Professional Documents

Culture Documents

Sop Finance and Accounting Department

Uploaded by

Nurul Nadhilah RoslainiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sop Finance and Accounting Department

Uploaded by

Nurul Nadhilah RoslainiCopyright:

Available Formats

lOMoARcPSD|24621526

SOP- Finance and Accounting Department

Accountancy (Philippine Normal University)

Studocu is not sponsored or endorsed by any college or university

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Standard Operating Policy and Procedures 1

Finance and Accounting Department

NOVEMBER 30, 2021

Del Rio Realty & Development of Bacolod, Inc.

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

TABLE OF CONTENTS

Section 1 Overview 1

1.1 Purpose of this Manual 1

Section 2 Finance Department Organizational Chart 2

Section 3 Area of Responsibility 3

Section 4 General Ledger and Chart of Accounts 4

Section 5 Internal Control 6

Section 6 Financial Statement Audit 6

Section 7 Accounting Procedures 7

7.1 Cash 7

A. Cash/Check Receipts 7

B. Cash Disbursements and Expense Allocation 11

C. Petty Cash Fund 14

D. Bank Reconciliations 15

E. Reimbursement of Accounts from one Building to Another 16

F. Cash Advanced for Liquidation (TBL) 17

7.2 Accounts Payable 19

7.3 Accounts Receivable Collection and Billing 21

7.4 Purchasing 24

7.5 Inventory Management 28

7.6 Payroll 32

7.7 Fixed Assets 38

Section 8 Documents Retention and Destruction Policy 44

Section 9 Insurance 46

Section 10 Financial Reports and Records 46

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

ii

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

SOP 1- ACCOUNTING & FINANCE DEPARTMENT

(Standard Operation Policy & Procedure)

Section 1 OVERVIEW

1.1 Purpose of this Manual:

The policies and procedures discussed herein address diverse accounting and financial policies.

These policies are designed to enhance financial accountability and transparency, eliminate

misunderstandings, and protect the assets and growth of the DRRDBI. It is the responsibility of

DRRDBI Finance and Accounting Department and DRRDBI Management Team to ensure sound

accounting practices and internal controls.

The major purpose of this policy and/or procedures manual is to document an organization's

system of internal controls and enforce control procedures. This Standard Operating Procedures

also seeks to a) aid in the preparation and processing of accounting transactions and reports; b)

provide training and direction to staff, especially to those new to their positions; c) increase

efficiency by promoting standardization; d) facilitate backup staffing, when necessary; e) offer a

repository of reference information; and f) provide documentation of current systems that

facilitate technological change and conversions.

This manual is subject to modification, amendment and deletion to ensure an up-to-date

reference. The Finance Department shall review this manual as often as needed to make

recommendations for amendments, addition or deletion.

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

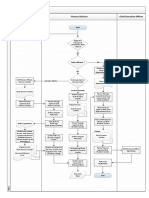

Section 2 FINANCE DEPARTMENT ORGANIZATIONAL

STRUCTURE

1. DRRDBI FINANCE DEPARTMENT

POSITIONS:

a. FINANCE MANAGER

b. ACCOUNTANT

c. BOOKKEEPER

d. AUDITOR

e. FINANCE OFFICER: PROPERTY MANAGEMENT DIVISION

f. FINANCE OFFICER: PROPERTY DEVELOPMENT DIVISION

g. COLLECTIONS OFFICER

h. PAYROLL OFFICER

i. MSS: FINANCE ASSISTANT LV2

j. MSS: FINANCE ASSISTANT LV1

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Section 3 AREA OF RESPONSIBILITY

It is the policy of the DRRDBI to ensure an adequate segregation of responsibilities with regard

to all aspects of the financial operations of the DRRDBI to include but not limited to cash

receipts, bank deposits, bank statement reconciliations, invoice approval, check preparation,

check signing, and expense reimbursement approvals. Additionally, the DRRDBI shall consult

with an independent CPA firm to study internal controls and recommend improvements in

segregation of duties.

