Professional Documents

Culture Documents

Payment Slip

Uploaded by

Angela Mia AyakoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

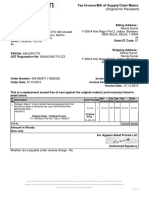

Payment Slip

Uploaded by

Angela Mia AyakoCopyright:

Available Formats

For General Tax Questions

Contact KRA Call Centre

Payment Slip Tel: +254 (020) 4999 999

Cell: +254(0711)099 999

Email: callcentre@kra.go.ke

www.kra.go.ke

Taxpayer PIN : P051345742D Payment Registration Date: 13/06/2023

Name and Address : Payment Registration Number

Edmonton Investments Limited 2020230001857832

BURUBURU, NAIROBI CITY, Makadara District,

PO Box:9343,

Postal Code:00100

Payment Details

Sr.No. Payment Type Tax Obligation Tax Period Amount to be Paid (Ksh)

1 Self Assessment Tax (0201) Value Added Tax (VAT) May 2023 149,390

Total Amount to be Paid (Ksh) 149,390

(To be filled by taxpayer during payment at bank)

CHEQUES ONLY CASH ONLY

Drawer Bank Cheque No. Amount (Ksh) Currency Count Amount (Ksh)

1,000 x

500 x

200 x

Amount in Words: One hundred fourty-nine thousand three hundred 100 x

ninety Kenyan Shillings

50 x

40 x

20 x

10 x

5x

BANK STAMP AND ENDORSEMENT 1x

Total Amount (Ksh)

Paid in by Contact Number

Date Signature

Search Code 769596568757LCV(Use this number to query the status of your Payment Slip)

M-Payment M-Pesa: Paybill ->Business No. 572572 -> Account No. 2020230001857832 -> Amount 149,390. NB: Amount should

be <70,000 Kshs.

Partner Banks You can make payment at any of the below mentioned authorized banks.

Bank of Africa, CFAOT, BOI, Chase, Equity, I&M, ABKEN, SIDIAN, CIBKE, Eco Bank, NBKKEN, KCBLKEN,

CBKEN, ABSA, KRABAN, Standard Chartered, UBA, CBA, SBM, Habib AG Zurich, Post Bank, Stanbic, GT Bank,

Oriental Commercial, Bank of Baroda, DTB, Citibank, ABC, Co-op Bank, Credit, Family, CONSOLDTD, Gulf

African, Guardian, Middle East, Paramount, Prime, NIC, Victoria.

Disclaimer If this slip is lost or defaced, you can reprint / regenerate from the portal itax.kra.go.ke or the nearest KRA office.

This is NOT a Receipt of payment. The payment must therefore be made through either of the Partner Banks/M-

Payment by the Tax Due Date as defined by the relevant Tax Laws.

Notice: Employers are reminded that the due date for PAYE Returns and remittance is the ninth day of each calendar month.

You might also like

- Í (N01È6Â Asejo Joselitoâââââââ E Ç+0!87Oî Mr. Joselito Eva AsejoDocument2 pagesÍ (N01È6Â Asejo Joselitoâââââââ E Ç+0!87Oî Mr. Joselito Eva AsejoPatrick AsejoNo ratings yet

- Vodafone Bill StructureDocument4 pagesVodafone Bill Structurenazim khanNo ratings yet

- Your Vi Bill: Mr. Dhruk RankDocument4 pagesYour Vi Bill: Mr. Dhruk RankVijendraNo ratings yet

- Your Vi Bill: Mr. GouthamDocument4 pagesYour Vi Bill: Mr. GouthamGouthamNo ratings yet

- Home Office and Branch Accounting Special ProblemsDocument27 pagesHome Office and Branch Accounting Special ProblemsAnna Marie Alferez80% (5)

- Marriott Case Study - LawrenceDocument4 pagesMarriott Case Study - Lawrencedamoses1100% (14)

- Chapter 6Document57 pagesChapter 6Léo Audibert75% (4)

