Professional Documents

Culture Documents

18 - Income Tax (TDS) Deducted at Source, Remittance, Filling of Returns (TDS Circulats)

18 - Income Tax (TDS) Deducted at Source, Remittance, Filling of Returns (TDS Circulats)

Uploaded by

Selva Raj0 ratings0% found this document useful (0 votes)

19 views8 pagesIncome Tax (TDS) deducted at source

Original Title

18_Income Tax (TDS) deducted at source, remittance, filling of Returns (TDS Circulats)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIncome Tax (TDS) deducted at source

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views8 pages18 - Income Tax (TDS) Deducted at Source, Remittance, Filling of Returns (TDS Circulats)

18 - Income Tax (TDS) Deducted at Source, Remittance, Filling of Returns (TDS Circulats)

Uploaded by

Selva RajIncome Tax (TDS) deducted at source

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 8

INCOME TAX SPECIAL

TAMIL NADU GENERATION AND DISTRIBUTION CORPORATION LIMITED

{ACCOUNTS BRANCH)

From To

S.Arulsamy, M.Com., AICWA., ACS.,B.Ed.,BGL., _A\ll Superintending Engineers

Chief Financial Controller, (2 copies each for Accounts

144, Anna Salai, and Administrative Branch)

‘Chennai - 600 002.

CIRCULAR Lr.No.CFC/GLIFC/ACCTS/DFCIBS/AOMT/D.No.54/2013, dt.29.06.2013.

Sir,

: Income Tax — Certain amendments made to the Act through Finance

Bill 2013 - Rates of Income Tax to be Deducted at Source from

Salaries and Charts for Deduction (TDS) and Collection (TCS) of Tax

during the Financial Year 2013-2014 - Communicating of-Reg. ~

Ref: 1. Circular Lt-No.CFC/TANGEDCO/PC/ACCTS/DFC/BS/IT/

20B/D.No.3/2012, dt.04.04.2012.

2. Circular Lr-No.CFC/TANGEDCO/FC/ACCTS/DFC/BS/T/

‘D.No.39/2012, dt.19.06.2012.

3. Circular Lr.No.CFC/GL/FCIACCTS/DFCIBS/AA O/IT/F.20B/

D.No.98/2012, dt.05.10.2012.

4, Finance Bill 2013

weeene

ly refer the Circular cited above wherein Rates of Income Tax to be

deducted at Source from Salaries and the Charts for TDS and TCS during the Financial Year

2012-13 have been communicated.

Now, the following amendments are made to the Provisions of Income Tax Act

1961 through Finance Bill 2013.

I. Rate of Income Tax to be Deducted at Source on Salaries.

‘There is no change in Rate of Income Tax to be deducted at source on Salaries for the

Financial Year 2013-14 (Assessment Year 2014-15). Hence, the rates communicated vide

reference (1) may be adopted for this Financial Year also,

Rebate of Income Tax in case of certain individuals (Section 87A)

However, an assessee whose total income does not exceed five lakh nipees shal!

be entitled to a deduction on the total income tax (computed before allowing this rebate), an

amount equal to the amount of income-tax payable on the total income for any assessment year

or an amount of two thousand rupees, whichever is less.

(1) Surcharge NIL.

2) Education Cess

“Education Cess on Income-tax” and “Secondary and Higher Education Cess on

income-tax” shall continue to be levied fur the: Purposes of Union at the rate of two per cent,

and one per cent respectively of income-tax inthe eases of deductions on payment of salary.

TLD ion in respect of interest on loan taken for residential house property

ted in the Income Tax Act through Finance

A new Section 80EE has been insert

Bill 2013. The details regarding this section as per Income Tax Act 2013 are reproduced below

for reference and adherence. .

The first home buyer borrowing upto Rs.25 Lakhs would be eligible for an

additional deduction of interest of Rs.1 lakh to be claimed in Assessment Yeu 2014-15

(Financial Year 2013-14) in addition to Rs.1.5 Lakhs allowed under Section 24 of the Income

Tax Act.

@) The deduction under sub section 80EE shall not exceed one lakh rupees and

hall be allowed in computing the total income of the individual for the assessment year

beginning on the 1% day’of April 2014 Financial Year 2013-14) and in a case where the

interest payable for the previous year relevant to the said assessment year is less than one lakh

Tupecs, the balance amount shall be allowed in the assessment year beginning on the I" day of

April 2015 (Financial Year 2014-15).

(G) The deduction under sub-section (1) shall be subject to the following conditions, namely.