Finance and Accounting Responsibilities:

1. General Ledger

2. Budgeting

3. Asset Management

4. Contract Administration

5. Purchasing

6. Account Receivable and Billing

7. Cash Receipt

8. Account Payable

9. Cash Disbursement

10. Payroll & Benefits

11. Financial Statement

12. External Reporting

13. Bank Reconciliation

14. Compliance with Government Reporting Requirements

15. Annual Audit

16. Lease & Tenant Account

17. Property Insurance

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Section 4 GENERAL LEDGER AND CHART OF

ACCOUNTS

The general ledger is the collection of:

1. Asset Account

2. Liability Accounts

3. Net Assets or Equity Accounts

4. Revenue and Expense Accounts.

It is used to accumulate all financial transactions and is supported by subsidiary ledgers that

provide details for certain accounts. The general ledger is the foundation for the accumulation of

data and production of reports.

Chart of Accounts

The chart of accounts is the framework for the general ledger system and the basis for the

accounting system. The chart of accounts consists of account titles and account numbers

assigned to the titles. General ledger accounts are used to accumulate transactions and the impact

of these transactions on each asset, liability, net asset, revenue and expense account.

All DRRDBI employees involved with account coding or budgetary responsibilities will be

issued a current chart of accounts. As the chart of accounts is revised, an updated copy of the

chart of accounts shall be promptly distributed to these individuals.

The Accountant monitors and controls the chart of accounts, including all account maintenance,

such as additions and deletions. Any additions or deletions of accounts should be approved by

the Accountant, who ensures that the chart of accounts is consistent with the Organizational

structure of DRRDBI and meets the needs of each division and department.

DRRDBI operate on a calendar year basis.

DRRDBI utilizes numerous estimates in the preparation of its interim and annual financial

statements such as:

A. Useful lives of property and equipment

B. Fair market values of investments

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

C. Values of contributed services

D. Allocations of certain indirect costs

E. Allocations of time/salaries, etc.

The Accountant will reassess, review, and approve all estimates yearly. All key conclusions,

bases, and other elements associated with each accounting estimate shall be documented in

writing. All material estimates, and changes in estimates from one year to the next, shall be

disclosed to the Finance Committee, the Audit Committee, and the external audit firm.

All general ledger entries that do not originate from a subsidiary ledger shall be supported by

journal vouchers or other documentation, including an explanation of each such entry.

Examples of such journal entries are:

a. Recording of noncash transaction

b. Corrections of posting errors

c. Nonrecurring accruals of income and expenses.

Recurring journal entries may include, but are not limited to:

a. Depreciation of fixed assets,

b. Amortization of prepaid expenses,

c. Accruals of recurring expenses,

d. Amortization of deferred revenue, etc.

Recurring journal entries shall be supported by a schedule associated with the underlying asset or

liability account or, in the case of short-term recurring journal entries or immaterial items, a

journal voucher.

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Section 5 INTERNAL CONTROL

Del Rio Realty and Development of Bacolod, Inc. will maintain an adequate system of internal

accounting controls to provide management with reasonable assurance as to the safeguarding of

assets against losses from unauthorized use or disposition and the reliability of financial records

for preparing financial statements and maintaining accountability of assets.

The characteristics of an adequate system of internal control will include:

A. Segregation of duties within the organization based on functional responsibilities

B. A system of authorization and record retention;

C. A degree of personnel competence commensurate with responsibilities.

To achieve these objectives, controls will be in place in ways that no one person shall have

complete control over all phases of any significant transaction and whenever possible, the flow

of work will be from one employee to another so that the work of the second, without duplicating

that of the first, provides a check upon it. Record keeping will be separated from operations or

the handling and custody of assets.

Additionally, the location and safekeeping of valuable assets must be carefully controlled so that

unauthorized individuals cannot have access to them.

To protect DRRDBI against fraudulent acts and other actions taken by an employee that are not

in line with the company’s goals, the following internal control procedures shall be adopted:

Claims of Expenses

A Cash Disbursement Voucher (CDV) from must be filled out and signed by the

employee confirming that all of the claims represent expenses purposely incurred

while pursuing company business;

It will be then reviewed by the next management level authorized or by the

manager as a check before being processed. This practice, the double signatory, is

the most common form of internal control.

Purchasing

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Employee wishing to procure an item in behalf of the company must complete a

Requisition Slip (RS) form explaining the requirement together with other details.

A second signature must be obtained from the manager or immediate supervisor

before the form will be sent to the purchaser.

Purchaser is responsible for ensuring that the correct form of procurement is

adhered to which requires at least two or three quotes from competing suppliers

before business is placed. This is to avoid the possibility of collusion between an

employee and an outside company.

