Professional Documents

Culture Documents

Minimum Reserve System of RBI

Uploaded by

chiku singOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Minimum Reserve System of RBI

Uploaded by

chiku singCopyright:

Available Formats

Minimum Reserve System of RBI:

Explained

Published on Thursday, March 23, 2017

Introduction

The Reserve bank of India has the authority to issue currency. The current

system of Indian government to issue notes is “Minimum Reserve System”.

Under this policy, the minimum reserves to be maintained in the form of

gold and foreign exchange should consists of rupees 200 crore. Out this

reserve, the value of gold to be maintained is rupees 115 crore. This

system was introduced in 1956 replacing the proportional reserve system,

and continues till date.

Currency Issue Department

The RBI has Issue Department under it for issue of currency. Minimum

reserves refer to the reserves maintained by the RBI against the notes

issued. The currency issued is the liability to RBI, as it has to pay the

currency holder the amount promised on the currency note. Therefore RBI

maintains certain reserve against this liability. The department can issue

any number of notes maintaining the aforementioned reserve. But RBI has

certain rules for issue of currency which is based on the economy of the

country. This system is inflationary in nature. This system has flexibility to

increase the money supply to meet the transactional needs of the people in

the country.

RBI Act of 1935

The issue of currency note is under the RBI Act of 1935. There are a

number of amendments made under this act. The present currency note

cannot be issued by the RBI in unlimited amount as it is an inconvertible

paper note. Under the current provisions, additional currency can be issued

by the EBI without maintaining the additional reserves.

Advantages:

o This method is elastic in nature.

o Increase in issue of notes does not require increase in the minimum

reserves.

o This method is reliable during financial crisis and emergencies like war,

earth quake and floods.

o This method is suitable for poor and developing countries.

Disadvantages:

o There is a danger of over issue thereby increasing the money supply

which brings inflation.

o The effective use of monetary policy measures can show good result

to control the inflation.

How new currencies are issued by RBI-

o Based on the economic growth of the country, RBI decides to expand

the money supply. With increase in the economic growth, the amount

of newly issued money increases. This maintains the economy without

falling into inflation.

o Each unit of new currency issued is a liability to the RBI, as it has to

pay to the bearer the amount promised on the currency. To be able to

pay this amount, there should be equal amount of assets with the RBI.

Therefore, RBI procures certain assets which are equal to the newly

issued currency. These assets are in the form of government bonds or

foreign assets. The foreign assets are kept at the Banking Department

and the reserves to be maintained are kept at Issue Department.

o The assets to be maintained by the RBI as a backup of the currency to

be issued consists of gold in the form of gold coins and gold bullion,

foreign securities, government of India securities , commercial paper,

internal bills of exchange and rupee coin.

Pros and Cons of RBI's Proportional

Reserve System

Published on Monday, March 20, 2017

Introduction

In order to issue currency notes of different denominations, the RBI

followed a system as the backing of the value of notes issued, which is

known as proportional reserve system. The proportional reserve system of

note issue was followed in India until 1956. The current system used for

note issue is minimum reserve system which will be discussed in another

article.

Reserve bank of India maintains certain reserves. This is to provide support

to the total volume of currency issued by the Reserve Bank of India.

According to proportional reserve system, out of the reserves, certain

percentage or proportion has to be held in the form of precious metals like

gold. The remaining amount of reserves is to be maintained in the form of

assets such as commercial bills or government securities.PRS was

adopted in India on recommendations of Hilton Young Commission in

1927.

History of the system

Germany was first to adopt the Proportional Reserve System of note issue

in the year 1875. A number of precious metals to be maintained in the

reserves usually varies from 25% (in countries like Canada and Argentina)

to 40% (in countries like Germany, USA and India). The remaining

proportion of the reserves must consist of standard securities that vary from

75% to 60%.

RBI Act, 1934

o The entire issue of currency notes is subjected to the regulations

framed in the RBI Act, 1934.

o As per section 33 (2) of the RBI Act, 1934, the amount of the reserves

to be maintained should be equal to the minimum of 40 per cent in gold

and sterling securities where the value of gold bullion should not be

less than Rs. 40 crore, for backing the issue of currency notes in India.

o This Act was amended in 1948 by replacing foreign securities in place

of sterling securities. As a result, as per the proportional reserve

system, the RBI had to maintain reserves equal to 40 % in gold and

foreign currencies.

o The remaining 60 % was maintained by one rupee notes or rupee

coins and government securities.

o The proportional reserve system proved to be very much inelastic and

inflexible with the growing demand for currency notes and the security

of gold.

o Therefore proportional reserve system was abolished in 1956 and the

RBI Act 1935 was again amended in 1957 so as to adopt minimum

reserve system of note issue.

