Professional Documents

Culture Documents

Chapter # 1 Issuance of Shares

Uploaded by

Rooh Ullah KhanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter # 1 Issuance of Shares

Uploaded by

Rooh Ullah KhanCopyright:

Available Formats

ADVANCED FINANCIAL ACCOUNTING

B.COM 2

CHAPTER # 1

JOINT STOCK COMPANY

INTRODUCTION

Rooh-Ullah Khan (M.Com)

0333-87 86 389

THE STANDARD GIRLS COLLEGE

Advanced Financial Accounting Page |1

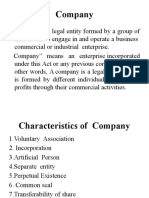

1. Joint Stock Company (J.S.C)

An artificial person created by law, with a common seal and having perpetual life.

2. Separate Legal entity

It means company is different from owners. It enjoys many of the rights of artificial person. For

example it can purchased property on its own name.

3. Perpetual existence of a company

It means Joint Stock Company has a continuous life. The death or insolvency of shareholders

does not affect the life of the company.

4. Common seal of a company

Company is an artificial person so it cannot make sign. A seal is used for signature purpose

which is called common seal. It is also called official signature of company.

5. Company limited by share

It is a type of company in which liability of shareholders is limited up to unpaid balance of

shares if any.

6. Private limited Company

A company which is formed by at least 2 and maximum 50 members. It can not invite general

public to purchases shares or debentures.

7. Public limited company

A company which is formed by at least 7 members. There is no limit of maximum number of

members. It can invite general public to purchase shares or debentures of company.

8. Company limited by guarantee

A company in which the liability of members is limited up to a guaranteed amount at time of

winding up.

9. Unlimited company

A Company in which liability of members is unlimited. In case of insolvency personal property

of members is also liable to pay debts.

10. Association not for profit

It is an organization which is formed for the promotion of commerce, art, religion etc. It has

same rights like limited company but cannot use word limited with its name.

11. Memorandum of association

It is the basic document of the company. Company can do only those activities which are

mentioned in MOA.

12. Article of Association

It is second important document in the incorporation of a company. It contains the rules and

regulations for the internal management of the company.

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |2

13. Prospectus

It is a document which is issued by company to invite general public to purchase share or

debentures of the company.

14. Share

Total amount of capital of a company is divided into smaller units. Each unit is called share.

15. Share Capital

The total par value of shares of a company is called share capital.

16. Authorized capital

The capital with which the company is registered is called authorized capital. It is also called

nominal or registered capital.

17. Issued capital

The total par value of shares offered to general public is called issued capital.

18. Subscribed Capital

The total par value of shares taken up by public is called subscribed capital.

19. Called up Capital

The portion of subscribed capital which is called up by the company from public is called called-

up capital.

20. Paid-up Capital

The total amount received by the company out of called up capital is called paid-up capital.

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |3

21. Reserve Capital

The portion of subscribed capital which the company, through a special resolution, reserves to

call in the event of winding up.

22. Primary expenses / Preliminary expenses

All the expenses which are incurred to start the business are called primary expenses. For

example registration fee, cost of printing documents etc.

23. Underwriting commission

Commission paid to underwriters for the sale of shares is called underwriting commission.

24. Par value of share

The value which is assigned to a unit of share is called par value of share. It is also known as

nominal value or face value.

25. Book value of share

The value of share according to books of the company is called book value of share.

26. Market value of share

The price at which buyer is willing to purchase and seller is willing to sell is called market value

of share.

27. Over Subscription

Over subscription means to receive more applications than shares offered to general public.

28. Under Subscription

Under subscription means to receive less applications than shares offered to general public.

29. Issue of share at premium

If the par value of a share is Rs. 100 and it is issued at Rs. 110 it is called shares issued at

premium.

30. Issue of share at Discount

If the par value of a share is Rs. 100 and it is issued at Rs. 90 it is called shares issued at

discount.

