Professional Documents

Culture Documents

NLPC IRS Complaint Against Alianza Americas July 10, 2023

Uploaded by

Gabe Kaminsky0 ratings0% found this document useful (0 votes)

11K views9 pagesObtained by Gabe Kaminsky of the Washington Examiner

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentObtained by Gabe Kaminsky of the Washington Examiner

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11K views9 pagesNLPC IRS Complaint Against Alianza Americas July 10, 2023

Uploaded by

Gabe KaminskyObtained by Gabe Kaminsky of the Washington Examiner

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

Form 13909 Department ofthe Treasury Internal Revenue Service

(December 2016) Tax-Exempt Organization Complaint (Referral)

T Name of refered organization

liana Americas

Street address

3030 W. Cermak Road

om Siato | ZP code Date of referral

Chicago 1 60603 July 10,2028

2. Organization's Employer Identification Number (EIN)

EIN 342066826

3. Nature of vciation

DirectorsiOficers/Persons are using incomelassets fr personal gain

C1 Organization is engaged in commercial, for-profit business activites

TZ incomesAssets are being used to suppor ilegal or terrorist activities

Organization is involved in poltical eampaign

TH] Organization is engaged in excessive lobbying acities

Organization refused to disclose or provide a copy of Form 900,

Qa

&

QO

o

Qo

Organization failed to report employment, income or excise tax libilty properly

Organization failed to fle required federal tax retums and forms,

Organization engaged in deceptive or improper fundraising practices

Other (describe)

Details of vioration

Name(s) of person(s) involved

Oscar Chacon, Executive Director, and Mirtha Colon, its President

Organizational ttte(s)

See above

Date(s) Dollar amouni(s) (if known)

Form 990 for 2021,

Description of activites

‘Alianza Americas engaged in extensive lobbying activities but reported in its Form 990 for 2021 (and for 2019 and 2020) tat it id not and thus

failed to file the required Schedule C to report the amount it spent on lobbying activites, See attached supplemental complain leter,

5. Submitter information

Name

National Legal and Policy Center

‘Occupation or business

[Nonprofit public interest ethics watchdog

Street address

107 Park Washington Court

iy ‘State ZIP code Telephone number

Falls Church va 22046 (703) 237-1970

Z_1am concemed that | might face retaliation or retribution if my i

iy is disclosed

6, Submission and documentation: The completed form, along with any supporting documentation, may be mailed to IRS EO

Classification, Mail Code 4910DAL, 1100 Commerce Street Dallas, TX 75242-1198, faxed to 214-413-5415 or emailed to

‘s0class@is gov. Disclaimer Notice: Your email submission of Form 13909 and attachments are nat encrypted for secutty

Catalog Number 508148 ‘wins.gov Form 13909 (Rev. 12-2016)

Co-Founder

Ken Boehm 1949-2018

National Legal and 2a"

Policy Centerysgm, Sate

oe

eee mn

m=

« ap + fs? Davia wntinson

‘omoting ethics in public life

br e p fe Since 1991

July 10, 2023

Robert Malone

Director, Exempt Organizations Division

Internal Revenue Service

‘TEGE Referrals Group - MC 4910 DAL

1100 Commerce Street

Dallas, TX 75242

‘Via Email: eoclass@irs.gov

Re: Supplement Documentation to Form 13909: Tax-Exempt Organization Complaint

(Referral) Alianza Americas, EIN 34-2066826

Dear Mr. Malone:

The National Legal and Policy Center (NLPC) hereby submits this supplemental

complaint to the attached Form 13909 Tax-Exempt Organization Complaint (Referral) regarding

violations of IRS rules and regulations by Alianza Americas, a registered 501 (c)(3) tax exempt

organization, Oscar Chacon, Executive Director, who signed the organization's 2021 Form 990,

and Mirtha Colon, its principal officer and President for falsely stating in its 2021 return that

Alianza Americas does not engage in lobbying activities and for failing to file Schedule C listing

the amount it spends on its lobbying activities.

This complaint is a supplement to the one that NLPC filed on October 26, 2022, against

Alianza Americas for also falsely reporting that it does not engage in lobbying activities for

years 2019 and 2020. See attached complaint which is incorporated herewith.

