Professional Documents

Culture Documents

2021 08 06 - Statement

Uploaded by

Mohamed Ali KalathingalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 08 06 - Statement

Uploaded by

Mohamed Ali KalathingalCopyright:

Available Formats

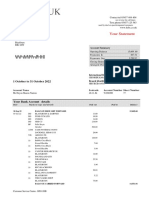

Your HSBC Premier Statement

Contact tel 03457 70 70 70

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

Dr M A Kalathingal

15 Pipistrelle Way

Oadby

Leicester

LE2 4QA Account Summary

Ope ning Balance 11,367.32

Paym e nts In 20,576.74

Paym e nts Out 2,229.05

Clos ing Balance 29,715.01

Ove rdraft Lim it 250.00

.

International Bank Account Number

GB67HBUK40471112207001

7 July to 6 August 2021 Branch Identifier Code

HBUKGB4109T

Acco unt Nam e S o rtcode Acco unt Num ber S he e t Num be r

Dr Mohamed Ali Kalathingal 40-47-11 12207001 330

Your Premier Bank Account details

Date Pay m e nt t y p e and de t ails Paid o ut Paid in Balance

A

06 Jul 21 BALANCE BROUGHT FORWARD . 11,367.32

07 Jul 21 BP Tutorface

Nazia E Kottasseri 143.92 11,223.40

12 Jul 21 DD BCARD FREEDOM RWDS 10.00 11,213.40

19 Jul 21 DD TSB CREDIT CARDS 1,036.99 10,176.41

24 Jul 21 BP CHOYI M

mohan 5.00 10,181.41

26 Jul 21 SO MUFEED

TARIQBHAI 10.00 10,171.41

29 Jul 21 CR TRANSFER TO OWN

RBC29071G7J9JNNL

MOHAMED ALI KALATH 19,497.74 29,669.15

31 Jul 21 BP Abdul Rafi Mohamme

From Ali Stokes 180.00 29,489.15

02 Aug 21 DD 247 HOME RESCUE 26.99

DD MTG 40048832779129 821.15

BP OADBY CLTS

15PIPIWAY AUG 1,074.00 29,715.01

06 Aug 21 BALANCE CARRIED FORWARD 29,715.01

Info rmatio n abo ut the Financial S e rvice s Co mpe ns atio n Sche m e

Your deposit is eligible for protection under the Financial Services Compensation Scheme (FSCS). For further information

about the compensation provided by the FSCS, refer to the FSCS website at www.FSCS.org.uk, call into your nearest branch

or call your telephone banking service. Further details can be found on the FSCS Information Sheet and Exclusions List

which is available on our website (www.hsbc.co.uk).

PO Box 33 9 Queen Square Wolverhampton West Midlands WV1 1TE

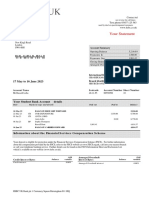

Your HSBC Premier Statement

Contact tel 03457 70 70 70

see reverse for call times

Text phone 03457 125 563

used by deaf or speech impaired customers

www.hsbc.co.uk

7 July to 6 August 2021

Acco unt Nam e S ortco de Acco unt Num ber S he e t Num be r

Dr Mohamed Ali Kalathingal 40-47-11 12207001 331

AER EAR

Cre dit Inte re s t Rate s balance variable Ove rdraft Inte re s t Rate s b alance variable

Cre dit inte re s t 0.00% upto 500 0.00%

ove r 500 39.90%

PO Box 33 9 Queen Square Wolverhampton West Midlands WV1 1TE

Interest For foreign currency (non-sterling) transactions we will charge a fee

Credit Interest is calculated daily on the cleared credit balance and is of 2.75% of the amount of the transaction. This fee will be shown on

paid monthly. Debit interest is calculated daily on the cleared debit a separate line of your statement as a ‘Non-Sterling Transaction Fee.

balance of your account, it accrues during your charging cycle Details of the current VISA Payment Scheme Exchange Rates can be

(usually monthly) and is deducted from your account following the obtained from the card support section of hsbc.co.uk or by calling

end of your charging cycle. us on the usual numbers. We will deduct the payment from your

Overdraft Service account once we receive details of the payment from the card

For HSBC Premier customers, the first £500 (or for HSBC Jade scheme.

customers, the first £1,000) of any arranged overdraft is provided Cash withdrawals in foreign currency made outside the UK, made

free of interest. with your HSBC Premier Visa Card (including HSBC Jade) do not incur

Before we deduct debit interest we will give you at least a non-sterling cash fee from HSBC. Some cash machine operators

14 days notice of the amount to be deducted. may apply a direct charge for withdrawals from their cash machines

and this will be advised on screen at the time of withdrawal.