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |4

Issuance of Shares

Shares can be issued to following parties

1. General public

2. Directors

3. Underwriters

4. Promoters

Journal Entries for issuance of shares

General Public Directors / Underwriters

(i) When applications received Bank A/c

Shares Capital A/c

Bank A/c

Shares applications A/c

(ii) When shares issued Shares issued to promoters against

preliminary expenses

Shares applications A/c

Shares capital A/c Preliminary expenses

Shares Capital A/c

(iii) When excess money refunded

Shares applications A/c

Bank A/c

Shares can be issued at Par, Premium

& Discount Issued at Discount

Issued at Premium General Public

General Public (i) Bank A/c

Shares applications A/c

(i) Bank A/c

Shares Applications A/c (ii) Shares applications A/c

Shares Discount A/c

(ii) Shares Applications A/c Shares capital A/c

Shares capital A/c

Shares premium A/c

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |5

Issued at Premium Issued at Discount

Directors / Underwriters Directors / Underwriters

Bank A/c Bank A/c

Shares capital A/c Shares Discount A/c

Shares premium A/c Shares Capital A/c

Issuance of shares other than Cash

Issuance of shares to vendor for the Shares issued to pay off Debt

Purchase of Assets

(i) When Asset Purchased Long term Debt A/c

Shares capital A/c

Assets A/c

Vendor A/c

(ii) When shares issued

Vendor A/c

Shares capital

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |6

ILLUSTRATIONS

1. Hammad Ltd. was registered with an authorized capital of Rs. 20,00,000 divided into 200,000

shares of Rs. 10, each. The company issued 80,000 ordinary shares to general public for

subscription at par value on 1st July 2010. Subscription date was fixed as 15th July. Pass the

entries in the books of the company if applications for 80,000 shares were received

Shares were allotted on 31st July 2010.

Also show how the figures would appear in the balance sheet of the company.

Solution

JOURNAL

Date Details L/F Rs. Rs.

2010

July 15 Bank A/c (80000×10) 800,000

Shares applications A/c 800,000

(Applications received with money)

July 31 Shares applications A/c (80000×10) 800,000

Shares capital A/c 800,000

(Shares allotted to applicants)

Hammad Ltd.

Balance sheet

As on 31st July 2010

Share Capital & Liabilities Rs. Assets Rs.

Authorized capital Current Assets

200,000 shares @ Rs. 10 each 20,00,000 Bank 800,000

Issued, subscribed and paid up

capital

80,000 shares @ Rs. 10 each 800,000

800,000 800,000

2. Hammad Ltd. was registered with an authorized capital of Rs. 20,00,000 divided into 200,000

shares of Rs. 10, each. The company issued 80,000 ordinary shares to general public for

subscription at par value on 1st July 2010. Subscription date was fixed as 15th July. Pass the

entries in the books of the company if applications for 95,000 shares were received

Shares were allotted on 31st July 2010.

Also show how the figures would appear in the balance sheet of the company.

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |7

JOURNAL

Date Details L/F Rs. Rs.

2010

July 15 Bank A/c (95000×10) 950,000

Shares applications A/c 950,000

(Applications received with money)

July 31 Shares applications A/c (80000×10) 800,000

Shares capital A/c 800,000

(Shares allotted to applicants)

July 31 Shares applications A/c 150,000

Bank A/c (15000×10) 150,000

(Excess money refunded)

Hammad Ltd.

Balance sheet

As on 31st July 2010

Share Capital & Liabilities Rs. Assets Rs.

Authorized capital Current Assets

200,000 shares @ Rs. 10 each 20,00,000 Bank (950,000 – 150,000) 800,000

Issued, subscribed and paid up

capital

80,000 shares @ Rs. 10 each 800,000

800,000 800,000

3. Crescent Ltd. was registered with an authorized capital of Rs. 250,000 divided into 25,000

shares of Rs. 10 each. On June 1, 2003 Decent Ltd. issued 25,000 ordinary shares @ Rs. 10 each.

Out of these 25,000 shares, 5,000 shares were issued to directors and remaining to the general

public. On 15th June (the subscription date) applications were received for 15000 shares.

Consequently 5000 shares were taken up by the underwriters as per agreement. On 30th June,

2003 the company allotted shares.

Pass the journal entries in the books of the company and draft a balance sheet.

JOURNAL

Date Details L/F Rs. Rs.

2003

June 1 Bank A/c (5000×10) 50,000

Shares capital A/c 50,000

(Shares issued to directors)

June 15 Bank A/c (15000×10) 150,000

Shares applications A/c 150,000

(Applications received with money)

June 30 Shares applications A/c (15,000 × 10) 150,000

Shares capital A/c 150,000

(Shares allotted to applicants)

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |8

June 30 Bank A/c (5000×10) 50,000

Shares capital A/c 50,000

(Shares issued to underwriters)

Crescent Ltd.

Balance sheet

As on 30 June 2003

Share Capital & Liabilities Rs. Assets Rs.

