Professional Documents

Culture Documents

Daily Derivatives

Uploaded by

Ranjan BeheraCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Derivatives

Uploaded by

Ranjan BeheraCopyright:

Available Formats

Derivatives Daily

Thursday, January 18, 2024

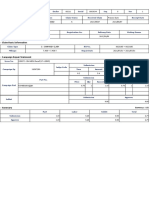

Nifty Snapshot Summary

Close Prv Cl. Ab chg % chg

Indian markets closed on a negative note where selling was mainly seen in Banking,

Spot 21,571.95 22,032.30 -460.35 -2.09 Pharmaceutical and Metal sectors. Nifty Jan Future closed at 21589.55 (down 439.95

Futures 21,589.55 22,029.50 -439.95 -2.00 points) at a premium of 17.60 pts to spot.

OI(ml shr) 13.66 14.58 -0.91 -6.25 FIIs were net sellers in Cash to the tune of 10578.13 Cr and were net sellers in index futures

Vol (lots) 282279 122353 159926 130.71 to the tune of 5048.40 Cr.

COC 17.60 -2.80 20.40 -728.6 India VIX increased by 11.10% to close 15.08 at touching an intraday high of 15.23.

PCR–OI 0.71 1.20 -0.49 -40.7 Open Interest in Nifty Options:

Nifty Futures Price v/s OI Open Interest in Nifty Options (in million units, All Expiries) Call Put

25.00

OI Nifty Futures

20.00 19.18 19.02

22,200 17 17.86

Open interest in millions

22,100

15 15.00 14.03

22,000

11.77

21,900 10.32

13

10.00 7.75 8.76

21,800 7.48

6.27 6.55 6.37 6.32 6.85

21,700 11 5.31

14.58

14.54

5.00 3.93

13.81

13.66

21,600 2.83

13.26

13.20

13.15

13.14

13.08

2.31

12.94

12.91

9 0.53 0.84

21,500 0.26 0.38

0.00

21,400

7 21000.00 21100.00 21200.00 21300.00 21400.00 21500.00 21600.00 21700.00 21800.00 21900.00 22000.00

21,300

21,200 5

20.00

3-Jan

4-Jan

5-Jan

8-Jan

9-Jan

10-Jan

11-Jan

12-Jan

15-Jan

16-Jan

17-Jan

Change in Open Interest in Nifty Options (in million units, All Expiries)

Call Put

15.41

15.00

11.01

10.00 7.36 7.98

7.25

Institutional Activity in previous trading session 5.00 4.09

2.16

(in Rs cr.) Buy Sell Net 1.34

0.39 0.04 0.57 0.21

0.00 1.630.14

Index Futures 6764.85 11813.25 -5048.40 -0.20 -0.10 -0.05 -0.22

Index Options 4291817.21 4348715.28 -56898.07 -5.00 -2.88

-4.19 -5.17

Stock Futures 24233.66 30246.09 -6012.43 -6.71

-10.00

21000.00 21100.00 21200.00 21300.00 21400.00 21500.00 21600.00 21700.00 21800.00 21900.00 22000.00

Stock Options 45643.68 44890.99 752.69

FII Cash 17,317.91 27,896.04 -10,578.1

DII Cash 15,188.62 11,182.18 4,006.44

Net FII Activity (in Rs cr.) The above second chart shows previous trading day’s change in Nifty options where

Date Idx Fut Stk Fut Idx Opt Cash Liquidation in OI were seen in 21900, 21800, 21700 strike Puts while Addition was seen at

17-Jan -5048.4 -6012.4 -56898.1 -10578 21600, 21700, 21800 strike Calls indicating market is likely to remain negative in the near

16-Jan -134.6 -1166.3 -2461.9 657 term.

15-Jan 1446.3 134.6 -7864.3 1086

Highest OI build-up is seen at 22000 strike Calls and 21000 strike Puts, to the tune of

12-Jan 63.9 550.8 23579.8 -340

19.02mn and 19.18mn respectively.

11-Jan 74.5 1666.8 -76149.1 -865

10-Jan -640.8 -1099.3 -68356.4 -1721 Outlook on Nifty:

Technical Pivot (Intraday): Index is likely to open on a gap down note today and is likely to remain negative

S2 S1 PIVOT R1 R2 during the day.