Section 6 FINANCIAL STATEMENT AUDIT

DRRDBI will have its financial statements audited by an Independent Certified Public

Accounting firm on an annual basis. It will have its financial statements audited annually in

accordance with generally accepted auditing standards. In preparing for the audit, the company

should complete a self-check audit program. Copies of the audited financial statements will be

distributed to the Managing Director, Finance Manager and/or Accountant and others at the

discretion of DRRDBI’s Heads. Additional copies will also be distributed to the Board of

Directors.

Section 7 ACCOUNTING PROCEDURES

7.1 : CASH

A. Cash/Check Receipts

Cash Receipts generally arises from:

1. Rental

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

2. Maintenance fee

3. BACIWA Bill

4. CENECO Bill

5. Other Fees stated in the contract

Purpose

1. Ensure that funds accepted follow the same process each time so that funds can be

deposited in a timely manner and easily tracked while keeping both the funds and

personnel handling the funds secure.

2. To establish proper controls and cash handling procedures throughout the company.

3. Controls are required to safeguard against loss and to define responsibilities in the

handling of cash.

4. “Cash” may consist of currency, checks, money orders, credit card transactions, and

electronic fund transfers.

Policy

1. All funds/checks collected by the company must be deposited into an authorized or

designated bank account as soon as practical, generally on the date of collection or on the

date the check due in case of PDC’s.

2. Where this is impractical and where the total deposit is less than ten thousand pesos

(₱10,000), the deposit may be made within one business day from the collection.

3. Cash Handling Policy

The company must follow proper procedures and exercise of internal controls when

handling the collection and deposits of cash and checks. The system is designated to

provide reasonable assurance that errors will be detected and corrected in the normal

course of activities.

a. Segregation of Duties

i. Collection/Receiving and custody of funds is the responsibility of Finance

Manager

ii. Custody of Funds is the Finance Officer responsibility

iii. Depositing the funds will be taken care of by the Finance Assistant

iv. Reconciling account balance is the work of the Bookkeeper.

b. Collection/Receiving of Funds

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

i. An Official Receipt is given only to Rental Payments received from

Tenants.

ii. Acknowledgement Receipt is given to every payment made by tenants with

Official Receipt in case of Rental.

iii. As a general rule, the receipt(s) must be written or entry made in a cash

register for each remittance received from the tenant.

iv. Each receipt(s) is pre-numbered with three (3) copies: the original copy will

be given to the payee, the third copy shall be retained in the receipt book,

while the second copy shall be attached on the Tenant’s folder.

v. Each Official Receipt must be itemized to show the date it is made, the

name of the payer/tenant, the unit it occupies, the total amount paid in

figures, the date check was deposited in case of PDC and signature of the

receiving officer.

c. Custody of Funds

i. Named individuals shall be responsible for cash and checks at each stage

before they are banked.

ii. The Finance Officer must be responsible for cash held within the

department and must retain custody and control over the cash fund for

which he/she is responsible at all times.

iii. The Finance Department must pre-assign secondary responsibility to

another designated individual in the department when the regular custodian

is absent.

iv. Custody of keys must be maintained by limited personnel only. The

Finance Manager and one designated person are the ones who should have

a copy of the keys and authorized to open the cash storage.

d. Depositing of Funds

i. The Finance Manager will determine to which bank accounts of the

company the funds will be deposited to.

ii. The Finance Officer shall then check and re-count the amount endorsed. In

case of check/PDC, he/she will check the date, the amount in figures and

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

in words, check for any alteration and double check the account number

where it will be deposited to.

iii. In case of cash of more than Fifty Thousand Pesos (₱ 50,000.00), the

Finance Officer shall be accompanied by one of the company’s appointed

personnel or shall be delivered directly to the bank using the company’s

vehicle.

e. Reconciling Funds/Accounts

i. The Bookkeeper is responsible for data entry into the accounting system

for reconciliation of amounts.

Procedures

The Steps in The Payment of Bills and Fees by The Tenants Are:

1. The TENANT shall deposit directly to the company’s bank account the dues on Billing

Notices for Rentals, Electric and Water Bill for the month;

2. Tenant shall then send a scanned copy of the deposits slip through company email, or

submit a photocopy of the deposit slip to the Administrative Office, no later than 2 business

days after date of deposit or before the deadline of said payment, for verification and

updating the tenants account.

