Professional Documents

Culture Documents

Capital Allowances

Uploaded by

Nurain Nabilah ZakariyaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Allowances

Uploaded by

Nurain Nabilah ZakariyaCopyright:

Available Formats

TAXATION 1

CAPITAL ALLOWANCES & CHARGES

Introduction

Term:

- Qe- Qualifying expenditure

- Initial allowances – once

- Annual allowances – until fully utilized

(100%)

- Residual expenditure/ tax written value

Plant

Qualifying expenditure (QE)

- Means an apparatus by a person for

Capital allowances is claimed if:

carrying on his business but does not

- Carriying the business include intangible asset, or any asset used

- Incurred qualifying plant expenditure or and function as a place within which a

qualifying building business is carried on.

- Used in the business

Plant Not plant

horse Floating restaurant

book Human

Movable partitions Light fittings

Small item Golf course

Car park

Customer database

Qualifying plant expenditure Installation of plant or machinery

- Expenditure incurred on the alteration of - Include preaprring, cutting, tunnelling,

an business an existing building for the levelling land in order to prepare as ite

purpose of installing that machinery or for the installation.

plant and other expenditure incurred - does not exceed 10% of agregrate the cost

incidental to the installation of the machinery and the cost of

- Expenditure incurred on preparing, preparing site.

cutting, tunelling, levelling land to

prepare a site of installation. NOT Foreign exchange difference

EXCEED 10% - the realized loss upon the foreign

- Expenditure incurred on fish pond, exchange would be a part of the capital

animal pens, chicken houses, cages, allowances

building and other structural

improvement on land for the purpose of initial allowance (IA)

poultry farms, animal farms, inland - given only once

fishing industry or other agricultural or - IA would be given if fulfil all the

pastoral pursuits. conditions:

o Incurred capital expenditure on

the provision plant and machinery

in the YA

o For the purpose of business

CAPITAL ALLOWANCES & CHARGES 1

TAXATION 1

CAPITAL ALLOWANCES & CHARGES

o The person in the owner of the

asset

Asset brought and sold in the same year

- IA can be claim

Annual Allowance

Temporary disuse

- Given every year until full utilized

- AA will continue to be claimes even if

- AA would be given if all the conditions

plant n machinery is not use but it is

fulfill:

deemed to be ‘in use’ if:

o Incurred

o Plant and machinery was use

o Asset is owned by owner

before disuse

o Use for business purposes

o Constantly maintained

Residual expenditure o Period disuse is temporary

Unutilized portion of the qualifying expenditure General disoposal value

- Total QE minus:

o IA

AA

Also known as the ‘tax written down value’

Hire purchase transaction

QE for motor vehicle

- Commercial vehicle (lorry, truck, bus, etc)

are not restricted.

Asset owned less than 2 years

CAPITAL ALLOWANCES & CHARGES 2

TAXATION 1

CAPITAL ALLOWANCES & CHARGES

- It will be clawback (apa yg dh claim, dia

akan campur balik)

IA & AA percentage

CAPITAL ALLOWANCES & CHARGES 3

You might also like

- AS 10 (Revised) : Property, Plant and EquipmentDocument34 pagesAS 10 (Revised) : Property, Plant and EquipmentAkshay PatilNo ratings yet

- As 10Document34 pagesAs 10Harsh PatelNo ratings yet

- Capital AllowanceDocument6 pagesCapital AllowancedidieNo ratings yet

- Ppe Acctng203Document5 pagesPpe Acctng203PgumballNo ratings yet

- TOPIC 7-Capital AllowancDocument41 pagesTOPIC 7-Capital AllowancAgnesNo ratings yet

- (H) - 3rd Year - BCH 6.4 (DSE-4) - Sem-6 - Financial Reporting and Analysis - Week 4 - Himani DahiyaDocument19 pages(H) - 3rd Year - BCH 6.4 (DSE-4) - Sem-6 - Financial Reporting and Analysis - Week 4 - Himani DahiyaARGHYA MANDALNo ratings yet

- Topic 6:: Capital Allowances & Charges On Plant & MachineriesDocument18 pagesTopic 6:: Capital Allowances & Charges On Plant & MachineriesNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- As 10Document17 pagesAs 10Dipak UgaleNo ratings yet

- Far510 - PPE 1Document19 pagesFar510 - PPE 1intanNo ratings yet

- ICAIEKM Material 180116Document57 pagesICAIEKM Material 180116INTER SMARTIANSNo ratings yet

- Chapter 6 Capital Allowance A231Document55 pagesChapter 6 Capital Allowance A231Patricia TangNo ratings yet

- Session # 17 Class MaterialDocument11 pagesSession # 17 Class MaterialTushar� SinghNo ratings yet

- Module 11Document14 pagesModule 11Maria Therese CorderoNo ratings yet

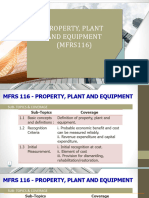

- Add Material MFRS116 NotesDocument37 pagesAdd Material MFRS116 NotesDont RushNo ratings yet