NIFTY 21870 21950 22045 22125 22215

BANKNIFTY 47885 48055 48250 48415 48610

(Price is in Rs; OI is in million units; Price chg and OI chg are in percentage) NB RESEARCH

Fresh Longs seen in: Fresh Shorts seen in:

Price Price OI

Scrip Price OI OI Chg Scrip Price OI

chg chg Chg

OFSS 5088.5 3.2 0.9 9.5 HDFCBANK 1541.3 -8.5 143.4 33.8

BHEL 207.8 1.9 95.3 8.7 BANKNIFTY 46159.3 -4.3 3.0 29.0

ICICIGI 1458.7 6.0 4.1 8.6 SAIL 113.2 -5.9 167.5 15.2

Short Covering seen in: Long Unwinding seen in:

Price Price OI

Scrip Price OI OI Chg Scrip Price OI

chg chg Chg

LTTS 5555.6 3.6 0.9 -20.7 CHAMBLFERT 384.6 -0.2 11.6 -9.0

METROPOLIS 1568.7 1.3 1.5 -8.4 ABFRL 223.3 -3.9 36.1 -7.9

POLYCAB 4437.9 2.2 3.4 -7.8 NATIONALUM 133.8 -4.0 94.2 -6.8

NIRAV HARISH CHHEDA AMIT BHUPTANI

AVP - DERIVATIVES AND TECHNICAL RESEARCH SR.DERIVATIVES AND TECHNICAL RESEARCH ANALYST

Derivatives Daily

Thursday, January 18, 2024

NIFTY50 Options OI (CE OI = Resistance) (PE OI = Support) NIFTY50 Options OI (CE OI = Resistance) ( PE OI = Support)

