Professional Documents

Culture Documents

Tax 04 10 Estate Taxation

Uploaded by

Lab Dema-alaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax 04 10 Estate Taxation

Uploaded by

Lab Dema-alaCopyright:

Available Formats

No. 125 Brgy.

San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

Estate Tax Tax 04-10

1. The following are the characteristics of estate tax, except:

a. National

b. General

c. Ad valorem

d. Excise

e. indirect

2. First Statement: Estate tax is a tax imposed on a person’s exercise of his right to gratuitously

dispose his property upon his death.

Second Statement: Donor’s tax is a tax imposed on a person’s exercise of his right to gratuitously

dispose his property during his lifetime without regard to the donee.

a. True, True

b. True, False

c. False, False

d. False, True

3. First Statement: Succession is the mode of acquisition whereby the property rights and

obligation of a person is deemed transmitted to his heirs, successors or beneficiaries, upon his

death, either by his will or by operation of law.

Second Statement: Succession takes effect upon acceptance by the heirs of the properties left

behind by the decedent.

a. True, True

b. True, False

c. False, False

d. False, True

4. First Statement: Estate Tax is governed by the law prevailing at the time of death of the

decedent.

Second Statement: Estate tax is governed by the law prevailing at the time of distribution of the

properties to the heirs.

a. True, True

b. True, False

c. False, False

d. False, True

5. The following are the elements of succession, except:

a. Decedent

b. Heir

c. Estate

d. Executor

6. Keno Lecta, single, died on December 15, 2017. The administrator of his estate provided you

with the following information:

Family Home - Philippines Php25,000,000 Funeral Expenses Php300,000

Personal Property - Php15,000,000 Medical Expenses Php 600,000

Philippines

Claim against the Php7,000,000

estate

The Net taxable estate of the decedent shall be:

a. Php30,300,000

b. Php18,000,000

c. Php40,000,000

d. Php22,000,000

1|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

7. Keno Lecta, single, died on January 5, 2018. The administrator of his estate provided you with

the following information:

Family Home - Philippines Php25,000,000 Funeral Expenses Php300,000

Personal Property - Php15,000,000 Medical Expenses Php 600,000

Philippines

Claim against the Php7,000,000

estate

The Net taxable estate of the decedent shall be:

a. Php30,300,000

b. Php18,000,000

c. Php40,000,000

d. Php22,000,000

8. The estate tax is determined by multiplying 6% of:

a. Gross estate within and outside of the Philippines of a decedent who was Chinese and

resident of the Philippines.

b. Net taxable estate within the Philippines of a decedent who was resident and citizen of

China.

c. Gross estate within the Philippines of a decedent who was resident and citizen of China.

d. Net taxable estate within and outside of the Philippines of a decedent who was a resident

and citizen of China.

9. Intangible properties located in the Philippines is included in the gross estate of the following

except:

a. Resident and citizen of the Philippines

b. Resident of the Philippines and citizen of Japan

c. Resident and citizen of the United States of America, with reciprocity

d. Resident of Japan and citizen of the United states of America, with reciprocity

10. The following are intangible properties in the Philippines, except:

a. Franchise which must be exercised in the Philippines

b. Shares, obligations or bonds issued by any corporation or sociedad anonima organized or

constituted in the Philippines in accordance with its laws

c. Shares, obligations or bonds issued by any foreign corporation sixty-five percent (65%) of

the business of which is located in the Philippines

d. Shares, obligations or bonds issued by any foreign corporation if such shares, obligations or

bonds have acquired business situs in the Philippines

e. Shares or rights in any partnership, business or industry established in the Philippines

11. The following are inclusions in the gross estate of the decedent, except

a. Donation mortis causa

b. Donation inter vivos

c. Transfer in contemplation of death

d. Transferred to the decedent under general power of appointment

12. Mr. Sulaiman, a certified public accountant, is in advanced age and terminally ill. With the

thought of his impending death he, sold his properties to his son. Two months after the sale, Mr.

Sulaiman died:

Selling Fair Market Value at Fair Market Value at

Price(consideration Sale death

received)

House & Lot, Marikina Php 50,000 Php5,000,000 Php5,000,050

Shares of stock of a Php 75,000 Php70,000 Php76,000

domestic corporation

Rolex Watch Ph50,000 Php75,000 Php45,000

2|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

How much should be added in Mr. Sulaiman’s gross estate.

a. Php4,950,000

b. Php25,000

c. Php5,145,000

d. d.Php5,975,000

13. Mr. Sulaiman, a certified public accountant, is in the prime of his life, he was so happy and

would like to share the joy with his son. In that frame of mind he sold his properties to his son.

