Professional Documents

Culture Documents

Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading Value

Uploaded by

Ikhlas SadiminOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading Value

Uploaded by

Ikhlas SadiminCopyright:

Available Formats

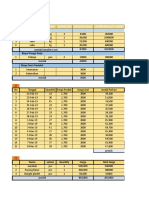

Weekly Statistics

No. 01 Volume 32, January 3 - 7, 2022

The Indonesia Stock Exchange

Billion Rp Composite Stock Price Index and Equity Trading Value Index

36,000 7,000

32,000

6,500

28,000

24,000 6,000

20,000

5,500

16,000

12,000 5,000

8,000

4,500

4,000

4,000

16-Jul 30-Jul 13-Aug 30-Aug 13-Sep 27-Sep 11-Oct 25-Oct 8-Nov 22-Nov 6-Dec 20-Dec 3-Jan

Index Hi Low Close Change Index Hi Low Close Change

Composite Index 6,738.110 6,677.199 6,701.316 1.82% Sharia Indices

LQ45 952.805 943.346 949.858 1.98% ISSI 191.956 189.681 190.035 0.54%

IDX30 509.319 503.937 507.699 2.13% JII 575.484 566.561 572.873 1.93%

IDX80 134.338 132.606 133.306 1.44% JII70 200.593 197.522 199.012 1.56%

IDX SMC Composite 354.984 350.728 350.261 0.20% Board Indices

IDX SMC Liquid 363.383 357.709 360.851 1.25% Main Board Index 1,726.490 1,710.802 1,714.738 1.01%

IDX High Dividend 20 478.189 472.832 476.565 1.76% Dev. Board Index 1,910.412 1,857.262 1,900.183 4.87%

IDX BUMN20 374.467 369.579 370.367 1.51% Sector Indices (IDX-IC)

IDX Value30 132.004 129.849 131.215 1.46% [A] IDXENERGY 1,177.239 1,155.128 1,172.833 2.93%

IDX Growth30 143.510 142.050 142.838 1.93% [B] IDXBASIC 1,248.448 1,220.147 1,209.255 (2.04%)

IDX Quality30 148.045 146.819 147.612 1.77% [C] IDXINDUST 1,051.177 1,036.268 1,044.085 0.71%

IDX ESG Leaders 139.729 138.382 138.188 1.55% [D] IDXNONCYC 674.845 670.043 672.673 1.29%

IDX-MES BUMN 17 97.297 95.240 95.306 0.71% [E] IDXCYCLIC 903.344 870.581 861.483 (4.32%)

Co-branding Indices [F] IDXHEALTH 1,456.660 1,426.345 1,444.462 1.72%

Kompas100 1,190.009 1,178.347 1,184.085 1.59% [G] IDXFINANCE 1,592.517 1,560.892 1,589.643 4.11%

BISNIS-27 523.972 518.793 522.618 2.09% [H] IDXPROPERT 789.787 762.451 757.680 (1.99%)

PEFINDO25 305.830 302.049 302.579 0.99% [I] IDXTECHNO 9,930.695 9,403.665 9,491.188 5.52%

SRI-KEHATI 373.673 369.617 372.473 1.93% [J] IDXINFRA 976.964 952.334 947.701 (1.21%)

ESG Sector Leaders IDX KEHATI 125.042 123.631 124.231 1.64% [K] IDXTRANS 1,648.328 1,615.793 1,630.068 1.92%

ESG Quality 45 IDX KEHATI 123.918 122.793 123.584 2.11%

SMinfra18 309.231 302.443 301.663 (0.52%) Market PER* : 19.18 Average PBV : 2.59

Investor33 443.553 439.195 441.721 1.78% WA PER* : 28.75 WA PBV : 2.07

Pefindo i-Grade 181.986 180.411 181.545 2.56% *Trailing PER

infobank15 1,059.534 1,043.621 1,056.809 2.50%

MNC36 320.868 317.809 319.990 2.13%

Daily Equity Trading Volume Daily Equity Trading Value Daily Equity Trading Frequency

