Professional Documents

Culture Documents

Sepa Business

Uploaded by

Isabelle KolibrieCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sepa Business

Uploaded by

Isabelle KolibrieCopyright:

Available Formats

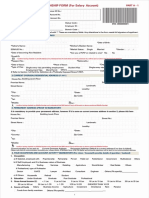

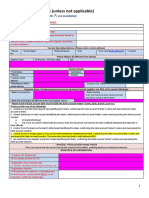

BUSINESS-TO-BUSINESS DIRECT DEBIT MANDATE

You must sign this mandate and then send it to your bank.

Make sure your bank has registered the RUM below

before making first payment from the designated account.

By signing this mandate form, you authorise the Public Finances Directorate General to send

instructions to your bank to debit your account and your bank to debit your account in accordance

with the instructions from the Public Finances Directorate General.

This mandate is only intended for business-to-business transactions.

You are not entitled to a refund from your bank after your account has been debited, but you are

entiled to request your bank not do debit your account up until the day on which the payment is due.

Please complete all the fields marked *

Mandate Reference (RUM) *

n n D G F I P

Debtor's SIREN (or IDSP) code *

Debtor's name *

Bank account holder (may be different from debtor) *

Legal Company

form * name *

Street number, Street name and Type :

Address *

Post code and City :

Country :

Account number – IBAN *

Bank Identifier Code – BIC. You have to complete this field only if the bank

is located outside the European Economic Area.

Creditor's name Public Finances Directorate General

Creditor's SEPA identifier F R 4 6 Z Z Z 0 0 5 0 0 2

Name of your local tax service :

Address *

Street number, Street name and Type :

Post code and City : FRANCE

Type of payment Recurrent payment

Location * Date * D D M M Y Y Y Y

Signature *

The information contained in this mandate is intended for use by the Public Finances Directorate General only. The

debtor/payer can oppose, access or modify the data, pursuant to Article 38 of Act no. 78-17 of 6 January 1978,

regarding data processing and freedom of information.

You might also like

- ON Supplier Registration FormDocument8 pagesON Supplier Registration FormPrashanth KumarNo ratings yet

- Salary Account Opening FormDocument12 pagesSalary Account Opening FormVijay DhanarajNo ratings yet

- Account Opening FormDocument22 pagesAccount Opening FormTarun BhardwajNo ratings yet

- Vendor Set Up FormDocument3 pagesVendor Set Up FormDELICIAS PASCAL CHILEAN FOODNo ratings yet

- Vendor Master FormDocument2 pagesVendor Master Formrekha0% (1)

- Borang Direct Debit PASDocument2 pagesBorang Direct Debit PASFirdaus CanNo ratings yet

- Personal Current Acc App SoleDocument7 pagesPersonal Current Acc App Soleaiss.ay.moussNo ratings yet

- New Supplier E-Payment FormDocument2 pagesNew Supplier E-Payment FormTareeke ThompsonNo ratings yet

- Mamay&Papay KainanDocument1 pageMamay&Papay KainanLorenzo GimpesNo ratings yet

- Funds Transfer Form - For Wholesale Banking Customers Only: Debit Account DetailsDocument1 pageFunds Transfer Form - For Wholesale Banking Customers Only: Debit Account Detailsdon EzeNo ratings yet

- Customer Request Form - BOSSDocument1 pageCustomer Request Form - BOSSAdeel ShahbazNo ratings yet

- Customer Information Updation Form Individual CustomersDocument2 pagesCustomer Information Updation Form Individual CustomersMohammed Ameen SaudagarNo ratings yet

- Supplier Information Form 2.0Document1 pageSupplier Information Form 2.0Tonie MbugaNo ratings yet

- Account Closure RequestDocument1 pageAccount Closure Requestanilmourya5No ratings yet

- Vendor Registration FormDocument2 pagesVendor Registration FormIrpan HerawanNo ratings yet

- Account Holder: Financial Identification Form (F.I.F.)Document1 pageAccount Holder: Financial Identification Form (F.I.F.)Carl MNo ratings yet

- Duplicate Pin Request BranchDocument1 pageDuplicate Pin Request BranchashokjpNo ratings yet

- Pi Withdrawal FormDocument4 pagesPi Withdrawal FormRaffy VelezNo ratings yet

- Debit Order FormDocument1 pageDebit Order Formgewmn7futNo ratings yet

- Current and Savings Account Opening Form For Non Individuals No Company Seal RequiredDocument14 pagesCurrent and Savings Account Opening Form For Non Individuals No Company Seal RequiredSan ThiyaNo ratings yet