@ the oan has been sanctioned by the financial institution during the period beginning on

the Ist day of April, 2013 and ending on the 31st day of March, 2014:

G3) the amount of loan sanctioned for acquisition of the residential house property does not

exceed twenty-five lakh rupees;

LG) the value of the residential house property does not exceed forty lakh rupees;

(iv) the assessee does not own any residential house property on the date of sanction of the

loan.

(@) Where a deduction under this section is allowed for any interest referred to in

sub seotion (1), deduction shall not be allowed in respect of such interest under any other

Provisions of the Act for the same or any other assessment year

(5) For the purposes of this section, —

@) “financial institution" means a banking company to which the Banking Regulation Act,

1949 (10 of 1949) applies including any bank or banking institution referred to in section

51 of that Act or a housing finance company;

(b) “housing finance company" means a public company formed or registered in India with

the main object of carrying on the husiness of providing long-term finance for

‘construction or purchase of houses in India for residential purposes.

TH Deduction in respect of investment made under an equity savings scheme (80CCG)

A new Section 80CCG was inserted in the Income Tax Act through Finance Bill 2012

and communicated vide reference (3) above. Now, the following sub-section (2) shall be

Substituted for the existing sub-section (2) of section 80CCG by the Finance Act, 2013, w.c.f.

1-4-2014 which is reproduced below:

2) The deduction under sub-section (1) shall be allowed in accordance with, and

subject to, the provisions of this section for three consecutive assessment years, beginning with

the assessment year relevant to the previous year in which the listed equity shares or listed units

of equity oriented fund were first acquired.

Further, in sub-section (3) (i) the gross total income of the assessee for the relevant

assessment year shall not exceed twelve lakh rupees (earlier limit Rupees Ten lakh).

A copy of Charts showing the rates of TDS and TCS (Tax Deduction at Source and Tax

Collection at Source), the: due date for remittance, the due date for filing Quarterly return

applicable for the Financial, Year 2013-14 (Assessment Year 2014-15) are communicated

herewith for reference and strict adherence.

Receipt of this circular letter shall be acknowledged by e-mail to

dfebs@tnebnet.ore.

‘Yours faithfully,

A! yo

. CHIEF FINANCIAY, CONTROL! Me.

Enel.: TDS and TCS charts in 4 pages

Ne6py bb Alll Chief Engineers. CE] OT Soniye RoBAOS

Copy-to All Drawing and Disbursing Officers at Head Quarters.

Copy to the Additional Director General of Police's Table.

Copy to the Superintending Engineer/Chairman's Office, TANGEDCO, Chennat

Copy to the Secretary/BOSB, TANGEDCO, Chennai

Copy to the Executive Engineer/Dicector(Distribution)’s Office, TANGEDCO, Chennai

ws

ss,

Copy to the Executive Assistant to Director(Generation), TANGEDCO, Chennai.

cep the Executive Assistant to Director(Finance), TANGEDCO, Chennai.

Py to the Director/Coal and Financial Controller/Coal, TANGEDCO, Chennai.

“opy to the Chief Financial Controller/General, Revenue TANGEDCO & TANTRANSCO.

Copy to the Chief Internal Audit Officer/BOAB, TANGEDCO, Chennai.

Copy to the Resident Audit Officer, TANGEDCO, Chennai.

Copy to the Accounts Officer/Establishment, Accounts Branch, TANGEDCO, Chennai.

Copy to the Chief Public Relations Officer, TANGEDCO, Chennai.

Copy to the Executive Engineer/Tariff Cell, Accounts Branch; TANGEDCO, Chennai.

Copy to Financial Controllet/General, Revenue, Cost, Accounts, Purchase-I & Purchase-lI and

all Deputy Financial Controllers in Accounts Branch/Head Quarters

Copy to the Assistant Personnel Officer/Tamil Development (2 copies) - for publication in

TANGEDCO Bulletin

Copy to the Bxecutive Assistant to Director/Finance/TANTRANSCO

Copy to the Executive Assistant to Managing Director/TANTRANSCO

Copy to the Executive Assistant to Director/Operation/TANTRANSCO

Copy to the Executive Assistant to Director/Transmission Projects/TANTRANSCO ‘

Copy to Stock File.

‘hand wn wee 3,91 €21A cf comet de, 26.

Sie caw ant a» Gomer (0 here ni tt aceope:

GO eran datos ham OUEST e kcos eats eee aN

‘eto gues tobe door usr en eet pape teeny fr 10mD0ch ey sed wh peo ee aye

FE ibe agro wots of sch

soucti Manrequ bea

‘tf Con oh mre than 8 0).

