ReactionDocument13 pagesChemical ReactionSujit LawareNo ratings yet

- Summarised Maths Notes (Neilab Osman)Document37 pagesSummarised Maths Notes (Neilab Osman)dubravko_akmacicNo ratings yet

- CS6711 Security Lab ManualDocument84 pagesCS6711 Security Lab ManualGanesh KumarNo ratings yet

- FMAI - Ch04 - Stock MarketDocument105 pagesFMAI - Ch04 - Stock Marketngoc duongNo ratings yet

- Unit 7 Noun ClauseDocument101 pagesUnit 7 Noun ClauseMs. Yvonne Campbell0% (1)

- Inner Unit EstimateDocument35 pagesInner Unit EstimateMir MoNo ratings yet

- Unit Rates and Cost Per ItemDocument213 pagesUnit Rates and Cost Per ItemDesiree Vera GrauelNo ratings yet

- Cengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaDocument32 pagesCengage Eco Dev Chapter 13 - The Environment and Sustainable Development in AsiaArcy LeeNo ratings yet

- Engr2227 Apr03Document10 pagesEngr2227 Apr03Mohamed AlqaisiNo ratings yet

- bk978 1 6817 4068 3ch1Document28 pagesbk978 1 6817 4068 3ch1fysmaNo ratings yet

- Power System Analysis and Design, SI EditionDocument5 pagesPower System Analysis and Design, SI EditionAkimeNo ratings yet

- PhoneFreedom 365 0 Instalment Postpaid Phone Plan DigiDocument1 pagePhoneFreedom 365 0 Instalment Postpaid Phone Plan DigiJals JNo ratings yet

- Lodha GroupDocument2 pagesLodha Groupmanish_ggiNo ratings yet

- Gartner CRM Handbook FinalDocument0 pagesGartner CRM Handbook FinalghanshyamdassNo ratings yet

- ZiffyHealth Pitch DeckDocument32 pagesZiffyHealth Pitch DeckSanjay Kumar100% (1)

- Reporte Corporativo de Louis Dreyfus Company (LDC)Document21 pagesReporte Corporativo de Louis Dreyfus Company (LDC)OjoPúblico Periodismo de InvestigaciónNo ratings yet

- Basic Facts in EventDocument1 pageBasic Facts in EventAllan AgpaloNo ratings yet

- Amazon Invoice Books 4Document1 pageAmazon Invoice Books 4raghuveer9303No ratings yet

- Hunk 150Document2 pagesHunk 150Brayan Torres04No ratings yet

- Sipmos Power Transistor: BUZ 104LDocument10 pagesSipmos Power Transistor: BUZ 104LAlexsander MeloNo ratings yet

- RTR Piping Inspection GuideDocument17 pagesRTR Piping Inspection GuideFlorante NoblezaNo ratings yet

- Plant Chicago 2Document4 pagesPlant Chicago 2api-321978505No ratings yet

- Etherpad Text-Based TutorialDocument5 pagesEtherpad Text-Based Tutorialapi-437836861No ratings yet

- Frequently Asked Questions About Ailunce HD1: Where Can Find HD1 Software & Firmware?Document5 pagesFrequently Asked Questions About Ailunce HD1: Where Can Find HD1 Software & Firmware?Eric Contra Color0% (1)