Two months after the sale, Mr. Sulaiman died:

Selling Fair Market Value at Fair Market Value at

Price(consideration Sale death

received)

House & Lot, Marikina Php 50,000 Php5,000,000 Php5,000,050

Shares of stock of a Php 75,000 Php70,000 Php76,000

domestic corporation

Rolex Watch Ph50,000 Php75,000 Php45,000

How much should be added in Mr. Sulaiman’s gross estate.

a. Php4,950,000

b. Php25,000

c. None

d. Php5,975,000

14. How much is the gross gift if any:

a. Php4,950,000

b. Php25,000

c. None

d. Php5,975,000

15. Xavier died intestate on March 15, 2021, leaving the following properties:

Common stocks of DelaMonte Corporation (1,000 shares) - listed in the Philippine Stock

Exchange(PSE) (highest - P40; lowest - P39).

Common stocks of Tantamount Corporation (500 shares) - not listed in PSE. Cost - P5 per share;

book value – P50 per share.

Preferred stocks of Trinitron Inc. (4,000 shares) – not listed in the PSE. Cost – P95 per share; book

value – P65 per share; par value – P10 per share

Real properties (zonal value - P1,250,000; assessed value – P870,000)

The gross estate of Xavier is –

a. Php1,159,500

b. Php870,000

c. Php1,354,500

d. Php1,200,000

16. Wade Wilson died on February 14, 2021 leaving the following properties:

House and Lot in California, USA 1,000,000

Vacant Lot in Manila 2,000,000

Shares of stock in a domestic corp., 20% business in 100,000

the Philippines

Shares of stock in a foreign corp., 90% of the business 200,000

is located in the Philippines

Car in Manila 500,000

How much is the gross estate?

a. Php3,800,000

b.Php2,500,000

c. P2,600,000

d. Php2,800,000

3|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

17. Based on the preceding number, but assuming the decedent is a non-resident alien, the gross estate

is:

a. Php3,800,000

b. Php2,800,000

c. Php2,500,000

d. Php2,000,000

18. Continuing number 16 and the rule of reciprocity applies, the gross estate is:

a. P3,800,000

b. Php2,800,000

c. P2,500,000

d. Php2,000,000

19. 1st statement: Diego died giving Hector power to appoint a person who will inherit Diego’s house

and lot. Hector, however can only choose among Anton, Donita and Fidel. Hector decided to transfer

the property to Fidel. The transfer from Hector to Fidel is subject to estate tax.

2nd statement: During Angela’s lifetime, he decided to give Brian as gift her (Angela’s) car subject to

the condition that if Brian does not become a CPA within 3 years, Angela shall revoke the transfer. In

the second year however, Angela died. The car should form part of Angela’s gross estate.

a. True, True

b. True, False

c. False, False

d. False, True

20. As one of the properties whereby the decedent exercises owner’s interest, proceeds of life insurance,

on the life of the decedent is generally included in the gross estate, except

a. Beneficiary is the estate, executor or administrator and the designation of the beneficiary on the

life insurance policy is revocable;

b. Beneficiary is the estate, executor or administrator and the designation of the beneficiary on the

life insurance policy is irrevocable;

c. Beneficiary is any person other than the estate, executor or administrator and the designation of

the beneficiary is revocable;

d. Beneficiary is other than the estate, executor or administrator and the designation of the

beneficiary is irrevocable.

21. The list provided below is excluded from the gross estate, except:

a. Exclusive property of the surviving spouse;

b. Properties outside the Philippines of a non-resident alien decedent;

c. Intangible personal property outside of the Philippines of non-resident alien when the rule of

Reciprocity applies.

d. Share of the surviving spouse in the conjugal/community properties;

22. The following are transfers exempt from transfer tax, except

a. Transmission from the first heir or donee in favor of another beneficiary in accordance with the

desire of the predecessor

b. Transmission or delivery of the inheritance or legacy by the fiduciary heir or legatee to the

fideicommissary

c. The merger of usufruct in the owner of the naked title

d. All bequests, devises, legacies or transfers to social welfare, cultural and charitable institutions

23. The following losses are deductible from the gross estate, except:

a. Car donated mortis causa, struck by lightning 2 hours after the decedent’s death;

b. 2 carats diamond ring reported stolen by the decedent, a night before his death;

c. Php50,000 cash in bank of the decedent, reported stolen to the BIR 30 days after the decedent’s

death;

d. A diamond necklace fairly valued at the time of the decedent’s death at Php2,000,000. It was

reported stolen, 45 days after the decedent’s death. The diamond necklace was insured whereby

the insurance company paid Php1,500,000 to the estate, due to the loss of the diamond necklace.

