Professional Documents

Culture Documents

AKD Daily Mar 20 202s

Uploaded by

Shujaat AhmadOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AKD Daily Mar 20 202s

Uploaded by

Shujaat AhmadCopyright:

Available Formats

AKD RESEARCH

March 20, 2023

PAKISTAN REP-019

AUTOS

VISTA

A walk in challenging times

The restrictions on imports have adversely impacted auto assemblers, leading to delays Kainat Rohra

in opening of LCs along with the clearance of CKD kits from ports, due to which auto as- kainat.rohra@akdsl.com

semblers are facing frequent plant shutdowns. 111-253-111 Ext: 646

In CY23 auto assemblers have hiked their prices for the 4th time culminating to an in-

crease of more than ~35% on average. Hikes in the policy rate and hefty PkR devaluation

have brought consumer affordability into question. We expect for demand to be reduced PSMC, INDU & HCAR vs. KSE100 Index

by more than 50% by the end of FY23.

20%

Restrictions on LCs have hit automobile assemblers hard. Since SBP’s SRO released in 10%

May’22, the situation has continued to deteriorate significantly and is seen from 8MFY23

0%

decline in production of passenger cars down by 43%YoY.

-10%

With a blend of supply and demand shocks, it is quite difficult for OEM’s to perform well

-20%

going forward. We believe in the absence of any prompt action on the ease of re-

-30%

strictions, the volume can end up decreasing by north of ~50%YoY in FY23.

-40%

Restrictions on the opening of LCs: The restrictions on imports have adversely impacted auto -50%

assemblers on the opening of LCs along with the clearance of CKD kits from ports, due to which

Jun-22

Jan-23

May-22

Apr-22

Jul-22

Oct-22

Nov-22

Dec-22

Aug-22

Sep-22

Mar-22

Mar-23

Feb-23

auto assemblers are facing frequent plant shutdowns. In CY23, PSMC’s plant remained shut for

PSMC INDU HCAR KSE100 Index

15 days and is currently operating on a single shift, INDU’s plant remained shut down for 14

days, also moving the production to single shift and HCAR announced the longest shutdown for Source: PSX & AKD Research

20 days in a row. In addition to this, the production of OEMs currently stands well below total

capacity and unless these restrictions are eased, further plant closures and non-production days

will be inevitable.

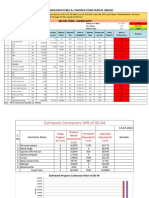

Demand crisis in the Industry: In CY23 auto assemblers have hiked their prices for the 4th time

culminating to an increase of more than ~35% on average amid PkR devaluation and increase in

sales tax. This is posing risk to the sustainability of the sector in terms of subdued demand. Fur-

thermore, in 7MFY23 auto financing has dropped by 8% to clock in at PkR331bn. Hikes in the

policy rate and hefty PkR devaluation have brought consumer affordability into question. We

expect to have demand reduced by more than 50% by the end of FY23.

Impact of supply shocks on OEMs: The restrictions on LCs have hit automobile assemblers

hard. Due to restrictions on CKD kits, the OEMs average delivery times on their vehicles have

been delayed. In addition to this, since SBP’s SRO released in May’22, the situation has contin-

ued to deteriorate significantly and is seen from 8MFY23 decline in the production of passenger

cars down by 43%YoY. On the other hand, sales volume continues to show a downward spiral

where 8MFY23 industry sales are down by 64%YoY.

Sales of Passenger cars and LCVs (Units) Consumer Financing for Transport (PkRmn)

30000 28378

380,000

25000

370,000 367,845

20000 18,378

16,965 360,000

360,547

13,502 352,544

15000

11,666 350,000

350,104 345,186

10000 11852

11,046 10,867

5,762 340,000 337,471

340,173

5000

330,000 331,984

0

Feb-23

Jul-22

Oct-22

Nov-22

Dec-22

Jun-22

Aug-22

Sep-22

Jan-23

320,000

Jun-22 Jul-22 Aug-22 Sep-22 Oct-22 Nov-22 Dec-22 Jan-23

AKD Securities Limited

Source: PAMA & AKD Research

Find AKD research on Bloomberg, firstcall.com, Reuters Knowledge and ResearchPool

Investment Perspective : With a blend of supply and demand shocks, it is quite difficult for

OEM’s to perform well going forward. Gross margins are expected to improve slightly in the

upcoming quarter as effective selling prices catch up to the multiple revisions in CY23. However,

the currency is expected to depreciate further, forcing OEM’s to further hike prices to balance

their margins or take a dent on their profitability. Moreover, the current localization levels

stood below 30% in value terms, which leads to a significant increase in raw material costs

whenever the local currency depreciates. We believe in the absence of any prompt action on

the ease of restrictions, the volume can end up decreasing by 50%YoY in FY23.