Highest CE Highest PE Highest CE Highest PE

Symbol CMP Symbol CMP

OI OI OI OI

ADANIPORTS 1200 1200 1171 INFY 1600 1500 1640

ADANIENT 3100 3000 2973 IOC 145 125 144

ASIANPAINT 3300 3200 3247 JSWSTEEL 900 800 814

AXISBANK 1150 1100 1082 KOTAKBANK 2000 1800 1779

BAJAJ-AUTO 7500 6500 7184 LT 3600 3400 3570

BAJAJFINSV 1700 1700 1586 LTIM 7000 6000 6294

BAJFINANCE 8000 7000 7377 M&M 1700 1600 1599

BHARTIARTL 1100 1050 1085 MARUTI 11000 9500 10050

BPCL 460 440 472 NESTLEIND 2700 2750 2550

BRITANNIA 5500 5000 5075 NTPC 330 300 310

CIPLA 1330 1200 1295 ONGC 220 220 233

COALINDIA 400 380 380 POWERGRID 250 240 239

DIVISLAB 4000 3900 3736 RELIANCE 2800 2600 2727

DRREDDY 6000 5700 5656 SBILIFE 1500 1400 1425

EICHERMOT 4000 3700 3753 SBIN 650 600 626

GRASIM 2191.3 1892.5 2068 SUNPHARMA 1300 1300 1301

HCLTECH 1600 1500 1565 TATACONSUM 1200 1000 1141

HDFCBANK 1700 1500 1541 TATAMOTORS 900 800 806

HDFCLIFE 650 600 608 TATASTEEL 140 130 132

HEROMOTOCO 4400 4000 4373 TCS 4000 3700 3864

HINDALCO 600 550 561 TECHM 1400 1200 1330

HINDUNILVR 2700 2500 2562 TITAN 3800 3700 3827

ICICIBANK 1000 1000 981 ULTRACEMCO 10000 9800 9881

ITC 480 470 467 UPL 600 550 551

INDUSINDBK 1700 1600 1645 WIPRO 500 450 483

NIRAV HARISH CHHEDA AMIT BHUPTANI

AVP - DERIVATIVES AND TECHNICAL RESEARCH SR.DERIVATIVES AND TECHNICAL RESEARCH ANALYST

Derivatives Daily

Thursday, January 18, 2024

OI against MWPL OI against MWPL

Limit for Open Limit for

Symbol MWPL Open Interest % OI Symbol MWPL % OI

next day Interest next day

NATIONALUM 178967755 199575000 Ban 112% MANAPPURAM 109696743 80166000 24045905 73%

IEX 177845485 177270000 Ban 100% CANBK 134484114 97448400 30311508 72%

POLYCAB 10228835 10122600 Ban 99% AUROPHARMA 56444627 39442700 14179695 70%

SAIL 289139949 278768000 Ban 96% WIPRO 281213926 194457000 72696229 69%

ZEEL 184440627 176193000 Ban 96% VEDL 269187421 181916200 73811849 68%

GNFC 18282414 16633500 734793 91% IDFCFIRSTB 881684797 579720000 257880557 66%

ABFRL 83620831 75618400 Ban 90% FEDERALBNK 444533804 285900000 136407113 64%

RBLBANK 120271928 107345000 6913331 89% TATAPOWER 339616396 211642875 110992701 62%

BALRAMCHIN 23040698 20409600 1479063 89% DLF 128335464 79287450 42631240 62%

ASHOKLEY 282359403 245890000 Ban 87% SBICARD 58820069 36068000 19811065 61%

METROPOLIS 5146496 4456800 Ban 87% LICHSGFIN 60244101 36196000 21035895 60%

DELTACORP 35744131 30924000 Ban 87% CANFINHOME 18644752 11141325 6571189 60%

HINDCOPPER 65482129 56079300 Ban 86% JINDALSTEL 76154801 45476250 26870810 60%

IDEA 4832931211 4121120000 470164650 85% M&MFIN 117884976 70120000 41870727 59%

PNB 591377974 503696000 58113075 85% TATACOMM 23447901 13942000 8333505 59%

NMDC 229794455 194274000 24030732 85% GLENMARK 30110093 17787875 10816713 59%

PVRINOX 14160340 11958881 Ban 84% PFC 290447407 162443875 113481161 56%

UPL 101555650 85503600 10974267 84% BANKBARODA 372635498 207961650 146042073 56%

GMRINFRA 494055219 415068750 54283708 84% AMBUJACEM 146089317 79776000 59008851 55%

SUNTV 19704232 16242000 2477020 82% HINDPETRO 127940594 67770000 53773564 53%

GRANULES 28132038 23036000 3689436 82% ADANIENT 62450033 32747100 26580431 52%

BHEL 256482590 209900250 33758210 82% HAL 37934515 19867800 16169989 52%

BANDHANBNK 193356582 158077500 Ban 82% ADANIPORTS 148906032 77651200 63809530 52%

IRCTC 60165566 49076125 8081162 82% JUBLFOOD 76339539 39357500 33165062 52%

CHAMBLFERT 32829989 26643700 Ban 81% MCX 10180563 5172400 4499134 51%

INDUSTOWER 167026256 132671400 26003543 79% LTTS 5544548 2810400 2456920 51%

PEL 23951791 18816000 3938201 79% OFSS 4710327 2374800 2100010 50%

BIOCON 93571885 72412500 16480790 77% L&TFH 168767877 84528128 75801355 50%

INDIACEM 44362911 34182300 7962465 77%

TATACHEM 31601465 24270400 5750991 77%

ABCAPITAL 161153272 122752800 30342808 76%

ESCORTS 6726893 5122425 1268123 76%

AARTIIND 40912236 30355000 8511624 74%

NIRAV HARISH CHHEDA AMIT BHUPTANI

AVP - DERIVATIVES AND TECHNICAL RESEARCH SR.DERIVATIVES AND TECHNICAL RESEARCH ANALYST

Derivatives Daily

Thursday, January 18, 2024

Derivative Recommendations:

Call

Stock Name Entry price Targets Stop Loss Duration Status

(Buy/Sell)

HINDALCO 590 CE Buy 10.5 20 6 Positional Open

NIRAV HARISH CHHEDA AMIT BHUPTANI

AVP - DERIVATIVES AND TECHNICAL RESEARCH SR.DERIVATIVES AND TECHNICAL RESEARCH ANALYST

Derivatives Daily

Thursday, January 18, 2024

FROM THE EQUITY DERIVATIVE DESK:

NIRAV HARISH CHHEDA AMIT BHUPTANI

AVP - DERIVATIVES AND TECHNICAL RESEARCH SNR.DERIVATIVES AND TECHNICAL RESEARCH ANALYST

E-Mail: nirav.chheda@nirmalbang.com E-Mail: amit.bhuptani@nirmalbang.com

Tel no: 6273-8199/8000 Tel no: 6273-8242/8000

DISCLOSURES

Research Reports that are published by Nirmal Bang Securities Private Limited (hereinafter referred to as “NBSPL”) are for private circulation

only. NBSPL is a registered Research Analyst under SEBI (Research Analyst) Regulations, 2014 having Registration no. INH000001766.

NBSPL is also a registered Stock Broker with National Stock Exchange of India Limited , BSE Limited ,Metropolitan Stock Exchange of India

Limited , Multi Commodity Exchange of India Limited , National Commodity and Derivative Exchange Limited and Indian Commodity

Exchange Limited in cash and Equity and Commodities derivatives segments.

NBSPL has other business divisions with independent research teams separated by Chinese walls, and therefore may, at times, have different

or contrary views on stocks and markets.

NBSPL or its associates have not been debarred / suspended by SEBI or any other regulatory authority for accessing / dealing in securities

Market. NBSPL, its associates or analyst or his relatives do not hold any financial interest (Except Investment) in the subject company.

NBSPL or its associates or Analyst do not have any conflict or material conflict of interest at the time of publication of the research report

with the subject company. NBSPL or its associates or Analyst or his relatives may or may not hold beneficial ownership of 1% or more in the

subject company at the end of the month immediately preceding the date of publication of this research report.

NBSPL or its associates / analyst has not received any compensation / managed or co-managed public offering of securities of the company

covered by Analyst during the past twelve months. NBSPL or its associates have not received any compensation or other benefits from the

company covered by Analyst or third party in connection with the research report. Analyst has not served as an officer, director or employee

of Subject Company . NBSPL / analyst has not been engaged in market making activity of the subject company.

Analyst Certification: The research analysts and authors of these reports, hereby certify that the views expressed in this research report

accurately reflects my/our personal views about the subject securities, issuers, products, sectors or industries. It is also certified that no part

of the compensation of the analyst(s) was, is, or will be directly or indirectly related to the inclusion of specific recommendations or views in

this research. The analyst(s) principally responsible for the preparation of this research report and has taken reasonable care to achieve

and maintain independence and objectivity in making any recommendations.

DISCLAIMER

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to

you. NBSPL is not soliciting any action based upon it. Nothing in this research shall be construed as a solicitation to buy or sell any security

or product, or to engage in or refrain from engaging in any such transaction. In preparing this research, we did not take into account the

investment objectives, financial situation and particular needs of the reader.

This research has been prepared for the general use of the clients of NBSPL and must not be copied, either in whole or in part, or distributed

or redistributed to any other person in any form. If you are not the intended recipient you must not use or disclose the information in this

research in any way. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time.

NBSPL will not treat recipients as customers by virtue of their receiving this report. This report is not directed or intended for distribution to

or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would

be contrary to law, regulation or which would subject NBSPL & its group companies to registration or licensing requirements within such

jurisdictions.

The report is based on the information obtained from sources believed to be reliable, but we do not make any representation or warranty that

it is accurate, complete or up-to-date and it should not be relied upon as such. We accept no obligation to correct or update the information

or opinions in it. NBSPL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any

person from any inadvertent error in the information contained in this report. NBSPL or any of its affiliates or employees do not provide, at

any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied

warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own

investigations.

This information is subject to change without any prior notice. NBSPL reserves its absolute discretion and right to make or refrain from

making modifications and alterations to this statement from time to time. Nevertheless, NBSPL is committed to providing independent and

transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Before making an investment decision on the basis of this research, the reader needs to consider, with or without the assistance of an

adviser, whether the advice is appropriate in light of their particular investment needs, objectives and financial circumstances. There are

risks involved in securities trading. The price of securities can and does fluctuate, and an individual security may even become valueless.

