Professional Documents

Culture Documents

CCR Basel II RBI

CCR Basel II RBI

Uploaded by

gopalushaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CCR Basel II RBI

CCR Basel II RBI

Uploaded by

gopalushaCopyright:

Available Formats

Capital Charge for Counterparty Credit Risk

The credit exposure for the purpose of counterparty credit risk on account of CDS

transactions in the Trading Book will be calculated according to the Current Exposure

Method9 under Basel II framework.

2.3.3.1 Protection Seller

A protection seller will have exposure to the protection buyer only if the fee / premia are

outstanding. In such cases, the counterparty credit risk charge for all single name long CDS

positions in the Trading Book will be calculated as the sum of the current marked-to-market

value, if positive (zero, if marked-to-market value is negative) and the potential future

exposure add-on factors based on table given below. However, the add-on will be capped to

the amount of unpaid premia.

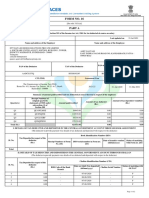

Add-on Factors for Protection Sellers

(As % of Notional Principal of CDS)

Type of Reference Obligation Add-on Factor

Obligations rated BBB- and above 10%

Below BBB- and unrated 20%

2.3.3.2 Protection Buyer

A CDS contract creates a counterparty exposure on the protection seller on account of the

credit event payment. The counterparty credit risk charge for all short CDS positions in the

Trading Book will be calculated as the sum of the current marked-to-market value, if positive

(zero, if marked-to-market value is negative) and the potential future exposure add-on factors

based on table given below

Add-on Factors for Protection Buyers

(As % of Notional Principal of CDS)

Type of Reference Obligation Add-on Factor

Obligations rated BBB- and above 10%

Below BBB- and unrated 20%

2.3.3.3 Capital Charge for Counterparty Risk for Collateralised Transactions in CDS

As mentioned in paragraph 3.3 of the circular IDMD.PCD.No.5053/14.03.04/2010-11 dated

May 23, 2011, collaterals and margins would be maintained by the individual market

participants. The counterparty exposure for CDS traded in the OTC market will be calculated

as per the Current Exposure Method. Under this method, the calculation of the counterparty

credit risk charge for an individual contract, taking into account the collateral, will be as

follows:

Counterparty risk capital charge = [(RC + add-on) – CA] x r x 9%

where:

RC = the replacement cost,

add-on = the amount for potential future exposure calculated according to paragraph 7 above.

CA = the volatility adjusted amount of eligible collateral under the comprehensive approach

prescribed in paragraphs 7.3 "Credit Risk Mitigation Techniques - Collateralised

Transactions" of the Master Circular on New Capital Adequacy Framework dated July 2,

2012, or zero if no eligible collateral is applied to the transaction, and

r = the risk weight of the counterparty.

You might also like

- Handbook of Basel III Capital: Enhancing Bank Capital in PracticeFrom EverandHandbook of Basel III Capital: Enhancing Bank Capital in PracticeNo ratings yet

- Security Interest Enforcement Rules PDFDocument14 pagesSecurity Interest Enforcement Rules PDFgopalushaNo ratings yet

- Credit DerivativesDocument37 pagesCredit DerivativesshehzadshroffNo ratings yet

- Job Order Costing Quiz AnswerDocument7 pagesJob Order Costing Quiz AnswerElaine Joyce GarciaNo ratings yet

- Counterparty Credit RiskDocument16 pagesCounterparty Credit RiskbankamitNo ratings yet

- Equity Derivatives Beginners ModuleDocument67 pagesEquity Derivatives Beginners ModuleVivek KumarNo ratings yet

- World Savings Bank REMIC 12 PSADocument88 pagesWorld Savings Bank REMIC 12 PSAmtgfixerNo ratings yet

- Techniques Used On The Credit Derivatives Market: Credit Default SwapsDocument14 pagesTechniques Used On The Credit Derivatives Market: Credit Default Swapskdshah85No ratings yet

