Professional Documents

Culture Documents

May 23 Tax RTP

Uploaded by

ShailjaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

May 23 Tax RTP

Uploaded by

ShailjaCopyright:

Available Formats

PAPER 4: TAXATION

SECTION A: INCOME TAX LAW

The Income-tax law, as amended by the Finance Act, 2022, including significant

notifications/circulars issued upto 31st October, 2022, is applicable for May, 2023 examination.

The relevant assessment year for May, 2023 examination is A.Y.2023-24. The May, 2022

edition of the Study Material is based on the provisions of Income-tax law as amended by the

Finance Act, 2022 and significant notifications/circulars issued upto 30.04.2022, and hence,

the same is relevant for May 2023 examination. The Statutory Update containing significant

notifications/circulars issued between 1.5.2022 and 31.10.2022 which are relevant for May,

2023 examination is webhosted at https://resource.cdn.icai.org/72468bos58397.pdf

QUESTIONS AND ANSWERS

Case Scenario

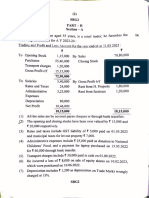

Kishore & Sons is a dealer of coal. Its turnover for the F.Y. 2021-22 was ` 12 crores. The

State Government of Hyderabad granted a lease of coal mine to Kishore & Sons on 1.5.2022

and charged ` 11 crores for the lease. Kishore & Sons sold coal of ` 95 lakhs to M/s BAC Co.

during the P.Y. 2022-23. M/s XYZ Ltd. purchased coal of ` 55 lakhs from Kishore & Sons for

trading purpose in July 2022. Turnover of M/s XYZ Ltd. during the P.Y. 2021-22 was ` 12

crores. PAN is duly furnished by the buyer and seller to each other. Details of sale to and

payments from M/s BAC Co. by Kishore & Sons are as follows:

S. Date of sale Date of receipt/ Amount (`)

No. Payment

1 29.05.2022 10.05.2022 35,00,000

2 30.06.2022 10.07.2022 25,00,000

3 25.11.2022 25.10.2022 8,00,000

4 20.01.2023 22.01.2023 15,00,000

5 01.03.2023 15.02.2023 12,00,000

Turnover of M/s BAC Co. during the P.Y. 2021-22 was ` 11 crores. The above amounts were

credited to Kishore & Sons account in the books of M/s BAC Co. on the date of sale. M/s BAC

Co. furnishes a declaration to Kishore & Sons that coal is to be utilised for generation of

power.

Based on the above facts, choose the most appropriate answer to Q. No. 1 to 5 –

1. Who is required to deduct/ collect tax at source in respect of lease of coal mine by the

State Government of Hyderabad to Kishore & Sons and at what rate?

© The Institute of Chartered Accountants of India

2 INTERMEDIATE EXAMINATION: MAY, 2023

(a) State Government of Hyderabad is liable to collect tax at source @ 2% on ` 11 crores

(b) State Government of Hyderabad is liable to collect tax at source @0.1% on ` 10.50

crores, being the amount exceeding ` 50 lakhs

(c) Kishore & Sons is liable to deduct tax at source @0.1% on ` 10.50 crores, being

the amount exceeding ` 50 lakhs

(d) Neither State Government of Hyderabad is liable to collect tax at source nor Kishore

& Sons is liable to deduct tax at source

2. Is Kishore & Sons required to collect tax at source in respect of the sale transactions with

M/s BAC Co. If yes, when and what is the amount of tax to be collected?

(a) Yes; ` 1,000 on 30.6.2022, ` 800 on 25.10.2022, ` 1,500 on 20.1.2023 and

` 1,200 on 15.2.2023

(b) Yes; ` 35,000 on 10.5.2022, ` 25,000 on 30.6.2022, ` 8,000 on 25.10.2022,

` 15,000 on 20.1.2023 and ` 12,000 on 15.2.2023

(c) Yes; ` 1,000 on 10.7.2022, ` 800 on 25.10.2022, ` 1,500 on 22.1.2023 and

` 1,200 on 15.2.2023

(d) No, Kishore & Sons is not liable to collect tax at source

3. Is Kishore & Sons required to collect tax at source in respect of the sale transaction with

M/s XYZ Ltd. If yes, what is the amount of tax to be collected?

(a) Yes; ` 55,000

(b) Yes; ` 5,500

(c) Yes; ` 500

(d) No, Kishore & Sons is not liable to collect tax at source

4. Is M/s BAC Co. required to deduct tax at source in respect of the purchase transactions

with Kishore & Sons. If yes, when and what is the amount of tax to be deducted?

(a) Yes; ` 1,000 on 30.6.2022, ` 800 on 25.10.2022, ` 1,500 on 20.1.2023 and

` 1,200 on 15.2.2023

(b) Yes; ` 3,500 on 10.5.2022, ` 2,500 on 30.6.2022, ` 800 on 25.10.2022, ` 1,500 on

20.1.2023 and ` 1,200 on 15.2.2023

(c) Yes; ` 1,000 on 10.7.2022, ` 800 on 25.10.2022, ` 1,500 on 22.1.2023 and

` 1,200 on 15.2.2023

(d) No, M/s BAC Co. is not liable to deduct tax at source

5. Assume for the purpose of this MCQ, M/s BAC Co.’s turnover for the F.Y. 2021-22 was

` 9 crore, who will be required to deduct/ collect tax at source in respect of transactions

between Kishore & Sons and M/s BAC Co. and at what rate?

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 3

(a) Kishore & Sons is liable to collect tax at source @1% of ` 95 lakhs

(b) Kishore & Sons is liable to collect tax at source @0.1% of ` 45 lakhs, being the sum

exceeding ` 50 lakhs

(c) M/s BAC Co. is liable to deduct tax at source @0.1% of ` 45 lakhs, being the sum

exceeding ` 50 lakhs

(d) Neither Kishore & Sons is liable to collect tax at source nor M/s BAC Co. is liable to

deduct tax at source

6. Mr. Virat has a house property in Chennai which he let out to Mr. Sumit. For acquisition

of this house, Mr. Virat has taken a loan of ` 30,00,000 @10% p.a. on 1-4-2016. He has

further taken a loan of ` 5 lakhs @12% p.a. on 1.7.2022 towards repairs of the house.

He has not repaid any amount of loan so far. The amount of interest deduction u/s 24(b)

to Mr. Virat for A.Y. 2023-24 if he opted for the provisions of section 115BAC is -

(a) ` 2,00,000

(b) ` 2,30,000

(c) ` 3,45,000

(d) ` 3,60,000

7. Mr. Rishabh, aged 65 years and a resident in India, has a total income of ` 4,50,00,000,

comprising long term capital gain taxable under section 112 of ` 85,00,000, long term

capital gain taxable under section 112A of ` 75,00,000 and other income of

` 2,90,00,000. What would be his tax liability for A.Y. 2023-24. Assume that

Mr. Rishabh has opted for the provisions of section 115BAC.

