Professional Documents

Culture Documents

IFRS Elearning

Uploaded by

Gurinder SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IFRS Elearning

Uploaded by

Gurinder SinghCopyright:

Available Formats

Certificate in IFRS E-Learning

Covering syllabus of ACCA Diploma in

International Financial Reporting Standards

Learning & Development Academy

by Grant Thornton in India

Learning &

Development Academy

Learning & Development Academy is an upskilling service offering of Grant Thornton

in India providing result-oriented finance and accounting courses to professionals and

students. Our impactful programmes can be customised to help you gain skills and

capabilities in your area of interest.

In a digital age, we strongly believe that the self paced e-learning is the new way to

learn. It not just save the time and cost for one, but also gives the flexibility. Learner

always have option to go through the content “on-the-go” to keep learning. Our

trainers are seasoned experts who will share their journey along with best practices

followed by the industry.

The Learning & Development Academy will leverage Firm’s rich experience in different

domains across various industries and its knowledge base to share practical insights,

helping participants understand and learn complex concepts.

How we are different

Access to a network of Market credibility

international firms with

relevant experience

Knowledge of Vast experience of

International GAAP, delivering training

commercial application sessions

Standard, globally Customised and cost-

accepted training effective solution with

methodology post-training support

Our top programmes

Certificate in Data analytics

Finance for Non-Finance Professionals

Certification in Financial Modelling & Valuation

GST workshop

Certification in Blockchain

Certificate in IFRS E-Learning

ACCA’s Diploma in IFRS About ACCA and diploma in IFRS

Our E-learning IFRS program is designed to make learner Diploma in IFRS is suitable for professional accountants or

understand the concepts of IFRS along with its applications in auditors in practice or business. Over 113 countries require or

various industries. This will also help the learner to prepare for permit the use of IFRS for publicly-traded companies. ACCA

ACCA Diploma in IFRS exam. has 2,19,000+ fully qualified members and 5,27,000+ students

worldwide.

Along with IFRS, we also cover its differences with

corresponding Ind AS and IGAAP, to help them learn the local

reporting requirements in India.

Who it is for Deliverables

• Professionals working in finance and accounts 70 hours of study

functions across various industries • include 48 hours of recorded videos

• Professionals working in audit or tax • 22 hours of other content and assessments

• Freshly qualified CAs Two way communication and query

resolution from “Ask an expert”