- Chapter 6 Capital Allowance Industrial Building AllowanceDocument57 pagesChapter 6 Capital Allowance Industrial Building AllowancePatricia TangNo ratings yet

- Property Plant and EquipmentDocument11 pagesProperty Plant and EquipmentRyla DocilNo ratings yet

- FAMA IndividualAssignmentDocument5 pagesFAMA IndividualAssignmentSRINIVAS BALIGANo ratings yet

- Capital AllowancesDocument11 pagesCapital Allowancesyi yi wiNo ratings yet

- 2022 06 DepreciationDocument46 pages2022 06 DepreciationSafi UllahNo ratings yet

- MFRS 116 PPE - Part 1 NotesDocument24 pagesMFRS 116 PPE - Part 1 NotesWAN AMIRUL MUHAIMIN WAN ZUKAMALNo ratings yet

- IAS 16 Property Plant and EquipmentDocument27 pagesIAS 16 Property Plant and Equipmentmanal.abdulazeez4No ratings yet

- Equipment: Chapter 25: PROPERTY, PLANT &Document4 pagesEquipment: Chapter 25: PROPERTY, PLANT &Czar RabayaNo ratings yet

- Summary Notes - PpeDocument5 pagesSummary Notes - PpeRommel VinluanNo ratings yet

- 5 Property Plant and Equipment Intermediate Accounting ReviewerDocument7 pages5 Property Plant and Equipment Intermediate Accounting ReviewerDalia ElarabyNo ratings yet

- NAS 16 Property, Plant and Equipment - UnlockedDocument54 pagesNAS 16 Property, Plant and Equipment - UnlockedAviTvNo ratings yet

- Lesson 1 PPEDocument17 pagesLesson 1 PPEBeatriz Jade TicobayNo ratings yet

- Chapter 2 Plant Asset PDFDocument20 pagesChapter 2 Plant Asset PDFWonde Biru100% (1)

- Plant AssetsDocument17 pagesPlant AssetsGizaw Belay100% (1)

- Audit of Item of FS Notes by CA Kapil GoyalDocument9 pagesAudit of Item of FS Notes by CA Kapil GoyalAbhimanyu Kumar ranaNo ratings yet

- IFA-I Chapter 5Document58 pagesIFA-I Chapter 5fikruhope533No ratings yet

- Capital AllowancesDocument11 pagesCapital Allowancesfaith olaNo ratings yet

- Property, Plant and Equipment: Initial RecognitionDocument6 pagesProperty, Plant and Equipment: Initial RecognitionMary Grace NaragNo ratings yet

- Topic 4 Plant and Intangible AssetsDocument28 pagesTopic 4 Plant and Intangible AssetsHà Trang NguyễnNo ratings yet

- Property, Plant and Equipment (Pas 16)Document1 pageProperty, Plant and Equipment (Pas 16)Jhets CalumbayNo ratings yet

- Financial&managerial Accounting - 15e Williamshakabettner Chap 9Document17 pagesFinancial&managerial Accounting - 15e Williamshakabettner Chap 9mzqaceNo ratings yet

- Intermediate Accounting 1 - 044932Document6 pagesIntermediate Accounting 1 - 044932AMIEL TACULAONo ratings yet

- FranchiseDocument3 pagesFranchiseANo ratings yet

- 01 - Finacc - Property, Plant, and EquipmentDocument5 pages01 - Finacc - Property, Plant, and EquipmentAbigail PadillaNo ratings yet

- CA Final Law - Charts by Swapnil PatniDocument42 pagesCA Final Law - Charts by Swapnil PatniDinesh TokasNo ratings yet

- Ias 16Document20 pagesIas 16Jasmine LamugNo ratings yet

- Job Aid Property - Plant - Equipment - BasicDocument2 pagesJob Aid Property - Plant - Equipment - BasicNadarajanNo ratings yet

- Property, Plant & EquipmentDocument16 pagesProperty, Plant & Equipmentjayadevsr2380No ratings yet

- Ind AS 16 - RBM (WBS)Document7 pagesInd AS 16 - RBM (WBS)KRISHNENDU JASHNo ratings yet

- 19 As10Document25 pages19 As10Selvi balanNo ratings yet

- Ias 16Document5 pagesIas 16Edga WariobaNo ratings yet

- Philippine Accounting Standard No. 16: Property, Plant and EquipmentDocument101 pagesPhilippine Accounting Standard No. 16: Property, Plant and EquipmentCoco MartinNo ratings yet

- RRC FAR Property Plant and EquipmentDocument18 pagesRRC FAR Property Plant and Equipmenthazel alvarezNo ratings yet

- Ind As 16Document41 pagesInd As 16Vidhi AgarwalNo ratings yet

- Cwip & FaDocument44 pagesCwip & FaRamkrishnarao BV0% (1)

- Module 5 - Property, Plant and Equipment (Part 1)Document9 pagesModule 5 - Property, Plant and Equipment (Part 1)Melanie RuizNo ratings yet

- Lecture 10-Ca IDocument69 pagesLecture 10-Ca I魔鬼No ratings yet

- Prepared By: Amal PaulDocument32 pagesPrepared By: Amal PaulChandra NNo ratings yet