Authorized capital Current Assets

25,000 shares @ Rs. 10 each 250,000 Bank 250,000

Issued, subscribed and paid up

capital

5000 shares @ Rs. 10 each to

directors 50,000

15000 shares @ Rs. 10 each to

General public 150,000

5000 shares @ Rs. 10 each to

underwriters 50,000

250,000 250,000

4. A Limited company was registered with an authorized capital of Rs. 10,00,000 divided into

20,000 shares of Rs. 50 each. On 1st November 2010 Company issued 14000 shares in the

following manner

2000 shares to promoters against preliminary expenses

4000 share to directors for cash

8000 share to general public

On 15th November 2010 company received applications for 10,000 shares. Shares were not

allotted to applicants of 2000 share and their application money was refunded.

Record the above information in company’s books and show the figures in the Balance sheet.

JOURNAL

Date Details L/F Rs. Rs.

2010

Nov. 1 Preliminary expenses(2000×50) 100,000

Shares capital A/c 100,000

(Shares issued to promoters)

Nov. 1 Cash A/c (4000×50) 200,000

Shares capital A/c 200,000

(Shares issued to directors)

Nov. 15 Bank A/c (10000×50) 500,000

Shares applications A/c 500,000

(Applications received with money)

Nov. 15 Shares applications A/c (8000×50) 400,000

Shares capital A/c 400,000

(Shares allotted to applicants)

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting Page |9

Nov. 15 Shares applications A/c (2000×50) 100,000

Bank A/c 100,000

(Excess money refunded)

Balance sheet

As on 30 June 2010

Share Capital & Liabilities Rs. Assets Rs.

Authorized capital Deferred Cost

20,000 shares @ Rs. 50 each 10,00,000 Preliminary expenses 100,000

Issued, subscribed and paid up

capital Current Assets

2000 shares @ Rs. 50 each to Cash 200,000

promoters 100,000 Bank (500,000 – 100,000) 400,000

4000 shares @ Rs. 50 each to

Directors 200,000

8000 shares @ Rs. 50 each to

General Public 400,000

700,000 700,000

5. On 1st Jan. 2010 a company was registered with an authorized capital of 50,000 shares of Rs.

10 each. On 1st Jan. the company issued 10,000 shares of Rs. 10 each to general public at 10%

premium. Applications were received for 15000 shares on 15th Jan. On 30th Jan. shares were

allotted and money was refunded to the applicants of 5000 shares.

Record the above transactions in the books of the company and draft the Balance sheet.

JOURNAL

Date Details L/F Rs. Rs.

2010

Jan. 15 Bank A/c (15000×11) 165,000

Shares applications A/c 165,000

(Applications received with money)

Jan. 30 Shares applications A/c (10000×11) 110,000

Shares capital A/c (10000×10) 100,000

Shares premium A/c(10000×1) 10,000

Jan. 30 (Shares allotted to applicants)

Shares applications A/c (5000×11) 55,000

Bank A/c 55,000

(Excess money refunded)

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting P a g e | 10

Balance sheet

As on 30 Jan. 2010

Share Capital & Liabilities Rs. Assets Rs.

Authorized capital Current Assets

50,000 shares @ Rs. 10 each 500,000 Bank 110,000

Issued, subscribed and paid up

capital

10,000 shares @ Rs. 10 each 100,000

Reserve

Share premium 10,000

110,000 110,000

6. Bashir Ltd. with an authorized capital of Rs. 5,00,000 divided into 50,000 shares of Rs. 10

each decided to issued 10,000 shares of Rs. 10 each at 10% discount. The issued was permitted

by the authorities. Applications were received for 8000 shares. Shares were allotted.

Make the necessary entries and prepare the Balance sheet.

JOURNAL

Date Details L/F Rs. Rs.

2010

Jan. 15 Bank A/c (8000×9) 72,000

Shares applications A/c 72,000

(Applications received with money)

Jan. 30 Shares applications A/c (8000×9) 72,000

Shares Discount (8000×1) 8,000

Shares capital A/c (8000×10) 80,000

(Shares allotted to applicants)

Balance sheet

As on 30 Jan. 2010

Share Capital & Liabilities Rs. Assets Rs.