3. No proof of deposit, the TENANT will be charged with the corresponding penalty fees

for delinquent payment. (See the Contract of Lease, Section P. Delinquent Payments)

4. Official Receipt and Acknowledge Receipt will be given to the TENANT after

verification of their payment with the bank or after three days of clearing.

For actual receipts of cash or check the following should be practiced:

1. Cash/Currency (For special Case only as all payments are either PDC or bank deposits)

i. The Finance Assistant or Officer receives the payment of client/tenant

ii. Then the amount received should be counted and verified

iii. The Finance Assistant will issue an Official Receipt or Acknowledgement Receipt

in triplicate copy for the payment

iv. Upon the receipt of payment/s, Cash Receipts Log book should be filled in

v. The Finance Officer will then endorse the cash and payment summary to the

Finance Manager

10

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

vi. Receipt(s) are distributed to the Tenants through the Maintenance personnel

assigned in the particular building.

2. Check

i. Upon the commencement of the lease, Tenants are required to provide their Post-

dated Check (PDC) for the term indicated in the contract. Checks accepted are

Business and Personal Bank Checks only.

ii. When accepting PDC’s, the following information should be verified:

a. Signature (as shown in their recipient file attached in their tenant folder)

b. Issued for Del Rio Realty and Development of Bacolod, Inc.

c. The amount in words and in figures must match.

d. The check is not stale dated.

e. The check has no alteration.

f. Check must be dated and amount should reflect as it is stated in their signed

contract.

iii. The Finance Manager receives the PDCs from the client and forward it to the Finance

Assistant.

iv. The Finance Assistant will scan the PDC, so that file can be easily access for future

reference, print a copy and attached it to the original checks.

v. The Finance Assistant will generate PDC’s Transmittal Document that contains the

list of the PDC’s bank name and account number, check number and amount along

with the description of the payment in three (3) copies, one copy to be given to the

client, one copy to the Finance Assistant and one copy attached in the tenant folder.

vi. The Finance Manager take responsibility of the custody of the checks to be endorsed

to the Finance Officer on the date of the checks, generally every first (1 st) day of the

month or within the first five (5) days of the month.

vii. Aside from the Transmittal document endorsed to the Manager, the Finance Assistant

will also have to email a file to the Finance Manager and Officer and the Managing

Director, containing the scanned and summary list of the PDCs.

viii. Checks Endorsement shall be done through the following:

11

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

a. ‘Endorsement’ means to type, write or stamp the back of the check with the

required information and instruction

b. It is the responsibility of the custodian of PDC’s to endorse the checks

immediately upon the due date of the checks.

c. This is to ensure that the funds received by check are protected from

fraudulent endorsement and theft of funds.

FOR DEPOSITS ONLY

Del Rio Realty and Development of Bacolod, Inc.

Name of the Building

Bank Account # xxxxxx

ix. The Finance Assistant will fill up deposit slip and deposits the checks and issue

Official Receipt and Acknowledgement Receipt to the client/tenant after three days of

clearing. Receipt(s) are distributed to the Tenants through the Maintenance Personnel.

B. Cash Disbursement and Expense Allocation

Cash disbursements are generally made for:

1. Payments to suppliers for goods and services

2. Taxes/license fees

3. Staff training and development.

4. Meeting expenses

5. Employee reimbursements

6. Various Purchases under Petty Cash Fund

Purpose

1. The cash disbursements process is designed to ensure that the company appropriately

processes payments to satisfy its accounts payable when they are due.

2. Cash disbursements may include payments made by check or with cash.

Policy

1. Documentation / Supporting documents: All Cash payments (to employees / vendors)

should be supported by:

12

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

i. An Original invoice/receipt for each expense item that matches the purchase

order.

ii. In exceptional circumstances, in the absence of invoice/receipt, the settlement

form should include an itemized list of missing receipts, including explanation

for their unavailability and should approved by the respective approvers as per

the policy.

iii. Vendor Invoices for cash payments should have Service / Goods received

acknowledgement, delivery note from the employee

iv. Purchase request (submitted on approved form) Employee expense report or

reimbursement request.

2. Disburse cash only for valid business purpose upon proper authorization.

3. Check Voucher authorization and signatories required:

a. Prepared by Finance Officer

b. Posted by Finance Assistant

c. Recorded by the Bookkeeper

d. Verified by Finance Manager

e. Certified by Managing Director

f. Approved by the CFO

g. Check Signatories

4. Checks Signatories are as assigned by the Board of Directors of Del Rio Realty and

Development, Inc.