(a) ` 1,41,40,750

(b) ` 1,38,86,990

(c) ` 1,38,84,390

(d) ` 1,39,81,240

8. Mr. A engaged in the retail trading of toys, had acquired a motor vehicle - A for ` 4 lakhs

on 20.08.2020, put to use on 04.10.2021 and another motor vehicle - B for ` 3 lakhs on

19.02.2021, put to use on 03.09.2021. On 01.04.2021, Mr. A took a vehicle loan of ` 5

lakhs at 10% p.a. and acquired the motor vehicle - C for ` 5 lakhs on 31.05.2021, put to

use on 30.06.2021. On 30.07.2022 the same vehicle - C was sold for ` 5.50 lakhs and

reacquired it back on 28.08.2022 for ` 6 lakhs. Assuming the above mentioned assets

are the only assets in the block of assets for Mr. A, what would be its total depreciation

claim under section 32 for P.Y. 2022-23?

(a) ` 1,66,594

© The Institute of Chartered Accountants of India

4 INTERMEDIATE EXAMINATION: MAY, 2023

(b) ` 1,62,094

(c) ` 1,37,438

(d) ` 1,60,500

9. Mrs. Roma, an Indian Citizen, is a government employee working for the Indian

Government. She submits the following information for the previous year ending

31.03.2023:

`

1 Salary income received in Malaysia for services rendered there 2,00,000

2 Profit from business carried on in Orissa 80,000

3 Loss from business carried on in Baroda (20,000)

4 Profit from business carried on in Paris (income is earned and 42,000

received in Sydney and business is controlled from Paris)

5 Loss from business carried on in Canada (though profits are not (46,000)

received in India, business is controlled from Dehradun)

6 Unabsorbed depreciation of business in Canada 16,000

7 Profit from Indonesia business (controlled form Delhi) and 60% of 70,000

profit deposited in a bank in Indonesia and 40% received in India

8 Rent from house property situated in Canada and received in 1,92,000

Canada

Determine the gross total income of Roma for the A.Y. 2023-24 ignoring the provisions of

section 115BAC on the assumption that she is:

(1) Resident but not ordinarily resident in India

(2) Non-resident in India.

10. Mr. Akash owns a residential house property whose Municipal Value, Fair Rent and

Standard Rent are ` 1,60,000, ` 1,70,000 and ` 1,90,000, respectively. The house has

two independent units. Unit I (25% of floor area) is utilized for the purpose of his

profession and Unit II (75% of floor area) is let out for residential purposes at a monthly

rent of ` 8,500. Municipal taxes @8% of the Municipal Value were paid during the year

by Mr. Akash. He made the following payments in respect of the house property during

the previous year 2022-23:

Light and Water charges ` 2,000, Repairs ` 1,45,000, Interest on loan taken for the

repair of property ` 36,000. Mr. Akash has taken a loan of ` 5,00,000 in July, 2016 for

the construction of the above house property. Construction was completed on 30 th June,

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 5

2019. He paid interest on loan @12% per annum and every month such interest was

paid. No repayment of loan has been made so far.

Income of Mr. Akash from his profession amounted to ` 8,00,000 during the year

(without debiting house rent and other incidental expenditure including admissible

depreciation of ` 8,000 on the portion of house used for profession).

Determine the Gross total income of Mr. Akash for the A.Y. 2023-24 ignoring the

provisions of section 115BAC.

11. Mr. Suresh has a sole proprietory manufacturing unit. On 1st April, 2022, he owns Plant A

and Plant B (rate of depreciation 15%). Depreciated value of the block on 1 st April, 2022

is ` 10,00,000. Plant B is transferred on 15 th October, 2022 for ` 19,00,000. Expenditure

on transfer of Plant B is ` 20,000. Plant C (rate of depreciation 15%) is purchased on

10th March, 2023 for ` 22,00,000. However, Plant C is put to use on 2 nd September, 2023

Business income of Mr. Suresh before claiming any depreciation is ` 11,00,000.

On 1st March, 2023, Mr. Suresh transfers 900 equity shares in A Ltd. (unlisted) for

` 23,50,000. Mr. Suresh does not own any residential house property. These shares

were purchased on 2 nd April, 2015 for ` 2,00,000. To avail of the benefit of exemption

under different sections, he made the following investments on 1 st May, 2023.

(i) A residential house property at Kolkata: ` 19,00,000 (out of which stamp duty

expenditure is ` 30,000).

(ii) NHAI bonds: ` 3,00,000.

Find out the gross total income of Mr. Suresh for the A.Y. 2023-24.

CII – F.Y. 2022-23: 331; F.Y. 2015-16:254

12. Mr. Ram, a resident Individual aged 65 years, submits the following details of his income

for the assessment year 2023-24:

Particulars `

Loss from speculative business A 30,000

Income from speculative business B 1,50,000

Loss from specified business covered under section 35AD 20,000

Income from Salary (computed) 2,00,000

Loss from let out house property 1,90,000

Loss from cloth business 80,000

Long-term capital gain from sale of urban land 3,00,000

Long-term capital loss on sale of shares (STT not paid) 1,00,000

Long-term capital loss on sale of listed shares in recognized stock 1,50,000

© The Institute of Chartered Accountants of India

6 INTERMEDIATE EXAMINATION: MAY, 2023

exchange (STT paid at the time of acquisition and sale of shares)

Income from betting (Gross) 80,000

Loss from gambling 8,000

Interest on saving bank deposits 12,000

Interest on fixed deposits with banks 40,000

Compute the total income of Mr. Ram and show the items eligible for carry forward,

assuming that he does not opt for the provisions of section 115BAC.

13. Examine the tax implication of each transaction and compute the total income of

Mr. Tushar and Mrs. Tushar and their minor son for the assessment year 2023-24,

assuming they do not wish to opt for section 115BAC.

(1) Mr. Tushar has a fixed deposit of ` 6,00,000 in State bank of India. He instructed

the bank to credit the interest on the deposit @9% from 1 st April, 2022 to 31st March,

2023 to the savings bank account of Mr. Raj, son of his brother, to help him in his

education.

(2) Mr. Tushar started a proprietary business on 1st May, 2022 with capital of

` 6,00,000. His wife, Mrs. Tushar, a software Engineer, gave cash of ` 5,00,000 on

1st May, 2022, which was immediately invested in the business by Mr. Tushar. He

earned a profit of ` 4,00,000 during the previous year 2022-23.

(3) Mr. Tushar's minor son derived an income of ` 20,000 through a business activity

involving application of his skill and talent.

14. Mr. Kamal, a resident individual aged 48 years, is working at a senior management

position in a private bank since past 20 years. During the previous year 202 2-23, he

received the following emoluments from the employer:

(a) Basic Salary ` 3,50,000 per month.

(b) Client entertainment reimbursement of ` 20,000 per month out of which he

submitted bills for ` 2,00,000 for the relevant year.

