Professional Documents

Culture Documents

Sfat Q4 2014

Sfat Q4 2014

Uploaded by

Ali Syed0 ratings0% found this document useful (0 votes)

15 views43 pagesOriginal Title

SFAT_Q4_2014

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

15 views43 pagesSfat Q4 2014

Sfat Q4 2014

Uploaded by

Ali SyedCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 43

Annual Report

Two Thousand

Manufacturers & Exporters of Woven & Knitted Garments

6) hiscon

Our company is amongst one of the leading manufacturer

and exporter of textile made ups and fashion appar

our vision is to produce international quality of woven

and knitted garments, Our prime vision is to equip the

factory with modern and sophisticated machines and

develop the associated facilities which will help to reduce

the cost of production, improve the quality of production,

ine’ he profitability to be shared by the Company

its workers, and its shareholders.

—~=-

NGsion

Our missi

ion is to promote our industry and boost our

sales by exploring the global markets for our products

specially those

hereas,

our product for the sat

ch have not been explored yet

ld endeavor to enhance the quality of

faction of the consumer, to

provide a comfortable place of work to our employees

\d to be an ethical partner to a

our business associates.

The Company is to explore more opportunities in

business and play a m

aningful role on sustainable

basis in the economy and social development of the

uuntry.

SATA

TSAFATERTILFS LIMITED

INDEX

SNe. Contents Page No,

1 3

2. Notice of Annual General Mecting, 4

3. Director's Report oi ar ar a co

4. Statement of Compliance with the Code of Corporate Governance. »

5. Comparative Statement of Operating Resulls.. siete ares ops ti

6. Review Report to the Members on Statement of Compliange....... 1

7. Auditors’ Report to the Members. 1B

8. Balance Sheeterssissessee 4

9. Profit & Loss Account......... asm sa , st 15

10, Stetment of Comprehensive Income......e:s0+ 16

TL. Cash Flow Statement. 7

12. Statement of Changes in Equity... Sees oe Is

13, Notes to the Financial Statements... . 19

14. Pattern of Shareholding.

15, Formof Proxy

AAA Resort 2014 mm

SATA ™

CORPORATE INFORMATION

BOARD OF DIRECTORS

Executive Director

Mr, Adnan Chief Execativ

Syed fabal Husat Direetor and Chairman

4 Tarique Husain Dsreetor Technical and Logis

Non-Executive Director

ochat Iqb Non -Excemtive Direc

Mrs. Seema Adn jon -Executive Direeto

Mrs. Saboen Tariq Non -Exceutive Directo

Syed Marib Husain Non Executive Direct

BOARD OF AUDIT COMMITTEE

Mrs. Fathat h Wi

Mrs. Sabeen Tarique Memb

Mr Sajjad Ziauddin Mi Interval Avait

CHIEF FINANCIAL OFFICER Mr. Agha Yousuf Ali Khan

COMPANY SECRETARY Miss Ruktsana Bukhst

LEGAL ADVISER ch 4 Pata (Advocate)

AUDITORS araz Rahim Iqbal Rafiq

No. 180, Block-A SMCS

achi-74400, Pakis

BANKERS NIB Bank Limited

Standard Chartered Bank Limited

Ik AV-Falab Lim

Habib Bank Li

Habib Metropolitan Bank Limi

s C.& K Management Associa

SHARE REGISTRAR

im No. 404, 4th F

Trade Tower,

ah Haroon Road,

REGISTERED OFFICE Plot No, :26 & 26/1 Sector 12-D,

AND FACTORY North Karachi industrial Area

TELEPHONE 92

TELEFAX (9221-3) 6958962

WEBSITE

EMAIL

SATA =

SAA TEXTILES LIMITED —

NOTICE OF ANNUAL GENERAL MEETING

Notice i

‘will be held at 11:30 AM., on Monday, 24th November, 20/4, at The Royal Rodale Sports at TC

‘Street, Khayaban-e-Sehar, Phase V-Ext. D.HLA, Karachi to transact the following business:

hereby given that the 29d) Annual General Meeting of the Sharchulders of Sift Textiles Limited

300

Ordinary Business:

1. To Approve the Minutes of Last Annual General Meeting,

2, To, receive, consider and adopt the Audited Financial Statements of the Company for the Year

30th June,2014 together with Auditor's and Director's Report thereon.

3 To clect 7 directors as fixed by the Board of Directors in accordance with the provisions of Section

178(1) of the Companies Ordinance, 1984 for the period of 3 years. The retiring directors, who are

cligible for re-election are:

1. Syed Tqbal Husain 2. Mr. Adnan Iqbal

3. Syed Tarique Husain 4, Mes. Seema Adnan

5. Mes. Sahcen Tarique 6. Mrs. Farhat Iqbal

7. Syed Marib Husain

4 To appoint the Auditors for the year ending June 30, 2015 and fix their emus

auditors being eligible, have offered the

ration, The reir

clves for reappointment

'. To transact any other business wth the permission of the chair.

By the order of the board

Karachi; October 31, 2014 Company Secretary

NOTES

1. The Share Transfer Books of the Company will remain closed from 1Sth November, 2014 to 24th

November, 2014 (Both days inclusive),

Any person who seeks to contest the election of Directors shall file with the Company at its registered

office not later than fourteen days before the above suit! mecting his / her intention to offer himselE

herself for the election of the Directors in terms of Section 178(3) of the Companies Ordinance, 1984,

3. A Member of the Company entitled to attend und vote a the Meeting may appoint anther Member 9s

hisher proxy 1 attend and vote the meeting oa hisher behalf. Proxies in order to be effective must be

received by the Company at the Registered Oflice not later than 48 hours belore the time of holding the

meeting

Shareholders are requested to immediately notify the change in their address, if any.

5. All CDC Account Holders and Sub Account Holders who wish ws attend the AGM should bring their

Original ID Card. In eaxe of proxies, a duly attested copy of CNIC should be attached with the Proxy

Form,

a S| ee Annual Report 2014 mm

DIRECTOR'S REPORT

Dear Members

On behalf of th x e

poet sent th h dived Punanciel Stat

Net (L988) Prot b

Net (Loss) Profi a

Opera

high i c F mate has also. bat industrial an

: r i company’ has sh ble operating ¢ Bhi

e by the haed work ofthe di members oF rs

a Comp eases! from R 62 million vil

Production,

Quatity Assuran

7 0 14 at each and

Research and Development

Profit hetore

&

Annual Report 2014 msm

Dividends

‘The board of directors regretfully inform that the company is not ina position to declare a dividend as company is Facing

Tiguidity shortage.

Earnings per share

During 2013 the earning per share was Rs.0.2N/=, and during 2014 earning per share is Rs. (2.05) The camings have

dropped due to increase in costs.

Fixed Assets

During the year we have made assets worth Rs.22.327 million, 1 includes capitalization of building, purchase of new

machinery, electrical appliances & office equipment . These additions were necessary to increase our production capacity

and value of our assets.

Financial Charges

Financial Changes including mark up for the year ended June 30, 2014 have decreased thom Rs.18.447 million to Rs

16.783 million.

Staff Provident Fund

The staff provident fund is being operated successfully for its present employees.

Appointment of Auditors.

(M's Rahman Sarfaraz Rahim Iqbal Rafig-Chariered Accountants have retired und being eligible, have offered themselves

for reappointment for te year 2014-2015 at the same terms & conditions.

Corporate Social Responsibility

* Corporate Philanthropy

At Safa Textiles Limited we follow the international standards tor corporate social responsibility set in a society

Where workmen often face difficulties at the workplace. Unlike other companies we offer an exemplary working

environment and assert great importance to the concern of CSR.

Energy Conservation

We have an energy conservation management system (ECMS) in) which the processes and policies are designed to.

reduce energy usage. We are implementing the suggestion given by HCMS fram time to time,

* Environment Protection Measures

Protecting the Environment

aud conserving natural resources are important for our Company. Through management

leadership and employees commitinent, we strive to conduct ils operations in a manner that is safe for the

environment and continually improves environmental performance

Annual Report 2014 s_—

D es Annual Report 2014 mm

STATEMENT OF COMPLATANCE WITH COD!

