Professional Documents

Culture Documents

23052900159020HDFC ChallanReceipt

Uploaded by

neha midha0 ratings0% found this document useful (0 votes)

10 views2 pagesThis document is a challan receipt from the Income Tax Department for Varun Narula for the assessment year 2024-25. It acknowledges payment of Rs. 25,000 in taxes for TDS on the sale of property through UPI using a Paytm bank account. The payment was deposited on May 29, 2023. The document thanks Varun for being a committed taxpayer and informs him about an appreciation initiative that recognizes taxpayers through certificates.

Original Description:

Original Title

23052900159020HDFC_ChallanReceipt

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a challan receipt from the Income Tax Department for Varun Narula for the assessment year 2024-25. It acknowledges payment of Rs. 25,000 in taxes for TDS on the sale of property through UPI using a Paytm bank account. The payment was deposited on May 29, 2023. The document thanks Varun for being a committed taxpayer and informs him about an appreciation initiative that recognizes taxpayers through certificates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pages23052900159020HDFC ChallanReceipt

Uploaded by

neha midhaThis document is a challan receipt from the Income Tax Department for Varun Narula for the assessment year 2024-25. It acknowledges payment of Rs. 25,000 in taxes for TDS on the sale of property through UPI using a Paytm bank account. The payment was deposited on May 29, 2023. The document thanks Varun for being a committed taxpayer and informs him about an appreciation initiative that recognizes taxpayers through certificates.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

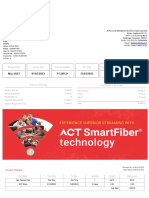

INCOME TAX DEPARTMENT

Challan Receipt

PAN : AJPPN3656D

Name : VARUN NARULA

Assessment Year : 2024-25

Financial Year : 2023-24

Major Head : Income Tax (Other than Companies) (0021)

Minor Head : TDS on Sale of Property (800)

Amount (in Rs.) : ₹ 25,000

Amount (in words) : Rupees Twenty Five Thousand Only

CIN : 23052900159020HDFC

Acknowledgement Number : AK02565673

Payment Gateway : HDFC Bank

Mode of Payment : UPI

Bank Name/Card Type : 7666123220603@paytm

Bank Reference Number : P2314900004446

Date of Deposit : 29-May-2023

BSR code : 0510002

Challan No : 22164

Tender Date : 29/05/2023

Tax Deposit Details (Amount In ₹)

Amount on which TDS to be deducted ₹ 25,00,000

TDS Amount ₹ 25,000

A Basic Tax ₹ 25,000

B Interest ₹0

C Fee under section 234E ₹0

Total (A+B+C) ₹ 25,000

Total (In Words) Rupees Twenty Five Thousand Only

Thanks for being a committed taxpayer!

To express gratitude towards committed taxpayers, the Income Tax Department has started a unique

appreciation initiative. It recognises taxpayers’ commitment by awarding certificates of appreciation to

them.Login to e-filing portal and visit Appreciations and Rewards to know more.

Congrats! Here’s what you have just achieved by choosing to pay online:

Time Paper e-Receipt

Quick and Seamless Save Environment Easy Access

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 23101800173405ICIC ChallanReceiptDocument2 pages23101800173405ICIC ChallanReceiptshikhar guptaNo ratings yet

- 23101800174383ICIC ChallanReceiptDocument2 pages23101800174383ICIC ChallanReceiptshikhar guptaNo ratings yet

- 23101800173869ICIC ChallanReceiptDocument2 pages23101800173869ICIC ChallanReceiptshikhar guptaNo ratings yet

- Challan Receipt - Dinesh GuptaDocument1 pageChallan Receipt - Dinesh GuptaMazhar HusainNo ratings yet

- 23112200026239SBIN ChallanReceiptDocument2 pages23112200026239SBIN ChallanReceiptvkiran_1989No ratings yet

- Challan Receipt - Naman GuptaDocument1 pageChallan Receipt - Naman GuptaMazhar HusainNo ratings yet

- 23060100062942RBIS ChallanReceiptDocument2 pages23060100062942RBIS ChallanReceiptAnuj BeniwalNo ratings yet