International investors are reminded of the additional risks inherent in international investments, such as currency fluctuations and

international stock market or economic conditions, which may adversely affect the value of the investment. Opinions expressed are subject to

change without any notice. Neither the company nor the director or the employees of NBSPL accept any liability whatsoever for any direct,

indirect, consequential or other loss arising from any use of this research and/or further communication in relation to this research. Here it

may be noted that neither NBSPL, nor its directors, employees, agents or representatives shall be liable for any damages whether direct or

indirect, incidental, special or consequential including lost revenue or lost profit that may arise from or in connection with the use of the

information contained in this report.

Copyright of this document vests exclusively with NBSPL. Our reports are also available on our website www.nirmalbang.com

NIRAV HARISH CHHEDA AMIT BHUPTANI

AVP - DERIVATIVES AND TECHNICAL RESEARCH SR.DERIVATIVES AND TECHNICAL RESEARCH ANALYST

You might also like

- Derivatives Daily: Wednesday, March 23, 2022Document5 pagesDerivatives Daily: Wednesday, March 23, 2022Prasad ChakkrapaniNo ratings yet

- Derivatives Daily: Monday, September 20, 2021Document5 pagesDerivatives Daily: Monday, September 20, 2021Equity NestNo ratings yet

- Derivatives Daily: Monday, October 25, 2021Document5 pagesDerivatives Daily: Monday, October 25, 2021ayushmagguNo ratings yet

- Daily Derivatives-20200803Document5 pagesDaily Derivatives-20200803Kiran KudtarkarNo ratings yet

- Derivatives Daily: Monday, April 05, 2021Document5 pagesDerivatives Daily: Monday, April 05, 2021SomendraNo ratings yet

- Market Report Nov'22Document19 pagesMarket Report Nov'22THUY LUDMINANo ratings yet

- Sensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38407) / Nifty (11323) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38407) / Nifty (11323) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Technical Derivatives 03-04-2024Document6 pagesTechnical Derivatives 03-04-2024fazalrehanNo ratings yet

- DTA's Morning Cafe-04th Oct 2021Document1 pageDTA's Morning Cafe-04th Oct 2021aaryinfoNo ratings yet

- Sensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Financial AccountingDocument7 pagesFinancial AccountingIshaPandeyNo ratings yet

- Icici Bank LTD.: Market ClosedDocument21 pagesIcici Bank LTD.: Market ClosedVarun KarthikNo ratings yet

- Sensex (38370) / Nifty (11308) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38370) / Nifty (11308) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Activity Statement: Account InformationDocument9 pagesActivity Statement: Account InformationAlexandru SimaNo ratings yet

- Sensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- ZerodhaDocument4 pagesZerodhameetdedhia33333No ratings yet

- Part 2 JournalDocument1 pagePart 2 JournalChaudhry M. BurairNo ratings yet

- Sensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38493) / Nifty (11301) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Understanding of Average Daily Price Distribution Cycle & AsianDocument9 pagesUnderstanding of Average Daily Price Distribution Cycle & AsiansaifulNo ratings yet

- Morning NoteDocument8 pagesMorning NoteAkshay YawaleNo ratings yet

- Technical Derivatives 21 02 2023Document5 pagesTechnical Derivatives 21 02 2023rajesh bhosaleNo ratings yet

- Technical Derivatives 22 02 2023Document5 pagesTechnical Derivatives 22 02 2023rajesh bhosaleNo ratings yet

- Market Update 31st August 2017Document1 pageMarket Update 31st August 2017Anonymous iFZbkNwNo ratings yet

- Sensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Cash-27 2 2023Document2 pagesCash-27 2 2023Thu VuNo ratings yet

- Sensex (38051) / Nifty (11247) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38051) / Nifty (11247) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Market Update 8th November 2017Document1 pageMarket Update 8th November 2017Anonymous iFZbkNwNo ratings yet

- Sensex (37930) / Nifty (11162) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37930) / Nifty (11162) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Daily Market Update 18.01Document1 pageDaily Market Update 18.01Inde Pendent LkNo ratings yet

- Sensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38220) / Nifty (11312) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Market Mantra 281222 ADocument8 pagesMarket Mantra 281222 AHimanshu BisaniNo ratings yet

