Professional Documents

Culture Documents

Finaincal Syllabus

Uploaded by

Abdulraqeeb AlareqiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finaincal Syllabus

Uploaded by

Abdulraqeeb AlareqiCopyright:

Available Formats

MBACC 202: FINANCIAL MANAGEMENT

Course Objective: The objective of this course is to provide the basic understanding

of corporate finance concepts. To enable the students, synthesize and explain the

corporate financial functions and decision-making dynamics in the broad framework of

a financial system.

Course Outcome: The course will prepare students

• To appraise and analyse the role and functions of a finance manager

• To assess the utility of concepts and principles of Financial Management from

the point of view of wealth maximisation objective of a firm

• To apply the course concepts in analysing capital structure and project

investment decisions.

• To demonstrate the application of basic principles of Financial Management in

varying situations of risk return trade-offs, cash management, credit and

inventory management.

• To evaluate the outcomes of a firm’s decision to use various financial assets in

short and long term

Unit I:

Nature of Financial Management: Scope and objectives of finance, role and functions

of finance manager, risk-return trade off, shareholders’ wealth maximization, agency

problem, General awareness of financial environment-financial instruments, regulation

and markets.

Unit II:

Investment Decisions: Analysis of Capital budgeting decisions, application of

discounted and non-discounted techniques in capital budgeting, time value of money,

capital rationing, risk analysis in capital budgeting.

Unit III:

Financing Decisions: Cost of Capital and & Dividend Decision: Optimum capital

structure, financial and operating leverages, sources of long-Term Finance, cost of

capital-components’ costs and Combined Cost (WACC), capital structure theories.

Unit IV:

Dividend theories, Irrelevance of dividend, MM Hypothesis, relevance of dividend and

Walter’s model, dividend policy determinants, share repurchase or buyback, Issue of

bonus share and its implications,

Unit V:

Working Capital Management: Principles of working capital management, Accounts

Receivable management, Inventory management and Cash management, factors

influencing working capital requirement, computation of working capital required in

business firm.

References: -

1. Principles of Managerial Finance by Lawrence J. Gitman, Pearson

2. Financial Management and Policy by Van Horne, Dhamija, Pearson

3. Fundamentals of Financial Management by Dr. R.P. Rastogi, Taxman’s

4. Financial Management by Ravi M Kishore, Taxman’s

5. Financial Management-Text Problems and Cases by Khan and Jain, Mc Graw Hill

Page 16 of 82

You might also like

- Financial Management BMS 5th Sem JulyDocument31 pagesFinancial Management BMS 5th Sem Julygusheenarora60% (5)

- Nature Purpose and Scope of Financial ManagementDocument18 pagesNature Purpose and Scope of Financial ManagementmhikeedelantarNo ratings yet

- Digital Notes Financial ManagementDocument89 pagesDigital Notes Financial ManagementDHARANI PRIYANo ratings yet

- Fundamentals of Financial Management: (Theory and Practicals)Document15 pagesFundamentals of Financial Management: (Theory and Practicals)tawandaNo ratings yet

- Corporate Finance-1 - 231224 - 200351Document89 pagesCorporate Finance-1 - 231224 - 200351Arkadeep UkilNo ratings yet

- Financial ManagementDocument2 pagesFinancial ManagementtrilochanmahapatraNo ratings yet

- Jaipuria Institute of Management, Lucknow Post Graduate Diploma in Management THIRD TRIMESTER (2013-2014)Document6 pagesJaipuria Institute of Management, Lucknow Post Graduate Diploma in Management THIRD TRIMESTER (2013-2014)saah007No ratings yet

- Financial ManagementDocument91 pagesFinancial ManagementkamaltechnolkoNo ratings yet

- Introduction To Corporate FinanceDocument14 pagesIntroduction To Corporate FinanceSHIVA THAVANINo ratings yet

- FinMan AE 19 Module 1 Intro To FinManDocument8 pagesFinMan AE 19 Module 1 Intro To FinManMILLARE, Teddy Glo B.No ratings yet

- Financial Management Study MaterialDocument164 pagesFinancial Management Study MaterialMohammed MubeenNo ratings yet

- Fundamentals of Financial ManagementDocument131 pagesFundamentals of Financial ManagementDhanraj MoreNo ratings yet

- MBA 333: Financial Management CourseDocument4 pagesMBA 333: Financial Management CourseDerek Cherian JojiNo ratings yet

- Mcom 202Document26 pagesMcom 202vikasNo ratings yet

- UNIT 1 - Foundations of Finance - Ver 19.0Document161 pagesUNIT 1 - Foundations of Finance - Ver 19.0Vasudevan R DNo ratings yet

- Unit 1 FINANCIAL MANAGEMENTDocument37 pagesUnit 1 FINANCIAL MANAGEMENTdhall.tushar2004No ratings yet

- Principles of FinanceDocument1 pagePrinciples of FinanceSaiful Islam100% (1)

- MGT 522 Corporate Finance Subject OutlineDocument5 pagesMGT 522 Corporate Finance Subject OutlineAbarna LoganathanNo ratings yet