4|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

24. The following are rules for deductibility of claims against the estate, except

a. The debt instrument must be duly notarized at the time the indebtedness was incurred such

promissory notes or contract of loans.

b. The debt instruments on debt granted by financial institution, where notarization is not part of

the business practice of the financial institution-lender, need not be not be notarized.

c. Duly notarized certification from the creditor as to the unpaid balance of the debt, including

interest as of the time of death.

d. A statement under oath, executed by the administrator or executor of the estate reflecting the

disposition of the proceeds of the loan if said loan was contracted within five (5) years prior to

the death of the decedent

25. The following are taxes deductible from the gross estate of a decedent, except

a. Estate tax

b. Real property tax accrued in the year of death, paid before death

c. Income tax on income earned before death and remaining unpaid

d. Unpaid donor’s tax on property donated before death

26. The following are the conditions for deductibility of the family home, except

a. The family home must be the actual residence of the decedent and his family at the time of his

death certified as such by the Barangay Captain of the locality where the family home is located.

b. The decedent must be a resident or citizen of the Philippines.

c. The total value of the family home must be included as part of the gross estate of the decedent.

d. Allowable deduction must be in an amount equivalent to the current fair market value of the

family home as declared or included in the gross estate, or to the extent of the decedent’s

interest (whether conjugal/community or exclusive) but not exceeding Php1,000,000.

27. The following are the requisites for deductibility of retirement pay received by the decedent as a

consequence of the latter’s death, pursuant to Republic Act 4917.

a. The retirement benefit received is in accordance with a reasonable private benefit plan

maintained by the employer.

b. The retiring employee has been with the same employer for a period of at least ten (10) years.

c. The retiring employee is at least sixty – five (65) years of age.

d. The retirement benefit is to be received by the employee only once.

28. The following are characteristics of estate taxation of a non-resident alien, except:

a. The gross estate shall comprise of properties located within the Philippines only.

b. Not allowed to claim family home deductions.

c. Not allowed to claim vanishing deductions.

d. Allowed deduction for expenses, losses, indebtedness, taxes, etc.

29. The following are the deductions allowed to the estate of a non-resident alien decedent, except

a. Property previously taxed A.K.A Vanishing deductions

b. Transfers for public use

c. Net share of the surviving spouse in the net conjugal/community property

d. Standard deduction of Php500,000

e. Full ELITE

30. Joe Bush was a citizen and resident of the United States of America. He died on January 5, 2020 leaving

behind the following properties with their respective fair market values:

Condominium Unit in BGC, Taguig 20,000,000

Cash in bank, Metrobank (MB), Taguig 500,000

Shares of stocks of SM Prime, Domestic Co. 750,000

Ferrari car, presently located in California, USA 11,250,000

House & Lot, California, USA 150,000,000

Funeral Expenses 200,000

Receivable from an insolvent person 300,000

Legacy in favor of City of Taguig,MB cash in bank 500,000

5|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

The Condominium unit was received by Joe, as a gift from a very generous benefactor, 15 months

before his death. Its fair market then was 15,000,000. At the time it was given to him it was subject

to a mortgage of P700,000 out of which P200,000 remain unpaid at the time of his death.

How much is the net taxable estate of Joe Bush

a. Php9,191,925.99 .

b.Php8,765,300

c. Php161,250,000

d.Php11,299,129.8

31. How much is the estate tax due

a. Php191,191,925.99

b. Php558,944.2

c. Php551,515.56

d. Php8,765,300

32 to 34 are based on the following:

Queena Leecho, married (celebrated 1 year before her death), died on January 2, 2018. She left behind 2

children, both from a previous marriage, and the following properties and obligations:

a. House and lot in Marikina, inherited 4 Php4,000,000

years and 2 months before her death

b. Farm lot in Nueva Ecija, received as a gift, 2,000,000

3 years and 4 months before death

c. Shares of of San Miguel Corporation, 750,000

inherited from Father 3 months before

her death

d. Car 500,000

e. Commercial Building 12,000,000

f. Receivable from an insolvent person 200,000

g. Diamond Ring 1,000,000

h. Cash in Bank 2,000,000

Funeral Expenses Php200,000, while Judicial Expenses amount to Php350,000. The House and lot in

Marikina was the place where the decedent and her family resides.