- BFS L0 QuesDocument360 pagesBFS L0 QuesShubhamKaseraNo ratings yet

- Marriott CaseDocument4 pagesMarriott CaseKyle FoleyNo ratings yet

- Republic-Act-9520 Aka Philippine Coop CodeDocument30 pagesRepublic-Act-9520 Aka Philippine Coop Codethe 13th fridayNo ratings yet

- Form 16 - FY 20 - 21 - FY 2020 - 2021Document9 pagesForm 16 - FY 20 - 21 - FY 2020 - 2021Amit GautamNo ratings yet

- RSK4804 Mayjun Exam 2023Document12 pagesRSK4804 Mayjun Exam 2023bradley.malachiclark11No ratings yet

- Risk Management - Insurances, Bonds and Collateral Warranties-1Document68 pagesRisk Management - Insurances, Bonds and Collateral Warranties-1LokuliyanaNNo ratings yet

- LVA, FVA, CVA, DVA Impacts On Derivatives ManagementDocument39 pagesLVA, FVA, CVA, DVA Impacts On Derivatives ManagementindisateeshNo ratings yet

- SCO IC 45 - 300kDocument3 pagesSCO IC 45 - 300kFarhan Ashraf100% (1)

- Zara Team Brand Positioning & Activation-2Document29 pagesZara Team Brand Positioning & Activation-2Rachel YangNo ratings yet

- Quantitative Equity Portfolio Management An Active Approach To Portfolio Construction and Management 2Nd Edition Ludwig B Chincarini All ChapterDocument68 pagesQuantitative Equity Portfolio Management An Active Approach To Portfolio Construction and Management 2Nd Edition Ludwig B Chincarini All Chapterwilliam.rebman745100% (6)

- Counterparty Credit Risk: Roman KornyliukDocument47 pagesCounterparty Credit Risk: Roman KornyliukAtul KapurNo ratings yet

- Credit Default Swap (CDS) : ExampleDocument5 pagesCredit Default Swap (CDS) : ExampleVeeken ChaglassianNo ratings yet

- Basel 3Document40 pagesBasel 3rodney101No ratings yet

- CRE52Document44 pagesCRE52Renu MundhraNo ratings yet

- CRE32Document14 pagesCRE32wissalriyaniNo ratings yet

- CRE31Document14 pagesCRE31soleimany.mehrdadNo ratings yet

- 11 - CDS Cash FlowsDocument4 pages11 - CDS Cash Flowssumit sharmaNo ratings yet

- Functioning of CDS PDFDocument5 pagesFunctioning of CDS PDFKeval ShahNo ratings yet

- Good Articke On Credit RiskDocument3 pagesGood Articke On Credit Riskumesh31027No ratings yet

- 11-12 1st MFI Credit DerivativesDocument22 pages11-12 1st MFI Credit DerivativesChris LauNo ratings yet

- RRRDocument1 pageRRRRohan SinghNo ratings yet

- CRE52 - Standardized ApproachDocument44 pagesCRE52 - Standardized ApproachCuong NguyenNo ratings yet

- Risk 1211 Brigo NewDocument5 pagesRisk 1211 Brigo NewevanderstraetenbisNo ratings yet

- Cloud Across AtlanticDocument6 pagesCloud Across AtlanticArif AhmedNo ratings yet

- BFM Mod D-1Document2 pagesBFM Mod D-1Raghvendra SinghNo ratings yet

- CRE31Document6 pagesCRE31wissalriyaniNo ratings yet

- BMMF5103 - Answer Scheme Exam July 2012Document8 pagesBMMF5103 - Answer Scheme Exam July 2012mohant3ch100% (1)

- Basel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskDocument19 pagesBasel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskAnghel StefanNo ratings yet

- Liability Is Something A Person or Company Owes, Usually A Sum of Money. ... Recorded OnDocument5 pagesLiability Is Something A Person or Company Owes, Usually A Sum of Money. ... Recorded OnedrianclydeNo ratings yet

- Insurance Pricing: Manoj Verma MaimsDocument17 pagesInsurance Pricing: Manoj Verma MaimsKanika KuchhalNo ratings yet

- Modelling The Loss Given Default For Retail Contracts CompressedDocument96 pagesModelling The Loss Given Default For Retail Contracts CompressedSushantNo ratings yet

