Professional Documents

Culture Documents

Derivatives Daily: Wednesday, March 23, 2022

Uploaded by

Prasad ChakkrapaniOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Derivatives Daily: Wednesday, March 23, 2022

Uploaded by

Prasad ChakkrapaniCopyright:

Available Formats

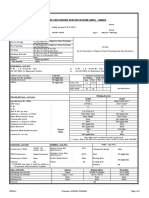

Derivatives Daily

Wednesday, March 23, 2022

Nifty Snapshot Market Summary:

Close Prv Cl. Ab chg % chg Indian markets closed on a positive note where buying was mainly seen in Banking, Automobile,

Spot 17,315.5 17,117.6 197.90 1.16 Technology sectors. Nifty March Future closed at 17362.80 (up 204.15 points) at a premium of

0 0 47.30 pts to spot.

Futures 17,362.8 17,158.6 204.15 1.19

OI (ml shr)

0

17.07

5

16.72 0.35 2.12

FIIs were net buyers in Cash to the tune of 384.48 Cr and were net buyers in index futures to the

tune of 901.09 Cr.

Vol (lots) 278292 223677 54615 24.4

India VIX decreased by 2.24% to close at 24.07 touching an intraday high of 25.16.

COC 47.30 41.05 6.25 15.2

PCR–OI 1.01 0.87 0.15 16.9 Open Interest in Nifty Options:

Nifty Futures Price v/s OI

Open Interest in Nifty Options (in million units, All Expiries) Call Put

OI Nifty Futures 12.00

10.16

17,500 19 9.50

10.00

Open interest in millions

17 8.28

17,000

8.00

15

16,500 5.85 5.96

13 6.00

4.57

17.94

4.65

17.72

17.48

17.25

17.12

17.07

16.77

16.72

16.60

16.31

3.80

16.27

11 3.80 3.76 4.06

16,000

4.00 3.70 3.42

3.17

9 2.81 2.56 2.79

15,500

2.00 1.68

7

0.81 1.05 0.97

0.62

15,000 5

0.00

7-Mar

8-Mar

9-Mar

10-Mar

11-Mar

14-Mar

15-Mar

16-Mar

17-Mar

21-Mar

22-Mar

16500.00 16600.00 16700.00 16800.00 16900.00 17000.00 17100.00 17200.00 17300.00 17400.00 17500.00

3.00 Change in Open Interest in Nifty Options (in million units, All Expiries)

Call Put

2.50 2.32

Nifty Futures Price v/s Change in OI

2.00

17,500 1.0

1.50 1.26 1.36

1.13 1.05

17,000

0.5 0.94 1.07 1.01 0.98

1.00 0.78

0.10

0.85

0.36

0.65

0.69

0.46

0.35

Open interest in millions

0.0

0.50 0.19

-0.88

-0.22

-1.41

-0.05

16,500

0.02 0.03

-0.5 0.00 -0.19

16,000 -0.02 0.00 -0.03 -0.08

-1.0 -0.50 -0.38 -0.33

-0.41

15,500

-1.5

-1.00

-1.50 -1.40

15,000 -2.0

7-Mar

8-Mar

9-Mar

10-Mar

11-Mar

14-Mar

15-Mar

16-Mar

17-Mar

21-Mar

22-Mar

-2.00

16500.00 16600.00 16700.00 16800.00 16900.00 17000.00 17100.00 17200.00 17300.00 17400.00 17500.00

OI ch g Nifty Futures

Institutional Activity in previous trading session The above second chart shows previous trading day’s change in Nifty options where Addition in OI

(in Rs cr.) Buy Sell Net were seen in 17400, 17300, 17100, 17000 strike Puts while liquidation was seen in 17200, 17300,

Index Futures 6122.37 5221.28 901.09 17100 strike Calls indicating market is likely to remain range-bound in the near term.

Index Options 527975.02 526858.06 1116.96 Highest OI build-up is seen at 17500 strike Calls and 16500 strike Puts, to the tune of 8.28mn and

Stock Futures 15171.28 16323.60 -1152.32 10.16mn respectively.

Stock Options 30526.07 30452.19 73.88

Outlook on Nifty:

FII Cash 9,858.98 9,474.50 384.48

DII Cash 4,499.91 5,101.96 -602.05 Index is likely to open on a positive note today and is likely to remain range-bound during the

day.