- Trust Bank Limited: Symbol: TRUSTBANK Sector: Bank Board: MainDocument2 pagesTrust Bank Limited: Symbol: TRUSTBANK Sector: Bank Board: MainMrittika SahaNo ratings yet

- Daily & Technical Update: Ciptadana Sekuritas AsiaDocument10 pagesDaily & Technical Update: Ciptadana Sekuritas AsiaTeja HusadaNo ratings yet

- Zensar Technologies: Hi Tech Drives ToplineDocument5 pagesZensar Technologies: Hi Tech Drives Toplinemani kantaNo ratings yet

- Escorts Kubota: (Escort)Document5 pagesEscorts Kubota: (Escort)Anjali DograNo ratings yet

- Market Strategy: Sensex Nifty Nifty Bank Nifty Midcap 50 Nifty Smallcap 50Document8 pagesMarket Strategy: Sensex Nifty Nifty Bank Nifty Midcap 50 Nifty Smallcap 50sameer singhNo ratings yet

- Market Update 21st September 2017Document1 pageMarket Update 21st September 2017Anonymous iFZbkNwNo ratings yet

- Profit Loss Account - ZSQIW - 2021-2022Document2 pagesProfit Loss Account - ZSQIW - 2021-2022Chhaya JainNo ratings yet

- Financial Statement 2020-21Document7 pagesFinancial Statement 2020-21celiaNo ratings yet

- Lankabangla Financial Portal - Live Stock Data of Dhaka Stock Exchange (DSE), Financial Statements, Research, Chart and Level 2 DataDocument2 pagesLankabangla Financial Portal - Live Stock Data of Dhaka Stock Exchange (DSE), Financial Statements, Research, Chart and Level 2 DataOpen_SenseNo ratings yet

- UCapital - JarirMarketingCo (Jarir) - 3Q23ResultReview - Oct - 11 - 2023Document3 pagesUCapital - JarirMarketingCo (Jarir) - 3Q23ResultReview - Oct - 11 - 2023robynxjNo ratings yet

- Technical Derivatives 17 02 2023Document5 pagesTechnical Derivatives 17 02 2023rajesh bhosaleNo ratings yet

- Sensex (34962) / Nifty (10312) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (34962) / Nifty (10312) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Daring DerivativesDocument4 pagesDaring DerivativessharmanmruNo ratings yet

- Lembar Jawab Jurnal - 07Document9 pagesLembar Jawab Jurnal - 07Salwa Anisa0% (1)

- Market Update 22nd November 2017Document1 pageMarket Update 22nd November 2017Anonymous iFZbkNwNo ratings yet

- HSBC HSBC Holdings PLC: (New York Stock Exchange)Document12 pagesHSBC HSBC Holdings PLC: (New York Stock Exchange)Anonymous P73cUg73LNo ratings yet

- PEP - PepsiCo Inc (Stock Report)Document21 pagesPEP - PepsiCo Inc (Stock Report)87yk9mddv7No ratings yet

- Sensex (38041) / Nifty (11214) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38041) / Nifty (11214) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Runspree Dashboard Feb 22-Feb 26Document1 pageRunspree Dashboard Feb 22-Feb 26whyNo ratings yet

- Transaction Status: Keep Track of Your TransactionDocument1 pageTransaction Status: Keep Track of Your TransactionbarliNo ratings yet

- final kế 2Document11 pagesfinal kế 2Đông JustNo ratings yet

- Cost Calculation Pome PAODocument2 pagesCost Calculation Pome PAOAULIA ANNANo ratings yet

- LPKR 290011-110211Document10 pagesLPKR 290011-110211Aditya WidiyadiNo ratings yet

- Bolan - Master PricingDocument2 pagesBolan - Master PricingIqra ChuhanNo ratings yet

- Claim VIN Information: Currency: USDDocument1 pageClaim VIN Information: Currency: USDLeonardo Albinagorta ParedesNo ratings yet

- Market Update 6th November 2017Document1 pageMarket Update 6th November 2017Anonymous iFZbkNwNo ratings yet