Tis statement is being presented to comply with the code of Corporate Gos

of Kar

F CORPORATE GOVERNANCE

ernaice under list

Stock Exchange Limited. In compliance with the provisions of the code, the Board is pleased so place os

record the following statement

“The Company has applied the principles contained in the Cade in the following manne

1

‘The management of the company prepares the financial statements fairly presents ils state of affairs. results

of operations, cash flows and changes in equity

2. Proper books af the accounts of the Company are maintained.

3. Appropriate accounting policies have been consistently applied in preparation of financial statements and

accounting estimates are based on reasonable and prudential judgment

4. Intemational Accounting Standards as applivable in Pakistan have been followed im preparation of financial

statements and any departure therein hus been adequately disclosed,

5. The system of intemal control is sound and has been effectively implemented ane! monitored,

6. There are no significant: doubts about the company’s ability to continue as a going eoncem

7. There has been no material departure from the best practices of the corporate governanee as devaied in the

listing regulation.

8. Key Operating & Financial Results for (7) seven years is summarized in annexure 1

9, All outstanding taxes and levies have been paid

10. Directors Meetings: During the year, four meetings of the board of directors were held and following were i

attendance

Name of Directors aareatigs

Attended

1+ Syed Iqbal Husain 4

2 Mr. Adnan lgbal 4

3. Syed Tarique Husain 4

4. Mrs. Ferhat Iqbal 4

5. Mrs. Sabeen Varique 4

6. Mrs, Seema Adnan, 4

7. Syed Mati Husain 4

Karachi, October 31, 2014 Mr. Adnan tgbal

Chie? Executive

Annual Report 2014 =

SATA”

|

|

|

i Statement of Compliance with the Code of Corporate Governance

r r

i ce with the b

T pol "i

| r

) allah Il f q h

pave bank DFI xch

1

6 ; r

i

7 ior of

c Ub fi

1

;

i

10

|

!

!

Annual Report 2014 =

y

By

wy

15)

16)

™

18)

1)

20)

2)

22)

2»

24)

25)

“SARA TEXTILES CIMITED

“The Board has approved appointment of CFO, Company Secretary and Head of Internal Audit, including their

emuneration and terins and conditions of employment as determined,

ams of the Code of

The Directors’ Report for this year has beem prepared in compliance with the requiten

deseribes the salient matters equined to he disclose.

The financial statements of the Company were duly endorsed by the CEO and CFO before the approval of

Board

The Directors, CEO and Executives do not hold any interest in the shares of the Company other than that

disclosed in the pattern of sharcholding,

and financial reporting requirements of the

‘The Company has complied with a

the corpor

‘The Board has formed an

Directors.

adit commie, It comprises three members, nwo of whom are Non-Fxecutive

‘The mectings of the audit coimmittze were held at least once in every quarter prior to approval of interim and

final results of the Company and as required by the Code. The terms of reference of the committee have been

formed and advised to the committee for compliance

‘The Bourd has formed HR and Remuneration committe. It comprises three members, of whom two are non

executive directors and the Chairman of the Committee is an independent director

The Board has set-up an effective intemal audit funetion with employees who are considered suitably

‘qualified and experienced for the purpose and are converssnt with the policies and procedures of the Company

and they (or their representatives) are invalved in the interal audit function,

‘The statutory auditors of the Company have confirmed that they have heen given satisfactory rating under

the Quality Control Review program of the Institute of Chartered Accountants of Pakistan (ICAP), thet they or

any of the parners of the Firm, their spouses and minor children do not hold shares of the Company and that

the Firm apd all its partners are in compliance with International Federation of Accountants (IFAC) guidelines

fon Code of Kthies as adopted by ICAP.

The statutory auditors or the persons associated with then have not been appointed to provide other services

exept in aceordance with the listing regulations and the auditors have confirmed that they have observed

HAC auidelines tn this reward,

‘The closed period prior to the announcement of intern

material affect on the market price of compuny’s se

employees and stock exchange

| results, and business decisions, which may have

ies was determined and intimated to directors,

No such material / price sensitive information existed which should be disseminated among all market

participants ar once through stack exchange.

We confirm that all other material principles contained in tie Code have been complied with

MR. ADNAN IQBAL.

Detaber 31, 2014 CHIPE EXECUTIV

Annual Report 2014 =_—

SAFA TEXTILES LIMIT

COMPARATIVE STATEMENT OF OPERATING RESULTS

FROM JUNE 2008 TO JUNE 2014 (7 YEARS)

ED

SATA”

ace TUNE ] JUNE] JUNE ] JUNE ] JUNE | UNE] JUNT

ak 2o0s_| 2009 | zara | 201 | 2012 | 23 | 2014

10s 6F GODS SOLD X Hoga ys] ais.2i 16005

= + +

GROSS PROFIT wane] sore | seats] oat] s3s00

OPERATING PROFT von] 930 18013

= 4 =| . —|—

SET PROFIE/ (LOSS) ee ee

TRANSFER TO GENERAL RESERVE 2.00) e000} |

CCUMULATED PROFIT (LOSS) B is oo] soso} 9.608] 1,156

| pivipenD pain (2.004

xccumutaren proritiossy cr | ois2] 7700] soso] 9663] nase r2283| 4077

A | € Annial Report 2014 m—

Sara TERILES LIMITED

REVIEW REPORT TO THE MEMBERS ON STATEMENT OF COMPLIANCE WITH

BEST PRACTICES OF CODE OF CORPORATE GOVERNANCE

We have reviewed the enclosed Statement of Compliance with the best practices contained in the

Gode of Corporate Govemance (ihe Code) prepared by the Board of Directors of

Sata Textiles Limited (‘the Company’), for the year endeci June 30, 2014 to comply with the Listing

Regulation No 35 Chapter XI of the Karachi Stock Exchange Limited, where the Company is listed.

The rosponsibiity for compliance with the Gode is that of the Board of Directors of the Company, Our

responsibilty is to review, to the extent where such compliance can be objectively verified, whether

the Statement of Compliance reflects the slatus of the Company's compliance with the provisions of

the Code and report if it does not and highlight any non-compliance with the requirements of the

Code. A review is limited primarily to inquiries of the Company's personnel and review of various

documents prepared by the Company to comp\y with the Code.

‘As part of the audit of financial statements we are required to oblain an understanding of the

‘accounting and intemal control systems sufficient fo plan the audit and develep an effective audit

‘approach. We are not required to conser whether the Board of Directors’ statement en internal

contro! covers all risks and control, or to form an opinion on the effectiveness of such internal controls,

the Company's corporate governance procedures and risks

The code requires the Company to place before the Audit Commitiee, and upon recommendation of

the Aucit Committee, place before the Board of Directors for their review anc approval of ils related

party transactions distinguishing between transactions carried out on terms equivalent to those that

prevail in the arms length transactions and transactions which are not executed at arm's length price

and recording proper justification for using such alternate pricing mechanism. Further, all such

transactions are also required to be separately placed belore the audit committee. We are only

required and have ensured compliance of this requirement to the extent of approval of related party

transactions by the board of directors upon recommendation o the Audit Committes. We have not

Carried out any procedures to determine whelher the related party transactions were undertaken at

arm's length price or net.

Based on our review, nothing has come to our alfention, which causes us to believe that the

Statement of Compliance docs not appropriately reflect the Company's compliance, in all material

respects, with the best practices contained in the Code o! Corporate Gevernance as applicable to the

Company for the year ended June 30, 2014.

Karachi. "Rahman Sarfaraz Rahim Fqbal Rafiq

Date’ 31st October 2014 Chartered Accountants

2

Annual Report 2014 mmm

SATA ~

AUDITORS’ REPORT TO THE MEMBERS

az Rahim Iqbal Rafiq

" Chartered Accountants

Date: 31st October 2014 Engagement partner: Muhammad Waseem

a || es Annual Report 2014 s—

SAFA TEXTILES LIMITED

BALANCE SHEET

AS AT JUNE 30, 2014

ASSETS

Non-Current Assets

Property, plant and equipment

Current Assets

Stores and spares

Stock in trade

Trade debts - considered good

Loans and advances - considered good

Deposits, prepayments and other receivables

Tax refunds due from Government

Cash and bank balances.

