Professional Documents

Culture Documents

Weekly Derivative Report 26 June 2023 - 26-06-2023 - 09

Uploaded by

Porus Saranjit SinghOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Derivative Report 26 June 2023 - 26-06-2023 - 09

Uploaded by

Porus Saranjit SinghCopyright:

Available Formats

Weekly Derivative Report

25 June 2023

NIFTY HIGHLIGHTS

Nifty futures of current expiry on Friday closed at 18705.9 on a negative note with -16.25% decrease in open interest and a price cut of -1.02% (-

193.25 points) indicating Long Unwinding.

Nifty annualized volatility index India Vix has decreased to 11.23% from 10.84% UP by 3.64%.

Bank Nifty futures of current expiry on Friday closed at 43671.65 on a negative note with -10.35% decrease in open interest and a price cut of -

0.84% (-370.95 points) indicating Long Unwinding.

The total outstanding OI in Nifty futures stands at 1,11,23,350 compared to 1,17,34,750 of previous week, while in Bank Nifty it’s at 28,44,480

against 27,65,850.

The ‘Long Short Ratio’ in the index futures for FII’s stands at 53 percent compared to 55 percent of last week indicating marginal Unwinding

in LONG POSITIONS.

Nifty PCR OI

PCR OI during the week has made a high

Call OI Put OI PCR OI of 1.29 & low of 0.93 and closed on

23.00 1.40 weekly basis at 0.93 levels compared to

21.00 1.29 of last week.

19.00 1.30

PUT CALL RATIO

17.00 1.20 PCR OI currently is at 0.93 level which is

15.00

OI in cr.

below the median line and shows that

13.00 1.10

market participants have bought more

11.00

9.00 1.00 numbers of CALL options compared to PUT

7.00 options in the week indicating that Nifty will

0.90 continue the current trend, but with a

5.00

3.00 0.80 cautious bias.

13-Jun

14-Jun

15-Jun

19-Jun

20-Jun

22-Jun

23-Jun

12-Jun

16-Jun

21-Jun

Open Interest Analysis

Put OI Call OI Options Built up Shows that for now Nifty

16,000 has strong support at 18,000 followed by

14,000 18,600, 18,500 and resistance at 19,000

12,000 levels followed by 18,800 & 18,700.

10,000 19,000, 18,800 & 18,900 strike CALL has

8,000 high open Interest concentration ; while in

6,000 Put strikes 18,000 followed by 18,800 &

4,000 18,700 strike has high open interest

Thousands

concentration which suggests that Nifty is

2,000

likely to trade between these levels of

0 18,800 on upside & 18,400 on downside for

18100

18200

18300

18400

18600

18700

18900

19000

19100

19200

19300

18500

18800

the coming week with 18,700 & 18,800

acting as pivotal level.

Change in Open Interest

Call OI Put OI This week major addition in monthly expiry

14,000

was seen on the PUT front in 18,800, 18,700

12,000 and 18,400 strike adding 48.33 Lac, 46.36

10,000 Lac and 35.26 Lac shares in OI respectively;

while there were was no significant

8,000

unwinding witnessed at any strike.

6,000

This week major addition in monthly expiry

4,000

was seen on the CALL front in 18,800,

2,000 18,900 and 18,700 strike adding 120.15 Lac,

73.00 Lac and 63.31 Lac shares in OI

Thousands

0

respectively; while there was marginal

-2,000

unwinding seen at 18,400 & 18,500 strike to

18100

18200

18300

18400

18600

18700

18900

19000

19100

19200

19300

18500

18800

the tune of 0.31Lac & 0.26Lac shares

respectively.

For private circulation only 1

Weekly Derivative Report

25 June 2023

Volatility Analysis

Implied volatility(IV) IV Call Iv Put Historic volatility IV DIFFERENTIAL between CALL and PUT has

18.00 DECREASED with decrease in IVs from last week’s

17.00 level indicating that Nifty is likely to continue trade

16.00

15.00 with positive trend, while the bias is likely to be

14.00 cautious.

