Professional Documents

Culture Documents

Recitation

Uploaded by

Mark John BetitoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Recitation

Uploaded by

Mark John BetitoCopyright:

Available Formats

1.

What critical issues were raised after examining/reading Brazil’s Development Problems and

Prospects?

Based on the Case Study about Brazil’s Economy, I can say that that there’s a myriad issues that

were raised including health, corruption, unemployment, political situation, education, income

distribution, inflation, poverty, inequality, and most importantly, the concentrated distribution of

resources. All of these factors explain why Brazil has experienced growth without development as

could be expected from it’s income level. These insurmountable economic barriers stop them from

becoming what they want to be. In short, the reason why their economy has failed to develop is the

failure of their policy makers to extract the potential of their resources, to allocate those resources

equitably to increase consumption of of the poor and to investment, and to channel their attention

into productive industries in the correct priority.

2. Why is domestic savings important for an economy? What is its crucial role in the economy?

Domestic savings is important for an economy because the accumulation of domestic

savings would help stabilize a country’s economic situation. Greater dependence on domestic sources

facilitates a more successful implementation of any planned economic development. It is important

to understand that foreign capital cannot create permanent basis for higher standard of living. Having

a stable domestic savings could be a leeway, a starting point for a country to slowly reduce

unemployment, enable greater development, and increase their GDP and people’s well being. This

strategy will reduce risks to the country’s economy as one of the major problems faced by some

developing countries, like the Philippines, is the burden of external debts and dependence on

international banks.

3. What should government do to increase domestic savings?

The government should focus in improving the saving and investment policies and increase

production. I think one of the reason why there is a relatively low domestic savings to other countries

is because of policies that are implemented prematurely. For example, the government can

incentivize savings by changing the relative interests related to it, either increase it or give more

benefits. Having a sound monetary policy will be the cornerstone to increase domestic savings.

4. What happens when a government over borrow, over tax ad under invest?

If a government over borrow, it can lead to trade imbalances and even financial crises in the long

run. It would have a domino effect in the economy as it will incur higher debt interest, increase tax

collection, and inflation. Higher tax collection will also yield negative effect on the economy. Over

taxing can also discourage work, savings, and investment. It causes inadequate incomes for the family,

low wages, high prices, low purchasing power and even permanent economic recession if not given

immediate attention. All of these could also lead to under investment of the government. And if there

is under investment, the government will not be able to create public infrastructure that is essential

for long term economic growth and societal well-being like roads, housing, school buildings, hospitals,

and communication networks.

You might also like

- Born On Third Base - IntroductionDocument6 pagesBorn On Third Base - IntroductionChelsea Green PublishingNo ratings yet

- Financial Planning Tute AnswersDocument11 pagesFinancial Planning Tute AnswersJason DaiNo ratings yet

- Emily Rosal Ate CokesDocument2 pagesEmily Rosal Ate CokesJazel CuyosNo ratings yet

- Fiscal PolicyDocument2 pagesFiscal PolicyredNo ratings yet

- B. Env. Unit 4 Part 3Document5 pagesB. Env. Unit 4 Part 3Sarthak AggarwalNo ratings yet

- Task 2 Yesterday's Himanshu KumarDocument6 pagesTask 2 Yesterday's Himanshu KumarImran HussainNo ratings yet

- Q 1Document40 pagesQ 1Gaurav AgarwalNo ratings yet

- Domestic Monetary Policy, Technology, and Economic GrowthDocument6 pagesDomestic Monetary Policy, Technology, and Economic GrowthSayed PiousNo ratings yet

- What Is The Issue That Is Being Addressed?Document4 pagesWhat Is The Issue That Is Being Addressed?Diela KasimNo ratings yet

- Public Fiscal AdministrationDocument4 pagesPublic Fiscal AdministrationCarmela Kim SicatNo ratings yet

- Effect of National Saving On Economic Growth of EthiopiaDocument8 pagesEffect of National Saving On Economic Growth of EthiopiaLema AsnakewNo ratings yet

- The Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsFrom EverandThe Power to Stop any Illusion of Problems: (Behind Economics and the Myths of Debt & Inflation.): The Power To Stop Any Illusion Of ProblemsNo ratings yet