- Your Vi Bill: Mr. Venkatachalapathi SivaprakasaDocument3 pagesYour Vi Bill: Mr. Venkatachalapathi Sivaprakasadekans000No ratings yet

- Ebill 024313735 202211 23 1Document3 pagesEbill 024313735 202211 23 1yung daisydaisyNo ratings yet

- Your Vi Bill: Mr. N G SuneelDocument3 pagesYour Vi Bill: Mr. N G SuneelIgnou Support100% (1)

- Your Vi Bill: Mr. Amit SinghDocument4 pagesYour Vi Bill: Mr. Amit Singhamit singhNo ratings yet

- January Postpay BillDocument4 pagesJanuary Postpay BillestrobetceoNo ratings yet

- Project BritanniaDocument15 pagesProject BritanniasaiNo ratings yet

- Your Vi Bill: Mr. Vignesh VDocument4 pagesYour Vi Bill: Mr. Vignesh VVigneshvkeyNo ratings yet

- Vodafone BillDocument3 pagesVodafone BillSatnam Singh SagguNo ratings yet

- 8th ATMA by Dalta Rsi - AnalysisDocument44 pages8th ATMA by Dalta Rsi - Analysissuresh100% (2)

- Retail Location StrategyDocument20 pagesRetail Location Strategysubbugss100% (1)

- Fractal Trading System 196Document5 pagesFractal Trading System 196Ajit Mishra50% (2)

- Payment SlipDocument1 pagePayment Slippeter kanyangiNo ratings yet

- Payment SlipDocument1 pagePayment SlipmainaNo ratings yet

- Payment SlipDocument1 pagePayment Slipbosco kiuriaNo ratings yet

- Payment SlipDocument1 pagePayment Slipyonah olupauNo ratings yet

- RenshaDocument1 pageRenshasimonNo ratings yet

- Ecojen Holdings LimitedDocument1 pageEcojen Holdings LimitedABOBO 254No ratings yet

- Payment SlipDocument1 pagePayment Slipchepkoechmourine100No ratings yet

- Payment SlipDocument1 pagePayment SlipBrian OderaNo ratings yet

- Payment Slip 2020200001570099Document1 pagePayment Slip 2020200001570099Sam MacNo ratings yet

- Payment SlipDocument1 pagePayment SlipStephen kioko.mNo ratings yet

- Payment SlipDocument2 pagesPayment SlipJess keramaNo ratings yet

- Payment SlipDocument2 pagesPayment SlipAlphie PabloNo ratings yet

- Payment SlipDocument2 pagesPayment Slipbillhaachieng92No ratings yet

- Payment SlipDocument2 pagesPayment SlipEmeka NkemNo ratings yet

- Sliop 2023 R12345Document1 pageSliop 2023 R12345Hon Fredrick JowiNo ratings yet

- Payment SlipDocument2 pagesPayment SlipMary AwuorNo ratings yet

- Your Vi Bill: M/s. Vision AceDocument4 pagesYour Vi Bill: M/s. Vision AceAbhay SharmaNo ratings yet

- Your Vi Bill: Rs 570.82 Rs 470.82 Rs 470.82 Rs 0.00 Rs 470.82Document4 pagesYour Vi Bill: Rs 570.82 Rs 470.82 Rs 470.82 Rs 0.00 Rs 470.82vijay rNo ratings yet

- Your Vi Bill - Mr. Venkatachalapathi Sivaprakasa - PDF - Roaming - PaymentsDocument9 pagesYour Vi Bill - Mr. Venkatachalapathi Sivaprakasa - PDF - Roaming - PaymentsLalit YadavNo ratings yet

- Your Vi Bill: Mr. Sarangapani KallyamoorthyDocument9 pagesYour Vi Bill: Mr. Sarangapani KallyamoorthySarangapani KaliyamoorthyNo ratings yet