Authorized capital Current Assets

50,000 shares @ Rs. 10 each 500,000 Bank 72,000

Issued, subscribed and paid up

capital Deferred Cost

8,000 shares @ Rs. 10 each 80,000 Shares discount 8,000

80,000 80,000

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting P a g e | 11

7. A trading Corporation was formed with an authorized capital of 60,000 ordinary shares of Rs.

1000 each. On 1st Jan. 2010, the company issued 40,000 share to the general public and 5000

share were issued to a vendor, Mr. Akmal from whom company had acquired machinery worth

Rs. 5,000,000 on 1st Jan. 2010. Applications were received on 10th Jan. 2010 only for 30000

shares and consequently 10,000 shares were taken up by the underwriters. On 20th Jan. 2010

shares were allotted to the applicants.

Pass the journal entries in the books of the company and show the Balance sheet.

JOURNAL

Date Details L/F Rs. Rs.

2010

Jan. 1 Machinery A/c 5,000,000

Mr. Akmal A/c 5,000,000

(Asset purchased from vendor)

Jan. 1 Mr. Akmal A/c (5000×1000) 5,000,000

Shares capital A/c 5,000,000

(Shares issued to vendor)

Jan. 10 Bank A/c (30000×1000) 30,000,000

Shares applications A/c 30,000,000

(Applications received with money)

Jan. 20 Shares applications A/c (30000×1000) 30,000,000

Shares capital A/c 30,000,000

(Shares allotted to applicants)

Jan. 20 Bank A/c (10000×1000) 10,000,000

Shares capital A/c 10,000,000

(Shares issued to underwriters)

Balance sheet

As on 20 Jan. 2010

Share Capital & Liabilities Rs. Assets Rs.

Authorized capital Fixed Assets

60,000 shares @ Rs. 1000 each 60,000,000 Machinery 5,000,000

Issued, subscribed and paid up

capital Current Assets

5000 shares @ Rs. 1000 each to Bank 40,000,000

vendor 5,000,000

30000 shares @ Rs. 1000 each to

General public 30,000,000

10000 shares @ Rs. 1000 each to

underwriters 10,000,000

45,000,000 45,000,000

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting P a g e | 12

8. Irfan Textiles Ltd. acquired the business of M/s Haroon & Sons. The assets and liabilities of

M/s Haroon & Sons at book value are given below.

Land & Building 25,000 Sundry Creditors 5,000

Machinery 20,000

Furniture 7,000

Debtors 3,000

The purchase consideration is to be paid by the company in fully paid up shares of Rs. 10 each.

Pass the journal entries if the shares are issued:

(a) At par (b) At 100% premium (c) At 50% discount.

Solution

JOURNAL

Date Details L/F Rs. Rs.

Land & Building A/c 25000

Machinery A/c 20000

Furniture A/c 7000

Debtors A/c 3000

Sundry Creditors A/c 5000

M/s Haroon A/c 50000

(Business purchased from vendor)

M/s Haroon A/c 50,000

Shares capital A/c (5000×10) 50,000

(Shares issued to vendor)

M/s Haroon A/c 50,000

Shares capital A/c(2500×10) 25,000

Share premium (2500×10) 25,000

(Shares issued to vendor)

M/s Haroon A/c 50,000

Share Discount (10000×5) 50,000

Shares capital A/c (10000×10) 100,000

(Shares issued to vendor)

No. of Shares issued to vendor

=

(a) At Par (b) At 100% Premium (c) At 50% Discount

= Rs. 50,000 / 10 = Rs. 50,000 / 20 = Rs. 50,000 / 5

= 5000 shares = 2500 Shares = 10,000 Shares

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting P a g e | 13

PROBLEMS

1. Sohail Ltd. was registered with an authorized capital of Rs. 40,00,000 divided into 400,000

shares of Rs. 10, each. The company issued 200,000 ordinary shares to general public for

subscription at par value on 1st July 2010. Subscription date was fixed as 15th July. Pass the

entries in the books of the company if applications for 200,000 shares were received

Shares were allotted on 31st July 2010.

Also show how the figures would appear in the balance sheet of the company.

Ans. Balance sheet Rs. 20,00,000

2. Sohail Ltd. was registered with an authorized capital of Rs. 40,00,000 divided into 400,000

shares of Rs. 10, each. The company issued 200,000 ordinary shares to general public for

subscription at par value on 1st July 2010. Subscription date was fixed as 15th July. Pass the

entries in the books of the company if applications for 230,000 shares were received

Shares were allotted on 31st July 2010.

Also show how the figures would appear in the balance sheet of the company.