NLPC is a nonprofit 501(c)(3) ethics watchdog organization that has filed ethics

complaints against public officials and organizations for failing to comply with relevant

disclosure laws and related laws and regulations at the state and federal level. This complaint is

For information about NLPC’s Government Integrity Project, see

w//www. nIpe.ore/?s=government*integrity+project, See also NLPC’s IRS Complaint

against Ebenezer Building Foundation and Senator Raphael Warnock for failing to disclose

related organizations in its ownership of an Atlanta apartment building where poor Black tenants

are being evicted for back rents as little as $28.55, https://www.nlpc.org/government-integrity-

tli led-agai r-wamocks-chur iden-own

apartment-building/ and NLPC’s IRS Complaint against Black Lives Matter Global Network

Foundation and Patrisse Cullors for personal use of nonprofit assets,

1

based on information regarding the questionable and possible continued illegal lobbying

activities of Alianza Americas as reported by investigative reporter Gabe Kaminsky in the

Washington Examiner, “Soros-backed charity that may have ‘violated! federal law still appears

10 be lobbying, experts say" (Nov. 22, 2022).

Alianza Americas Continued Lobbying Activities in 2021

Besides the unreported lobbying activities that Alianza Americas engaged in in 2019 and

2020 as described in our October 26, 2022 complaint, the group continued to engage in

unreported lobbying activities in 2021. As reported in the November 22, 2022, Washington

Examiner article:

In October 2021, Alianza called on Congress to "pass legislation that grants permanent

protections to immigrants," including those who have TPS status. The charity posted a

video of a TPS "beneficiary" urging the White House and Congress to grant those

protections, and in November 2021, Alianza's executive director, Oscar Chacon, led a

TPS protest in front of the White House.

And yet, in its 2021 Form 990, filed on November 11, 2022 and only recently available, it

answered “No” in Part IV, line 4 to the following question:

Section 501(c)(3) organizations. Did the organization engage in lobbying activities, or

have a section 501(h) election in effect during the tax year? If "Yes," complete Schedule

C, Part 11.3

According to the IRS’s definition of lobbying, “An organization will be regarded as

attempting to influence legislation if it contacts, or urges the public to contact, members or

employees of a legislative body for the purpose of proposing, supporting, or opposing legislation,

of if the organization advocates the adoption or rejection of legislation.” * It seems abundantly

//www. nlp.

pirchase/ and for unlawful fundraising

Inttps://www.n rate-integrit

matter-over-fundraising.

2 https://www. washingtonexaminer.com/policy/immigration/soros-charity-lobbying-alianza-

americas

3 https://projects.propublica.org/nonprofits/organizations/342066826/202203159349302020/full

In its 2021 Form 990, Alianza Americas noted its new address as 3030 W. Cermak Road,

Chicago, IL 60623. https://www.trulia.com/p/il/chicago/3030-w-cermak-rd-chicago-il-60623—

2104178508, The address listed in its 2020 Form 990 was 2875 W. Cermak Road, Chicago, IL

60623, but that address is the Apollo 2000 Theater, a concert hall, an unlikely office address.

https://www.choosechicago.com/listing/apollos-2000/

4

https://www. irs. gov/charities-non-profits/lobbying

clear that Alianza Americas has violated the IRS laws and regulations for failing to report that it

engages in lobbying activities as defined by the IRS and failing to file the required Schedule C

listing the expenditures for such activities,

This latest violation is all the more egregious since the group was on notice when NLPC

filed its complaint against it on October 26, 2022 that it failed to disclose its lobbying activities

for 2019 and 2020, and yet, a month later when it filed its 2021 Form 990, it continued to declare

to the IRS under penalty of perjury that it did not engage in lobbying activities in 2021

CONCLUSION

The IRS must conduct a full investigation and audit of Alianza Americas’ lobbying

activities and to assess appropriate civil and criminal penalties because the 2021 Form 990 as

well as the 2019 and 2020 Form 990s were signed under penalty of perjury, and to revoke its tax

exempt status for its repeated violations. The public interest demands it,

NLPC reserves the right to further supplement this complaint with addition information

that it may obtain.

Sincerely,

4s/ Paul D. Kamenar

Paul D. Kamenar, Esq.

