Professional Documents

Culture Documents

5 6

Uploaded by

VasunOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5 6

Uploaded by

VasunCopyright:

Available Formats

5.

5

Danny Crane

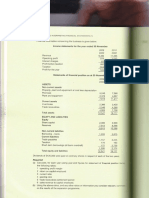

Statement of Cash Flow for the year ended 31 December x5

RM’000 RM’000

Cash Flow from Operating Activities 1,427

Cash receipts from customers (w1)

(-) Cash payment to supplier and employees (291)

(w2) (111,000 + 180,000)

Cash generated from operation 1,136

(-) Interest paid (40)

(-) Tax paid (225)

Net CF from Operating Activities 871

Cash Flow from Investing Activities - NCA

Income from investment 50

Purchased of new Plant and Machinery (800)

Proceed from disposal Plant and Machinery 200

Development expenditure (478)

Proceed from disposal of investment (170 + 25) 195

Net CF from Investing Activities (833)

Cash Flow from Financing Activities – NCL,

Capital, Reserves

Issue new Ordinary shares 220

Redemption of Preference shares (50)

Dividend paid:

Preference shareholders (50)

Ordinary shareholders (72)

Redemption of 8% Debentures (50)

Net CF from Financing Activities (2)

Net increased in cash and cash equivalent 36

Cash and cash equivalent at the beginning of Note A (89) (a)

the year

Cash and cash equivalent at the end of the year Note A (53) (b)

Note A: Cash and cash equivalent Opening Closing

Cash in hand 31 27

Cash at bank - -

Bank overdraft (120) (80)

Short term investment (<3 months) - -

(89) (a) (53) (b)

Trade Receivables a/c

Balance b/d 20,000 Bank 1,427,000

Sales 1,440,000

Balance b/d 33,000

1,460,000 1,460,000

Cash payment to suppliers = RM111,00

Trade Payables a/c

Bank 111 Balance b/d 42

Purchases 124

Balance c/c 55

166 166

Material Consumed

Opening inventories 56 P/L (material consumed) 140

Purchases 124

Closing inventories 40

180 180

Cash payment to employees (cash expenses) = RM180,000

Staff cost 180

Taxation a/c

Balance recoverable b/d xxx Balance payable b/d 25

Increased Deferred Tax xx Decreased in Deferred tax xx

Bank (tax paid) 225 P/L (tax for the year) 210

Balance payable c/d 10 Balance recoverable c/d xxx

235 235

Land and Building

Balance /d 1650

ARR (surplus) 100

Balance b/d 16000

Plant and Machinery – carrying amount

Balance b/d 790 Depreciation 190

Bank 800 Disposal 230

Balance c/d 1,170

1,590 1,590

Retained Earning

Interim dividend: Balance b/d 320

Pref shares 50

Ordinary share 72

P/L (PAT) 715

Balance c/d 913

1,035 1,035

You might also like

- Financial Reporting Ii AssignmentDocument7 pagesFinancial Reporting Ii AssignmentemeraldNo ratings yet

- Exercises of Session 8Document4 pagesExercises of Session 8tranhlthNo ratings yet

- f3 AssignmentDocument6 pagesf3 Assignmentnoumanchaudhary902No ratings yet

- Statement of Kamran Establishment C o DFDocument4 pagesStatement of Kamran Establishment C o DFRazaAmin100% (1)

- Cash Flows Tutorial QuestionsDocument6 pagesCash Flows Tutorial Questionssmlingwa100% (1)

- Mock Final F3.2Document3 pagesMock Final F3.2Phạm Việt BáchNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- Cash Flow (Exercise)Document5 pagesCash Flow (Exercise)abhishekvora7598752100% (1)

- Tutorial Cash FlowDocument18 pagesTutorial Cash FlowmellNo ratings yet

- Solutions PDFDocument5 pagesSolutions PDFprim2698No ratings yet

- Topic 2 - Assets, Equities and LiabilitiesDocument29 pagesTopic 2 - Assets, Equities and Liabilitiesahmadamsyar083No ratings yet