The fair market value of the house and lot in Marikina, at the time of inheritance from the previous owner,

was Php3,000,000 and subject to a mortgage of Php500,000 at the time. By the time of her death, the

remaining unpaid mortgage amount to Php100,000.

32. Assuming the regime of Absolute Community of property, the net taxable estate amounts to:

a. Php2,042,338.53

b. Php3,357,661.47

c. Php22,450,000

d. Php6,750,000

33. The final tax on the estate, assuming the heirs decided to withdraw the cash in bank prior to the

payment of the estate tax.

a. Php120,000

b.Php180,000

c.Php300,000

d.Php250,0000

6|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

34. Assuming the regime of absolute community of property and assuming further that final tax on the

cash in bank was paid, the amount of cash in bank to be included in the determination of the net

taxable estate.

a. Php2,000,000

b.Php1,880,000

c.Php1,940,000

d. Php0

35. Decedent who is married with a surviving spouse and one legitimate child and two illegitimate

children, left the following properties.

Real properties P3,000,000

Family home 1,000,000

Other real property (exclusive) 2,000,000

Family lot (exclusive) 400,000

Funeral expenses 300,000

Taxes and losses 1,300,000

Medical expenses 1,000,000

Assuming the decedent died on January 5, 2018, what is the total net taxable estate:

a. P1,250,000

b. ( P2,150,000)

c. c.P1,150,000

d. d. P2,450,000

36. Don Fortunato, a widower, died in May, 2011. In his will, he left his estate of P100 million to his four

children. He named his compadre, Don Epitacio, to be the administrator of the estate. When the BIR

sent a demand letter to Don Epitacio for the payment of the estate tax, he refused to pay claiming

that he did not benefit from the estate, he not being an heir. Forthwith, he resigned as administrator.

As a result of the resignation, who may be held liable for the payment of the estate tax?

a. Don Epitacio since the tax became due prior to his resignation.

b. The eldest child who would be reimbursed by the others.

c. All the four children, the tax to be divided equally among them.

d. The person designated by the will as the one liable.

37. The estate of the following deceased persons may claim credit for estate taxes paid to a foreign

country except for a:

a. Filipino citizen residing in California

b. Filipino national residing in Marikina

c. Korean national residing in Hong Kong

d. Chinese national residing in Baguio

38. George Robinson, an American residing in the Philippines died and left behind substantial properties

in and outside of the Philippines. The administrator of his estate provided you with the following

information.

Net Taxable Estate, Philippines Php10,000,000 Estate Tax paid in Japan Php100,000

Net Taxable Estate, Germany 5,000,000 Estate Tax paid in Germany 500,000

Net Taxable Estate, USA 3,000,000

Net Taxable Estate, Japan 2,000,000

The foregoing Net Taxable Estate values are already net of allowable deductions.

Considering the foregoing, how much is the estate tax due, after credit.

a. Php1,200,000

b. Php600,000

c. Php800,000

d. Php400,000

7|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

39. First Statement – Notice of death of the decedent shall be filed within 2 months from the time of

death.

Second Statement – Estate tax returns showing a gross estate exceeding a value of Php5,000,000 shall

be supported with a statement duly certified by a Certified Public Account.

a. True, True

b. True, False

c. False, False

d. False, True

40. First Statement – The estate tax return shall be filed within one (1) year from the approval by the Court

of the project of partition of the estate.

Second Statement – the Commissioner of any Revenue Officer authorized by the former, shall have

the authority to grant in meritorious cases, a reasonable extension, not exceeding thirty (30) days, for

filing the return.

a. True, True

b. True, False

c. False, False

d. False, True

41. First Statement – The Commissioner, for any reason he may see fit, may extend the time for payment

of the estate tax not to exceed five (5) years in case the estate is being settled through the courts, or

two (2) years in case the estate is being settled out of court.

Second Statement – Where the request for extension is by reason of negligence, intentional disregard

of rules and regulations, or fraud on the part of the taxpayer, the Commissioner may grant an

extension subject to 50% surcharge of the amount due.

a. True, True

b. True, False

c. False, False

d. False, True

42. First Statement – If an extension is granted, the Commissioner or his duly authorized representative

may require the executor, or administrator, or beneficiary, as the case may be, to furnish a bond in

such amount, not exceeding double the amount of the tax and with such sureties as the Commissioner

deems necessary, conditioned upon the payment of the said tax in accordance with the terms of the

extension.