- 23080300048465HDFC ChallanReceiptDocument2 pages23080300048465HDFC ChallanReceiptmahesh rahejaNo ratings yet

- Challlan ReceiptDocument2 pagesChalllan ReceiptYash KavteNo ratings yet

- 24030701423838SBIN ChallanReceiptDocument1 page24030701423838SBIN ChallanReceiptFiroz AliNo ratings yet

- 24030701385192SBIN ChallanReceiptDocument1 page24030701385192SBIN ChallanReceiptFiroz AliNo ratings yet

- 23080300055186HDFC ChallanReceiptDocument2 pages23080300055186HDFC ChallanReceiptmahesh rahejaNo ratings yet

- 23080300051201HDFC ChallanReceiptDocument2 pages23080300051201HDFC ChallanReceiptmahesh rahejaNo ratings yet

- 23071000063268RBIS ChallanReceiptDocument2 pages23071000063268RBIS ChallanReceiptAnuj BeniwalNo ratings yet

- 23093000342398SBIN ChallanReceiptDocument2 pages23093000342398SBIN ChallanReceiptCA Final Mission 2021No ratings yet

- 23053100136921ICIC ChallanReceiptDocument2 pages23053100136921ICIC ChallanReceiptVivek SugandhiNo ratings yet

- Income Tax Department: Challan ReceiptDocument2 pagesIncome Tax Department: Challan Receiptpchak.sbiNo ratings yet

- Income Tax Department: Challan ReceiptDocument2 pagesIncome Tax Department: Challan Receiptpchak.sbiNo ratings yet

- 23052200045673SBIN ChallanReceiptDocument2 pages23052200045673SBIN ChallanReceiptpchak.sbiNo ratings yet

- 23052200045673SBIN ChallanReceiptDocument2 pages23052200045673SBIN ChallanReceiptpchak.sbiNo ratings yet

- 23110600119064HDFC ChallanReceiptDocument2 pages23110600119064HDFC ChallanReceiptUjjwal MamtaniNo ratings yet

- Income Tax Department: Challan ReceiptDocument2 pagesIncome Tax Department: Challan Receiptdebaditya2008No ratings yet

- 23043000062036HDFC ChallanReceiptDocument2 pages23043000062036HDFC ChallanReceiptanil panwarNo ratings yet

- 24040600201802UTIB ChallanReceiptDocument1 page24040600201802UTIB ChallanReceiptabdulbeg1986No ratings yet

- 23060700713048BARB ChallanReceiptDocument2 pages23060700713048BARB ChallanReceiptfinanceNo ratings yet

- Challan Revised ReturnDocument2 pagesChallan Revised Returnparwindersingh9066No ratings yet

- 23043000057251HDFC ChallanReceiptDocument2 pages23043000057251HDFC ChallanReceiptanil panwarNo ratings yet

- $RHUZB92Document2 pages$RHUZB92akxerox47No ratings yet

- 24030701379609SBIN ChallanReceiptDocument1 page24030701379609SBIN ChallanReceiptFiroz AliNo ratings yet

- 23112300030457KKBK ChallanReceiptDocument2 pages23112300030457KKBK ChallanReceiptprashanth.financialpanditNo ratings yet

- 23062600519594BKID ChallanReceiptDocument2 pages23062600519594BKID ChallanReceiptNitesh KumarNo ratings yet

- 23062700549040HDFC ChallanReceiptDocument2 pages23062700549040HDFC ChallanReceiptgaaya 3onlineNo ratings yet

- 23071500358316SBIN ChallanReceiptDocument2 pages23071500358316SBIN ChallanReceiptVarun BhatiaNo ratings yet

- 23120500288895UTIB ChallanReceiptDocument1 page23120500288895UTIB ChallanReceiptbinitashah11573No ratings yet

- 23072200431544SBIN ChallanReceiptDocument2 pages23072200431544SBIN ChallanReceiptcryNo ratings yet

- 24040800030981HDFC ChallanReceiptDocument1 page24040800030981HDFC ChallanReceiptkunal3152No ratings yet

- 23043000063466HDFC ChallanReceiptDocument2 pages23043000063466HDFC ChallanReceiptanil panwarNo ratings yet