Mill. Shares Rp. Billion Thousand (Times)

30,000 28,000 1,500

25,000 24,000

1,200

20,000 20,000

16,000 900

15,000

12,000 600

10,000

8,000

5,000 300

4,000

- - -

03 04 05 06 07 03 04 05 06 07 03 04 05 06 07

Sell - Buy FI - FI DI - FI FI - DI DI - DI Note : DI = Domestic Investor, FI = Foreign Investor

Instruments Volume Value (Rp) Freq. (x) STOCK MARKET HIGHLIGHTS

Stocks 101,821,623,122 66,334,162,769,027 6,446,331 Stock Market Capitalization (Rp) 8,433,792,155,861,400

Rights 3,725,627,663 39,788,590,447 11,300 Total Listed Shares 7,310,110,843,355

Warrants 4,463,978,055 107,696,275,932 93,670 Number of Listed Companies 767

ETFs 1,229,800 509,056,000 903 Number of Listed Stocks 770

REITs 4,222,300 359,137,800 84 Active Stocks This Week 719

DINFRA - - - Active Brokerage Houses This Week 94

Total 110,016,680,940 66,482,515,829,206 6,552,288 New Stock Listing

Number of Shares Offered 6,607,081,500

Derivatives Volume (Contracts) Value (Rp) Freq. (x) Fund Raised (Rp) 660,708,150,000

Futures - - - BOND, SUKUK, & ABS OUTSTANDING

Options - - - Gov. Bonds & Sukuk - IDR Denomination 4,537.68 Trillion

Gov. Bonds & Sukuk - USD Denomination 300.00 Million

Foreign Transaction Volume Value (Rp) Freq. (x) Corp. Bonds & Sukuk - IDR Denomination 430.33 Trillion

Buy 8,176,087,916 26,054,006,448,844 632,106 Corp. Bonds & Sukuk - USD Denomination 47.50 Million

Sell 14,178,232,866 23,862,558,818,213 643,912 Asset-backed Securities (ABS) - IDR Denomination 4.91 Trillion

Indonesia Stock Exchange Building, 1st Tower

Jl. Jend. Sudirman Kav. 52-53 Jakarta 12190, Indonesia

Call Center: 150515 | WA: +62811-81-150515 | contactcenter@idx.co.id

Indonesia Stock Exchange, Weekly Statistics, January 3 - 7, 2022

Top 10 Stocks of The Week by Trading Value Top 10 Stocks of The Week by Trading Frequency

No. Listed Stocks Volume Value Freq. No. Listed Stocks Volume Value Freq.

1. ISAT Indosat Tbk. 1,792 11,573,865 23,731 1. CSIS Cahayasakti Investindo Sukses Tbk. 845 128,887 159,038

2. ARTO Bank Jago Tbk. 221 3,929,460 89,345 2. REAL Repower Asia Indonesia Tbk. 3,838 362,715 150,349

3. BBCA Bank Central Asia Tbk. 469 3,507,085 79,430 3. BUKA Bukalapak.com Tbk. 2,985 1,436,172 133,653

4. BBRI Bank Rakyat Indonesia (Persero) Tbk. 654 2,731,931 76,320 4. TRUK Guna Timur Raya Tbk. 1,350 296,651 114,033

5. ADRO Adaro Energy Tbk. 1,071 2,479,166 79,445 5. AGRO Bank Raya Indonesia Tbk. 612 957,263 105,888

6. TLKM Telkom Indonesia (Persero) Tbk. 413 1,698,930 58,741 6. KBAG Karya Bersama Anugerah Tbk. 5,894 313,129 102,272

7. BUKA Bukalapak.com Tbk. 2,985 1,436,172 133,653 7. YELO Yelooo Integra Datanet Tbk. 842 119,236 95,926

8. CARE Metro Healthcare Indonesia Tbk. 2,736 1,358,784 17,529 8. BIMA Primarindo Asia Infrastructure Tbk. 346 92,815 92,533