1629 K Street, N.W.

Suite 300

‘Washington, D.C. 20006

301-257-9435

pkamenar@nlpc.orz

Counsel to NLPC

Encls: Form 13909: Tax-Exempt Organization Complaint (Referral) Alianza Americas, 34-

2066826 (July 10, 2023).

NLPC Complaint October 26, 2022

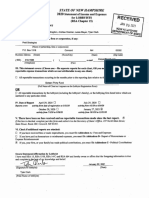

Department of he Treasury - Internal Revenue Service

Tax-Exempt Organization Complaint (Referral)

Form 13909

(December 2016)

1, Name of referred organization

Alianza Americas

Street address

2875 W. Cermak Road

oy State ZIP code Date of referral

Chicago IL 60623, October 26, 2022

2 Organization's Employer Identifcation Number (EIN)

EIN 34-2066826

3 Nature of violation

LZ Directorsiorticers/Persons are using income/assets for personal gain

‘Organization is engaged in commercial, for-profit business actives

IncomerAssets are being used to support illegal or terorist activities

Organization is involved in a political campaign

Organization is engaged in excessive lobbying activities

Organization refused to disclose or provide a copy of Form 990

Organization faled to report employment, income or excise tax libilly propery

Organization failed to file required federal tax returns and forms

Organization engaged in deceptive or improper fundraising practices

0 other (describe)

®@OOmMOO0

4. Details of violation

Name(s) of person(s) involved

Claudio Lucero, principal officer and Oscar Chaco, Executive Director, and Mirtha Colon its Present

Organizational tile(s)

See above

Date(s) Dollar amount(s) (if known)

Forms 990 for 2019 and 2000

Description of activities

Alianza Américas engaged in extensive lobbying activites but reported in its Porm 990s for both 2019 and 2020 that tc not and thus filed to file

the required Schedule C to report the amount it spent on lobbying activites. IF'those expenditures were a significant part o its activities, its tax

‘exempt staus must be revoked, See attached supplemental complaint eter.

5 Submitter information

Name

[National Legal and Poliey Cemter

Occupation or business

‘Nonprofit publi interest ethics watchdog

Street address

107 Park Washington Court

oy State ZIP code Telephone number

Falls Chureh vA 22046 (703) 237-1970,

2m concemed that | might face retaltion or retibuton if my identity is disclosed

6. Submission and documentation: The completed form, along with any supporting documentation, may be mailed to IRS EO

Classification, Mail Code 4910DAL, 1100 Commerce Street Dallas, TX 75242-1198, faxed to 214-413-5415 or emailed to

20ciass@irs.dov. Disclaimer Notice: Your email submission of Form 13909 and atiachments are not encrypted for security

Catalog Number 506148, ww is gov Form 13909 (Rev. 12-2016)

Co-Founder

‘Ken Boehm 1949-2018

National Legal and comes een

Policy Center

‘Kurt Christensen, Vice-Chairman

Michae! Falcone

Fiohard F Latfounain

“Life™ David Wikinson

a ting ethics in public life

Promoting if Since 1991

October 26, 2022

Robert Malone

Director, Exempt Organizations Division

Internal Revenue Service

TEGE Referrals Group - MC 4910 DAL

1100 Commerce Street

Dallas, TX 75242

Via Email: eoclass@irs.gov

Re: Supplement Documentation to Form 13909: Tax-Exempt Organization Complaint

(Referral) Alianza Americas, EIN 34-2066826

Dear Mr. Malone:

The National Legal and Policy Center (NLPC) hereby submits this supplemental

complaint to the attached Form 13909 Tax-Exempt Organization Complaint (Referral) regarding

violations of IRS rules and regulations by Alianza Americas, a registered 501(c)(3) tax exempt

organization, and Claudio Lucero, its listed principal officer and Oscar Chaco, Executive

Director, who signed the organization’s 2019 Form 990; and Mirtha Colon, its principal officer

and President. who signed the organization’s 2020 Form 990 return, for falsely stating in each of

those filings that Alianza Americas does not engage in lobbying activities and for failing to file

Schedule C listing the amount it spends on its lobbying activities,

NLPC is a nonprofit 501(c)(3) ethics watchdog organization that has filed ethics.

