Professional Documents

Culture Documents

Lesson 2 Aasi

Uploaded by

din matanguihan0 ratings0% found this document useful (0 votes)

12 views1 pageOriginal Title

LESSON 2 AASI

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageLesson 2 Aasi

Uploaded by

din matanguihanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

AASI: Correction of Errors error occurred; or (b) if the error occurred before the earliest prior

Errors period presented, restating the opening balances of assets, liabilities

Error refers to an unintentional misstatement in a financial and equity for the earliest prior period presented.

statement including the omission of an amount or a disclosure, Types of Errors

including: Balance sheet or statement of financial position errors

1. A mistake in gathering or processing data from which financial Affect only the presentation of an asset, liability, or

statements are prepared; stockholders' equity account. When the error is discovered in the error

2. An incorrect accounting estimate arising from oversight or year, the company reclassifies the item to its proper position. If the

misinterpretation of facts; error in a prior year is discovered in a subsequent period, the

3. A mistake in the application of accounting principles relating to company should restate the statement of financial position (SFP) of

measurement, recognition, classification, presentation or disclosure. the prior year for comparative purposes.

Fraud Income statement errors

Fraud refers to the intentional act by one or more individuals Income statement (IS) errors are errors affecting only the

among management, those charged with governance, employees, income statement accounts and may include improper classification

or third parties involving the use of deception to obtain an unjust or of revenues or expenses. A company must make a reclassification

illegal advantage. entry when it discovers the error in the error year. If the error

Prior Period Errors discovered pertains to a prior year, the company should restate the

Prior period errors are omissions from, and misstatements in, income statement of the prior year for comparative purposes. Since

the entity's financial statements for one or more prior periods arising these errors involve two nominal accounts, net income and retained

from a failure to use or misuse of reliable information that: (a) was earnings during the period are unaffected.

available when financial statements for those periods were authorized Combined statement of financial position and income statement

for issue; and (b) could reasonably be expected to have been errors

obtained and taken into account in the preparation and Errors affecting both the SFP and IS can be classified as:

presentation of those financial statements. Such errors include the a. Counterbalancing errors - errors that will offset or be corrected over

effects of mathematical mistakes, mistakes in applying accounting two accounting periods b. Non-counterbalancing errors - errors do

policies, oversights or misinterpretations of facts, and fraud. not offset in the next accounting period. Therefore, companies must

Accounting Treatment of Prior Period Error correct entries, even if they have closed the books.

According to PAS 8 par 42, “an entity shall correct material Working capital

prior period errors retrospectively in the first set of financial statements Working capital is the capital of a business that is used in its

authorized for issue after their discovery by: (a) restating the day-to-day trading operations, computed as the current assets minus

comparative amounts for the prior period(s) presented in which the the current liabilities.

You might also like

- Correction of ErrorsDocument9 pagesCorrection of ErrorsJaneNo ratings yet

- Meridian, B. (2000) - Lunar Cycle & Stock Market (13 P.)Document13 pagesMeridian, B. (2000) - Lunar Cycle & Stock Market (13 P.)Alexa CosimaNo ratings yet

- Correction of Errors PDFDocument7 pagesCorrection of Errors PDFKylaSalvador0% (2)

- Auditing Problems Lecture On Correction of ErrorsDocument6 pagesAuditing Problems Lecture On Correction of Errorskarlo100% (3)

- Communication Plan September 27Document24 pagesCommunication Plan September 27Rosemarie T. BrionesNo ratings yet

- Module I. Prior Period ErrorsDocument4 pagesModule I. Prior Period ErrorsMelanie SamsonaNo ratings yet

- Po - Komal Spare Parts (00000002)Document9 pagesPo - Komal Spare Parts (00000002)Navdeep Singh GrewalNo ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- Consumer Behaviour, 2nd Edition - Chapter 1Document42 pagesConsumer Behaviour, 2nd Edition - Chapter 1guptamadras100% (1)

- 02 - REO Correction of Errors2 PDFDocument8 pages02 - REO Correction of Errors2 PDFARISNo ratings yet