AKD RESEARCH

Disclosure Section

Neither the information nor any opinion expressed herein constitutes an offer or a solicitation of an offer to transact in any securities or other financial instrument

and is for the personal information of the recipient containing general information only. AKD Securities Limited (hereinafter referred as AKDS) is not soliciting any

action based upon it. This report is not intended to provide personal investment advice nor does it provide individually tailored investment advice. This report does

not take into account the specific investment objectives, financial situation/financial circumstances and the particular needs of any specific person. Investors should

seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this

report and should understand that statements regarding future prospects may not be realized. AKDS recommends that investors independently evaluate particular

investments and strategies and it encourages investors to seek the advice of a financial advisor.

The appropriateness of a particular investment or strategy will depend on an investor's individual circumstances and objectives. The securities or strategies dis-

cussed in this report may not be suitable for all investors, and certain investors may not be eligible to purchase or participate in some or all of them.

Reports prepared by AKDS research personnel are based on public information. AKDS makes every effort to use reliable, comprehensive information, but we make

no representation that it is accurate or complete. Facts and views presented in this report have not been reviewed by and may not reflect information known to

professionals in other business areas of AKDS including investment banking personnel. AKDS has established information barriers between certain business groups

maintaining complete independence of this research report.

This report has been prepared independently of any issuer of securities mentioned herein and not in connection with any proposed offering of securities or as agent

of any issuer of any securities. Neither AKDS, nor any of its affiliates or their research analysts have any authority whatsoever to make any representation or war-

ranty on behalf of the issuer(s). AKDS Research Policy prohibits research personnel from disclosing a recommendation, investment rating, or investment thesis for

review by an issuer prior to the publication of a research report containing such rating, recommendation or investment thesis.

We have taken all reasonable care to ensure that the information contained herein is accurate, up to date, and complies with all prevailing Pakistani legislations.

However, no liability can be accepted for any errors or omissions, or for any loss resulting from the use of the information provided as any data and research mate-

rial provided ahead of an investment decision are for information purposes only. We shall not be liable for any errors in the provision of this information, or for any

actions taken in reliance thereon. We reserve the right to amend, alter, or withdraw any of the information contained in these pages at any time and without no-

tice. No liability is accepted for such changes.

Stock Ratings

Investors should carefully read the definitions of all ratings used in each research report. In addition, research reports contain information carrying the analyst's

view and investors should carefully read the entire research report and not infer its contents from the rating ascribed by the analyst. In any case, ratings or research

should not be used or relied upon as investment advice. An investor's decision to buy, sell or hold a stock should depend on individual circumstances and other

considerations. AKDS uses a three tier rating system: i) Buy, ii) Neutral and iii) Sell with total returns (capital upside + dividend yield) benchmarked against the ex-

pected one year forward floating (variable) risk free rate (10yr PIB) plus risk premium.

Valuation Methodology

To arrive at our period end target prices, AKDS uses different New Rating Definitions

valuation techniques including: Buy > 29% expected total return (Rf: 20% + Rp: 9%)

Discounted Cash Flow (DCF, DDM) Neutral > 20% to < 29% expected total return

Relative Valuation (P/E, P/B, P/S etc.) Sell < 20% expected total return (Rf: 20%)

Equity & Asset return based methodologies (EVA, Residual Income etc.)

Analyst Certification of Independence

The analysts hereby certify that their views about the companies and their securities discussed in this report are accurately expressed and that they have not re-

ceived and will not receive direct or indirect compensation in exchange for expressing specific recommendations or views in this report.

The research analysts, strategists or research associates principally having received compensation responsible for the preparation of this AKDS research report

based upon various factors including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.