complaints against public officials and organizations for failing to comply with relevant

disclosure laws and related laws and regulations at the state and federal level. This complaint is

} For information about NLPC’s Government Integrity Project, see

‘ittosy/www.nlpe.org/?s=government+ integrity project. See also NLPC’s IRS Complaint

against Ebenezer Building Foundation and Senator Raphael Wamock for failing to disclose

related organizations in its ownership of an Atlanta apartment building where poor Black tenants

are being evicted for back rents as little as $28.55, https://www.nlpe.org/zovernment-integrity-

ject/irs-complaint-filed-against-senator-warnocks-church-for-hidden-ownership-of-atlanta-

apartment-building/ and NLPC’s IRS Complaint against Black Lives Matter Global Network

Foundation and Patrisse Cullors for personal use of nonprofit assets,

:/ www nlpe.org/featured-news/irs-complaint-filed-against-black-lives-matter-for-mansion-

purchase! and for unlawful fundraising

htpsy/Awww.nlpe.org/corporate-i

matter-over-fundraising.

inst-black-lives-

107 Park Washington Court Falls Church, VA * 22046

703-237-1970 * fax 703-237-2090 * www.nipe.org

based on information regarding the questionable and possible illegal lobbying activities of

Alianza Americas as reported by investigative reporter Gabe Kaminsky in a recent news story in

the Washington Examiner, “Soros-backed nonprofit group may have illegally used federal

grants: GOP” (Oct. 22, 2022)

Alianza Americas Lobbying Activities

Alianza Americas made news recently when it filed a class action lawsuit against Florida

Governor Ron DeSantis for sending a group of migrants from Venezuela seeking asylum in the

United States to Martha’s Vineyard. In the Washington Examiner article, Mr. Kaminsky reports

that complaints were filed on October 21, 2022 with the Inspector General of the Department of

Health and Human Services (HHS) by Brian Harrison, the former Chief of Staff of HHS and

now Texas State Representative, and U.S. Representatives Chip Roy and Beth Van Duyne from

the border state of Texas, calling on the Inspector General to investigate whether Alianza

‘Americas violated federal criminal law, 18 U.S.C. 1315, which prohibits any lobbying with

appropriated federal funds. Alianza Americas was awarded federal grants of some $8.5 million

by HHS.

As reported in the Washington Examiner article:

“have continued to monitor actions taken by the Department and am deeply concerned

that taxpayer dollars, in the guise of federal grants from the Centers for Disease Control

and Prevention (CDC) and the Health Resources and Services Administration (HRSA),

are being used to fund lobbying activities and contacts in the United States and foreign

jurisdictions and to promote illegal immigration into the United States," Harrison wrote

in his lenter.

"As members of Congress we take seriously our roles of ensuring taxpayer dollars are

used wisely and within the confines of the law, and we are sure you share that goal,” Roy

and Van Duyne wrote in their letter. "As such, we are requesting a review of all grants

received by Alianza Americas as well as the publicly disclosed actions taken by Alianza

Americas that would be in violation of the law and federal regulations."

Alianza held "two congressional briefings” in Washington, D.C., on immigration-

related issues and made over 200 "visits 0 Congress" between June 2017 and September

2019, the nonprofit group disclosed on its 2019 tax documents. Alianza also disclosed it

? https://www.washingtonexaminer.com/news/bidens-hhs-may

soros-nonprofit,

> https://www.nbenews.com/politics/immigration/migrants-flown-marthas-vinevard-sue-

desantis-lawsuit-alleging-fraud-rena48649

-illegally-given-millions-to-

"activated a nationwide community organizing strategy” after the Trump administration's

“cancellation” of temporary protected status — letting immigrants remain in the United

States if their native country is dealing with armed conflict or other extraordinary

condition.*

Indeed, an examination of Alianza America’s Form 990 retums for both 2019 and 2020

show extensive lobbying activities. In its 2020 Form 990 filing, the group reports in Part II:

This organization and mobilization led by Alianza Americas and member organizations

have enabled our network and partner organizations in various states to engage

Iuundreds of TPS holders so they could tell their own stories to policymakers in Congress

and advocate for permanent solutions, and for immediate measures to protect TPS

holders. Recent results our organizational strategy: Two congressional briefings on

TPS, DACA and DED, held in Washington, DC More than 200 visits to Congress made

between June 2017 and September 2019. (emphasis added).