Learning outcomes Course material

After the successful completion of this programme, • E-book of BPP Study text

participants should be able to: • E-book of BPP revision kit

• Prepare financial reports as per requirement • GT Presentation

under IFRS and Ind AS Quiz of all accounting standards covered

• Understand the complex financial reporting

standards like financial instruments,

Final assessment

consolidation and share based payments

• Understand accounting and disclosure

LMS access of 1 year

requirement for new standards: IFRS 15 - Revenue

from Contracts with Customers and IFRS 16 -

Certificate of completion on successfully

Leases

passing the final assessment

Features of E-learning and LMS

Two way communication Flexible – learn anytime Offer remote learners an

through “Ask and Expert” from anywhere engaging learning experience

Query resolution within Streaming session – Cost effective

24 hours experience similar to

instructor led training

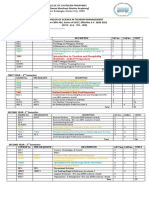

Certificate in IFRS E-Learning

Programme coverage

1 IFRS 1 First-time Adoption of International Financial 19 IAS 12 Income Taxes

Reporting Standards

20 IAS 16 Property, Plant and Equipment

2 IFRS 2 Share-based Payments

21 IAS 19 Employee Benefits

3 IFRS 3 Business Combinations

22 IAS 20 Accounting for Government Grants and

4 IFRS 5 Non-current Assets Held for Sale and Disclosure of Government Assistance

Discontinued Operations

23 IAS 21 The Effects of Changes in Foreign Exchange

5 IFRS 6 Exploration for and Evaluation of Mineral Rates

Resources

24 IAS 23 Borrowing Costs

6 IFRS 7 Financial Instruments: Disclosures

25 IAS 24 Related Party Disclosures

7 IFRS 8 Operating Segments

26 IAS 27 Separate Financial Statements

8 IFRS 9 Financial Instruments

27 IAS 28 Investments in Associates and Joint Ventures

9 IFRS 10 Consolidated Financial Statements

28 IAS 32 Financial Instruments: Presentation

10 IFRS 11 Joint Arrangements

29 IAS 33 Earnings Per Share

11 IFRS 12 Disclosure of Interests in Other Entities

30 IAS 34 Interim Financial Reporting

12 IFRS 13 Fair Value Measurement

31 IAS 36 Impairment of Assets

13 IFRS 15 Revenue from Contracts with Customers

32 IAS 37 Provisions, Contingent Liabilities and

14 IFRS 16 Leases Contingent Assets

15 IAS 1 Presentation of Financial Statements 33 IAS 38 Intangible Assets

16 IAS 2 Inventories 34 IAS 40 Investment Property

17 IAS 8 Accounting Policies, Changes in Accounting 35 IAS 41 Agriculture

Estimates and Errors

18 IAS 10 Events after the Reporting Period

Fees: INR 14,999+ taxes

The fees exclude

ACCA exam fees of GBP 185, which is to be paid directly

to ACCA at the time of registration for the exam

Program agenda & flow may change without prior notice

Certificate in IFRS E-Learning

What our participants say

There are too many good points to list! The course was very relevant to my finance and accounting job and

will help me in most aspects of my work. Objectives were clearly stated from the start. I gained a greater

knowledge of IFRS and its correct implementation. I feel better equipped to manage after completing the

course. This was my objective at the beginning. The trainer got the learning message across by breaking

everything down into simplified sections. He gave a broad range of examination criteria and had a very good

knowledge of the standards.

Kapil Duggal

Senior Manager

Bureau Veritas Consumer Product Services

The workshop on Diploma in International Financial Reporting conducted by Grant Thornton was insightful,

structured and organised. I appreciate the diverse collection of learning tools that complement the classroom

sessions - from the books to presentation materials, practice sessions and online videos. I would highly

recommend this workshop to people interested to learn this course.

Arnel Mutuc

Assistant Vice President

Deutsche Bank

Training was helpful to understand the concept practically and provide confidence to deal with issues

pertaining to IFRS. The best part about this training is its flexibility. Due to the nature of our work, we

sometimes end up working on weekends as well. But Grant Thornton understands this concern and gives us

the flexibility to attend any session as per our convenience.

Gaurav Saboo

Associate III

Royal Bank of Scotland (RBS)

Certificate in IFRS E-Learning

Why Grant Thornton

in India

Ranked No 1 in training and development Based in over 135 Countries, with

in India amongst Accounting Firms: 53,000+ people and one of the largest

Universum 2018 fully integrated Assurance, Tax & Advisory

firms in India with 15 offices across India

Standard, globally accepted training Customised and cost-effective solution

methodology with post-training support

Access to a network of international firms Knowledge of International GAAP,

with relevant experience commercial application

ACCA Diploma in IFRS examination Eligibility criteria for Diploma in IFRS

ACCA Diploma in IFRS examinations are held twice a year in This qualification is suitable for professional accountants or

December and June at ACCA exam centres. The Diploma in auditors who work in practice or business, and are qualified

International Financial Reporting (DipIFR) includes a single 3 according to national accounting standards.

hours and 15 minutes written exam.

Graduate/Postgraduates who are working in practice but are

We can help participants prepare for the Diploma in IFRS exam not yet qualified may still be eligible for the qualification. They

based on the syllabus of ACCA. will need to prove that they have one of the following:

For updated exam centres, please visit the ACCA website

Three years’ A relevant An ACCA

relevant degree Certificate in

accounting plus two International

experience years’ work Financial

(candidates experience Reporting plus

and/or their two years’ work

previous experience

employers

should write a

letter confirming

this)

Certificate in IFRS E-Learning

About Grant Thornton

More than

53,000

people Total global Member firm within

Grant Thornton

revenues Over International

USD 5.45bn 4,500

people

Base in over (as in 2018)

