Professional Documents

Culture Documents

Intermediate Accounitng 3 - MC Problems

Uploaded by

Nicole Santiago0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

INTERMEDIATE ACCOUNITNG 3 - MC PROBLEMS

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageIntermediate Accounitng 3 - MC Problems

Uploaded by

Nicole SantiagoCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

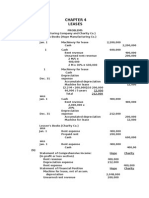

Intermediate Accounting 3

MC 30 – B

Capitalized leased asset on May 1, 2022 (400,000 x 5.95) 2,380,000

MC 31 – D

Depreciation is based on the economic life of the asset (2,400,000 – 200,000) / 8 years 275,000

MC 32 – D

Present value of annual rentals (1,742,174 x 3.48685) 6,074,699

Present value of guaranteed residual value (1.2M x 0.68301) 819,612

Capitalized cost of the machine 6,894,311

MC 33 – C

Depreciation is based on the lease term (6,894,311 – 1,200,000) / 4 1,423,578

MC 34 – A

Present value of annual rentals (1,742,174 x 3.48685) 6,074,699

MC 35 – D

Depreciation is based on the lease term 6,074,699 / 4 1,518,675

MC 36 – D

Cost of leased asset 6,245,450

Accumulated depreciation (6,245,250 – 80,000) / 6 = 1,027,575; 1,027,575 x 4 years (4,110,300)

Carrying value, end of lease term 2,135,150

Bargain option price (250,000)

Loss from failure to exercise the purchase option 1,885,150

You might also like

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Depreciation AnswersDocument13 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (2)

- RevaluationDocument4 pagesRevaluationArtisanNo ratings yet

- Financial Feasibility of Business PlanDocument14 pagesFinancial Feasibility of Business PlanRizaldi DjamilNo ratings yet

- Instructor: Võ H NG Đ C Group Members:: T Khánh LinhDocument20 pagesInstructor: Võ H NG Đ C Group Members:: T Khánh LinhMai Trần100% (1)

- Depreciation AnswersDocument22 pagesDepreciation AnswersGabrielle Joshebed Abarico100% (1)

- F.A. - Robles Empleo MC CH 1 2 3 4 5 6 7 8 9Document12 pagesF.A. - Robles Empleo MC CH 1 2 3 4 5 6 7 8 9Carlyn Joy Paculba67% (9)

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Revaluation ModelDocument33 pagesRevaluation ModelLumongtadJoanMaeNo ratings yet

- Management Accounting: Page 1 of 6Document70 pagesManagement Accounting: Page 1 of 6Ahmed Raza MirNo ratings yet

- Problem Set IV (9 Marks) : YTM/2) (n2)Document5 pagesProblem Set IV (9 Marks) : YTM/2) (n2)steve bobNo ratings yet

- Lagrimas - Leases Multiple ChoicesDocument4 pagesLagrimas - Leases Multiple ChoicesSarah Nicole S. LagrimasNo ratings yet

- Cpa 8Document13 pagesCpa 8justinorchidsNo ratings yet

- Pre FinalsDocument14 pagesPre FinalsJohn Kenneth Escober BentirNo ratings yet

- Assignment On: Principles of Accounting Course Code: ACC1101Document4 pagesAssignment On: Principles of Accounting Course Code: ACC1101Ruelliyas xxNo ratings yet

- RoughDocument5 pagesRoughSiya GuptaNo ratings yet

- CMA Presentation: Bill French CaseDocument12 pagesCMA Presentation: Bill French CaseSahaj SharmaNo ratings yet

- In Class File Chapter 11Document17 pagesIn Class File Chapter 11kathleen fajardoNo ratings yet

- SD17 Hybrid F9 Answers Clean ProofDocument10 pagesSD17 Hybrid F9 Answers Clean ProofVinny Lu VLNo ratings yet

- Answers - Chapter 2 Vol 2 2009Document13 pagesAnswers - Chapter 2 Vol 2 2009Crystin Marie Tiu100% (1)

- Test - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswersDocument10 pagesTest - 2 Paper - 2 Vsmart Academy Examprep Strategic Financial Management Suggested AnswerswinNo ratings yet

- Module - 5 Activities/Assessment Assignment 1Document3 pagesModule - 5 Activities/Assessment Assignment 1Rosalie Colarte LangbayNo ratings yet

- Tax Planning With Reference To Managerial DecisionsDocument22 pagesTax Planning With Reference To Managerial DecisionsdharuvNo ratings yet

- Capital Budgeting: Initial InvestmentDocument5 pagesCapital Budgeting: Initial InvestmentMd. Shakil Ahmed 1620890630No ratings yet

- Stock Shares Price ($) Market Value of AssetsDocument34 pagesStock Shares Price ($) Market Value of AssetsRADHIKA BANSALNo ratings yet