Second Statement – Any amount paid after the statutory due date of the tax, but within the extension

period, shall be subject to interest but no surcharge.

a. True, True

b. True, False

c. False, False

d. False, True

43. First statement- In case of insufficiency of cash, the estate tax may be paid in installments within two

(2) years from the date of filing of the estate tax return.

Second Statement – The frequency (i.e., montly, quarterly, semi-annually or annually), deadline and

amount of each installment shall be indicated in the estate tax return, subject to prior approval by the

BIR.

a. True, True

b. True, False

c. False, False

d. False, True

44. First Statement – The heirs are allowed to withdraw from the decedent’s bank account without

presenting proof of payment of the estate tax, i.e., eCAR issued by the CIR or his duly authorized

representative, provided the withdrawal will be subjected to a final withholding tax of six percent

(6%) of the amount to be withdrawn.

Second Statement - Cash in bank, withdrawn within 1 year from the death of the decedent, and

subjected to the 6% withholding tax, is no longer required to be added in the gross estate in the course

of filing the estate tax return.

a. True, True

b. True, False

c. False, False

8|Pa g e AESCARTIN/TLOPEZ /JPAPA

No. 125 Brgy. San Sebastian

Lipa City, Batangas, Philippines

Mobile : 0927 283 8234

Telephone : (043) 723 8412

Gmail : www.icarecpareview@gmail.com

d. False, True

45. First Statement – An estate tax amnesty rate of six percent (6%) shall be imposed on each decedent’s

total net taxable estate at the time of death without penalties, provided that the minimum estate amnesty

tax for the transfer of each decedent shall be Five Thousand Pesos (Php5,000).

Second Statement – The estate tax amnesty shall cover the estate of those who have died in 2017 earlier

and can only be availed until June 14, 2023 or 2 years from the effectivity date of RR 6-2019 and as

extended `by RA 11569 .

a. True, True

b. True, False

c. False, False

d. False, True

46. Query: Is the BIR authorized to collect estate tax deficiencies by the summary remedy of levy upon

and sale of real properties of the decedent without first securing the authority of the court sitting in

probate over the supposedwill of the decedent?

Answer 1: Yes. The BIR is authorized to collect estate tax deficiency through the summary remedy of

levying upon and sale of real properties of a decedent, without the cognition and authority of the

court sitting in probate over the supposedwill of the deceased, because the collection of estate tax is

executive in character. As such the estate tax is exempted from the application of the statute of non-

claims, and this is justified by the necessity of government funding, immortalized in the maxim that

taxes are the lifeblood of the government.

Answer 2: Yes, if the tax assessment has already become final, executory and enforceable. The

approval of the court sitting in probate over the supposed will of the deceased is not a mandatory

requirement for the collection of the estate tax. The probate court is determining issues which are

not against the property of the decedent, or a claim against the estate as such, but is against the

interest or property right which the heir, legatee, devisee, etc. has in the property formerly held by

the decedent.

a. Both answers are correct

b. Only answer 1 is correct

c. Only answer 2 is correct

d. Both answers are incorrect

That in all things God will be glorified

9|Pa g e AESCARTIN/TLOPEZ /JPAPA

You might also like

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocument7 pagesAescartin/Tlopez/Jpapa: Mobile Telephone GmailReynalyn BarbosaNo ratings yet

- TAX05-02 Individual Income TaxDocument7 pagesTAX05-02 Individual Income TaxJeth ConchaNo ratings yet

- Donors TaxDocument5 pagesDonors TaxHana Grace MamangunNo ratings yet

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocument4 pagesAescartin/Tlopez/Jpapa: Mobile Telephone GmailKarenNo ratings yet

- TAX02 06 Gross Income EncryptedDocument8 pagesTAX02 06 Gross Income EncryptedEbno MaruhomNo ratings yet

- Cpa Reviewer in TaxationDocument34 pagesCpa Reviewer in TaxationMika MolinaNo ratings yet

- TAX05-03 Fringe Benefits TaxDocument4 pagesTAX05-03 Fringe Benefits TaxJeth ConchaNo ratings yet

- Tax02 04 Corporate Income Taxation EncryptedDocument11 pagesTax02 04 Corporate Income Taxation EncryptedRalph Adian Tolentino0% (1)

- Estate 1Document5 pagesEstate 1Israel MarquezNo ratings yet

- TAX05 - First Preboard ExaminationDocument13 pagesTAX05 - First Preboard ExaminationMIMI LANo ratings yet

- Taxation PrincipleDocument14 pagesTaxation Principlegean eszekeilNo ratings yet

- TAX05-04 Corporate Income TaxDocument13 pagesTAX05-04 Corporate Income TaxJeth ConchaNo ratings yet

