Professional Documents

Culture Documents

MMPF-1 Ques Paper

Uploaded by

pallavi kumari0 ratings0% found this document useful (0 votes)

22 views2 pagesThis document provides an exam for a Master of Business Administration degree. It contains 8 questions related to the topic of working capital management. The questions cover concepts like gross and net working capital, factors influencing working capital determination, credit policy analysis, credit evaluation models, bank lending principles, cash credit systems, commercial papers, working capital objectives and barriers for small/medium enterprises, and short notes on just-in-time, credit rating, public deposits, consortium lending, payables, and money market. Students must choose 5 questions to answer in the 3 hour exam.

Original Description:

question paper

Original Title

MMPF-1 ques paper

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an exam for a Master of Business Administration degree. It contains 8 questions related to the topic of working capital management. The questions cover concepts like gross and net working capital, factors influencing working capital determination, credit policy analysis, credit evaluation models, bank lending principles, cash credit systems, commercial papers, working capital objectives and barriers for small/medium enterprises, and short notes on just-in-time, credit rating, public deposits, consortium lending, payables, and money market. Students must choose 5 questions to answer in the 3 hour exam.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesMMPF-1 Ques Paper

Uploaded by

pallavi kumariThis document provides an exam for a Master of Business Administration degree. It contains 8 questions related to the topic of working capital management. The questions cover concepts like gross and net working capital, factors influencing working capital determination, credit policy analysis, credit evaluation models, bank lending principles, cash credit systems, commercial papers, working capital objectives and barriers for small/medium enterprises, and short notes on just-in-time, credit rating, public deposits, consortium lending, payables, and money market. Students must choose 5 questions to answer in the 3 hour exam.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

No.

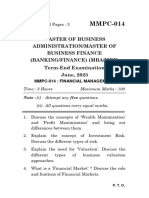

of Printed Pages : 2 MMPF-001

MASTER OF BUSINESS ADMINISTRATION

(MBA, MBAFM)

Term-End Examination

December, 2022

MMPF-001 : WORKING CAPITAL MANAGEMENT

Time : 3 hours Maximum Marks : 100

Note : (i) Attempt any five questions.

(ii) All questions carry equal marks.

1. Explain the ‘Gross Concept’ and ‘Net Concept’ of

working capital. Discuss the different types of

working capital and their behaviour in different

categories of firms.

2. What is working capital ? What are the various

factors influencing the determination of working

capital ?

3. The management of Alpha Ltd. is considering to

change its existing credit policy. The details of

options are given below :

(< ’000)

Credit Policy Existing X Y Z

Sales 50 56 60 62

Variable cost

40 448 48 496

(80% of sale)

Fixed cost 6 6 6 6

Average collection

30 45 60 75

period (days)

Firm’s rate of investment is 20%

Assume 360 days in a year

You are required to advise which of these options is

the best.

MMPF-001 1 P.T.O.

4. What is the need for credit evaluation of a

customer ? Discuss the different credit evaluation

models used for evaluating the creditworthiness

of customers.

5. Explain the principles followed by banks while

lending loans. What are the salient features of

cash credit system ? Discuss the merits and

demerits of cash credit system.

6. What do you understand by the term

‘Commercial Papers (CP)’ ? Describe the

eligibility conditions prescribed and the

procedure followed for issuing Commercial

Papers.

7. What are the objectives of working capital

management in Small and Medium Enterprises

(SMEs) ? Discuss the various barriers in

optimization of working capital in SMEs.

8. Write short notes on any four of the following :

(a) Just-In-Time

(b) Credit Rating

(c) Public Deposits

(d) Consortium Lending

(e) Payables

(f) Money Market

MMPF-001 2

You might also like

- Rodrigo Zeidan - The General Model of Working Capital Management (2022, Palgrave Macmillan) - Libgen - LiDocument277 pagesRodrigo Zeidan - The General Model of Working Capital Management (2022, Palgrave Macmillan) - Libgen - LiBob100% (1)

- The Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiFrom EverandThe Basel Ii "Use Test" - a Retail Credit Approach: Developing and Implementing Effective Retail Credit Risk Strategies Using Basel IiNo ratings yet