- Dcom307 - DMGT405 - Dcom406 - Financial Management PDFDocument318 pagesDcom307 - DMGT405 - Dcom406 - Financial Management PDFBaltej singhNo ratings yet

- LT 3. Finacial Management - 1399-3!21!20-02Document72 pagesLT 3. Finacial Management - 1399-3!21!20-02jibridhamoleNo ratings yet

- Financial Management1Document43 pagesFinancial Management1aruna2707No ratings yet

- Financial Management Class Notes Bba Iv Semester: Unit IDocument49 pagesFinancial Management Class Notes Bba Iv Semester: Unit IGauravs100% (1)

- Basic Finance E-BookDocument140 pagesBasic Finance E-BooksatstarNo ratings yet

- Corporatte Finance OutlineDocument7 pagesCorporatte Finance OutlinemehwishNo ratings yet

- Managerial FinanceDocument3 pagesManagerial FinanceManjunath BVNo ratings yet

- 22PGD202 CFDocument3 pages22PGD202 CFRohit KumarNo ratings yet

- Corporate Finance Class NotesDocument80 pagesCorporate Finance Class NotesAnmol Srivastava100% (1)

- Financial Management EssaysDocument14 pagesFinancial Management EssaysGilberto MuhiNo ratings yet

- Financial ManagementDocument107 pagesFinancial ManagementFarshan SulaimanNo ratings yet

- Financial Management - SyllabusDocument2 pagesFinancial Management - SyllabusAnonymous sMqylHNo ratings yet

- AFMDocument2 pagesAFMsrish.srccNo ratings yet

- SLM-19617-B Com-Financial ManagementDocument148 pagesSLM-19617-B Com-Financial ManagementMohammed RasiqueNo ratings yet

- International Financial Managment For OnlineDocument331 pagesInternational Financial Managment For OnlineAmity-elearning75% (4)

- 5 TH Sem NEPACFM2023 BBADocument2 pages5 TH Sem NEPACFM2023 BBAgurulinguNo ratings yet

- Subject Commerce: Paper No.: 8 Module No.: 1Document7 pagesSubject Commerce: Paper No.: 8 Module No.: 1Ekta Saraswat VigNo ratings yet

- Chapter 3 Basic Finance 2023 2024Document3 pagesChapter 3 Basic Finance 2023 2024PACIOLI-EDRADA, BEANo ratings yet

- Paper 3 - Advanced Financial Management ObjectiveDocument2 pagesPaper 3 - Advanced Financial Management ObjectiveindhumathigNo ratings yet

- MFL - AE19-FM - Module 11Document35 pagesMFL - AE19-FM - Module 11Jemalyn PiliNo ratings yet

- Financial ManagementDocument1 pageFinancial ManagementSanjay GomastaNo ratings yet

- Mba856 2022-1Document57 pagesMba856 2022-1Vivian ArigbedeNo ratings yet

- Econ f315 Summer Term 2016-17 IdDocument13 pagesEcon f315 Summer Term 2016-17 IdSrikar RenikindhiNo ratings yet

- Nature, Purpose and Scope of Financial ManagementDocument2 pagesNature, Purpose and Scope of Financial ManagementJullie Carmelle ChattoNo ratings yet

- FM108 Prelim HandoutsDocument8 pagesFM108 Prelim HandoutsKarl Dennis TiansayNo ratings yet

- I. Course DescriptionDocument1 pageI. Course DescriptionvhsinsNo ratings yet

- An Overview of Finance Functions and ObjectivesDocument38 pagesAn Overview of Finance Functions and ObjectivesDhanalakshmi MurugesanNo ratings yet

- Financial Management Question and AnswerDocument85 pagesFinancial Management Question and AnswerAzhar Ali50% (2)

- Financial ManagementDocument15 pagesFinancial ManagementAjay BalajiNo ratings yet

- New Advanced Financial ManagementDocument253 pagesNew Advanced Financial ManagementDerrick NyakibaNo ratings yet

- Bba 4 Semester BBA417C3 Financial Management COURSE OBJECTIVE: To Acquaint Students With The Techniques of Financial Management and TheirDocument2 pagesBba 4 Semester BBA417C3 Financial Management COURSE OBJECTIVE: To Acquaint Students With The Techniques of Financial Management and TheirNoOneNo ratings yet

- Introduction To Financial ManagementDocument29 pagesIntroduction To Financial Managementraymundojr.junioNo ratings yet

- Financial Decision Making: Module Outline and AimsDocument7 pagesFinancial Decision Making: Module Outline and AimsAmrit PatnaikNo ratings yet

- Finance Notes SifdDocument104 pagesFinance Notes SifdSuresh KumarNo ratings yet

- Financial ManagementDocument17 pagesFinancial ManagementSmita PriyadarshiniNo ratings yet

- 204 - Financial - ManagementDocument2 pages204 - Financial - Managementenzio-rebel-2747No ratings yet

- Intro To FM OnlineDocument21 pagesIntro To FM Onlinehitisha agrawalNo ratings yet