EQUITY AND LIABILITIES

‘Share Capital and Reserves

Authorized capital

$5,000,000 (2013: 5,000,000) ordinary shares

of Rs. 10/- each

Issued, subscribed and paid-up capital

General reserves

Unappropriated profit

Non-Current Liabilities

Advance from customers

Current Liabilities

‘Trade and other payables

‘Accrued markup

‘Short term borrowings.

Unclaimed dividend

Contingencies and Commitments

4

9

10

"

12

13

The annexed notes from 1 to 30 form an integral part of these financial statements.

CHIEF EXECUTIVE

4

2014 2013,

Rupees

144,219,252 192,010,147

1,222,623 7758 6

122,570,846 | | 125,394,214

1,391,042 6,617,262

38,087,865 19,259,341

12,422,389 12,278,472

668,064 525,649

5,930,631 1,560,800

782,273,461 167,394,083

326,492,713 _ 299,344,230

50,000,000 __50,000,000

40,000,000 40,000,000

6,000,000 6,000,000,

4,077,024 12,283,176

50,077, 158,283,176

26,555,265, 18/893,614

114,477,631 93,580,226

2,066,306 3,347,906

192,512,182 | | 124,838,689

4,305, 400,620

249,860,424 222,167,440

326,402,713 __290,344,200

DIRECTOR

Annual Report 2014 mmm

SAFA TEXTILES LIMITED

PROFIT AND LOSS ACCOUNT

FOR THE YEAR ENDED JUNE 30, 2014

Profit before taxation

(Loss)/Profit after taxation

Earnings per share - basic and diluted

CHIEF EXECUTIVE

2014 2013

——— Rupees ———

14 731,675,409 1,761,666

15 (646,005,376) (674,946,924)

5,670,033,

16 029,156)

17 627,434)

(72,656,590)

13,013,443

ra I

18 (16,753,370) 18

19 3,683,935

20 (603,716)|

(13,673,151) __

(659,708) 246,87

21 (7,546,444)

(8,206,152)

22 (2.05) 2

DIRECTOR

Annual Report 2014 mam

SAFA TEXTILES LIMITED

‘STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEAR ENDED JUNE 30, 2014

2014 2013

Rupees ———

(Loss) / Profit atter taxation (8,206,152) 1,126,668

Other comprehensive income : :

Total comprehensive (loss) / income (6 206,152) 7,128,668

The annexed notes from 1 to 30 form an integral part of these financial statements,

CHIEF EXECUTIVE. DIRECTOR

SS | ee Anna! Report 2014 me

SAFA TEXTILES LIMITED

CASH FLOW STATEMENT

FOR THE YEAR ENDED JUNE 30, 2014

Cash Flow from Operating Activities

Adjustments for non-cash and other It

Operating pri

Changes in working capital

ros and 3p

1 cash generated from operating activitio:

Cash Fiow trom investing Activities

Net cash (used in)’ generated from investing activities

Cash Flow from Financing Activities

Net cash generatec

Cash and cash equivalents at the begi

ning of the year

Cash and cash equivalents at the end of year

Cash and cash equivalents comprise of

CHIEF EXECUTIVE

a

SATA”

2014 2013

10,088,908 | 239 |

26,872,150

26,212,442

(18,808,524) 19,861,151

10,427,131) 3

15,785,311 60,146,625

20,897.40: 29,089,983

(7,234,970) 8

(7s88 ¢

(24,923,827) 26.198.540),

11,758,889 5.016.468

waearT

(14.872,119)| |_@a

(22,327,087) aa, 1

(10,568,998) 4,959.19.

396,315)

7,661,651 382.

(3,303,662) 7,288,741

(023,277,889)

(126.581,551),

5,930,631 4,560,800

(192,512,182) __ (124,890,689)

(026,581,551)

DIRECTOR

Annual Report 2014

"SNA pees

SAFA TEXTILES LIMITED

STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED JUNE 30, 2014

General Unappropriated

Share Capital Reserves Profit co

Rupees

Balance as at July 01, 2012 40,000,000 6,000,000 11,156,508 57,156,508

Total comprehensve income “ : 1126668 1,126,668

Balance as at June 30, 2013 40,000,000 6,000,000 TERETE 58.203,176_

Balance as al July 01, 2013, 40,000,000 6,000,000 12.283,178 58,289,176

Total comprehensive loss : c (8,206,182) (€,206,152)

Balance as at June 30, 2014 40,000,000 000,000 ROT GR__ 60,077,024

The annexed notes from 1 to 30 form an integral part of these financial statements.

(CHIEF EXECUTIVE DIRECTOR

Annual Report 2014 mmm

28

PREPARATION

r F P ng able in

5 Drdinance uid directive 2cen followec

sis of measurement

Functional and presentation currency

Th cial statements are presented in Pakistan Rupees which is the functional and

he estimates and associal lions are based on historical experienc

asi of making judg about the ia

fF ather sources. Actual 1es6 estimate

: 4 un 3 assumpti reviewed on joing 8 Revisions to

inal _ fod in which the & 0 ”

Note

) Resid nd useful 7 of propery, plant and equipm: 3

es | es Annual Report 2014 m«—_

SATA

SSAFATENTILES LIMITED —

2.5 Amendments / interpretation to existing standard and forthcoming requirements

9) Standards, amendments to published standards and interpretations that are effective in

‘current year and are relevant to the Company:

Standards, amendments to published standards and interpretations that are effective in year

beginning from July 01, 2013 and are relevant to the company:

= AS 1, ‘Financial statement presentation’ regarding other comprehensive income, emphasises on

the requirement for entities to group items presented in other comprehensive income (OCI) on the

basis of whether they are potentially reciassitiable to profit or loss subsuquently (reclassification

adjustments). The application of the amendment has not affected the results or not assets of the

Company as itis only concemed with presentation and cisciosures.

= IAS 16 Property, Plant and Equipment is amended to clarify the accounting of spare pants, stand:

by equipment and servicing equipment. Applicable (o annual periods beginning on or alter

January t, 2013.

= IAS 32 Financial instruments: Presentation - Applicable ta annual periods beginning on or after 1

January 2013 ,i8 amended to clanty that IAS 12 Income Taxes applies to the accounting for

income 1ax05 relating to distributions to holders of an equity instrument and transaction casts of

an equity transaction

= 1S 28 "Investments in Associates and Joint Ventures”. applicable to annual reporting periods

beginning on or aller January 1, 2073.

+ IFRS 12, ‘Disclosure of interests in other entities’, effective for annual periods beginning on or

allor January 1, 2013.

= IFRS 13, Fair value measurement, effective for annual periods beginning on or after January 1,

2013.

+ IAS 19 (revised) ‘Employee Benefits’ has eliminated the corridor approach and requires to

cealculate finance cost on nat funding bases. The Company has applied this chango in accounting

policy retrospectively in accordance with IAS 8 ‘Accounting Policies, Changes in Accounting

Estimates and Errors’ and recorded unrecognized actuarial iosses net of taxes asseciated with

relirement benefit plan by adjusting the opening balance of unappropriatee profit and retirement

benefit for the prior years presented.

b) Standards, amendments to published standards and interpretations to existing standards

that are not yet effective and have not been early aciopted by the Company.

= IFRIG 21- Levies ‘an Interpretation on the accounting for levies imposed ny governments’

(ellective for annual periods beginning on or alter 1 January 2014). |FRIC 21 is an interpretation

of IAS 37 Provisions, Contingent Liabilities and Contingent Assets. IAS 37 sets out critera for the

recognition of a liability, one of which is the requirement for the entity to have a present obligation

a3 a result of a past event (known as an obligating event). The Interpretation clarifies that the

obligating event that gives rise to a lability 1o pay a levy &s the activity cescribed in the relevant

lagisiation that triggers the payment af the levy. The interpretation is not likely to have an impact

on Company's financial statements.