(c) Leave travel allowance of ` 4,00,000 per annum. He took a trip to Goa with his

spouse and two children in December 2022, for which plane boarding tickets of

` 1,00,000 and hotel bookings of ` 3,00,000 were submitted to the employer.

(d) Performance bonus amounting to 20% of annual basic salary.

(e) He is eligible to take a staff housing loan upto ` 20,00,000 at a concessional rate of

2.5% p.a. He availed a housing loan of ` 15,00,000 out of the same on 1 st June

2022. No repayment of loan has been made during the F.Y. 2022-23. The lending

rate of SBI as on 1.4.2022 for housing loan may be taken as 8% p.a.

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 7

(f) The Bank also allotted 1,500 sweat equity shares to Mr. Kamal in May 2022 at the

rate of ` 1,300 per share. The Fair market value of the share was ` 1,500 per share

on the date of exercise of option by Mr. Kamal. He sold all the shares for ` 2,100

per share on 31.03.2023 on recognised stock exchange. Assume Securities

transaction tax has been paid.

The following transactions were made by Mr. Kamal during the previous year 2022-23:

(a) He earned rental income of ` 35,000 per month from a 3 BHK residential flat

situated at Delhi. He purchased the said flat for ` 45 Lakhs in June, 2022 using the

housing loan availed from the employer and his own savings. It was let out from

July, 2022. Municipal taxes of ` 12,000 for F.Y. 2022-23 was paid by Mr. Kamal.

(b) He invested ` 30,00,000 in RBI Floating Rate Savings Bonds on 1 st September

2022 earning an interest of 7% p.a. Interest is credited half yearly on 1 st January

and 1 st July every year. (Assume receipt basis for taxation)

(c) He also paid LIC premium of ` 15,000 for self, ` 20,000 for wife and ` 30,000 for

dependent father, aged 75 years. Medical insurance premium paid on the health of

dependent brother and major dependent son amounted to ` 5,000 (paid by cheque)

and ` 10,000 (paid in cash), respectively.

(d) In December 2022, he earned dividend income of ` 5,00,000 (gross) on shares of

the bank held by him.

You are required to compute his total income and tax liability for the assessment year

2023-24, clearly showing all workings. (Ignore section 115BAC provisions)

15. Mr. Aakash has undertaken certain transactions during the F.Y.2022 -23, which are listed

below. You are required to identify the transactions in respect of which quoting of PAN is

mandatory in the related documents –

S.No. Transaction

1. Opening a current account with HDFC Bank

2. Sale of shares of ABC (P) Ltd. for ` 1,50,000

3. Purchase of two wheeler motor vehicle of ` 1 lakh

4. Purchase of a professional laptop of ` 3 lakhs

© The Institute of Chartered Accountants of India

8 INTERMEDIATE EXAMINATION: MAY, 2023

SUGGESTED ANSWERS

MCQ No. Most Appropriate Answer MCQ No. Most Appropriate Answer

1. (a) 5. (d)

2. (d) 6. (c)

3. (a) 7. (b)

4. (a) 8. (c)

9. Computation of gross total Income of Mrs. Roma for the A.Y. 2023-24

Particulars of income Resident Non-

but not Resident

ordinarily (`)

Resident

(`)

1 Salary income received in Malaysia for services 2,00,000 2,00,000

rendered there (Note 1)

Less: Standard deduction under section 16(ia) 50,000 50,000

1,50,000 1,50,000

2 Profit from business carried on in Orissa [Since it 80,000 80,000

accrues or arises in India]

3 Loss from business carried on in Baroda [Since it (20,000) (20,000)

accrues or arises in India]

4 Profit from business carried on in Paris (income is Nil Nil

earned and received in Sydney and business is

controlled from Paris) [Since it accrues or arises

outside India]

5 Loss from business carried on in Canada (business is (46,000) Nil

controlled from Dehradun)

6 Unabsorbed depreciation of business in Canada (16,000) Nil

7 Profit from Indonesia business (business is controlled 70,000 28,000

from Delhi)

8 Rent from property situated in Canada and received in Nil Nil

Canada

Gross Total Income 2,18,000 2,38,000

Note 1 - Income from “Salaries” payable by the Government to a citizen of India for

services rendered outside India is deemed to accrue or arise in India as per section

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 9

9(1)(iii). Standard deduction under section 16(ia) is allowable, irrespective of residential

status.

Note 2 – In case of a non-resident, only income received or deemed to be received in

India and income accruing or arising or deemed to accrue or arise in India is chargeable

to tax. However, in case of a resident but not ordinarily resident, income derived from a

business controlled in or profession set up in India is also taxable even though it accrues

or arises outside India.

Therefore, income referred to in S. No. 1, 2 and 3 are taxable in the hands of Mrs. Roma

in both cases if she is a resident but not ordinarily resident or if she is a non-resident.

Loss from business carried on in Canada, unabsorbed depreciation of business in

Canada and Profit from Indonesia business would be fully chargeable to tax in India if

she is a resident but not ordinarily resident as it derived from a business controlled in

India. However, Profit from Indonesia business is taxable in case of non-resident to the

extent of such profits received in India.

10. Computation of Gross total income of Mr. Akash for the A.Y. 2023-24

Particulars ` `

I Income from House Property

Unit-II (75% of floor area)

Gross Annual Value

(a) Actual rent received (` 8,500 x 12) ` 1,02,000

(b) Expected rent ` 1,27,500

[Higher of municipal value (i.e. ` 1,60,000) and fair rent

(i.e. ` 1,70,000) but restricted to standard rent (i.e.

` 1,90,000) ` 1,70,000 x 75%]

Higher of (a) or (b) is GAV 1,27,500

Less: Municipal taxes (` 1,60,000 x 8% x 75%) 9,600

NAV 1,17,900

Less: Deductions u/s 24

(a) 30% of NAV ` 35,370

(b) Interest on loan (See note) ` 96,750 1,32,120 (14,220)

II Profits & Gains of business & profession

Income from Profession 8,00,000

Less: Light & Water Charges (25% of ` 500

` 2,000)

© The Institute of Chartered Accountants of India

10 INTERMEDIATE EXAMINATION: MAY, 2023

Municipal taxes (25% of ` 12,800) ` 3,200

Repairs (25% of ` 1,45,000) ` 36,250

Interest on loan taken for repair (25% of ` 9,000

` 36,000)

Interest on loan taken for construction of ` 15,000

house property (25% of ` 60,000)

Depreciation ` 8,000 71,950 7,28,050

Gross Total Income 7,13,830

Note:

Computation of Interest on loan

`

Interest for the year (` 5,00,000 x 12%) 60,000

Pre-construction period Interest-

12% of ` 5,00,000 for 33 months = ` 1,65,000

To be allowed in 5 equal instalments from the year of completion 33,000

(` 1,65,000 x 1/5)

Interest on loan taken for repair (no restriction for let out property) 36,000

Total Interest deduction u/s 24(b) 1,29,000

Total Interest deduction u/s 24(b) for let out property (75% x 96,750

` 1,29,000)