- Counterparty Risk 20 Feb 08Document20 pagesCounterparty Risk 20 Feb 08Shanaz ParsanNo ratings yet

- Counterparty Risk Subject To Additional Termination Event ClausesDocument36 pagesCounterparty Risk Subject To Additional Termination Event ClausesgileperNo ratings yet

- Not InsuranceDocument3 pagesNot InsuranceKritiNo ratings yet

- Basel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskDocument439 pagesBasel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskHamza AmiriNo ratings yet

- CRE32 - IRB ApproachDocument20 pagesCRE32 - IRB ApproachCuong NguyenNo ratings yet

- New or Revised Financial Reporting Standards Part 2.: Intended Learning Outcomes (Ilos)Document6 pagesNew or Revised Financial Reporting Standards Part 2.: Intended Learning Outcomes (Ilos)Mon RamNo ratings yet

- Chapters 12 and 12ADocument29 pagesChapters 12 and 12ACarlos VillanuevaNo ratings yet

- CAR18 chpt5Document53 pagesCAR18 chpt5Charles HouedjissiNo ratings yet

- Unit 2Document4 pagesUnit 2iDeo StudiosNo ratings yet

- Fi 19Document9 pagesFi 19priyanshu.goel1710No ratings yet

- Risks in Business: The Business of Banking Means "Accepting of Deposit For The Purpose of Onward Lending"Document3 pagesRisks in Business: The Business of Banking Means "Accepting of Deposit For The Purpose of Onward Lending"Vatsal BhavsarNo ratings yet

- Domestic Factoring GuidelinesDocument32 pagesDomestic Factoring GuidelinesAnkitmehra8No ratings yet

- Cyber ProtectDocument28 pagesCyber ProtectkaushikbachanNo ratings yet

- Far 4104Document8 pagesFar 4104Alrahjie AnsariNo ratings yet

- MAR50 With FaqDocument23 pagesMAR50 With FaqRenu MundhraNo ratings yet

- ODI AnalysisDocument11 pagesODI AnalysisYASH MAKADIYANo ratings yet

- An Efficient, Distributable, Risk Neutral Framework For CVA CalculationDocument18 pagesAn Efficient, Distributable, Risk Neutral Framework For CVA CalculationJustine WebsterNo ratings yet

- Counterparty Valuation AdjustmentsDocument23 pagesCounterparty Valuation Adjustmentshjstein6984No ratings yet

- 01 Eb09 D SusanneKroiss RiskAdjustedLoanPricingDocument17 pages01 Eb09 D SusanneKroiss RiskAdjustedLoanPricingmenkakukreja6197No ratings yet

- Kim Booklet 1 Aug 23Document524 pagesKim Booklet 1 Aug 23successinvestment2005No ratings yet

- Credit Valuation AdjustmentDocument14 pagesCredit Valuation Adjustmenttasneem chherawalaNo ratings yet

- ASC 842: Calculating The Incremental Borrowing Rate As A LesseeDocument4 pagesASC 842: Calculating The Incremental Borrowing Rate As A LesseeTheoNo ratings yet

- Exercise No. Mod 3-1 (Essay) : B 1. Which of The Following Is Incorrect About Credit Risk?Document3 pagesExercise No. Mod 3-1 (Essay) : B 1. Which of The Following Is Incorrect About Credit Risk?Johanz Nicole SupelanaNo ratings yet

- 2Document14 pages2MARIANo ratings yet

- SSRN Id4030548Document22 pagesSSRN Id4030548Usman Salah-ud-dinNo ratings yet

- IMDocument346 pagesIMMarya YoanaNo ratings yet

- CDS Default ProbabilitiesDocument8 pagesCDS Default ProbabilitiesjhanishantNo ratings yet

- KuvukulesivetabusDocument2 pagesKuvukulesivetabusPrasad PNo ratings yet

- Credit Risk 1 TestbankDocument6 pagesCredit Risk 1 TestbankTrinh Nguyễn Ngọc PhươngNo ratings yet

- 08Document2 pages08gopalushaNo ratings yet

- Assets $M: InterestDocument5 pagesAssets $M: InterestgopalushaNo ratings yet

- TF Important IssuesDocument32 pagesTF Important Issuesgopalusha100% (1)

