Professional Documents

Culture Documents

Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading Value

Uploaded by

Abd YasinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading Value

Uploaded by

Abd YasinCopyright:

Available Formats

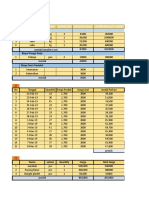

Weekly Statistics

No. 04 Volume 32, January 24 - 28, 2022

The Indonesia Stock Exchange

Billion Rp Composite Stock Price Index and Equity Trading Value Index

36,000 7,000

32,000

6,500

28,000

24,000 6,000

20,000

5,500

16,000

12,000 5,000

8,000

4,500

4,000

4,000

6-Aug 23-Aug 6-Sep 20-Sep 4-Oct 18-Oct 1-Nov 15-Nov 29-Nov 13-Dec 27-Dec 10-Jan 24-Jan

Index Hi Low Close Change Index Hi Low Close Change

Composite Index 6,712.262 6,601.337 6,645.511 (1.20%) Sharia Indices

LQ45 955.230 944.649 949.771 (1.04%) ISSI 189.651 188.090 188.362 (0.74%)

IDX30 511.214 505.350 508.177 (1.08%) JII 564.790 559.032 557.515 (1.55%)

IDX80 133.339 131.830 132.597 (0.85%) JII70 195.074 192.115 191.877 (1.74%)

IDX SMC Composite 347.486 341.578 344.990 (0.48%) Board Indices

IDX SMC Liquid 350.304 344.502 346.605 (1.08%) Main Board Index 1,713.732 1,694.431 1,701.022 (1.00%)

IDX High Dividend 20 485.160 479.291 484.823 0.06% Dev. Board Index 1,921.038 1,859.916 1,881.925 (1.67%)

IDX BUMN20 367.447 362.023 367.447 0.21% Sector Indices (IDX-IC)

IDX Value30 130.537 128.527 129.395 (0.83%) [A] IDXENERGY 1,296.752 1,261.192 1,292.432 2.14%

IDX Growth30 143.364 140.220 140.754 (1.96%) [B] IDXBASIC 1,203.739 1,185.610 1,198.033 (0.40%)

IDX Quality30 149.560 148.383 149.153 (0.72%) [C] IDXINDUST 1,047.243 1,027.738 1,032.555 (0.85%)

IDX ESG Leaders 138.044 136.381 136.961 (1.26%) [D] IDXNONCYC 665.882 660.327 658.690 (0.98%)

IDX-MES BUMN 17 92.160 90.487 90.225 (2.10%) [E] IDXCYCLIC 872.433 855.917 870.035 1.44%

Co-branding Indices [F] IDXHEALTH 1,449.719 1,422.165 1,439.326 0.73%

Kompas100 1,188.391 1,175.888 1,183.195 (0.76%) [G] IDXFINANCE 1,599.881 1,545.920 1,566.748 (2.22%)

BISNIS-27 524.688 518.533 522.925 (0.83%) [H] IDXPROPERT 736.994 715.318 714.649 (2.48%)

PEFINDO25 302.335 296.939 295.528 (2.27%) [I] IDXTECHNO 8,157.000 7,756.421 7,802.748 (4.15%)

SRI-KEHATI 376.167 372.822 376.105 (0.54%) [J] IDXINFRA 947.599 922.829 920.340 (2.70%)

ESG Sector Leaders IDX KEHATI 124.963 123.531 124.397 (0.89%) [K] IDXTRANS 1,692.592 1,607.576 1,690.689 5.17%

ESG Quality 45 IDX KEHATI 123.662 122.264 123.184 (0.87%)

SMinfra18 303.809 300.573 300.111 (1.27%) Market PER* : 18.34 Market PBV : 1.35

Investor33 445.863 441.704 443.579 (0.99%) WA PER* : 28.88 WA PBV : 2.05

Pefindo i-Grade 183.947 182.001 183.708 (0.61%) *Trailing PER

infobank15 1,089.892 1,065.288 1,089.892 0.90%

MNC36 323.307 319.653 322.242 (0.85%)