- Property, Plant, & EquipmentDocument1 pageProperty, Plant, & EquipmentMarthy DayagNo ratings yet

- Week 9 Impairment of Non-Current Assets (MFRS 136) For StudentsDocument32 pagesWeek 9 Impairment of Non-Current Assets (MFRS 136) For StudentsAnselmNo ratings yet

- Chapter 10 PPTDocument48 pagesChapter 10 PPTkjw 2No ratings yet

- To Recognize The Purchase of Investment PropertyDocument3 pagesTo Recognize The Purchase of Investment PropertyShantalNo ratings yet

- Cfas NotesDocument56 pagesCfas Notesfrincese gabrielNo ratings yet

- Pas 16Document8 pagesPas 16Maxyne Dheil CastroNo ratings yet

- Property, Plant, and Equipment - Initial RecognitionDocument38 pagesProperty, Plant, and Equipment - Initial RecognitionCaila Nicole M. ReyesNo ratings yet

- Phil Tax Midterm ExamDocument25 pagesPhil Tax Midterm ExamDanica VetuzNo ratings yet

- 11.23.13 MOCK EXAM Real Property Assessment Exercises No AnswerDocument2 pages11.23.13 MOCK EXAM Real Property Assessment Exercises No AnswerMiggy Zurita100% (1)

- Good CVDocument2 pagesGood CVChild TimeNo ratings yet

- 2316 (1) 2Document2 pages2316 (1) 2jonbelzaNo ratings yet

- 1904 Bir FormDocument2 pages1904 Bir Formal bentulanNo ratings yet

- B P Impex Inv-425Document2 pagesB P Impex Inv-425aman.dubey.resNo ratings yet

- Introduction To Business TaxationDocument12 pagesIntroduction To Business TaxationMariel CadayonaNo ratings yet

- F. HTAX230-1-Jan-June2024-FA1-AP-V2-23012024Document12 pagesF. HTAX230-1-Jan-June2024-FA1-AP-V2-23012024kashmeerpunwasiNo ratings yet

- Tax Invoice - Ezcash: Transaction DetailsDocument1 pageTax Invoice - Ezcash: Transaction DetailsShoaib AbbasiNo ratings yet

- SL No. 1: Proforma InvoiceDocument2 pagesSL No. 1: Proforma InvoiceameygandhiNo ratings yet

- Survey of Metro Manila RPT RatesDocument6 pagesSurvey of Metro Manila RPT RatesMarcus DoroteoNo ratings yet

- Gala 2010 SponsorshipDocument2 pagesGala 2010 SponsorshipMaryland Democratic PartyNo ratings yet

- 3 Sales Invoice RelaxoDocument3 pages3 Sales Invoice RelaxoSantosh OjhaNo ratings yet

- SPIT. Abella SamplexDocument5 pagesSPIT. Abella SamplexEins BalagtasNo ratings yet

- Income Tax Mock Test 3Document2 pagesIncome Tax Mock Test 3Mary Ellen LuceñaNo ratings yet

- Income Tax Payment Challan: PSID #: 43239093Document1 pageIncome Tax Payment Challan: PSID #: 43239093Rizwan Akram RizwanNo ratings yet

- HO.14 - Deductions From Gross Estate and Estate Tax PayableDocument3 pagesHO.14 - Deductions From Gross Estate and Estate Tax PayableAngelica Jem Ballesterol CarandangNo ratings yet

- Guidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnDocument1 pageGuidelines and Instructions For BIR Form No. 1707-A Annual Capital Gains Tax ReturnKylie sheena MendezNo ratings yet

- Sindoor 2Document2 pagesSindoor 2sanju.wageeshaNo ratings yet

- SHOAIBDocument2 pagesSHOAIBshaikhNo ratings yet

- Return of IncomeDocument6 pagesReturn of IncomeKartikNo ratings yet

- GST Invoice Format No. 15Document1 pageGST Invoice Format No. 15paramesh chadaramNo ratings yet

- CPAR Tax On Partnerships (Batch 90) - HandoutDocument4 pagesCPAR Tax On Partnerships (Batch 90) - HandoutAljur SalamedaNo ratings yet

- Irs - 2553 FormDocument4 pagesIrs - 2553 FormmeikaizenNo ratings yet

- Aacpt8112a 2021 110889938Document77 pagesAacpt8112a 2021 110889938vnpNo ratings yet

- ITDocument4 pagesITMahesh KumarNo ratings yet

- Tax ExemptionDocument5 pagesTax ExemptionRamon TambisNo ratings yet

- Income Tax Limits Days Summay by CA Vivek Gaba TAX LOVE. 1Document82 pagesIncome Tax Limits Days Summay by CA Vivek Gaba TAX LOVE. 1KrishnaNo ratings yet

- Solved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromDocument1 pageSolved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromAnbu jaromia0% (1)

- Confirmation - Letter - Spectrum Printing Supplies LLCDocument2 pagesConfirmation - Letter - Spectrum Printing Supplies LLCzakariaeNo ratings yet