- Regulations ExportDocument37 pagesRegulations ExportgopalushaNo ratings yet

- The 5 Hottest Technologies in BankingDocument6 pagesThe 5 Hottest Technologies in BankinggopalushaNo ratings yet

- CPC ConceptDocument22 pagesCPC ConceptgopalushaNo ratings yet

- Bank Frauds in IndiaDocument31 pagesBank Frauds in IndiagopalushaNo ratings yet

- Oveview of Forex Markets, Exchange Rate Mechanism and Margin MatrixDocument50 pagesOveview of Forex Markets, Exchange Rate Mechanism and Margin MatrixgopalushaNo ratings yet

- Case Study - Parallel BankingDocument11 pagesCase Study - Parallel BankinggopalushaNo ratings yet

- 3 Years of Currency Derivatives Segment: DigestDocument68 pages3 Years of Currency Derivatives Segment: DigestgopalushaNo ratings yet

- Case Reporting, Group 8Document8 pagesCase Reporting, Group 8lyla lasdoceNo ratings yet

- Colin Drury 6e Chapter 2Document18 pagesColin Drury 6e Chapter 2Mohsin Ali TajummulNo ratings yet

- FIN448-Final-Exam-Fall2020-Review - MCDocument85 pagesFIN448-Final-Exam-Fall2020-Review - MCMay ChenNo ratings yet

- Marathon 1 - Time Value of MoneyDocument116 pagesMarathon 1 - Time Value of Moneypriyanshusingh.inboxNo ratings yet

- Global Enabling Trade Report 2008Document436 pagesGlobal Enabling Trade Report 2008World Economic Forum100% (36)

- C Mart NoteDocument14 pagesC Mart NoteDMMU BEMETARANo ratings yet

- Branding StrategiesDocument68 pagesBranding StrategiesBSA3Tagum MariletNo ratings yet

- ED 2019 Answers KeyDocument11 pagesED 2019 Answers KeyRishabh TiwariNo ratings yet

- Macroeconomics 21st Edition McConnell Test Bank 1Document40 pagesMacroeconomics 21st Edition McConnell Test Bank 1christopher100% (44)

- Ug SCB Tariff Guide Booklet Nov LiteDocument30 pagesUg SCB Tariff Guide Booklet Nov Litemugabert2016No ratings yet

- The Year: Add: Non-Allowable Depreciation 12,497Document23 pagesThe Year: Add: Non-Allowable Depreciation 12,497peter richNo ratings yet

- L&J Presentation Group 9Document54 pagesL&J Presentation Group 9Andrei ShadowSNo ratings yet

- Equicom FormDocument17 pagesEquicom FormJovito SesbreñoNo ratings yet

- Outline Elc231 Muhammad ZahidDocument2 pagesOutline Elc231 Muhammad ZahidZahid ZaidiNo ratings yet

- Nissan 152081HC0A Oil Filter: Exporter From IndiaDocument1 pageNissan 152081HC0A Oil Filter: Exporter From IndiaSmart Parts ExportsNo ratings yet

- Asm Chap 4 Bus 3382Document9 pagesAsm Chap 4 Bus 3382Đào ĐăngNo ratings yet

- Substantive Procedures - Audit of PPEDocument2 pagesSubstantive Procedures - Audit of PPEAnonymityNo ratings yet

- Bill of Lading Draft: CarrierDocument2 pagesBill of Lading Draft: CarrierHéctor Pereda de la CruzNo ratings yet

- 2016 Retrofit Fair Vendor ListDocument10 pages2016 Retrofit Fair Vendor Listvenkii VenkatNo ratings yet

- Metals and Engineering SectorDocument3 pagesMetals and Engineering SectorodacremyrrahNo ratings yet

- IIP Final Project ReportDocument29 pagesIIP Final Project ReportI am IneffableNo ratings yet

- BL Data 01Document8 pagesBL Data 01transhomes2005No ratings yet

- Module 2 - Comparative Economic Development Key PointsDocument19 pagesModule 2 - Comparative Economic Development Key PointsMarjon DimafilisNo ratings yet