- CFS - 18 Oct 2022Document11 pagesCFS - 18 Oct 2022Kartik SujanNo ratings yet

- Paragon SPL & SFP With AnswerDocument3 pagesParagon SPL & SFP With Answerramyaa baluNo ratings yet

- SCF With DODocument3 pagesSCF With DOMuhammad Asif KhanNo ratings yet

- Bookkeeping Practice SetDocument31 pagesBookkeeping Practice SetSittie Norhanizah100% (1)

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- Financial Accounting 2 Assign 2Document7 pagesFinancial Accounting 2 Assign 2ronellNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- Jawaban Chapter 23 - Soal DikerjakanDocument2 pagesJawaban Chapter 23 - Soal Dikerjakanabd storeNo ratings yet

- 3 Beethoven Schubert Bach Text 2018Document11 pages3 Beethoven Schubert Bach Text 2018djaaaamNo ratings yet

- Solution Aman BHDDocument4 pagesSolution Aman BHDIZZAH ATHIRAH MOHD SALIMINo ratings yet

- 05 DEC QuestionDocument10 pages05 DEC Questionkhengmai100% (1)

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Managerial Accounting PPDocument42 pagesManagerial Accounting PPSaurav KumarNo ratings yet

- Exercise 3 - Group Accounts - SolutionDocument5 pagesExercise 3 - Group Accounts - SolutionAnh TramNo ratings yet

- CFS Baf 1 CpaDocument6 pagesCFS Baf 1 CpaErnest NyangiNo ratings yet

- Cash Flow Statements Interim Check 1 Yolo LTD Question and AnswerDocument5 pagesCash Flow Statements Interim Check 1 Yolo LTD Question and AnswerjunaidahNo ratings yet

- Accounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusDocument18 pagesAccounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusAung Zaw HtweNo ratings yet

- 47246mtpbosicai Sa p1 Sr2Document13 pages47246mtpbosicai Sa p1 Sr2AnsariMohammedShoaibNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Cash FlowDocument12 pagesCash FlowalguienNo ratings yet

- Chapter: Common Size, Comparative and Trend AnalysisDocument6 pagesChapter: Common Size, Comparative and Trend Analysiseldridatech pvt ltdNo ratings yet

- Confusion Plcs SolutionsDocument8 pagesConfusion Plcs SolutionsJen Hang WongNo ratings yet

- FM 1 Assignment 1Document3 pagesFM 1 Assignment 1Jelly Ann AndresNo ratings yet

- SESSION 3 Practice TemplateDocument7 pagesSESSION 3 Practice Templateyimin liuNo ratings yet

- Ratio Analysis WorksheetDocument5 pagesRatio Analysis WorksheetAnish AroraNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- CH 21 in Class Exercises Day 2Document2 pagesCH 21 in Class Exercises Day 2Abdullah alhamaadNo ratings yet

- Week 4 Final Quiz Solutions 1 12Document4 pagesWeek 4 Final Quiz Solutions 1 12Learning PointNo ratings yet

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Document3 pages20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceNo ratings yet

- No Items RM'000 Working (RM'000)Document4 pagesNo Items RM'000 Working (RM'000)Chushan TehNo ratings yet

- Company Financial Statements - FORMAT LTDDocument5 pagesCompany Financial Statements - FORMAT LTDrumelrashid_seuNo ratings yet

- BCC620 Business Financial Management Main (NOV) E1 21-22Document9 pagesBCC620 Business Financial Management Main (NOV) E1 21-22Rukshani RefaiNo ratings yet

- Evernew LTD (Basic) : Cfap 1: A A F RDocument1 pageEvernew LTD (Basic) : Cfap 1: A A F R.No ratings yet

- Finacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsDocument5 pagesFinacial Accounting Ii FA260US ASSIGNMENT 1 (5 Group Member Only) Faculty Department Course Course Code Due Date Possible Marks Examiner (S) Moderator InstructionsJohanna AseliNo ratings yet

