Professional Documents

Culture Documents

Challan Receipt - Naman Gupta

Uploaded by

Mazhar Husain0 ratings0% found this document useful (0 votes)

2 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageChallan Receipt - Naman Gupta

Uploaded by

Mazhar HusainCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

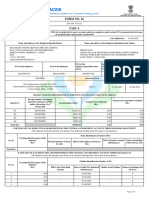

INCOME TAX DEPARTMENT

Challan Receipt

PAN : BAJPG0751Q

Name : NAMAN GUPTA

Assessment Year : 2024-25

Financial Year : 2023-24

Major Head : Income Tax (Other than Companies) (0021)

Minor Head : TDS on Sale of Property (800)

Amount (in Rs.) : ₹ 35,000

Amount (in words) : Rupees Thirty Five Thousand Only

CIN : 24031200169878HDFC

Acknowledgement Number : AK21353301

Payment Gateway : HDFC Bank

Mode of Payment : UPI

Bank Name/Card Type : 8056848622@ybl

Bank Reference Number : P2407200003311

Date of Deposit : 12-Mar-2024

BSR code : 0510002

Challan No : 24293

Tender Date : 12/03/2024

Tax Deposit Details (Amount In ₹)

Amount on which TDS to be deducted ₹ 35,00,000

TDS Amount ₹ 35,000

A Basic Tax ₹ 35,000

B Interest ₹0

C Fee under section 234E ₹0

Total (A+B+C) ₹ 35,000

Total (In Words) Rupees Thirty Five Thousand Only

Thanks for being a committed taxpayer!

Please print this challan receipt only if absolutely required. Save Paper, Save Environment.

Congrats! Here’s what you have just achieved by choosing to pay online:

Time Paper e-Receipt

Quick and Seamless Save Environment Easy Access

You might also like

- Challan Receipt - Dinesh GuptaDocument1 pageChallan Receipt - Dinesh GuptaMazhar HusainNo ratings yet

- 23112200026239SBIN ChallanReceiptDocument2 pages23112200026239SBIN ChallanReceiptvkiran_1989No ratings yet

- 23052900159020HDFC ChallanReceiptDocument2 pages23052900159020HDFC ChallanReceiptneha midhaNo ratings yet

- 23101800174383ICIC ChallanReceiptDocument2 pages23101800174383ICIC ChallanReceiptshikhar guptaNo ratings yet

- 23101800173405ICIC ChallanReceiptDocument2 pages23101800173405ICIC ChallanReceiptshikhar guptaNo ratings yet

- 24030701423838SBIN ChallanReceiptDocument1 page24030701423838SBIN ChallanReceiptFiroz AliNo ratings yet

- 23101800173869ICIC ChallanReceiptDocument2 pages23101800173869ICIC ChallanReceiptshikhar guptaNo ratings yet

- PRAKASHDocument1 pagePRAKASHSUBHENDU PATTANAYAKNo ratings yet

- 24040900011525HDFC ChallanReceiptDocument1 page24040900011525HDFC ChallanReceiptkunal3152No ratings yet

- 23092400072996SBIN ChallanReceiptDocument1 page23092400072996SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24042300003472KKBK ChallanReceiptDocument1 page24042300003472KKBK ChallanReceiptGanapathyGaneshNo ratings yet

- Jaswinder Kaur Sandhu Challan Ay 202324Document1 pageJaswinder Kaur Sandhu Challan Ay 202324SANJEEV KUMARNo ratings yet

- Tds Oct To DecDocument1 pageTds Oct To Decadarshtiw787No ratings yet

- 24030701379609SBIN ChallanReceiptDocument1 page24030701379609SBIN ChallanReceiptFiroz AliNo ratings yet

- 24030701385192SBIN ChallanReceiptDocument1 page24030701385192SBIN ChallanReceiptFiroz AliNo ratings yet

- 24031200008039SBIN ChallanReceiptDocument1 page24031200008039SBIN ChallanReceiptgudiverma111No ratings yet

- 23120500288895UTIB ChallanReceiptDocument1 page23120500288895UTIB ChallanReceiptbinitashah11573No ratings yet

- 24040600201802UTIB ChallanReceiptDocument1 page24040600201802UTIB ChallanReceiptabdulbeg1986No ratings yet

- 23092400076660SBIN ChallanReceiptDocument1 page23092400076660SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24033000124545UBIN ChallanReceiptDocument1 page24033000124545UBIN ChallanReceiptDEEPAK MALIKNo ratings yet

- 24020700082337ICIC ChallanReceiptDocument1 page24020700082337ICIC ChallanReceiptyadav.santosh650No ratings yet

- Atikur Rahaman Khan Itr Challan 23-24Document1 pageAtikur Rahaman Khan Itr Challan 23-24Mohan MistryNo ratings yet