And yet, it answered “No” in Part IV, line 4 to the following questior

Section 501(c)(3) organizations. Did the organization engage in lobbying activities. or

have a section 501(h) election in effect during the tax year? If "Yes," complete Schedule

C, Part ILS

Similarly, in its Form 990 filed for calendar year 2019, Allianz described its lobbying

activity in Schedule O of their return as follows:

Save TPS:

In response to the cancellation of Temporary Protected Status (TPS) programs, we

activated a nationwide community organizing strategy led by our members, including the

"House for House" campaign in key cities in the USA This organization and mobilization

led by Alianza Americas and member organizations have enabled our network and

partner organizations in various states to engage hundreds of TPS holders so they could

tell their own stories to policymakers in Congress and advocate for permanent

solutions, and for immediate measures to protect TPS holders.

Recent results our organizational strategy:

Two congressional briefings on TPS, DACA and DED, held in Washington, DC More

than 200 visits to Congress made between June 2017 and September 2019.6

# See note 2, supra.

* https://projects.propublica.org/nonprofits/organizations/342066826/2021 1 1689349300341 /full

° https://projects.propublica.ore/nonprofits/display_990/342066826/05 2021 prefixes 34-

35%2F342066826 201912 990_2021051318106130

And just as they did in their 2020 return, they checked the box “No” in response to the following

question:

Section S01(c)(3) organizations. Did the organization engage in lobbying activities, or

have a section 501(h) election in effect during the tax year? If "Yes," complete Schedule

, Part

According to the IRS’s definition of lobbying, “An organization will be regarded as

attempting to influence legislation if it contacts, or urges the publie to contaet, members or

employees of a legislative body for the purpose of proposing, supporting, or opposing legislation,

ot if the organization advocates the adoption or rejection of legislation,” (Emphasis added).? It

seems abundantly clear that Alianza Americas has violated the IRS laws and regulations for

failing to report that it engages in lobbying activities as defined by the IRS and failing to file the

required Schedule C listing the expenditures for such activities.

CONCLUSION

The IRS must conduct a full investigation and audit of Alianza Americas’ lobbying

activities and to assess appropriate civil and criminal penalties, because the Form 990s were

signed under penalty of perjury, and to revoke its tax exempt status if warranted, ‘The public

interest demands it.

NLPC reserves the right to further supplement this complaint with addition information

that it may obtain.

Sincerely,

(s( Paul D. Kamenar

Paul D. Kamenar, Esq.

1629 K Street, N.W.

Suite 300

Washington, D.C. 20006

Paul.kamenar@gmail.com

Counsel to NLPC

Encl: Form 13909: Tax-Exempt Organization Complaint (Referral) Alianza Americas, 34-

2066826

7 htips://www.irs.gov/charities-non-profits/lobbying

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Adeel Mangi Supplemental Letter March 2024 Senate Judiciary CommitteeDocument1 pageAdeel Mangi Supplemental Letter March 2024 Senate Judiciary CommitteeGabe KaminskyNo ratings yet

- Lawsuit State, FDRLST, DW, Preliminary Injunction. Feb, 6, 2024Document51 pagesLawsuit State, FDRLST, DW, Preliminary Injunction. Feb, 6, 2024Gabe Kaminsky100% (1)

- 2022 GDI Tax Forms (AN Foundation)Document15 pages2022 GDI Tax Forms (AN Foundation)Gabe KaminskyNo ratings yet

- UNRWA Elimination ActDocument3 pagesUNRWA Elimination ActGabe KaminskyNo ratings yet

- 2022 GDI Tax Forms (Disinformation Index)Document32 pages2022 GDI Tax Forms (Disinformation Index)Gabe KaminskyNo ratings yet

- Mangi SJQ Supplement Letter - 3.9.24Document1 pageMangi SJQ Supplement Letter - 3.9.24Gabe KaminskyNo ratings yet

- ZLI Coalition Prosecution Request To AGDocument51 pagesZLI Coalition Prosecution Request To AGGabe KaminskyNo ratings yet

