Professional Documents

Culture Documents

Value Added Statements B

Uploaded by

lil telCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Value Added Statements B

Uploaded by

lil telCopyright:

Available Formats

VALUE ADDED STATEMENTS

Value Added Statement is a financial statement that depicts wealth created by an organization

and how is that wealth distributed among various stakeholders. The various stakeholders

comprise of the employees, shareholders, government, creditors and the wealth that is retained in

the business.

As per the concept of Enterprise Theory, profit is calculated for various stakeholders by an

organization. Value Added is this profit generated by the collective efforts of management,

employees, capital and the utilization of its capacity that is distributed amongst its various

stakeholders.

Table of Contents

1. Example of Value Added Statement

2. Advantages of a Value Added Statement

3. Difference between Value Added and Profit

Consider a manufacturing firm. A typical firm would buy raw materials from the market. Process

the raw materials and assemble them to produce the finished goods. The finished goods are then

sold in the market. The additional work that the firm does to the raw materials in order for it to

be sold in the market is the value added by that firm. Value added can also be defined as the

difference between the value that the customers are willing to pay for the finished goods and the

cost of materials.

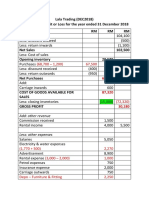

Example of Value Added Statement

Following is the format of the statement of Value Added explained with an example.

Sales Revenue 1000

Less: Cost of bought in goods and services 200

Gross Profit 800

Employee Salary 250

To capital providers interest 100

Taxes 100

Depreciation 200

650

Profit 150

Sales Revenue 1000

Less: Cost of bought in goods and services 200

Value Added 800

Application of Value Added

Employee Benefits 250

To capital providers (Creditors and Lenders) 100

Taxes 100

Value retained (depreciation and expansion of

350

business)

Value Added 800

From the above illustration, the difference between sales and cost of bought-in materials and

services gives the value added by the organization.

The second part the statement gives the distribution of the value added by the organization.

Off the $800 added by the firm, $250 is utilized for employee benefits. $100 is given as interest

of loans and dividends to shareholders. Another $100 is contributed to the government in the

form of taxes. Whereas, $350 is retained for expansion of the current business and part of it is

kept aside for depreciation amount.

Thus, value added statement not only gives the value added by the organization but also the

distribution of it across various stakeholders.

Advantages of a Value Added Statement

It is easy to calculate.

Helps a company to apportion the value to various stakeholders. The company can use

this to analyze what proportion of value added is allocated to which stakeholder.

Useful for doing a direct comparison with your competitors.

Useful for internal comparison purposes and to devise employee incentive schemes.

The various advantages of defining income in such a way are as follows:-

1. Value Added Statement reflects a broader view of the companies ives and

responsibilities, so it improve the attitude of the employees towards the employing

company.

2. Value Added Statement makes it easier for the company to introduce the productivity

linked bonus scheme for employees based on Value Added for this Value Added payroll

ratio is used as a basis.

3. Value Added provides a very good measure of the size and importance of a company.

4. Value Added Statement link a companies financial accounts to the National Income. A

companies Value Added Statement indicates the companies contribution to National

Income.

Difference between Value Added and Profit

Profit subtracts all the cost incurred in the process of generating revenues. The value added, on

the other hand only subtracts the cost of bought-in goods and services. Profits are meant for

shareholders whereas value added is meant for stakeholders who include shareholders also.

Therefore, value added is a wider term.

You might also like

- Answers - FA 1Document7 pagesAnswers - FA 1AsmaNo ratings yet

- Business ValuationDocument24 pagesBusiness ValuationBurhan100% (1)

- Lala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTDocument3 pagesLala Trading DEC2018 - SOPL & SOFP DEC2018 AFTER ADJUSTMENTAFIQ RAFIQIN RAHMADNo ratings yet

- Unit-4 Financing DecisionDocument58 pagesUnit-4 Financing DecisionFaraz SiddiquiNo ratings yet

- PART 5 - Statement of Comprehensive Income and Its ElementsDocument6 pagesPART 5 - Statement of Comprehensive Income and Its ElementsHeidee BitancorNo ratings yet