- P5 Strategic MGT QADocument12 pagesP5 Strategic MGT QACLIVENo ratings yet

- Mba DEC 2022 Exam - MergedDocument13 pagesMba DEC 2022 Exam - MergedAman SharmaNo ratings yet

- Management Programme CD)Document4 pagesManagement Programme CD)mohit pandeyNo ratings yet

- MMPC-014 Jun 2023Document3 pagesMMPC-014 Jun 2023twinklekumari76263No ratings yet

- 2012 Ii PDFDocument23 pages2012 Ii PDFMurari NayuduNo ratings yet

- MMPC 014Document6 pagesMMPC 014Pawan ShokeenNo ratings yet

- MML 5202Document6 pagesMML 5202MAKUENI PIGSNo ratings yet

- Master of Commerce Term-End Examination December, 2OO8Document4 pagesMaster of Commerce Term-End Examination December, 2OO8Smriti SoniNo ratings yet

- AGSO J07 Question Paper Final DraftDocument4 pagesAGSO J07 Question Paper Final Draftatish7No ratings yet

- McomDocument4 pagesMcomPiyush Prasad SwainNo ratings yet

- Code: 5P1A22Document9 pagesCode: 5P1A22Nakshtra DasNo ratings yet

- Institute of Management Technology: Centre For Distance LearningDocument2 pagesInstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- Icap Question PaperDocument2 pagesIcap Question Paperrohail51No ratings yet

- MBA108CDocument2 pagesMBA108CRohit TushirNo ratings yet

- ACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgDocument2 pagesACFrOgDyc9k8h IouBPfnYdw4bD1QFiJrmZx LhZbxlTlNWzZLDfyT72KmbfpXfnuBNrHdPuA8TyMY9hUahg5rNBGV5optJk1BQ4K1 YxmHbnmQPyZDjQZLl9wWBb75kM ZDGNHhQxKiU BSAn2Dkl2TQCx8qHSDbsdtDDcPhgGauri SinghNo ratings yet

- 260 - MCO-7 - ENG D18 - CompressedDocument2 pages260 - MCO-7 - ENG D18 - CompressedTushar SharmaNo ratings yet

- Mfs 93th JaibbDocument4 pagesMfs 93th JaibbMd Abul KalamNo ratings yet

- MMPC 14Document2 pagesMMPC 14twinklekumari76263No ratings yet

- Management Programme Term-End Examination December, 2009Document4 pagesManagement Programme Term-End Examination December, 2009Anonymous pKsr5vNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological Universityamit raningaNo ratings yet

- MA0043Document2 pagesMA0043Tenzin KunchokNo ratings yet

- Bba 502Document4 pagesBba 502Innocent BwalyaNo ratings yet

- DMGT207 8Document1 pageDMGT207 8rjaggi0786No ratings yet

- MMPMC 014Document3 pagesMMPMC 014Ashvanee Kr. PathakNo ratings yet

- Financial Management Question BankDocument9 pagesFinancial Management Question BankAnonymous uHT7dDNo ratings yet

- SME IIT Jodhpur ExamDocument15 pagesSME IIT Jodhpur ExamJatin yadavNo ratings yet

- Sem 2 PypDocument21 pagesSem 2 Pypsakshi srivastavaNo ratings yet

- Pokhara University 6thDocument12 pagesPokhara University 6thashmee dhakalNo ratings yet

- Question BankDocument8 pagesQuestion BankEvangelineNo ratings yet

- Xaviers Institute of Business Management StudiesDocument2 pagesXaviers Institute of Business Management StudiesJay KrishnaNo ratings yet

- Sessional Examination: Master of Business Administration (MBA) Semester: IIIDocument4 pagesSessional Examination: Master of Business Administration (MBA) Semester: IIINishaTripathiNo ratings yet

- M.B.A. (E-Business) Degree Examination, 2010: 210. Financial MangementDocument2 pagesM.B.A. (E-Business) Degree Examination, 2010: 210. Financial MangementMahesh RNo ratings yet