11. Computation of gross total income of Mr. Suresh for the A.Y. 2023-24

Particulars Amount (`) Amount (`)

Profits and gains of business or profession

Business income before depreciation 11,00,000

Depreciated value of the block on April 1, 2022 10,00,000

Add: “Actual cost” of Plant C acquired on March 10, 22,00,000

2023

Less: Sale Consideration of Plant B 19,00,000

Written down value on March 31, 2023 13,00,000

Normal depreciation (not available as Plant C is not put Nil

to use during the P.Y. 2022-23)

Additional depreciation (not available as Plant C is not Nil

put to use during the P.Y. 2022-23)

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 11

Capital Gains

Long term capital gain on transfer of unlisted equity

shares [Since shares were held for more than 24

months]

Sale consideration 23,50,000

Less: Indexed Cost of Acquisition [2,00,000 x 331/254] 2,60,630

20,89,370

Less: Exemption under section 54EC Nil

[Deduction under section 54EC is allowable only in

respect of long term capital gain on transfer of land and

building]

Exemption under section 54F 16,89,278 16,89,278

[20,89,370 x 19,00,000/23,50,000]

4,00,092

Gross Total Income 15,00,092

12. Computation of total income of Mr. Ram for the A.Y. 2023-24

Particulars Amount (`) Amount (`)

Salaries

Income from Salary 2,00,000

Less: Loss from house property set-off against salary 1,90,000

10,000

Profits and gains from business or profession

Income from speculative business B 1,50,000

Less: Loss of ` 30,000 from speculative business A 30,000

Less: Loss from cloth business [Loss from non-

speculative business can be set off against profits from

speculative business] 80,000

40,000

Capital Gains

Long-term capital gain from sale of urban land 3,00,000

Less: Long-term capital loss on sale of shares (STT not 1,00,000

paid)

Less: Long-term capital loss on sale of listed shares in

recognizes stock exchange (STT paid at the time of

acquisition and sale of shares) 1,50,000

50,000

© The Institute of Chartered Accountants of India

12 INTERMEDIATE EXAMINATION: MAY, 2023

Income from Other Sources

Income from betting 80,000

Interest on savings bank deposits 12,000

Interest on fixed deposits with banks 40,000 1,32,000

Gross Total Income 2,32,000

Less: Deduction under section 80TTB (Maximum being 50,000

` 50,000, since Mr. Ram is a senior citizen)

Total Income 1,82,000

Notes:

(i) Loss from specified business covered under section 35AD can be set off only

against profits and gains of any other specified business. Therefore, such loss

cannot be set off against any other income. The unabsorbed loss of ` 20,000 has to

be carried forward for set-off against profits and gains of any specified business in

the following year.

(ii) Loss from gambling can neither be set off against any other income, nor can be

carried forward.

13. Computation of total income of Mr. Tushar and Mrs. Tushar

and minor son for the A.Y. 2023-24

Particulars Amount Amount Amount

(`) (`) (`)

Mr. Tushar Mrs. Tushar Minor Son

Interest on Mr. Tushar fixed Deposit 54,000

with State bank of India (` 6,00,000 x

9%)

As per section 60, in case there is a

transfer of income without transfer of

assets from which such income is

derived, such income shall be treated

as income of the transferor. Therefore,

the fixed deposit interest of ` 54,000

transferred by Mr. Tushar to Mr. Raj

shall be included in the total income of

Mr. Tushar

Profit for P.Y. 2022-23 to be 2,18,182 1,81,818

apportioned on the basis of capital

employed on the first day of previous

year i.e. as on 1 st May, 2022, since

business started on 1.5.2022 (6:5)

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 13

Share of income of Mr. Tushar

[` 4,00,000 x 6/11]

Share of Income of Mrs. Tushar

[` 4,00,000 x 5/11]

Section 64(1)(iv) of the Income-tax Act,

1961 provided for the clubbing of

income in the hands of the individual, if

the income earned is form the assets

(other than house property) transferred

directly or indirectly to the spouse of the

individual, otherwise than for adequate

consideration or in connection with an

agreement to live apart.

Income of minor son through a business 20,000

activity involving application his skill and

talent.

In case the income earned by minor

child is on account of any activity

involving application of any skill or

talent, then, such income of the minor

child shall not be included in the income

of the parent, but shall be taxable in the

hands of the minor child.

Therefore, the income of ` 20,000

derived by minor son through a

business activity involving the

application of his skill and talent shall

not be clubbed in the hands of the

parent. Such income will be taxable in

the hands of the minor son.

Total Income 2,72,182 1,81,818 20,000

14. Computation of total income of Mr. Kamal for the A.Y. 2023-24

Particulars Amount (`) Amount (`)

I Income from salaries

Basic Salary [` 3,50,000 x 12] 42,00,000

Client entertainment reimbursement [` 2,40,000 - 40,000

` 2,00,000]

Leave Travel Allowance [` 4,00,000 - ` 1,00,000] 3,00,000

[Note 1]

© The Institute of Chartered Accountants of India

14 INTERMEDIATE EXAMINATION: MAY, 2023

Performance Bonus (20% of Basic Salary) 8,40,000

Interest on Housing loan 68,750

[` 15,00,000 x (8% - 2.5%) x 10/12]

Sweat Equity allotted by the employer 3,00,000

(` 1,500 - ` 1,300) x 1,500

Gross Salary 57,48,750

Less: Standard deduction 50,000

Taxable Salary 56,98,750

II Income from house property

Gross Annual Value under section 23(1) [Rent 3,15,000

received for 9 months has been taken as the

Gross Annual Value in the absence of other

information relating to Municipal Value, Fair Rent

and Standard Rent] [` 35,000 x 9]

Less: Municipal taxes paid [Paid by Mr. Kamal] 12,000

Net Annual Value (NAV) 3,03,000

Less: Deduction u/s 24

(a) @30% of NAV 90,900

(b) Interest on borrowed capital [15,00,000 x 2.5% 31,250

x 10/12]

1,80,850

III Capital gains

STCG on sale of sweat equity shares [1,500 X 9,00,000

(` 2,100 - ` 1,500)]

IV Income from other sources

Dividend Income 5,00,000

Interest on RBI bonds [` 30,00,000 X 7% X 4/12) 70,000 5,70,000

Gross total Income 73,49,600

Less: Deduction under Chapter VI-A

Deduction u/s 80C for LIC premium paid for self 35,000

and wife [Note 2]

Deduction u/s 80 D [Note 3] Nil 35,000

Total Income 73,14,600

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 15

Computation of tax liability of Mr. Kamal for the A.Y. 2023-24

Particulars Amount (`) Amount (`)

Tax on STCG u/s 111A @15% on ` 9,00,000 1,35,000

Tax on other income of ` 64,14,600

Upto ` 2,50,000 Nil

` 2,50,001 - ` 5,00,000 @5% 12,500

` 5,00,001 - ` 10,00,000 @20% 1,00,000

` 10,00,001 - ` 64,14,600 @30% 16,24,380 17,36,880

18,71,880

Add: Surcharge@10% since total income exceeds 1,87,188

` 50 lakhs but does not exceed ` 1 crore

20,59,068

Add: Health and Education cess @ 4% 82,363

Tax Liability 21,41,431

Tax Liability (Rounded off) 21,41,430

Notes:

(1) Hotel Bookings and lodgings are not covered under leave travel facility. Hence, only

` 1,00,000 of cost of tickets would be exempt under section 10(5).