15 locations in

135+ and over 13 cities

countries 700 one of the largest

fully integrated Assurance,

offices

Tax & Advisory firms in India

6 compelling reasons to consider Grant Thornton

A truly global A single global Deep expertise in

organisation audit approach non-audit services

01 02 03 04 05 06

Proven global A different way Strong local

credentials of doing business expertise

To know more about our training solutions, please contact:

Pradeep Pandey Kapil Arora

Associate Director Associate Director

Grant Thornton India LLP Grant Thornton India LLP

M: +91 78380 00185 M: +91 96541 90274

E: pradeep.pandey@in.gt.com E: Kapil.Arora@in.gt.com

Certificate in IFRS E-Learning

Contact us

To know more, please visit www.grantthornton.in or contact any of our offices as mentioned below:

NEW DELHI NEW DELHI AHMEDABAD BENGALURU

National Office 6th floor 7th Floor, 5th Floor, 65/2, Block A,

Outer Circle Worldmark 2 Heritage Chambers, Bagmane Tridib, Bagmane

L 41 Connaught Circus Aerocity Nr. Azad Society, Tech Park, C V Raman Nagar,

New Delhi 110001 New Delhi 110037 Nehru Nagar, Bengaluru - 560093

T +91 11 4278 7070 T +91 11 4952 7400 Ahmedabad - 380015 T +91 80 4243 0700

CHANDIGARH CHENNAI DEHRADUN GURGAON

B-406A, 4th Floor 7th Floor, Prestige Polygon Suite no. 2211, 2nd floor Building 21st Floor, DLF Square

L&T Elante Office Building 471, Anna Salai, Teynampet 2000, Michigan Avenue, Jacaranda Marg

Industrial Area Phase I Chennai - 600 018 Doon Express Business Park DLF Phase II

Chandigarh 160002 T +91 44 4294 0000 Subhash Nagar, Dehradun - 248002 Gurgaon 122002

T +91 172 4338 000 T +91 0135 2646 500. T +91 124 462 8000

HYDERABAD KOCHI KOLKATA MUMBAI

7th Floor, Block III 6th Floor, Modayil Centre point 10C Hungerford Street 16th Floor, Tower II

White House Warriam road junction 5th Floor Indiabulls Finance Centre

Kundan Bagh, Begumpet M. G. Road Kolkata 700017 SB Marg, Prabhadevi (W)

Hyderabad 500016 Kochi 682016 T +91 33 4050 8000 Mumbai 400013

T +91 40 6630 8200 T +91 484 406 4541 T +91 22 6626 2600

MUMBAI NOIDA PUNE

Kaledonia, 1st Floor, Plot No. 19A, 3rd Floor, Unit No 309 to 312

C Wing (Opposite J&J office) 7th Floor West Wing, Nyati Unitree

Sahar Road, Andheri East, Sector – 16A Nagar Road, Yerwada

Mumbai - 400 069 Noida 201301 Pune- 411006

T +91 120 485 5900 T +91 20 6744 8800

For more information or for any queries, write to us at contact@in.gt.com

Follow us @GrantThorntonIN

© 2020 Grant Thornton India LLP. All rights reserved.

“Grant Thornton in India” means Grant Thornton India LLP, a member firm within Grant Thornton International Ltd, and those legal entities which are its related parties as defined by the

Companies Act, 2013.

Grant Thornton India LLP is registered with limited liability with identity number AAA-7677 and has its registered office at L-41 Connaught Circus, New Delhi, 110001.

References to Grant Thornton are to Grant Thornton International Ltd (Grant Thornton International) or its member firms. Grant Thornton International and the member firms are not a worldwide

partnership. Services are delivered independently by the member firms.