13.00

12.00

11.00 Call IV’s is currently at 9.69% versus 8.72% compared

10.00

9.00

to last week, while Put IV’s is at 9.72% versus 10.99%

8.00 compared to last week.

12-Jun-23

13-Jun-23

14-Jun-23

15-Jun-23

19-Jun-23

21-Jun-23

23-Jun-23

16-Jun-23

20-Jun-23

22-Jun-23

Implied Volatility of option for the current series is at

9.71% in contrast to 9.81% of last week, while in the

coming week it’s likely to be FLAT-to-INCREASING.

Weekly Participant Wise Open Interest

FUT IDX Long FUT IDX Short FUT STK

Participant Net Chg Net Chg FUT STK Long Net

(contracts) (contracts) Participant Short Net Chg

(contracts) Chg (contracts)

Client 1,81,323 7,092 1,78,087 -6,377

Client 13,84,057 29,151 2,87,755 -4,519

DII 53,410 -1,447 44,919 -2,045

DII 77,037 2,073 14,71,272 -16,787

FII 91,127 -7,593 81,705 1,370 FII 13,41,495 -4,248 11,85,452 72,974

Pro 32,218 1,480 53,367 6,584 Pro 4,13,754 49,963 2,71,864 25,271

FII Index Futures

19-Jun 20-Jun 21-Jun 22-Jun 23-Jun Last week FII's, No. of contracts in INDEX FUTURES

concluded at 1,72,832 compared to 1,79,055 of last

Thousands

600 180

400 178 week unwinding -6,223 contracts.

200 176

0 174

The total open interest position of FII's in Index

-200 172 Futures is at Rs 16,142 which on weekly basis have

-400 decreased by Rs -1,037 Crs.

170

-600

168

-800

In Crores

166 Last week FII's, No. of contracts in NIFTY OPTIONS

-1,000

-1,200 164 concluded at 18,76,379 compared to 17,53,640 of last

-1,400 162 week wherein there was addition of 1,22,739 contracts

-1,600 160 and in Bank Nifty it has reduced by -1,96,839 contracts

and ended the week with 7,32,874 contracts against

NET AMT OI_QTY

9,29,713 of last week.

FII Stock Futures

19-Jun 20-Jun 21-Jun 22-Jun 23-Jun Last week FII's, No. of contracts in STOCK FUTURES

1,000 2,540 concluded at 25,26,947 compared to 24,58,221 of last

Thousands

500 week adding 68,726 contracts.

2,520

0

2,500

The total open interest position of FII's in Stock

-500 Futures is at Rs 1,83,667 which on weekly basis have

-1,000 2,480 increased by Rs 2,794 Crs.

In Crores

-1,500

-2,000

2,460

Last week FII's, No. of contracts in STOCK OPTIONS

-2,500

2,440 concluded at 3,33,003 compared to 3,16,035 of last

week adding 16,968 contracts.