5. Check and Check Voucher Signing schedule

i. Managing Director – sign check vouchers every Tuesday and Thursday

ii. Check Signatories – sign check every Monday, Wednesday, and Friday

iii. Special signing schedule is done sometimes depending on the availability of the

assigned check signatories.

6. Prior to the signing of check by the Managing Director, all check voucher attachments

must be stamped “DRRDBI Paid” indicating the CV number to ensure that it is not

inadvertently processed again. This includes stamping all accounting and supporting

documents that indicate the cash/check disbursement voucher and check number.

7. Checks management are as follows:

13

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

a. BLANK checks are prohibited under any circumstances.

b. TBL checks are the responsibility and accountability of the Finance Manager and

will generate checks for approved invoices and should be signed by the Managing

Director and the CFO, or other authorized signatories in case one of them will not

be able to do so.

c. CANCELLED/VOIDED checks should be stamped “cancelled” and will be kept

in file. Cancelled Checks due to errors or mistake of employees shall be subject to

equivalent to the price of the check per piece.

d. OUTSTANDING CHECKS over 90 days should be taken action by the Finance

Manager.

In no case

a. Invoices will be paid unless approved by authorize signatories

b. TBL checks be signed in advance

c. Checks be made out to cash, petty cash, etc.,

d. Checks be made or prepared through verbal authorization unless approved by the

Managing Director or the CFO.

C. Petty Cash Fund

Purpose

1. Petty cash funds are maintained by the organization to provide fund for minor expenditures.

2. The funds are to be used for unanticipated business expenses, where the use of alternative

means is neither feasible nor cost effective

3. The intent is to simplify the reimbursement of staff members and visitors for small

expenses such as taxi fares, postage, office supplies, meals and drinks, etc.

Policy

1. A request for Petty Cash Fund is to be made by the Finance Officer to be approve by the

Finance Manager, or by the Managing Director in the absence of the former.

2. The Finance Assistant is the Petty Cash custodian (for special project, the petty cash

custodian is the Finance Officer) and is the only one who has access to the fund.

14

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

3. In the event of requesting the increase, decrease of the amount, change of custodian or

close the account of Petty Cash Fund, the Officer in-charge should pass Petty Cash

Request/Change Form.

4. All Original Receipts must be obtained for each petty cash expenditure.

5. For each disbursement, the following information must be documented:

i. Payee

ii. Date

iii. Amount

iv. Business Purpose

v. Description of purchase

6. The Petty Cash Fund amount for the building are combined.

7. Petty cash funds in no case be deposited into personal bank accounts or commingled with

other funds, except the company assigned accounts.

8. The Finance Department should not establish bank accounts for petty cash funds unless

approved by the Managing Director

9. Purchases of goods and services for more than two thousand pesos (₱2,000.00) should not

be made with petty cash.

10. In NO case Petty Cash funds may be expended for:

i. Salaries, wages, or similar payments to employees, or individuals unless

previously approved by the Finance Manager or Managing Director.

ii. Purchases of goods and services for the personal use of the Employees.

iii. Payroll advances, travel advances, and loans to employees unless otherwise

approved by the Finance Manager or Managing Director

iv. Cashing Checks for employees or other individual.

v. Gifts

vi. Interest Charged\s

vii. Recurring Expense (e.g. Electric and water Bill, Cellphone expenses, etc.)

11. Cash on hand and receipts for disbursements made should always equal the assigned

amount of the petty cash fund and should be counted daily if applicable.

12. Reimbursement for petty cash must be for the exact amount of the expense. Requesting

reimbursement of less than the full amount of the expense is specifically not allowed.

15

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Procedure

Setting up Petty Cash Fund

1. The finance officer draw check equal to the approve amount of Petty cash

fund/expense.

2. Cashed the check and endorsed to the custodian.

3. Make a list of expenditures from the petty cash account as you make them. Attached to

that list should be receipts for each expenditure.

Petty Cash Fund Replenishment

1. The Finance Assistant will gather and file the receipts if half of the monthly limit is

expensed, next prepare the Petty Cash Replenishment Summary and then submit to

Finance Manager for Approval.