245 IDs.

Guar

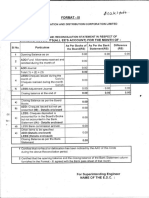

CHART FOR DEDUCTION OF TAX AT SOURCE.

(espec of payments to resident assesser turing te Feseoe Gear 2019-14

See TET AcE] Wn t coat ta a Achat] wheniodenc] PRESCRIGGS SS CENTRIC

Ssucnass [noe aeseicae™ sors] Pees a

eet Eereted| eoveonteron [Reige? [pres

| 2 doveramer eaters sas

; ! orstarencan oe

4 t-———} — 5 —}- oC

| tity te tne la as eal] Ono batwel ~ Gaaneay roman we pos

| Paymom "where "est [ie Pat trols Pt| 9" dopa tan) | Suarery [rome

2x ant olay [Sete "2° toe 22 9 eee

fe Cazonirs: woeet [tes onop 214317" | eaeaen! | weaooenie leer

| Othe) spare Wes) | Forvtas 200 A

iH JE, [A tie tie of rede or Atte ates prescibad| On or before] | (ntespecot Fe

| Interest on payment whichever ‘sin Past tof the Frst|7" cays trom] | l@xceduced — [fenyuo- 164] 307 2003s,

| scutes’ [Efe So atc Sehedle” 1° ene SE of BC| | uactancace (feces, [se oaeath

sii orth esha om eSes|| Rae lowe |Sbaasay

| sree ‘ces ot Eesti] | tewepeaor [MON fest

| sce i Bee omtos peat

| ti pleases trae 8

| ey ys Baa

| on a tonsa, ae

| Sao pai parent | Nias ams peice Oso ae] | we tak cote

i eee aba | Path a te falas oe| | Se eee am

fr con anes, |Poaresae"@ 1 | Mees | pon ance meen

cis eee te ae Pe aseiee|| func |S

ees Eset | Sapa

| ‘ Hae cee [Ate Be oh eat | te aes pascal] On or beara] [Sattar ew) te

| Hetaome [pmear nauere & [A bar Wel teh he 988) bomen

than “interest on | tres when tw aggregate |Sctwodule "10" she |te end of the| [ dovered. tothe |{ene on .

| sede" (ae are tee [reese ot aeae eal | Sere, [eee

| Fee [eae oes ens | | etmcomo te a"

ee. |S Smee I] | Syne foo

Rte ee i Shepocin |

| oo 5 a tant as prc | Goat) | SUE. a ns ea] os

| Hertigs tom [Sari cereare anal] par eet ta ea] So ae yee |S

| lotiery or Schedule 10 the |the end of the| | OGIS.Ouedate [eorage,,

ore Beares" 22 R/S Ate] | Gremcny [eae

fend Shots /aMaaaaee| | Stes fa

| ae game & other ser Weer | Se ootats,

194067 rat te me oF ant | At the rates JO or before} | 1210201988 loam Na, 16h] Oo

Wanngs [ote O'Gara |e POR Par ae] an Goel | wsreonase [EE

= "Bet ehaase "toatl of el | (Se corttin [don

Boe ce rans a | ge es| | Sais [ie

” is made Refer] | quarter ending

a __ frou’ | Sec

Ben. Ses el eaeeaamey|oy 2, ae] | Soc

rrenete | poet wiser |maie i eae | Sa wees | 222200,

-contractors/sub- sub-contractor- fend day ot the| | 3

satiety essere] | mpsaney

‘eres Ener | Tene

note 2] @ =

| ee ie seo :

fanaa ear

getenot annem anh, e

Ca os boar naa cma TTF ga OTE STORE EN I eS

moet

ak hoc meyer cys te Sar npn aa nh

Perl mere Oa rae BS Sets Cais os SO gee Soak ae

tee

Hee eeneecneranman emt eninaaanaommoye

{1 TE ain reared ba cada at cio on payer income by my finaetexendny (1) 10600 en ne 0, tars deposi

aqecicee ts Seacrest rs oe mamas tetas

| | Seer ee aseismic gacarseeeenage eyes ccteeamuemaanoas

Sen redo alo eal tobe eroded or paid ung rail Yr nents e700, dation

346

CHART FOR DEDUCTION OF TAX AT SOURCE (Conta)

in regpeet of payments to resident acsessee during the Financial year 2012-14]