- Cost of Living and Standard of LivingDocument23 pagesCost of Living and Standard of LivingsafwanaliibroNo ratings yet

- ACCA BT Topic 4 NotesDocument5 pagesACCA BT Topic 4 Notesعمر اعظمNo ratings yet

- Class 1 ECO 214Document2 pagesClass 1 ECO 214Peter DundeeNo ratings yet

- Jethro Reales AB-Political Science Fiscal and Monetary PolicyDocument6 pagesJethro Reales AB-Political Science Fiscal and Monetary PolicyBug me notNo ratings yet

- Impact of Fiscal Policy in India: J J, (Last Visited September 15, 2018)Document4 pagesImpact of Fiscal Policy in India: J J, (Last Visited September 15, 2018)Harjyot SinghNo ratings yet

- ACAD WritingExercise1Document2 pagesACAD WritingExercise1Kaia HamadaNo ratings yet

- Jimma University College of Agriculture and Veterinary MedicineDocument2 pagesJimma University College of Agriculture and Veterinary MedicineÜm Yöñí Åvïd GödNo ratings yet

- Eco TambakDocument5 pagesEco TambakmickaelarosegardiolaNo ratings yet

- Applied Economic ReportDocument24 pagesApplied Economic ReportNj SarioNo ratings yet

- Government Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmallDocument6 pagesGovernment Saving Has Not Grown Much in The Developing Countries and Corporate Saving Is Relatively SmalljoooNo ratings yet

- Responsibility of Fiscal Policy UPDATEDDocument24 pagesResponsibility of Fiscal Policy UPDATEDFiona RamiNo ratings yet

- Topic: Economic Policies: I. Learning ObjectivesDocument11 pagesTopic: Economic Policies: I. Learning ObjectivesAlexis KingNo ratings yet

- 26 Economic Development & 4.2 Measuring DevelopmentDocument95 pages26 Economic Development & 4.2 Measuring DevelopmentDarryn FlettNo ratings yet

- Fiscal PolicyDocument10 pagesFiscal PolicygyytgvyNo ratings yet

- Importance of Economic DevelopmentDocument7 pagesImportance of Economic DevelopmentORINDAY, Precious Pearl C.No ratings yet

- Fiscal PolicyDocument12 pagesFiscal PolicyPule JackobNo ratings yet

- Name: Hieu Nguyen FIN 516: Managerial Macroeconomic Prof. Jessica RutledgeDocument10 pagesName: Hieu Nguyen FIN 516: Managerial Macroeconomic Prof. Jessica RutledgeHiếu Nguyễn Minh HoàngNo ratings yet

- Chapter 10 ReportDocument19 pagesChapter 10 ReportDarwin SolanoyNo ratings yet

- Business Studies 4 (Unit 1)Document8 pagesBusiness Studies 4 (Unit 1)haidulamonicaNo ratings yet

- Applied Economics Week 2: Harold Sta. Cruz, ABM 11 CañoneroDocument3 pagesApplied Economics Week 2: Harold Sta. Cruz, ABM 11 CañoneroHaryoung Sta CruzNo ratings yet

- Fiscal Policy - 1Document6 pagesFiscal Policy - 1Prashant SinghNo ratings yet

- 10 Strong Economical Countries Around The WorldDocument3 pages10 Strong Economical Countries Around The WorldMd Sabbir HossainNo ratings yet

- Macroeconomic Problems of India Economy ProjectDocument4 pagesMacroeconomic Problems of India Economy ProjectSatyendra Latroski Katrovisch77% (52)

- Public Fiscal ManagementDocument5 pagesPublic Fiscal ManagementClarizze DailisanNo ratings yet

- Contemp 3Document3 pagesContemp 3Johanna Marie PeroyNo ratings yet

- Process of Capital FormationDocument2 pagesProcess of Capital Formationmanishaamba7547100% (2)

- Performance TaskDocument19 pagesPerformance TaskNadine Ailet CornelNo ratings yet

- Lesson Materials and Activity Sheets in Applied Economics - Week 7Document13 pagesLesson Materials and Activity Sheets in Applied Economics - Week 7Willie Cientos GantiaNo ratings yet