9. MDKA Merdeka Copper Gold Tbk. 336 1,342,459 39,026 9. BBYB Bank Neo Commerce Tbk. 495 1,202,945 91,233

10. BBYB Bank Neo Commerce Tbk. 495 1,202,945 91,233 10. ARTO Bank Jago Tbk. 221 3,929,460 89,345

Top 10 Gainers Stocks of The Week Top 10 Losers Stocks of The Week

No. Listed Stocks Last Week This Week Change No. Listed Stocks Last Week This Week Change

1. ADMR Adaro Minerals Indonesia Tbk. 100 380 280.00% 1. FLMC Falmaco Nonwoven Industri Tbk. 510 338 (33.73%)

2. CMPP AirAsia Indonesia Tbk. 184 342 85.87% 2. AKSI Maming Enam Sembilan Mineral Tbk. 885 625 (29.38%)

3. ALKA Alakasa Industrindo Tbk 256 462 80.47% 3. MSKY MNC Sky Vision Tbk. 600 426 (29.00%)

4. PSKT Red Planet Indonesia Tbk. 50 90 80.00% 4. INCF Indo Komoditi Korpora Tbk. 276 196 (28.99%)

5. SDMU Sidomulyo Selaras Tbk. 68 120 76.47% 5. SNLK Sunter Lakeside Hotel Tbk. 900 640 (28.89%)

6. NASI Wahana Inti Makmur Tbk. 224 356 58.93% 6. IPTV MNC Vision Networks Tbk. 168 120 (28.57%)

7. LABA Ladangbaja Murni Tbk. 98 152 55.10% 7. LPIN Multi Prima Sejahtera Tbk 1,175 845 (28.09%)

8. DEFI Danasupra Erapacific Tbk. 1,000 1,455 45.50% 8. SINI Singaraja Putra Tbk. 336 258 (23.21%)

9. BBHI Allo Bank Indonesia Tbk. 7,075 10,150 43.46% 9. AGRO Bank Raya Indonesia Tbk. 1,810 1,400 (22.65%)

10. BSML Bintang Samudera Mandiri Lines Tbk. 194 278 43.30% 10. DART Duta Anggada Realty Tbk. 312 246 (21.15%)

Top 10 Brokerage Firms of The Week by Total Trading Value Top 10 Brokerage Firms of The Week by Total Trading Frequency

No. Brokerage Firms Volume Value Freq. No. Brokerage Firms Volume Value Freq.

1. OD BRI Danareksa Sekuritas 3,233 12,597,244 130,048 1. YP Mirae Asset Sekuritas Indonesia 31,243 10,318,747 2,543,218

2. GW HSBC Sekuritas Indonesia 1,788 11,413,998 1,070 2. PD Indo Premier Sekuritas 11,520 5,511,734 1,292,634

3. YP Mirae Asset Sekuritas Indonesia 31,243 10,318,747 2,543,218 3. XC Ajaib Sekuritas Asia 5,674 1,657,436 1,110,816

4. AK UBS Sekuritas Indonesia 3,380 6,705,912 397,986 4. CC Mandiri Sekuritas 11,638 6,380,359 877,169

5. BK J.P. Morgan Sekuritas Indonesia 4,413 6,397,811 350,574 5. NI BNI Sekuritas 4,824 1,744,516 424,623

6. CC Mandiri Sekuritas 11,638 6,380,359 877,169 6. KK Phillip Sekuritas Indonesia 4,994 1,751,282 414,321

7. PD Indo Premier Sekuritas 11,520 5,511,734 1,292,634 7. AK UBS Sekuritas Indonesia 3,380 6,705,912 397,986

8. YU CGS-CIMB Sekuritas Indonesia 6,554 5,153,915 309,540 8. BK J.P. Morgan Sekuritas Indonesia 4,413 6,397,811 350,574

9. ZP Maybank Sekuritas Indonesia 2,896 4,362,986 281,713 9. EP MNC Sekuritas 4,798 1,870,439 313,850

10. CS Credit Suisse Sekuritas Indonesia 1,773 3,721,052 155,149 10. YU CGS-CIMB Sekuritas Indonesia 6,554 5,153,915 309,540