Merits

The proportional reserve system has the following advantages:

o This system guarantees convertibility of paper currency.

o The monetary authority can issue paper currency much more than that

warranted by reserves thereby it ensures elasticity in the monetary

system;

o This method of note issue is economical and can be easily adopted by

the developing or under-developed countries.

Demerits

The proportional reserves system has following drawbacks:

o Under this system, a large amount of precious metal lies locked in the

reserve and cannot be put to productive use. This results in wastage of

their use.

o It is easy to expand or increase the currency but very difficult to reduce

it. The reduction of currency has deflationary effects in the economy.

o In practice, high denomination notes are converted into low

denomination notes and not into coins. Therefore the convertibility of

paper notes is not practical.

You might also like

- Currency Printing and CreationDocument47 pagesCurrency Printing and CreationAakanksha SanctisNo ratings yet

- Chapter # 7 Foreign Exchange MarketDocument27 pagesChapter # 7 Foreign Exchange Marketalap_onNo ratings yet

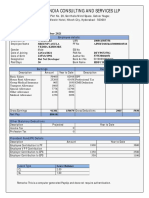

- Purview India Consulting and Services LLPDocument1 pagePurview India Consulting and Services LLPmamatha vemulaNo ratings yet

- FabHotels Invoice 15UR2XDocument1 pageFabHotels Invoice 15UR2XDev singh100% (1)

- Payslip Details for Amit Chaudhary in February 2011Document1 pagePayslip Details for Amit Chaudhary in February 2011Parveen KumarNo ratings yet

- The Foreign Exchange MarketDocument29 pagesThe Foreign Exchange MarketChamiNo ratings yet

- Monetary Policy RBI.Document28 pagesMonetary Policy RBI.santoshys50% (2)

- Overview of RbiDocument28 pagesOverview of RbiAnkit KacholiyaNo ratings yet

- Monetary Policy Rbi PPT NewDocument14 pagesMonetary Policy Rbi PPT Newpraharshitha100% (2)

- Monetary SystemDocument7 pagesMonetary SystemHOD Management DepartmentNo ratings yet

- A Study On The Impact of RBI Monetary Policies On Indian Stock MarketDocument63 pagesA Study On The Impact of RBI Monetary Policies On Indian Stock MarketNavaneeth GsNo ratings yet

- Krishna Singh RBI AssignmentDocument8 pagesKrishna Singh RBI AssignmentJNU BSCAGNo ratings yet

- Eco Project Rbi 2Document19 pagesEco Project Rbi 2tusharNo ratings yet

- Structure and Functions of RbiDocument20 pagesStructure and Functions of RbiSneh GuptaNo ratings yet

- Reserve Bank of India: Central BoardDocument25 pagesReserve Bank of India: Central Boardganesh_280988No ratings yet

- Reserve Bank of IndiaDocument9 pagesReserve Bank of IndiaAxomiya GotNo ratings yet

- Understanding the Role of the Reserve Bank of India (RBIDocument31 pagesUnderstanding the Role of the Reserve Bank of India (RBIBishal ShresthaNo ratings yet

- Functions, Roles and Monetary PoliciesDocument21 pagesFunctions, Roles and Monetary Policiesviveksharma51No ratings yet

- RBI Role in Indian EconomyDocument8 pagesRBI Role in Indian EconomyanushkNo ratings yet

- Banking ProjectDocument8 pagesBanking ProjectanushkNo ratings yet

- Indian Foreign Exchange MarketDocument18 pagesIndian Foreign Exchange MarketAbhimanyu GoyalNo ratings yet

- 1.1 Structure of Indian Banking SystemDocument17 pages1.1 Structure of Indian Banking SystemInderpreet KaurNo ratings yet

- RBI's Role in India and Pandemic ResponseDocument11 pagesRBI's Role in India and Pandemic ResponseHarish Chandani100% (1)

- Indian Banking Industry: What Is A Bank?Document7 pagesIndian Banking Industry: What Is A Bank?Taru SrivastavaNo ratings yet

- Avik Static Final Gradeup12.PDF-94Document58 pagesAvik Static Final Gradeup12.PDF-94Jagannath JagguNo ratings yet

- RBI's key roles in the Indian economyDocument2 pagesRBI's key roles in the Indian economynikitasharma88_49144No ratings yet

- Rbi Functions ListDocument7 pagesRbi Functions ListVinod Kumar ReddyNo ratings yet

- Money - MultiplierDocument10 pagesMoney - MultiplierSparsh JainNo ratings yet

- Role of RBI in Indian EconomyDocument4 pagesRole of RBI in Indian EconomySubhashit SinghNo ratings yet