- Development Economics Research Paper TopicsDocument5 pagesDevelopment Economics Research Paper Topicsafmcsmvbr100% (1)

- Governments Role in Managing The EconomyDocument6 pagesGovernments Role in Managing The EconomyAMIEL TACULAONo ratings yet

- Unit 2. Market Economy vs. Planned Economy: 1. After Reading The Text, Provide Answers To The Following QuestionsDocument3 pagesUnit 2. Market Economy vs. Planned Economy: 1. After Reading The Text, Provide Answers To The Following Questionsmihaela007mNo ratings yet

- EC112 Bonus Paper 1Document2 pagesEC112 Bonus Paper 1BRIAN GODWIN LIMNo ratings yet

- Five Debates by Jatin Ravi N MaheshDocument33 pagesFive Debates by Jatin Ravi N Maheshyajuvendra7091No ratings yet

- Assignment 2 DEDocument5 pagesAssignment 2 DEbakhtawarNo ratings yet

- Eco ProjctDocument8 pagesEco Projctneha shaikhNo ratings yet

- Kathamandu University School of Management (KUSOM) : Development Economics Analytical Assignment # 4 Corruption and GrowthDocument5 pagesKathamandu University School of Management (KUSOM) : Development Economics Analytical Assignment # 4 Corruption and Growthivan kayasthaNo ratings yet

- Public Finance IIDocument8 pagesPublic Finance IIBimo Danu PriambudiNo ratings yet

- MBA-101: Business Environment Ques 3. What Is Disinvestment? Explain Various Challenges To Disinvestment ProgrammeDocument8 pagesMBA-101: Business Environment Ques 3. What Is Disinvestment? Explain Various Challenges To Disinvestment ProgrammeAtul JainNo ratings yet

- DOC2Document2 pagesDOC2nickNo ratings yet

- Research Paper On Monetary and Fiscal PolicyDocument8 pagesResearch Paper On Monetary and Fiscal Policyafeascdcz100% (1)

- Two Major Issues of Fiscal Policy and Potential Harms To The EconomyDocument10 pagesTwo Major Issues of Fiscal Policy and Potential Harms To The Economysue patrickNo ratings yet

- Online Class Activity 1 Cash Management in A CrisisDocument9 pagesOnline Class Activity 1 Cash Management in A CrisisReb RenNo ratings yet

- Macroeconomics AssignmentDocument3 pagesMacroeconomics AssignmentVinoRaviNo ratings yet

- C E S - C I W S: Urrent Conomic Cenario AN Ndia Eather The TormDocument5 pagesC E S - C I W S: Urrent Conomic Cenario AN Ndia Eather The TormAbhishek DattaNo ratings yet

- August 2020Document2 pagesAugust 2020Ravindra JainNo ratings yet

- ECM NotesDocument18 pagesECM NotesJustin LipmanNo ratings yet

- Fiscal PolicyDocument23 pagesFiscal Policyapi-376184490% (10)

- Eco Dev MidtermDocument6 pagesEco Dev MidtermGlenn VeluzNo ratings yet

- Answer: 2,000,000 Solution:: Sample ProblemDocument17 pagesAnswer: 2,000,000 Solution:: Sample ProblemJohayra AbbasNo ratings yet

- EuthanasiaDocument1 pageEuthanasiaMark John BetitoNo ratings yet

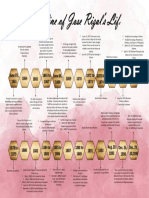

- Timeline of Jose RizalDocument1 pageTimeline of Jose RizalMark John BetitoNo ratings yet

- RIZALDocument1 pageRIZALMark John BetitoNo ratings yet

- Pop CultureDocument2 pagesPop CultureMark John BetitoNo ratings yet

- Life and Works of RizalDocument1 pageLife and Works of RizalMark John BetitoNo ratings yet

- Life and Works of Rizal 2Document3 pagesLife and Works of Rizal 2Mark John BetitoNo ratings yet

- The Treasures of The EarthDocument51 pagesThe Treasures of The EarthJCGF100% (1)

- Conversations With MillionairesDocument227 pagesConversations With MillionairesPhạm An Viên100% (4)