- ChallanFormDocument1 pageChallanFormrmzmuhammedNo ratings yet

- Challan No. / Itns 280: Tax Applicable (Tick One) Assessment YearDocument1 pageChallan No. / Itns 280: Tax Applicable (Tick One) Assessment YearKaran AsodariyaNo ratings yet

- Globe at Home E-Bill - 910299541-2022-07-30Document3 pagesGlobe at Home E-Bill - 910299541-2022-07-30Trainer EntainNo ratings yet

- Kalim Pan Link RecieptDocument1 pageKalim Pan Link Recieptmithunrmtelecom7No ratings yet

- Your Vi Bill: Mr. Ahammed ManzoorDocument4 pagesYour Vi Bill: Mr. Ahammed ManzoorkajkargroupNo ratings yet

- Pay ChalanDocument1 pagePay ChalanSDO BUxar50% (2)

- Your Vi Bill: Mr. Miller Ganj Ludhiana Ludh LudhianaDocument4 pagesYour Vi Bill: Mr. Miller Ganj Ludhiana Ludh LudhianaAvnish KhuranaNo ratings yet

- Your Vi Bill: Mrs. Jangeetijyotsna RaoDocument4 pagesYour Vi Bill: Mrs. Jangeetijyotsna RaoDOLANNo ratings yet

- SendDocument4 pagesSendsanthoshdoss21No ratings yet

- Onecard Statement (31 Oct 2023 - 19 Nov 2023) : Ranjeet KumarDocument4 pagesOnecard Statement (31 Oct 2023 - 19 Nov 2023) : Ranjeet Kumarranjeetkumar64665fdNo ratings yet

- Your Vodafone Bill: Mr. Ahammed ManzoorDocument4 pagesYour Vodafone Bill: Mr. Ahammed ManzoorkajkargroupNo ratings yet

- VIL Bill 9999320596Document1 pageVIL Bill 9999320596parmeshwarchidriNo ratings yet

- OCT 2020 eBill-VodafoneDocument10 pagesOCT 2020 eBill-Vodafonearvindgangwar80No ratings yet

- Your Vodafone Bill: Amount DueDocument3 pagesYour Vodafone Bill: Amount DueNeerja M GuhathakurtaNo ratings yet

- Vi Nov'21 Unlocked Pages 1Document1 pageVi Nov'21 Unlocked Pages 1Disha AhujaNo ratings yet

- Your Vi Bill: Mr. Ahammed ManzoorDocument4 pagesYour Vi Bill: Mr. Ahammed ManzoorkajkargroupNo ratings yet

- Parmjit Singh Challan Ay 202324Document1 pageParmjit Singh Challan Ay 202324SANJEEV KUMARNo ratings yet

- MG Freesites LTD.: Za Kasarnou 1, 831 03 Bratislava, SlovakiaDocument1 pageMG Freesites LTD.: Za Kasarnou 1, 831 03 Bratislava, Slovakiakundan singhNo ratings yet

- Globe Bill 927599321-1Document2 pagesGlobe Bill 927599321-1emzthineNo ratings yet

- VIL Bill 9591127614 2022-02-25..Document1 pageVIL Bill 9591127614 2022-02-25..Vinod kumarNo ratings yet

- Your Reliance Bill: Summary of Current Charges Amount (RS)Document3 pagesYour Reliance Bill: Summary of Current Charges Amount (RS)shimmmNo ratings yet

- Nov 2019Document4 pagesNov 2019John PaulNo ratings yet

- Globe Bill 926357334Document3 pagesGlobe Bill 926357334leiza mae dela cruzNo ratings yet

- Income Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)Document1 pageIncome Tax Department E-Filing Anyhere Antrne: 95XXXXXX93 4502) 89193)DilleshNo ratings yet

- 23113000097469SBIN ChallanReceiptDocument1 page23113000097469SBIN ChallanReceiptDeep HandaNo ratings yet