- Financial Leverage and Capital Structure Policy: Conducted by Ranjika Perera & Chanaka KarunasenaDocument53 pagesFinancial Leverage and Capital Structure Policy: Conducted by Ranjika Perera & Chanaka Karunasenacharitha007No ratings yet

- FinanceDocument34 pagesFinanceJared OtienoNo ratings yet

- Financial Ratio Analysis Putting The Numbers To Work PDFDocument5 pagesFinancial Ratio Analysis Putting The Numbers To Work PDFSchemf SalamancaNo ratings yet

- Strategic Financial Management-84-97-8Document1 pageStrategic Financial Management-84-97-8joko waluyoNo ratings yet

- Financial Statement Analysis Chapter 2Document10 pagesFinancial Statement Analysis Chapter 2Houn Pisey100% (1)

- Capital StructureDocument32 pagesCapital Structurestd30000No ratings yet

- Lesson 24 - Note PDFDocument15 pagesLesson 24 - Note PDFFathik FouzanNo ratings yet

- Business ValuationDocument17 pagesBusiness ValuationWassi Ademola MoudachirouNo ratings yet

- Value Added StatementDocument6 pagesValue Added StatementPooja SheoranNo ratings yet

- Capital Structure and Leverage AnalysisDocument57 pagesCapital Structure and Leverage AnalysisbirhanuNo ratings yet

- Four Financial StatementDocument17 pagesFour Financial StatementAbeiku QuansahNo ratings yet

- Chapter 2 FM ContinuedDocument58 pagesChapter 2 FM ContinuedDesu GashuNo ratings yet

- CH01 Introduction To Accounting PDFDocument40 pagesCH01 Introduction To Accounting PDFindra6rusadie100% (1)

- Managing finance profit statement ratiosDocument6 pagesManaging finance profit statement ratiosCarolina Guzman TorresNo ratings yet

- LeveragesDocument50 pagesLeveragesPrem KishanNo ratings yet

- Profitability RatioDocument3 pagesProfitability Ratiobhawna.licdu318No ratings yet

- Corp Fin - Session 11 & 12 - Capital StructureDocument31 pagesCorp Fin - Session 11 & 12 - Capital StructurebipokNo ratings yet

- Chapter 1-4Document20 pagesChapter 1-4BookDownNo ratings yet

- Finanacial Restructuring 2Document48 pagesFinanacial Restructuring 2Jim Mathilakathu100% (2)

- Fundamentals of Accounting: Interpretation of Financial StatementsDocument44 pagesFundamentals of Accounting: Interpretation of Financial Statementscons theNo ratings yet

- Financial Accounting & Analysis: Key ConceptsDocument6 pagesFinancial Accounting & Analysis: Key ConceptsDimpleNo ratings yet

- Lecture 1-Financial Statements I-SDocument75 pagesLecture 1-Financial Statements I-SjamesbinstrateNo ratings yet

- Ratio AnalysisDocument17 pagesRatio AnalysisPGNo ratings yet

- EFIN542 U09 T01 PowerPointDocument26 pagesEFIN542 U09 T01 PowerPointcustomsgyanNo ratings yet

- NIM Genap 2. - in Equity Security Market There Are Two Kind of Analysis Namely Fundamental and TechnicalDocument3 pagesNIM Genap 2. - in Equity Security Market There Are Two Kind of Analysis Namely Fundamental and TechnicalyudaNo ratings yet

- Leverage AND TYPES of LeaverageDocument10 pagesLeverage AND TYPES of Leaveragesalim1321100% (2)

- 33 Advanced AccountingDocument264 pages33 Advanced AccountingKrunal ShahNo ratings yet

- Corporate Finance DecisionsDocument17 pagesCorporate Finance DecisionsSahil SharmaNo ratings yet

- Financial Statements: Prepared By: Muhammad AkhtarDocument11 pagesFinancial Statements: Prepared By: Muhammad AkhtarMuhammad akhtarNo ratings yet

- Leverage: Definition 1Document11 pagesLeverage: Definition 1diptishahNo ratings yet

- LeverageDocument6 pagesLeverageAhsane RNo ratings yet

- AF1401 2020 Autumn Lecture 2Document38 pagesAF1401 2020 Autumn Lecture 2Dhan AnugrahNo ratings yet