Ans. Balance sheet Rs. 20,00,000

3. Decent Ltd. was registered with an authorized capital of Rs. 500,000 divided into 50,000

shares of Rs. 10 each. On June 1, 2003 Decent Ltd. issued 50,000 ordinary shares @ Rs. 10 each.

Out of these 50,000 shares, 10,000 shares were issued to directors and remaining to the general

public. On 15th June (the subscription date) applications were received for 35000 shares.

Consequently 5000 shares were taken up by the underwriters as per agreement. On 30th June,

2003 the company allotted shares.

Pass the journal entries in the books of the company and draft a balance sheet.

Ans. Balance sheet Rs. 500,000

4. On May 1, 2010 Salman & Co Ltd. offered 40,000 shares @ Rs. 10 each for public

subscription. On May 10 2010 it is made known to the company that applications were received

for 35000 shares. The 5000 shares not taken by the public and as per agreement, taken by the

underwriters. On May 20, 2010 the company allotted the shares. Pass the journal entries and

draft Balance sheet on the company.

Ans. Balance sheet Rs. 400,000

5. A Limited company was registered with an authorized capital of Rs. 500,000 divided into

10,000 shares of Rs. 50 each. On 1st November 2010 company issued 7000 shares in the

following manner

1000 shares to promoters against preliminary expenses

2000 share to directors for cash

4000 share to general public

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting P a g e | 14

On 15th November 2010 company received applications for 6000 shares. Shares were not allotted

to applicants of 2000 share and their application money was refunded.

Record the above information in company’s books and show the figures in the Balance sheet.

Ans. Balance sheet Rs. 350,000

6. A limited company was registered with an authorized capital of Rs. 10,00,000 divided into

100,000 shares of Rs. 10 each. On 1st August 2010 15000 shares were issued to promoters in

connection with their services and preliminary expenses paid by them. 50,000 shares were

offered to the general public for subscription. Applications were received for 60,000 shares on

the 10th August, 2010 the subscription date. On 25th August 2010 shares were allotted to the

applicants of 50,000 shares and the excess applications money was refunded. Pass the journal

entries and show how would they appear in the Balance sheet.

Ans. Balance sheet Rs. 650,000

7. Dewan Corporation Limited was formed with an authorized capital of Rs. 20,000 shares of Rs.

50 each. 5000 shares issued to the directors on 10th May, 2010 and 10,000 shares were offered to

the public for subscription. The applications were received for only 8000 shares on 20th May

2010. The shares were allotted to the applicants on 5th June, 2010. The remaining shares were

taken by the underwriters on 6th June, 2010 as per agreement. Pass the necessary journal entries

in the books of the company.

8. On 1st Jan. 2003 a company was registered with an authorized capital of 100,000 shares of Rs.

10 each. On 1st Jan. the company issued 20,000 shares of Rs. 10 each to general public at 10%

premium. Applications were received for 35000 shares on 15th Jan. On 30th Jan. shares were

allotted and money was refunded to the applicants of 15000 shares.

Record the above transactions in the books of the company and draft the Balance sheet.

Ans. Balance sheet Rs. 220,000

9. On 1st July 2010 Noor Chemicals Ltd. was formed with an authorized capital of 500,000

shares of Rs. 10 each. The management of the company decided to issued 100,000 shares at a

premium of Rs. 2 per share. Applications were received for 120,000 shares. Share were allotted

and money was refunded for applicants of 20,000 shares.

Pass the necessary journal entries and draft balance sheet of the company.

Ans. Balance sheet Rs. 12,00,000

10. Asif Bashir Ltd. with an authorized capital of Rs. 10,00,000 divided into 100,000 shares of

Rs. 10 each decided to issued 20,000 shares of Rs. 10 each at 10% discount. The issued was

permitted by the authorities. Applications were received for 15000 shares. Shares were allotted.

Make the necessary entries and prepare the Balance sheet.

Ans. Balance sheet Rs. 150,000

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

Advanced Financial Accounting P a g e | 15

11. Asif Ltd. with an authorized capital of 100,000 share of Rs. 10 each passed a resolution in a

general meeting to issue 40,000 shares at a discount of 5%. 10,000 shares were issued to

directors and 30,000 shares were offered to general public. Applications were received for 25000

shares and subsequently shares were allotted. Record the transactions in the books of the

company and show the reflection in the Balance sheet.