= Offsetting Financial Assets and Financial Liabilties (Amendments to IAS 32) ~ (elective tor

annual periods beginning on or after 1 January 2014). The amendments address inconsistencios

in current practice when applying the offsetting criteria in IAS 32 Financial Instruments:

Prasentation. The amendments clarify the meaning of ‘currently has a legally enforceable right of

set-off; and that some gross selllement systems may be considered equivalent to net settlement

The amendments are not likely to have an impact on Company's financial statements.

(2oj

Annual Report 2014 mum

eq

"

1g on or alter 1 Ji

ie rellet trom

amendments add a

ting hedging relationship when a novatic a mplated it

umentalion meet

> AS ts ans 6 Property, Plan pert (attecthve tor

iods begin January 2016) introduce severe restactions on the use of

a 1 jor property, plant and Vt 1

yo-bal iisation methods f assets i

nme or revenue and the consumstor ¢ le benott

‘hight ated’, or when the 1 is expressed as a me

fe not likely to have an impact on y's fina temen

Bearer Pu jendment to IAS 16 and IAS 44) (etfecti annual perio

of aller 1 January 2016), Bear are 1S 16 Property

sted al fair val el) unde 1 ture. A bearer pl

used in the supply of agricultural prod x Juce tor more than ons

and has a remote likelihood of bei as agri . ‘maturity, bearer

(0 IAS 27 ‘Separate Financial Slatements’ (eftective for annual period beginning o

nts, Managem ute ating the implicat

overn 10-2012 and 2011-2019 eycles ( lendments will apply prospectively t

ayn been amended to clan Jetinition of ‘vesting

Dn by 56 ly detining ‘perte . v lon’. The amendmen

. < fica asureme

F t >

i h t i

ncliation of the tolal of the reporiabl : suited

Annual Report 2014 mmm

"SATA

SABA TEXTILES EIMTTED_

Amendments to IAS 16'Property, plant and equipment’ and IAS 38 ‘Intangible Assets. The

amendments elanty the requirements of the revaluation model in IAS 16 and IAS 38, recognizing

that the rastatement of accumulated depreciation (amortization) is not always proportionate to the

change in the gross carrying amount ef the asset

IAS 24 ‘Rolated Party Disclosure’. The detiniion of related party is extended to include a

management entity that provides key management personnel Services to the reporting entity,

either directly or through a group entity.

IAS 40 ‘Investment Property’. IAS 40 has been amended to clarity that an entity should: assess

whether an acquired property is an investment property under IAS 40 and perform a separate

‘assessment under IFRS 3 te determine whether tho acquisition of the investment property

constilules a business combination.

IFRIC 21- Levies ‘an Interpretation on the accounting for levies imposed by govemments'

(effective for annual periods beginning on or after 1 January 2014). IFRIC 21 is an interpretation

of IAS 37 Provisions, Contingent Liabilities and Contingent Assets IAS 37 sets out criteria for the

recognition of a liability, one of which is the requirement for the entity to have a present obligation

as a result of 2 past event (known as an obligating event). The Interpretation claniies that the

‘obligating event that gives rise to a liability to pay a levy is the activity deseribed in the relevant

legislation that triggers the payment ef the levy.

‘Amendment to IAS 36 “Impairment of Assets’ Recoverable Amount Disclosures fer Non-Financial

Assets (etfective for annual periods beginning on or after 1 January 2014), These narrow-scope

amendments to IAS 36 Impairmont of Assets adores the disclosure of information about the

recoverable amount of Impaired assets if that amount is based on fair value less costs of

disposal. These are nol expected to have any imaact other than mcreased disclosures,

Secutitios and Exchange Commission of Pakistan (SECP) vide SRO 633(1)/2014 dated 10th July

2014 has approved ihe below IFRS

= IFRS 10 ‘Consolidated Financial Statements"

= IFRS 11 Joint Arrangements

IFRS 12 ‘Disclosure of interests in other entitios!

IFRS 13 ‘Fair Value Measurement

3 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

a4

Property, plant and equipment

‘These are stated at cost less accumulated depreciation and impairment loss, if any, except free

hold land and capital work in progress which aro stated at cost. Cost includes expenditure that

are directly attibutable to the acquisition of the asset.

Depreciation is charged to profit & loss account applying the reducing balance mathod whereby

the cost of an asset is written off over ifs uselul life at the rates specified in note 4.2 to the

financial statements. Depreciation on additions is charged from the quarter in which an assel is

pul to use and no depreciation charged in the quarter in which assct is disposed.

Subsequent costs are included in the asset's carrying amounts or recagnised as a separate

assets, as appropriate, only when it is probable that fulure economic benefits assceiated with the

item will flaw to the Company and the cost of the tem can be measured reliably,

Capital work in pragress is stated at cost and consists of expenditure incurred and advances

made in respect of property, plani and equipment in the course of their construction and

installation. Transfers are made to relevant asset s category a8 and when assets are available lor

2

Annual Report 2014 mmm

SATA™

SSATATEXTILES LIMITED

Gains and losses on disposal of assets, if any, ate laken to the profit and loss account. Disposal

is recognized when significant risks and rewards incidental to ownership have been transferred to

buyer.

The assets’ residual values, useful lives are reviewed, and adjusted if appropriate, at each

financial year end. The Company's estimate of resicual value of property and equipment as at 30.

June 2013 did not require any adjustment as its impact is considered insignificant.

‘An itom of property, plant and equipment is derecognized upon disposal or when no future

feconore benelis are expected {rom its use oF disposal. Any gain or loss arising on derecognition

of the asset (calculated as the difference between the net disposal proceeds and the carrying

amount of the asso!) is included in the profit and loss account in the year in which the asset is

cerecognized,

» 3.2 Intangible assets

7 An inlangible asset is recognised as an asset if it is probable thal the economic benefits

attributable to the asset will flow to the Company and the cost of the asset can be measured

reliably

7 Computer software

Expenditure incurred to acquire identitiable computer software and having probable economic

benefits exceeding the cost beyond one year, is recognised as an intangble asset. Such

expenditure includes the purchase cost of software (license tee) and related overhead cost

Costs associated with maintaining computer software programmes are recognised as an expense

‘whon incurred.

Costs which enhance or extend the performance of computer software beyond its original

spectfication and useful life is recognised as capital improvement and added to the original cost,

of the software.

Computer sottware and license costs are stated at cost less accumulated amortisation and any

identified impairment loss is amortised over a period of Five years using the reducing balance

method

Amortisation is charged from the month in which the related asset is available for use while no

‘amortisation is charged during the month in which such assel is disposed ott,

3.3. Impairment of non-financial assets

Assets are reviewed for impairment whenever events or changes in circumstances indicate that

the carrying amount of these assets may not be recoverable. Whenever the carrying amount ot

these assets exceed their recoverable amount, an impaitment loss is recognised in the profit and

loss account

3.4 Stores, spares and stock in trade

These are valued at lower of cost and net realizable value; cost being determined as under:

Storos and spares - ‘At moving average cast

Raw materials, : FIFO basis (First In First Out)

Materia in transit 2 ‘At cost comprising invoice value plus incidental

charges

Work in process and finish goods = At estimate average manutacturing cost

Waste : Atnet realizable value

————

Annual Report 2014 mm

SATA

35

37

TSAFATENTIES LINTTED—

Manufacturing cost in relation to work-in-process and finished goods comprises cost of material

labour and appropriate manufacturing overheads.

‘Net realizable value signitias tha selling price at which goods in stock could he currently sold lass:

any further cost which would be incurred to complete tho sale,

Provisions are made in the financial statements fc lete and slow moving inventory, stores

and spares based on management's best estimate regarding there future uselity

‘Trade and other receivables

Trade and other receivables are cartied al original invoice amounticost, which is the fair value of

the consideration to be received, less an estimatc made for doubtful receivables which is,

determined based on management review of outstanding amounts and previous repayment

pattern. Bad debls are written off as incurrad and provision is made against aebis considered

doubtful when the collection of full amount is no longer probable.