- LeverageDocument7 pagesLeverageKomal ThakurNo ratings yet

- Chapter 4 - Balance SheetDocument10 pagesChapter 4 - Balance SheetrtohattonNo ratings yet

- Value Added StatementDocument14 pagesValue Added StatementInigorani0% (2)

- Ratio Analysis:: Analysis of Fin Statements IIDocument88 pagesRatio Analysis:: Analysis of Fin Statements IIHANEESHA BNo ratings yet

- Background Note 2 - Operating LeverageDocument8 pagesBackground Note 2 - Operating LeverageENS SunNo ratings yet

- Dwnload Full Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manual PDFDocument35 pagesDwnload Full Financial Management For Decision Makers Canadian 2nd Edition Atrill Solutions Manual PDFbenboydr8pl100% (12)

- Finance For Managers-Module 4B-LeveragesDocument27 pagesFinance For Managers-Module 4B-LeveragesChayaGandhiNo ratings yet

- LeveragesDocument41 pagesLeveragesSohini ChakrabortyNo ratings yet

- LeverageDocument8 pagesLeverageKalam SikderNo ratings yet

- Leverages 1Document13 pagesLeverages 1Jayant RaneNo ratings yet

- Value Added Metrics: A Group 3 PresentationDocument43 pagesValue Added Metrics: A Group 3 PresentationJeson MalinaoNo ratings yet

- Maximizing Firm Value with Optimal Capital StructureDocument11 pagesMaximizing Firm Value with Optimal Capital StructurebashirNo ratings yet

- Rahul FM - Rahul GoyalDocument5 pagesRahul FM - Rahul GoyalVishvesh GargNo ratings yet

- P&L STATEMENT BREAKDOWN FOR CASE ANALYSISDocument3 pagesP&L STATEMENT BREAKDOWN FOR CASE ANALYSISNeha AroraNo ratings yet

- Payroll AccountingDocument2 pagesPayroll Accountingsunil.ctNo ratings yet

- Corporate Restructuring-ValuationDocument17 pagesCorporate Restructuring-ValuationHimanshi AplaniNo ratings yet

- Statement of Comprehensive IncomeDocument2 pagesStatement of Comprehensive IncomeRandom AcNo ratings yet

- Operating LeverageDocument5 pagesOperating LeverageSalman MajeedNo ratings yet

- 4.1 Value Added: Meaning: Chapter 4: Value Added and Economic Value Added Analysis 85Document5 pages4.1 Value Added: Meaning: Chapter 4: Value Added and Economic Value Added Analysis 85nupurNo ratings yet

- Assignment-2-Group 5Document4 pagesAssignment-2-Group 5Raven RoxasNo ratings yet

- LeverageDocument14 pagesLeverageSurya ElvinoNo ratings yet

- Unit 2 Uderstanding Financial StatementsDocument23 pagesUnit 2 Uderstanding Financial StatementsSG dNo ratings yet

- Operating Leverage: DefinitionDocument3 pagesOperating Leverage: DefinitionJessaNo ratings yet

- TutorialDocument153 pagesTutorialReddyNo ratings yet

- Whats NewDocument36 pagesWhats Newlil telNo ratings yet

- C ApiDocument336 pagesC ApiRaj A DesaiNo ratings yet

- Howto FunctionalDocument20 pagesHowto FunctionalPavan KalyanNo ratings yet

- Howto IpaddressDocument6 pagesHowto IpaddressXerach GHNo ratings yet

- Howto UnicodeDocument13 pagesHowto UnicodeITTeamNo ratings yet

- Howto InstrumentationDocument8 pagesHowto InstrumentationPavan KalyanNo ratings yet

- Howto Isolating ExtensionsDocument8 pagesHowto Isolating Extensionslil telNo ratings yet

- Python Descriptor HowTo GuideDocument21 pagesPython Descriptor HowTo Guideandrea 01No ratings yet

- Howto CursesDocument8 pagesHowto CursesXerach GHNo ratings yet

- Howto SocketsDocument6 pagesHowto SocketskidbarrocoNo ratings yet

- Industrial Attachment ReportDocument47 pagesIndustrial Attachment Reportlil telNo ratings yet

- Accounting For Price Level Changes 1Document8 pagesAccounting For Price Level Changes 1lil telNo ratings yet

- Python Docs ExtendingDocument109 pagesPython Docs ExtendingRaj A DesaiNo ratings yet