You might also like

- ACCA-Certificate in International Financial Reporting IFRSDocument7 pagesACCA-Certificate in International Financial Reporting IFRSwer78230No ratings yet

- CFAP-01 CA PakistanDocument630 pagesCFAP-01 CA PakistanMuhammad ShehzadNo ratings yet

- Frequently Asked Questions in International Standards on AuditingFrom EverandFrequently Asked Questions in International Standards on AuditingRating: 1 out of 5 stars1/5 (1)

- SBR Revision NotesDocument294 pagesSBR Revision Notesbubbly100% (2)

- ACCA P2 - Latest Revision NotesDocument198 pagesACCA P2 - Latest Revision NotesFive Fifth100% (1)

- Advanced Accounting and Financial Reporting (PDFDrive)Document1,015 pagesAdvanced Accounting and Financial Reporting (PDFDrive)Tafadzwanashe MaringireNo ratings yet

- DipIFRS Brochure 150205Document4 pagesDipIFRS Brochure 150205kevior2100% (1)

- SBR Study Notes - 2018 - FinalDocument293 pagesSBR Study Notes - 2018 - Finalprerana pawar100% (2)

- P2 ACCA Summary + Revision Notes 2017Document186 pagesP2 ACCA Summary + Revision Notes 2017SrabonBarua100% (1)

- Corporate Reporting Supplement 2021Document238 pagesCorporate Reporting Supplement 2021Nishhhhiii100% (1)

- Accounting CA BookDocument558 pagesAccounting CA BookzahoorbalouchNo ratings yet

- Corporate ReportingDocument864 pagesCorporate ReportingIRIBHOGBE OSAJIENo ratings yet

- IFRS vs Vietnamese GAAP: Key DifferencesDocument99 pagesIFRS vs Vietnamese GAAP: Key Differencesdaaf100% (1)

- Corporate GovernanceDocument22 pagesCorporate Governanceroman empireNo ratings yet

- Day 1 Dipifrs Batch 10 Weekend NotesDocument31 pagesDay 1 Dipifrs Batch 10 Weekend NotesKathleen De JesusNo ratings yet

- Msc. & Bsc.-Accounting and Finance Acc-501 Advanced Financial Accounting Acc-405 Advanced Financial Accounting - Ii Spring Semester, 2010Document5 pagesMsc. & Bsc.-Accounting and Finance Acc-501 Advanced Financial Accounting Acc-405 Advanced Financial Accounting - Ii Spring Semester, 2010umer12No ratings yet

- 2.2 SBR Study NotesDocument297 pages2.2 SBR Study Notesfahad100% (2)

- SBR Revision NotesDocument294 pagesSBR Revision NotesThembisile P ZwaneNo ratings yet

- KPMG Ifrs Handbook PDFDocument202 pagesKPMG Ifrs Handbook PDFSaad Olath100% (1)

- PWC Ifrs Overview 2019Document59 pagesPWC Ifrs Overview 2019John Lucky FernandezNo ratings yet

- PWC Ifrs Overview 2019Document59 pagesPWC Ifrs Overview 2019iTax BTONo ratings yet

- PWC Ifrs Overview 2019Document59 pagesPWC Ifrs Overview 2019Wenge XiaoNo ratings yet

- Indian Accounting Standards (One Pager)Document29 pagesIndian Accounting Standards (One Pager)sridhartks100% (1)

- Cfap 01 AafrDocument1,052 pagesCfap 01 AafrMuhammad Irfan100% (3)

- Unit 2 MANAGEMENT ACCOUNTINGDocument43 pagesUnit 2 MANAGEMENT ACCOUNTINGSANDFORD MALULU100% (1)

- 1 MSA Syllabus Summer 2021Document6 pages1 MSA Syllabus Summer 2021Javed AnwarNo ratings yet

- Training Material of AuditDocument89 pagesTraining Material of AuditNaeem Uddin100% (10)

- Advanced Accounting 1: Accounting Lab Module Uph Business SchoolDocument36 pagesAdvanced Accounting 1: Accounting Lab Module Uph Business SchoolDenisse Aretha LeeNo ratings yet

- Accounting Question Bank 2022Document334 pagesAccounting Question Bank 2022tafsirmhinNo ratings yet

- ICAEW Accounting QB 2023Document322 pagesICAEW Accounting QB 2023diya p100% (1)

- SAP FICO End User TrainingDocument5 pagesSAP FICO End User TrainingCorpsalesNo ratings yet

- F6uk ExamdocDocument14 pagesF6uk Examdocanon-660777No ratings yet

- Ifs 2016 Illustrative DisclosuresDocument231 pagesIfs 2016 Illustrative DisclosuresVeronica NedelcuNo ratings yet