Effective from 14 March 2020

Monthly cap on unarranged overdraft charges Recurring Transaction

1. Each current account will set a monthly maximum A recurring transaction, sometimes called a continuous payment

charge for: authority, is a series of payments collected with your agreement from

your card by a retailer or supplier (for example, insurance cover).

(a) going overdrawn when you have not arranged an overdraft; or

This is an agreement between you and the retailer. The Direct Debit

(b) going over/past your arranged overdraft limit (if you Guarantee does not cover these transactions. If you wish to cancel a

have one). recurring transaction you can do this with the retailer or us. We can

2. This cap covers any: cancel the payment, however contacting the retailer allows you to

(a) interest and fees for going over/past your arranged overdraft also deal with the agreement you have with them and you can make

limit; other arrangements for the payment or cancellation of the goods or

(b) fees for each payment your bank allows despite lack of funds; services. If you cancel with the retailer, we recommend you keep

and evidence of the cancellation. Once you have cancelled with the

retailer or us, if the retailer does try to collect any future payments

(c) fees for each payment your bank refuses due to lack

under the recurring transaction agreement, we will treat these as

of funds.

unauthorised. If we miss any of the cancelled transactions, please

The monthly cap on unarranged overdraft charges for the HSBC contact us.

Jade and the HSBC Premier Bank Account is £20.

Dispute resolution

Monthly unarranged pre 14 March from 14 March If you have a problem with your agreement, please try to resolve it

overdraft cap 2020 2020 with us in the first instance. If you are not happy with the way in

which we handled your complaint or the result, you may be able to

HSBC Premier Bank £500 £20

complain to the Financial Ombudsman Service. If you do not take up

Account

your problem with us first you will not be entitled to complain to the

HSBC Jade Bank £2,000 £20 Ombudsman. We can provide details of how to contact the

Account Ombudsman.

Unarranged overdraft charges incurred before 14 March 2020 may Telephone Banking Service

debit your account after this date (we’ll still give advance notice). Customer representatives are available 24 hours a day everyday.

Charges incurred before 14 March 2020 won’t count towards the Calls may be monitored or recorded for quality purposes.

new £20 cap as they’ll relate to the previous month’s charging Alternatively for all your banking needs go to hsbc.co.uk

period. Disabled Customers

Debit cards To find out more about our accessible services please visit

UK currency cash machine hsbc.co.uk/accessibility or ask at any of our branches.

You can use your debit card to make cash withdrawals in Euros or If you’d like this in another format such as large print, Braille or

US Dollars from some of our self-service machines. The HSBC UK audio, please contact us. A textphone service is available for

prevailing exchange rate and the amount of currency you will receive customers with hearing and/or speech impairments. If you use

and the Sterling amount will be shown on the screen. The amount of your own textphone you can call us on 03457 125 563

the cash withdrawal converted into Sterling will be deducted from (+44 207 088 2077 from outside the UK).

your account balance immediately.

BSL Video Relay Service is also available (Monday-Friday 8am-6pm,

Using your card outside the UK excluding Bank and Public Holidays) at hsbc.co.uk/accessibility.

When you use your card outside the UK, your statement will show

Lost and stolen cards

where the transaction took place, the amount spent in foreign

If any of your cards issued by us are lost or stolen please call our

currency and the amount converted into sterling. We also monitor

24-hour service immediately on 0800 085 2401 from the UK

transactions to protect you against your card being used

or if you are calling from outside the UK, please call us on

fraudulently.

+44 1442 422 929.

Unless you agree that the currency conversion is done at the point of

sale or withdrawal and agree the rate at that time, for example with

the shopkeeper or on the self-service machine screen, the exchange

rate that applies to any debit card payments in a foreign currency

(including cash withdrawals) is the VISA Payment Scheme Exchange

Rate applying on the day the conversion is made.

HSBC UK Bank plc, registered in England and Wales number 09928412. Registered office 1 Centenary Square, Birmingham B1 1HQ. Authorised by the Prudential

Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under reference number 765112.

RFB1903 MCP54588 12/19. ©HSBC Group 2019. All Rights Reserved.