Cash and cash equivalents

Cash in hand and al banks, short term bank deposits and shor term running finances, # any. are

‘camned at cost. For the purpose of cash flow statement, cash and cash equivalents consists of

cash in hand and deposits in bank, net of short term runing finances ( if any ) that are highy

liquid in nature, readily convertible into known amounts of cash and subject to insigniti

change in value.

Financial Instruments

Financial instruments carried on the balance sheet include investments, deposits, trade debls and

other receivables, cash and bank balances, trade and other payables, tong term loan, accrued

mark-up on short term finance and short term borrowings,

- Financial assets

‘The Company classifies its financial assets in held to maturity, fair value through protit and loss,

and availabie-for-sale categories, The classification depends on the purpese for which the

financial assets are acquired, Management dolarmines the classification of its financial assets at

Initia! recognition.

(a) Held-to-maturity

‘These are non-derivative financial assets with fixed o” determinable payments and fixed maturity

that the Company has the positive intention and ability (o fold tll maturity.

{b) Fair value through profit and loss.

Financial assets at fair value through profit or loss are tinancial assets held for trading, A financial

asset is classified in this category if acquired principally tor the purpose of selling im the shart-

term. Derivatives ate also categorized as held for trading unless they are designated as hedges.

‘Assets in this category are classified as current assets, There were no financial assets at fair

valve through protit or joss on the balance sheet date.

za

Annual Report 2014 smn

SATA™

SARA TEXTILES LIMITED

(c) Available for sale

Available for sale financial assets are non-derivative:

or not classified in any of the other catagories.

inat ave either designated in this category

All financial assets are recognised at the time mes a party to the

tractiia! provisions of the instrument. Regular purchases and sales of investments are

racognised on trade date - the date on which the Company commits to purchase or sell the asst

Financial assets are initially recognised at fair valve plus transaction costs forall financial assets

not cartied at fair value through profit or loss. Financial assets are derecognised when the right to

receive the cash flows from the assets have expired or have been transferred and the Company

stantially all the risks and rewards of ownarships.

nen the Company be

as transferred s

Fair value of available-for-sale investments a

Mutual Fund Association of Pakistan for debt sec:

end mutual funds, or PKRV sheets,

ermined on the basis of rates notified by

ligs, relevant redemption prices for the open:

Available-tor-sale financial assets are Subsequently cartied at fair value with changes in fair value

recognised in other comprehensive income until derecognised or impaired. When securities

classified as avallable-for- sale aro sold or impaired, the accumulated lair value adjustment

recognised in equity are incudad in the profit and loss account as gains and losses from

Investment secunties, Interest on avallable-tor-sale securities calculated using the effective

interest method is recognised in the profit and loss account Dividends on avaiiable-for-sale

equity instruments are recognised in the profit and loss account when the Company's right to

receive the dividends Is established,

The Company assesses at the end of each reporting date whether there is objective evidence

that a financial asset or 2 group of financial assels is impaired. I any such evidence exists for

avallable-tor-sale tinancial assets, the cumulative loss Is removed from equity and is recognised

in the profit and loss account. Impairment losses recognised in the profit and loss account on

equity instruments are not reversed through the profit and loss account.

The Company follows trade date accounting for regular way purchase and sales of secu’

Financial tiabilities

All financial liabilities are recognised al the time when the Company becomes a party to the

contractual provisions of the Instruments. & financial liability is derecognised wnen the obligation

under the Kabilty is discharged, cancelled or expired

3.8 Offsetting

Financial asset and financial liabilities and tax assets and tax liabilities are set off in the balance

sheet, only when the Company has a legally enforceable right to set olf the recognized amount

and intends cither to settle on a net basis or to realize the assets and seltle the liabilities

simultaneously.

3.9 Employee benefits

Defined contribution plans

A defined contribution plan is a post-employment Benefit plan under which an entity pays fixed

contribution into a separate entity and will have no legal or constructive obligation to pay further

amounts, Obligations for contributions to defined contributions plans are recognised as an

employee benefit expense in protit or loss when they are due.

a

Annual Report 2014 s_—

"SATA

SARA TENTITES LIMITED

The Company operates an approved provident fund scheme lor eligible employees of the

Company. Equal monthly contributions are made by the Company and empioyees at the rate of

50 of basic salary.

3.10 Taxation

The tax expense for the year comprises current anc deferred tax. Tax is recognised in the profit

and loss account, except to the extent that it ralates to items recognised in other comprehensive

income or directly in equity. In this ease the tax is a'so recognised in other comprehensive income

(0 directly in equity, respectively

Current

‘The current income tax charge is based on the taxable income for the year calculated on the

basis of the tax laws enacted or substantively enacted at the balance sheet date, and any

adjustment to tax payable in respect of previous ycars,, Presently provision for current taxation is

based on final tax ragime in accordance with the provisions of sectian 154 of the Income Tax

Ordinance, 2001

Deferred

Deferred tax is recognised using balance shect lability method, providing for all temporary

differences between carrying amounts of assets ard liabilities for financial reporting purposes and

the amounts used tor taxation purposes. Deferred tax is measured at the tax rates that are

expected to be applied to the temporary differences when they reverse, based on the laws that

have been enacted er substantively enacted by the reporting date.

A deferred tax asset is recognised only to the extent that itis probable that future taxable profits

will be available against which temporary differences can be ublized. Deferred tax assets are

reviewed at the end of each reporting period and reduced to the exlent that it is no longer

probable that the related tax benofit wil be realized. Currently there ate no deferred tax balances

singe the Gompany income falls under final tax regirre.

3.11 Provisions

Provision is recognised when, as a result of past event, the company has a present lagal or

constructive obligation that can be estimated reliably and it 's probable that an outflow of

resources empodying economic benefits will bo required to settle the obligation. Subsequently

provisions are reviewed at each balance sheet date and adjusted to rellect the current best

estimate,

3.12 Revenue recognition

Revenue is racugnises to the extent that itis probable thal the economic benelits will low to the

‘Company and the amount of revenue can be measured reliably. Revenue Is measured at the fair

valve of the consideration received or receivable, net of any direct expanses. Revenve is,

recognised on the following basis:

- Local sales are recognised on dispatch of goods to customers,

Export sales are recognised at the time of receipt of bil of lading,

+ Export rebate is recognised on accrual basis al the time of making the export sale

«Interest income Is recognised on a time proportion basis by reference to principal outstanding

‘amount and taking into account the effective yioid rate,

2.13 Borrowing costs

Borrowing costs are recognised as an expense in the period in which they are incurred except

borrowing costs that are directly attributablo to acquisition, construction or production of a

qualilying asset are capitalized as a part of the cost of that asset

[a5

Annual Report 2014 sm

Se IA

4.14 Foreign currency transaction and translation

Foreign currencies are transiated into reporting currency al the rates of exchange prevailing on

‘na cate of transactions. Monetary assels and liabililes denominated in foreign currencies are

translated into reporting curtency equivalents using year-end spot foreign exchange rates. Non-

monetary assats are translated using exchange rates that existed when the values were

determined. Exchange diferences on foreign curency translations are included in income

cureently,

2014 2013

Rupees

4 PROPERTY, PLANT AND EQUIPMENT

Capital work in progress 4a 39204927 24,412,717

Operating Fixed Assets 42 40429991 107,492,200

Intangiole Assets 250,494 108,230

744.219,252_ 132,010,147

4.1 Capital work in progress.

Balance as at July 1, 2013 24412717 :

Additions during the year 14872110 24,412,717

Transfer to property, plant and equipment :

‘during the year

Balance as at June 30, 2014 3o2e4eo7__24.412.717_

42. Operating Fixed Assets

al igh nd Hd tn Feil ga, OM

im tose moi ano a

eww ae ~

a ee ee ee

‘eesigtes ‘mm cian data fan ‘gary Sa fae aaa

me as —S - —s —e ——te e -e

‘ureaaoet 98

SecGen kee caw one me ue ur aa we

terre mer aos tae Sas

Sorter yan Qian ohh asf oan “aan ieam

pce Sa a 2 ee ee ee

a ee ee ee

a 3 iy (aaa Sati ay eas

saat ce to ine uae ee ee

tread i

ee ee

pel nae ‘ce ‘tam “in

cenartoane aim > cans

conan sit Sit ha Ser age “nt ta

sonic

a ae ee ee ee

‘canton ions Gutm Gay nay fy eam amas

= win ~~ att — ‘et "aa So "ta a

Aeon aes of deprocation = 7 a iy

Annual Report 2014 —

4.3 Intangible assets

Rupees

As at July 1, 2012

Cost 295,000

Accumulated amortization (221,900)