- Lesson 2 LeaseDocument26 pagesLesson 2 Leaselil telNo ratings yet

- Conditional Statements in JavaDocument15 pagesConditional Statements in Javalil telNo ratings yet

- Com 322 Sensitivity 2Document11 pagesCom 322 Sensitivity 2lil telNo ratings yet

- Silo - Tips - Student S Attachment Log BookDocument13 pagesSilo - Tips - Student S Attachment Log Booklil telNo ratings yet

- EconomicDocument32 pagesEconomicSeyiNo ratings yet

- Nitafan v. Cir Case DigestDocument1 pageNitafan v. Cir Case DigestNina Majica PagaduanNo ratings yet

- Bos 50847 MCQP 7Document150 pagesBos 50847 MCQP 7keshav bajajNo ratings yet

- W6 Module 5 Dupont System of AnalysisDocument14 pagesW6 Module 5 Dupont System of AnalysisDanica VetuzNo ratings yet

- Feasib ScriptDocument3 pagesFeasib ScriptJeremy James AlbayNo ratings yet

- Exam in Accounting-FinalsDocument5 pagesExam in Accounting-FinalsIyarna YasraNo ratings yet

- P&G Phils Can Claim Tax RefundDocument3 pagesP&G Phils Can Claim Tax RefundKarl MinglanaNo ratings yet

- Adam Smith Father of EconomicsDocument3 pagesAdam Smith Father of EconomicsGleizuly VaughnNo ratings yet

- Business Solution Enterprise Statement of Financial Position As of December 31, 2018 AssetsDocument4 pagesBusiness Solution Enterprise Statement of Financial Position As of December 31, 2018 AssetsCheche Casaljay AmpoanNo ratings yet

- AMICAE Housings Co-OperativeDocument5 pagesAMICAE Housings Co-OperativeTia clemenNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

- Equity Program FAQDocument14 pagesEquity Program FAQNikhil SinghalNo ratings yet

- Module 3 Exercises Statement of Changes in EquityDocument3 pagesModule 3 Exercises Statement of Changes in EquityArjay CorderoNo ratings yet

- 'Unshell' - Rules To Prevent The Misuse of Shell EntitiesDocument8 pages'Unshell' - Rules To Prevent The Misuse of Shell EntitiesKgjkg KjkgNo ratings yet

- Engineering Economy Refresher Set PdfbooksforumDocument5 pagesEngineering Economy Refresher Set PdfbooksforumEdmond BautistaNo ratings yet

- Accounting What The Numbers Mean 10th Edition Marshall Test BankDocument48 pagesAccounting What The Numbers Mean 10th Edition Marshall Test Banklarrybrownjcdnotkfab100% (25)

- Topic 3 -Joint ArrangementsDocument5 pagesTopic 3 -Joint Arrangementsduguitjinky20.svcNo ratings yet

- UNIT-3: Assessment of Firms Section-ADocument6 pagesUNIT-3: Assessment of Firms Section-ANaveenNo ratings yet

- 20 EU / EEA Certificate: Personal DetailsDocument3 pages20 EU / EEA Certificate: Personal Detailsgaga sebiskveradzeNo ratings yet

- Making Capital Investment Decisions Incremental Cash Flows: Skema Business SchoolDocument30 pagesMaking Capital Investment Decisions Incremental Cash Flows: Skema Business Schooldongyi YuNo ratings yet

- Funtional Areas of FinanceDocument3 pagesFuntional Areas of FinanceAyushi TiwariNo ratings yet

- The Cheat Sheet RatiosDocument6 pagesThe Cheat Sheet RatiosDan ButuzaNo ratings yet

- Home Assignments, Week 1, 2023Document4 pagesHome Assignments, Week 1, 2023jovanaNo ratings yet

- 1082 Muhasibat Aqil E.Document12 pages1082 Muhasibat Aqil E.DanielNo ratings yet

- Income From House PropertyDocument6 pagesIncome From House PropertyPraveen EkkaNo ratings yet

- Sales ForecastingDocument16 pagesSales ForecastingvaishalicNo ratings yet

- Business Taxation Prelim PDFDocument30 pagesBusiness Taxation Prelim PDFTrine De LeonNo ratings yet