Disclosure of Interest Area

AKDS and the authoring analyst do not have any interest in any companies recommended in this research report irrespective of the fact that AKD Securities Limited

may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market in issues of,

any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or investment services in

relation to the investment concerned or a related investment.

Regional Disclosures (Outside Pakistan)

The information provided in this report and the report itself is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where

such distribution or use would be contrary to law or regulation or which would subject AKDS or its affiliates to any registration or licensing requirements within such

jurisdiction or country.

Furthermore, all copyrights, patents, intellectual and other property in the information contained in this report are held by AKDS. No rights of any kind are licensed

or assigned or shall otherwise pass to persons accessing this information. You may print copies of the report or information contained within herein for your own

private non-commercial use only, provided that you do not change any copyright, trade mark or other proprietary notices. All other copying, reproducing, trans-

mitting, distributing or displaying of material in this report (by any means and in whole or in part) is prohibited.

For the United States

Compliance Notice.

This research report prepared by AKD Securities Limited is distributed in the United States to Major US Institutional Investors (as defined in Rule 15a-6 under the

Securities Exchange Act of 1934, as amended) only by Decker & Co, LLC, a broker-dealer registered in the US (registered under Section 15 of Securities Exchange Act

of 1934, as amended). All responsibility for the distribution of this report by Decker & Co, LLC in the US shall be borne by Decker & Co, LLC. All resulting transactions

by a US person or entity should be effected through a registered broker-dealer in the US. This report is not directed at you if AKD Securities Limited or Decker & Co,

LLC is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to you. You should satisfy yourself before reading it that

Decker & Co, LLC and AKD Securities Limited are permitted to provide research material concerning investment to you under relevant applicable legislations and

regulations.

AKD Securities Limited

602, Continental Trade Centre,

Clifton Block 8, Karachi, Pakistan.

research@akdsl.com

You might also like

- Performance-Based Road Maintenance Contracts in the CAREC RegionFrom EverandPerformance-Based Road Maintenance Contracts in the CAREC RegionNo ratings yet

- Autos: Super Tax To Suppress Earnings During 4QFY22Document3 pagesAutos: Super Tax To Suppress Earnings During 4QFY22Khalid Abbas ChaudhryNo ratings yet

- Gati LTD Long Term RecommendationDocument43 pagesGati LTD Long Term RecommendationRishab taankNo ratings yet

- Cement - 3QFY24 Earnings To Decline by 25%QoQDocument4 pagesCement - 3QFY24 Earnings To Decline by 25%QoQmuhammadghufran1No ratings yet

- Spark IT Sector Update - Pain Is IncreasingDocument27 pagesSpark IT Sector Update - Pain Is Increasingsarvo_44No ratings yet

- Investor Meet - PresentationDocument47 pagesInvestor Meet - PresentationShweta ChaudharyNo ratings yet

- Textile Sector ReportDocument8 pagesTextile Sector ReportKashifSadiqNo ratings yet

- JS-Cements 23FEB23Document3 pagesJS-Cements 23FEB23FakharNo ratings yet

- IDirect TransformersRectifiers NanoNiveshDocument9 pagesIDirect TransformersRectifiers NanoNiveshthiruvenkadambeNo ratings yet

- Strategy Auto 20230302 Mosl Su PG012Document12 pagesStrategy Auto 20230302 Mosl Su PG012Aakash ChhariaNo ratings yet

- Purchase Summary Aine Infra Till Nov 2022Document1 pagePurchase Summary Aine Infra Till Nov 2022Rishabh Naresh JainNo ratings yet

- Automobiles SectorDocument45 pagesAutomobiles SectorTejesh GoudNo ratings yet

- Js Efert 13oct22Document3 pagesJs Efert 13oct22aroosha 2110No ratings yet

- IIFL - Powermech Projects - Company Update - 20230118-1Document9 pagesIIFL - Powermech Projects - Company Update - 20230118-1Dhittbanda GamingNo ratings yet

- Pakistan Technology - IT Exports For Apr-23 Hit Amid Lower Working Days Down 15% MoM To US$191mnDocument4 pagesPakistan Technology - IT Exports For Apr-23 Hit Amid Lower Working Days Down 15% MoM To US$191mnmuddasir1980No ratings yet