Net book value 73,100,

‘Year ended June 30, 2013

‘Opening net book value 73,100

Additions during the year 55,000

‘Amortization - (22,870)

losing net book value 305.250

‘As at July 01, 2013

Cost 380,000

Accumulated amortization (244,770)

Not book value 705,250

‘Year ended June 30, 2014

‘Opening net book value 105,230

Additions during the year 175,000

Amortization __ (28.798)

Closing net book value 250,434

As at June 30, 2014

Cost ‘525,000

Accumulated amortization (274,566)

Net book value 250,838

Annual rate of amortization 20%

2014 2013

4.4 Depreciation and amortisation for the year has been allocated ~———— Rupees

as under :

= Cost of sales 7,083,147 6,888,778

~ Administrative expenses 3,035,633 952,333

70,118,780 9,841,109

5 STOCK IN TRADE ——_

Raw material and accessories 29,775,987 45,449,011

Work in process: 20,427,402 36,058,541

Finished gooos 43,826,662

725,334,214

6 LOANS AND ADVANCES - CONSIDERED GOOD

Unsecured

Loans to statt 64 586,681 798,077

Advances tor:

= raw materials 25,261,224 14,031,283

‘expenses 123,760 918,022

~ supplies and services 12,096,199 __ 3,511,959

"38,067, 79,259,341

a A

6.1 These are interest free and are given for general purpose in accordance with the terms of

employment, These loans are repayable within one year and are recovered through deduction

a

Annual Report 2014 sm

10

"

DEPOSITS, PREPAYMENTS AND OTHER RECEIVABLES

Security deposits

Propaid insurance

Other receivables :

Export rebate receivable

Duty draw back receivable

~ Sales tax refundable

Otnars

CASH AND BANK BALANCES

Cash with banks.

= PLS accounts

Current accounts

Cash in hand

ISSUED, SUBSCRIBED AND PAID UP CAPITAL,

Number of Shares

2014 2013

Ordinary shares of Rs. 10/- each fully paid

incach,

Ordinary shares of Ais. 10/- each issued

as fully paid bonus shares

3,990,900 3,990,900

00, 9,100

4,000,000 2,660,000.

ADVANCE FROM CUSTOMERS

Allura Imports i

Mag Brands LLC

Others

10.1

Less: Current portion

10.1

SATA ~

TEXTILES LIMITED

2014 pora

Rupees

1,438,510 1,136,900

143,338, 144,084

3,837,637 2,083,540

3,895,492 7,922,285

3,310,412 1,781,663,

50,000

72,422,389

12,686 4528

5,838,456 1,584,012

79,489 2.260

53590,631_ ___1,560,800

39,909,000 39,909,000

91,000 91,000

H9,000,000_ __40,000,000.

3,550,557 $263,728

30,894,976 || 27,561,818

3,959,733, :

38,405,265 31.831 S40

(14,850,000) (12,937,932)

2

—25.585.265, 1S 655514

This represents balance of aggregale amount of advance of US $388,914 from customers,

against export orders that are adjustable against shipment effected to the said customers.

TRADE AND OTHER PAYABLES.

Trade creditors

Accrued expenses

Current portion of advance from customers

Other payable:

Withholding tax payable

Workers profits participation fund

Workers’ welfare fund

Staff provident fund

2014 2013

Rupees

89,615,715 68,060,090

yarez261 17,019,688

111850,000 12,997 932

725,38 Bas

1032.762 962249

609.716 516.554

7748 9.258

729.655. 7.552.576

3e,580.226

Annual Report 2014 sm

nA

2

13

———— Pupees

Workers’ profits participation fund

Opening balance 862,249 358,968

Charge tor the year 503,286,

Interest for the year 170,513

Less: Paymonts made during the year

SHORT TEAM BORROWINGS

Secured

NIB Bank Lt :

Finance against packing credit 124 {97,000,000 |{~ 103,000,000

Letter of credits 122 6,643,181 || 21,898,689

Finance against imported merchandize 123 -

TPA AGE GBD

Unsecured

Loan trom director

12.1 This loan is secured against equitable mortgage of As. 162.54 milion (June 30, 2019: 194

milion) over tied assets of the Company at their lactony at Plot no. 26 & 261, Sector 12-D, North

Karachi Industrial Area, Karachi40% margin to be maintained. tst registered / Hypothecation

charge of Rs.112 millon over movables and receivables of the Company at their factory. 25%

margin to be maintained. Personal guarantee of ail directors ard mortgagors covering all the

facilities, Such other securities as may reasonably be requested by the Dank from lime to me . In

addition, the bank shall have a banker's lien on all the customer's deposits, accounts and

properties held with the bank Lien over export hills. The term of the facility is 180 days or

maximum as allowed by SBP. This carries markup al 1% per annum over SBP refinance rato.

12.2 This taciity is of Fs 10 milion with 10% cash margin on sight and usuance letter of credit or as

per SBP margin requirement whichever is high secured through en over import documents.

12.3 This facility is of Rs 26 millon with 10% cash margin secured by way of valid trust receipt anc

pledge of imported goods under contro! of Bank's approved Muccacam,

CONTINGENCIES AND COMMITMENTS:

Contingencies

‘There were no contingencies existed at balance sheet date(2013: Nil).

Commitments.

Raw materials

For capital expenditure 871,000 14,587,283.

Exports of goods 140,828

Annual Report 2014 mz

14

15

SALES - NET

Export sales

Export rabate

COST OF SALES

Raw materials consumed

Accessones consumed

Packing materials consumed

Manufacturing Expenses

Salaries, wages and other benefits

Cutting and stitching charges:

Conversion cost

Stores and spares

Fuel and power

Rent, rates and taxes,

Repair and maintenance

Water charges

Travelling

Canteen

Depreciation and amortisation

Work in process - opening

closing

Cost of goods manufactured

Finished goods - opening

154

= closing

Raw materials consumed

Opening stock

Purchases during the year

Available for consumption

Closing stock

15.41

44

SATA ™

_SAFA TEXTILES LIMITED

2014 2013

Rupees

728,684,213 769,442,237

2,991,196 2,319,429

731,675,409 771,761,666

308,207,846

81,609,073

27,060,507

416,877,426

333,610,592

421,439,090

45,677,207 |{ 36,861,924

114,725,898 || 91,999,297

35,735,214 || 102,254,449

14,046,735 || 14,034,674

16,421,401 || 14,125,929

1,186,600 1,141,605,

5,397,153

454,078

1,586,292

48,795

6,888,776

274,732,912,

32,654,845,

(20,427,402)|| _ (38,058,541)

15,631,139 (3.403.696)

674,546,771 692,768,906

43,826,662 |[ 26,005,280

(72,368,057)] | _ (43,826,662)

(28,541,395) (17,821,982)

646,005,376.

846,008,575,

22,084,091

307,773,616

929,837,707

674,946,926

11,760,599

343,914,084

955,674,683

(21,629,861) __ (22,064,091)

308,207,646

333,610,592

Annual Report 2014 mm

"SATA

SAFA TEXTILES LIMITED

16

7

18

2014 2013

Rupees

ADMINISTRATIVE EXPENSES

Directors’ remuneration 23.4 2,999,994 2,999,910

Salaries and benefits 16.1 33,963,842 27,147,671

Printing and stationery 1,503,872 1,734,645

Telephone, telex and postage 2.419.692 2,084,574

Rent, rate and taxes 758,674 721.947

Cantaan expenses 2,129,500 05.563

Newspapers, subscription and advertisements 49,830 62,384

Travelling and conveyance 1,686,201 1,595,876

Repair and maintenance and service charges 3,987,544

Certification expenses 193,969,

‘Computer expenses 508,700

Legal and professional fee 66,000

‘Auditors’ remuneration 162 534,900, 489,950

Donation 16.3 61,700 158,020

Advances written off 303,983, :

Insurance premium 864,122 729,478

Depreciation and amortisation aa 3,035,633 __2,952.933

55,029,156_ 45,888 861

16.1 This includes Company's contribution towards catined contribution plan amounting to Fis.45,558

(2013: Ais.145,502). The company has sel up provident fund for its employees and the

contributions were made to the trust in accordance with the requirement of section 227 of the

‘Companies Ordinance, 1984

2014 2013

162 Auditors’ remuneration - Rupees

Audit foo 300,000 250,009

Halt yearly review fee 125,000 125,000

‘Other cerifications’ fee 50,000 50,000

Reimbursement of out of pocket expenses 59,900 64.950

534,900 79,950.