Ans. Balance sheet Rs. 350,000

12. A trading Corporation was formed with an authorized capital of 50,000 ordinary shares of

Rs. 1000 each. On 1st Jan. 2010, the company issued 30,000 share to the general public and

5000 share were issued to a vendor, Mr. Asghar from whom company had acquired machinery

worth Rs. 50,00,000 on 1st Jan. 2010. Applications were received on 10th Jan. 2010 only for

25000 share and consequently 5000 shares were taken up by the underwriters. On 20th Jan. 2010

shares were allotted to the applicants.

Pass the journal entries in the books of the company and show the Balance sheet.

Ans. Balance sheet Rs. 3,50,00,000

13. Imran Textiles Ltd. acquired the business of M/s Noor & Sons. The assets and liabilities of

M/s Noor & Sons at book value are given below.

Land & Building 50,000 Sundry Creditors 10,000

Machinery 40,000

Furniture 14,000

Debtors 5,000

The purchase consideration is to be paid by the company in fully paid up shares of Rs. 10 each.

Pass the journal entries if the shares are issued:

(b) At par (b) At 10% premium (c) At 10% discount.

Roohullah (M.Com) 0333-87 86 389 Lecturer: The Standard College

You might also like

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- SERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKFrom EverandSERIES 65 EXAM STUDY GUIDE 2021 + TEST BANKNo ratings yet

- Equity Investment for CFA level 1: CFA level 1, #2From EverandEquity Investment for CFA level 1: CFA level 1, #2Rating: 5 out of 5 stars5/5 (1)

- Refined MacdDocument17 pagesRefined Macdapolodoro7No ratings yet

- Technical Analysis From A To ZDocument222 pagesTechnical Analysis From A To ZPraveen R VNo ratings yet

- The Easy Forex Breakout Trend Trading Simple System Basic Manual VersionDocument30 pagesThe Easy Forex Breakout Trend Trading Simple System Basic Manual VersionChakrey LeaderNo ratings yet

- BE309 Final Exam Due March 5Document3 pagesBE309 Final Exam Due March 5GrnEyz79100% (1)

- AGRICULTURAL FINANCE Class Notes 1Document23 pagesAGRICULTURAL FINANCE Class Notes 1ouko kevin100% (1)

- Far410 Chapter 4 EquityDocument34 pagesFar410 Chapter 4 EquityAQILAH NORDINNo ratings yet

- Key Takeaway Stakeholders Wealth: © 2013 Harvard Business School Publishing 1Document29 pagesKey Takeaway Stakeholders Wealth: © 2013 Harvard Business School Publishing 1Spardha KudalkarNo ratings yet

- Issue of Shares ProblemsDocument37 pagesIssue of Shares ProblemsgeddadaarunNo ratings yet

- Issue of SharesDocument26 pagesIssue of SharesPriyanka GargNo ratings yet

- Issue of SharesDocument26 pagesIssue of SharesAmandeep Singh MankuNo ratings yet

- Chapter-5-Accounting for Partnerships in EthiopiaDocument17 pagesChapter-5-Accounting for Partnerships in EthiopiaYasinNo ratings yet

- Issue and Forfeiture and Reissued of SharesDocument59 pagesIssue and Forfeiture and Reissued of Sharesvidhya_yog100% (3)

- accountingforsharecapital-160107074250Document47 pagesaccountingforsharecapital-160107074250nemewep527No ratings yet

- Applicationform PDFDocument3 pagesApplicationform PDFV. santhoshNo ratings yet

- CHAPTER 5 partDocument9 pagesCHAPTER 5 partTasebe GetachewNo ratings yet

- Unit 4. Accounting For Partnerships: A PartnershipDocument17 pagesUnit 4. Accounting For Partnerships: A PartnershipHussen AbdulkadirNo ratings yet

- Unit 4. Accounting For Partnerships: A PartnershipDocument17 pagesUnit 4. Accounting For Partnerships: A PartnershipHussen AbdulkadirNo ratings yet

- Corporate Accounting1Document58 pagesCorporate Accounting1Dhamodharan MNo ratings yet

- Corporate AccountingDocument12 pagesCorporate AccountingGunja TandonNo ratings yet

- Corporate Accounting PDFDocument193 pagesCorporate Accounting PDFK GanesanNo ratings yet

- Corp Accounting 9th AugustDocument53 pagesCorp Accounting 9th AugustParkavi ArunachalamNo ratings yet

- Week 12 Tutorial Questions Companies AF101Document4 pagesWeek 12 Tutorial Questions Companies AF101Silo KetenilagiNo ratings yet