-3,000 2,420

NET AMT OI_QTY

For private circulation only 2

Weekly Derivative Report

25 June 2023

Weekly Price Change Weekly OI Change Weekly Roll Over Change

Wkly Price change Wkly OI change Wkly Roll Over change

Finance

1.32% Finance 4.97%

25.39% Finance

-3.09% Power

0.00% Power

18.89% Power

4.06% Pharma

-0.55% Pharma

21.90% Pharma

-3.21% Index

-0.65% Index Index

9.78%

-0.69% Automobile

-1.14% Automobile Automobile

Banking 25.48%

2.12%

-1.44% Banking Banking

-0.17% Technology 26.17%

-1.64% Technology Metals 24.80% Technology

0.58%

-1.81% Metals 2.51% Chemicals 24.26% Metals

-2.25% Chemicals 10.74% Telecom 22.25% Chemicals

-2.28% 0.58% Oil_Gas

Telecom 22.36% Telecom

0.89% Textile

-2.58% Oil_Gas 23.36% Oil_Gas

1.76% Capital_Goods

-2.88% Textile 24.85% Textile

-7.11% Realty

-3.01% Capital_Goods 24.03% Capital_Goods

-6.32% Cement

-3.37% Realty

28.56% Realty

2.09% Infrastructure

-3.58% 28.72% Cement

Cement 2.13% Media

-4.83% 21.92% Infrastructure

Infrastructure -2.98% FMCG

-4.89% 31.89% Media

Media

-6.86% 21.51% FMCG

FMCG

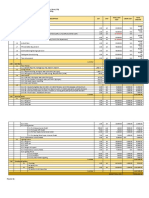

Weekly Open Interest Gainer Weekly Open Interest Loser

Script ID Price % Chg OI Futures % Chg Script ID Price % Chg OI Futures % Chg

SHRIRAMFIN 1675.9 19.00% 7932000 64.92% OFSS 3821.05 -1.80% 311400 -24.75%

COROMANDEL 925.8 -1.67% 1917300 31.30% RAIN 163.35 -5.36% 8732500 -23.40%

RBLBANK 166.2 -4.51% 63620000 28.71% L&TFH 117.9 -0.55% 82252508 -22.19%

ATUL 6916.95 -1.79% 294075 28.56% TATACHEM 974.7 1.70% 8688400 -13.23%

PEL 883.8 12.44% 10957050 27.28%

TCS 3225.95 1.11% 12651975 -11.35%

Weekly Price Gainer Weekly Price Loser

Script ID Price % Chg OI Futures % Chg Script ID Price % Chg OI Futures % Chg

SHRIRAMFIN 1675.9 19.00% 7932000 64.92% ADANIENT 2235.3 -11.08% 12579850 21.86%

PEL 883.8 12.44% 10957050 27.28% IDFC 98.25 -9.45% 196950000 3.74%

MFSL 747.9 7.80% 5659000 9.95% AMBUJACEM 425.95 -7.96% 55915200 0.34%

EXIDEIND 232.3 7.55% 21927600 1.65% BANDHANBNK 236.4 -7.11% 35434000 2.84%

HDFCAMC 2009.55 5.47% 4759500 25.71% INDIACEM 209.4 -6.83% 18316400 -4.53%

During the week Stocks which witnessed significant OI addition along with price gains are SHRIRAMFIN, PEL,

METROPOLIS

Stock wise Open andInterest

HDFCAMC.Distribution in Banking Sector

During the week Stocks which witnessed significant OI addition along with decrease in price are INDIAMART,

COROMANDEL, RBLBANK and ATUL.

For private circulation only 3

Weekly Derivative Report

25 June 2023

Stock wise Open Interest Distribution in Banking Sector

3,50,000

3,00,000

Thousands

2,50,000

2,00,000

1,50,000

1,00,000

50,000

Bank Nifty Strike wise open interest distribution

Open Interest

Call OI Put OI

4,500

4,000

3,500

3,000

2,500

2,000

1,500

1,000

500

Thousands

0

42800

42900

43200

43300

43600

43900

44000

44300

44400

44600

42700

43000

43100

43400

43500

43700

43800

44100

44200

44500

Bank Nifty as per monthly expiry has a strong support at 43,500; as 43,500 Put strike is having high OI

concentration followed by 43,000 & 42,500; while on the Call front 45,000CE strike has high OI

concentration indicating strong resistance level followed by 44,000 & 44,500; with 43,700 will be acting

as a pivotal level.

Weekly Open Interest Gainer Weekly Open Interest Loser

Script ID Price % Chg OI Futures % Chg Script ID Price % Chg OI Futures % Chg

RBLBANK 166.20 -4.51% 6,36,20,000 28.71% IDFCFIRSTB 77.65 -4.08% 25,93,95,000 -8.80%

CANBK 296.80 -2.75% 4,88,99,700 13.51% KOTAKBANK 1,834.60 -1.37% 2,80,63,600 -4.86%

SBIN 555.95 -3.08% 8,56,90,500 13.00%

Weekly Price Gainer Weekly Price Loser

Script ID Price % Chg OI Futures % Chg Script ID Price % Chg OI Futures % Chg

HDFCBANK 1,644.85 2.10% 9,34,25,750 1.60% BANDHANBNK 236.40 -7.11% 3,54,34,000 2.84%

BANKBARODA 191.90 1.75% 9,62,32,500 0.73% AUBANK 736.45 -5.49% 1,19,78,000 9.36%

RBLBANK 166.20 -4.51% 6,36,20,000 28.71%

For private circulation only 4

Weekly Derivative Report

25 June 2023

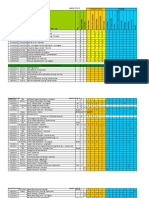

INDEX Since Inception INDEX Weekly Data

%

FINNIFTY 11-Jan-21 23-Jun-23 % Diff. FINNIFTY 16-Jun-23 23-Jun-23

Diff.