- Tds Oct To DecDocument1 pageTds Oct To Decadarshtiw787No ratings yet

- 24022300117266SBIN ChallanReceiptDocument1 page24022300117266SBIN ChallanReceipttarun gotiNo ratings yet

- Screenshot 2023-12-07 at 5.27.16 PMDocument1 pageScreenshot 2023-12-07 at 5.27.16 PMdrsadhu2001No ratings yet

- Active Listening in CounsellingDocument2 pagesActive Listening in CounsellingSiddhi BhanushaliNo ratings yet

- 23062900837134SBIN ChallanReceiptDocument2 pages23062900837134SBIN ChallanReceiptMadhu YADAVNo ratings yet

- 23103100255734HDFC ChallanReceiptDocument2 pages23103100255734HDFC ChallanReceiptNishank JindalNo ratings yet

- 24031200008039SBIN ChallanReceiptDocument1 page24031200008039SBIN ChallanReceiptgudiverma111No ratings yet

- 23073000665832ICIC ChallanReceiptDocument2 pages23073000665832ICIC ChallanReceiptsunil jadhavNo ratings yet

- 23061900103508SBIN ChallanReceiptDocument2 pages23061900103508SBIN ChallanReceipttrustleadsfutureNo ratings yet

- 23072700343210ICIC ChallanReceiptDocument2 pages23072700343210ICIC ChallanReceiptrohan choudhariNo ratings yet

- 23052200056818SBIN ChallanReceiptDocument2 pages23052200056818SBIN ChallanReceiptks.udayaNo ratings yet

- 23103100266467IDIB ChallanReceiptDocument2 pages23103100266467IDIB ChallanReceiptvaikunda maniNo ratings yet

- 24031200304903HDFC ChallanReceiptDocument1 page24031200304903HDFC ChallanReceiptprasadriri45No ratings yet

- 24040200022628HDFC ChallanReceiptDocument1 page24040200022628HDFC ChallanReceipttaxindia610No ratings yet

- 23062600636313KKBK ChallanReceiptDocument2 pages23062600636313KKBK ChallanReceiptshaik saifulla lNo ratings yet

- Income Tax Department: Challan ReceiptDocument2 pagesIncome Tax Department: Challan Receiptpchak.sbiNo ratings yet

- 23100900016963SBIN ChallanReceiptDocument2 pages23100900016963SBIN ChallanReceiptpchak.sbiNo ratings yet

- Jaswinder Kaur Sandhu Challan Ay 202324Document1 pageJaswinder Kaur Sandhu Challan Ay 202324SANJEEV KUMARNo ratings yet

- 23060701227268ICIC ChallanReceiptDocument2 pages23060701227268ICIC ChallanReceiptsrm finservNo ratings yet

- 24042500264680SBIN ChallanReceiptDocument1 page24042500264680SBIN ChallanReceiptsunil132patelNo ratings yet

- 23060701227268ICIC ChallanReceiptDocument2 pages23060701227268ICIC ChallanReceiptsrm finservNo ratings yet

- 24031400013395KKBK ChallanReceiptDocument1 page24031400013395KKBK ChallanReceiptRammurat PranamiNo ratings yet

- 1 s2.0 S0039625720300709 MainDocument23 pages1 s2.0 S0039625720300709 Mainneha midhaNo ratings yet

- Childhood Glaucoma TableDocument1 pageChildhood Glaucoma Tableneha midhaNo ratings yet

- 10.5.2019 Quality of Life in GlaucomaDocument30 pages10.5.2019 Quality of Life in Glaucomaneha midhaNo ratings yet

- Childhood Glaucoma 2Document1 pageChildhood Glaucoma 2neha midhaNo ratings yet

- Current and Savings Account StatementDocument40 pagesCurrent and Savings Account StatementDeepak SuranaNo ratings yet

- EFSL - 7028011153 - NCD Oct'23 - Product NoteDocument6 pagesEFSL - 7028011153 - NCD Oct'23 - Product Notechandraprakash sharmaNo ratings yet

- Amount Chargeable (In Words)Document1 pageAmount Chargeable (In Words)Varun GopalNo ratings yet