- GlossaryDocument8 pagesGlossaryjas28No ratings yet

- Company AccountsDocument41 pagesCompany AccountsNisarga T DaryaNo ratings yet

- SPCM Unit 3 Bba II TMV NotesDocument11 pagesSPCM Unit 3 Bba II TMV NotesRaghuNo ratings yet

- Accounting for PartnershipsDocument36 pagesAccounting for Partnershipsedo100% (2)

- CHAPTER FOUR partnershipDocument16 pagesCHAPTER FOUR partnershipfikruhope533No ratings yet

- advanced accounting solved (2)Document5 pagesadvanced accounting solved (2)waleedkhan567799No ratings yet

- Limited Company Format A2 (Repaired)Document7 pagesLimited Company Format A2 (Repaired)Sterling ArcherNo ratings yet

- Week 7 NotesDocument6 pagesWeek 7 NotescalebNo ratings yet

- Company Types and Share CapitalDocument21 pagesCompany Types and Share CapitalAbhishek BaliarsinghNo ratings yet

- Investment Banking BasicsDocument92 pagesInvestment Banking BasicsUmesh VadlaNo ratings yet

- Accounts For Joint Stock Companies: Equity FinancingDocument30 pagesAccounts For Joint Stock Companies: Equity Financingaruba anwarNo ratings yet

- Partnership Formation GuideDocument9 pagesPartnership Formation GuideChariz Audrey100% (1)

- Chapter Five-CorporationDocument6 pagesChapter Five-Corporationbereket nigussieNo ratings yet

- Work Sheet On Accounting For Share Capital Board Exam Questions Fro 2016-2020Document22 pagesWork Sheet On Accounting For Share Capital Board Exam Questions Fro 2016-2020Cfa Deepti BindalNo ratings yet

- Stockholders' Equity Part 1Document24 pagesStockholders' Equity Part 1Ma. Jhezarie PobadoraNo ratings yet

- Tutor Marked AssignmentDocument10 pagesTutor Marked Assignmentfarozeahmad100% (2)

- Study Note 7.1, Page 470 508Document39 pagesStudy Note 7.1, Page 470 508s4sahithNo ratings yet

- Issue of Equity Shares Syllabus:: Call in Advance/ Calls in Arrears, Forfeiture and Re Issue of Forfeited SharesDocument8 pagesIssue of Equity Shares Syllabus:: Call in Advance/ Calls in Arrears, Forfeiture and Re Issue of Forfeited SharesMubin Shaikh NooruNo ratings yet

- Chapter Exercise 2 (March 2022)Document7 pagesChapter Exercise 2 (March 2022)Woo JohnsonNo ratings yet

- Share CapitalDocument22 pagesShare CapitalNirbhay SinghNo ratings yet

- Chapter 13 Corporations and Stockholders' EquityDocument23 pagesChapter 13 Corporations and Stockholders' EquityKiri SorianoNo ratings yet

- Buy Back of SharesDocument32 pagesBuy Back of SharesMehul SesodiyaNo ratings yet

- Accounting of Share CapitalDocument102 pagesAccounting of Share Capitalmohanraokp22790% (1)

- UNIT 4: Company Accounts-Share CapitalDocument13 pagesUNIT 4: Company Accounts-Share CapitalpraveentyagiNo ratings yet

- The Law of Corporate Finance & Securities RegulationDocument26 pagesThe Law of Corporate Finance & Securities Regulationchandni.ambaniandassociatesNo ratings yet

- Definition of Promoters - Can Be Incorporator, Member of The Board of DirectorsDocument6 pagesDefinition of Promoters - Can Be Incorporator, Member of The Board of DirectorsIrish AnnNo ratings yet

- Primarymarkets SebiDocument27 pagesPrimarymarkets SebiAnand BabuNo ratings yet

- Company Accounts—Underwriting of Shares and DebenturesDocument36 pagesCompany Accounts—Underwriting of Shares and DebenturesRajaramanNo ratings yet

- Session 3a Share Capital & Reserves: HI5020 Corporate AccountingDocument16 pagesSession 3a Share Capital & Reserves: HI5020 Corporate AccountingFeku RamNo ratings yet

- Corporate AccountingDocument253 pagesCorporate AccountingPrerna Madnani100% (1)

- ACCOUNTING FOR SHARE CAPITAL AND DEBENTURESDocument22 pagesACCOUNTING FOR SHARE CAPITAL AND DEBENTURESAnonymous 3yqNzCxtTzNo ratings yet