Daily Equity Trading Volume Daily Equity Trading Value Daily Equity Trading Frequency

Mill. Shares Rp. Billion Thousand (Times)

30,000 16,000 1,500

25,000

1,200

12,000

20,000

900

15,000 8,000

600

10,000

4,000

5,000 300

- - -

24 25 26 27 28 24 25 26 27 28 24 25 26 27 28

Sell - Buy FI - FI DI - FI FI - DI DI - DI Note : DI = Domestic Investor, FI = Foreign Investor

Instruments Volume Value (Rp) Freq. (x) Stock Market Highlights

Stocks 108,524,468,241 60,316,368,043,734 6,678,367 Stock Market Capitalization (Rp) 8,371,145,992,695,870

Rights - - - Total Listed Shares 7,381,346,288,638

Warrants 3,772,684,021 88,743,484,630 72,653 Number of Listed Companies 771 Active Stocks This Week 718

ETFs 588,300 297,112,900 725 Number of Listed Stocks 774 Active Brokerage Houses This Week 94

REITs 153,400 12,589,600 72 New Stock Listing Highlights

DINFRA - - - Number of New Stock Listings 3

Total 112,297,893,962 60,405,421,230,864 6,751,817 Number of Shares Offered 4,764,577,100

Fund Raised (Rp) 947,613,371,600

Derivatives Volume (Contracts) Value (Rp) Freq. (x)

Futures - - - Bonds, Sukuk, & ABS Denomination No. of Series Outstanding

Options - - - Government Bonds & Sukuk IDR 144 4,667.27 Trillion

USD 1 200.00 Million

Foreign Transaction Volume Value (Rp) Freq. (x) Corporate Bonds & Sukuk IDR 886 432.41 Trillion

Buy 11,881,749,399 17,398,539,786,251 624,644 USD 1 47.50 Million

Sell 13,043,689,928 17,203,058,551,596 786,477 Asset-backed Securities (ABS) IDR 11 4.91 Trillion

Indonesia Stock Exchange Building, 1st Tower

Jl. Jend. Sudirman Kav. 52-53 Jakarta 12190, Indonesia

Call Center: 150515 | WA: +62811-81-150515 | contactcenter@idx.co.id

Indonesia Stock Exchange, Weekly Statistics, January 24 - 28, 2022

Top 10 Stocks of The Week by Trading Value Top 10 Stocks of The Week by Trading Frequency

No. Listed Stocks Volume Value Freq. No. Listed Stocks Volume Value Freq.