- Virinchi Result Analysis 2023-05-20Document13 pagesVirinchi Result Analysis 2023-05-20Atul TandonNo ratings yet

- Pick of The Week - Birla Corporation Ltd. - 08-09-2023Document3 pagesPick of The Week - Birla Corporation Ltd. - 08-09-2023deepaksinghbishtNo ratings yet

- FMR Oct 2023Document39 pagesFMR Oct 2023Qamber RazaNo ratings yet

- IDirect NTPC Q1FY23Document6 pagesIDirect NTPC Q1FY23PavanNo ratings yet

- Pricol - CU-IDirect-Mar 3, 2022Document6 pagesPricol - CU-IDirect-Mar 3, 2022rajesh katareNo ratings yet

- IDirect GSPL CoUpdate May23Document7 pagesIDirect GSPL CoUpdate May23Nagababu SomuNo ratings yet

- Property & Constructio: Kingdom of Saudi Arabia Quarterly Update - January 2020Document2 pagesProperty & Constructio: Kingdom of Saudi Arabia Quarterly Update - January 2020Ty BorjaNo ratings yet

- JS-MCB 29feb24Document3 pagesJS-MCB 29feb24Rizwan IqbalNo ratings yet

- Suguna Electroplaters Sales Purchase September 2022-1Document1,372 pagesSuguna Electroplaters Sales Purchase September 2022-1Saravanan ParthasarathyNo ratings yet

- Result Preview - Telecom - Q2FY22 - Idirect - 061021Document4 pagesResult Preview - Telecom - Q2FY22 - Idirect - 061021GaganNo ratings yet

- Practice - GeeksforGeeks - A Computer Science Portal For GeeksDocument1 pagePractice - GeeksforGeeks - A Computer Science Portal For GeeksTriloki KumarNo ratings yet

- Wegnar Insurance - 18029740007Document3 pagesWegnar Insurance - 18029740007nata rajNo ratings yet

- European Union CO2 Standards For New Passenger Cars and Vans: Interim Targets For New Vehicle CO2 EmissionsDocument3 pagesEuropean Union CO2 Standards For New Passenger Cars and Vans: Interim Targets For New Vehicle CO2 EmissionsThe International Council on Clean TransportationNo ratings yet

- Consultant RTU Weekly Site Report Week 51Document3 pagesConsultant RTU Weekly Site Report Week 51tayyab zafarNo ratings yet

- Automobiles: Angels Outweighing DemonsDocument14 pagesAutomobiles: Angels Outweighing DemonsbradburywillsNo ratings yet

- GCC Telecom Insight - Issued by STC Kuwait - April 2020Document29 pagesGCC Telecom Insight - Issued by STC Kuwait - April 2020AKNo ratings yet

- HallticketDocument2 pagesHallticket48.Muhammed mazin M 1467No ratings yet

- Pakistan by The Numbers: Budget May See Stock-Specific News, But COVID-19 Dynamics Still Drive The MarketDocument17 pagesPakistan by The Numbers: Budget May See Stock-Specific News, But COVID-19 Dynamics Still Drive The MarketmudasserNo ratings yet

- WOrk Package 1Document18 pagesWOrk Package 1beahfeacinNo ratings yet

- National Stock Exchange of India Ltd. BSE LTD.: Saligrama Mohan Kumar Adithya JainDocument40 pagesNational Stock Exchange of India Ltd. BSE LTD.: Saligrama Mohan Kumar Adithya JainJ&J ChannelNo ratings yet

- CircularlistDocument3 pagesCircularlistbrijeshNo ratings yet

- NSH Procurement 2022-07-11Document3 pagesNSH Procurement 2022-07-11Renante GordoveNo ratings yet

- 02..MCU Record Validasi Form Mitrakerja STM HSR KPI 2023Document2 pages02..MCU Record Validasi Form Mitrakerja STM HSR KPI 2023safety.acm.askimahciwimandiriNo ratings yet

- CG ievr9aCRJ Dloys7avgDocument7 pagesCG ievr9aCRJ Dloys7avgchethangowda.1922No ratings yet

- 14 Infographics 03Document1 page14 Infographics 03Michitha BandaraNo ratings yet