Total Daily Trading for Stock Equity

Regular Market (RG) Cash Market (TN) Negotiated Market (NG) Total Composite

Date

Volume Value Freq. Volume Value Freq. Volume Value Freq. Volume Value Freq. Index

03-Jan-22 18,255 8,799,171 1,248,343 1.182 346.06 33 2,114 986,475 526 20,371 9,785,992 1,248,902 6,665.308

04-Jan-22 18,590 9,784,339 1,356,793 0.440 110.01 12 6,343 1,238,095 560 24,933 11,022,544 1,357,365 6,695.373

05-Jan-22 18,011 10,602,472 1,276,975 0.036 31.06 5 3,046 12,556,069 638 21,057 23,158,573 1,277,618 6,662.299

06-Jan-22 17,999 10,314,286 1,324,695 0.711 361.68 14 959 677,021 573 18,958 10,991,669 1,325,282 6,653.351

07-Jan-22 15,707 10,470,731 1,236,751 0.074 49.99 6 795 904,603 407 16,502 11,375,385 1,237,164 6,701.316

Note: volume in million shares, value in million Rp, and Frequency in times.

New Stock Listings This Week

No. Listed Stocks Offered Shares Listed Shares IPO Price Listing Date Par Value Board Sharia Sub Sector

1. ADMR Adaro Minerals Indonesia Tbk. 6,607,081,500 40,882,331,500 100 3-Jan-22 50 Dev. S A Oil, Gas, and Coal

The facts and opinions stated or expressed in this publication are for information purposes only and are not necessarily and must not be relied upon as being those of the publisher or of the institutions for which the contributing authors work. Although every care has

been taken to ensure the accuracy of the information contained within the publication, it should not be by any person relied upon as the basis for taking any action or making any decision. The Indonesia Stock Exchange cannot be held liable or otherwise responsible

in anyway for any advice, action taken or decision made on the basis of the facts and opinions stated or expressed or stated within this publication.You are prohibited from using and disseminating Information obtained from Website to other parties for comercial

purpose without prior written consent from Indonesia Stock Exchange and/or the original owner of such Information and/or data. The use of Information, including information citation not for commercial purposes is permitted by mentioning the complete source

accompanied with the date of your access citing such information on Website.

You might also like

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Indonesia stock market reportDocument3 pagesWeekly Indonesia stock market reportIkhlas SadiminNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueAbd YasinNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueYamada RieNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- Indonesia Stock Exchange Weekly Report May 23 - 27, 2022Document2 pagesIndonesia Stock Exchange Weekly Report May 23 - 27, 2022Mandiri Mesindo PatiNo ratings yet

- HTTPSWWW - Idx.co - Idmedia0ykgvw11wr230401 e PDFDocument2 pagesHTTPSWWW - Idx.co - Idmedia0ykgvw11wr230401 e PDFAkbar GaleriNo ratings yet

- Weekly Statistics: No. 34 Volume 31, August 23 - 27, 2021Document2 pagesWeekly Statistics: No. 34 Volume 31, August 23 - 27, 2021Kipli SNo ratings yet

- Weekly Statistics: No. 33 Volume 31, August 16 - 20, 2021Document2 pagesWeekly Statistics: No. 33 Volume 31, August 16 - 20, 2021Kipli SNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueKipli SNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- IDX Weekly Statistics Feb 13-17, 2023Document2 pagesIDX Weekly Statistics Feb 13-17, 2023Jhonli Aji KasioNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueGayeong KimNo ratings yet

- Weekly Statistics: No. 35 Volume 31, August 30 - September 3, 2021Document2 pagesWeekly Statistics: No. 35 Volume 31, August 30 - September 3, 2021Kipli SNo ratings yet

- Weekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueDocument2 pagesWeekly Statistics: The Indonesia Stock Exchange Composite Stock Price Index and Equity Trading ValueKipli SNo ratings yet

- Weekly Indonesia stock market reportDocument2 pagesWeekly Indonesia stock market reportRyanNo ratings yet

- Page01 PSEWeeklyReport2019 wk43Document1 pagePage01 PSEWeeklyReport2019 wk43craftersxNo ratings yet

- Page01 PSEWeeklyReport2020 wk21Document1 pagePage01 PSEWeeklyReport2020 wk21craftersxNo ratings yet

- Page01 PSEWeeklyReport2019 wk46Document1 pagePage01 PSEWeeklyReport2019 wk46craftersxNo ratings yet

- PDFDocument8 pagesPDFtbnc5nbdqwNo ratings yet

- Harrisons 2022 Annual Report Final CompressedDocument152 pagesHarrisons 2022 Annual Report Final Compressedarusmajuenterprise80No ratings yet

- Tahsil Profile: Census of India 2011Document6 pagesTahsil Profile: Census of India 2011Megha SawantNo ratings yet

- Weekly Statistics 24-28 February 2020Document2 pagesWeekly Statistics 24-28 February 2020LiaNo ratings yet

- Weekly Statistics 24-28 February 2020 PDFDocument2 pagesWeekly Statistics 24-28 February 2020 PDFLiaNo ratings yet

- Down-Payment Payable Trade-In Offered PriceDocument2 pagesDown-Payment Payable Trade-In Offered PriceAna ZaraNo ratings yet

- Gaji Dan Imbuhan PekerjaDocument5 pagesGaji Dan Imbuhan PekerjaWiwienNo ratings yet

- Data Visualization ExercisesDocument151 pagesData Visualization ExercisesPUNITH S 1NT20BA065No ratings yet

- Calculo Wacc - AlicorpDocument14 pagesCalculo Wacc - Alicorpludwing espinar pinedoNo ratings yet

- Total Accumulated ManhoursDocument3 pagesTotal Accumulated ManhoursMark HeinNo ratings yet

- Serba Farm Organic PlantationDocument23 pagesSerba Farm Organic PlantationET Hadi SaputraNo ratings yet

- PRMG 30-Project Budgeting and Financial Control Assignment (6) Cash Flow AnalysisDocument4 pagesPRMG 30-Project Budgeting and Financial Control Assignment (6) Cash Flow AnalysisamerNo ratings yet

- Equity Research Report on Gold Mining Company Projects Revenue Growth of 21.6% in 2022Document6 pagesEquity Research Report on Gold Mining Company Projects Revenue Growth of 21.6% in 2022Fathan MujibNo ratings yet

- Warung Desa: Tian Lion Cv. Delapan DelapanDocument10 pagesWarung Desa: Tian Lion Cv. Delapan DelapanNurAnisSafitriNo ratings yet

- Cargills Ceylon Sustainability 2020-21 FinalDocument52 pagesCargills Ceylon Sustainability 2020-21 FinalPasindu HarshanaNo ratings yet

- Kamdhenu Dairy SchemeDocument4 pagesKamdhenu Dairy SchemeJASWANT MEHTA PCE19CS077No ratings yet

- ASII 2018 PriceDocument1 pageASII 2018 PriceStar LyfeNo ratings yet

- The Wolf of Investing Supplemental PDFDocument15 pagesThe Wolf of Investing Supplemental PDFMark HarmonNo ratings yet

- Logbook Pemeriksaan Rawat Inap 2022Document16 pagesLogbook Pemeriksaan Rawat Inap 2022Lab Rs kesremNo ratings yet

- Sour Crude Diet: Venezuela Production Decline Shifts Lighter Crude Slates For Heavy RefinersDocument21 pagesSour Crude Diet: Venezuela Production Decline Shifts Lighter Crude Slates For Heavy RefinersLindsey BondNo ratings yet