FUTURE FUTURE

PRICE

15,676.25 19,539.00 24.64%

PRICE 19,512.65 19,539.00 0.14%

OPEN - OPEN

77,880 46,200 45,720 46,200 1.05%

INTEREST 40.68% INTEREST

On the weekly basis FINNIFTY futures have seen a price Increment to the tune of 0.14% with a Increase in

Open Interest by 1.05% indicating Long Build Up.

COMPARISION TABLE

WEEKLY PRICE WEEKLY OI

SR.NO STOCKS CMP CURRENT OI OI INT

DIFF DIFF

1 AXISBANK 960.95 53199000 -1.85% -2.80% LU

2 BAJAJFINSV 1503.8 8848500 -0.60% 1.54% SB

3 BAJFINANCE 6992.5 3837625 -3.13% 2.90% SB

4 CHOLAFIN 1093.05 10551250 -3.21% -2.72% LU

5 HDFC 2723.3 26958300 2.23% -3.62% SC

6 HDFCAMC 2009.55 4759500 5.47% 25.71% LB

7 HDFCBANK 1644.85 93425750 2.10% 1.60% LB

8 HDFCLIFE 628.45 19492000 2.60% -8.06% SC

9 ICICIBANK 925.45 86669800 -1.34% 5.86% SB

10 ICICIGI 1274.85 5034850 1.13% 0.73% LB

11 ICICIPRULI 557.9 13714500 4.22% 18.22% LB

12 IEX 127.1 51266250 0.47% -5.31% SC

13 KOTAKBANK 1834.6 28063600 -1.37% -4.86% LU

14 MUTHOOTFIN 1224.8 5585250 4.39% 1.33% LB

15 PFC 200.45 66550800 1.21% 0.70% LB

16 RECLTD 156.15 68888000 1.83% 19.43% LB

17 SBICARD 859.85 8248800 -6.17% -0.49% LU

18 SBILIFE 1266.05 9785250 -0.99% 16.14% SB

19 SBIN 555.95 85690500 -3.08% 13.00% SB

19 SHRIRAMFIN 1675.9 7932000 19.00% 64.92% LB

1) Buy HDFCAMC FUT in range :-> 2010 – 1990 SL 1982 Target 2038 & 2060.

2) Sell KOTAKBANK FUT in range :-> 1835 – 1855 SL 1867 Target 1803 & 1787.

2) Buy PFC 197.50 PE in range :-> 3 – 2 SL 1 Target 6.50 & 8.80.

For private circulation only 5

Weekly Derivative Report

25 June 2023

Disclosures:

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (herein after referred to as the

Regulations).

1. Axis Securities Ltd. (ASL) is a SEBI Registered Research Analyst having registration no. INH000000297. ASL, the Research Entity

(RE) as defined in the Regulations, is engaged in the business of providing Stock broking services, Depository participant services &

distribution of various financial products. ASL is a subsidiary company of Axis Bank Ltd. Axis Bank Ltd. is a listed public company and

one of India’s largest private sector bank and has its various subsidiaries engaged in businesses of Asset management, NBFC,

Merchant Banking, Trusteeship, Venture Capital, Stock Broking, the details in respect of which are available on www.axisbank.com.

2. ASL is registered with the Securities & Exchange Board of India (SEBI) for its stock broking & Depository participant business activities

and with the Association of Mutual Funds of India (AMFI) for distribution of financial products and also registered with IRDA as a

corporate agent for insurance business activity.

