100% found this document useful (1 vote)

3K views2 pagesMS Excel Exam

1. Open a new Excel workbook and save it as "MS_Excel_Exam" on the desktop.

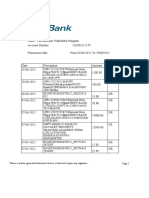

2. Create a table on sheet1 called "EthioNet IT Solutions Employee Payroll" with columns for name, gender, basic salary, transport allowance, overtime, gross salary, pension tax, income tax, and net pay.

3. Calculate transport allowance as 25% of basic salary, overtime as 30% of basic salary, and gross salary as basic salary plus overtime.

Filter female employees and copy to sheet2 renamed as "Female". Save the workbook.

Uploaded by

getanehCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

100% found this document useful (1 vote)

3K views2 pagesMS Excel Exam

1. Open a new Excel workbook and save it as "MS_Excel_Exam" on the desktop.

2. Create a table on sheet1 called "EthioNet IT Solutions Employee Payroll" with columns for name, gender, basic salary, transport allowance, overtime, gross salary, pension tax, income tax, and net pay.

3. Calculate transport allowance as 25% of basic salary, overtime as 30% of basic salary, and gross salary as basic salary plus overtime.

Filter female employees and copy to sheet2 renamed as "Female". Save the workbook.

Uploaded by

getanehCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Microsoft Excel Practical Exam

- Student Mark List Creation