1. ARTO Bank Jago Tbk. 277 4,646,572 137,459 1. YELO Yelooo Integra Datanet Tbk. 3,471 539,202 180,305

2. BBCA Bank Central Asia Tbk. 497 3,841,948 62,504 2. INDY Indika Energy Tbk. 828 1,602,815 160,491

3. TLKM Telkom Indonesia (Persero) Tbk. 569 2,443,944 57,848 3. IPTV MNC Vision Networks Tbk. 5,027 460,294 143,333

4. BBRI Bank Rakyat Indonesia (Persero) Tbk. 591 2,416,220 86,064 4. ARTO Bank Jago Tbk. 277 4,646,572 137,459

5. BMRI Bank Mandiri (Persero) Tbk. 311 2,308,163 36,856 5. BCAP MNC Kapital Indonesia Tbk. 4,082 342,922 128,830

6. BEBS Berkah Beton Sadaya Tbk. 460 2,087,599 43,527 6. GPSO Geoprima Solusi Tbk. 456 70,507 115,748

7. BBNI Bank Negara Indonesia (Persero) Tbk. 273 1,947,335 56,348 7. MITI Mitra Investindo Tbk. 966 276,119 106,746

8. INDY Indika Energy Tbk. 828 1,602,815 160,491 8. ASLC Autopedia Sukses Lestari Tbk. 1,965 593,815 96,482

9. CARE Metro Healthcare Indonesia Tbk. 3,053 1,522,947 16,636 9. MLPL Multipolar Tbk. 1,913 396,966 95,273

10. ADRO Adaro Energy Tbk. 609 1,365,874 55,276 10. ANTM Aneka Tambang Tbk. 619 1,108,366 93,486

Top 10 Gainers Stocks of The Week Top 10 Losers Stocks of The Week

No. Listed Stocks Last Week This Week Change No. Listed Stocks Last Week This Week Change

1. KONI Perdana Bangun Pusaka Tbk 2,210 4,310 95.02% 1. SBMA Surya Biru Murni Acetylene Tbk. 286 202 (29.37%)

2. BCAP MNC Kapital Indonesia Tbk. 54 91 68.52% 2. SAMF Saraswanti Anugerah Makmur Tbk. 910 655 (28.02%)

3. SLIS Gaya Abadi Sempurna Tbk. 600 930 55.00% 3. KOTA DMS Propertindo Tbk. 87 63 (27.59%)

4. IPTV MNC Vision Networks Tbk. 75 111 48.00% 4. UFOE Damai Sejahtera Abadi Tbk. 1,380 1,040 (24.64%)

5. TMAS Temas Tbk. 1,305 1,900 45.59% 5. IBST Inti Bangun Sejahtera Tbk. 7,500 5,700 (24.00%)

6. POLL Pollux Properties Indonesia Tbk. 665 930 39.85% 6. AMAR Bank Amar Indonesia Tbk. 665 510 (23.31%)

7. SHID Hotel Sahid Jaya International Tbk. 1,065 1,480 38.97% 7. TOYS Sunindo Adipersada Tbk. 228 175 (23.25%)

8. IBFN Intan Baruprana Finance Tbk. 52 72 38.46% 8. UVCR Trimegah Karya Pratama Tbk. 410 320 (21.95%)

9. INDY Indika Energy Tbk. 1,585 2,150 35.65% 9. SNLK Sunter Lakeside Hotel Tbk. 755 590 (21.85%)

10. MITI Mitra Investindo Tbk. 238 320 34.45% 10. POLA Pool Advista Finance Tbk. 160 126 (21.25%)

Top 10 Brokerage Firms of The Week by Total Trading Value Top 10 Brokerage Firms of The Week by Total Trading Frequency

No. Brokerage Firms Volume Value Freq. No. Brokerage Firms Volume Value Freq.

1. YP Mirae Asset Sekuritas Indonesia 33,202 12,144,123 2,658,306 1. YP Mirae Asset Sekuritas Indonesia 33,202 12,144,123 2,658,306