3. ASL has no material adverse disciplinary history as on the date of publication of this report.

4. I/We, authors (Research team) and the name/s subscribed to this report, hereby certify that all of the views expressed in this research

report accurately reflect my/our views about the subject issuer(s) or securities. I/We (Research Analyst) also certify that no part of

my/our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I/we or

my/our relative or ASL or its Associate does not have any financial interest in the subject company. Also I/we or my/our relative or ASL

or its Associates may have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding

the date of publication of the Research Report. Since associates of ASL are engaged in various financial service businesses, they

might have financial interests or beneficial ownership in various companies including the subject company/companies mentioned in this

report. I/we or my/our relative or ASL or its associate does not have any material conflict of interest. I/we have not served as director /

officer, etc. in the subject company in the last 12-month period.

Research Team

Sr. No Name Designation E-mail

1 Rajesh Palviya Technical & Derivative Analyst - (Head) rajesh.palviya@axissecurities.in

2 Rahil Vora Derivative Analyst rahil.vora@axissecurities.in

3 HemangGor Derivative Analyst hemang.gor@axissecurities.in

5. ASL or its Associates has not received any compensation from the subject company in the past twelve months. I/We or ASL or its

Associate has not been engaged in market making activity for the subject company.

6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report,

ASL or any of its associates may have:

i. Received compensation for investment banking, merchant banking or stock broking services or for any other services from the

subject company of this research report and / or;

ii. Managed or co-managed public offering of the securities from the subject company of this research report and / or;

iii. Received compensation for products or services other than investment banking, merchant banking or stock broking services

from the subject company of this research report;

ASL or any of its associates have not received compensation or other benefits from the subject company of this research report or any other

third-party in connection with this report.

Term& Conditions:

This report has been prepared by ASL and is meant for sole use by the recipient and not for circulation. The report and information contained

herein is strictly confidential and may not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to

the media or reproduced in any form, without prior written consent of ASL. The report is based on the facts, figures and information that are

considered true, correct, reliable and accurate. The intent of this report is not recommendatory in nature. The information is obtained from

publicly available media or other sources believed to be reliable. Such information has not been independently verified and no guaranty,

representation of warranty, express or implied, is made as to its accuracy, completeness or correctness. All such information and opinions are

subject to change without notice. The report is prepared solely for informational purpose and does not constitute an offer document or solicitation

of offer to buy or sell or subscribe for securities or other financial instruments for the clients. Though disseminated to all the customers

simultaneously, not all customers may receive this report at the same time. ASL will not treat recipients as customers by virtue of their receiving

this report.

For private circulation only 6

Weekly Derivative Report

25 June 2023

Disclaimer:

Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy is suitable or

appropriate to the recipient’s specific circumstances. The securities and strategies discussed and opinions expressed, if any, in this report may not

be suitable for all investors, who must make their own investment decisions, based on their own investment objectives, financial positions and

needs of specific recipient.

This report may not be taken in substitution for the exercise of independent judgment by any recipient. Each recipient of this report should make

such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this

report (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment.

Certain transactions, including those involving futures, options and other derivatives as well as non-investment grade securities involve substantial

risk and are not suitable for all investors. ASL, its directors, analysts or employees do not take any responsibility, financial or otherwise, of the

losses or the damages sustained due to the investments made or any action taken on basis of this report, including but not restricted to, fluctuation

in the prices of shares and bonds, changes in the currency rates, diminution in the NAVs, reduction in the dividend or income, etc. Past

performance is not necessarily a guide to future performance. Investors are advise necessarily a guide to future performance. Investors are

advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ

materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ASL and its affiliated companies, their directors and employees may; (a) from time to time, have long or short position(s) in, and buy or sell the

securities of the company(ies) mentioned herein or (b) be engaged in any other transaction involving such securities or earn brokerage or other

compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or investment

banker, lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other

related information and opinions. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take

this into account before interpreting this document.

ASL and / or its affiliates do and seek to do business including investment banking with companies covered in its research reports. As a result, the

recipients of this report should be aware that ASL may have a potential conflict of interest that may affect the objectivity of this report.