- Mahindra & Mahindra Limited: Financial HighlightsDocument2 pagesMahindra & Mahindra Limited: Financial HighlightsRanjan BeheraNo ratings yet

- 323403405corporate Action MeterDocument4 pages323403405corporate Action MeterRanjan BeheraNo ratings yet

- NCC Limited: Financial HighlightsDocument3 pagesNCC Limited: Financial HighlightsRanjan BeheraNo ratings yet

- AXIS SEC - Hero Motocorp LTDDocument5 pagesAXIS SEC - Hero Motocorp LTDRanjan BeheraNo ratings yet

- Alkyl Amines Chemicals Limited: Financial HighlightsDocument2 pagesAlkyl Amines Chemicals Limited: Financial HighlightsRanjan BeheraNo ratings yet

- State Bank of India: Q2 Fy 2021 ResultsDocument7 pagesState Bank of India: Q2 Fy 2021 ResultsRanjan BeheraNo ratings yet

- Adani Green Energy - Red AlertDocument8 pagesAdani Green Energy - Red AlertRanjan BeheraNo ratings yet

- Investment Ideas: SmartDocument2 pagesInvestment Ideas: SmartRanjan BeheraNo ratings yet

- Johnson Controls-Hitachi A/C, India: '22Bn Revenue Since Fy18, Roice Dips To 11%, From Peak 21%Document10 pagesJohnson Controls-Hitachi A/C, India: '22Bn Revenue Since Fy18, Roice Dips To 11%, From Peak 21%Ranjan BeheraNo ratings yet

- BCL IndustriesDocument1 pageBCL IndustriesRanjan BeheraNo ratings yet

- Nifty - Elliot Wave PerspectiveDocument4 pagesNifty - Elliot Wave PerspectiveRanjan BeheraNo ratings yet

- Why Are Markets Rising?: WebinarDocument4 pagesWhy Are Markets Rising?: WebinarRanjan BeheraNo ratings yet

- Diamond Futures 30centsDocument14 pagesDiamond Futures 30centsRanjan BeheraNo ratings yet

- Mahendra CIE AutomotiveDocument7 pagesMahendra CIE AutomotiveRanjan BeheraNo ratings yet

- Securities and Exchange Board of IndiaDocument2 pagesSecurities and Exchange Board of IndiaRanjan BeheraNo ratings yet

- Horse (E)Document2 pagesHorse (E)Ranjan BeheraNo ratings yet

- Market Strategy: Trading Strategy M&M AUG Fut (Sell at Rs.611-615, Target Rs590, Stop Loss Rs621)Document9 pagesMarket Strategy: Trading Strategy M&M AUG Fut (Sell at Rs.611-615, Target Rs590, Stop Loss Rs621)Ranjan BeheraNo ratings yet

- Daily Research Update: Today's Focus PointDocument2 pagesDaily Research Update: Today's Focus PointRanjan BeheraNo ratings yet

- Apollo Tyres: Debt, Return Ratio Commentary EncouragingDocument11 pagesApollo Tyres: Debt, Return Ratio Commentary EncouragingRanjan BeheraNo ratings yet

- Maruti Suzuki April Sales DataDocument2 pagesMaruti Suzuki April Sales DataRanjan BeheraNo ratings yet

- Eicher Sales DataDocument2 pagesEicher Sales DataRanjan BeheraNo ratings yet

- Dalmia BharatDocument10 pagesDalmia BharatRanjan BeheraNo ratings yet

- Simply: Question Bank For NCFM Commodity DerivativesDocument12 pagesSimply: Question Bank For NCFM Commodity DerivativesRanjan BeheraNo ratings yet

- Dark Horse EDocument2 pagesDark Horse ERanjan BeheraNo ratings yet

- Revision in Trading Hours - Dec 2018Document3 pagesRevision in Trading Hours - Dec 2018Ranjan BeheraNo ratings yet

- Sbi Statement1 MergedDocument18 pagesSbi Statement1 MergedRanjan BeheraNo ratings yet

- Acting Tips: Book 4Document9 pagesActing Tips: Book 4Ranjan BeheraNo ratings yet

- Sundaram Finance Holdings LimitedDocument1 pageSundaram Finance Holdings LimitedRanjan BeheraNo ratings yet