- Invest in Our Future PT 3Document11 pagesInvest in Our Future PT 3Gabe KaminskyNo ratings yet

- Tyler Clark Lobbying For Sixteen Thirty Fund: Nikki Haley CampaignDocument1 pageTyler Clark Lobbying For Sixteen Thirty Fund: Nikki Haley CampaignGabe KaminskyNo ratings yet

- Daily Wire and Federalist Lawsuit Against State Department On Global Disinformation Index, Gabe KaminskyDocument67 pagesDaily Wire and Federalist Lawsuit Against State Department On Global Disinformation Index, Gabe KaminskyGabe KaminskyNo ratings yet

- Tyler Clark, Sixteen Thirty Fund Lobbying: Nikki Haley CampaignDocument3 pagesTyler Clark, Sixteen Thirty Fund Lobbying: Nikki Haley CampaignGabe KaminskyNo ratings yet

- FDR 2022 Thomas-CDocument9 pagesFDR 2022 Thomas-CGabe KaminskyNo ratings yet

- Al-Haq Gaza War 2023 - NGO MonitorDocument5 pagesAl-Haq Gaza War 2023 - NGO MonitorGabe KaminskyNo ratings yet

- NYC Teacher Judi Cheng Email To UFT Union Employees 10/17/23.Document3 pagesNYC Teacher Judi Cheng Email To UFT Union Employees 10/17/23.Gabe KaminskyNo ratings yet

- Report: U.N. Teachers Celebrated Hamas MassacreDocument68 pagesReport: U.N. Teachers Celebrated Hamas MassacreWilliams PerdomoNo ratings yet

- Ahmed Cover LetterDocument3 pagesAhmed Cover LetterAlexis LeonardNo ratings yet

- Letter Calling For Jennifer Granholm's ResignationDocument5 pagesLetter Calling For Jennifer Granholm's ResignationNick PopeNo ratings yet

- 2023-08-03 JDJ To Ahmed - CCDHDocument3 pages2023-08-03 JDJ To Ahmed - CCDHGabe KaminskyNo ratings yet

- 07.12.23 Letter To Sec Granholm Re FordDocument2 pages07.12.23 Letter To Sec Granholm Re FordGabe KaminskyNo ratings yet

- Stripe Letter - August 2023 - Washington ExaminerDocument2 pagesStripe Letter - August 2023 - Washington ExaminerGabe KaminskyNo ratings yet

- Alito 2022 Financial DisclosureDocument13 pagesAlito 2022 Financial DisclosureJimmy HooverNo ratings yet

- 2022 OJS246 710894 enDocument4 pages2022 OJS246 710894 enGabe KaminskyNo ratings yet

- 2023-07-26 CDP Supplement To MUR 8119Document2 pages2023-07-26 CDP Supplement To MUR 8119Gabe KaminskyNo ratings yet

- Granholm Supplemental Ethics Complaint - Ford DRAFTDocument10 pagesGranholm Supplemental Ethics Complaint - Ford DRAFTGabe KaminskyNo ratings yet

- Contract Letter From GdiDocument10 pagesContract Letter From GdiGabe KaminskyNo ratings yet

- 06.07.2023 - Letter To Global Engagement Center - Small Business CommitteeDocument4 pages06.07.2023 - Letter To Global Engagement Center - Small Business CommitteeGabe KaminskyNo ratings yet

- Stripe Letter (00009782xF5606)Document4 pagesStripe Letter (00009782xF5606)Gabe KaminskyNo ratings yet

- 07.24.2023 - Follow-Up Letter To Global Engagement CenterDocument2 pages07.24.2023 - Follow-Up Letter To Global Engagement CenterGabe KaminskyNo ratings yet

- Brian Harrison Letter To Ut Austin Global Disinformation IndexDocument1 pageBrian Harrison Letter To Ut Austin Global Disinformation IndexGabe KaminskyNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Appointment Rules of Law Officer 2010 PDFDocument3 pagesAppointment Rules of Law Officer 2010 PDFHammad AliNo ratings yet

- Mother TeresaDocument11 pagesMother TeresaKenNo ratings yet

- Abante, Jr. vs. Lamadrid Bearing & Parts Corp.Document1 pageAbante, Jr. vs. Lamadrid Bearing & Parts Corp.Ron DecinNo ratings yet