Net FII Activity (in Rs cr.)

Date Idx Fut Stk Fut Idx Opt Cash

22-Mar 901.1 -1152.3 1117.0 384

21-Mar -551.4 -1233.8 5226.9 -2962

17-Mar 4303.7 823.2 6041.1 2800 Technical Pivot (Intraday):

16-Mar 1822.8 1314.8 4035.4 312 S2 S1 PIVOT R1 R2

NIFTY 16935 17150 17265 17480 17600

15-Mar -1229.0 -1064.0 -776.1 -1250

BANKNIFTY 35070 35775 36185 36890 37300

14-Mar 568.9 -839.6 1997.5 -177

Derivatives Daily

Wednesday, March 23, 2022

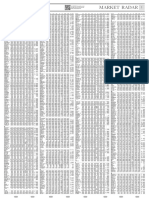

Volume Buzzers (Contract wise) Stock Ideas

One RELIANCE & INFY calls of strike 2500 & 1900 respectively were amongst the most active Calls

Current Volume Price Month whereas RELIANCE & TATASTEEL puts of strike 2500 & 1300 respectively were amongst most

Symbol Volume Change Chg Avg

active Puts.

SUNTV 7906 292% -1.3% 1914

BSOFT & WIPRO are likely to show good strength whereas DIXON & DELTACORP are likely to

OBEROIRLTY 2407 262% 0.2% 1399 show weakness in today’s trading session.

APOLLOHOSP 8894 216% -2.1% 5643

BANDHANBNK 12032 202% 3.2% 4905 (Price is in Rs; OI is in million units; Price chg and OI chg are in percentage) NB RESEARCH

Fresh Longs seen in: Fresh Shorts seen in:

LICHSGFIN 4344 184% 2.6% 3240

HINDUNILVR 18424 175% -2.9% 7417 Price OI Price OI

Scrip Price OI Scrip Price OI

chg Chg chg Chg

GODREJCP 4869 171% -3.1% 3305

BSOFT 467.9 5.3 4.2 28.1 DIXON 4340.3 -2.9 0.7 22.7

IDFCFIRSTB 4369 170% -2.7% 2796

GNFC 792.4 4.1 4.4 22.6 JKCEMENT 2393.3 -2.8 0.5 14.7

SBICARD 1813 160% 0.6% 1965 OBEROIRLTY 916.1 0.2 2.7 21.4 IDFCFIRSTB 40.8 -2.7 176 10.6

Short Covering seen in: Long Unwinding seen in:

ZEEL 8419 148% -3.2% 5898

Price OI Price OI

Scrip Price OI Scrip Price OI

chg Chg chg Chg

WIPRO 609.5 1.4 33.0 -6.5 DELTACORP 305.0 -2.8 16.2 -15.8

FROM THE EQUITY DERIVATIVE DESK:

JUBLFOOD 2634.4 3.0 2.8 -5.9 BALRAMCHIN 492.1 -1.8 8.1 -13.0

NIRAV HARISH CHHEDA ASHOKLEY 112.6 1.5 43.4 -4.8 TORNTPHARM 2770.9 -0.2 0.8 -8.2

SENIOR DERIVATIVES AND TECHNICAL ANALYST

E-Mail: nirav.chheda@nirmalbang.com

Tel no: 6273-8199/8000

Technical Pivot (Intraday):

Script Name

AMIT BHUPTANI S2 S1 PIVOT R1 R2

DERIVATIVES AND TECHNICAL ANALYST BSOFT 436 452 461 477 487

E-Mail: amit.bhuptani@nirmalbang.com

Tel no: 6273-8242/8000 DIXON 4176 4258 4377 4459 4578

WIPRO 589 599 605 615 621

DELTACORP 290 297 305 312 320

Disclaimer

Nirmal Bang Securities Private Limited (hereinafter Call Entry Stop

Stock Name Targets Duration Status

referred to as “NBSPL”)is a registered Member of National (Buy/Sell) price Loss

Stock Exchange of India Limited, Bombay Stock Exchange

Limited and MCX stock Exchange Limited. We have been NO CALLS

granted certificate of Registration as a Research Analyst

with SEBI . Registration no. is INH000001766 for the period

23.09.2015 to 22.09.2020.