- 23092400070301SBIN ChallanReceiptDocument1 page23092400070301SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- 24030800135378IDIB ChallanReceiptDocument1 page24030800135378IDIB ChallanReceiptSamiulla SkNo ratings yet

- 24031400013395KKBK ChallanReceiptDocument1 page24031400013395KKBK ChallanReceiptRammurat PranamiNo ratings yet

- 23120500253875UTIB ChallanReceiptDocument1 page23120500253875UTIB ChallanReceiptbinitashah11573No ratings yet

- 24032100084119KKBK ChallanReceiptDocument1 page24032100084119KKBK ChallanReceipts114111010No ratings yet

- 24040800030981HDFC ChallanReceiptDocument1 page24040800030981HDFC ChallanReceiptkunal3152No ratings yet

- 23120500291281UTIB ChallanReceiptDocument1 page23120500291281UTIB ChallanReceiptbinitashah11573No ratings yet

- Parmjit Singh Challan Ay 202324Document1 pageParmjit Singh Challan Ay 202324SANJEEV KUMARNo ratings yet

- 24022300033455PUNB ChallanReceiptDocument1 page24022300033455PUNB ChallanReceiptrupindersingh23390No ratings yet

- 23123000084162SBIN ChallanReceiptDocument1 page23123000084162SBIN ChallanReceiptMala Jeevan KashidNo ratings yet

- 23122100083801KKBK ChallanReceiptDocument1 page23122100083801KKBK ChallanReceiptnksuranaandcoNo ratings yet

- 24041900008655KKBK ChallanReceiptDocument1 page24041900008655KKBK ChallanReceiptvikash865138No ratings yet

- 23113000097469SBIN ChallanReceiptDocument1 page23113000097469SBIN ChallanReceiptDeep HandaNo ratings yet

- 23120500259735UTIB ChallanReceiptDocument1 page23120500259735UTIB ChallanReceiptbinitashah11573No ratings yet

- 23122400011045SBIN ChallanReceiptDocument1 page23122400011045SBIN ChallanReceiptpiyaliNo ratings yet

- 23080300048465HDFC ChallanReceiptDocument2 pages23080300048465HDFC ChallanReceiptmahesh rahejaNo ratings yet

- 23092600219233SBIN ChallanReceiptDocument1 page23092600219233SBIN ChallanReceiptSundararajan GopalakrishnanNo ratings yet

- Screenshot 2023-12-07 at 5.27.16 PMDocument1 pageScreenshot 2023-12-07 at 5.27.16 PMdrsadhu2001No ratings yet

- 24031200304903HDFC ChallanReceiptDocument1 page24031200304903HDFC ChallanReceiptprasadriri45No ratings yet

- 23080300051201HDFC ChallanReceiptDocument2 pages23080300051201HDFC ChallanReceiptmahesh rahejaNo ratings yet

- 24022400065950SBIN ChallanReceiptDocument1 page24022400065950SBIN ChallanReceiptvisainfo238No ratings yet

- 23093000342398SBIN ChallanReceiptDocument2 pages23093000342398SBIN ChallanReceiptCA Final Mission 2021No ratings yet

- Kalim Pan Link RecieptDocument1 pageKalim Pan Link Recieptmithunrmtelecom7No ratings yet

- 24030600031518HDFC ChallanReceiptDocument1 page24030600031518HDFC ChallanReceiptAbbas WaniNo ratings yet

- 23112300030457KKBK ChallanReceiptDocument2 pages23112300030457KKBK ChallanReceiptprashanth.financialpanditNo ratings yet

- 23053100136921ICIC ChallanReceiptDocument2 pages23053100136921ICIC ChallanReceiptVivek SugandhiNo ratings yet

- 23120600536613HDFC ChallanReceiptDocument1 page23120600536613HDFC ChallanReceiptArun ShindeNo ratings yet

- 23080300055186HDFC ChallanReceiptDocument2 pages23080300055186HDFC ChallanReceiptmahesh rahejaNo ratings yet

- Challlan ReceiptDocument2 pagesChalllan ReceiptYash KavteNo ratings yet

- 24020701009190HDFC ChallanReceiptDocument1 page24020701009190HDFC ChallanReceiptitr.gobindNo ratings yet

- Rajinder ChallanReceiptDocument1 pageRajinder ChallanReceiptAZAAD GULAMNo ratings yet

- 23052200045673SBIN ChallanReceiptDocument2 pages23052200045673SBIN ChallanReceiptpchak.sbiNo ratings yet

- 23052200045673SBIN ChallanReceiptDocument2 pages23052200045673SBIN ChallanReceiptpchak.sbiNo ratings yet