- Exchange Rate Policy and Modelling in IndiaDocument117 pagesExchange Rate Policy and Modelling in IndiaArjun SriHariNo ratings yet

- March BillDocument2 pagesMarch BillKrishna Kumar Rajasekhar NaiduNo ratings yet

- Tally Assignment AfrozDocument17 pagesTally Assignment AfrozAfrozNo ratings yet

- A Gr.4 FMDocument6 pagesA Gr.4 FMAbhinav AttriNo ratings yet

- Po 4000322788 Shailesh AssociatesDocument590 pagesPo 4000322788 Shailesh Associatesvineetku624No ratings yet

- Sap JVC GuideDocument4 pagesSap JVC Guidegabrielsyst0% (1)

- NCFM Technical AnalysisDocument18 pagesNCFM Technical AnalysisJagannathasarmaNo ratings yet

- Registered Office: Plot No.C-27, 'G' Block, Bandra Kurla Complex, Bandra (E), Mumbai, Maharashtra 400051Document2 pagesRegistered Office: Plot No.C-27, 'G' Block, Bandra Kurla Complex, Bandra (E), Mumbai, Maharashtra 400051KiranNo ratings yet

- Value Chart For YES Prosperity Edge Credit CardDocument1 pageValue Chart For YES Prosperity Edge Credit CardRajeev KumarNo ratings yet

- Functions of SBPDocument20 pagesFunctions of SBPanumkaziNo ratings yet

- Mcqs On ForexDocument43 pagesMcqs On ForexRam Iyer90% (10)

- ET Banking & FinanceDocument35 pagesET Banking & FinanceSunchit SethiNo ratings yet

- IntrDocument6 pagesIntrranjan08me42No ratings yet

- Governor Gernal in Council 1910 PDFDocument170 pagesGovernor Gernal in Council 1910 PDFtauseekhanNo ratings yet

- HDFC Top 100 Fund - Patience Pays!Document4 pagesHDFC Top 100 Fund - Patience Pays!Manju Bhashini M RNo ratings yet

- RBI/2007-2008/22 Master Circular No./6 /2007-08 July 2, 2007Document53 pagesRBI/2007-2008/22 Master Circular No./6 /2007-08 July 2, 2007Makarand LonkarNo ratings yet

- C3-Jay Bharat Spices PVT LTDDocument11 pagesC3-Jay Bharat Spices PVT LTDBobbyNo ratings yet

- V3 BOQ Multicurrency TemplateDocument6 pagesV3 BOQ Multicurrency TemplateGaurav mandageNo ratings yet

- Why Some Currencies Are Convertible and Others Are Not Convertible?Document7 pagesWhy Some Currencies Are Convertible and Others Are Not Convertible?Nehal SharmaNo ratings yet

- Dynamic Engineering Services: Valuer Empanelled With Hon'ble Calcutta High Court & Punjab National Bank (PM & IM)Document10 pagesDynamic Engineering Services: Valuer Empanelled With Hon'ble Calcutta High Court & Punjab National Bank (PM & IM)Souma Dip BhaduriNo ratings yet

- Beer (Domestic) R C ADocument18 pagesBeer (Domestic) R C Asaketh chowdaryNo ratings yet

- Arun Ice Cream CaseDocument28 pagesArun Ice Cream CaseArpit JainNo ratings yet

- Border Road Organisation Chief Engineer Project Sampark: (Ministry of Defence) Government of IndiaDocument130 pagesBorder Road Organisation Chief Engineer Project Sampark: (Ministry of Defence) Government of IndiaER Rajesh MauryaNo ratings yet

- Practice Questions - 2021-22 Term 1 - Class 12 EconomicsDocument12 pagesPractice Questions - 2021-22 Term 1 - Class 12 EconomicssarthakNo ratings yet

- 1mg BillDocument1 page1mg BillkgagansinghNo ratings yet

- IFM Lesson 3Document29 pagesIFM Lesson 3Vikas SharmaNo ratings yet

- Money and Banking ObjectiveDocument5 pagesMoney and Banking Objectivebhivanshu mukhijaNo ratings yet