Professional Documents

Culture Documents

2023 06 16 - Statement

Uploaded by

Russell LoboOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023 06 16 - Statement

Uploaded by

Russell LoboCopyright:

Available Formats

Contact tel

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

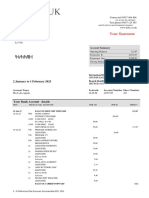

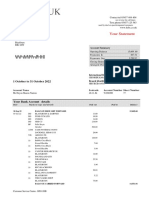

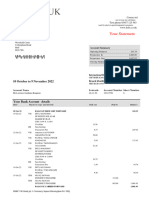

Your Statement

Mr R Lobo

24 Ranelagh Mansions

New Kings Road

London

SW6 4RH Account Summary

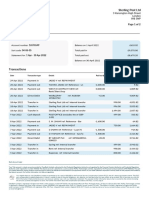

Ope ning Balance 5,21 6.0 0

Paym e nts In 1,560.00

Paym e nts Out 1,961.43

Clos ing Balance 4,814.57

Arrange d Ove rdraft Lim it 1,000.00

.

International Bank Account Number

GB14HBUK40119500556998

17 May to 16 June 2023 Branch Identifier Code

HBUKGB4195Z

Acco unt Nam e S o rtcode Acco unt Num ber S he e t Num be r

Mr Russell Lobo 40-11-95 00556998 10

Your Student Bank Account details

Date Pay m e nt t y p e and de t ails Paid o ut Paid in Balance

A

16 May 23 BALANCE BROUGHT FORWARD . 5,216.00

22 May 23 CR UOB EXPENDITURE 1,550.00 6,766.00

01 Jun 23 CR ANITA LOBO

Anita Lobo 10.00 6,776.00

08 Jun 23 BP Sophie Thompson

Russell Rent 1,961.43 4,814.57

16 Jun 23 BALANCE CARRIED FORWARD 4,814.57

Info rmatio n abo ut the Financial S e rvice s Co mpe ns atio n Sche m e

Your deposit is eligible for protection under the Financial Services Compensation Scheme (FSCS). For further information

about the compensation provided by the FSCS, refer to the FSCS website at www.FSCS.org.uk, call into your nearest branch

or call your telephone banking service. Further details can be found on the FSCS Information Sheet and Exclusions List

which is available on our website (www.hsbc.co.uk).

AER Arrange d Ove rdraft EAR

Cre dit Inte re s t Rate s b alance variab le Inte re s t Rate s b alance variable

Cre dit inte re s t 0.00% Arrange d Ove rdraft inte re s t 0.00%

HSBC UK Bank plc 1 Centenary Square Birmingham B1 1HQ

Commercial Banking Customers Effective from 14 March 2020

Interest and Charges Monthly cap on unarranged overdraft charges

[Your] Business Banking Terms and Conditions cover how and when 1. Each current account will set a monthly maximum charge for:

we can charge our interest rates and charges. (a) going overdrawn when you have not arranged an overdraft; or

Details of Debit interest together with details of the interest rate we (b) going over/past your arranged overdraft limit (if you

pay and charge in full [for all accounts] are available in [our] Business have one).

Price List. All [our] business current accounts are non-interest bearing 2. This cap covers any:

when in credit unless we individually agree a rate with you.

(a) interest and fees for going over/past your arranged overdraft limit;

Overdrafts:

(b) fees for each payment your bank allows despite lack of funds; and

Arranged overdraft: Where you ask us for an overdraft before

making any transactions that takes your account overdrawn, or over (c) fees for each payment your bank refuses due to lack of funds.

your current arranged overdraft limit. Interest rates are individually The monthly cap on unarranged overdraft charges for the HSBC

agreed, for a period of 12 months, and are linked to the Bank of Advance Bank Account, HSBC Bank Account, HSBC Current Account,

England base rate. For details of our fees and charges, please refer Home Management Account and HSBC Graduate Bank Account is £20.

to our Business Price List – see Additional Information below. The monthly cap on unarranged overdraft charges is not applicable

Unarranged overdraft: When you make a payment that takes your to Bank Account Pay Monthly, Basic Bank Account, Student Bank

account overdrawn if you don’t have an arranged overdraft limit, or Account, Amanah Bank Account and MyAccount as these accounts

takes your account over your arranged overdraft limit. When you do not incur unarranged overdraft charges.

don’t have an arranged overdraft limit, we will charge our Business Unarranged overdraft charges incurred before 14 March 2020 may