- 24031800091905SBIN ChallanReceiptDocument1 page24031800091905SBIN ChallanReceiptraj kumariNo ratings yet

- 24031900134717KKBK ChallanReceiptDocument1 page24031900134717KKBK ChallanReceiptMITHUN MARICKNo ratings yet

- 23043000062036HDFC ChallanReceiptDocument2 pages23043000062036HDFC ChallanReceiptanil panwarNo ratings yet

- 23073000665832ICIC ChallanReceiptDocument2 pages23073000665832ICIC ChallanReceiptsunil jadhavNo ratings yet

- MCQ BasicsDocument11 pagesMCQ BasicsBharat ThackerNo ratings yet

- Form16PartA Unhale ABFPU8256Q 2019-2020Document2 pagesForm16PartA Unhale ABFPU8256Q 2019-2020Milind UnhaleNo ratings yet

- Quiz 3 Cost AccountingDocument2 pagesQuiz 3 Cost AccountingRocel DomingoNo ratings yet

- Quiz 4 - Gross IncomeDocument6 pagesQuiz 4 - Gross IncomeVanessa Grace100% (1)

- CIR v. Primetown PropertyDocument3 pagesCIR v. Primetown Propertyamareia yapNo ratings yet

- CH 1 - BasicsDocument3 pagesCH 1 - BasicsHritik HarlalkaNo ratings yet

- JMA 2021 BudgetDocument8 pagesJMA 2021 BudgetJerryJoshuaDiazNo ratings yet

- Reportorial RequirementsDocument3 pagesReportorial RequirementsMark Anthony P. TarroquinNo ratings yet

- Income Taxation Bir FormDocument2 pagesIncome Taxation Bir FormVince AbabonNo ratings yet

- Principles of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1Document7 pagesPrinciples of Taxation For Business and Investment Planning 20th Edition Jones Test Bank 1ambermcbrideokdcjfmgbx100% (27)

- Ca Ipcc Costing Guideline Answer For May 2016 ExamDocument10 pagesCa Ipcc Costing Guideline Answer For May 2016 ExamAishwarya GangawaneNo ratings yet

- WSJ+ Tax-Guide 2022Document73 pagesWSJ+ Tax-Guide 2022JoeNo ratings yet

- Taxation - Corporation - Quizzer - 2018Document4 pagesTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Short Form: Texas Sales and Use Tax ReturnDocument2 pagesShort Form: Texas Sales and Use Tax ReturnBrenda ScharmannNo ratings yet

- Amazon Labor Union LMs For 2023Document28 pagesAmazon Labor Union LMs For 2023LaborUnionNews.comNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Eros Sampoornam Price List: " Ajay Enterprises Pvt. Ltd. "Document1 pageEros Sampoornam Price List: " Ajay Enterprises Pvt. Ltd. "ATS GREENSNo ratings yet

- PWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 NotifiedDocument9 pagesPWC News Alert 30 September 2020 Taxation and Other Laws Relaxation and Amendment of Certain Provisions Act 2020 Notifiedsujit guptaNo ratings yet

- RMO No. 23-2018 DigestDocument4 pagesRMO No. 23-2018 DigestMary Joy NavajaNo ratings yet

- 1700 Job AidDocument12 pages1700 Job AidAljohn Stephen Dela cruzNo ratings yet

- Income Statement - Brillare - Singlestep 1Document2 pagesIncome Statement - Brillare - Singlestep 1api-434210060No ratings yet

- Form 16 Lenskart - AspxDocument7 pagesForm 16 Lenskart - AspxPrince JainNo ratings yet

- 0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaDocument9 pages0 - Income-Tax-Calculator-FY-2018-19 Final ProformaaSrinivas PulimamidiNo ratings yet

- Payslip MatrimonyDocument2 pagesPayslip MatrimonyPuneeth KumarNo ratings yet

- TCC ReportDocument1 pageTCC ReportbrightNo ratings yet

- Memorandum of AgreementDocument4 pagesMemorandum of AgreementmbbdelenaNo ratings yet

- IAS 12 Solutions PDFDocument74 pagesIAS 12 Solutions PDFrafid aliNo ratings yet

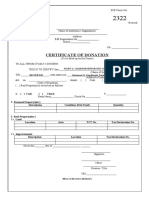

- BIR Form 2322 Cert of Don - FG Calderon High SchoolDocument3 pagesBIR Form 2322 Cert of Don - FG Calderon High SchoolEdmund G. VillarealNo ratings yet

- Form 1612052021 111453Document3 pagesForm 1612052021 111453SandhyaNo ratings yet

- Adobe Transaction No 1150271428 20200214 PDFDocument1 pageAdobe Transaction No 1150271428 20200214 PDFFrancisca InvernoNo ratings yet