- Exercise No. 1-Estate TaxationDocument4 pagesExercise No. 1-Estate TaxationRed Velvet100% (1)

- Downloadfile 2Document17 pagesDownloadfile 2Jung Hwan SoNo ratings yet

- Practice Set No. 1 - Estate Tax - QuestionnaireDocument6 pagesPractice Set No. 1 - Estate Tax - QuestionnaireAeron Arroyo IINo ratings yet

- Tax 2Document6 pagesTax 2Zerjo CantalejoNo ratings yet

- ICARE - TAX - PreWeek - Batch 4Document17 pagesICARE - TAX - PreWeek - Batch 4john paulNo ratings yet

- University of Batangas Estate Tax: Multiple Choice ExercisesDocument5 pagesUniversity of Batangas Estate Tax: Multiple Choice ExercisesEdnel Loterte100% (1)

- Estate and Donor'S TaxDocument10 pagesEstate and Donor'S TaxJoseph MangahasNo ratings yet

- 3-1. Discussion Questions / ProblemsDocument4 pages3-1. Discussion Questions / Problemscoleen paraynoNo ratings yet

- Ae 208 Bustax ProblemDocument3 pagesAe 208 Bustax ProblemPaulo OronceNo ratings yet

- Estate Tax Practice Set With AnswersDocument6 pagesEstate Tax Practice Set With AnswersXin ZhaoNo ratings yet

- Business Taxation ReviewerDocument10 pagesBusiness Taxation ReviewerCyrelle AnnNo ratings yet

- Allowable Deductions in Gross EstateDocument2 pagesAllowable Deductions in Gross EstateRNo ratings yet

- 89 05 Estate and Trust Taxation PDF FreeDocument3 pages89 05 Estate and Trust Taxation PDF Freefrostysimbamagi meowNo ratings yet

- Gross Estate QuizDocument29 pagesGross Estate QuizGanie Mar R. BiasonNo ratings yet

- Donors Tax Practice Problem PDFDocument2 pagesDonors Tax Practice Problem PDFMelisa Joy MalenabNo ratings yet

- ACAE 18 - Deduction From Gross EstateDocument4 pagesACAE 18 - Deduction From Gross Estatechen dalitNo ratings yet

- Quiz 2 Tax 2 Answer KeyDocument10 pagesQuiz 2 Tax 2 Answer KeyJamaica DavidNo ratings yet

- ICARE First Preboard TAXDocument12 pagesICARE First Preboard TAXLuna VNo ratings yet

- 6 Estate Tax Lecture - CompressDocument5 pages6 Estate Tax Lecture - CompressbrennaNo ratings yet

- 91 12 Donors TaxDocument4 pages91 12 Donors TaxEl Gene Lois MontesNo ratings yet

- Quiz2 Chapter2Document3 pagesQuiz2 Chapter2argene.malubayNo ratings yet

- Transfer Tax QuizDocument3 pagesTransfer Tax QuizMary Grace SalcedoNo ratings yet

- Taxn03b Pexam QuestionnaireDocument2 pagesTaxn03b Pexam Questionnairesmosaldana.cvtNo ratings yet

- PayrollDocument9 pagesPayrollKen MabalotNo ratings yet

- Finals Business TaxationDocument5 pagesFinals Business TaxationSherwin DueNo ratings yet

- Deductions: Philippines Gross Estate World Gross Estate Deductible LITDocument3 pagesDeductions: Philippines Gross Estate World Gross Estate Deductible LITMaria LopezNo ratings yet

- Consignment True or False: Page Rferrer/Rlaco/Atang/DejesusDocument6 pagesConsignment True or False: Page Rferrer/Rlaco/Atang/DejesusNicoleNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- Tax Lecture Estate Tax Part 2Document7 pagesTax Lecture Estate Tax Part 2Kathreen Aya ExcondeNo ratings yet

- Ferlin Acol Quiz 2 Gross Estate Part 1Document3 pagesFerlin Acol Quiz 2 Gross Estate Part 1Julienne UntalascoNo ratings yet

- 598481Document10 pages598481btstanNo ratings yet

- Icare Tax First Preboard Examinations Batch 3Document14 pagesIcare Tax First Preboard Examinations Batch 3Merliza JusayanNo ratings yet

- Cagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IDocument3 pagesCagayan State University Aparri, Cagayan: Preliminary Examination - Transfer and Business Tax IJenelyn BeltranNo ratings yet

- TAX 06 Preweek LectureDocument16 pagesTAX 06 Preweek LectureJohn DoeNo ratings yet