Standard Debit Interest Rate on any balances. When you have an debit your account after this date (we’ll still give advance notice).

existing arranged overdraft limit and go over this limit, we will charge Charges incurred before 14 March 2020 won’t count towards the new

interest at the rate we have agreed with you on the balance of your £20 cap as they’ll relate to the previous month’s charging period.

arranged overdraft limit and will charge Standard Debit Interest Rate

on any balance over your arranged overdraft facility. In either of these Your debit card

circumstances, unarranged overdraft charges will be applied on each When you use your card outside the UK, your statement will show

working day that your account is overdrawn (if you don’t have an where the transaction took place, the amount spent in foreign

arranged overdraft) or you go over your arranged overdraft limit (if currency and the amount converted into sterling. We also monitor

you have an arranged overdraft). For details of our fees and charges, transactions to protect you against your card being used fraudulently.

please see our Business Price List and for information on our Interest Unless you agree that the currency conversion is done at the point of

Rates – see Additional Information below. sale or withdrawal and agree the rate at that time, for example with

the shopkeeper or on the self-service machine screen, the exchange

Your debit card rate that applies to any foreign currency debit card payments

For debit card charges and how foreign currency transactions are (including cash withdrawals) is the VISA Payment Scheme Exchange

converted to sterling please refer to the Business Price List. Rate applying on the day the conversion is made. For foreign

Additional Information currency transactions we will charge a fee of 2.75% of the amount

A copy of [our] Business Price List and the Business Banking of the transaction. This fee will be shown as a separate line on your

Terms and Conditions can be found on our website statement as a ‘Foreign Currency Transaction Fee’. Details of the

www.business.hsbc.uk/en-gb/gb/generic/ current VISA Payment Scheme Exchange Rates can be obtained from

legal-information. the card support section of hsbc.co.uk or by calling us on the usual

Information on our Interest Rates can be found on our website numbers. We will deduct the payment from your account once we

www.business.hsbc.uk/en-gb/interest-rates/interest-rates- receive details of the payment from the card scheme, at the latest, the

finance-borrowing. next working day. For cash machine withdrawals in a currency other

than sterling we will charge a Non Sterling Cash Fee of 2% (minimum

This information is also available in our branches, by calling

£1.75, maximum £5). This fee applies to all cash machines outside

03457 60 60 60 (lines are open GMT 8am to 10pm, Monday to

the UK, and to cash machines in the UK, if we convert the withdrawal

Sunday) or by textphone 0345 12 55 63. [Details of the interest

to Sterling for you. HSBC Advance customers are exempt from this

rate we pay and charge are also separately available through

fee. Some cash machine operators may apply a direct charge for

these channels.]

withdrawals from their cash machines and this will be advised on

To help us continuously improve our service and in the interests of screen at the time of withdrawal.

security, we may monitor and/or record your telephone calls with us.

Commercial and Personal Banking Customers

Personal Banking Customers Lost and Stolen Cards

Interest If any of your cards are lost or stolen please call 0800 032 7075

Credit Interest is calculated daily on the cleared credit balance and is or if you are calling from outside the UK, please call us on

paid monthly if applicable (this is not paid on all accounts, e.g. Basic +44 1442 422 929. Lines are open 24 hours.

Bank Account, Bank Account and HSBC Advance). For personal

Dispute Resolution

current accounts, overdraft interest is charged on the whole overdraft

If you have a problem with your agreement, please try to resolve

balance above any interest free amount. Debit interest is calculated

it with us in the first instance. If you are not happy with the way in

daily on the cleared debit balance of your account, it accrues during

which we handled your complaint or the result, you may be able to

your charging cycle (usually monthly) and is deducted from your

complain to the Financial Ombudsman Service. If you do not take

account following the end of your charging cycle.

up your problem with us first you will not be entitled to complain

Overdrafts to the Ombudsman. We can provide details of how to contact the

Arranged overdraft: Where you ask us for an overdraft before Ombudsman.

making any transactions that takes your account overdrawn, or over

Disabled Customers

your current arranged overdraft limit.

We offer a number of services such as statements in Braille or large

Unarranged overdraft: When you make a payment that takes your print. Please contact us by calling 03457 60 60 60 (lines are open

account overdrawn if you don’t have an arranged overdraft, or takes GMT 8am to 10pm, Monday to Sunday) or textphone 0345 12 55 63

your account over your arranged overdraft limit. to let us know how we can serve you better.