NBSPL or its associates including its relatives/analyst do

not hold any financial interest/beneficial ownership of more

than 1% in the company covered by Analyst (in case any

financial interest is held kindly disclose)

NBSPL or its associates/analyst has not received any

compensation from the company covered by Analyst during

the past twelve months. NBSPL /analyst has not served as

an officer, director or employee of company covered by

Analyst and has not been engaged in market making

activity of the company covered by Analyst.

The views expressed are based solely on information

available publicly and believed to be true. Investors are

advised to independently evaluate the market

conditions/risks involved before making any investment

decision.

Derivatives Daily

Wednesday, March 23, 2022

NIFTY50 Options OI (CE OI = Resistance) (PE OI = Support) NIFTY50 Options OI (CE OI = Resistance) ( PE OI = Support)

Highest CE Highest PE Highest CE Highest PE

Symbol OI OI CMP Symbol OI OI CMP

ADANIPORTS 750 700 742 INFY 1900 1800 1891

ASIANPAINT 3100 3000 3062 IOC 130 110 121

AXISBANK 800 700 735 JSWSTEEL 700 650 698

BAJAJ-AUTO 3700 3500 3653 KOTAKBANK 2000 1700 1813

BAJAJFINSV 17000 15000 16562 LT 1800 1800 1780

BAJFINANCE 7000 6000 7009 M&M 780 780 787

BHARTIARTL 720 700 721 MARUTI 8000 7000 7791

BPCL 360 350 369 NESTLEIND 18000 17000 17481

BRITANNIA 3500 3000 3169 NTPC 135 130 133

CIPLA 1100 900 1036 ONGC 200 170 176

COALINDIA 200 160 184 POWERGRID 230 215 210

DIVISLAB 5000 4000 4465 RELIANCE 2500 2400 2539

DRREDDY 4500 4000 4043 SBILIFE 1120 1100 1100

EICHERMOT 2700 2200 2390 SBIN 500 500 496

GRASIM 1700 1600 1586 SHREECEM 25000 22000 23423

HCLTECH 1200 1200 1181 SUNPHARMA 900 880 916

HDFC 2500 2400 2412 TATACONSUM 800 600 754

HDFCBANK 1500 1300 1494 TATAMOTORS 500 400 442

HDFCLIFE 600 520 530 TATASTEEL 1300 1200 1306

HEROMOTOCO 2800 2400 2431 TCS 4000 3600 3708

HINDALCO 600 550 595 TECHM 1540 1500 1543

HINDUNILVR 2100 2000 2000 TITAN 2800 2600 2721

ICICIBANK 800 700 721 ULTRACEMCO 7000 6000 6234

ITC 250 230 250 UPL 800 750 783

INDUSINDBK 1000 900 932 WIPRO 600 600 610

Derivatives Daily

Wednesday, March 23, 2022

OI against MWPL OI against MWPL

Limit for Limit for

Symbol MWPL Open Interest next day % OI Symbol MWPL Open Interest next day % OI

SUNTV 19704232 21808500 Ban 111%

GNFC 18282414 18483400 Ban 101%

DELTACORP 35635456 34035400 Ban 96%

BALRAMCHIN 23498849 22006400 Ban 94%

IDEA 1606294231 1470280000 55699519 92%

SAIL 289139949 264033500 10649451 91%

IBULHSGFIN 80556813 72155600 Ban 90%

NATIONALUM 178967755 152558000 17461367 85%

JINDALSTEL 80699820 64507500 12157329 80%

BHEL 256482590 187488000 56170460 73%

PNB 591377974 420768000 141041075 71%

ESCORTS 14114257 9858750 3549794 70%

ADANIPORTS 145684825 99740000 38660583 68%

TATAMOTORS 355933451 234723150 103413628 66%

LICHSGFIN 60244101 39656000 17575895 66%

RBLBANK 119890099 76876100 37019494 64%

L&TFH 180580821 109024508 62527271 60%

PVR 10116165 6102558 3507798 60%

NMDC 229794455 136144000 82160732 59%

BANKBARODA 372635498 218684700 135319023 59%

STAR 12641694 7342200 4667409 58%

TATAPOWER 339616396 195932250 126703326 58%

HINDCOPPER 65482129 37689500 24518522 58%

CANBK 134484114 74298600 53461308 55%

MANAPPURAM 109926618 59214000 45216287 54%

INDIACEM 44365911 22939000 19208615 52%

BIOCON 92946457 47313300 40985834 51%

DLF 124016568 62127450 55688289 50%

GRANULES 28779078 14390200 12949924 50%

Derivatives Daily

Wednesday, March 23, 2022

DISCLOSURES or to engage in or refrain from engaging in any such transaction. In preparing this

research, we did not take into account the investment objectives, financial situation and

particular needs of the reader.