- Globe at Home E-Bill - 0279057747-2022-04-13 PDFDocument2 pagesGlobe at Home E-Bill - 0279057747-2022-04-13 PDFRen DiocalesNo ratings yet

- Onecard Statement (20 Nov 2022 - 19 Dec 2022) : Souvik PanDocument4 pagesOnecard Statement (20 Nov 2022 - 19 Dec 2022) : Souvik Pansouvik panNo ratings yet

- 23120500256641UTIB ChallanReceiptDocument1 page23120500256641UTIB ChallanReceiptbinitashah11573No ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- 06 Equity InvestmentsDocument8 pages06 Equity InvestmentsAllegria AlamoNo ratings yet

- Chapter 1 "Document4 pagesChapter 1 "Dhairyaa BhardwajNo ratings yet

- Buletin Statistic de Preturi Nr12 1Document83 pagesBuletin Statistic de Preturi Nr12 1Ionela MarcuNo ratings yet

- Skema Test 1 Sem 2 20162017Document7 pagesSkema Test 1 Sem 2 20162017Farhan Amira100% (1)

- Microsoft Stock Analysis ReportDocument2 pagesMicrosoft Stock Analysis ReportInvestingSidekickNo ratings yet

- How Do We Get There? What Direction Should We Take?: Strategic ChoiceDocument39 pagesHow Do We Get There? What Direction Should We Take?: Strategic ChoiceRichille SordillaNo ratings yet

- 123Document1 page123adarshNo ratings yet

- Chapter 2 - Forex RateDocument20 pagesChapter 2 - Forex RateTrần Minh PhụngNo ratings yet

- Chap 006Document54 pagesChap 006Imad RahimNo ratings yet

- Direct Marketing With Digital and Data-Driven MarketingDocument56 pagesDirect Marketing With Digital and Data-Driven Marketinggelmarr.psgNo ratings yet

- Maple Leaf Foods MLF Is A Canadian Manufacturer of MeatDocument1 pageMaple Leaf Foods MLF Is A Canadian Manufacturer of MeatLet's Talk With HassanNo ratings yet

- Types of CustomersDocument5 pagesTypes of CustomersSyed Noman Shah100% (2)

- Trend Detection: by Arthur MerrillDocument3 pagesTrend Detection: by Arthur MerrillHendra SetiawanNo ratings yet

- Free MACD Divergence Chart Pattern Training VideosDocument3 pagesFree MACD Divergence Chart Pattern Training VideosMohamed Abdel FattahNo ratings yet

- Marketing Strategy To Effective SaleDocument12 pagesMarketing Strategy To Effective SaleSaurabh ParasharNo ratings yet

- Beyond Cash Dividends: Buybacks, Spin Offs and DivestituresDocument49 pagesBeyond Cash Dividends: Buybacks, Spin Offs and DivestituresayzlimNo ratings yet

- Download pdf Investment Analysis And Portfolio Management 11Th Edition Frank K Reilly ebook full chapterDocument53 pagesDownload pdf Investment Analysis And Portfolio Management 11Th Edition Frank K Reilly ebook full chaptermargaret.redd792100% (1)

- INVESTMENTS IN DEBT SECURITIES-ExercisesDocument4 pagesINVESTMENTS IN DEBT SECURITIES-ExercisesJazmine Arianne DalayNo ratings yet

- Rubrics EvaluationDocument4 pagesRubrics EvaluationMuhammad Aiman Md NorNo ratings yet

- India Power Inverter Market Outlook, 2023Document8 pagesIndia Power Inverter Market Outlook, 2023Bonafide ResearchNo ratings yet

- International Marketing Planning DR Said El Mansour CherkaouiDocument40 pagesInternational Marketing Planning DR Said El Mansour Cherkaouiapi-230019653No ratings yet

- Brand Awareness On XiaomiDocument11 pagesBrand Awareness On XiaomiHTG INFOTECHNo ratings yet

- Side Job EbookDocument30 pagesSide Job EbookChristine N. BrousseauNo ratings yet