- Currency IssueDocument7 pagesCurrency IssueAnkit SinhaNo ratings yet

- Notes On by Aman SrivastavaDocument5 pagesNotes On by Aman SrivastavaAshish LatherNo ratings yet

- Unit 5Document71 pagesUnit 522m146No ratings yet

- Methods of Money Notes Issuing and Functions of State Bank of PakistanDocument7 pagesMethods of Money Notes Issuing and Functions of State Bank of PakistanArshad Munir100% (1)

- Your Big IdeaDocument12 pagesYour Big IdeaBHUVNESH KUMAWATNo ratings yet

- RBI FunctionsDocument11 pagesRBI Functionsredarrow05No ratings yet

- m1-2 Regulation, Rbi, Func, PolicyDocument15 pagesm1-2 Regulation, Rbi, Func, PolicyMEENUNo ratings yet

- Structure of Interest Rates in IndiaDocument19 pagesStructure of Interest Rates in IndiashantnishantNo ratings yet

- Brief History of RBI: Hilton Young CommissionDocument24 pagesBrief History of RBI: Hilton Young CommissionharishNo ratings yet

- RBI Established to Regulate Currency, Credit SystemDocument35 pagesRBI Established to Regulate Currency, Credit SystemaadishNo ratings yet

- Digital Assignment-1 Subject Code-Bmt1013 Subject Name - Banking and InsuranceDocument9 pagesDigital Assignment-1 Subject Code-Bmt1013 Subject Name - Banking and InsuranceSwethaNo ratings yet

- Exchange Rate System in IndiaDocument8 pagesExchange Rate System in IndiaVandana SharmaNo ratings yet

- Prepared by Debasish Chakraborty Mallika Bera Khoda Pinki Wajidah Anwar Bijay Raut Rakesh SahaDocument23 pagesPrepared by Debasish Chakraborty Mallika Bera Khoda Pinki Wajidah Anwar Bijay Raut Rakesh SahaRakesh SahaNo ratings yet

- Mep Assignment: - BY: - Saranya - Shireesha - SugandhaDocument16 pagesMep Assignment: - BY: - Saranya - Shireesha - SugandhaSugandha Gajanan GhadiNo ratings yet

- RBI Functions and StructureDocument26 pagesRBI Functions and StructureAjit Pandey SunnyNo ratings yet

- Rbi PDFDocument26 pagesRbi PDFAjit Pandey SunnyNo ratings yet

- Institution, Which Controls The Monetary Policy of The Indian April 1935 in Accordance WithDocument16 pagesInstitution, Which Controls The Monetary Policy of The Indian April 1935 in Accordance WithSamridhi100% (1)

- General Awareness - Bullet: About Reserve Bank of India (RBI)Document28 pagesGeneral Awareness - Bullet: About Reserve Bank of India (RBI)rohanbhawsarNo ratings yet

- Reserve Bank of IndiaDocument10 pagesReserve Bank of Indiatejaskamble45No ratings yet

- RBI's Role in Regulating India's Banking & Financial SystemDocument20 pagesRBI's Role in Regulating India's Banking & Financial SystemSophiya KhanamNo ratings yet

- FIM-Module II-Banking InstitutionsDocument11 pagesFIM-Module II-Banking InstitutionsAmarendra PattnaikNo ratings yet

- Functions of RBI: Prof. Divya GuptaDocument22 pagesFunctions of RBI: Prof. Divya GuptaNeha SharmaNo ratings yet

- Submitted By: Bachkaniwala Priyanka Bavda Nikita Lalwani Sonam Submitted To: Mr. Paresh Dave S. R. Luthra Institute of ManagementDocument31 pagesSubmitted By: Bachkaniwala Priyanka Bavda Nikita Lalwani Sonam Submitted To: Mr. Paresh Dave S. R. Luthra Institute of ManagementMuana Lal Thla JAfNo ratings yet

- Commercial Banks To RBI: Bank RateDocument11 pagesCommercial Banks To RBI: Bank RatedileepsiddiNo ratings yet

- Reserve Bank of India EcoDocument15 pagesReserve Bank of India EcoKirti ParkNo ratings yet

- S.K.School of Business ManagementDocument14 pagesS.K.School of Business ManagementchthakorNo ratings yet

- Monetary PoliciesDocument16 pagesMonetary PoliciesCharley AquinoNo ratings yet

- India's 5 Key Financial RegulatorsDocument6 pagesIndia's 5 Key Financial RegulatorsRaman SrivastavaNo ratings yet

- RBI - VI sem B&F all functionsDocument10 pagesRBI - VI sem B&F all functionsvinushriyuNo ratings yet

- Features / Characteristics of Indian Money MarketDocument5 pagesFeatures / Characteristics of Indian Money Marketnaved7No ratings yet