(2) Premium for life insurance policy of father is not allowed as deduction under

section 80C.

(3) Medical insurance premium on the health of brother is not allowable since brother

does not come within the meaning of family u/s 80D. In case of son, premium is

paid in cash, hence, the same is not allowed.

15.

Transaction Is quoting of PAN mandatory in related

documents?

1. Opening a current account with Yes, quoting of PAN is mandatory on opening

HDFC Bank of a current account by a person with bank.

2. Sale of shares of ABC (P) Ltd. Yes, since the amount for sale of unlisted

for ` 1,50,000 shares exceeds ` 1,00,000

3. Purchase of two wheeler motor Since the purchase is of two wheeler motor

vehicle of ` 1 lakh vehicle, quoting of PAN is not mandatory

4. Purchase of a professional Yes, since the amount paid exceeds

laptop of ` 3 lakhs ` 2,00,000

© The Institute of Chartered Accountants of India

16 INTERMEDIATE EXAMINATION: MAY, 2023

PAPER 4B - INDIRECT TAXES

QUESTIONS

(1) All questions should be answered on the basis of the position of GST law as

amended up to 31.10.2022.

(2) The GST rates for goods and services mentioned in various questions are

hypothetical and may not necessarily be the actual rates leviable on those goods

and services. Further, GST compensation cess should be ignored in all the

questions, wherever applicable.

Manavtaa Trust is a charitable trust registered under section 12AB of the Income-tax Act, 1961.

The trust is well known for its educational, charitable and religious activities. The trust became

liable to registration under GST in the current financial year since it exceeded the threshold limit

for registration and thus, got itself registered in the State of Gujarat in the month of May.

In the month of June, a multinational company, Dhruvtara Ltd., gifted 500 laptops worth ` 50

lakh to the trust free of cost for the charitable purposes, without any intention of seeking any

business promotion from the same. Manavtaa Trust distributed these laptops for free in the

same month to the needy students for facilitating them in their higher studies.

Manavtaa Trust owns a higher secondary school – Manavtaa Higher Secondary School - in

Gujarat. In the month of July, the trust availed security personnel services from ‘Perfect

Security Solutions’, Gujarat, a proprietorship concern, for security of the school premises for a

consideration of ` 2,00,000. It also received legal consultancy services from ‘Maya & Co.’ a

firm of advocates for the issues relating to the said school for ` 1,20,000, in the same month.

Manavtaa Trust furnished the following information regarding the expenses incurred by it in

the month of August; all transactions being inter-State:

(i) Services received and used for supplying taxable outward supplies – ` 3,50,000.

(ii) Catering services received for students of Manavtaa Higher Secondary School

– ` 2,00,000.

(iii) Buses purchased with seating capacity of 25 persons including driver – ` 10,50,000

(Buses were delivered in the first week of September).

Manavtaa Trust provided the following information in respect of the services provided by it

during the month of August:

(i) It runs an old age home for senior citizens. Nominal monthly charges of ` 15,000 for

boarding, lodging and maintenance are charged from each member. Total number of

members is 20.

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 17

(ii) It rents out a community hall situated within the precincts of a temple managed by it on

15th August for a religious function in first half for `5,000 and for an art exhibition in

second half for ` 6,000.

(iii) It rents out the rooms in the precincts of said temple to the devotees for a rent of ` 950

per room per day. Total rent collected in August amounts to ` 35,000.

All the figures given above are exclusive of taxes wherever applicable. Aggregate turnover of

Manavtaa Trust for the preceding financial year was ` 15 lakh. All the conditions necessary

for availment of ITC are fulfilled subject to the information given. Manavtaa Trust intends to

avail exemption from GST wherever applicable.

Based on the information given above, choose the most appropriate answer to the following

questions-

1. Which of the following activities of Manavtaa Trust does not amount to supply under the

GST law?

(a) Free laptops distributed to the needy students

(b) Boarding, lodging and maintenance of the senior citizens by the old age home run

by the trust

(c) Renting of community hall situated within the precincts of the temple managed by

the trust

(d) Renting of rooms in the precincts of the temple managed by the trust

2. Compute the value of inward supplies on which tax is payable by Manavtaa Trust under

reverse charge, for the month of July.

(a) ` 2,00,000

(b) ` 3,20,000

(c) ` 1,20,000

(d) Nil

3. Compute the value of exempt supply made by Manavtaa Trust for the month of August.

(a) ` 3,00,000

(b) Nil

(c) ` 3,35,000

(d) ` 35,000

4. Compute the value of taxable supply made by Manavtaa Trust for the month of August.

(a) ` 3,00,000

(b) ` 11,000

© The Institute of Chartered Accountants of India

18 INTERMEDIATE EXAMINATION: MAY, 2023

(c) Nil

(d) ` 35,000

5. Determine the amount of ITC that can be credited to the Electronic Credit Ledger of

Manavtaa Trust, in the month of August assuming rate of GST to be 18%.

(a) ` 36,000

(b) ` 63,000

(c) ` 1,89,000

(d) ` 2,88,000

6. Mr. Prithviraj, registered under GST, is engaged in supplying services (as discussed in

the table below) in Maharashtra. He has furnished the following information with respect

to the services provided/ received by him, during the month of February:

S. Particulars Amount

No. (`)

(i) Carnatic music performance given by Mr. Prithviraj to promote a 1,40,000

brand of readymade garments (Intra-State transaction)

(ii) Outdoor catering services availed for a marketing event organised 50,000

for his prospective customers (Intra-State transaction)

(iii) Services of transportation of students provided to Subhaskar 1,00,000

College providing education as part of a curriculum for obtaining a

recognised qualification (Intra-State transaction)

(iv) Legal services availed for official purpose from an advocate 1,75,000

located in Gujarat (Inter-State transaction)

(v) Services provided to Wealth Bank as a business correspondent 2,00,000

with respect to accounts in a branch of the bank located in urban

area (Intra-State transaction)

(vi) Recovery agent’s services provided to a car dealer (Intra-State 15,000

transaction)

(vii) General insurance taken on a car (seating capacity 5) used for 40,000

official purposes (Intra-State transaction)

Note:

(i) Rates of CGST, SGST and IGST are 9%, 9% and 18% respectively.

(ii) All inward and outward supplies are exclusive of taxes, wherever applicable.

(iii) All the conditions necessary for availing the ITC have been fulfilled.

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 19

(iv) The turnover of Mr. Prithviraj was ` 2.5 crore in the previous financial year.