- Managerial FinanceDocument2 pagesManagerial Financeminn4063No ratings yet

- Jamia Millia Islamia New Delhi: An Assignment On: Financial ManagementDocument8 pagesJamia Millia Islamia New Delhi: An Assignment On: Financial ManagementAnonymous XVUefVN4S8No ratings yet

- Sbaa 3004Document71 pagesSbaa 3004mohanrajk879No ratings yet

- Financial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessFrom EverandFinancial Literacy for Entrepreneurs: Understanding the Numbers Behind Your BusinessNo ratings yet

- Translating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationFrom EverandTranslating Strategy into Shareholder Value: A Company-Wide Approach to Value CreationNo ratings yet

- Helen's exam probability and Ryan's graduate school acceptanceDocument2 pagesHelen's exam probability and Ryan's graduate school acceptancePutri Ayuningtyas KusumawatiNo ratings yet

- Beginner's Guide to Bitcoin and CryptoDocument47 pagesBeginner's Guide to Bitcoin and CryptoShah MuradNo ratings yet

- M6 CgbleDocument2 pagesM6 Cgblezeeshan sikandarNo ratings yet

- Wyeth Pakistan Annual Report 2018 1Document89 pagesWyeth Pakistan Annual Report 2018 1mahamamir012No ratings yet

- Monthly Financial Statements Summary Excel TemplateDocument6 pagesMonthly Financial Statements Summary Excel Templatesantoshkumar945No ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test BankDocument25 pagesFinancial Reporting Financial Statement Analysis and Valuation 6th Edition Stickney Test Bankcleopatramabelrnnuqf100% (27)

- IFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsDocument40 pagesIFRS 17 Discount Rates and Cash Flow Considerations For Property and Casualty Insurance ContractsWubneh AlemuNo ratings yet

- Practice Exercise - Ravensburger - BlankDocument3 pagesPractice Exercise - Ravensburger - Blank155- Salsabila GadingNo ratings yet

- BSBCRT611 BriefDocument2 pagesBSBCRT611 BriefJohnNo ratings yet

- Strategic Marketing Course OutlineDocument2 pagesStrategic Marketing Course OutlineDr. Muhammad Nawaz KhanNo ratings yet

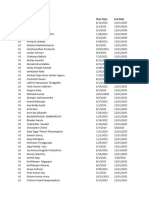

- Acct Statement - XX2800 - 03042023Document25 pagesAcct Statement - XX2800 - 03042023Nikhil khandelwalNo ratings yet

- Finance and Accounting Are Not The SameDocument14 pagesFinance and Accounting Are Not The SameDaniel KiokoNo ratings yet

- Ckyc & Kra Kyc FormDocument27 pagesCkyc & Kra Kyc Formwww.sandeepmazumder1234567890No ratings yet

- Marketing The Core 5th Edition Kerin Solutions Manual DownloadDocument28 pagesMarketing The Core 5th Edition Kerin Solutions Manual DownloadDinorah Strack100% (26)

- Marketing Module 4Document5 pagesMarketing Module 4Iphone PicturesNo ratings yet

- Cecchetti-5e-Ch20 - Money Growth, Money Demand and Monetary PolicyDocument74 pagesCecchetti-5e-Ch20 - Money Growth, Money Demand and Monetary PolicyammendNo ratings yet

- Bank Income Statement ProblemsDocument7 pagesBank Income Statement Problemsياسين البيرنسNo ratings yet

- Active US ResourcesDocument12 pagesActive US ResourcesVarma PinnamarajuNo ratings yet

- Wakata Commerce 2020Document5 pagesWakata Commerce 2020Nabuzaale JoanNo ratings yet

- Chap 5Document18 pagesChap 5yhikmet613No ratings yet

- VC Glossary Terms TLV PartnersDocument12 pagesVC Glossary Terms TLV PartnersAditya PatelNo ratings yet

- Advance AssigmentDocument3 pagesAdvance AssigmentAdugna MegenasaNo ratings yet

- PCM Book - Part IDocument72 pagesPCM Book - Part Ithilina madhushanNo ratings yet

- NO BS Order Flow Trading by PriceActionNinja @tradingpdfgratis 1Document34 pagesNO BS Order Flow Trading by PriceActionNinja @tradingpdfgratis 1Tarun AggarwalNo ratings yet

- F3 Progress 2 QuestionDocument10 pagesF3 Progress 2 QuestiontommydunkNo ratings yet

- Subasish - Pani - Revealed - The - Thread - by - Niki - Poojary - Mar 7, 23 - From - RattibhaDocument16 pagesSubasish - Pani - Revealed - The - Thread - by - Niki - Poojary - Mar 7, 23 - From - RattibhasandeepNo ratings yet

- Online Marketing & ImpacT On SocietyDocument13 pagesOnline Marketing & ImpacT On SocietyAnanna MaimunaNo ratings yet

- Porter's Competitive Forces Model Information SystemDocument13 pagesPorter's Competitive Forces Model Information SystemhimanshuNo ratings yet

- Equity Shares-1Document98 pagesEquity Shares-1Mayur MankarNo ratings yet

- Summary #17Document2 pagesSummary #17atika suriNo ratings yet