- Intl Ifstmts 12 012 Gafs Illst DisclDocument210 pagesIntl Ifstmts 12 012 Gafs Illst DisclMaximo Gutierrez100% (1)

- Illustrative Disclosures: Guide To Annual Financial StatementsDocument210 pagesIllustrative Disclosures: Guide To Annual Financial StatementsAnge100% (1)

- Guide To Financial Statements 1650885684Document230 pagesGuide To Financial Statements 1650885684Luis Eduardo Lopez Gamboa100% (1)

- IFRS BrocherDocument3 pagesIFRS Brocherasifmarkatiya1563No ratings yet

- Dipifr BG (Low)Document8 pagesDipifr BG (Low)breazuNo ratings yet

- Topic 1 - Conceptual framework-SVDocument103 pagesTopic 1 - Conceptual framework-SVHONG NGUYEN THI KIMNo ratings yet

- Topic 1 - Conceptual Framework-SVDocument103 pagesTopic 1 - Conceptual Framework-SVKHANH BÙI PHƯƠNGNo ratings yet

- LD Branch Package - Auditing Leases (FINAL)Document91 pagesLD Branch Package - Auditing Leases (FINAL)Jefri SNo ratings yet

- Panma Oil Ltd.Document46 pagesPanma Oil Ltd.Shagor AhmedNo ratings yet

- Guide To New Standards Ifrs 9, Ifrs 15, Ifrs 16 and Research OpportunitiesDocument67 pagesGuide To New Standards Ifrs 9, Ifrs 15, Ifrs 16 and Research OpportunitiesnnauthooNo ratings yet

- Certificate in Bookkeeping and Accounting Level 2Document38 pagesCertificate in Bookkeeping and Accounting Level 2McKay TheinNo ratings yet

- Electronic Way Bill Under GSTDocument46 pagesElectronic Way Bill Under GSTDeepak WadhwaNo ratings yet

- Cfap 1 Aafr SSMDocument612 pagesCfap 1 Aafr SSMsaqlain khan100% (1)

- Insights Into IFRS, 16th Edition 2019-20 Part 1Document32 pagesInsights Into IFRS, 16th Edition 2019-20 Part 1Adham AghaNo ratings yet

- IFRS ElearningDocument8 pagesIFRS ElearningAjith VaibhavNo ratings yet

- IFRSSDocument12 pagesIFRSSPratik RNo ratings yet

- IFRS Pocket Guide: Isbn FSCDocument65 pagesIFRS Pocket Guide: Isbn FSCJigar MakwanaNo ratings yet

- Ifs 2016 Illustrative DisclosuresDocument231 pagesIfs 2016 Illustrative DisclosuresGlenn Taduran100% (1)

- IFRS IntroductionDocument44 pagesIFRS Introductionpadm0% (1)

- 2005 Model FsDocument72 pages2005 Model FsMuji1No ratings yet

- Isg Ifs 2023 FundsDocument101 pagesIsg Ifs 2023 FundsALNo ratings yet

- CFAP Syllabus Summer 2020Document16 pagesCFAP Syllabus Summer 2020Farhan RajaNo ratings yet

- IFRS 17 Ebook - AptitudeSoftwareDocument40 pagesIFRS 17 Ebook - AptitudeSoftwareAnton LimNo ratings yet

- Construction of Secondary School - Kapaso Mumi - 231109 - 01 - 01.fr - enDocument10 pagesConstruction of Secondary School - Kapaso Mumi - 231109 - 01 - 01.fr - enKritika KakkarNo ratings yet

- List TourisumDocument62 pagesList TourisumhimanshuNo ratings yet

- Applied Economics: Impact of Business On The Community: ExternalitiesDocument13 pagesApplied Economics: Impact of Business On The Community: ExternalitiesPangangan NHS100% (1)

- June 2009 PRC Room Assignment (Manila Examinees)Document1,712 pagesJune 2009 PRC Room Assignment (Manila Examinees)lylesantos84% (25)

- Learning: Misamis University Wilnirose C. MalinaoDocument3 pagesLearning: Misamis University Wilnirose C. MalinaoTine Vasiana DuermeNo ratings yet