2. Once approved, the person in charge will prepare the check and check voucher upon

receiving the approved Petty Cash Replenishment Summary from the Finance

Manager.

3. In case of online transfer, the Finance Officer or the Maker, will prepare the transfer of

funds to be authorized or approved by the Managing Director online. Then printout the

check voucher for online transfer.

4. The Finance Assistant must ensure that the check voucher is signed by herself/himself,

Finance Officer, Finance Manager, Managing Director and check signatory.

5. Check Signatories required are delegated only by the Board of Director of Del Rio

Realty and Development of Bacolod, Inc.

6. The check and the check voucher will be sent to Finance Manager for safekeeping,

approval and update the cash flow which is reviewed by the Managing Director every

now and then.

7. The Finance Manager will be the only one authorized to release the check.

Recording of Petty Cash Fund

i. Petty Cash Fund account is debited and Cash in bank is credited upon setting up

the fund.

ii. Expenses are recognized only upon replenishment.

16

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

iii. Shortage of receipts compare to the total expenses are charged against the petty

cash custodian.

D. Bank Reconciliations

Purpose

1. Outlines monthly bank statement reconciliation practices to ensure the accuracy of the

company bank account records.

2. To ensure that:

i. all receipts and disbursements are recorded (an essential process in ensuring

complete and accurate monthly financial statements);

ii. Checks are clearing the bank in a reasonable time;

iii. Reconciling items are appropriate and are being recorded; and

iv. The reconciled cash balance agrees to the general ledger cash balance.

Policy

1. These procedures apply to all Corporate Bank Accounts under the company.

2. Each bank account will be reconciled on a monthly basis every 20th business day of the

month.

3. Bank account reconciliations will be prepared by the Bookkeeper and approved by the

Finance Manager and affix their signatures on the bank account reconciliation summary

that will confirm that current procedures were followed and that the reconciliation

accurately presents the status of the account at the bank

Procedure

1. The Bank will issue the Bank Statement in a monthly basis.

2. The bookkeeper will reconcile the bank statements/passbook from the

record of check issuance, deposits slip, and other proofs that the tenants has deposited its

payments (e.g. screen shots in case of bank transfers) and prepares Bank reconciliations

Report.

3. The Finance Manager will check the report and approved it through

signing.

4. The Managing Director receives the said report at least quarterly or as

necessary.

17

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

E. Reimbursement of Accounts from One Building to Another

The need for reimbursement of accounts from one building to another arise from the

following:

1. Administrative Salary, Wages and Allowances

2. Office Furniture and Equipment

3. Other Administrative Expenses

Purpose

1. To allocate the share of each building to the administrative expenses.

2. To have an accurate accounting of computing expenses that each building should

recognize.

Policy

1. The Finance Officer computes the total expenses incurred.

2. Reimbursement of accounts from one building to another is done when the Finance

Manager authorizes the transfer hence approved by the Managing Director.

3. Expenses subject for allocation is totaled by the end of the month or by the time that all

receipts for expenses is already at the possession of the finance department.

4. The Finance Assistant will prepare a summary list of the expenses to be reimbursed to be

attached to the Check Voucher along with other necessary supporting documents.

5. Check Voucher of other buildings should note the CV No. of payer account to serve as

reference such as receipts, purchase order, delivery receipts, etc.

Procedures

1. The Finance Officer computes the total expenses and post to individual ledger of the

buildings.

2. The Finance Officer prepares the check and check voucher corresponds to the amount

approved.

18

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

3. The Finance Assistant submits complete documentation for signing of the Check and

Check Voucher.

4. The Finance Officer must ensure that the check voucher is signed by herself/himself, the

Finance Manager, the Managing Director and the CFO.

5. Check Signatories required is the Managing Director/CFO.

6. Finance Manager receives check and check voucher for safekeeping and for updating of

cash flow.

7. Finance Manager will instruct the Finance Assistant to which company bank account the

check must be deposited.

F. Cash Advanced for Liquidation (TBL Requests)

Purpose

1. To prepare for expected expenses to be incurred in the next month such as salaries and

wages, light and water, petty cash fund, accounts payable, etc.

2. This is done for the signatories are not always in town to approve and signed the

documents.

Policy

1. The checks are Post-dated Checks dated on the day it should be cashed or be given to the

payee.

2. The Finance Officer should prepare TBL Log where all TBL checks are listed to monitor

its movement and replenishment.