Compute the net GST payable in cash, by Mr. Prithviraj for the month of February.

7. Determine whether GST is payable in each of the following independent transactions:

(i) Dhruv Developers sold a plot of land in Greater Noida after levelling, laying down of

drainage lines, water lines and electricity lines.

(ii) Deccan Shipping Pvt. Ltd., registered under GST in Andaman and Nicobar islands,

provided the passenger transportation services to the local residents in the ferries

owned by it from Neil Island to Havelock Island.

8. State the person liable to pay GST in the following independent services provided:

(i) Siddhi Builders, registered in Haryana, rented out 20 residential units owned by it in

Sanskriti Society to Rudra Technologies, an IT based firm registered in the State of

Haryana, for accommodation of its employees.

(ii) M/s. Purohit Consultants, a partnership firm registered in Delhi as a regular tax

payer, paid sponsorship fees of ` 70,000 at a seminar organized by a private NGO

(a partnership firm) in Delhi.

9. Briefly enumerate the contraventions which make a registered person liable to

cancellation of registration, as prescribed under rule 21 of the CGST Rules, 2017.

10. State the order in which every taxable person discharges his tax and other dues under

GST law, as provided under section 49 of the CGST Act, 2017.

SUGGESTED ANSWERS

Question Answer

No.

1 (a) Free laptops distributed to the needy students

2 (d) Nil

3 (c) ` 3,35,000

4 (b) ` 11,000

5 (b) ` 63,000

© The Institute of Chartered Accountants of India

20 INTERMEDIATE EXAMINATION: MAY, 2023

6. Computation of GST payable

Particulars Value of CGST SGST IGST

supply @ 9% (`) @ 9% @ 18%

(`) (`) (`)

GST payable under forward charge

Carnatic music performance given to 1,40,000 12,600 12,600 Nil

promote a brand of readymade

garments

[Carnatic music performance by

Mr. Prithviraj is not exempt from GST

even though the consideration charged

does not exceed ` 1,50,000 since said

performance has been made by him as

a brand ambassador.]

Services of transportation of students 1,00,000 9,000 9,000 Nil

provided to Subhaskar College

[Services of transportation of students

provided to an educational institution

other than an institution providing pre-

school education or education up to

higher secondary school, are not

exempt.]

Services provided to Wealth Bank as a 2,00,000 18,000 18,000 Nil

business correspondent

[Services provided by a business

correspondent to a banking company

are not exempt when such services are

provided with respect to accounts in its

urban area branch.]

Services provided as a recovery agent 15,000 1,350 1,350 Nil

[Tax is payable under forward charge

since recovery agent’s services are

being provided to a person other than

banking company/financial institution/

non-banking financial company.]

Total GST payable under forward 40,950 40,950 Nil

charge (A)

GST payable under reverse charge

Legal services availed from an advocate 1,75,000 Nil Nil 31,500

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 21

[Legal services received by a business

entity with aggregate turnover in the

preceding financial year exceeding

threshold limit for registration (` 20 lakh)

are not exempt and tax on the same is

payable under reverse charge.]

Total GST payable under reverse Nil Nil 31,500

charge (B)

Total GST payable [(A)+(B)] 40,950 40,950 31,500

Computation of total ITC available

Particulars Value of CGST SGST IGST

supply @ 9% @ 9% @ 18%

(`) (`) (`) (`)

Outdoor catering services availed 50,000 Nil Nil Nil

[ITC on outdoor catering services is

blocked except when such services are (i)

used by the taxpayer who is in the same

line of business or (ii) provided by the

employer to its employees under a

statutory obligation.]

Legal services availed 1,75,000 Nil Nil 31,500

[ITC is available as said services are used

in course or furtherance of business.]

General insurance taken on a car (seating 40,000 Nil Nil Nil

capacity 5) used for official purposes

[ITC on motor vehicles for transportation

of persons with seating capacity ≤ 13

persons (including the driver) is blocked

except when the same are used for (i)

making further taxable supply of such

motor vehicles (ii) making taxable supply

of transportation of passengers (iii)

making taxable supply of imparting

training on driving such motor vehicles.

Further, ITC is not allowed on services of

general insurance relating to such

ineligible motor vehicles.]

Total ITC available Nil Nil 31,500

© The Institute of Chartered Accountants of India

22 INTERMEDIATE EXAMINATION: MAY, 2023

Computation of net GST payable in cash

Particulars CGST SGST IGST

@ 9% @ 9% @ 18%

(`) (`) (`)

GST payable under forward charge 40,950 40,950 Nil

Less: ITC of IGST1 (15,750) (15,750) -

IGST IGST

25,200 25,200 Nil

Add: GST payable under reverse charge in cash Nil Nil 31,500

[Tax payable under reverse charge, being not an

output tax, cannot be set off against ITC and thus,

will have to be paid in cash.]

Net GST payable in cash 25,200 25,200 31,500

Note: CGST and SGST is payable on the intra-State transaction and IGST is payable on

the inter-State transactions.

7. (i) GST is not payable by Dhruv Developers on sale of plot of land. Circular No.

177/09/2022 GST dated 03.08.2022 clarifies applicability of GST on sale of land

after levelling, laying down of drainage lines etc. As per Para 5 of Schedule III of

the CGST Act, 2017, ‘sale of land’ is neither a supply of goods nor a supply of

services. Therefore, the sale of land does not attract GST. Land may be sold either

as it is or after some development such as levelling, laying down of drainage lines,

water lines, electricity lines, etc. It is clarified that sale of such developed land is

also sale of land and is covered by Para 5 of Schedule III and accordingly, does not

attract GST.

(ii) Transportation of passenger services provided by the private operator - Deccan

Shipping Pvt. Ltd. - are exempt from GST. Circular No. 177/09/2022 GST dated

03.08.2022 clarifies the applicability of GST on private ferry tickets. Transportation

of passengers by public transport, other than predominantly for tourism purpose, in

a vessel between places located in India is exempt from GST vide Notification No.

12/2017 CT (R) dated 28.06.2017. It is clarified that this exemption would apply to

tickets purchased for transportation from one point to another irrespective of

whether the ferry is owned or operated by a private sector enterprise or by a

PSU/Government.

1ITC of IGST can be utilised towards payment of CGST and SGST in any proportion and in any order.

Therefore, there can be multiple ways of setting off of IGST credit against CGST and SGST liability and

accordingly, in the given case, amount of net GST payable in cash under the heads of CGST and

SGST will vary. However, total amount of net GST payable in cash will be ` 81,900 in each case.

© The Institute of Chartered Accountants of India

PAPER – 4: TAXATION 23

It is further clarified that, the expression ‘public transport’ used in the said

exemption notification only means that the transport should be open to public. It can

be privately or publicly owned. Only exclusion is on transportation wh ich is

predominantly for tourism, such as services which may combine with transportation,

sightseeing, food and beverages, music, accommodation such as in shikara, cruise

etc.