Research Reports that are published by Nirmal

This research has been prepared for the general use of the clients of NBSPL and must not

Bang Securities Private Limited (hereinafter

be copied, either in whole or in part, or distributed or redistributed to any other person in

referred to as “NBSPL”) are for private circulation

any form. If you are not the intended recipient you must not use or disclose the information

only. NBSPL is a registered Research Analyst

in this research in any way. Though disseminated to all the customers simultaneously, not

under SEBI (Research Analyst) Regulations, 2014

all customers may receive this report at the same time. NBSPL will not treat recipients as

having Registration no. INH000001766. NBSPL is

customers by virtue of their receiving this report. This report is not directed or intended for

also a registered Stock Broker with National Stock

distribution to or use by any person or entity resident in a state, country or any

Exchange of India Limited , BSE Limited

jurisdiction, where such distribution, publication, availability or use would be contrary to

,Metropolitan Stock Exchange of India Limited ,

law, regulation or which would subject NBSPL & its group companies to registration or

Multi Commodity Exchange of India Limited ,

licensing requirements within such jurisdictions.

National Commodity and Derivative Exchange

The report is based on the information obtained from sources believed to be reliable, but we

Limited and Indian Commodity Exchange Limited

do not make any representation or warranty that it is accurate, complete or up-to-date and

in cash and Equity and Commodities derivatives

it should not be relied upon as such. We accept no obligation to correct or update the

segments.

information or opinions in it. NBSPL or any of its affiliates or employees shall not be in any

NBSPL has other business divisions with

way responsible for any loss or damage that may arise to any person from any inadvertent

independent research teams separated by Chinese

error in the information contained in this report. NBSPL or any of its affiliates or employees

walls, and therefore may, at times, have different

do not provide, at any time, any express or implied warranty of any kind, regarding any

or contrary views on stocks and markets.

matter pertaining to this report, including without limitation the implied warranties of

NBSPL or its associates have not been debarred /

merchantability, fitness for a particular purpose, and non-infringement. The recipients of

suspended by SEBI or any other regulatory

this report should rely on their own investigations.

authority for accessing / dealing in securities

This information is subject to change without any prior notice. NBSPL reserves its absolute

Market. NBSPL, its associates or analyst or his

discretion and right to make or refrain from making modifications and alterations to this

relatives do not hold any financial interest (Except

statement from time to time. Nevertheless, NBSPL is committed to providing independent

Investment) in the subject company. NBSPL or its

and transparent recommendations to its clients, and would be happy to provide

associates or Analyst do not have any conflict or

information in response to specific client queries.

material conflict of interest at the time of

Before making an investment decision on the basis of this research, the reader needs to

publication of the research report with the subject

consider, with or without the assistance of an adviser, whether the advice is appropriate in

company. NBSPL or its associates or Analyst or

light of their particular investment needs, objectives and financial circumstances. There are

his relatives may or may not hold beneficial

risks involved in securities trading. The price of securities can and does fluctuate, and an

ownership of 1% or more in the subject company

individual security may even become valueless. International investors are reminded of the

at the end of the month immediately preceding

additional risks inherent in international investments, such as currency fluctuations and

the date of publication of this research report.

international stock market or economic conditions, which may adversely affect the value of

NBSPL or its associates / analyst has not received

the investment. Opinions expressed are subject to change without any notice. Neither the

any compensation / managed or co-managed

company nor the director or the employees of NBSPL accept any liability whatsoever for any

public offering of securities of the company

direct, indirect, consequential or other loss arising from any use of this research and/or

covered by Analyst during the past twelve months.

further communication in relation to this research. Here it may be noted that neither

NBSPL or its associates have not received any

NBSPL, nor its directors, employees, agents or representatives shall be liable for any

compensation or other benefits from the company

damages whether direct or indirect, incidental, special or consequential including lost

covered by Analyst or third party in connection

revenue or lost profit that may arise from or in connection with the use of the information

with the research report. Analyst has not served

as an officer, director or employee of Subject contained in this report.