- Blackrock Asian Tiger Bond FundDocument3 pagesBlackrock Asian Tiger Bond Fundh3493061No ratings yet

- Foundations of Finance 8th Edition Keown Test Bank 1Document40 pagesFoundations of Finance 8th Edition Keown Test Bank 1carita100% (44)

- Pillar 1 CompleteDocument301 pagesPillar 1 CompleteAnshul SinghNo ratings yet

- CH 08Document43 pagesCH 08LilyNo ratings yet

- Interview Capsule For CUB ExecutivesDocument169 pagesInterview Capsule For CUB Executivesvenkatesh pkNo ratings yet

- National Insurance Policy 2015Document37 pagesNational Insurance Policy 2015FrancisNo ratings yet

- 2 Risk and ReturnsDocument53 pages2 Risk and ReturnsAkwasi BoatengNo ratings yet

- Project On NJ India Invest PVT LTDDocument68 pagesProject On NJ India Invest PVT LTDbabloo200650% (2)

- Literature Review On Credit Risk Management in Banks PDFDocument8 pagesLiterature Review On Credit Risk Management in Banks PDFgw1m2qtfNo ratings yet

- 1st Assignment - 2023Document15 pages1st Assignment - 2023harmanchahalNo ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsConrad DuncanNo ratings yet

- UGBA 120B Discussion Section 7 10 12 12Document18 pagesUGBA 120B Discussion Section 7 10 12 12jennyz365No ratings yet

- What Makes The US Dollar and EUR Tick?: Kathy LienDocument56 pagesWhat Makes The US Dollar and EUR Tick?: Kathy LienIndranil ChakrabortyNo ratings yet

- Financial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions ManualDocument13 pagesFinancial and Managerial Accounting The Basis For Business Decisions 18th Edition Williams Solutions Manuallaylasaintbq83pu100% (33)

- Notes1 & 2Document17 pagesNotes1 & 2wingkuen107No ratings yet

- 4 - صناديق الاستثمار الإسلامية - نموذج مجلةDocument42 pages4 - صناديق الاستثمار الإسلامية - نموذج مجلةElabdallaoui AbdelghafourNo ratings yet

- Case Study - 5Document7 pagesCase Study - 5CA Saurabh LonawatNo ratings yet

- How To Get All The Money You Need To Buy PropertyDocument83 pagesHow To Get All The Money You Need To Buy PropertyKora Sadler100% (2)

- 2008 Final Review - Financial Update3Document2 pages2008 Final Review - Financial Update3friendresh1708No ratings yet

- Testing Weak Form Efficiency For Indian Derivatives MarketDocument4 pagesTesting Weak Form Efficiency For Indian Derivatives MarketVasantha NaikNo ratings yet

- SEBI Guidelines For IPODocument12 pagesSEBI Guidelines For IPOAbhishek KhemkaNo ratings yet

- Chapter 2 Premium LiabilityDocument18 pagesChapter 2 Premium LiabilityClarissa Atillano FababairNo ratings yet

- Nasdaq Dubai Ipo GuideDocument104 pagesNasdaq Dubai Ipo GuidetamersalahNo ratings yet

- Var, CaR, CAR, Basel 1 and 2Document7 pagesVar, CaR, CAR, Basel 1 and 2ChartSniperNo ratings yet

- SSLM in GenMath For G11 Q2 Module 6Document5 pagesSSLM in GenMath For G11 Q2 Module 6OmarieNo ratings yet

- Pre Imbalance BibleDocument67 pagesPre Imbalance BibleVarun 99100% (1)

- Understanding Income StatementsDocument39 pagesUnderstanding Income StatementsMarsh100% (1)

- RIT Case Brief ALGO2 Algorithmic Market MakingDocument3 pagesRIT Case Brief ALGO2 Algorithmic Market MakingmarioNo ratings yet

- CAPE Management of Business 2014 U1 P2Document7 pagesCAPE Management of Business 2014 U1 P2Jolene GoolcharanNo ratings yet

- Macaulay Duration Formula Excel TemplateDocument6 pagesMacaulay Duration Formula Excel TemplateMustafa Ricky Pramana SeNo ratings yet