8. (i) Services provided by way of renting of residential dwelling for use as residence is

exempt from GST. However, where the residential dwelling is rented to a registered

person, said exemption is not available. Further, tax on service provided by way of

renting of residential dwelling to a registered person is payable by the recipient

under reverse charge.

Therefore, in the given case, Rudra Technologies is liable to pay GST on the

residential dwellings taken on rent by it from Siddhi Builders, under revers e charge

mechanism.

(ii) In case of services provided by any person by way of sponsorship to any body

corporate or partnership firm, GST is liable to be paid under reverse charge by such

body corporate or partnership firm located in the taxable territory.

Since in the given case, sponsorship services are being provided by the private

NGO to a partnership firm – M/s. Purohit Consultants, GST is payable by Purohit

Consultants on said services under reverse charge.

9. Rule 21 of the CGST Rules, 2017 prescribes the contraventions which make a registered

person liable to cancellation of registration. As per said rule, the registration granted to a

person is liable to be cancelled, if the said person -

(a) does not conduct any business from the declared place of business.

(b) issues invoice/bill without supply of goods/services in violation of the provisions of

this Act, or the rules made thereunder.

(c) violates the provisions of section 171 of the CGST Act. Section 171 contains

provisions relating to anti-profeetering measure.

(d) violates the provision of rule 10A of the CGST Rules relating to furnishing of bank

account details.

(e) avails input tax credit in violation of the provisions of section 16 of th e CGST Act or

the rules made thereunder.

(f) furnishes the details of outward supplies in Form GSTR-1 under section 37 of the

CGST Act for one or more tax periods which is in excess of the outward supplies

declared by him in his valid return under section 39 for the said tax periods.

© The Institute of Chartered Accountants of India

24 INTERMEDIATE EXAMINATION: MAY, 2023

(h) being a registered person required to file return under section 39(1) of the CGST

Act for each month or part thereof (i.e. monthly return filer), has not furnished

returns for a continuous period of 6 months.

(i) being a registered person required to file return under proviso to section 39(1) of the

CGST Act for each quarter or part thereof (i.e. quarterly return filer), has not

furnished returns for a continuous period of 2 tax periods.

10. Section 49 of the CGST Act, 2017 stipulates that every taxable person shall discharge

his tax and other dues under the GST law in the following order, namely:–

(a) self-assessed tax, and other dues related to returns of previous tax periods;

(b) self-assessed tax, and other dues related to the return of the current tax period;

(c) any other amount payable under this Act or the rules made thereunder including the

demand determined under section 73 or section 74.

© The Institute of Chartered Accountants of India

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- TaxationDocument24 pagesTaxation1088Anushka SharmaNo ratings yet

- CA Inter Tax RTP May 2023Document24 pagesCA Inter Tax RTP May 2023olivegreen52No ratings yet

- Paper 4: Taxation Section A: Income Tax Law: Questions and AnswersDocument24 pagesPaper 4: Taxation Section A: Income Tax Law: Questions and AnswersShivani KumariNo ratings yet

- 78728bos63016 p3Document34 pages78728bos63016 p3dileepkarumuri93No ratings yet

- MCQDTDocument17 pagesMCQDTsubi subhashreeNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- Bos 59265Document46 pagesBos 59265oproducts96No ratings yet

- Taxation RTP May 24 InterDocument34 pagesTaxation RTP May 24 Intertholkappiyanjk14No ratings yet

- Tax May 22 RTPDocument26 pagesTax May 22 RTPShailjaNo ratings yet

- DT MCQs & Case Scenarios Booklet Solutions Yash KhandelwalDocument89 pagesDT MCQs & Case Scenarios Booklet Solutions Yash Khandelwalhtassociates12No ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- MCQ CH 14 - TDS and TCS - Nov 23Document18 pagesMCQ CH 14 - TDS and TCS - Nov 23NikiNo ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Tax Nov 21 RTPDocument25 pagesTax Nov 21 RTPShailjaNo ratings yet

- MTP 10 17 Questions 1694188914Document11 pagesMTP 10 17 Questions 1694188914luvkumar3532No ratings yet

- 1643296847cma Inter DT MCQ Jd22Document216 pages1643296847cma Inter DT MCQ Jd22Vibha Gupta100% (1)

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- CA Inter Taxation Q MTP 1 May 2024 Castudynotes ComDocument15 pagesCA Inter Taxation Q MTP 1 May 2024 Castudynotes Comraghavkanoongo3No ratings yet

- DT Smart WorkDocument15 pagesDT Smart WorkmaacmampadNo ratings yet

- TDS Final PDFDocument10 pagesTDS Final PDFvivekNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- CA Inter Tax RTP May22Document26 pagesCA Inter Tax RTP May22karnimasoni12No ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- MTP 17 50 Questions 1709941063Document15 pagesMTP 17 50 Questions 1709941063Naveen R HegadeNo ratings yet

- CA Inter Taxation RTP May 2024 Castudynotes ComDocument34 pagesCA Inter Taxation RTP May 2024 Castudynotes ComkspriyarjpmNo ratings yet

- CA INT Super 30 Q DT PDFDocument64 pagesCA INT Super 30 Q DT PDFKomal BasantaniNo ratings yet

- 27-3-24... 4110 GR I... Int-3019... Tax Mcq... QueDocument7 pages27-3-24... 4110 GR I... Int-3019... Tax Mcq... Quenikulgauswami9033No ratings yet

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsDocument11 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 7: Direct Tax LawsAnshul JainNo ratings yet

- Ca Final DT Rtps Paper 4Document29 pagesCa Final DT Rtps Paper 4chandrakantchainani606No ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- Test Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument9 pagesTest Series: November, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- Full Length DT TestDocument7 pagesFull Length DT Testyvispute71No ratings yet

- Test Series - Set 5 - Ay 20-21Document16 pagesTest Series - Set 5 - Ay 20-21Urusi TeklaNo ratings yet

- TAXQDocument7 pagesTAXQcashubhamkelaNo ratings yet

- 71240bos57247 P7aDocument27 pages71240bos57247 P7abhagirath prakrutNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- 73507bos59335 Inter p1qDocument7 pages73507bos59335 Inter p1qRaish QURESHINo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- Test Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: AccountingDocument8 pagesTest Series: November, 2021 Mock Test Paper - 2 Intermediate (New) : Group - I Paper - 1: Accountingsunil1287No ratings yet

- CAF Test2 Accounts June23 R2 (Que)Document4 pagesCAF Test2 Accounts June23 R2 (Que)AISHWARYA DESHMUKHNo ratings yet

- IncomeTax-IIDocument7 pagesIncomeTax-IIAditya .cNo ratings yet

- Final DT 30 QPDocument6 pagesFinal DT 30 QPshivam chaturvediNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Taxation-II (Honors) 2022-23Document5 pagesTaxation-II (Honors) 2022-23futureisgreat0592No ratings yet

- 71668bos57670 Inter p4q PDFDocument11 pages71668bos57670 Inter p4q PDFmonikaNo ratings yet