Company . NBSPL / analyst has not been engaged

in market making activity of the subject company. Copyright of this document vests exclusively with NBSPL.

Analyst Certification: The research analysts and Our reports are also available on our website www.nirmalbang.com

authors of these reports, hereby certify that the

views expressed in this research report accurately

reflects my/our personal views about the subject

securities, issuers, products, sectors or

industries. It is also certified that no part of the

compensation of the analyst(s) was, is, or will be

directly or indirectly related to the inclusion of

specific recommendations or views in this

research. The analyst(s) principally responsible

for the preparation of this research report and has

taken reasonable care to achieve and maintain

independence and objectivity in making any

recommendations.

DISCLAIMER

This report is for the personal information of the

authorized recipient and does not construe to be

any investment, legal or taxation advice to you.

NBSPL is not soliciting any action based upon it.

Nothing in this research shall be construed as a

solicitation to buy or sell any security or product,

You might also like

- Derivatives Daily: Monday, September 20, 2021Document5 pagesDerivatives Daily: Monday, September 20, 2021Equity NestNo ratings yet

- Derivatives Daily: Monday, October 25, 2021Document5 pagesDerivatives Daily: Monday, October 25, 2021ayushmagguNo ratings yet

- Daily DerivativesDocument5 pagesDaily DerivativesRanjan BeheraNo ratings yet

- Daily Derivatives-20200803Document5 pagesDaily Derivatives-20200803Kiran KudtarkarNo ratings yet

- Derivatives Daily: Monday, April 05, 2021Document5 pagesDerivatives Daily: Monday, April 05, 2021SomendraNo ratings yet

- Market Mantra 281222 ADocument8 pagesMarket Mantra 281222 AHimanshu BisaniNo ratings yet

- Key Parameters Current Previous: Nifty Most Active Call Nifty Most Active PutDocument4 pagesKey Parameters Current Previous: Nifty Most Active Call Nifty Most Active Putanon_601430920No ratings yet

- Technical Derivatives 22 02 2023Document5 pagesTechnical Derivatives 22 02 2023rajesh bhosaleNo ratings yet

- Technical Derivatives 21 02 2023Document5 pagesTechnical Derivatives 21 02 2023rajesh bhosaleNo ratings yet

- Market Strategy: Sensex Nifty Nifty Bank Nifty Midcap 50 Nifty Smallcap 50Document8 pagesMarket Strategy: Sensex Nifty Nifty Bank Nifty Midcap 50 Nifty Smallcap 50sameer singhNo ratings yet

- Key Parameters Current Previous: Nifty Most Active Call Nifty Most Active PutDocument4 pagesKey Parameters Current Previous: Nifty Most Active Call Nifty Most Active Putshivratan007No ratings yet

- Real Estate Infographic June 2020Document1 pageReal Estate Infographic June 2020Vivek KasarNo ratings yet

- Technical Derivatives 17 02 2023Document5 pagesTechnical Derivatives 17 02 2023rajesh bhosaleNo ratings yet

- Derivatives Report 29 Dec 2010Document3 pagesDerivatives Report 29 Dec 2010parishkaaNo ratings yet

- Real Estate Infographic June 2020Document2 pagesReal Estate Infographic June 2020Vikhyat SharmaNo ratings yet

- DTA's Morning Cafe-04th Oct 2021Document1 pageDTA's Morning Cafe-04th Oct 2021aaryinfoNo ratings yet

- Most Active Calls: Map of The Market Top Ten Gainers / Losers Most Active Securities / ContractsDocument2 pagesMost Active Calls: Map of The Market Top Ten Gainers / Losers Most Active Securities / ContractstapasNo ratings yet

- Sensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37872) / Nifty (11133) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38182) / Nifty (11270) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Money Morning: 01 September 2017Document5 pagesMoney Morning: 01 September 2017GNo ratings yet

- HSBC HSBC Holdings PLC: (New York Stock Exchange)Document12 pagesHSBC HSBC Holdings PLC: (New York Stock Exchange)Anonymous P73cUg73LNo ratings yet