- HallticketDocument2 pagesHallticketAdirth sunil Adith Sunil ksNo ratings yet

- Topigeon - Fisa Imbarcare ConcursDocument1 pageTopigeon - Fisa Imbarcare ConcursBerbeca AdiNo ratings yet

- Cement: Down But Is It OutDocument7 pagesCement: Down But Is It OutbradburywillsNo ratings yet

- India Pune Industrial h2 2023Document2 pagesIndia Pune Industrial h2 2023sync mildNo ratings yet

- Power Sector MCQ PartDocument40 pagesPower Sector MCQ PartHossainNo ratings yet

- Roland Berger Disruption Off Highway IndustryDocument12 pagesRoland Berger Disruption Off Highway IndustrySiraj ShaikhNo ratings yet

- SystematixDocument11 pagesSystematixSaketh DahagamNo ratings yet

- SMUD - Program Schedule DRAFT - Plot B v0 - 10.22.18Document4 pagesSMUD - Program Schedule DRAFT - Plot B v0 - 10.22.18moksha123No ratings yet

- Pakistan Textile SectorDocument4 pagesPakistan Textile Sectorkaka shipaiNo ratings yet

- DPR For The Day of 13-07-2022 of OD-04 KLDocument8 pagesDPR For The Day of 13-07-2022 of OD-04 KLKHADAR VALINo ratings yet

- Report On The Capacity, Demand and Reserves (CDR) in The ERCOT Region, 2023-2032Document44 pagesReport On The Capacity, Demand and Reserves (CDR) in The ERCOT Region, 2023-2032Rebecca SalinasNo ratings yet

- MEMO-Policy Update 2023Document3 pagesMEMO-Policy Update 2023gerwinpanghulanNo ratings yet

- Indian Market Overview and OutlookDocument37 pagesIndian Market Overview and OutlookAtiesh MishraNo ratings yet

- THAIDocument27 pagesTHAIPateera Chananti PhoomwanitNo ratings yet

- Pick of The Week - Steel Strip Wheels LTDDocument3 pagesPick of The Week - Steel Strip Wheels LTDshaubhikmondalNo ratings yet

- The Wonky DonkeyDocument26 pagesThe Wonky DonkeyTherese IversenNo ratings yet

- Hateem City Monthly Residential Plot Price List - 01!06!2022Document1 pageHateem City Monthly Residential Plot Price List - 01!06!2022Asif KhanNo ratings yet

- BillDocument1 pageBillEngineer Salman ShaikhNo ratings yet

- Power Transmission & Distribution - PACRA Research Jan 22Document38 pagesPower Transmission & Distribution - PACRA Research Jan 22JehanzebNo ratings yet

- Super Hornet CLIN 3 & 6 - On Going Activities - 22 September 2022Document5 pagesSuper Hornet CLIN 3 & 6 - On Going Activities - 22 September 2022Ali ElHelfawyNo ratings yet

- Pakistan Stock Market: News HighlightsDocument2 pagesPakistan Stock Market: News HighlightsShujaat AhmadNo ratings yet

- Pakistan Stock Market: News HighlightsDocument2 pagesPakistan Stock Market: News HighlightsShujaat AhmadNo ratings yet

- Sd/Fincon/Ca-Briefing/Psx/2020: United Bank Ubl Head Offioe Chundrigar Road Pakistan 111-825-888 UblunitedbankudlDocument2 pagesSd/Fincon/Ca-Briefing/Psx/2020: United Bank Ubl Head Offioe Chundrigar Road Pakistan 111-825-888 UblunitedbankudlShujaat AhmadNo ratings yet

- Directors ReportDocument14 pagesDirectors ReportShujaat AhmadNo ratings yet

- Secretary's DepartmentDocument1 pageSecretary's DepartmentShujaat AhmadNo ratings yet

- Nam Chart of AccountsDocument143 pagesNam Chart of AccountsHumayoun Ahmad Farooqi100% (3)

- Level III 2018 IFT Mock Exams SampleDocument30 pagesLevel III 2018 IFT Mock Exams SamplepharssNo ratings yet

- Kotak On Jindal Stainless HisarDocument6 pagesKotak On Jindal Stainless HisarKrishna PaladuguNo ratings yet