- Contoh Family BudgetDocument3 pagesContoh Family BudgetReno VehardianNo ratings yet

- NO Struktur Biaya Satuan Jumlah Fisik Biaya Per Satuan Jumlah Biaya Per 1 BulanDocument4 pagesNO Struktur Biaya Satuan Jumlah Fisik Biaya Per Satuan Jumlah Biaya Per 1 Bulanyoga permanaNo ratings yet

- LP Meet Point, J InvestorDocument2 pagesLP Meet Point, J Investorvira marsitaNo ratings yet

- BACS Weekly Monetary Report 25-07-18Document7 pagesBACS Weekly Monetary Report 25-07-18Gian MarcosNo ratings yet

- Cameron Alexander, Director Metals Demand Asia, GFMS: August 2018Document13 pagesCameron Alexander, Director Metals Demand Asia, GFMS: August 2018Olivia JacksonNo ratings yet

- Qu Hưu Trí Na Uy - Gpfg-Half-Year-Report - 2022Document41 pagesQu Hưu Trí Na Uy - Gpfg-Half-Year-Report - 2022huynhtruonglyNo ratings yet

- MCF Hyundai Feb23Document1 pageMCF Hyundai Feb23Egi SugihartoNo ratings yet

- Oyo Ar 0706Document58 pagesOyo Ar 0706Neema chandokNo ratings yet

- Kekurangan Okt 2016 S/D Februari 2017: September OktoberDocument4 pagesKekurangan Okt 2016 S/D Februari 2017: September OktoberPuskesmas MasbagikNo ratings yet

- Kid's Clothing - GPV Improvement PlanDocument2 pagesKid's Clothing - GPV Improvement PlanSagar BhattNo ratings yet

- Rms Balfin: Weekly Business Progress Report As at 11 JULY 2021Document7 pagesRms Balfin: Weekly Business Progress Report As at 11 JULY 2021elmudaaNo ratings yet

- DR Reddy LabsDocument6 pagesDR Reddy LabsAdarsh ChavelNo ratings yet

- WORKSHEET (Lembar Jawaban)Document10 pagesWORKSHEET (Lembar Jawaban)I Gede Wahyu krisna DarmaNo ratings yet

- Lecture Notes Chapter 7 Exercises and AnswersDocument102 pagesLecture Notes Chapter 7 Exercises and AnswersAbhipsaNo ratings yet

- Glo DGF Ocean Market UpdateDocument23 pagesGlo DGF Ocean Market UpdateKicki AnderssonNo ratings yet

- Adani PortDocument6 pagesAdani PortAdarsh ChavelNo ratings yet

- Laporan Penjualan Crusher dan Keuangan CV Maju JayaDocument8 pagesLaporan Penjualan Crusher dan Keuangan CV Maju JayaHaikal KhanNo ratings yet

- Government Publications: Key PapersFrom EverandGovernment Publications: Key PapersBernard M. FryNo ratings yet

- Step by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyDocument25 pagesStep by Step Guide On Discounted Cash Flow Valuation Model - Fair Value AcademyIkhlas SadiminNo ratings yet

- ASSA Express Growth Continues on Strong Anteraja PerformanceDocument8 pagesASSA Express Growth Continues on Strong Anteraja PerformanceIkhlas SadiminNo ratings yet

- PT Adi Sarana Armada Tbk 2020 Financial StatementsDocument152 pagesPT Adi Sarana Armada Tbk 2020 Financial StatementsIkhlas SadiminNo ratings yet

- ASSA Revenue Up 37.9% in 3M20 on Strong Growth Across SegmentsDocument8 pagesASSA Revenue Up 37.9% in 3M20 on Strong Growth Across SegmentsIkhlas SadiminNo ratings yet

- Demographic and Socioeconomic StudyDocument15 pagesDemographic and Socioeconomic StudyMuhammad NaufalNo ratings yet

- ZIMSEC O LEVEL GEOGRAPHY FORM 4 - IndustryDocument30 pagesZIMSEC O LEVEL GEOGRAPHY FORM 4 - Industrycharles hofisiNo ratings yet