Compensation of Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. ASL

may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither this report nor any copy of it may be taken or transmitted into the United State (to U.S. Persons), Canada, or Japan or distributed, directly

or indirectly, in the United States or Canada or distributed or redistributed in Japan or to any resident thereof. If this report is inadvertently sent or

has reached any individual in such country, especially, USA, the same may be ignored and brought to the attention of the sender. This report is

not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or

other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation or which would subject ASL to any

registration or licensing requirement within such jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions

or to certain category of investors.

The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as

endorsement of the views expressed in the report. The Company reserves the right to make modifications and alternations to this document as

may be required from time to time without any prior notice. The views expressed are those of the analyst(s) and the Company may or may not

subscribe to all the views expressed therein.

Copyright in this document vests with Axis Securities Limited.

Axis Securities Limited, SEBI Single Reg. No.- NSE, BSE & MSEI – INZ000161633, ARN No. 64610, CDSL-IN-DP-CDSL-693-2013, SEBI-

Research Analyst Reg. No. INH 000000297, SEBI Portfolio Manager Reg. No.- INP000000654, Main/Dealing off.- Unit No. 2, Phoenix Market

City, 15, LBS Road, Near Kamani Junction, Kurla (west), Mumbai-400070, Tel No. – 022 40508080 / 022 61480808,

Reg. off.- Axis House, 8th Floor, Wadia International Centre, PandurangBudhkar Marg, Worli, Mumbai – 400 025.Compliance Officer:

AnandShaha, E-Mail ID: compliance.officer@axisdirect.in,Tel No: 022-42671582.

For private circulation only 7

Weekly Derivative Report

25 June 2023

For private circulation only 8

You might also like

- Daily Derivatives-20200803Document5 pagesDaily Derivatives-20200803Kiran KudtarkarNo ratings yet

- Derivatives Daily: Monday, September 20, 2021Document5 pagesDerivatives Daily: Monday, September 20, 2021Equity NestNo ratings yet

- Derivatives Daily: Monday, April 05, 2021Document5 pagesDerivatives Daily: Monday, April 05, 2021SomendraNo ratings yet

- Daily DerivativesDocument5 pagesDaily DerivativesRanjan BeheraNo ratings yet

- Hoja de Medicion de Resultados - BullFinanzasDocument70 pagesHoja de Medicion de Resultados - BullFinanzaskamo flazh100% (3)

- Rate Analsis Chapter No. 13 (Painting and Varnishing)Document1 pageRate Analsis Chapter No. 13 (Painting and Varnishing)M HAFEEZ RAJA100% (1)

- Sensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Derivatives Daily: Monday, October 25, 2021Document5 pagesDerivatives Daily: Monday, October 25, 2021ayushmagguNo ratings yet

- Denah Lantai 1: R. Karyawan R. NarkotikaDocument1 pageDenah Lantai 1: R. Karyawan R. NarkotikaFarica Deskhirna FanniNo ratings yet

- Ashmore Dana Obligasi Nusantara: Fund Update Jul 2019Document2 pagesAshmore Dana Obligasi Nusantara: Fund Update Jul 2019Power RangerNo ratings yet

- Technical Derivatives 22 02 2023Document5 pagesTechnical Derivatives 22 02 2023rajesh bhosaleNo ratings yet

- Bill of MaterialsDocument2 pagesBill of MaterialsGicco CastorNo ratings yet

- Summary Report For X1 (MM) Summary Report For X2 (MM) : 95% Confidence Intervals 95% Confidence IntervalsDocument1 pageSummary Report For X1 (MM) Summary Report For X2 (MM) : 95% Confidence Intervals 95% Confidence IntervalsIlmaRabbayaniNo ratings yet

- Sensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Weekly Currency Report 12 June 2023 - 11-06-2023 - 22Document4 pagesWeekly Currency Report 12 June 2023 - 11-06-2023 - 22Porus Saranjit SinghNo ratings yet

- IDirect HCLTech Q1FY23Document10 pagesIDirect HCLTech Q1FY23Porus Saranjit SinghNo ratings yet