2. AK UBS Sekuritas Indonesia 4,993 7,872,156 462,798 2. PD Indo Premier Sekuritas 14,077 6,286,744 1,375,373

3. YU CGS-CIMB Sekuritas Indonesia 4,935 6,572,026 307,396 3. XC Ajaib Sekuritas Asia 5,982 1,907,678 1,121,240

4. PD Indo Premier Sekuritas 14,077 6,286,744 1,375,373 4. CC Mandiri Sekuritas 11,190 5,798,899 862,260

5. BK J.P. Morgan Sekuritas Indonesia 4,980 5,912,190 344,761 5. AK UBS Sekuritas Indonesia 4,993 7,872,156 462,798

6. CC Mandiri Sekuritas 11,190 5,798,899 862,260 6. MG Semesta Indovest Sekuritas 14,972 4,457,471 421,590

7. ZP Maybank Sekuritas Indonesia 3,437 5,782,081 269,109 7. NI BNI Sekuritas 4,742 1,690,067 416,997

8. MG Semesta Indovest Sekuritas 14,972 4,457,471 421,590 8. KK Phillip Sekuritas Indonesia 5,925 1,757,400 413,202

9. KZ CLSA Sekuritas Indonesia 1,696 3,245,268 121,785 9. BK J.P. Morgan Sekuritas Indonesia 4,980 5,912,190 344,761

10. CS Credit Suisse Sekuritas Indonesia 1,214 2,934,351 155,558 10. EP MNC Sekuritas 5,896 1,554,244 318,004

Total Daily Trading for Stock Equity

Regular Market (RG) Cash Market (TN) Negotiated Market (NG) Total Composite

Date

Volume Value Freq. Volume Value Freq. Volume Value Freq. Volume Value Freq. Index

24-Jan-22 17,624 9,102,021 1,251,621 0.193 95.83 19 1,575 1,284,757 445 19,199 10,386,874 1,252,085 6,655.166

25-Jan-22 21,324 11,815,169 1,425,852 0.166 23.99 5 1,897 1,435,998 491 23,221 13,251,191 1,426,348 6,568.173

26-Jan-22 22,635 11,396,622 1,401,299 4.345 570.22 9 2,151 2,200,799 699 24,791 13,597,991 1,402,007 6,600.819

27-Jan-22 17,782 9,939,326 1,256,272 0.021 8.58 6 3,297 1,483,441 489 21,079 11,422,775 1,256,767 6,611.161

28-Jan-22 19,268 10,203,622 1,340,688 0.013 8.29 4 967 1,453,906 468 20,235 11,657,537 1,341,160 6,645.511

Note: volume in million shares, value in million Rp, and Frequency in times.

New Stock Listings This Week

Offered IPO Listing Fund Raised

No. Code Company Name Shares Listed Shares Price Date Nominal (m. Rp) Board Sharia Sub Sector

1. ASLC Autopedia Sukses Lestari Tbk. 2,549,271,000 12,746,354,780 256 25-Jan-22 16 652,613 Dev. S E7 Retailing

2. NETV Net Visi Media Tbk. 765,306,100 23,453,177,240 196 26-Jan-22 100 150,000 Dev. - E6 Media & Entertainment

3. BAUT Mitra Angkasa Sejahtera Tbk. 1,450,000,000 4,800,000,000 100 28-Jan-22 10 145,000 Dev. S E7 Retailing

The facts and opinions stated or expressed in this publication are for information purposes only and are not necessarily and must not be relied upon as being those of the publisher or of the institutions for which the contributing authors work. Although every care has

been taken to ensure the accuracy of the information contained within the publication, it should not be by any person relied upon as the basis for taking any action or making any decision. The Indonesia Stock Exchange cannot be held liable or otherwise responsible

in anyway for any advice, action taken or decision made on the basis of the facts and opinions stated or expressed or stated within this publication.You are prohibited from using and disseminating Information obtained from Website to other parties for comercial

purpose without prior written consent from Indonesia Stock Exchange and/or the original owner of such Information and/or data. The use of Information, including information citation not for commercial purposes is permitted by mentioning the complete source

accompanied with the date of your access citing such information on Website.

You might also like

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Indonesia stock market reportDocument3 pagesWeekly Indonesia stock market reportIkhlas SadiminNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueIkhlas SadiminNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueYamada RieNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- Weekly Statistics: No. 34 Volume 31, August 23 - 27, 2021Document2 pagesWeekly Statistics: No. 34 Volume 31, August 23 - 27, 2021Kipli SNo ratings yet

- Weekly Statistics: No. 33 Volume 31, August 16 - 20, 2021Document2 pagesWeekly Statistics: No. 33 Volume 31, August 16 - 20, 2021Kipli SNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- HTTPSWWW - Idx.co - Idmedia0ykgvw11wr230401 e PDFDocument2 pagesHTTPSWWW - Idx.co - Idmedia0ykgvw11wr230401 e PDFAkbar GaleriNo ratings yet