- Daily Derivatives: December 15, 2016Document3 pagesDaily Derivatives: December 15, 2016Sarvesh SinghNo ratings yet

- Trading Strategy: Morning NoteDocument6 pagesTrading Strategy: Morning Noteganesh chavanNo ratings yet

- Sensex (36472) / Nifty (10740) : Exhibit 1: Nifty Hourly ChartDocument5 pagesSensex (36472) / Nifty (10740) : Exhibit 1: Nifty Hourly ChartbbaalluuNo ratings yet

- Sensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (36052) / Nifty (10618) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Financial AccountingDocument7 pagesFinancial AccountingIshaPandeyNo ratings yet

- 2022-11-10 19 30 51 Morning-NoteDocument8 pages2022-11-10 19 30 51 Morning-Notevikalp123123No ratings yet

- Summary of Placement For The Batch - 2019-20: VNR Vignana Jyothi Institute of Engineering & TechnologyDocument1 pageSummary of Placement For The Batch - 2019-20: VNR Vignana Jyothi Institute of Engineering & TechnologyAmalley ChloeNo ratings yet

- Activity Statement: Account InformationDocument9 pagesActivity Statement: Account InformationAlexandru SimaNo ratings yet

- Indian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG YtdDocument11 pagesIndian Markets Last Price % CHG 1d % CHG 3m % CHG 6m % CHG Ytdvikalp123123No ratings yet

- Market Update 22nd November 2017Document1 pageMarket Update 22nd November 2017Anonymous iFZbkNwNo ratings yet

- ICICIDIRECTDocument8 pagesICICIDIRECTRajesh SharmaNo ratings yet

- Sensex (34962) / Nifty (10312) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (34962) / Nifty (10312) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Capital Structure (1) Solved ProbDocument8 pagesCapital Structure (1) Solved Prob121733601011 MADENA KEERTHI PRIYA100% (1)

- Man Ho 1103994Document3 pagesMan Ho 1103994car insurance singaporeNo ratings yet

- Sensex (34869) / Nifty (10305) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (34869) / Nifty (10305) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (35430) / Nifty (10471) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (35430) / Nifty (10471) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Sensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (37419) / Nifty (11022) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Mindtree LTD: Strong Numbers, Rich ValuationsDocument8 pagesMindtree LTD: Strong Numbers, Rich ValuationsBhavyaNo ratings yet

- GetQuoteFO JSP PDFDocument1 pageGetQuoteFO JSP PDFravi kumarNo ratings yet

- Infosys Financial Balance Sheet Analysis PDFDocument1 pageInfosys Financial Balance Sheet Analysis PDFIshan AwastiNo ratings yet

- Sensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (38025) / Nifty (11200) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Market Update 29th September 2017Document1 pageMarket Update 29th September 2017Anonymous iFZbkNwNo ratings yet

- Morning NoteDocument8 pagesMorning NoteAkshay YawaleNo ratings yet

- IoTeX Price Today, IOTX To USD Live, Marketcap and Chart CoinMarketCapDocument1 pageIoTeX Price Today, IOTX To USD Live, Marketcap and Chart CoinMarketCapAhmad Husein SyamNo ratings yet

- Gold Futures Technical AnalysisDocument2 pagesGold Futures Technical AnalysisYudhishthir KumarNo ratings yet

- Daily Derivative Report - 13072022 - 13-07-2022 - 09Document5 pagesDaily Derivative Report - 13072022 - 13-07-2022 - 09Porus Saranjit SinghNo ratings yet

- Salary Slip: Mar'18: EarningsDocument1 pageSalary Slip: Mar'18: EarningsAmol GadeNo ratings yet

- Accelya Solutions: Improving Travel Demand To Drive GrowthDocument5 pagesAccelya Solutions: Improving Travel Demand To Drive GrowthAryan SharmaNo ratings yet

- Daring DerivativesDocument4 pagesDaring DerivativessharmanmruNo ratings yet

- Market Update 12th Sept 2018Document1 pageMarket Update 12th Sept 2018Anonymous FnM14a0No ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Quicky Repair Shop - General Ledger 1Document5 pagesQuicky Repair Shop - General Ledger 1Bea Garcia100% (1)

