Professional Documents

Culture Documents

AOC 1 Solution - PdfToWord

Uploaded by

Dapeng BuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AOC 1 Solution - PdfToWord

Uploaded by

Dapeng BuCopyright:

Available Formats

Acquisition of Control Additional Question Solution

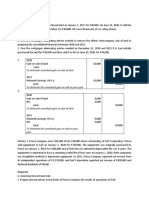

Cost UCC FMV

Marketable Securities $100,000 N/A $600,000

Inventory 66,000 N/A 90,000

Land 180,000 N/A 400,000

Building 240,000 $166,000 360,000

Equipment 170,000 68,000 40,000 - business loss

1) Election available to any non-depreciable or depreciable properties where fair

value is greater than cost/UCC, as a result, the election could be made on:

Marketable securities,

Land

Building

Election made to Marketable securities and land since if an election made on

building or equipment, a recapture would occur, which need to be offset by non-

capital loss. But, the non-capital loss could be carry over to future years.

Net-capital loss by Aug 31, 2020 is $80,000 ($20,000 + $60,000)

To fully utilize the net-capital loss, 160,000 capital gain need to be elected to

either, land or Marketable securities.

Elected amount for land would be $340,000 and securities would be $260,000

2)

Assume: election amount applied to land ACB = 180,000 + 160,000=340,000

ACB UCC

Marketable Securities 100,000 N/A

Inventory 66,000 N/A

Land 340,000 N/A

Building 240,000 166,000

Equipment 170,000 40,000

Assume: election amount applied to land ACB = 180,000 + 160,000=340,000

3) ITL:

Business loss (75,000)

Business loss for Equipment (28,000)

Taxable Capital Gain 80,000

Net-Capital Loss (80,000) 0

Net Income $103,000

4) Non-Capital loss: 80,000 + 120,000+103,000 =$303,000

5) In order to deduct the non-capital losses, the IT consulting business, which incurred the

losses, must be carried on throughout the taxation year at a profit or with a reasonable

expectation of profit.

These conditions are met in 2020 and 2021. The IT consulting business is carried on at a

profit throughout both of these years.

The non-capital losses can be deducted to the extent there is income from the business that

incurred the losses (IT consulting) or income from a business selling similar products or

providing similar services as the IT consulting business. In this case there are no similar

businesses being carried on. Non-capital losses of $60,000 and $120,000 can be deducted

in 2020 and 2021, respectively.

You might also like

- Intercompany Sale of Fixed AssetsDocument5 pagesIntercompany Sale of Fixed AssetsasdasdaNo ratings yet

- WORKSHEET - 5 On CFSDocument6 pagesWORKSHEET - 5 On CFSNavya KhemkaNo ratings yet

- Let's Check: To Eliminate Unrealized Gain On Sale of LandDocument4 pagesLet's Check: To Eliminate Unrealized Gain On Sale of Landalmira garciaNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Lape - ACP312 - ULOa - Let's Check! Week 8Document3 pagesLape - ACP312 - ULOa - Let's Check! Week 8Bryle Jay LapeNo ratings yet

- DIFFICULTDocument7 pagesDIFFICULTQueen ValleNo ratings yet

- ProblemDocument30 pagesProblemJenika AtanacioNo ratings yet

- Key UNIT II B SubsequentDocument6 pagesKey UNIT II B SubsequentDaisy TañoteNo ratings yet

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocument5 pagesBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- ACC 345 Module One Homework Template - StudentDocument37 pagesACC 345 Module One Homework Template - Studenttara50% (10)

- Solution.: ST ND RD THDocument4 pagesSolution.: ST ND RD THhaggaiNo ratings yet

- Find Question 3Document2 pagesFind Question 3hasgonde123No ratings yet

- Reference: Picker Et Al (2012) - Chapter 12 IAS 16 Property, Plant and EquipmentDocument25 pagesReference: Picker Et Al (2012) - Chapter 12 IAS 16 Property, Plant and EquipmentBrenden KapoNo ratings yet

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- Quiz 3 Ppe QuestionsDocument4 pagesQuiz 3 Ppe QuestionsJessica Marie MigrasoNo ratings yet

- ACT 421 Ch. 1Document6 pagesACT 421 Ch. 1Kristilyn CartaNo ratings yet

- Far Quiz 2 Final W AnswersDocument4 pagesFar Quiz 2 Final W AnswersMarriz Bustaliño Tan78% (9)

- Events After The Reporting PeriodDocument5 pagesEvents After The Reporting PeriodIohc NedmiNo ratings yet

- Pfrs 3 and 10 EXAM - FINALDocument12 pagesPfrs 3 and 10 EXAM - FINALElizabeth DumawalNo ratings yet