- Indonesia Stock Exchange Weekly Report May 23 - 27, 2022Document2 pagesIndonesia Stock Exchange Weekly Report May 23 - 27, 2022Mandiri Mesindo PatiNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueKipli SNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueKipli SNo ratings yet

- Weekly Statistics: No. 35 Volume 31, August 30 - September 3, 2021Document2 pagesWeekly Statistics: No. 35 Volume 31, August 30 - September 3, 2021Kipli SNo ratings yet

- IDX Weekly Statistics Feb 13-17, 2023Document2 pagesIDX Weekly Statistics Feb 13-17, 2023Jhonli Aji KasioNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- Weekly Indonesia stock market reportDocument2 pagesWeekly Indonesia stock market reportRyanNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- Page01 PSEWeeklyReport2020 wk21Document1 pagePage01 PSEWeeklyReport2020 wk21craftersxNo ratings yet

- Tahsil Profile: Census of India 2011Document6 pagesTahsil Profile: Census of India 2011Megha SawantNo ratings yet

- Page01 PSEWeeklyReport2019 wk43Document1 pagePage01 PSEWeeklyReport2019 wk43craftersxNo ratings yet

- Page01 PSEWeeklyReport2019 wk46Document1 pagePage01 PSEWeeklyReport2019 wk46craftersxNo ratings yet

- PDFDocument8 pagesPDFtbnc5nbdqwNo ratings yet

- Harrisons 2022 Annual Report Final CompressedDocument152 pagesHarrisons 2022 Annual Report Final Compressedarusmajuenterprise80No ratings yet

- Kid's Clothing - GPV Improvement PlanDocument2 pagesKid's Clothing - GPV Improvement PlanSagar BhattNo ratings yet

- Cost S-Curve (Rev.1)Document1 pageCost S-Curve (Rev.1)xchannel28No ratings yet

- Serba Farm Organic PlantationDocument23 pagesSerba Farm Organic PlantationET Hadi SaputraNo ratings yet

- Calculo Wacc - AlicorpDocument14 pagesCalculo Wacc - Alicorpludwing espinar pinedoNo ratings yet

- Logbook Pemeriksaan Rawat Inap 2022Document16 pagesLogbook Pemeriksaan Rawat Inap 2022Lab Rs kesremNo ratings yet

- Cargills Ceylon Sustainability 2020-21 FinalDocument52 pagesCargills Ceylon Sustainability 2020-21 FinalPasindu HarshanaNo ratings yet

- BACS Weekly Monetary Report 25-07-18Document7 pagesBACS Weekly Monetary Report 25-07-18Gian MarcosNo ratings yet

- Weekly Statistics 24-28 February 2020 PDFDocument2 pagesWeekly Statistics 24-28 February 2020 PDFLiaNo ratings yet

- Weekly Statistics 24-28 February 2020Document2 pagesWeekly Statistics 24-28 February 2020LiaNo ratings yet

- ASII 2018 PriceDocument1 pageASII 2018 PriceStar LyfeNo ratings yet

- Oyo Ar 0706Document58 pagesOyo Ar 0706Neema chandokNo ratings yet

- Kamdhenu Dairy SchemeDocument4 pagesKamdhenu Dairy SchemeJASWANT MEHTA PCE19CS077No ratings yet

- Total Accumulated ManhoursDocument3 pagesTotal Accumulated ManhoursMark HeinNo ratings yet

- The Wolf of Investing Supplemental PDFDocument15 pagesThe Wolf of Investing Supplemental PDFMark HarmonNo ratings yet

- Down-Payment Payable Trade-In Offered PriceDocument2 pagesDown-Payment Payable Trade-In Offered PriceAna ZaraNo ratings yet

- Data Visualization ExercisesDocument151 pagesData Visualization ExercisesPUNITH S 1NT20BA065No ratings yet

- NO Struktur Biaya Satuan Jumlah Fisik Biaya Per Satuan Jumlah Biaya Per 1 BulanDocument4 pagesNO Struktur Biaya Satuan Jumlah Fisik Biaya Per Satuan Jumlah Biaya Per 1 Bulanyoga permanaNo ratings yet