- Sensex (34911) / Nifty (10311) : Exhibit 1: Nifty Daily ChartDocument5 pagesSensex (34911) / Nifty (10311) : Exhibit 1: Nifty Daily ChartbbaalluuNo ratings yet

- Technical Derivatives 03-04-2024Document6 pagesTechnical Derivatives 03-04-2024fazalrehanNo ratings yet

- MISC Berhad: 1QFY03/11 Net Profit Jumps 83% YoY On Reduced Container Liner Losses - 20/08/2010Document3 pagesMISC Berhad: 1QFY03/11 Net Profit Jumps 83% YoY On Reduced Container Liner Losses - 20/08/2010Rhb InvestNo ratings yet

- Market Update 18th October 2017Document1 pageMarket Update 18th October 2017Anonymous iFZbkNwNo ratings yet

- Market Update 23rd August 2017Document1 pageMarket Update 23rd August 2017Anonymous iFZbkNwNo ratings yet

- VF H Ply Lug N LJ 1598098702091Document10 pagesVF H Ply Lug N LJ 1598098702091Shilpi KumariNo ratings yet

- WPS P1 Group Any To P1 Group Any GTAW FCAW Manual MachineDocument2 pagesWPS P1 Group Any To P1 Group Any GTAW FCAW Manual MachinePrasad ChakkrapaniNo ratings yet

- WPS P1 Group Any To P1 Group Any GTAW-FCAW (Manual-Machine)Document2 pagesWPS P1 Group Any To P1 Group Any GTAW-FCAW (Manual-Machine)Prasad ChakkrapaniNo ratings yet

- Commodity Technical Report Sept 27Document7 pagesCommodity Technical Report Sept 27Prasad ChakkrapaniNo ratings yet

- Gas Chromatography Terms and Relationships: Standard Practice ForDocument6 pagesGas Chromatography Terms and Relationships: Standard Practice ForPrasad ChakkrapaniNo ratings yet

- KSL BL 22-04-2022 Chennai EPaper Stocks 01Document1 pageKSL BL 22-04-2022 Chennai EPaper Stocks 01Prasad ChakkrapaniNo ratings yet

- Salary Survey: Perfect Job Perfect JobDocument27 pagesSalary Survey: Perfect Job Perfect JobPrasad ChakkrapaniNo ratings yet

- Treating Technologies of Shell Global Solutions For Natural Gas and Refinery Gas StreamsDocument19 pagesTreating Technologies of Shell Global Solutions For Natural Gas and Refinery Gas StreamsPrasad ChakkrapaniNo ratings yet

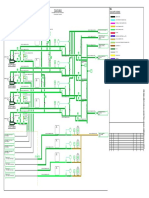

- TO VP 1001C TO VP 1001A TO VP 1001B TO VP 1001D Colour CodingDocument1 pageTO VP 1001C TO VP 1001A TO VP 1001B TO VP 1001D Colour CodingPrasad ChakkrapaniNo ratings yet

- Radiogrphy Inspection of Corrosion Circuit (Wnd-Pj-Cs-27)Document14 pagesRadiogrphy Inspection of Corrosion Circuit (Wnd-Pj-Cs-27)Prasad ChakkrapaniNo ratings yet

- Course Outline - Who Should A End - Registra On - in House - On Demand - Online Courses - PPT Slides+Testbank - Course ListDocument8 pagesCourse Outline - Who Should A End - Registra On - in House - On Demand - Online Courses - PPT Slides+Testbank - Course ListPrasad ChakkrapaniNo ratings yet

- Infosys - Initiating Coverage - 310820Document11 pagesInfosys - Initiating Coverage - 310820Anand SangeetNo ratings yet

- Morning Star User GuideDocument22 pagesMorning Star User Guideee1993No ratings yet

- Loma 357 C1Document13 pagesLoma 357 C1May ThirteenthNo ratings yet

- Avenue Supermarts (DMART IN) : Q3FY22 Result UpdateDocument7 pagesAvenue Supermarts (DMART IN) : Q3FY22 Result UpdateLucifer GamerzNo ratings yet

- Canadian Investment Funds CourseDocument2 pagesCanadian Investment Funds CourseNancy ShenoudaNo ratings yet

- Contact Resume Objective: + Rs L Focus KingDocument2 pagesContact Resume Objective: + Rs L Focus KingRajesh khadkaNo ratings yet