- Batch 5 Preweek LectureDocument18 pagesBatch 5 Preweek LectureMiguel ManagoNo ratings yet

- AFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedDocument5 pagesAFAR02-06 JOINT-ARRANGEMENT-iCARE-March-2021 - EncryptedSophia PerezNo ratings yet

- Business Tax 4Document24 pagesBusiness Tax 4Cheska AtienzaNo ratings yet

- Practice Exercises No. 3, 4, and 5Document3 pagesPractice Exercises No. 3, 4, and 5Ei Ar TaradjiNo ratings yet

- Tax 01 Prefinals Sept 9 2018 BSA4 Answer KeyDocument11 pagesTax 01 Prefinals Sept 9 2018 BSA4 Answer KeyJohn Carlo Dela CruzNo ratings yet

- ICARE - AFAR - PreWeek - Batch 4Document14 pagesICARE - AFAR - PreWeek - Batch 4john paulNo ratings yet

- St. Vincent'S College Incorporated College of Accounting EducationDocument8 pagesSt. Vincent'S College Incorporated College of Accounting Educationrey mark hamacNo ratings yet

- Reviewer in TaxationDocument44 pagesReviewer in TaxationBroniNo ratings yet

- Taxa2 Quiz3Document14 pagesTaxa2 Quiz3ishinoya keishiNo ratings yet

- TAX05-05 Income Taxation of Partnership Estate and TrustDocument6 pagesTAX05-05 Income Taxation of Partnership Estate and TrustJeth ConchaNo ratings yet

- Quiz On Estate TaxDocument4 pagesQuiz On Estate TaxRenz CastroNo ratings yet

- Chapter 3 Deductions From The Gross Estate Part 5Document3 pagesChapter 3 Deductions From The Gross Estate Part 5bernaNo ratings yet

- Estate WorkbookDocument10 pagesEstate WorkbookXin ZhaoNo ratings yet

- A B C D E F: Ground Floor Lighting Lay Out PlanDocument1 pageA B C D E F: Ground Floor Lighting Lay Out PlanLab Dema-alaNo ratings yet

- Schedule of Loads:: Automatic Fire Supression System Panelboard (Afss PB)Document1 pageSchedule of Loads:: Automatic Fire Supression System Panelboard (Afss PB)Lab Dema-alaNo ratings yet

- A B C D E F: Second Floor Sewer Line Lay Out PlanDocument1 pageA B C D E F: Second Floor Sewer Line Lay Out PlanLab Dema-alaNo ratings yet

- A B C D E F: Ground Floor Roof Framing Plan (Parking Area)Document1 pageA B C D E F: Ground Floor Roof Framing Plan (Parking Area)Lab Dema-alaNo ratings yet

- D-1 D-2 D-3 D-4: Door ScheduleDocument1 pageD-1 D-2 D-3 D-4: Door ScheduleLab Dema-alaNo ratings yet

- A B C D E F: Ground Floor Lighting Lay Out PlanDocument1 pageA B C D E F: Ground Floor Lighting Lay Out PlanLab Dema-alaNo ratings yet

- RFBT03-19 - Banking LawsDocument41 pagesRFBT03-19 - Banking LawsWesNo ratings yet

- Solution Manual - Capital Budgeting Part 2Document21 pagesSolution Manual - Capital Budgeting Part 2Lab Dema-alaNo ratings yet

- Other Proponent of Administrative Management Theories: Luther Gulick and Lyndall UrwickDocument44 pagesOther Proponent of Administrative Management Theories: Luther Gulick and Lyndall UrwickLab Dema-alaNo ratings yet

- Vicel Nadden Jane G. Ebrio Jade C. Cordero Joe-An H. Felicerta Lovelyn C. Dema-AlaDocument32 pagesVicel Nadden Jane G. Ebrio Jade C. Cordero Joe-An H. Felicerta Lovelyn C. Dema-AlaLab Dema-alaNo ratings yet

- FPG PI Proposal Form 11.16Document7 pagesFPG PI Proposal Form 11.16Liza BuetaNo ratings yet

- Evidence 2 Group 6Document8 pagesEvidence 2 Group 6JamesNo ratings yet

- Environmental JurisprudenceDocument6 pagesEnvironmental JurisprudencePranshJainNo ratings yet

- CSEET Legal Aptitude - Adv Chirag Chotrani, YES Academy For CS, PuneDocument153 pagesCSEET Legal Aptitude - Adv Chirag Chotrani, YES Academy For CS, Punesaloni100% (2)