16.3 Donations were not made to any donee in which any directer of the company or his/her spouse

brad any interest.

2018 2013

DISTRIBUTION COSTS ——— Fupees

Salaries and benefits 1,694,211 1,431.68

Shipping and clearing expenses 12,908,583 14,054,563

Postage and courier 1.067.110, 1,280,419)

Travelling 4,957,570, 6.646.632

17,627,434. __25.412,982

FINANCE COSTS.

Markup and interest charges in short term borrowings 9,961,918 10,714,517

Interest on Werkers' profit participation fund 170,513 :

Bank charges and commission 6,620,939 7,792,700,

16,753,370 is

iy

Annual Report 2014 =——

at

ant

22

22.4

22.2

23,

2014 2013

OTHER INCOME ——— Fupees

Income from financial assets:

Gain on term deposits account - 359,073,

Profit on saving accou 21,818 .

Exchange gain-net 3,566,661

Trade creditors reversal - 619,519

Income from non-financial assets

Sale of wastage stock 228.820,

3,683,035 7.207.412

OTHER CHARGES:

Workers welfare fund 603,716 615,554

Workers’ profi participation fund - 503,286

Exchange loss - net = 807.289,

05716 7726 128

PROVISION FOR TAXATION

Current

-for the year 7,546,444 7,820,209

prior year -

7546484 7,820,209

‘The Company's income is chargeable to tax under Final Tax Regime prescribed under the Income Tax

Ordinance, 2001 and hence tax reconciliation is nol being presented.

EARNINGS PER SHARE - BASIC AND DILUTED,

Earning por share-basic

(Loss)/Profit after taxation (8,206,152) __1,126,668

Numbers

Weighted average number of ordinary shares 4,000,000 4,000,000

Rupees

Eamings per share - basic (2.05) 0.28

Earnings per share-diluted

“There is no dilution effect on the shares of the company(2013:Ni).

RELATED PARTY TRANSACTIONS.

Related party comprise asscciates, other companies with common directorship, directors ‘and key

‘management personnel which are carried at arm’s length basis. Detail of transactions with related parties

during the peried are as follows:

Nature of Transaction Relationship 2014 2013

with company ——— Rupees

Directors! remuneration Key 23.4 2,999,994 2,999,910

Rent for marketing Olfice management 450,000 ‘450,000

personnel

Loan from director Director 10,500,000 :

Purchase of accessories Associated company 12,960,282 7,003,072

Balanee Outstanding Associated Company 5,951,184 6,763,072

3

Annual Report 2014 sm_-

23.1 Directors’ Remuneration

‘The Chief Executive and Directors are also provided with free use of company maintained car

24 FINANCIAL INSTRUMENTS

Financial risk management objectives and polici

‘The Company has exposures to the following risks from its use of financial instruments:

+ Grodit risk

Liquidity risk

Market risk

‘The Company's overall risk management programme focuses on the unpredictability of financial markets

and seeks to minimize potential adverse effects on the financial performance. Overall, risks arising trom

the Company’ financial assets and liabilities are limited. The Company consistently managos ts

‘exposure to financial risk without any material change from previous period in the manner described in

notes below.

The Board of Directors has overall responsibilty for the establishment and oversight of Company's tisk

management framework. The Board is also responsible for developing and monitoring the Company's risk

management policies.

24.1 Credit risk

Credit risk is the risk that one party fo a financial instrument wil fail io discharge an obligation

and cause the other party to incur a financial loss, without taking into account the fair value of any

collateral. Concentration of credit risk arses when a number of financial instruments or contracts

are entered inte with the same party, or when counter partios are engaged in similar business

activities, or activities in the same geographic region, oF have similar economic. features that

would cause their ability to meet contractual obiijations to be similarly affected by change in

economics, political of other conditions. Concentration of credit risk indicates that relative

sensitivity of the Company's performance fo development alfecting a particular industry.

‘The carrying amount of financial assets represents the maximum credit exposure. To manage

exposure to credit risk, the Company applies crecit limits to thei customers. Cash is held only

with banks with high quality cred worthiness.

‘The carrying amount of financial assets represents the maximum credit exposure. The maximum

exposure to crecit risk at the reporting date is

2014 2013

Rupees ———

‘Trade debis - considered good 1,391,042 6,617,262

Loans and advances « considered good 38,067,865 19,259,341

Deposits, prepayments and otter receivables 12,422,989 © 12,278,472

Gash and bank balances 5,930,631, 1,560,800

57,811,928 39,715,875.

es | gees Antal Report 2014 mm

SATA“

Rupees

1,391,042 ¢

2014

Gross Impairment Gross

= ———-~ Rupees —

e with

sion other th

Based on past expe 3k record over

the Company beliave not require any impairment

xcept ised in @ other financial assets are

either past due or im

liquid funds is hig ne count banks wit

liquid tunds can be a: with reference to extemal

Liquidity risk

ions as they fall auidity Fisk the " any could

b ited a : expecte ui " al

3 lic a , will always uid

eet i s b z 7 " incurnng

mag eputat

33 million (2013: ion) and , 13 4 milion).

es | eee Anna! Report 2014 a

"SATA

aaa

283.2

TSAFA TENTILES LIMITED

Seariig —Goniaciant Wwlve nanihe Two te Fe Wore han

mount each ows or oa yearn fhe yearn

‘Advance feu customers 5265 30,605,268

Bresiscss

“rade nn cna oayabion foeinzes 856022

Unciasmod awstena foam "eco.

Market risk

Market risk is the risk that the value of the financis| instrument may Mictuate as a result of

changes in market intotest rates ar the market price cue to a change in credit rating of the issuer

‘or the instrument, change in market sentiments, speculative activites, supply and demand of

securities and liquidity in the market. The Company ‘© oxposed to currency risk and interest rate

risk.

Currency risk

Foreign currency nisk is the risk that the value of financial asset or a lability will fluctuate due to a

change in foreign exchange rales. It arises mainly whore receivables and payables exist due to

lransactions entered into foreign currencies

Exposure to currency risk

‘The Company is exposed to currency risk on trade clobts, sales, trade payables and purchases

thal are denominated in a currency other than the rascective functional currency of the Gompany

“The currencies in which these transactions are denominated is the US Dollars.