You might also like

- 2023 08 31 - Statement 1Document2 pages2023 08 31 - Statement 1ranielysilvaukNo ratings yet

- 2023 08 16 - StatementDocument5 pages2023 08 16 - Statementumrankamran530No ratings yet

- Monthly Account Summary: Page 1 of 3Document3 pagesMonthly Account Summary: Page 1 of 3jrkwilsonNo ratings yet

- PreviewDocument4 pagesPreviewJoshua PerumalaNo ratings yet

- Bill 06242018Document5 pagesBill 06242018JOANNENo ratings yet

- Statement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023Document4 pagesStatement: Your Current Details Period 30 Dec 2022 To 27 Jan 2023tevisthomas205No ratings yet

- SBSA Statement 2023-03-10Document42 pagesSBSA Statement 2023-03-10Maestro ProsperNo ratings yet

- Maury UtilityDocument4 pagesMaury Utilityyusufosoba51No ratings yet

- Statement 517014 78338832 22 Dec 2023Document5 pagesStatement 517014 78338832 22 Dec 2023cressidafunkeadedareNo ratings yet

- 2022 10 31 - StatementDocument7 pages2022 10 31 - StatementGiovanni SlackNo ratings yet

- 2023 06 16 - StatementDocument2 pages2023 06 16 - StatementRussell Lobo100% (1)

- Your Current Account Statement: Miss Blessing Urhie 94 Tanners Hall Co CarlowDocument2 pagesYour Current Account Statement: Miss Blessing Urhie 94 Tanners Hall Co CarlowPaula UrhieNo ratings yet

- 2022 11 09 - StatementDocument3 pages2022 11 09 - StatementlorenzoNo ratings yet

- RevolutDocument6 pagesRevolutAndré SilvaNo ratings yet

- CurrentAccountStatement 07102023Document4 pagesCurrentAccountStatement 07102023caraleighjaneNo ratings yet

- Globe at Home E-Bill - 884810304-2020-10-06 PDFDocument2 pagesGlobe at Home E-Bill - 884810304-2020-10-06 PDFParciNo ratings yet

- Statement 14-APR-23 AC 63755886 16042114Document6 pagesStatement 14-APR-23 AC 63755886 16042114Shauna DunnNo ratings yet

- Australia Bank StatementDocument1 pageAustralia Bank Statementmdabir44567No ratings yet

- ViewEpsiiaEStatementDetail PDFDocument6 pagesViewEpsiiaEStatementDetail PDFsjeyarajah21No ratings yet

- Statement May 21 XXXXXXXX1414Document2 pagesStatement May 21 XXXXXXXX1414Adithya MalnadNo ratings yet

- 5 6217778743729982038 PDFDocument3 pages5 6217778743729982038 PDFdyadik24No ratings yet

- SCC Comunicados Pi Batch0100151117a93d91eec74400Document2 pagesSCC Comunicados Pi Batch0100151117a93d91eec74400JilShethNo ratings yet

- StatementsDocument1 pageStatementsossamamhelmyNo ratings yet

- August 2021Document1 pageAugust 2021Julio DelarozaNo ratings yet

- Denmark Jyske Bank StatementDocument1 pageDenmark Jyske Bank StatementdariaharjuNo ratings yet

- Statement 17-FEB-23 AC 73929213 19042852Document4 pagesStatement 17-FEB-23 AC 73929213 19042852FahimNo ratings yet

- EBL Statement 09 02 2022Document1 pageEBL Statement 09 02 2022r0% (1)

- Power NI: Welcome ToDocument14 pagesPower NI: Welcome TovictorcpkNo ratings yet

- PreviewDocument7 pagesPreviewMartyn James PrattNo ratings yet

- Bill JANUARY 2022: Thank You For Making The Smarter Choice by Paying With Credit/Debit Card! - $34.41Document2 pagesBill JANUARY 2022: Thank You For Making The Smarter Choice by Paying With Credit/Debit Card! - $34.41XuaN XuanNo ratings yet

- Statement Fred MACUDocument8 pagesStatement Fred MACURahul Sharma JiNo ratings yet

- Basic Top-Up Debit Card: Your Account Summary ForDocument2 pagesBasic Top-Up Debit Card: Your Account Summary ForViorel OpreaNo ratings yet

- Your Accounts at A Glance: Premier BankingDocument6 pagesYour Accounts at A Glance: Premier BankingSuzanne MurphyNo ratings yet

- Statement 2020 03 10Document3 pagesStatement 2020 03 10BrendaNo ratings yet

- Your Account Summary BalanceDocument1 pageYour Account Summary BalanceВиктория ГринькоNo ratings yet

- Preview 29Document16 pagesPreview 29kakabadzebaiaNo ratings yet

- DHL BillDocument4 pagesDHL BillアンちゃんNo ratings yet

- Bill ElectricityDocument3 pagesBill Electricityمحمد أسماعيلNo ratings yet

- Statement: Foundation AccountDocument1 pageStatement: Foundation AccountFu YingNo ratings yet