- Vendor Registration Form-Ver2Document1 pageVendor Registration Form-Ver2Robert TuranganNo ratings yet

- Bank Accounts Registration FormDocument2 pagesBank Accounts Registration FormSuresh SharmaNo ratings yet

- Financial Identification: Banking DetailsDocument1 pageFinancial Identification: Banking DetailsCristina PopescuNo ratings yet

- Bank Account Updation FormDocument2 pagesBank Account Updation Forms.sabapathyNo ratings yet

- Account Opening Form NR IndividualDocument2 pagesAccount Opening Form NR IndividualGraham EvansNo ratings yet

- Bank of Baroda: Account Opening Form For Non-IndividualsDocument6 pagesBank of Baroda: Account Opening Form For Non-IndividualsCoolGamer RoshNo ratings yet

- Resident To Nro Conversion FormDocument3 pagesResident To Nro Conversion FormAbhiruchiNo ratings yet

- Metrobank (Updated ATDA Form)Document1 pageMetrobank (Updated ATDA Form)Cherrie Mae CongsonNo ratings yet

- Financial Identification: Banking DetailsDocument1 pageFinancial Identification: Banking DetailsPiyush ChaturvediNo ratings yet

- E3f Fif en PDFDocument1 pageE3f Fif en PDFperfilma2013No ratings yet

- B6. b8j1 - Annexvifif - en PDFDocument1 pageB6. b8j1 - Annexvifif - en PDFKlaudija LutovskaNo ratings yet

- b8j1 Annexvifif en PDFDocument1 pageb8j1 Annexvifif en PDFМилена ТрендафиловаNo ratings yet

- Bank Account Form-EnDocument1 pageBank Account Form-EnSimona SzabovaNo ratings yet

- Annex E - Financial Identification FormDocument1 pageAnnex E - Financial Identification FormXhavit BektashiNo ratings yet

- B6. b8j1 - Annexvifif - en PDFDocument1 pageB6. b8j1 - Annexvifif - en PDFKlaudija LutovskaNo ratings yet

- Annex E - FINANCIAL IDENTIFICATION FORM PDFDocument1 pageAnnex E - FINANCIAL IDENTIFICATION FORM PDFAnonymous XSixrIuNo ratings yet

- Common Modification Request FormDocument2 pagesCommon Modification Request FormRajkumar manokaranNo ratings yet

- Auto Debit Mandate 9Document2 pagesAuto Debit Mandate 9dipakkaushalNo ratings yet

- Subscription 12A9HYADocument2 pagesSubscription 12A9HYAHarsh ManotNo ratings yet

- F.249 Fund Transfer Request Form1Document3 pagesF.249 Fund Transfer Request Form1OscarNo ratings yet

- Module 2 - Technical AnalysisDocument3 pagesModule 2 - Technical AnalysisManmohan TiwariNo ratings yet

- Direct Credit Authorisation Form: InstructionsDocument1 pageDirect Credit Authorisation Form: InstructionsAbh ParNo ratings yet

- Application Form For BCsDocument2 pagesApplication Form For BCsAbhijit SingNo ratings yet

- Premature Withdrawal Form - 102Document8 pagesPremature Withdrawal Form - 102sher singhNo ratings yet

- Vendor AdditionDocument1 pageVendor Additionmustafa jawadNo ratings yet

- Financial IdentificationDocument1 pageFinancial IdentificationVicente EgNo ratings yet

- Ερωτηματολόγιο Φυ PDFDocument4 pagesΕρωτηματολόγιο Φυ PDFJiojeqNo ratings yet

- Account Closure RequestDocument1 pageAccount Closure Requestanon_519336046No ratings yet

- Retirement Notification FormDocument2 pagesRetirement Notification FormAbongile PhinyanaNo ratings yet

- FASTag Application FormDocument4 pagesFASTag Application FormAtul Kumar DixitNo ratings yet

- Payment SlipDocument2 pagesPayment SlipMohit AgarwalNo ratings yet

- Eage Banking Change of Address FormDocument2 pagesEage Banking Change of Address FormKushaal SainNo ratings yet

- Eage Banking Change of Address FormDocument2 pagesEage Banking Change of Address Formbhkrish_276677No ratings yet

- Eage Banking Change of Address FormDocument2 pagesEage Banking Change of Address FormRaghavendra ReddyNo ratings yet