- Annual 2019 Poverty GuidelinesDocument1 pageAnnual 2019 Poverty GuidelinesAlexandra BjörnNo ratings yet

- Industrial JurisprudenceDocument37 pagesIndustrial JurisprudenceNandha KumaranNo ratings yet

- Merits and Demerits of Islamic Economic SystemDocument2 pagesMerits and Demerits of Islamic Economic SystemjadoonnnNo ratings yet

- Blume Durlauf 2015 JPE Capital in 21st Century ReviewDocument29 pagesBlume Durlauf 2015 JPE Capital in 21st Century ReviewhoangpvrNo ratings yet

- Heather Dockery 3721 S 152ND ST Apt 20 TUKWILA, WA 98188Document2 pagesHeather Dockery 3721 S 152ND ST Apt 20 TUKWILA, WA 98188Heather dockeryNo ratings yet

- Combination or Series of Overt or Criminal ActsDocument2 pagesCombination or Series of Overt or Criminal ActssashinaNo ratings yet

- Project Batubara PT - Dimori Jaya Atau PT. ECIDocument1 pageProject Batubara PT - Dimori Jaya Atau PT. ECIwindu ajiNo ratings yet

- 1hughes J Dummett P Life Upper Intermediate Workbook b2Document5 pages1hughes J Dummett P Life Upper Intermediate Workbook b2Ira Verhogliad0% (1)

- ACC19 Financial Management: College of Accountancy and Business AdministrationDocument4 pagesACC19 Financial Management: College of Accountancy and Business Administrationjelyn bermudezNo ratings yet

- 07363769410070872Document15 pages07363769410070872Palak AgarwalNo ratings yet

- Helix Bond - Privilidge - Wealth PDFDocument12 pagesHelix Bond - Privilidge - Wealth PDFhyenadogNo ratings yet

- CH 27 Sect 2 Affluent SocietyDocument6 pagesCH 27 Sect 2 Affluent SocietysarajamalsweetNo ratings yet

- Zakat CalculatorDocument10 pagesZakat CalculatorAmliyatNo ratings yet

- Alexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002Document45 pagesAlexander G. S., Comparing The Two Legal Realisms American and Scandinavian, 2002andresabelr100% (1)

- Social Harmony and Democracy. DR - Kedar.karki BackgroundDocument4 pagesSocial Harmony and Democracy. DR - Kedar.karki BackgroundvivNo ratings yet

- Economics Class 11 Unit 1 - Basic-Concept-Of-EconomicDocument0 pagesEconomics Class 11 Unit 1 - Basic-Concept-Of-Economicwww.bhawesh.com.np100% (5)

- GR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)Document7 pagesGR Oup: 1: Mahnoor Naseer (6155129) Khadija Azeem (6155127) Fiza Alvi (6155111) Rabia Malik (615511)fiza alviNo ratings yet

- How Capitalism Works - HowStuffWorksDocument10 pagesHow Capitalism Works - HowStuffWorksSérgio BragaNo ratings yet

- Economic Analysis of India and Industry Analysis of Chemical IndustryDocument28 pagesEconomic Analysis of India and Industry Analysis of Chemical IndustrySharanyaNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationAlijah MercadoNo ratings yet

- Malaysia Inequality & PovertyDocument5 pagesMalaysia Inequality & PovertyYusri YusoffNo ratings yet

- The Wealth Report Wealth PopulationsDocument4 pagesThe Wealth Report Wealth Populationsremo meinNo ratings yet

- Fundamentals Cheat SheetDocument2 pagesFundamentals Cheat SheetUDeconNo ratings yet

- ECON 121 Printed NotesDocument27 pagesECON 121 Printed NotesShrau ShrauNo ratings yet

- Wealth of NationsDocument3 pagesWealth of Nationsbloodberry1017No ratings yet

- Matrix of Mind RealityDocument27 pagesMatrix of Mind RealityAkosuia100% (4)

- e-WME 3.0 Workbook (Eng) Rev02 Dated 01092019Document56 pagese-WME 3.0 Workbook (Eng) Rev02 Dated 01092019Ali AbduNo ratings yet