- Ilovepdf MergedDocument7 pagesIlovepdf Mergedahdasdsadasdasasdadasdasdasdasdasdasdasd asdasdasdNo ratings yet

- Attachment-1 1Document5 pagesAttachment-1 1Aniella94No ratings yet

- PDF Bill 6199007 - CompressDocument2 pagesPDF Bill 6199007 - CompressWaqas RazaNo ratings yet

- February 01, 2020 Through February 29, 2020Document4 pagesFebruary 01, 2020 Through February 29, 2020Jimario SullivanNo ratings yet

- Wells Fargo Essential CheckingDocument3 pagesWells Fargo Essential Checking123No ratings yet

- Preview 26Document15 pagesPreview 26kakabadzebaiaNo ratings yet

- Statement 19-APR-23 AC 73929213 21041533Document3 pagesStatement 19-APR-23 AC 73929213 21041533FahimNo ratings yet

- Document 3119946238763383936Document2 pagesDocument 3119946238763383936abel zhangNo ratings yet

- E-Bill# 003045008 Dated June 2020 For Account# 00000693168Document2 pagesE-Bill# 003045008 Dated June 2020 For Account# 00000693168Keisha MussingtonNo ratings yet

- Agl Better Bills Sample Bill NecfDocument2 pagesAgl Better Bills Sample Bill Necfnurulamin00023No ratings yet

- Attachment PDFDocument1 pageAttachment PDFmuhammad arhum aishNo ratings yet

- Statment REV OctDocument4 pagesStatment REV OctSlabu FatoumataNo ratings yet

- Halifax StatementDocument4 pagesHalifax Statementgreatfelix09No ratings yet

- 2023 04 11 Caruna Invoice 313042097Document3 pages2023 04 11 Caruna Invoice 313042097shabir kazmiNo ratings yet

- Your Visa Card Statement: From Overseas Tel 44 1226 261 010Document3 pagesYour Visa Card Statement: From Overseas Tel 44 1226 261 010Toni MirosanuNo ratings yet

- Screenshot 2022-12-11 at 18.17.13 PDFDocument1 pageScreenshot 2022-12-11 at 18.17.13 PDFLihle ShongweNo ratings yet

- Lioyds Bank Statment 3Document4 pagesLioyds Bank Statment 3zainabNo ratings yet

- Statement 25197479 EUR 2024-02-02 2024-03-03Document4 pagesStatement 25197479 EUR 2024-02-02 2024-03-03Gabriel BuitiNo ratings yet

- Metro OctDocument3 pagesMetro Octinfo.familyemailNo ratings yet

- Statement 24-MAR-23 AC 83249816 26152728Document5 pagesStatement 24-MAR-23 AC 83249816 26152728Анастасия ГорбачNo ratings yet

- Your Statement: 20 May To 19 June 2021Document3 pagesYour Statement: 20 May To 19 June 2021Cristina Rotaru100% (1)

- FW 'Medical Certificate' - E-Service ActivationDocument5 pagesFW 'Medical Certificate' - E-Service ActivationMohamed Ali KalathingalNo ratings yet

- Kiss Covid VaccinationsDocument4 pagesKiss Covid VaccinationsMohamed Ali KalathingalNo ratings yet

- Ticket ApplicationDocument1 pageTicket ApplicationMohamed Ali KalathingalNo ratings yet

- Mohamed Rayyan 16-08-2021Document1 pageMohamed Rayyan 16-08-2021Mohamed Ali KalathingalNo ratings yet

- Tenbek - WikipediaDocument1 pageTenbek - WikipediaMohamed Ali KalathingalNo ratings yet

- Ticket ApplicationDocument1 pageTicket ApplicationMohamed Ali KalathingalNo ratings yet

- OutlookDocument3 pagesOutlookMohamed Ali KalathingalNo ratings yet

- Edathola Kottasseri Nazia 16-08-2021Document1 pageEdathola Kottasseri Nazia 16-08-2021Mohamed Ali KalathingalNo ratings yet

- Ticket ApplicationDocument1 pageTicket ApplicationMohamed Ali KalathingalNo ratings yet

- Year 3 QU Students and Faculty 2019-20 Sept-Dec 04 09 2019Document12 pagesYear 3 QU Students and Faculty 2019-20 Sept-Dec 04 09 2019Mohamed Ali KalathingalNo ratings yet

- Ticket ApplicationDocument1 pageTicket ApplicationMohamed Ali KalathingalNo ratings yet

- Ticket ApplicationDocument1 pageTicket ApplicationMohamed Ali KalathingalNo ratings yet