SET iaé| Wien 7 cose ws Bi] Rpateamentote]wniggemal Preggmpe” | _ TOS CERTEATE

Riad of ncome! | see saseRS secs | aesotey F OM og =

payment 2 sr Ca 2}, UE DAT =

{es ger Cor 2 edrnursimmeanssuc |Prescibed |r sa of

SSUrTemen SrerateMENT Or FON. | Coancas

"PX DEDUCTED

| t z x os 7

jea0 Gos Tas at we Gif Ais aes pruned ]O~ x See] Gunrinty (Fam Bo 1A) 30720198

| Fer ce [Rea Mase fe lio Part of de Fact]? "days “tom | statement

| Insurance, | ment vywoayeoate | Schedule to. the} the ere ote] | Gearon

| Sgt atte aes 8 ot Z

| fascEi year exceees | @i0z a1" eedueten| | ws. 20009

| Fao 00 evade Ferma 240

| foie fevespotof x

i seed

| fe 18a

ine ot aaa |Ba Saal | freee

| ‘att GoRe ine payment | Ae ale PH a5 Doe afore) | oeepuctot

BSc omor [momen gpente som [114 eee een] | Gretel

Sees ueder [She 2a0 or moe incon of Bel

$opent Sovngs | toancat yen scar arte | byatoter

fete eh ton | deoston toa oh {Re aetucton| | dooucors er

» BebSBbetie "| re dopo fir ote] __| Sof tmawoe | _

. seer we sop ite ae of 20k won 9 He 7] | um toa oroee [FEmpo] OP

ee Beso | Sry amour reload wi |TT omens {einbe

i setowmct, |S 800c8e) re ‘eran| | defvoredy te

ao re"seasrten| | parton deducting jown

| SR iered to Eek | Cri

isne 0600 : __|rowt} | chataniv.

| arcr Ts ta a Gea GLA rw Tao oTOR ws] On Store 7] | Stqvaty °

| [Eerosion, ote | payments whichever fT 2555 cam ea

sa Bean | saline, wha eeoets | SPF oh in| | siemens De

Resets tear SS Shi ea|| catvre.to he

ectr General

| jaa Commis. [A te tine of creat | oO ae

4 Sonerorotsrage, | payment, wichevar i (Syste) O15}

| Be payable ln” wien "agave ‘rte person

\® Baten elmer | sume cioatecrat So | ‘tanocneaby te

ety | eee eo ooo Bis. Ove date

| te. reramesin

f iar wa Wes A cat oil he ae specRedn [Gn oberg 7] | Seowraes

Ix sieve | foes Sqetonensal | 157-2008

payee

eens ae en | | 15 1020198,

Some" created Or pad Segeton al | e1amewe

Serio the tana year

‘reas Re 9 80.000 __ [Rag ety | se zmess

| Se adit oc[Aifie we of 10H a=] On or Before] | HDETON

‘wiuchewer | "1 3 Spe tram| | uarterending

ine ‘ed of Be] | en 20.62013,

ay

tho wien he a

corn tes | Sealers

ie ona yor xen ie deaustn|

Fi, 901000, any of Oe Sat ido | sts2z58

esse ot aiaan,

; respecvely

‘ {Roornete

-Avtho tre af payment in| A Ho ate OF TOK ws [On or Daf lean ea] Oo

vant | Ht ca eon (cance

fhe aggreaate payment the fs

Sueg, rs eH non en| oc ow

eons Re 2180000 Seiden atest

Fax ete eer ie

| et Set tomere na on pape

Benne, a athe or i ,

Senet ea oe natu main parker ecpment. ater TH EI tee

PERRET meta sprees Pinter wale nae atom TT

acest how mavtns ovate ont Pa

1 em sen aR rae Wane ea

Fee ee a ete avn be Fane O23 pase by mbt af ears er fen} 8 5

kn ch any tx ig foci ay

itt Rs 1200 eben eed ow errno foe

ars.