- IDirect Mindtree Q1FY23Document11 pagesIDirect Mindtree Q1FY23Porus Saranjit SinghNo ratings yet

- Porus Singh 1 Page CV 17-Oct-2023Document1 pagePorus Singh 1 Page CV 17-Oct-2023Porus Saranjit SinghNo ratings yet

- Aptus Value Housing Finance LTD - Pick of The Week - Axis Direct - 100623 (1) - 12-06-2023 - 09Document4 pagesAptus Value Housing Finance LTD - Pick of The Week - Axis Direct - 100623 (1) - 12-06-2023 - 09Porus Saranjit SinghNo ratings yet

- Metals & Mining: Steel Companies' Ebitda/Tonne Likely To Soften QoqDocument5 pagesMetals & Mining: Steel Companies' Ebitda/Tonne Likely To Soften QoqPorus Saranjit SinghNo ratings yet

- HSL - End of The Day Summary 15072022-202207151712151972854Document4 pagesHSL - End of The Day Summary 15072022-202207151712151972854Porus Saranjit SinghNo ratings yet

- Currency Report - Daily - 14 July 2022 - 13-07-2022 - 22Document4 pagesCurrency Report - Daily - 14 July 2022 - 13-07-2022 - 22Porus Saranjit SinghNo ratings yet

- Daily Derivative Report - 13072022 - 13-07-2022 - 09Document5 pagesDaily Derivative Report - 13072022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- Derivatives Weekly View: Positive Bias Remains Intact Till Nifty Holds Above 15900Document13 pagesDerivatives Weekly View: Positive Bias Remains Intact Till Nifty Holds Above 15900Porus Saranjit SinghNo ratings yet

- IDirect NeogenChemicals ICDocument18 pagesIDirect NeogenChemicals ICPorus Saranjit SinghNo ratings yet

- 5paisa Capital: Curb in Opex Aids BottomlineDocument6 pages5paisa Capital: Curb in Opex Aids BottomlinePorus Saranjit SinghNo ratings yet

- Daily Derivative Report - 15072022 - 15-07-2022 - 07Document5 pagesDaily Derivative Report - 15072022 - 15-07-2022 - 07Porus Saranjit SinghNo ratings yet

- Currency Report - Daily - 15 June 2022 - 15-06-2022 - 07Document4 pagesCurrency Report - Daily - 15 June 2022 - 15-06-2022 - 07Porus Saranjit SinghNo ratings yet

- Currency Report - Daily - 13 July 2022 - 13-07-2022 - 09Document4 pagesCurrency Report - Daily - 13 July 2022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- Opening Bell: September 22, 2021 Market Outlook Today's HighlightsDocument8 pagesOpening Bell: September 22, 2021 Market Outlook Today's HighlightsPorus Saranjit SinghNo ratings yet

- Cement - Q4FY22 Earnings Preview - 06-04-2022 - 10Document9 pagesCement - Q4FY22 Earnings Preview - 06-04-2022 - 10Porus Saranjit SinghNo ratings yet

- Opening Bell: July 13, 2022 Market Outlook Today's HighlightsDocument8 pagesOpening Bell: July 13, 2022 Market Outlook Today's HighlightsPorus Saranjit SinghNo ratings yet

- IDirect JSWSteel Q4FY22Document10 pagesIDirect JSWSteel Q4FY22Porus Saranjit SinghNo ratings yet

- Paras Defence & Space Technologies LTD: UnratedDocument12 pagesParas Defence & Space Technologies LTD: UnratedPorus Saranjit SinghNo ratings yet

- Opening Bell: Market Outlook Today's HighlightsDocument8 pagesOpening Bell: Market Outlook Today's HighlightsPorus Saranjit SinghNo ratings yet

- Covid Recovery Pulse: September 17, 2021Document7 pagesCovid Recovery Pulse: September 17, 2021Porus Saranjit SinghNo ratings yet

- Recipe of Vada PavDocument6 pagesRecipe of Vada PavPorus Saranjit Singh0% (1)

- Annual Report 2016 Kewal KiranDocument196 pagesAnnual Report 2016 Kewal KiranPorus Saranjit SinghNo ratings yet