- Text 5Document1 pageText 5Mohamed Ali KalathingalNo ratings yet

- Pharmacy Reasearch Study PHCCDCR202112076-PO01Document2 pagesPharmacy Reasearch Study PHCCDCR202112076-PO01Mohamed Ali KalathingalNo ratings yet

- Inventory - PPT Presentation For Inventory MangmentDocument71 pagesInventory - PPT Presentation For Inventory MangmentPSYCHOTHEWALLNo ratings yet

- Payment Slip: Summary of Charges / Payments Current Bill AnalysisDocument8 pagesPayment Slip: Summary of Charges / Payments Current Bill AnalysisMelanie Kelly NeilsonNo ratings yet

- Invoice: Payment To: Myanmar Link Co., LTDDocument1 pageInvoice: Payment To: Myanmar Link Co., LTDAye Min TunNo ratings yet

- 2012a Buyback NoticeDocument4 pages2012a Buyback Noticekv chandrasekerNo ratings yet

- Tax Invoice For: Your Telstra BillDocument2 pagesTax Invoice For: Your Telstra BillGaro KhatcherianNo ratings yet

- Recapitulation PDFDocument2 pagesRecapitulation PDFMargaretha Maria YunitaNo ratings yet

- Life Scenarios Banzai CurriculumDocument16 pagesLife Scenarios Banzai Curriculumapi-344976556No ratings yet

- Premium Rates - Sampoorn Samridhi PDFDocument1 pagePremium Rates - Sampoorn Samridhi PDFnavingNo ratings yet

- Documentary Credits - HRP IBSDocument28 pagesDocumentary Credits - HRP IBSNITISH KUNJBIHARI SHAHNo ratings yet

- Road Blocks On Main Truck Transit Routes:are All Check Points in Tanzania Necessary?Document13 pagesRoad Blocks On Main Truck Transit Routes:are All Check Points in Tanzania Necessary?Center for Economic Prosperity100% (1)

- Recording Merchandising TransactionsDocument4 pagesRecording Merchandising Transactionsacidreign50% (2)

- Heritage With Cloudy Mountain: Guwahati - Shillong - Cherrapunji 3N/4DDocument11 pagesHeritage With Cloudy Mountain: Guwahati - Shillong - Cherrapunji 3N/4DAmit VermaNo ratings yet

- Formato Recepcion UsdDocument1 pageFormato Recepcion UsdRicardo Villalón WNo ratings yet

- RMC No 51-2008Document7 pagesRMC No 51-2008Yasser MangadangNo ratings yet

- 2018 Bir Tax CalendarDocument40 pages2018 Bir Tax CalendarSeasaltandsandNo ratings yet

- Accts Project For Class Xi 2015 16-1Document2 pagesAccts Project For Class Xi 2015 16-1Narsingh Das AgarwalNo ratings yet

- Logistics in Supply ChainDocument14 pagesLogistics in Supply ChainHannah Rejoice Nueva ErlinaNo ratings yet

- Bank ReconciliationDocument4 pagesBank ReconciliationSimra RiyazNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Income-Tax Banggawan2019 CR7Document10 pagesIncome-Tax Banggawan2019 CR7Noreen Ledda11% (9)

- e-StatementBRImo 007101021908533 Jun2023 20230711 223750-1Document14 pagese-StatementBRImo 007101021908533 Jun2023 20230711 223750-1biasasajaa59No ratings yet

- Dematologist Appointment Abhishekdixit 22oct5.20pmdigital RegistrarDocument1 pageDematologist Appointment Abhishekdixit 22oct5.20pmdigital RegistrarabhishekNo ratings yet

- Marine Insurance QuestionnaireDocument4 pagesMarine Insurance QuestionnaireSuraj Theruvath100% (5)

- Docs in Int'l TradeDocument14 pagesDocs in Int'l TradeRounaq DharNo ratings yet

- Jamaica Tax GuideDocument30 pagesJamaica Tax GuideAMNo ratings yet

- Bureau of Customs Presentation On Balikbayan BoxesDocument45 pagesBureau of Customs Presentation On Balikbayan BoxesPortCalls0% (1)

- Fedex Sli PDFDocument3 pagesFedex Sli PDFud exportsNo ratings yet

- 223 Bob Statement PDFDocument4 pages223 Bob Statement PDFdhirendraNo ratings yet

- Code MIGO-Transfer Posting Accounting EntriesDocument3 pagesCode MIGO-Transfer Posting Accounting EntriesShiv P100% (1)

- Reg No 139 Obligatory Use of Sales RegisterDocument11 pagesReg No 139 Obligatory Use of Sales RegisterbiniNo ratings yet