- 4 Key Accounting Principles ExplainedDocument8 pages4 Key Accounting Principles ExplainedRaviSankarNo ratings yet

- Responsibility AccountingDocument4 pagesResponsibility AccountingEllise FreniereNo ratings yet

- BioPharma Case StudyDocument4 pagesBioPharma Case StudyNaman Chhaya100% (3)

- Notes in Auditing Problems - Correction of ErrorsDocument3 pagesNotes in Auditing Problems - Correction of ErrorsNiño Jemerald TriaNo ratings yet

- Correction of Error LECTUREDocument3 pagesCorrection of Error LECTUREKobe bryantNo ratings yet

- International HR StrategiesDocument51 pagesInternational HR Strategiesmandar85% (26)

- Misstatement in The Financial StatementsDocument3 pagesMisstatement in The Financial Statementspanda 1No ratings yet

- REVIEWER AACA (Midterm)Document15 pagesREVIEWER AACA (Midterm)cynthia karylle natividadNo ratings yet

- Notes - Prior Period Errors PDFDocument6 pagesNotes - Prior Period Errors PDFESTRADA, Angelica T.No ratings yet

- Module 015 Week005-Finacct3 Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocument6 pagesModule 015 Week005-Finacct3 Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNo ratings yet

- Prior Period Error Correction and RestatementDocument1 pagePrior Period Error Correction and Restatementlo jaNo ratings yet

- AP-01B Correction of ErrorsDocument6 pagesAP-01B Correction of ErrorsmarkNo ratings yet

- Suryani Ikasari: Accounting Changes and Error AnalysisDocument4 pagesSuryani Ikasari: Accounting Changes and Error AnalysisSuryani Ikasari SE100% (1)

- Accounting Changes and Error CorrectionsDocument7 pagesAccounting Changes and Error CorrectionsRizzel SubaNo ratings yet

- Correction of Prior Periods ErrorsDocument1 pageCorrection of Prior Periods ErrorsRicky Lloyd TerrenalNo ratings yet

- Financial Statements Recognition Disclosure: Error CorrectionDocument9 pagesFinancial Statements Recognition Disclosure: Error CorrectionWild FlowerNo ratings yet

- Audit Prior Errors Accounting ChangesDocument3 pagesAudit Prior Errors Accounting ChangesNEstandaNo ratings yet

- Notes On Correction of Errors With AnswerDocument12 pagesNotes On Correction of Errors With AnswerprelandgNo ratings yet

- La Verdad Christian College Applied Auditing Correction of ErrorsDocument4 pagesLa Verdad Christian College Applied Auditing Correction of ErrorsMikaela SalvadorNo ratings yet

- Errors and Corrections in AccountingDocument2 pagesErrors and Corrections in AccountingZvioule Ma FuentesNo ratings yet

- Notes On Correction of ErrorsDocument11 pagesNotes On Correction of ErrorsEustaquio Jr., Felix C.No ratings yet

- Accounting ChangesDocument3 pagesAccounting Changesmary aligmayoNo ratings yet

- Example of Prior Period ErrorDocument2 pagesExample of Prior Period ErrorMjhayeNo ratings yet

- DocumentDocument5 pagesDocumentRica RegorisNo ratings yet

- Fa 3 Chapter 15 Error CorrectionDocument5 pagesFa 3 Chapter 15 Error CorrectionKristine Florence Tolentino100% (1)

- Acctg5 C15 Summary Error CorrectionDocument2 pagesAcctg5 C15 Summary Error CorrectionJan Anthony Carlo GuevaraNo ratings yet

- Handout 2 Audit IntegDocument6 pagesHandout 2 Audit IntegJung JeonNo ratings yet

- CFAS Graded Recitation CompleteDocument14 pagesCFAS Graded Recitation CompleteJONATHAN LANCE JOBLENo ratings yet

- 74705bos60485 Inter p1 cp7 U2Document14 pages74705bos60485 Inter p1 cp7 U2jdeconomic06No ratings yet