- Sales and Lease Midterm ReviewerDocument38 pagesSales and Lease Midterm ReviewerAriel Maghirang100% (3)

- HC Land Division Uganda 2018 31Document17 pagesHC Land Division Uganda 2018 31mustapha lubegaNo ratings yet

- Fealty and Freedom L5RDocument162 pagesFealty and Freedom L5RDominic Roman Tringali100% (4)

- Visual Vocab 1Document39 pagesVisual Vocab 1viswaduttNo ratings yet

- Valdez V Dabon (Digest)Document2 pagesValdez V Dabon (Digest)GM AlfonsoNo ratings yet

- Caste System in IndiaDocument2 pagesCaste System in IndiaMarleneAgustinNo ratings yet

- Barber, Stephen - Genet JeanDocument141 pagesBarber, Stephen - Genet JeanJoshua CurtisNo ratings yet

- Sree Narayana Public SchoolDocument6 pagesSree Narayana Public SchoolRatheesh SatadhiNo ratings yet

- 1150 Islamiyat MCQs by FARHAN KHANDocument12 pages1150 Islamiyat MCQs by FARHAN KHANWaqar KhanNo ratings yet

- Case Digest - Elegado Vs Court of Tax AppealsDocument1 pageCase Digest - Elegado Vs Court of Tax AppealsValencia and Valencia OfficeNo ratings yet

- Niche List PDFDocument28 pagesNiche List PDFEdward WestNo ratings yet

- ScriptDocument3 pagesScriptfarheena sindgiNo ratings yet

- Movertrade Vs COA PDFDocument13 pagesMovertrade Vs COA PDFBeboy Paylangco EvardoNo ratings yet

- Written InterrogatoriesDocument2 pagesWritten InterrogatoriesRay Legaspi100% (1)

- 10 Rizal's Second Sojourn in EUROPEDocument18 pages10 Rizal's Second Sojourn in EUROPELeah RoseNo ratings yet

- Full Download Book Mike Meyers Comptia Security Certification Guide Second Edition Exam Sy0 501 PDFDocument22 pagesFull Download Book Mike Meyers Comptia Security Certification Guide Second Edition Exam Sy0 501 PDFjack.payne841100% (16)

- 20 VIẾT LẠI CÂU VỀ HOW TO EXPRESS PURPOSESDocument2 pages20 VIẾT LẠI CÂU VỀ HOW TO EXPRESS PURPOSESDuy PhướcNo ratings yet

- Byron Kirk, Press ReleaseDocument3 pagesByron Kirk, Press ReleaseByron KirkNo ratings yet

- Matthew Williams Charging DocsDocument3 pagesMatthew Williams Charging DocsCurtis CartierNo ratings yet

- DNB PDCET (Emergency Medicine) Indicative Seat Matrix July 2017 - 06.09.2017Document4 pagesDNB PDCET (Emergency Medicine) Indicative Seat Matrix July 2017 - 06.09.2017Sam sanNo ratings yet

- GRADE 7 ICA English Quiz - How The World Began & Indarapatra & SulaymanDocument4 pagesGRADE 7 ICA English Quiz - How The World Began & Indarapatra & SulaymanKat sandaloNo ratings yet

- Donna Orsuto - Gaudete Et ExsultateDocument7 pagesDonna Orsuto - Gaudete Et Exsultatehabteyes abateNo ratings yet

- Kim - Jiyoung - Born - 1982 - Cho - Nam-Joo Review: Student's Name Institution of Affiliation Course Code Instructor's Name DateDocument6 pagesKim - Jiyoung - Born - 1982 - Cho - Nam-Joo Review: Student's Name Institution of Affiliation Course Code Instructor's Name DateErick OtienoNo ratings yet

- BarangayDocument2 pagesBarangayRafael Joshua LedesmaNo ratings yet

- Abacus v. AmpilDocument11 pagesAbacus v. AmpilNylaNo ratings yet

- Surfacing SummaryDocument3 pagesSurfacing SummaryAbhishek M NNo ratings yet

- Passenger Locator Form: AmberDocument4 pagesPassenger Locator Form: AmberMathian ZotarelliNo ratings yet