- AFE5008-B Exam Type Question-2-Model AnswerDocument2 pagesAFE5008-B Exam Type Question-2-Model AnswerDiana TuckerNo ratings yet

- Information and Communications University: TH THDocument5 pagesInformation and Communications University: TH THKj NayeeNo ratings yet

- Financial Management Mock 2Document7 pagesFinancial Management Mock 2sadathamid03No ratings yet

- Chapter 23Document59 pagesChapter 23boboandiandiNo ratings yet

- ACCT1002 Assignment 3B 2nd S 2021-2022Document16 pagesACCT1002 Assignment 3B 2nd S 2021-2022Zenika PetersNo ratings yet

- BFA301 Solution For Lecture Example 3-2Document6 pagesBFA301 Solution For Lecture Example 3-2erinNo ratings yet

- Calculate The Following Ratios:: A) Roce B) Current RatioDocument9 pagesCalculate The Following Ratios:: A) Roce B) Current RatioPham TrangNo ratings yet

- CR Inter QuestionsDocument22 pagesCR Inter QuestionsRichie BoomaNo ratings yet

- CO517 - Financial AccountingDocument4 pagesCO517 - Financial Accountingmiciker416No ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Ad 339512145 C 6 e 1Document10 pagesAd 339512145 C 6 e 1VasunNo ratings yet

- Chapter 3 PFS2173Document18 pagesChapter 3 PFS2173VasunNo ratings yet

- 5 6233119928824628177Document6 pages5 6233119928824628177VasunNo ratings yet

- David SMCC16ge ppt01Document28 pagesDavid SMCC16ge ppt01VasunNo ratings yet

- Consolidated Statement of Cash FlowDocument14 pagesConsolidated Statement of Cash FlowVasunNo ratings yet

- Lecture 2 Development of MaDocument23 pagesLecture 2 Development of MaVasunNo ratings yet

- Winding UpDocument10 pagesWinding UpVasunNo ratings yet

- Teaching Plan: Financial Accounting and Reporting 3, Oxford Fajar SDN BHDDocument4 pagesTeaching Plan: Financial Accounting and Reporting 3, Oxford Fajar SDN BHDVasunNo ratings yet

- CH - 03 - Business IdeaDocument30 pagesCH - 03 - Business IdeaVasunNo ratings yet

- Please Fill in The Following ParticularsDocument8 pagesPlease Fill in The Following ParticularsVasunNo ratings yet

- Answer Booklet: Centre For Foundation & General StudiesDocument1 pageAnswer Booklet: Centre For Foundation & General StudiesVasunNo ratings yet

- This Study Resource Was: COMM 12423 Business Communication Assignment 1 Direct Instructional Memo (10%)Document2 pagesThis Study Resource Was: COMM 12423 Business Communication Assignment 1 Direct Instructional Memo (10%)VasunNo ratings yet

- Case Study of Organizational Behavioural. Case Incident 1 On-Borading or On-LeavingDocument11 pagesCase Study of Organizational Behavioural. Case Incident 1 On-Borading or On-LeavingVasunNo ratings yet

- Sample Letter Credit RejectionDocument1 pageSample Letter Credit RejectionVasunNo ratings yet

- Request Letter (Information) : A7/A Zirkon Street, Section 7, 40000 Shah Alam, SelangorDocument2 pagesRequest Letter (Information) : A7/A Zirkon Street, Section 7, 40000 Shah Alam, SelangorVasunNo ratings yet

- Dividend Decisions Unit 5Document8 pagesDividend Decisions Unit 5md saifNo ratings yet

- Order Management and Fulfillment Cloud Implementation R18.05 - Student GuideDocument630 pagesOrder Management and Fulfillment Cloud Implementation R18.05 - Student GuideVictor MillanNo ratings yet

- A Project Report On Direct TaxDocument44 pagesA Project Report On Direct Taxrani26oct100% (2)

- 21 73NCLRev563 (1994-1995)Document394 pages21 73NCLRev563 (1994-1995)Stacey RowlandNo ratings yet