- DISBURSEMENT VOUCHER (JC) - AugustDocument2 pagesDISBURSEMENT VOUCHER (JC) - Augusthekeho3180No ratings yet

- Chapter 1Document38 pagesChapter 1CharleneKronstedtNo ratings yet

- Vision & Mission StatementsDocument3 pagesVision & Mission StatementsVyom Shakti Nigam100% (2)

- 300 Business Card Details Updated FileDocument42 pages300 Business Card Details Updated FileDebobrota K. Sarker0% (1)

- Expenditure Multipliers: ("Notes 7" - Comes After Chapter 6)Document57 pagesExpenditure Multipliers: ("Notes 7" - Comes After Chapter 6)hongphakdeyNo ratings yet

- Accounting For Non Specialists Australian 7th Edition Atrill Test BankDocument36 pagesAccounting For Non Specialists Australian 7th Edition Atrill Test Bankfractionswangp5i0ec100% (24)

- LaborDocument4 pagesLaborVince LeidoNo ratings yet

- A Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofDocument88 pagesA Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofAkash SinghNo ratings yet

- USPTO TTAB Cancellation 92050564 For NETBOOK (Psion Teklogix)Document6 pagesUSPTO TTAB Cancellation 92050564 For NETBOOK (Psion Teklogix)savethenetbooks100% (2)

- Sig Ar 0405Document84 pagesSig Ar 0405kapoorvikrantNo ratings yet

- Kase Fund Letter To Investors-Q1 14Document4 pagesKase Fund Letter To Investors-Q1 14CanadianValue100% (1)

- Omnibus Sworn StatementDocument2 pagesOmnibus Sworn StatementRhenze Kristine AbrenicaNo ratings yet

- AccountingDocument336 pagesAccountingVenkat GV100% (2)

- Tutorial 7 Solutions W7Document2 pagesTutorial 7 Solutions W7Henry Ng Yong KangNo ratings yet

- Complete Assignment - Docx (Final)Document15 pagesComplete Assignment - Docx (Final)anmeannNo ratings yet

- BrochureDocument12 pagesBrochureKundan KushwahaNo ratings yet

- Rakuten - Affiliate Report 2016 - Forrester ConsultingDocument13 pagesRakuten - Affiliate Report 2016 - Forrester ConsultingtheghostinthepostNo ratings yet

- How Practitioners Set Share Fractions in Target Cost ContractsDocument8 pagesHow Practitioners Set Share Fractions in Target Cost ContractschouszeszeNo ratings yet

- Computer Integrated ManufacturingDocument45 pagesComputer Integrated ManufacturingVinoth KumarNo ratings yet

- Abid RehmatDocument5 pagesAbid RehmatSheikh Aabid RehmatNo ratings yet

- Ecommerce SrsDocument14 pagesEcommerce SrsVikram ShekhawatNo ratings yet

- Bovee CH02Document24 pagesBovee CH02Malik WajihaNo ratings yet

- Price Determination For AutomobilesDocument11 pagesPrice Determination For AutomobilesAbubakarNo ratings yet

- Lion Air Eticket Itinerary / Receipt: Wijaya/Ari MRDocument3 pagesLion Air Eticket Itinerary / Receipt: Wijaya/Ari MRhaldokoNo ratings yet

- Social Cost Benefit AnalysisDocument13 pagesSocial Cost Benefit AnalysisMohammad Nayamat Ali Rubel100% (1)

- Project List (Updated 11 30 12) BADocument140 pagesProject List (Updated 11 30 12) BALiey BustamanteNo ratings yet

- Boston Consulting Group Matrix (BCG Matrix)Document19 pagesBoston Consulting Group Matrix (BCG Matrix)c-191786No ratings yet

- 04 - Invesco European Bond FundDocument2 pages04 - Invesco European Bond FundRoberto PerezNo ratings yet

- Strategic Acceleration SummaryDocument6 pagesStrategic Acceleration SummarycoacherslandNo ratings yet

- Chapter 12 Lecture OutlineDocument7 pagesChapter 12 Lecture OutlineirquadriNo ratings yet