- CBSE-XII Accounts - Chap-A7-A8, B4Document43 pagesCBSE-XII Accounts - Chap-A7-A8, B4priyanshudevil2005No ratings yet

- Unit 4. Accounting For Partnerships: A PartnershipDocument14 pagesUnit 4. Accounting For Partnerships: A PartnershipHussen AbdulkadirNo ratings yet

- Unit 8. Accounting For PartnershipsDocument26 pagesUnit 8. Accounting For PartnershipsYeron GeseNo ratings yet

- Accounting for PartnershipsDocument28 pagesAccounting for PartnershipsYeron GeseNo ratings yet

- D0683SP Ans2Document18 pagesD0683SP Ans2Tanmay SanchetiNo ratings yet

- Capital Market InstrumentsDocument72 pagesCapital Market InstrumentsAFNA SHERIN KNo ratings yet

- Shares and DebenturesDocument20 pagesShares and DebenturesVíshál RánáNo ratings yet

- Unit 2Document41 pagesUnit 2SharmilaNo ratings yet

- Parcor FinalDocument6 pagesParcor FinalChris YuNo ratings yet

- Overview Period End Closing Steps and References Number Process Category DescriptionDocument4 pagesOverview Period End Closing Steps and References Number Process Category Descriptionbbazul1No ratings yet

- Chapter 13 Dividend Policy DecisionDocument23 pagesChapter 13 Dividend Policy DecisionMd. Sohel BiswasNo ratings yet

- Topic 1Document26 pagesTopic 1Mohd NajitNo ratings yet

- Opalesque 2010 Hong Kong RoundtableDocument22 pagesOpalesque 2010 Hong Kong RoundtableOpalesque PublicationsNo ratings yet

- Haldiram Products Private LimitedDocument7 pagesHaldiram Products Private LimitedAman GuptaNo ratings yet

- Salary Information - Asia: Banking & Financial Services - 2010Document4 pagesSalary Information - Asia: Banking & Financial Services - 2010Vicky OngNo ratings yet

- IASB Framework Sets Financial Reporting StandardsDocument3 pagesIASB Framework Sets Financial Reporting StandardsFaizSheikhNo ratings yet

- Break-Even Analysis: Margin of SafetyDocument2 pagesBreak-Even Analysis: Margin of SafetyNiño Rey LopezNo ratings yet

- G G ToysDocument5 pagesG G Toysnivetha gnanavelNo ratings yet

- Financial Assets Amortized Cost Lesson QuizDocument3 pagesFinancial Assets Amortized Cost Lesson QuizNavsNo ratings yet

- IFR Magazine - Issue 2413 11 December 2021Document84 pagesIFR Magazine - Issue 2413 11 December 2021Gabriel Ho Kwan LeeNo ratings yet

- Tugas CH 9 Manajemen KeuanganDocument5 pagesTugas CH 9 Manajemen KeuanganL RakkimanNo ratings yet

- Pricing Strategy Chapter 1 QuizDocument3 pagesPricing Strategy Chapter 1 QuizJenifer AtonNo ratings yet

- Portfolio Management 3-228-07Document48 pagesPortfolio Management 3-228-07divyarai12345No ratings yet

- YubarajDocument4 pagesYubarajYubraj ThapaNo ratings yet

- Management Accounting Assignment 1Document3 pagesManagement Accounting Assignment 1saurabhma23.pumbaNo ratings yet

- Income Statement For The Year Ended, December, 31, 2016: Pt. ZaliaDocument4 pagesIncome Statement For The Year Ended, December, 31, 2016: Pt. ZaliaNofi Nurlaila0% (1)

- Venture Financing in India PDFDocument12 pagesVenture Financing in India PDFChandni Makhijani100% (1)

- Overview of Indian Capital MarketDocument23 pagesOverview of Indian Capital MarketShruti PuriNo ratings yet

- Grow Well 1Document12 pagesGrow Well 1ShivamKumar DubeyNo ratings yet

- Arbitrage PDFDocument60 pagesArbitrage PDFdan4everNo ratings yet

- Crude Oil FactorsDocument39 pagesCrude Oil FactorsPrasad KulkarniNo ratings yet

- FEC ContractsDocument2 pagesFEC ContractssatyambhanduNo ratings yet

- Technical AnalysisDocument4 pagesTechnical AnalysisShaira Ellyxa Mae VergaraNo ratings yet