- Final Account WorksheetDocument4 pagesFinal Account Worksheetravikumarbadass0No ratings yet

- Prime Company Lane Company: RequiredDocument8 pagesPrime Company Lane Company: RequiredSinta AnnisaNo ratings yet

- Quiz - Topic 5Document3 pagesQuiz - Topic 5mariakate LeeNo ratings yet

- A1c019112 Jeremy Christ Manuel AklDocument21 pagesA1c019112 Jeremy Christ Manuel AklJeremy Christ ManuelNo ratings yet

- Audit of PPE AnnotatedDocument10 pagesAudit of PPE AnnotatedLloydNo ratings yet

- Week 5 TutorialDocument8 pagesWeek 5 TutorialRenee WongNo ratings yet

- Module 3 - Subsequent To AcquisitionDocument8 pagesModule 3 - Subsequent To AcquisitionRENZ ALFRED ASTRERONo ratings yet

- Chapter 5Document6 pagesChapter 5Villanueva, Jane G.No ratings yet

- Homework CH 5 1Document46 pagesHomework CH 5 1LNo ratings yet

- Yohannes Sinaga - 023001801165 - AKL - Bab4 2Document6 pagesYohannes Sinaga - 023001801165 - AKL - Bab4 2Yohannes SinagaNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document7 pagesQuiz Chapter 5 Consol. Fs Part 2Meagan AndesNo ratings yet

- Far Quiz 2 Final W AnswersDocument6 pagesFar Quiz 2 Final W AnswersGia HipolitoNo ratings yet

- Comprehensive Problem On Intercompany TransactionsDocument9 pagesComprehensive Problem On Intercompany TransactionsasdasdaNo ratings yet

- Jawaban Soal Quiz No 2 Dan 3Document4 pagesJawaban Soal Quiz No 2 Dan 3Anthony indrahalimNo ratings yet

- Accounting QuestionsDocument18 pagesAccounting QuestionsashmitaNo ratings yet

- 1.statement of Cash Flows - MIDTERMDocument27 pages1.statement of Cash Flows - MIDTERMMaeNo ratings yet

- PANOPIO Activity1 BLOCK3209Document6 pagesPANOPIO Activity1 BLOCK3209panopiojessiemae4No ratings yet

- Ffa ADocument5 pagesFfa Aaccounts officerNo ratings yet

- Solutions To ProblemsDocument33 pagesSolutions To ProblemsggjjyyNo ratings yet

- Solutions Ch08Document19 pagesSolutions Ch08KyleNo ratings yet

- Assignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliDocument5 pagesAssignment: 1: Submitted By: Reema Saju STUDENT ID:301119165 Submitted To: Prof - Neha KohliReema SajuNo ratings yet

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your OwnDocument9 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As Your Ownkswb12No ratings yet

- Problems On Flexible BudgetDocument3 pagesProblems On Flexible BudgetsafwanhossainNo ratings yet

- ClassProblemsChapter5 SolutionDocument6 pagesClassProblemsChapter5 SolutionA373728272No ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- QPractical Accounting Problems IIDocument34 pagesQPractical Accounting Problems IIZee GuillebeauxNo ratings yet

- Practice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementDocument5 pagesPractice Problem Set #1 Capital Budgeting - Solution - : FIN 448, Sections 2 & 3, Fall 2020 Advanced Financial ManagementAndrewNo ratings yet

- Brigham Chap 11 Practice Questions Solution For Chap 11Document11 pagesBrigham Chap 11 Practice Questions Solution For Chap 11robin.asterNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Quiz Chapter 5 Consol. Fs Part 2Document14 pagesQuiz Chapter 5 Consol. Fs Part 2Maryjoy Sarzadilla JuanataNo ratings yet

- DAGUPLO - Tour 131 WFX - Exercises For Nov 17Document2 pagesDAGUPLO - Tour 131 WFX - Exercises For Nov 17Alexis B. DaguploNo ratings yet

- Principles of Taxation Mmu Jan-April 2022 AssignmentDocument4 pagesPrinciples of Taxation Mmu Jan-April 2022 AssignmentFlora WairimuNo ratings yet

- Accountancy-I SubjectiveDocument2 pagesAccountancy-I SubjectiveAhmedNo ratings yet

- Enriquez, Michaella Activity1 Bsa3203Document13 pagesEnriquez, Michaella Activity1 Bsa3203Miks EnriquezNo ratings yet

- MODULE 3-Short Problems (2.0)Document4 pagesMODULE 3-Short Problems (2.0)asdasdaNo ratings yet

- 1 - Accounting Information Systems Problems With SolutionsDocument22 pages1 - Accounting Information Systems Problems With Solutionsbusiness docNo ratings yet

- Intellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementFrom EverandIntellectual Property: Valuation, Exploitation, and Infringement Damages, 2016 Cumulative SupplementNo ratings yet

- File1 7708Document26 pagesFile1 7708SanthoshNo ratings yet

- FIDIC IV - Design & Build (Turnkey) ContractDocument70 pagesFIDIC IV - Design & Build (Turnkey) Contractlittledragon0110100% (6)

- Junos Security Swconfig Interfaces and RoutingDocument1,050 pagesJunos Security Swconfig Interfaces and RoutingAkhilesh KumarNo ratings yet

- Pintu Tax Report 2022 (02.08.23 17.29.46)Document2 pagesPintu Tax Report 2022 (02.08.23 17.29.46)Dulah SaepulohNo ratings yet

- Balance Sheet 2022Document4 pagesBalance Sheet 2022Llus NaruamNo ratings yet

- Confiscation of Jewish Property in EuropeDocument156 pagesConfiscation of Jewish Property in EuropeRadu Simandan100% (2)

- Pearsons Federal Taxation 2018 Corporations Partnerships Estates Trusts 31st Edition Anderson Solutions ManualDocument39 pagesPearsons Federal Taxation 2018 Corporations Partnerships Estates Trusts 31st Edition Anderson Solutions Manualhenrycpwcooper100% (13)

- Liggett & Myers Co. v. United States, 299 U.S. 383 (1937)Document4 pagesLiggett & Myers Co. v. United States, 299 U.S. 383 (1937)Scribd Government DocsNo ratings yet

- Annual Report 2016Document49 pagesAnnual Report 2016Muhammad haseebNo ratings yet

- Chapter 3Document16 pagesChapter 3Zhang XuantaoNo ratings yet

- Integrated Tax Management System in KenyaDocument15 pagesIntegrated Tax Management System in KenyaGeorge OtienoNo ratings yet

- Settlement of EstatesDocument25 pagesSettlement of EstatesRochelle Adajar-BacallaNo ratings yet

- A Review of Roy Rohatgis Basic International TaxaDocument7 pagesA Review of Roy Rohatgis Basic International TaxaAto SumartoNo ratings yet

- Fsapm AssignmentDocument19 pagesFsapm AssignmentAnkita DasNo ratings yet

- 20244231544240339sro 614 (I) 2024Document1 page20244231544240339sro 614 (I) 2024BILWANI CONo ratings yet

- Constellation Software SH Letters (Merged)Document105 pagesConstellation Software SH Letters (Merged)RLNo ratings yet

- BAC 4644 Assignment Sem 47Document5 pagesBAC 4644 Assignment Sem 47Nur AmiraNo ratings yet

- R R MarblesDocument9 pagesR R Marblessri sai digital careNo ratings yet

- Management AnalysisDocument23 pagesManagement AnalysisMiracle Vertera100% (1)

- M3104 Industrial Touch Screen Monitor: User and Calibration ManualDocument14 pagesM3104 Industrial Touch Screen Monitor: User and Calibration ManualfachrulNo ratings yet

- Standard Apartment Cost Sheet: 24K OpulaDocument1 pageStandard Apartment Cost Sheet: 24K OpulaRavi NigamNo ratings yet

- CC Inr-26886192 PDFDocument1 pageCC Inr-26886192 PDFJhumpa MalNo ratings yet

- Dwnload Full Practical Financial Management 7th Edition Lasher Solutions Manual PDFDocument13 pagesDwnload Full Practical Financial Management 7th Edition Lasher Solutions Manual PDFkerbeylopuhh100% (10)

- PUBLIC PROCUREMENT. BPLM II, BPSAF II, BAC III - 2019 by Tubeti MwitaDocument539 pagesPUBLIC PROCUREMENT. BPLM II, BPSAF II, BAC III - 2019 by Tubeti MwitaFesto OtuomaNo ratings yet

- Public ExpenditureDocument18 pagesPublic ExpenditureFrank MaluluNo ratings yet

- GST On Reverse ChargeDocument5 pagesGST On Reverse ChargeHEERA BABU MERTIANo ratings yet

- GD PI Topics 2019Document54 pagesGD PI Topics 2019satyajitNo ratings yet

- Himalayan Java - Proposed Expansion Plan Into South KoreaDocument27 pagesHimalayan Java - Proposed Expansion Plan Into South KoreaUttam Rai0% (1)

- Indonesia 2nd Edition The Transfer Pricing Law ReviewDocument22 pagesIndonesia 2nd Edition The Transfer Pricing Law ReviewArianty Damaiance SilabanNo ratings yet

- Ud Abadi (Data Awal)Document2 pagesUd Abadi (Data Awal)syifaNo ratings yet