- DT Icai MCQ 2Document5 pagesDT Icai MCQ 2Anshul JainNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- Income Tax MCQ Question Bank May 2023 (130 Pages)Document130 pagesIncome Tax MCQ Question Bank May 2023 (130 Pages)PRITESH JAIN100% (1)

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- DT - Test 2 - D23 - NSDocument3 pagesDT - Test 2 - D23 - NSMadhav TailorNo ratings yet

- Test Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument10 pagesTest Series: October, 2021 Mock Test Paper 1 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionPriyanshu TomarNo ratings yet

- MTP 3 14 Questions 1680520270Document7 pagesMTP 3 14 Questions 1680520270Umar MalikNo ratings yet

- Ca-Inter Nov.'21 Batch Test of Taxation Topic Covered: PGBPDocument5 pagesCa-Inter Nov.'21 Batch Test of Taxation Topic Covered: PGBPshettymihir9No ratings yet

- Basic 6 Treasury AccountingDocument25 pagesBasic 6 Treasury AccountingShailjaNo ratings yet

- Accounts Nov 22 SuggestedDocument29 pagesAccounts Nov 22 SuggestedShailjaNo ratings yet

- Tax May 22 RTPDocument26 pagesTax May 22 RTPShailjaNo ratings yet

- Tax May 22 SuggesstedDocument30 pagesTax May 22 SuggesstedShailjaNo ratings yet

- Tax May 22 CorrignDocument1 pageTax May 22 CorrignShailjaNo ratings yet

- Core 3 Corporate FinanceDocument54 pagesCore 3 Corporate FinanceShailjaNo ratings yet

- Strategic Management 1-3-4Document2 pagesStrategic Management 1-3-4ShailjaNo ratings yet

- Competitive StrategyDocument56 pagesCompetitive StrategyShailjaNo ratings yet

- Teaching Notes-FMI-342 PDFDocument162 pagesTeaching Notes-FMI-342 PDFArun PatelNo ratings yet

- Bodie Investments 12e IM CH03Document6 pagesBodie Investments 12e IM CH03lexon_kbNo ratings yet

- Keeping A Cool Head in A Hot Market Edward Dobson PDFDocument36 pagesKeeping A Cool Head in A Hot Market Edward Dobson PDFtak01100% (4)

- IINCOME TAXATION PART 1 - SorianoDocument18 pagesIINCOME TAXATION PART 1 - SorianoPoPo MillanNo ratings yet

- The Cost of Capital and Financial Risk From Investors' PerspectiveDocument14 pagesThe Cost of Capital and Financial Risk From Investors' Perspectivejepu jepNo ratings yet

- Definition of Dividend Capitalization ModelDocument4 pagesDefinition of Dividend Capitalization Modelnuk.2021018028No ratings yet

- Business Finance Module 2 and 3Document7 pagesBusiness Finance Module 2 and 3Lester Mojado100% (1)

- ON Financial Analysis of BSNL: A Project ReportDocument51 pagesON Financial Analysis of BSNL: A Project ReportNar CosNo ratings yet

- 18M183 Sharan Karvy SIP REPORTDocument26 pages18M183 Sharan Karvy SIP REPORTsharan ChowdaryNo ratings yet

- All Board Subjects Material 1Document28 pagesAll Board Subjects Material 1Blessy Zedlav LacbainNo ratings yet

- SWOT Analysis of HDFC BankDocument2 pagesSWOT Analysis of HDFC BankRaghavendra KmNo ratings yet

- Survey of Accounting: Introduction To Financial StatementsDocument33 pagesSurvey of Accounting: Introduction To Financial StatementsTiaraNo ratings yet

- CA Inter Accounts (New) Suggested Answer Dec2021Document24 pagesCA Inter Accounts (New) Suggested Answer Dec2021omaisNo ratings yet

- Rangkuman Bab 12 Market EfficiencyDocument4 pagesRangkuman Bab 12 Market Efficiencyindah oliviaNo ratings yet

- CA Inter FM Super 50 Q by Sanjay Saraf SirDocument129 pagesCA Inter FM Super 50 Q by Sanjay Saraf SirSaroj AdhikariNo ratings yet

- Sassen - The Global City - Introducing A ConceptDocument18 pagesSassen - The Global City - Introducing A ConceptPedro Felizes100% (1)

- BFN 111 Week 7 - 8Document33 pagesBFN 111 Week 7 - 8CHIDINMA ONUORAHNo ratings yet

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Investment Policy Statement Diocese of Brisbane2117Document21 pagesInvestment Policy Statement Diocese of Brisbane2117Dwitya Estu NurpramanaNo ratings yet

- Unit 1 Business and Its EnvironmentDocument28 pagesUnit 1 Business and Its EnvironmentMaham ButtNo ratings yet

- Financial Markets Advanced Module PDFDocument134 pagesFinancial Markets Advanced Module PDFAditya Vikram SinghNo ratings yet

- Question # 1. "The Success and Failure of A Corporation Depends On The Relationship Between ItsDocument5 pagesQuestion # 1. "The Success and Failure of A Corporation Depends On The Relationship Between ItsQavi ShaikhNo ratings yet

- SVFC BS Accountancy - 2nd Set Online Resources SY20-19 1st Semester PDFDocument11 pagesSVFC BS Accountancy - 2nd Set Online Resources SY20-19 1st Semester PDFLorraine TomasNo ratings yet

- Microsoft - NAV - National Pharmaceutical Company (Dynamics NAV Win Over SAP)Document9 pagesMicrosoft - NAV - National Pharmaceutical Company (Dynamics NAV Win Over SAP)Tayyabshabbir100% (1)

- COrporate Finance OutlineDocument130 pagesCOrporate Finance Outlinepun33tNo ratings yet

- CVAT Vs GPT PDFDocument3 pagesCVAT Vs GPT PDFBing777No ratings yet

- JPM Campisi 15-3Document22 pagesJPM Campisi 15-3acastaldoNo ratings yet

- Paper 1 Financial Reporting For May 2012Document68 pagesPaper 1 Financial Reporting For May 2012Kunal KhandualNo ratings yet

- Group 4 Williams SFMDocument7 pagesGroup 4 Williams SFMthisissick100% (3)

- Nism Series Ix Merchant Banking WorkbookDocument127 pagesNism Series Ix Merchant Banking Workbookalpha012550% (2)

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessFrom EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthFrom EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNo ratings yet

- Estrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoFrom EverandEstrategias de Impuestos: Cómo Ser Más Inteligente Que El Sistema Y La IRS Cómo Un Inversionista: Al Incrementar Tu Ingreso Y Reduciendo Tus Impuestos Al Invertir Inteligentemente Volumen CompletoNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)

- S Corporation ESOP Traps for the UnwaryFrom EverandS Corporation ESOP Traps for the UnwaryNo ratings yet

- The Payroll Book: A Guide for Small Businesses and StartupsFrom EverandThe Payroll Book: A Guide for Small Businesses and StartupsRating: 5 out of 5 stars5/5 (1)