- The Zoning OrdinanceDocument56 pagesThe Zoning OrdinanceMJ CarreonNo ratings yet

- Naim Ahamed Vs State (NCT of Delhi) On 30 January, 2023Document14 pagesNaim Ahamed Vs State (NCT of Delhi) On 30 January, 2023JoyNo ratings yet

- Cases AgencyDocument26 pagesCases AgencyLyra Cecille Vertudes AllasNo ratings yet

- 5 - Hall Vs Piccio - DigestDocument1 page5 - Hall Vs Piccio - DigestXing Keet LuNo ratings yet

- ICC FraudNet Global Annual Report 2023 LRDocument266 pagesICC FraudNet Global Annual Report 2023 LRAZHAR HASANNo ratings yet

- Intermountain To Seek Writ SCOTUSDocument9 pagesIntermountain To Seek Writ SCOTUSHLMedit100% (1)

- Kautilya Theory of StateDocument15 pagesKautilya Theory of StateFRONTMAN 666No ratings yet

- Credit & Transaction CasesDocument4 pagesCredit & Transaction CasesNica09_foreverNo ratings yet

- Paternity LeaveDocument2 pagesPaternity LeaveR B VARIANo ratings yet

- CRIM 1 Module 4Document19 pagesCRIM 1 Module 4jeffrey PogoyNo ratings yet

- Del Rosario v. Chingcuangco, 18 SCRA 1156Document7 pagesDel Rosario v. Chingcuangco, 18 SCRA 1156Jerald Oliver MacabayaNo ratings yet

- The School-to-Prison Pipeline: How Roles of School-Based Law Enforcement O Cers May Impact Disciplinary ActionsDocument29 pagesThe School-to-Prison Pipeline: How Roles of School-Based Law Enforcement O Cers May Impact Disciplinary ActionsJohanna SannNo ratings yet

- Maricalum Corp. v. Florentino DigestDocument6 pagesMaricalum Corp. v. Florentino DigestDanica BellaflorNo ratings yet

- Agpalo Chap - VI NatureAndCreationOfAttorney-ClientRelationshipDocument5 pagesAgpalo Chap - VI NatureAndCreationOfAttorney-ClientRelationshipGelo MVNo ratings yet

- Ethics Vision VAM MergedDocument255 pagesEthics Vision VAM MergedKhogenNo ratings yet

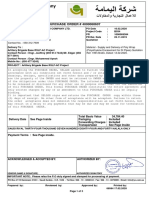

- Al-Yamama Company: PURCHASE ORDER # 4000068607Document3 pagesAl-Yamama Company: PURCHASE ORDER # 4000068607Dusngi MoNo ratings yet

- Vita PDFDocument45 pagesVita PDFsarfraz hussainNo ratings yet

- Heirs of Sandueta v. RoblesDocument3 pagesHeirs of Sandueta v. RoblesPaul Joshua SubaNo ratings yet

- 14-128 MTR Veh Appraisal FormDocument2 pages14-128 MTR Veh Appraisal FormJASONNo ratings yet

- Government of Andhra PradeshDocument3 pagesGovernment of Andhra PradeshGmr VarunNo ratings yet

- Bernhard Hofmann-Wellenhof, Helmut Moritz - Physical Geodesy (2005, Springer)Document412 pagesBernhard Hofmann-Wellenhof, Helmut Moritz - Physical Geodesy (2005, Springer)Nanin Trianawati Sugito100% (1)

- Code of Corporate GovernanceDocument30 pagesCode of Corporate GovernanceJagrityTalwarNo ratings yet

- SALN Form TeacherDocument2 pagesSALN Form TeacherJohnna Mae Erno100% (5)

- Screwfix Recruitment Privacy NoticeDocument6 pagesScrewfix Recruitment Privacy NoticeRizBrozNo ratings yet

- Del Monte Corporation-USA vs. Court of AppealsDocument13 pagesDel Monte Corporation-USA vs. Court of AppealsKristine Hipolito SerranoNo ratings yet

- DBP vs. Environmental Aquatics Inc. - FullDocument5 pagesDBP vs. Environmental Aquatics Inc. - FullVhin ChentNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- LLC Startup 2023: How to Create Financial Freedom Through Launching a Successful Small Business. From Creating a Business Plan for the Limited Liability Company to Turning the Vision into a Reality.From EverandLLC Startup 2023: How to Create Financial Freedom Through Launching a Successful Small Business. From Creating a Business Plan for the Limited Liability Company to Turning the Vision into a Reality.No ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)