- MCI - 2019-2020 - Part 2 - Profiles - ENGDocument404 pagesMCI - 2019-2020 - Part 2 - Profiles - ENGYulia NemyrivskaNo ratings yet

- Chapter 2 SolutionsDocument5 pagesChapter 2 SolutionskendozxNo ratings yet

- Sia Prestorming Gs I 2023 24 Test22 Budgeteconomicsurvey QPDocument17 pagesSia Prestorming Gs I 2023 24 Test22 Budgeteconomicsurvey QPVEYINI RAMAMOORTHYNo ratings yet

- Markets and Commodity Figures: Liberty Excelsior InvestmentsDocument1 pageMarkets and Commodity Figures: Liberty Excelsior InvestmentsTiso Blackstar GroupNo ratings yet

- Deduction U/s 80C, 80CCC, 80CCD, 80CCE, 80D, 80DD, 80DDB, 80E, 80G EtcDocument10 pagesDeduction U/s 80C, 80CCC, 80CCD, 80CCE, 80D, 80DD, 80DDB, 80E, 80G EtcHimanshu SharmaNo ratings yet

- NATURALIZATION2Document5 pagesNATURALIZATION2Sean ArcillaNo ratings yet

- Barangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3Document16 pagesBarangay Micro Business Enterprise (Bmbe) Act: 13284-TOPIC 3kim cheNo ratings yet

- 65-5 Ex. 5 1st Fidelity Mortgages Sent 2nd Lien Ext. Letters 9.13.12Document49 pages65-5 Ex. 5 1st Fidelity Mortgages Sent 2nd Lien Ext. Letters 9.13.12larry-612445No ratings yet

- (CBTP)Document23 pages(CBTP)gudissagabissaNo ratings yet

- BRN Annual Report 2013/14Document80 pagesBRN Annual Report 2013/14benmtegaNo ratings yet

- RV ICE S: Krishna Sales & ServicesDocument1 pageRV ICE S: Krishna Sales & ServicesSaikatNo ratings yet

- A Proposed Silay City Local Economic Development StrategyDocument76 pagesA Proposed Silay City Local Economic Development StrategyRuben Carlo Asuncion100% (2)

- Fe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityDocument2 pagesFe Cereñado Obe: #37C Hornbill St. Sitio Veterans, Area 3 Brgy. Bagong Silangan, Quezon CityJoanna PaulaNo ratings yet

- Finance EssayDocument16 pagesFinance EssayJoe BobNo ratings yet

- Business Rules For Cafeteria Ordering System (Partial) : ID Rule Definition Type of Rule Static or Dynamic SourceDocument1 pageBusiness Rules For Cafeteria Ordering System (Partial) : ID Rule Definition Type of Rule Static or Dynamic SourceManh Hung TranNo ratings yet

- Chapter XI - XII CasesDocument177 pagesChapter XI - XII CasesJolpha Del MundoNo ratings yet

- Banking Questions For IBPS Gr8AmbitionZDocument25 pagesBanking Questions For IBPS Gr8AmbitionZshahenaaz3No ratings yet

- Nursery Care vs. Acevedo PDFDocument17 pagesNursery Care vs. Acevedo PDFEvan NervezaNo ratings yet

- 9.tolentino V Sec Finance 235 Scra 630Document217 pages9.tolentino V Sec Finance 235 Scra 630Song OngNo ratings yet

- Land RegistrationDocument46 pagesLand Registrationrachelle almonte100% (4)

- Taxation - Income TaxDocument158 pagesTaxation - Income Taxnaren197667% (6)

- SavasDocument17 pagesSavasMarc VivesNo ratings yet

- Financial Analysis of A Selected CompanyDocument20 pagesFinancial Analysis of A Selected CompanyAmid Abdul-Karim100% (1)

- Get The Bir Form 1701qDocument7 pagesGet The Bir Form 1701qMyka4No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)maaathanNo ratings yet

- Payslip For The Month of November 2020: Cms It Services Private LimitedDocument2 pagesPayslip For The Month of November 2020: Cms It Services Private LimitedKrishna AryanNo ratings yet