- Functions of RbiDocument14 pagesFunctions of RbiSheetal SainiNo ratings yet

- 2.FIM-Module II-Banking InstitutionsDocument11 pages2.FIM-Module II-Banking InstitutionsAmarendra PattnaikNo ratings yet

- N 53 Ce 23 D 7 Aaed 0Document9 pagesN 53 Ce 23 D 7 Aaed 0chiku singNo ratings yet

- Credit Control Methods of RBIDocument2 pagesCredit Control Methods of RBIchiku singNo ratings yet

- Issuance of Currency in IndiaDocument4 pagesIssuance of Currency in Indiachiku singNo ratings yet

- Clean Note Policy of RBIDocument2 pagesClean Note Policy of RBIchiku singNo ratings yet

- April 2022Document185 pagesApril 2022chiku singNo ratings yet

- May 2022Document161 pagesMay 2022chiku singNo ratings yet

- Early Career Masters ProgrammesDocument20 pagesEarly Career Masters ProgrammesAnonymous dNcT0IRVNo ratings yet

- CEO Compesation: Presentation OnDocument11 pagesCEO Compesation: Presentation OnEra ChaudharyNo ratings yet

- G.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-LibraryDocument10 pagesG.R. No. 217411 - PHILIPPINE BANK OF COMMUNICATIONS, PETITIONER, VS. RIA DE GUZMAN RIVERA, RESPONDENT.D E C I S I O N - Supreme Court E-Librarymarvinnino888No ratings yet

- Ifrs 5Document4 pagesIfrs 5Jay FajardoNo ratings yet

- Personal Financial Report Of: Rajesh Sharma & FamilyDocument13 pagesPersonal Financial Report Of: Rajesh Sharma & FamilyMit MakwanaNo ratings yet

- E Newspaper 9 - 15 July 2020Document12 pagesE Newspaper 9 - 15 July 2020raphaelmashapaNo ratings yet

- Banks Competitor Analysis Total AssetsDocument3 pagesBanks Competitor Analysis Total AssetsMd. Muhinur Islam AdnanNo ratings yet

- Second Paper: Elements of Financial ManagementDocument5 pagesSecond Paper: Elements of Financial ManagementGuruKPONo ratings yet

- Revision Test Paper CAP III June 2020Document233 pagesRevision Test Paper CAP III June 2020Roshan PanditNo ratings yet

- New Politics Network Accounts Year Ending 31/03/07Document11 pagesNew Politics Network Accounts Year Ending 31/03/07unlockdemocracyNo ratings yet

- 1 - Blank Financial AppendixDocument57 pages1 - Blank Financial AppendixJax TellerNo ratings yet

- ConsignmentDocument6 pagesConsignmentendouusaNo ratings yet

- 5.-SIANEN Nego Case-DigestDocument53 pages5.-SIANEN Nego Case-DigestEarl Justine OcuamanNo ratings yet

- DMC 020 s2021Document12 pagesDMC 020 s2021RoxyNo ratings yet

- Words Related With Business AdministrationDocument181 pagesWords Related With Business AdministrationRamazan MaçinNo ratings yet

- 1987 Coca Cola Annual Report - CompleteDocument56 pages1987 Coca Cola Annual Report - CompleteTed MaragNo ratings yet

- COMM324-03 Investing in Tesla Stock Run-UpDocument2 pagesCOMM324-03 Investing in Tesla Stock Run-UpKendra HalmanNo ratings yet

- Chapter 4 Income Tax Schemes, Accounting Periods, Methods, and ReportingDocument16 pagesChapter 4 Income Tax Schemes, Accounting Periods, Methods, and ReportingBisag AsaNo ratings yet

- 1 The Nature, Purpose and Scope of AuditingDocument12 pages1 The Nature, Purpose and Scope of Auditingyebegashet100% (1)

- IIML Stratos Competition GuidelinesDocument12 pagesIIML Stratos Competition GuidelinessharadvasistaNo ratings yet

- SEAL AR 2020 (Final) (Resize)Document130 pagesSEAL AR 2020 (Final) (Resize)BenjaminNo ratings yet

- Bond Price Volatility - Problem SetDocument3 pagesBond Price Volatility - Problem SetHitesh JainNo ratings yet

- Case No: F05YM581 judgment on unfair PPI claimDocument20 pagesCase No: F05YM581 judgment on unfair PPI claimDamaris Emilia IrimieNo ratings yet

- Midterm Examination With SolutionDocument2 pagesMidterm Examination With SolutionSeulgi Bear100% (1)

- Union Budget 2012-13: HighlightsDocument15 pagesUnion Budget 2012-13: HighlightsNDTVNo ratings yet