- Jawaban Kuis AK2Document37 pagesJawaban Kuis AK2clara_patricia_2No ratings yet

- Alternative Evaluation ProceduresDocument14 pagesAlternative Evaluation ProceduresNiranjan DahalNo ratings yet

- Financial Accounting 2 Chapter 4Document27 pagesFinancial Accounting 2 Chapter 4Elijah Lou ViloriaNo ratings yet

- Lease 5. Sales and LeasebackDocument40 pagesLease 5. Sales and LeasebackChuckay SealedNo ratings yet

- Pile cp2Document35 pagesPile cp2casarokarNo ratings yet

- Strategic Finance All Question-6Document1 pageStrategic Finance All Question-6TheNOOR129No ratings yet

- 4.1 AFM Investment Appraisal NPV 201223Document13 pages4.1 AFM Investment Appraisal NPV 201223Kushagra BhandariNo ratings yet

- Case Study LeasingDocument4 pagesCase Study LeasingSarwanti PurwandariNo ratings yet

- Answers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security ValuationDocument8 pagesAnswers To Chapter 3 Questions: Chapter 03 - Interest Rates and Security Valuationimamoody1No ratings yet

- Total Increase in PPE 9,700,000Document22 pagesTotal Increase in PPE 9,700,000Stephanie gasparNo ratings yet

- Selected Solutions From Chapter 22: QuestionsDocument6 pagesSelected Solutions From Chapter 22: QuestionsmimitayelNo ratings yet

- Question 4Document8 pagesQuestion 4Jeremiah NcubeNo ratings yet

- Make Versus Buy CaseDocument2 pagesMake Versus Buy CaseAamirNo ratings yet

- Strategic Finance All Question-13Document1 pageStrategic Finance All Question-13TheNOOR129No ratings yet

- Answer Key ACCTG 202Document3 pagesAnswer Key ACCTG 202Sanilyn DomingoNo ratings yet

- Latest Financials - DR Agarwals May 2022Document11 pagesLatest Financials - DR Agarwals May 2022Mr SmartNo ratings yet

- IGB REIT-Interim Report-Dec19-200122Document18 pagesIGB REIT-Interim Report-Dec19-200122Gan Zhi HanNo ratings yet

- Licenciatura em Contabilidade E Auditoria Contabilidade Financeira IiDocument16 pagesLicenciatura em Contabilidade E Auditoria Contabilidade Financeira IiFarai MwafulirwaNo ratings yet

- Acquisition Phase For Crane MachineDocument5 pagesAcquisition Phase For Crane MachineFarah ArishaNo ratings yet

- SPIL Q2FY22 Financial ResultsDocument10 pagesSPIL Q2FY22 Financial ResultsKARANNo ratings yet

- BAFI3200 - Tran Nguyen Ngoc Khanh - s3740817 - Assignment 1Document20 pagesBAFI3200 - Tran Nguyen Ngoc Khanh - s3740817 - Assignment 1KhánhNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- 30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowDocument13 pages30 Year 10% 0%: Q. Use The Present Worth Method To Determine The Total Cost (LCC) of The Three Alternatives BelowPMPNo ratings yet

- SMChap 006Document22 pagesSMChap 006Anonymous mKjaxpMaLNo ratings yet

- Bisaya LyricsDocument2 pagesBisaya LyricsNimrah AbarabarNo ratings yet

- Bon Julie Ann D. BS Accountancy 2A Chapter 1: Sales and LeasebackDocument5 pagesBon Julie Ann D. BS Accountancy 2A Chapter 1: Sales and LeasebackJulie Ann BonNo ratings yet

- Chapter 28Document6 pagesChapter 28Shane Ivory ClaudioNo ratings yet

- Chapter 3 Problem 6 LenzierDocument25 pagesChapter 3 Problem 6 LenzierJohn Lenzier TurtorNo ratings yet

- 2014 Volume 2 CH 2 AnswersDocument15 pages2014 Volume 2 CH 2 AnswersJames Louis B. AntonioNo ratings yet

- Chapter 3 Depreciation - Sum of The Years Digit MethodPart 4Document8 pagesChapter 3 Depreciation - Sum of The Years Digit MethodPart 4Tor GineNo ratings yet

- ACCT105 Quizzes and SolutionsDocument8 pagesACCT105 Quizzes and SolutionsAway To PonderNo ratings yet

- LeaseDocument6 pagesLeasevnprakash sharmaNo ratings yet

- CMA Individual AssignmentDocument5 pagesCMA Individual Assignment227248No ratings yet

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Document13 pagesTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdNo ratings yet

- Contoh Soal Dan Jawaban AKM Accounting For LeasingDocument5 pagesContoh Soal Dan Jawaban AKM Accounting For LeasingRaden Arif Kurniawan100% (1)