- Compensation Analyst or Financial Analyst or Data Analyst or OpeDocument2 pagesCompensation Analyst or Financial Analyst or Data Analyst or Opeapi-77649810No ratings yet

- Mergers & Acquisitions: Master in Management - Investment BankingDocument21 pagesMergers & Acquisitions: Master in Management - Investment Bankingisaure badreNo ratings yet

- Moody's A Rms Ratings of Ping An Life, Ping An P&C, and POAH Outlook Stable A RM Ratings of Ping An Bank Changes Outlook To Stable From PositiveDocument16 pagesMoody's A Rms Ratings of Ping An Life, Ping An P&C, and POAH Outlook Stable A RM Ratings of Ping An Bank Changes Outlook To Stable From PositivechongjhuangNo ratings yet

- Final Placement Report PDFDocument14 pagesFinal Placement Report PDFARPAN DHARNo ratings yet

- Communicating Strategy To Financial AnalystsDocument8 pagesCommunicating Strategy To Financial AnalystsWilliam StephensonNo ratings yet

- Indonesia E-Logistics: A Volume GameDocument6 pagesIndonesia E-Logistics: A Volume GameYonataLio SugiantoNo ratings yet

- Sai Ram Shares & Commodities: Analysis: Nifty (Fut) 7300.6 Follow 7090 SL For Positional Longs On Closing BasisDocument10 pagesSai Ram Shares & Commodities: Analysis: Nifty (Fut) 7300.6 Follow 7090 SL For Positional Longs On Closing Basisapi-237713995No ratings yet

- Downloadmela Com Business Analyst in Capital Market Domain With 4 5 Years Experience ResumeDocument4 pagesDownloadmela Com Business Analyst in Capital Market Domain With 4 5 Years Experience ResumeKaushik Bhanushali100% (1)

- Financial Management Principles and Applications 7th Edition Titman Test BankDocument16 pagesFinancial Management Principles and Applications 7th Edition Titman Test Banktrancuongvaxx8r100% (34)

- Analysis of Pharma Sector in Post Covid Era - Summer Internship Project (Ruchi Shah - M-10150)Document31 pagesAnalysis of Pharma Sector in Post Covid Era - Summer Internship Project (Ruchi Shah - M-10150)prajakta vaidyaNo ratings yet

- Financial Analysis ProjectDocument13 pagesFinancial Analysis ProjectAnonymous NflYP4O100% (1)

- Financial Statement Analysis Syllabus Spring 2020 MBADocument6 pagesFinancial Statement Analysis Syllabus Spring 2020 MBABedri M AhmeduNo ratings yet

- CPA Resume SampleDocument2 pagesCPA Resume SampleJameeca MohiniNo ratings yet

- The Ultimate Guide To LinkedIn SummariesDocument98 pagesThe Ultimate Guide To LinkedIn Summarieskaren.viviana.guerrero.leonNo ratings yet

- Abba Ali Habib EquityDocument2 pagesAbba Ali Habib Equityali ahmadNo ratings yet

- Reed Hungary 2021 Salary Guide - OriginalDocument29 pagesReed Hungary 2021 Salary Guide - OriginalTNo ratings yet

- Finance Coursework ExampleDocument8 pagesFinance Coursework Examplegbfcseajd100% (2)

- Barclays US REITs Real Estate The Year Ahead Conference - Key TakeawaysDocument17 pagesBarclays US REITs Real Estate The Year Ahead Conference - Key TakeawaysJames ChaiNo ratings yet

- Equity QuestionsDocument9 pagesEquity QuestionsDuyên HànNo ratings yet

- Ambit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFDocument15 pagesAmbit Capital - Strategy - Can 'Value' Investors Make Money in India (Thematic) PDFRobert StanleyNo ratings yet

- Gani Hartanto M Comm.: ExperienceDocument6 pagesGani Hartanto M Comm.: ExperienceGreen Sustain EnergyNo ratings yet

- Finance Analyst - Finance All in One BundleDocument16 pagesFinance Analyst - Finance All in One Bundleyogesh patilNo ratings yet

- Eagle Alpha White PaperDocument30 pagesEagle Alpha White PapertabbforumNo ratings yet

- Haskayne Resume Template 1Document1 pageHaskayne Resume Template 1Mako SmithNo ratings yet