HSBC UK Bank plc, registered in England and Wales number 09928412. Registered office 1 Centenary Square, Birmingham B1 1HQ. Authorised by the

Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under reference number 765112.

RFB1898 MCP54585 ©HSBC Group 2019

You might also like

- Your Statement: 2 January To 1 February 2023Document6 pagesYour Statement: 2 January To 1 February 2023Lydia AppiahNo ratings yet

- PreviewDocument4 pagesPreviewandrealhepburnNo ratings yet

- HSBC StatementDocument2 pagesHSBC StatementWaifubot 2.1No ratings yet

- Statement 14-APR-23 AC 93025888 16042114Document2 pagesStatement 14-APR-23 AC 93025888 16042114Shauna DunnNo ratings yet

- CurrentAccountStatement 07112023Document4 pagesCurrentAccountStatement 07112023caraleighjaneNo ratings yet

- Statement Standarter 123Document1 pageStatement Standarter 123SW Project0% (1)

- StatementDocument62 pagesStatementisaac ellisNo ratings yet

- Statement 16-MAR-23 AC 63755886 18042921Document6 pagesStatement 16-MAR-23 AC 63755886 18042921Shauna DunnNo ratings yet

- Statement 21-JUN-21 ADocument13 pagesStatement 21-JUN-21 AJasmina Cakaj100% (1)

- Basic Account: Your Account Summary ForDocument4 pagesBasic Account: Your Account Summary ForSuphattharachai SuwantemeeNo ratings yet

- SCC Comunicados Ed 02ef11fc44216a3910a0c93714358Document4 pagesSCC Comunicados Ed 02ef11fc44216a3910a0c93714358srikanth829No ratings yet

- Bank StatementDocument2 pagesBank StatementsaNo ratings yet

- Ireland Flogas Natural GasDocument1 pageIreland Flogas Natural GasMyt WovenNo ratings yet

- MR Eduards Valkovs 12 Serby Ave Royston Sg8 5eh: Your Account Summary BalanceDocument1 pageMR Eduards Valkovs 12 Serby Ave Royston Sg8 5eh: Your Account Summary BalanceRus Ru0% (1)

- Your Account Summary BalanceDocument1 pageYour Account Summary BalanceВиктория ГринькоNo ratings yet

- PreviewDocument3 pagesPreviewvi6205552No ratings yet

- StatementDocument20 pagesStatementBernadette TsakalosNo ratings yet

- Statement 09apr2023Document8 pagesStatement 09apr2023Daia SorinNo ratings yet

- Electricity Bill April 2023Document2 pagesElectricity Bill April 2023Eric CartmanNo ratings yet

- US SantanderDocument2 pagesUS Santanderfxckdabrain100% (1)

- Banco Popular StatementDocument2 pagesBanco Popular StatementLong Home ProductsNo ratings yet

- UntitledDocument4 pagesUntitledRJN CabinetmakingNo ratings yet

- SCC Comunicados Pi Batch0100151117a93d91eec74400Document2 pagesSCC Comunicados Pi Batch0100151117a93d91eec74400JilShethNo ratings yet

- SantanderDocument1 pageSantanderKabanNo ratings yet

- 2021 08 06 - StatementDocument3 pages2021 08 06 - StatementMohamed Ali KalathingalNo ratings yet

- Statement 13-NOV-23 GH 63962504 26043107Document5 pagesStatement 13-NOV-23 GH 63962504 26043107bartsusy.67No ratings yet

- Statement 2023 5Document1 pageStatement 2023 5MasoomaIjazNo ratings yet

- Statement April 2022Document2 pagesStatement April 2022Taim JadidNo ratings yet

- Drozynski MaciejDocument3 pagesDrozynski MaciejITNo ratings yet

- Everyday Basics Account: Opening Balance $858.91 123-456 1234567890 1/04/2021 - 30/04/2021 Closing Balance $93.25Document7 pagesEveryday Basics Account: Opening Balance $858.91 123-456 1234567890 1/04/2021 - 30/04/2021 Closing Balance $93.25Wenjie65No ratings yet

- SCC COMUNICADOS PI Batch0100151115e8f50a18381100 PDFDocument3 pagesSCC COMUNICADOS PI Batch0100151115e8f50a18381100 PDFVolodymyr BokovnyaNo ratings yet