347 TDs.

CHR

Notes The Assessing Oto muy. wih he x sepa! of he Jot Commision, pean quay yen of a dex! under

2 Tend au Sore | swcharge ox 17: and ebdonal $C on LE SC

5 Ter etd ander foes ase Some | SW ERIESEE frm her hee donate compo rap

1 TUR Seedy ay od er ha foe ee E3pR | Wipe ales wet tie ie ie 38) ond

STS plate mat eng ter ta oes 25be | pirate cue 1103012) of he rence ul, 2017 5

6 Sp Some | Fa te ta Hees of Peden

Hrd, eng esl gio i oe boom

ection 206C(IG) provides Wat, every person, who grants a lease or a, licenee of sre nto a contract or otherwise

Seon BONO eis a Lora por mine or gure tants peion oe tan 8 FUN

“oan Gen 0 Sa Ugo he pou para ye te oe hac A

ers ett omn Ben i s e SO sSe ees

Uke heme ce of a ef champ grea SC ar aio al, SC. 08 he 0

Fy dc eg ot eng go cee ea pay a an a fin a

oe gis gary oleae Gace lia ohae Hane ak Wis pany eh eae foc

1d ae 28 a plo ern any aunt nash comiraon of

vation PoC ate nyc any oer aie meng 1a a) reel

vt or a anh colt foreheuger acon call Bel

efauch ant a ee cle enceie Rs 5D AN, Buyer dened o mean pean oe

bon pec RS 2.600, 0) cst nce thre engaged gee

he nae specied nn PDO) sa fad she ret ofthe Cental Government

eee moun cole OSC cco a made (ie Rae TEN. Teron colecg the STR

1 wat tra dy a he or nd Fl, Sa Sr Cree oat

gage oct ree or belre 67 013 0g, ATONE IS S204 ree

{go te psc une ona 3 2014p Crop etn OED ERE A TS UL

ce eet Tr henae of eee om neta of caus (Fam Nay 27D) Et

ree oe Et ake genen ropa be colegng ee FC a

ga cote ia von 2008.1, 85 E57 Eanrl Coenen an pv seat, tf al NG

Smee iBe el ter geo rg trate ee ere fs nso

sop eres dhe at of 1 ex mgt 0 Der sae pa ore mung the are Salen

ste dnc on td ee al it a hte prom ey aati

caer im eordance with con 208) cla he Gon POH), ries ein RTE rong

ie fetter ect eeme cesar mh rotbionr a eon 286, be

Co a cet cor ora femelle ea ee at

thoi pantie wl eer nee ene ae sed Bak }sAhae tapos AO

few re Every pean ae oun mamber form a Ga capa) (Secon 2054)

aa sc rte eee wp hove aro tlc ye ber fr he purges oC male ee t§

f oe ee ie dope the fren

shogs oor she rs ete oe Yo ne tx tain Pues a

hoe os Soe the alien then he txt mo pe colected se PP eli & required so dckrer one copy of such deca the Ghat

Fo fC eae ne ek ah St bing ti noth a daar «td hm eon OSA)

ae ee ae aa met

142 to econ HENIC

re Sea re sie Cnet gi Se ed pa een

cepted ae rt abe de toe le an Lxind tna aede ae

Bae a edcnlg se a repre Se ae

+ ay obaee ome aesids peed be Oo

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Annexure1 - 10Document1 pageAnnexure1 - 10Selva RajNo ratings yet

- Call LettersDocument4 pagesCall LettersSelva RajNo ratings yet

- 14 - Health Fund Scheme - 2Document34 pages14 - Health Fund Scheme - 2Selva RajNo ratings yet

- Tnerc Gazette August 17 2022 TamilDocument9 pagesTnerc Gazette August 17 2022 TamilSelva RajNo ratings yet

- 42 - Bank Reconciliation Statement IDocument7 pages42 - Bank Reconciliation Statement ISelva RajNo ratings yet

- UG - B.Com - Commerce (English) Corporate Accounting - 1796Document508 pagesUG - B.Com - Commerce (English) Corporate Accounting - 1796Selva Raj100% (1)

- Gangman - Physical Test - PTE User ManualDocument14 pagesGangman - Physical Test - PTE User ManualSelva RajNo ratings yet

- Secure and Efficient Intermediate Node Authentication in Wireless Sensor NetworksDocument4 pagesSecure and Efficient Intermediate Node Authentication in Wireless Sensor NetworksSelva RajNo ratings yet

- Power Generation From Kitchen and Industrial Wastewater Using Microbial Fuel Cells (MFCS) With Graphite Cathode and AnodeDocument6 pagesPower Generation From Kitchen and Industrial Wastewater Using Microbial Fuel Cells (MFCS) With Graphite Cathode and AnodeSelva RajNo ratings yet

- Bio-Electricity Generation From Sugar Mill Waste Water Using MFCDocument2 pagesBio-Electricity Generation From Sugar Mill Waste Water Using MFCSelva RajNo ratings yet

- Water Dependency of Energy Production and Power GeDocument21 pagesWater Dependency of Energy Production and Power GeSelva RajNo ratings yet