- Financial Management 14 JuneDocument3 pagesFinancial Management 14 JunerajNo ratings yet

- Financial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMDocument6 pagesFinancial Management (Paper Code-303) End Term Papers - Shilpa Arora - IINTMMatthew HughesNo ratings yet

- Rockwood Institute Business Studies Xii CBSE Term-II Examination 2022Document3 pagesRockwood Institute Business Studies Xii CBSE Term-II Examination 2022Rockwood InstituteNo ratings yet

- Credit Risk Assessment 1 May 2011Document5 pagesCredit Risk Assessment 1 May 2011Basilio MaliwangaNo ratings yet

- AMF3872 Compensatory Assignment 1 and 2Document3 pagesAMF3872 Compensatory Assignment 1 and 2SoblessedNo ratings yet

- Solved SMU Assignment / ProjectDocument3 pagesSolved SMU Assignment / ProjectArvind KNo ratings yet

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- Mba AssignmentsDocument18 pagesMba Assignmentsassignmentbazaar100% (1)

- BCOE - 143 E DoneDocument4 pagesBCOE - 143 E DoneAmit YadavNo ratings yet

- Screenshot 2023-05-04 at 11.40.13 PDFDocument5 pagesScreenshot 2023-05-04 at 11.40.13 PDFTshidiso KgosiemangNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Fall 2012 (February 2013) ExaminationsDocument2 pagesInstitute of Cost and Management Accountants of Pakistan Fall 2012 (February 2013) Examinationssalmanahmedkhi1No ratings yet

- Management Programme Term-End Examination December, 2018 Ms-004: Accounting and Finance For ManagersDocument3 pagesManagement Programme Term-End Examination December, 2018 Ms-004: Accounting and Finance For ManagersreliableplacementNo ratings yet

- Ininstitute of Management Technology: Centre For Distance LearningDocument2 pagesIninstitute of Management Technology: Centre For Distance Learningabhimani5472No ratings yet

- BMSDocument3 pagesBMSaliNo ratings yet

- Answer All Questions (100 Marks) Question One (20 Marks) : Bwfm5013 Corporate Finance MATRIC NODocument14 pagesAnswer All Questions (100 Marks) Question One (20 Marks) : Bwfm5013 Corporate Finance MATRIC NONur LiyanaNo ratings yet

- QPB - Dec - 20 Mock 1 Q FinalDocument9 pagesQPB - Dec - 20 Mock 1 Q FinalBernice Chan Wai WunNo ratings yet

- Financial Management-1Document6 pagesFinancial Management-1chelseaNo ratings yet

- Business Studies Class XII I Pre-Board Paper (2021-22)Document4 pagesBusiness Studies Class XII I Pre-Board Paper (2021-22)Ashish GangwalNo ratings yet

- Model Question Paper - CIHRM EX III - Business Acumen (CIHRMS9, CIHRMS10)Document4 pagesModel Question Paper - CIHRM EX III - Business Acumen (CIHRMS9, CIHRMS10)aakilar111No ratings yet

- Year QT - No. Questions Marks Answer Any 5 Questions Strategic Management - Univerisity Question Papers From 2002 - 2007Document18 pagesYear QT - No. Questions Marks Answer Any 5 Questions Strategic Management - Univerisity Question Papers From 2002 - 2007Jinesh GadaNo ratings yet

- 05 s603 MabsDocument2 pages05 s603 MabsmehmudassarNo ratings yet

- GET NMIMS MBA Solved Assignment Solutions Case Studies & Projects Contact: Sunita Call Us +919632359315 orDocument2 pagesGET NMIMS MBA Solved Assignment Solutions Case Studies & Projects Contact: Sunita Call Us +919632359315 orMbacasestudyhelp100% (1)

- Question 262122Document3 pagesQuestion 262122groverpankaj04No ratings yet

- Ignou July-December 2017 Solved Assignments at 160 Per AssignmentDocument22 pagesIgnou July-December 2017 Solved Assignments at 160 Per AssignmentDharmendra Singh SikarwarNo ratings yet

- Stream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementFrom EverandStream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementNo ratings yet