‘The Company's exposure to loreign currency risk is as follows:

2014 2013

Uso Tet USD. Tatar

Rupees

Trade debts 1,391,042 1.391.042 6,617.62 6,617,262

Gross balance sheet exposure 1,391,042 391,042 6.617.262 _ 6.617.262,

K 7,391,042 6.617.262 6617.262

The following significant exchange rates applied during the year

Dora 23

| USD to PKR | JSD to PKA

Hoparingdaterae | Average Tae Reporting dave rate | Average rate

buying | setiing | buying | selling | buying | setting | buying | selling

oass | 9875 | 127 | 02s | ome 988 967 969

|

Annual Report 2014 samme

243.3

2038

SATA

Se

Sensitivity Analysis,

A 10 percent strengthening / weakening of the PKR against USD at 30 June would nave

ecreased / increased post-tax profit by the amounts shown below. This analysis assumes thal all

other variables, in particular interest rates, remain constant, The analysis 's performed on tho

same basis for 2013,

2014

Effect on (lossy/profit —_—— Rupees

2 __ (820,615) 112,687

The sensitivity analysis preparad is not necessarily indicative of the effacts on profit /loss for the

year and assets and liabiltios of the Company,

Interest rate risk

Interest rate risk is the risk that the fair value or future cash flows of a financial instrument will

fluctuate because of changes in market interest rates. Majority of the interest rate exposure arises

from short and long term borrowings from banks . At the reporting date, the interest rate profile of

the Company's interest-bearing financial instruments was as follows:

Carrying amount

2014 2

Rupees

Financial liabilities

Variable rate instruments

‘Shor term borrowings 192,512,182 _124,638,689

Fair value sensitivity analysis for fixed rate instruments

‘The Company does not account for any fixed rate financial assets and liabilties at fair value

through profit and joss. Therefore, a change in interest rates at the reporting date would not affect

profit and loss account

Cash tiow sensitivity analysis for variable rate instruments

A change of 100 basis points in interest rates at the reporting date would have increased /

(decreased) profit for the year by the amounts shown below. This analysis assumes that all other

variables, in particular foreign currency rates, remain constant. The analysis Is performed on the

same basis for 2013.

Effect on profit and loss

100 bp 100 bp

increase decrease

As al 30 June 2014

Cash flow sonsitivity-Variable rate instruments 1,325,122

As at 30 June 2013 —

Cash flow sonsitivity-Varlable rate instruments

1,248,8;

The sensitivity analysis prepared is not necessarily indicative of the effects on profit for the year

and liabilities of the Company

Fair value of financial instruments

The carying values of the financial assels and financial liabilities approximate their fair values,

Fair value is the amount for which an asset could be exchanged, or a liability settled, between

knowledgeable, wiling parties in an arm's length transaction,

a

Annual Report 2014 m—

"SATA

25

25

28

SSAFATERTILES LIMITED —

OPERATING SEGMENTS

‘These financial statements have been prepared on the basis of a single reportable segment

25.1 Revenue from export sales represents 99.59% (2013 = 99.7%) of the folal revenue of the

Company.

252 All non-current assets of the Company at 90 June 2074 are located in Pakistan

253 CAPITAL RISK MANAGEMENT

‘The Board's policy is to maintain a strong capital base so as to maintain investor, creditor and

market contidence, sustain future development of tne business, safeguard the Company's ability

to continue as a going concern in order to provide retums for sharehalders and benelit for other

stakeholders and to maintain an optimal capital sicucture to reduce the cost of capital. The Board

of Directors monitors the return on capital, which ne Company defines as net profit after taxation

civided by total shareholders’ equity. The Board of Directors also monitors the level of dividend 10

ordinary shareholders. There were no changes to the Company’s approach to capital

management during the year and the Company is not subject to externally imposed capital

requirements.

CAPACITY AND PRODUCTION

‘The production capacity of the Company cannot be delermined because of processes involved and

variation in sizes, styles and texture of cloth etc.

NUMBER OF EMPLOYEES 2014 2013

(Number)

Total number of employees as at June 30 151 143

Average number of employees during the year 148 139

DISCLOSURES RELATING TO PROVIDENT FUND, 2014 2013

Rupees ———

(Size of the fund 1,049,766, 958,650,

(i) Cost of investment made - -

Gil) Percentage of investments made F <

iv) Fair value of investments _ .

The figures for 2014 are based on the un-audited financial statements of the provident fund.

DATE OF AUTHORIZATION FOR ISSUE

‘These financial statements have been authorized for issue on 3tst October 2014 by the Board of

Directors of the Company.

GENERAL

Figures have been rounded off to the nearest rupee.

CHIEF EXECUTIVE DIRECTOR

&

Annual Report 2014 mmm

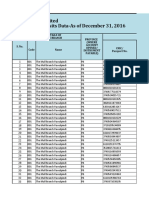

PATTERN OF SHAREHOLDING

AS ON JUNE 30, 2014

SHARE HOLDERS,

ADDITIONAL INFORMATION REQUIRED BY SECP

SATA™

TOTAL

SHARES

HELD

NIL

S. aha ts

400.

2 SEE

IC — NG OF Te

| SHARES ones

NIL

39]

Annual Report 2014 m—

FA TEXTIES LIMITED

FORM OF PROXY

(full addres failing him

(ful

tend and vote for my / our behalf at 29h Annual General Meeting of the

non Monday, 24th N 2014 at The Royal Rodale Sports at TCV

xt DA, K

journment there

LA ANNA! Report 2014 ma

a

SAFA TEXTILES LIMITED

Pee ies Memb Dr

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Active CompaniesDocument164 pagesActive CompaniesAli SyedNo ratings yet

- S Customer/ Owner of Property No. of Property Address Zone Fia E-Mail Mobile Contact Other Telephone Social Media ProfileDocument28 pagesS Customer/ Owner of Property No. of Property Address Zone Fia E-Mail Mobile Contact Other Telephone Social Media ProfileAli Syed100% (2)

- Fujiyama MenuDocument6 pagesFujiyama MenuAli SyedNo ratings yet

- Gujarat - Leaflet Diet On AnginaDocument2 pagesGujarat - Leaflet Diet On AnginaAli SyedNo ratings yet

- Details of Licences Granted For Transportation of LPG Through Road BowsersDocument2 pagesDetails of Licences Granted For Transportation of LPG Through Road BowsersAli SyedNo ratings yet

- Sectoral ExportersDocument78 pagesSectoral ExportersAli SyedNo ratings yet

- O Level Biology Read and Write BookDocument118 pagesO Level Biology Read and Write BookAli Syed0% (1)

- Minutes of The 32th Meeting AIDCDocument11 pagesMinutes of The 32th Meeting AIDCAli SyedNo ratings yet

- List of Allianz Efu Network (Panel) Hospitals: Hospital Name Address Contact NoDocument5 pagesList of Allianz Efu Network (Panel) Hospitals: Hospital Name Address Contact NoAli SyedNo ratings yet

- Unclaimed Deposit For Year 2016Document3,430 pagesUnclaimed Deposit For Year 2016Ali SyedNo ratings yet

- Pakistan Market Price Bulletin November 2014 Issue HighlightsDocument3 pagesPakistan Market Price Bulletin November 2014 Issue HighlightsAli SyedNo ratings yet

- Spiritof: GrowthDocument35 pagesSpiritof: GrowthAli SyedNo ratings yet

- Home Group Introduction News Center Business Corporate Culture Join UsDocument2 pagesHome Group Introduction News Center Business Corporate Culture Join UsAli SyedNo ratings yet

- Banks Resource Persons List Updated As of September 24, 2019Document5 pagesBanks Resource Persons List Updated As of September 24, 2019GOME PrivateNo ratings yet

- Minutes 252 5-4-2017 - ApprovedDocument94 pagesMinutes 252 5-4-2017 - ApprovedAli SyedNo ratings yet

- List of FLL OperatorsDocument7 pagesList of FLL OperatorsAli SyedNo ratings yet

- Vdocuments - MX - Name As Found in CBR Company Name Name As Found in CBR Company Name NaeemDocument102 pagesVdocuments - MX - Name As Found in CBR Company Name Name As Found in CBR Company Name NaeemAli SyedNo ratings yet

- PantherTyresLimited ProspectusDocument150 pagesPantherTyresLimited ProspectusAli Syed100% (1)

- China's Foreign Agriculture Investments: April 2018Document60 pagesChina's Foreign Agriculture Investments: April 2018Ali SyedNo ratings yet

- 2020116191945407punjab SocialWelfareIndustriesDataDocument608 pages2020116191945407punjab SocialWelfareIndustriesDataAli SyedNo ratings yet

- Sectoral ExportersDocument80 pagesSectoral ExportersAli SyedNo ratings yet

- National University of Sciences and Technology Sector H-12, Islamabad Open Auction NoticeDocument1 pageNational University of Sciences and Technology Sector H-12, Islamabad Open Auction NoticeAli SyedNo ratings yet

- BHP Billiton 2010 Case Studies FinalDocument16 pagesBHP Billiton 2010 Case Studies FinalAli SyedNo ratings yet