- Frequently Asked Questions Relating To Comfort Letters and Comfort Letter PracticeDocument12 pagesFrequently Asked Questions Relating To Comfort Letters and Comfort Letter PracticeKennith NgNo ratings yet

- Memorandum of AssociationDocument9 pagesMemorandum of Associationguptarajesh_kNo ratings yet

- Banking Notes BBA PDFDocument19 pagesBanking Notes BBA PDFSekar Murugan50% (2)

- ReviewerDocument11 pagesReviewerAbdel Escander100% (1)

- UntitledDocument40 pagesUntitledMamu SirNo ratings yet

- Intro To Finance VideoDocument18 pagesIntro To Finance VideoDave SallaoNo ratings yet

- Ch-23 Mutual FundDocument14 pagesCh-23 Mutual FundAR RafiNo ratings yet

- KASIKORNBANK Public Company LimitedDocument45 pagesKASIKORNBANK Public Company LimitedPallavi WaghmareNo ratings yet

- Seagate Veritas Summary 021501Document4 pagesSeagate Veritas Summary 021501satheesh21090% (1)

- Role of The Indian Capital MarketDocument2 pagesRole of The Indian Capital MarketSanjay BorahNo ratings yet

- Analyzing Investing Activities: Intercorporate InvestmentsDocument38 pagesAnalyzing Investing Activities: Intercorporate Investmentsshldhy100% (1)

- Summer Internship Report On SharekhanDocument59 pagesSummer Internship Report On SharekhanKanika LohanNo ratings yet

- Tax Updates For June 2014 ExaminationDocument52 pagesTax Updates For June 2014 ExaminationNarasimha AkashNo ratings yet

- 5 Semester Online Class: Corporate Accounting Chapter - Underwriting of Shares and DebenturesDocument17 pages5 Semester Online Class: Corporate Accounting Chapter - Underwriting of Shares and DebenturesGopal DasNo ratings yet

- A Case Study On Credit Appraisal For Working Capital Finance To Small and Medium Enterprises in Bank of IndiaDocument34 pagesA Case Study On Credit Appraisal For Working Capital Finance To Small and Medium Enterprises in Bank of Indiaarcherselevators0% (1)

- Baker McKenzie A Guide To Regulatory Fintech Sandboxes InternationallyDocument40 pagesBaker McKenzie A Guide To Regulatory Fintech Sandboxes InternationallyCocoNo ratings yet

- (Cambodia - 1996) Law On Organization and Functioning of The National Bank of CambodiaDocument73 pages(Cambodia - 1996) Law On Organization and Functioning of The National Bank of Cambodiaរ័ត្នវិសាល (Rathvisal)No ratings yet

- Discovering Gold in Latin AmericaDocument14 pagesDiscovering Gold in Latin AmericaMauro CaleroNo ratings yet

- Forterra ProspectusDocument255 pagesForterra ProspectussterkejanNo ratings yet

- CEMAP Question PaperDocument7 pagesCEMAP Question Paperash0% (1)

- HSL Weekly Insight: Retail ResearchDocument5 pagesHSL Weekly Insight: Retail ResearchumaganNo ratings yet

- Standard & Poor's Business and Financial Terms July 2014Document25 pagesStandard & Poor's Business and Financial Terms July 2014Andy LeungNo ratings yet

- Final Internship ReportDocument36 pagesFinal Internship Reportrajesh0% (1)

- ADR and GDRDocument43 pagesADR and GDRsurabhikhanna86675750% (4)

- Amity University Jharkhand: Assignment of Personal Financial Planning (FIBA311)Document6 pagesAmity University Jharkhand: Assignment of Personal Financial Planning (FIBA311)Ayush KesriNo ratings yet

- Financial Markets A Beginners ModuleDocument16 pagesFinancial Markets A Beginners ModulePuneeta Gupta100% (1)

- Summer Internship Project On SIP & Mutual FundDocument97 pagesSummer Internship Project On SIP & Mutual FundMayank Sharma71% (24)

- Equivalence Between ISO 15022 and ISO 20022Document93 pagesEquivalence Between ISO 15022 and ISO 20022Slim FerjaniNo ratings yet