- R2A1 BhargavMakadia PFP23071Document40 pagesR2A1 BhargavMakadia PFP23071bhargav.pup23071No ratings yet

- Glo DGF Ocean Market UpdateDocument23 pagesGlo DGF Ocean Market UpdateKicki AnderssonNo ratings yet

- Trial Balance3Document3 pagesTrial Balance3Marcos DmitriNo ratings yet

- Qu Hưu Trí Na Uy - Gpfg-Half-Year-Report - 2022Document41 pagesQu Hưu Trí Na Uy - Gpfg-Half-Year-Report - 2022huynhtruonglyNo ratings yet

- Equity Research Report on Gold Mining Company Projects Revenue Growth of 21.6% in 2022Document6 pagesEquity Research Report on Gold Mining Company Projects Revenue Growth of 21.6% in 2022Fathan MujibNo ratings yet

- Accounting Equation: Under The Guidance ofDocument7 pagesAccounting Equation: Under The Guidance ofAcademic BunnyNo ratings yet

- Contoh Family BudgetDocument3 pagesContoh Family BudgetReno VehardianNo ratings yet

- Example Weibull Probability Plots Using The Weibull Excel ModelDocument2 pagesExample Weibull Probability Plots Using The Weibull Excel ModelAlexander Arenas JimenezNo ratings yet

- PRMG 30-Project Budgeting and Financial Control Assignment (6) Cash Flow AnalysisDocument4 pagesPRMG 30-Project Budgeting and Financial Control Assignment (6) Cash Flow AnalysisamerNo ratings yet

- Sour Crude Diet: Venezuela Production Decline Shifts Lighter Crude Slates For Heavy RefinersDocument21 pagesSour Crude Diet: Venezuela Production Decline Shifts Lighter Crude Slates For Heavy RefinersLindsey BondNo ratings yet

- ASII 2016 PriceDocument1 pageASII 2016 PriceStar LyfeNo ratings yet

- Project PresentationDocument20 pagesProject PresentationMuraliKrishna VunnamNo ratings yet

- Gaji Dan Imbuhan PekerjaDocument5 pagesGaji Dan Imbuhan PekerjaWiwienNo ratings yet

- SBR1 Dummy With Cash FlowDocument15 pagesSBR1 Dummy With Cash Flowakansha.associate.workNo ratings yet

- Water Statistics Report 2009-2018Document2 pagesWater Statistics Report 2009-2018At Day's WardNo ratings yet

- EMI Calculator ExplainedDocument22 pagesEMI Calculator Explainedsushaht modiNo ratings yet

- Health Service Delivery Analysis, Hospital & Health Workforce MasterplanDocument13 pagesHealth Service Delivery Analysis, Hospital & Health Workforce MasterplanADB Health Sector GroupNo ratings yet

- Idx StatDocument8 pagesIdx StatAbd YasinNo ratings yet

- Chemical EquationsDocument2 pagesChemical EquationsAbd YasinNo ratings yet

- Chemical EquilibriumDocument3 pagesChemical EquilibriumAbd YasinNo ratings yet

- Amaranthus Spinosus Leaf Meal As Potential DietaryDocument10 pagesAmaranthus Spinosus Leaf Meal As Potential DietaryAbd YasinNo ratings yet

- ETHICSDocument4 pagesETHICSJeth Vigilla NangcaNo ratings yet

- Fraser, Nancy - Beyond The Master-Subject Model. Reflections On Carole Pateman's Sexual ContractDocument10 pagesFraser, Nancy - Beyond The Master-Subject Model. Reflections On Carole Pateman's Sexual ContractRafaelBluskyNo ratings yet

- Minnesota DPPA Complaint DVS Drivers License Records PrivacyDocument114 pagesMinnesota DPPA Complaint DVS Drivers License Records PrivacyghostgripNo ratings yet