- Statement 600606 35438479 2 11 2022 1 12 2022Document1 pageStatement 600606 35438479 2 11 2022 1 12 2022Orhan DagdelenNo ratings yet

- 2022 10 31 - StatementDocument7 pages2022 10 31 - StatementGiovanni SlackNo ratings yet

- SBSA Statement 2023-03-10Document42 pagesSBSA Statement 2023-03-10Maestro ProsperNo ratings yet

- Your Bill Highlights: Your Electricity Usage Over Time You Used A Total of 1,681 KWH From Feb 26, 2021 To Apr 27, 2021Document2 pagesYour Bill Highlights: Your Electricity Usage Over Time You Used A Total of 1,681 KWH From Feb 26, 2021 To Apr 27, 2021Fast BlastNo ratings yet

- Commonweath Bank StatementDocument1 pageCommonweath Bank StatementShaggy ShagNo ratings yet

- Statement 5563 Jul-23Document4 pagesStatement 5563 Jul-23Allison LesterNo ratings yet

- Nov Pay PDFDocument7 pagesNov Pay PDFRoland Lovelace OpokuNo ratings yet

- Account Statement - 2022 04 01 - 2022 04 30 - en GB - 72261aDocument6 pagesAccount Statement - 2022 04 01 - 2022 04 30 - en GB - 72261acaitiewhiteman1993No ratings yet

- Classic Account 24 December 2021 To 21 January 2022Document4 pagesClassic Account 24 December 2021 To 21 January 2022blinkleyNo ratings yet

- Statement 01-DEC-22 AC 50882755 03042555 PDFDocument5 pagesStatement 01-DEC-22 AC 50882755 03042555 PDFferuzbekNo ratings yet

- Wise USD Statement March 2023Document1 pageWise USD Statement March 2023Aires C FestoNo ratings yet

- Classic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Document4 pagesClassic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Deva LinaNo ratings yet

- SCC Comunicados Pi Batch01001511179c5be3ce710500Document2 pagesSCC Comunicados Pi Batch01001511179c5be3ce710500Sagal HusseinNo ratings yet

- Statement - 63055249 - EUR - 2023-06-21 - 2023-07-20 - CopieDocument1 pageStatement - 63055249 - EUR - 2023-06-21 - 2023-07-20 - Copiefaridi abdoNo ratings yet

- Futuresave 62785064660: Summary in Botswana Pula BWPDocument4 pagesFuturesave 62785064660: Summary in Botswana Pula BWPSnr Berel ShepherdNo ratings yet

- Bank Statment Wells FargoDocument7 pagesBank Statment Wells FargoYu ShilohNo ratings yet

- Hippocrates Health Institute, Inc.Document2 pagesHippocrates Health Institute, Inc.bg giangNo ratings yet

- Statement 2024 1Document5 pagesStatement 2024 1nahidahcomNo ratings yet

- Leaving UK - Getting Tax RightDocument4 pagesLeaving UK - Getting Tax RightAbhay PatodiNo ratings yet

- 2023 10 03 - StatementDocument3 pages2023 10 03 - StatementIuliana CameliaNo ratings yet

- PreviewDocument5 pagesPreviewFaz AliNo ratings yet

- 2022 11 09 - StatementDocument3 pages2022 11 09 - StatementlorenzoNo ratings yet

- Sweden Mjölby Kraftnat ABDocument1 pageSweden Mjölby Kraftnat ABАнна БужинскаяNo ratings yet

- DA3MQ92LKD1N2KS1Document2 pagesDA3MQ92LKD1N2KS1LAURENE MANANSALANo ratings yet

- Your Visa Card Statement: From Overseas Tel 44 1226 261 010Document3 pagesYour Visa Card Statement: From Overseas Tel 44 1226 261 010Toni MirosanuNo ratings yet

- N26 Bank Account DetailsDocument1 pageN26 Bank Account DetailsLibreria DigitalNo ratings yet

- Transactions: 08th October 2023 Shunnosuke Maki Japan 3-8-12 Chiyodamachi, Maebashi, Gunma, 371-0022Document1 pageTransactions: 08th October 2023 Shunnosuke Maki Japan 3-8-12 Chiyodamachi, Maebashi, Gunma, 371-0022yusufabid1111No ratings yet

- Statement 49723864 USD 2023-01-09 2023-02-08Document2 pagesStatement 49723864 USD 2023-01-09 2023-02-08Md. Mintu MiaNo ratings yet