- Eage Banking Change of Address FormDocument2 pagesEage Banking Change of Address FormUjjain OfficeNo ratings yet

- Evaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersFrom EverandEvaluation of Some Online Banks, E-Wallets and Visa/Master Card IssuersNo ratings yet

- Operations Worksheet MasterDocument174 pagesOperations Worksheet MasterVedank ParasharNo ratings yet

- CBME2 - Quiz No. 1 - Finals PDFDocument3 pagesCBME2 - Quiz No. 1 - Finals PDFRaca DesuNo ratings yet

- Best Practice in Savesoo As An Amazon ReviewerDocument2 pagesBest Practice in Savesoo As An Amazon ReviewerSave SooNo ratings yet

- Management Accounting Objectives Sem VDocument14 pagesManagement Accounting Objectives Sem VytsNo ratings yet

- Law Practice Start Up KitDocument34 pagesLaw Practice Start Up KitSerena Lim100% (2)

- Lesson 1 Profit or Loss For A Business: Let's Explore and DiscoverDocument8 pagesLesson 1 Profit or Loss For A Business: Let's Explore and DiscoverScarlet VillamorNo ratings yet

- IPMA PEB BOOK-2019 WEB ShopDocument126 pagesIPMA PEB BOOK-2019 WEB ShopNeringa Ieva LenciauskaiteNo ratings yet

- FMOB RESEARCH PAPER - Organising As A Function of ManagementDocument16 pagesFMOB RESEARCH PAPER - Organising As A Function of ManagementRidhiNo ratings yet

- Vendor Development H&MDocument14 pagesVendor Development H&MAdarsh SinghNo ratings yet

- Chapter 14Document6 pagesChapter 14Mychie Lynne MayugaNo ratings yet

- NCFM Mutual Fund Begginer ModuleDocument71 pagesNCFM Mutual Fund Begginer ModuleIshpreet SinghNo ratings yet

- Druk WangDocument24 pagesDruk WangSonam Peldon (Business) [Cohort2020 RTC]No ratings yet

- Common Bankruptcy Questions and AnswersDocument1 pageCommon Bankruptcy Questions and AnswersTâm Anh MạcNo ratings yet

- Cambridge IGCSE: Accounting 0452/11Document12 pagesCambridge IGCSE: Accounting 0452/11Khaled AhmedNo ratings yet

- Midterm Exams - Pract 2 (1st Sem 2012-2013)Document13 pagesMidterm Exams - Pract 2 (1st Sem 2012-2013)jjjjjjjjjjjjjjjNo ratings yet

- Traders Guide To Global Equity MarketsDocument166 pagesTraders Guide To Global Equity MarketsZerohedge100% (3)

- MKTG 420 NotesDocument19 pagesMKTG 420 NotesFaith DilmoreNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument17 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceShafeya SulemanNo ratings yet

- 10.1 Thesis - FachiDocument85 pages10.1 Thesis - FachiMadalitso MukiwaNo ratings yet

- OBM752 HM Model Part A QnsDocument2 pagesOBM752 HM Model Part A QnsaNo ratings yet

- The Essential Tax Guide - 2023 EditionDocument116 pagesThe Essential Tax Guide - 2023 Editionธนวัฒน์ ปิยะวิสุทธิกุล100% (2)

- Section A: Multiple Choice Questions - Single OptionDocument25 pagesSection A: Multiple Choice Questions - Single OptionKenny HoNo ratings yet

- Geog1012 Week8 S1 2022Document40 pagesGeog1012 Week8 S1 2022Zephyrine ChengNo ratings yet

- Production Layout Improvement For Steel Fabrication WorksDocument5 pagesProduction Layout Improvement For Steel Fabrication WorksyemNo ratings yet

- Credit and Collection Chapter 2Document45 pagesCredit and Collection Chapter 2BEA CARMONANo ratings yet

- Fe Acc101Document89 pagesFe Acc101Phan Thien Nhan (K17 CT)No ratings yet

- UAE Top ConsultantsDocument4 pagesUAE Top ConsultantsAnil kumar RNo ratings yet

- Updated Clients DBDocument247 pagesUpdated Clients DBMohit Yadav100% (1)

- JD - Associate Product ManagerDocument3 pagesJD - Associate Product ManagersNo ratings yet

- Green Blue Cute 3D Group Project Classroom School Education PresentationDocument18 pagesGreen Blue Cute 3D Group Project Classroom School Education PresentationHanissandra Franz V. DalanNo ratings yet