- From Steven & From Makers: OfficialDocument68 pagesFrom Steven & From Makers: Officialcomicbookman100% (3)

- Labor2 Cases2Document89 pagesLabor2 Cases2Anne OcampoNo ratings yet

- Letter of Authorization: To Whom It May ConcernDocument2 pagesLetter of Authorization: To Whom It May ConcernAvinash NandaNo ratings yet

- Promotion of Inter-Religious Dialogue in Conflict AffectedDocument16 pagesPromotion of Inter-Religious Dialogue in Conflict AffecteduriseapacNo ratings yet

- Catalog 2022 New 24.09Document26 pagesCatalog 2022 New 24.09gjjaiswalNo ratings yet

- BS en 00477-1999Document8 pagesBS en 00477-1999Vicky GautamNo ratings yet

- Introduction of HDFCDocument2 pagesIntroduction of HDFCALi AsamdiNo ratings yet

- LAWS1052 Legal Research NotesDocument17 pagesLAWS1052 Legal Research NotesBaar SheepNo ratings yet

- Obtain Occupancy Certificate for BBMP PropertiesDocument1 pageObtain Occupancy Certificate for BBMP PropertiesMadhu R KNo ratings yet

- Department of Education Republic of The PhilippinesDocument17 pagesDepartment of Education Republic of The PhilippinesGlychalyn Abecia 23No ratings yet

- Death Note RulesDocument10 pagesDeath Note RulesShiraMeikoNo ratings yet

- Attachment B - MSDS Fibagel UV LV ResinDocument4 pagesAttachment B - MSDS Fibagel UV LV ResinAlam MD SazidNo ratings yet

- Canoreco v. Torres GR 127249 2-27-1998Document10 pagesCanoreco v. Torres GR 127249 2-27-1998HjktdmhmNo ratings yet

- BowecDocument48 pagesBowecsyakiroh100% (2)

- Timeline of Philippine HistoryDocument6 pagesTimeline of Philippine HistoryCarlos Baul DavidNo ratings yet

- Green, J. - The Shadow of Unfairness - A Plebeian Theory of Liberal DemocracyDocument265 pagesGreen, J. - The Shadow of Unfairness - A Plebeian Theory of Liberal DemocracySimón RamírezNo ratings yet

- CIS Apple IOS 16 Benchmark v1.0.0Document262 pagesCIS Apple IOS 16 Benchmark v1.0.0krenNo ratings yet

- Case Study of EBay IncDocument3 pagesCase Study of EBay IncyibungoNo ratings yet

- Marques v. Far East BankDocument3 pagesMarques v. Far East Bankmiles1280100% (1)

- Ra 4200Document34 pagesRa 4200sajdy100% (1)

- Ar 135-178 Enlisted Administrative SeparationsDocument111 pagesAr 135-178 Enlisted Administrative SeparationsMark CheneyNo ratings yet

- MCQ NegoDocument20 pagesMCQ NegoMark Hiro NakagawaNo ratings yet

- Compel Annual Stockholders' MeetingDocument4 pagesCompel Annual Stockholders' MeetingJake MendozaNo ratings yet

- Sample Document For Practical Training ReportDocument32 pagesSample Document For Practical Training ReportChai Yung Ken100% (1)

- Tle9agricropproduction - q1 - m9 - Observingworkplacepracticesandreportingproblemsincompletingworkforhorticulturalproduction - v3Document24 pagesTle9agricropproduction - q1 - m9 - Observingworkplacepracticesandreportingproblemsincompletingworkforhorticulturalproduction - v3Maricris Pamulaklakin AlmendrasNo ratings yet

- Registration Form CRO0601096-IPCDocument2 pagesRegistration Form CRO0601096-IPCHimanshi VohraNo ratings yet

- Paper 1Document55 pagesPaper 1Prakash SundaramNo ratings yet