- 2024 01 19 - StatementDocument2 pages2024 01 19 - StatementjanmejaychhetriNo ratings yet

- DHL Terms and Conditions ApplyDocument2 pagesDHL Terms and Conditions ApplypranithpreethNo ratings yet

- Internet BillDocument4 pagesInternet BillKanchan Asnani0% (1)

- Your Annual Mortgage Statement Explained - 10-DeC-23 12030556Document12 pagesYour Annual Mortgage Statement Explained - 10-DeC-23 12030556haroonraja579No ratings yet

- SOP Supply ManagementDocument4 pagesSOP Supply ManagementKaty SanchezNo ratings yet

- Shipper's Domestic Truck Bill of LadingDocument1 pageShipper's Domestic Truck Bill of LadingSreeramNo ratings yet

- x1114 Account PlexDocument45 pagesx1114 Account PlexAvitu MarcoNo ratings yet

- History of Accounting Rex VillanuevaDocument3 pagesHistory of Accounting Rex Villanuevalgucabugao treasuryNo ratings yet

- Dbatu MisDocument1 pageDbatu MisVaibhav “Sam” DeshpandeNo ratings yet

- Accounting Concepts and Principles: Lanip - PalestinaDocument13 pagesAccounting Concepts and Principles: Lanip - PalestinaLira Ausa100% (1)

- Returnform PDFDocument1 pageReturnform PDFacsd xNo ratings yet

- Jyso PartnerDocument23 pagesJyso PartnerSahil Khan100% (1)

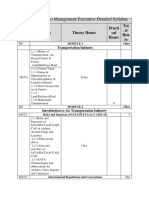

- Air Cargo Management Executive-Detailed Syllabus: Mod Ule & Units Topics Theory Hours Practi Cal Hours Tot Al Hou RsDocument5 pagesAir Cargo Management Executive-Detailed Syllabus: Mod Ule & Units Topics Theory Hours Practi Cal Hours Tot Al Hou RsAimms AimmsNo ratings yet

- Pengantar Akuntansi S1Document4 pagesPengantar Akuntansi S1Ela SelaNo ratings yet

- Mr. AnshulDocument2 pagesMr. AnshulAnshul SharmaNo ratings yet

- Service Agreement TemplateDocument3 pagesService Agreement Templateceleste law50% (6)

- Tutorial 8 Consumer ProtectionDocument7 pagesTutorial 8 Consumer Protectionmajmmallikarachchi.mallikarachchiNo ratings yet

- Internal controls for production cycleDocument39 pagesInternal controls for production cycleJane GavinoNo ratings yet

- Implementing Arubaos CX Switching Rev 20 21Document5 pagesImplementing Arubaos CX Switching Rev 20 21Muhammed AKYUZNo ratings yet

- Truck Stop Business PlanDocument40 pagesTruck Stop Business PlanBy Gibran Roman71% (7)

- Six Most Dangerous WordsDocument2 pagesSix Most Dangerous WordsrobrogersNo ratings yet

- Calling 24o7 BPO Services Pvt. PMAX Solutions LLP Call CentrDocument3 pagesCalling 24o7 BPO Services Pvt. PMAX Solutions LLP Call Centrwaris bhatNo ratings yet

- Exit Meeting With Ndic Examiners and Board 13-08-2018Document4 pagesExit Meeting With Ndic Examiners and Board 13-08-2018OMOLAYONo ratings yet

- New Identifier Requirements for Payment Facilitators and MarketplacesDocument2 pagesNew Identifier Requirements for Payment Facilitators and MarketplacesBayo PuddicombeNo ratings yet

- Cybercrime GlsDocument36 pagesCybercrime GlsHerman ClederaNo ratings yet

- Basic TerminologiesDocument20 pagesBasic TerminologiesMOHAMED USAIDNo ratings yet

- Spisak Bolnica U GrckojDocument5 pagesSpisak Bolnica U GrckojVladimir IbraimovicNo ratings yet

- Menton Bank: The New Focus On Customer Service at Menton BankDocument9 pagesMenton Bank: The New Focus On Customer Service at Menton BankmiladNo ratings yet

- Pharm Care 4 Chapter 1Document25 pagesPharm Care 4 Chapter 1MaraNagaSambarani100% (1)

- Ar TipsDocument6 pagesAr Tipspravindhanokar1No ratings yet

- LX30B Q40TDocument2 pagesLX30B Q40T905471408.isegperuNo ratings yet