- Finals ReviewerDocument5 pagesFinals ReviewerGaia BautistaNo ratings yet

- 15 Retained EarningsDocument8 pages15 Retained Earningsrandomlungs121223No ratings yet

- 03 Correction of Error - CTDIDocument15 pages03 Correction of Error - CTDIrubydelacruzNo ratings yet

- Libby 4ce Solutions Manual - Ch04Document92 pagesLibby 4ce Solutions Manual - Ch047595522No ratings yet

- Compilation of Real LifeDocument9 pagesCompilation of Real LifeTristan GarciaNo ratings yet

- Saint Columban College Refreshment Course Financial Statement NotesDocument9 pagesSaint Columban College Refreshment Course Financial Statement Notesۦۦۦۦۦ ۦۦ ۦۦۦNo ratings yet

- Cendant CorporationDocument1 pageCendant Corporation秦雪岭No ratings yet

- Gov Acc Fin Reporting ComDocument7 pagesGov Acc Fin Reporting ComPia Angela ElemosNo ratings yet

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Document36 pagesFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1richardacostaqibnfpmwxd100% (22)

- Financial Accounting Canadian 6th Edition Libby Solutions Manual 1Document107 pagesFinancial Accounting Canadian 6th Edition Libby Solutions Manual 1sharon100% (43)

- Write Offs and Allowance Policy Under 40 CharactersDocument7 pagesWrite Offs and Allowance Policy Under 40 Characterszimitaw yibekalNo ratings yet

- Error Correction MethodsDocument2 pagesError Correction MethodsValentina Tan DuNo ratings yet

- 03 Correction of Error CTDIDocument15 pages03 Correction of Error CTDIAiden PatsNo ratings yet

- FAR1 - Lecture 04 Adjusting Entries - Step 5Document6 pagesFAR1 - Lecture 04 Adjusting Entries - Step 5Patricia Camille AustriaNo ratings yet

- Accounting Policies, Changes and ErrorsDocument16 pagesAccounting Policies, Changes and ErrorsmattNo ratings yet

- Topic Overview: Error CorrectionDocument33 pagesTopic Overview: Error Correctionadarose romaresNo ratings yet

- GHANA COMMUNICATION TECHNOLOGY UNIVERSITY ACCOUNTING CYCLEDocument7 pagesGHANA COMMUNICATION TECHNOLOGY UNIVERSITY ACCOUNTING CYCLEYano NettleNo ratings yet

- Completing The Accounting CycleDocument9 pagesCompleting The Accounting CycleTikaNo ratings yet

- Summary of PAS 8 (Accounting Policies, Changes in Accounting Estimates and Errors)Document3 pagesSummary of PAS 8 (Accounting Policies, Changes in Accounting Estimates and Errors)Mary Jullianne Caile SalcedoNo ratings yet

- Financial Statements Explained: Balance Sheet, Income Statement & Cash FlowDocument12 pagesFinancial Statements Explained: Balance Sheet, Income Statement & Cash FlowDurdana NasserNo ratings yet

- Correction of Errors - NotesDocument1 pageCorrection of Errors - NotesAnne Margarette OngNo ratings yet

- Correction of Accounting ErrorsDocument3 pagesCorrection of Accounting ErrorsClyde RamosNo ratings yet

- Risk and ResponsesDocument10 pagesRisk and ResponsesAbdullahNo ratings yet

- Financial Reporting and Accounting Part III 1 Semester, AY 2017-2018Document10 pagesFinancial Reporting and Accounting Part III 1 Semester, AY 2017-2018Gloria BeltranNo ratings yet

- Ifrs Indian GAPP Cost V/s Fair Value: Components of Financial StatementsDocument8 pagesIfrs Indian GAPP Cost V/s Fair Value: Components of Financial Statementsnagendra2007No ratings yet

- Accounting Errors CorrectionDocument5 pagesAccounting Errors CorrectionandreaNo ratings yet

- CARO 2020 strengthens financial reportingDocument4 pagesCARO 2020 strengthens financial reportingakshali raneNo ratings yet