- How To Successfully Negotiate A Higher Salary: Her First $100KDocument11 pagesHow To Successfully Negotiate A Higher Salary: Her First $100Kkikichi54No ratings yet

- Chapter 8 - Forms of Intellectual Property and Methods of ValuationDocument6 pagesChapter 8 - Forms of Intellectual Property and Methods of ValuationSteffany RoqueNo ratings yet

- Wok Immersion Work Sheet 2024Document173 pagesWok Immersion Work Sheet 2024Ashley FajardoNo ratings yet

- MGT 1 AClass OrientationDocument25 pagesMGT 1 AClass OrientationGlazerie Quijano GalabinNo ratings yet

- Project Management L5 Assessment Brief May 2021Document8 pagesProject Management L5 Assessment Brief May 2021JisanNo ratings yet

- Gold Exp A2 U4 Skills Test ADocument2 pagesGold Exp A2 U4 Skills Test ANuria OliboNo ratings yet

- Education Department Clearance FormDocument1 pageEducation Department Clearance FormShaira Banag-MolinaNo ratings yet

- Notification SSC CGL Exam 2021 - 220106 - 132239Document69 pagesNotification SSC CGL Exam 2021 - 220106 - 132239Arun yadavNo ratings yet

- IM PS Fashion-Business-Digital-Communication-And-Media 3Y Course Pathway MI 04Document7 pagesIM PS Fashion-Business-Digital-Communication-And-Media 3Y Course Pathway MI 04oliwia bujalskaNo ratings yet

- HKEx Financial Data 14chDocument12 pagesHKEx Financial Data 14chzakkNo ratings yet

- Evolution and Rise of Marwari Business EmpireDocument34 pagesEvolution and Rise of Marwari Business EmpireKeshav AgarwalNo ratings yet

- Ey India Sustainability Report 2018Document78 pagesEy India Sustainability Report 2018Abhinav NaiduNo ratings yet

- BML 203 Wba September December 2021Document9 pagesBML 203 Wba September December 2021Kenya's FinestNo ratings yet

- GRADE-12 (Commerce), PORTION FOR FIRST TERM EXAMINATION, 2023-24Document2 pagesGRADE-12 (Commerce), PORTION FOR FIRST TERM EXAMINATION, 2023-24Not DreafNo ratings yet

- Research On The Evolution of Innovation Behavior oDocument27 pagesResearch On The Evolution of Innovation Behavior oWafaa AlkafaweenNo ratings yet

- DMMA College Tourism ManagementDocument6 pagesDMMA College Tourism ManagementSophia Joril CantorneNo ratings yet

- COVID-19 Agreeement Letter The Lakewood Board of Education Sent To Staff On Nov. 24, 2020Document2 pagesCOVID-19 Agreeement Letter The Lakewood Board of Education Sent To Staff On Nov. 24, 2020Asbury Park PressNo ratings yet

- MGT657 Chapter8Document21 pagesMGT657 Chapter8adamNo ratings yet

- Daily-Lesson LogDocument3 pagesDaily-Lesson LogFaith Tulmo De Dios100% (1)

- Corporate Product Recall and Its Influence On Corporate PerformanceDocument6 pagesCorporate Product Recall and Its Influence On Corporate PerformanceAouniza AhmedNo ratings yet

- Professional Course: CSCP - Certified Supply ChainDocument5 pagesProfessional Course: CSCP - Certified Supply ChainHesham TaherNo ratings yet

- Intro To Service Management - #2Document10 pagesIntro To Service Management - #2Endrei Clyne MerculloNo ratings yet

- CODAL - Corp LawDocument128 pagesCODAL - Corp LawAsia WyNo ratings yet

- Scheme of Work: Cambridge IGCSE / Cambridge IGCSE (9 1) Business Studies 0450 / 0986Document41 pagesScheme of Work: Cambridge IGCSE / Cambridge IGCSE (9 1) Business Studies 0450 / 0986Will BarnardNo ratings yet

- 2022 - 2023 Second Sem ExamsDocument43 pages2022 - 2023 Second Sem ExamsBinaebi DoubraNo ratings yet