- Man - Enterpreneurship in Macroeconomics s10436-008-0105-7Document17 pagesMan - Enterpreneurship in Macroeconomics s10436-008-0105-7Luvy123No ratings yet

- The Role of Mining Sector in Indian EconomyDocument9 pagesThe Role of Mining Sector in Indian EconomyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Banco de Oro, Et Al vs. Republic of The Philippines, Et AlDocument2 pagesBanco de Oro, Et Al vs. Republic of The Philippines, Et AlJerome GonzalesNo ratings yet

- SE ContractDocument21 pagesSE Contractaugusta.mironNo ratings yet

- DAY 03 06 Oct 2022Document26 pagesDAY 03 06 Oct 2022Venu GopalNo ratings yet

- A1946758328 12348 2 2021 Finm551ca1Document8 pagesA1946758328 12348 2 2021 Finm551ca1MithunNo ratings yet

- OM - Finals - Answer KeyDocument7 pagesOM - Finals - Answer KeyMisha Laine De LeonNo ratings yet

- 2 Discussion: This GradedDocument85 pages2 Discussion: This GradedkirinNo ratings yet

- Banking Law Syllabus For 2020-2021Document6 pagesBanking Law Syllabus For 2020-2021Sarah Cruz100% (2)

- Tim Hortons' Key Success Factors: Brand Recognition, Location, Customer SatisfactionDocument2 pagesTim Hortons' Key Success Factors: Brand Recognition, Location, Customer SatisfactionSong LiNo ratings yet

- S.No Compay Name Designation NameDocument35 pagesS.No Compay Name Designation NameSaravanan G0% (1)

- Statement 603021 37840886 23 08 2023 22 09 2023 2Document5 pagesStatement 603021 37840886 23 08 2023 22 09 2023 2danNo ratings yet

- Fundamentals of AccountingDocument2 pagesFundamentals of AccountingDiane SorianoNo ratings yet

- 2022 Q2 Netherlands Marketbeat-IndustrialDocument1 page2022 Q2 Netherlands Marketbeat-IndustrialjihaneNo ratings yet

- Presentation 1Document14 pagesPresentation 1Tanvi SidhayeNo ratings yet

- NNN Financial Class Application 2023Document3 pagesNNN Financial Class Application 2023WNDUNo ratings yet

- Liquidation of CompaniesDocument4 pagesLiquidation of CompanieshanumanthaiahgowdaNo ratings yet

- Syn 7 - Introduction To Debt Policy and ValueDocument11 pagesSyn 7 - Introduction To Debt Policy and Valuerudy antoNo ratings yet

- Final Product CostDocument2 pagesFinal Product CostAlokKumarNo ratings yet

- The Haryana Value Added Tax ACT, 2003Document83 pagesThe Haryana Value Added Tax ACT, 2003adwiteya groverNo ratings yet

- Dell's Working Capital - RDocument23 pagesDell's Working Capital - REmaNo ratings yet

- Certificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncDocument2 pagesCertificate of Donation: ABS-CBN Lingkod Kapamilya Foundation, IncGuile Gabriel AlogNo ratings yet

- CorporationDocument1 pageCorporationHanaNo ratings yet

- Chapter 2 Exercises-TheMarketDocument7 pagesChapter 2 Exercises-TheMarketJan Maui VasquezNo ratings yet

- The Strategic Era of Procurement in Construction VFDocument7 pagesThe Strategic Era of Procurement in Construction VFJpbNo ratings yet

- Hospital Equipment Management - CorrectedDocument13 pagesHospital Equipment Management - CorrectedReuben Vijaysekar100% (1)

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDocument3 pagesV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNo ratings yet

- Main - Product - Report-Zhejiang Jindun Pressure Vessel Co., Ltd.Document9 pagesMain - Product - Report-Zhejiang Jindun Pressure Vessel Co., Ltd.Ayman Eid Salem MoussaNo ratings yet