- STCM 04 Ge CVPDocument2 pagesSTCM 04 Ge CVPdin matanguihanNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- Lesson 5 BtaxDocument6 pagesLesson 5 Btaxdin matanguihanNo ratings yet

- Lesson 4 BtaxDocument4 pagesLesson 4 Btaxdin matanguihanNo ratings yet

- Lesson 6 BtaxDocument5 pagesLesson 6 Btaxdin matanguihanNo ratings yet

- Earn Money Through Product EndorsementDocument16 pagesEarn Money Through Product EndorsementVidya SonawaneNo ratings yet

- Session 12-Balance of PaymentsDocument19 pagesSession 12-Balance of PaymentsJai GaneshNo ratings yet

- Pollution ControlDocument62 pagesPollution ControlshubhamNo ratings yet

- Hyper Launch BrochureDocument22 pagesHyper Launch BrochureQuintin McDonaldNo ratings yet

- Natlonalaerospace8%Andabd: Aiainas N A S 5 6 0Document2 pagesNatlonalaerospace8%Andabd: Aiainas N A S 5 6 0Glenn CHOU100% (1)

- Marcopper Mining CorpDocument7 pagesMarcopper Mining CorpChristine Ivy Delos SantosNo ratings yet

- College of Engineering Perumon: Print ReceiptDocument1 pageCollege of Engineering Perumon: Print ReceiptDILJITH D SNo ratings yet

- Premium CH 2 Thinking Like An EconomistDocument36 pagesPremium CH 2 Thinking Like An EconomistdavidNo ratings yet

- Romania Pestel Analysis Comprehensive Country OutlookDocument6 pagesRomania Pestel Analysis Comprehensive Country OutlookAtharva UppalwarNo ratings yet

- IBS Selection Process GuideDocument24 pagesIBS Selection Process GuideApna time aayegaNo ratings yet

- Accounting Information System: Midterm ExamDocument35 pagesAccounting Information System: Midterm ExamHeidi OpadaNo ratings yet

- Macroeconomics Encapsulated in Three Models (Recovered)Document33 pagesMacroeconomics Encapsulated in Three Models (Recovered)Katherine Asis NatinoNo ratings yet

- Ir l04 U06 TestDocument5 pagesIr l04 U06 TestghostarixNo ratings yet

- Pelangi 2019 PDFDocument194 pagesPelangi 2019 PDFTharshanraaj RaajNo ratings yet

- SAP NetWeaver WAS Administration TrainingDocument8 pagesSAP NetWeaver WAS Administration Trainingchaduvula1995No ratings yet

- A Plan With NO Health Questions and Medical Check-UpsDocument20 pagesA Plan With NO Health Questions and Medical Check-UpsSubang Jaya Youth ClubNo ratings yet

- Goldsavers Food Enterprises - Business PlanDocument50 pagesGoldsavers Food Enterprises - Business PlanAyie Rose HernandezNo ratings yet

- Becoming an Operations Consultant in 40 StepsDocument2 pagesBecoming an Operations Consultant in 40 StepsNicolae NistorNo ratings yet

- PPM02 Project Portfolio Prioritization Matrix - AdvancedDocument5 pagesPPM02 Project Portfolio Prioritization Matrix - AdvancedHazqanNo ratings yet

- Befa Question BankDocument9 pagesBefa Question Bank20bd1a6655No ratings yet

- Assessment On The Influence of Tax Education On Tax Compliance The Case Study of Tanzania Revenue Authority - Keko Bora Temeke BranchDocument33 pagesAssessment On The Influence of Tax Education On Tax Compliance The Case Study of Tanzania Revenue Authority - Keko Bora Temeke BranchSikudhani MmbagaNo ratings yet

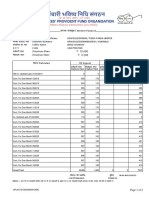

- Member Passbook DetailsDocument2 pagesMember Passbook DetailsNaveen SinghNo ratings yet