3. Custody of checks should be under the Finance Manager and access should be restricted

to him/her only.

4. Releasing of checks should be the date upon its face.

5. Upon replenishment, the Finance Officer should update the TBL Log.

Procedure

TBL Preparation

1. The Finance Officer prepares the list of accounts for TBL.

19

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

2. The Finance Manager verified accounts for TBL.

3. The Managing Director and CFO will approve TBL Amount.

4. The Finance Officer prepares check and check voucher upon approval.

5. The Finance Manager keeps the check and check voucher and updates cash flow.

6. The Finance Manager release the check to the payee when due.

TBL Replenishment

1. Finance Assistant gathers and file the receipts for the preparation of TBL Replenishment

Summary.

2. Finance Officer prepares check and check voucher for TBL replenishment of each Bldg.

3. The Finance Officer must ensure that the check voucher is signed by herself/himself, the

Finance Manager, the Managing Director and the President/CFO.

4. Check Signatories required are delegated only by the Board of Director of Del Rio Realty

and Development of Bacolod, Inc.

5. The check and the check voucher will be sent to Finance Manager for safekeeping,

approval and update the cash.

6. Finance Manager will deposit the check to the bank under ‘On-us Check deposit’.

TBL Recording

1. TBL is an asset account prior to disbursement of funds.

2. Amount is transferred through debiting Cash in Bank-Current Account and then credit

Cash Advanced for Liquidation account.

3. Expense should be recognized upon Replenishment

7.2 : ACCOUNTS PAYABLE

Purpose

i. Establishes the procedures for the payment of purchase order and non-purchase

order procured goods and services on accounts otherwise known as accounts

payable.

20

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Policy

1. All invoices must be verified to ensure payments are appropriately made to the correct

vendor for the correct amount for goods and services delivered.

2. For purchase order-based payments, discrepancies between the vendor invoice and the

purchase order greater than 5 percent must be resolved before the payment can be

processed.

3. Accounts payable officer should verify that the items invoiced match the items ordered

on the purchase order and consider the following:

a. invoice match the vendor information on the purchase order

b. invoice issued prior to the purchase order being approved

c. all purchase orders should be issued prior to invoices being received.

d. items invoiced the same as the items ordered

e. if paying on an open purchase order, do the items match the general category of

items authorized

f. amounts invoiced (by total or by item) match the purchase order

g. invoice have enough detail to verify that the services were performed as

contracted

h. an invoice for services (e.g. Construction in Progress) especially a progress

invoice, should include details such as dates of service, description of services,

and hours of service.

i. All required documents been received (i.e., signed contracts, public works

requirements, etc.)

4. For direct payments, the accounts payable officer will match a vendor invoice to an

authorization to pay. Direct payments are payments made without a formal purchase

order being issued. One common use of direct payments is utility services which are

invoiced regardless of a purchase order being authorized.

Procedures

21

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

1. The Administrative/Finance Assistant received the invoice mailed or delivered by the

vendor.

2. This is forwarded to Finance Assistant if received by the Admin Assistant.

3. The Operations Manager check the invoice received and approved by the Managing

Director and send to Finance Department for payment.

4. Processing invoices for payment by the Finance Officer

a. Receive the purchase order copy from the purchasing department. Check if

appropriate approval is present.

b. Obtain the receiving report (delivery receipt, signed purchase order copy) and

compare quantities ordered in purchase order. Attach to purchase requisition slip

and purchase order copy.

c. Receive the vendor invoice, and check price and quantity against purchase order

and receiving report.

d. Check the Bank Balance to ensure funds are available for disbursements

e. Verify that the expenditures were received by the Maintenance Manager

f. File the Purchase order copy, purchase requisition, receiving report and invoice by

due date in the unpaid invoice file

g. After obtaining approvals for disbursements (check and check voucher

approvals), re-file the receiving report with the corresponding invoice and support

in the unpaid invoice file.

h. Finance Officer prepares the check & check voucher to the vendor indicating on

the stub the account number and description of purchase.

i. The Finance Officer must ensure that the check voucher is signed by

herself/himself, the Finance Manager, the Managing Director and the CFO.

j. Check Signatories required are delegated only by the Board of Director of Del

Rio Realty and Development of Bacolod, Inc.

k. The check and the check voucher will be sent to Finance Manager for

safekeeping, approval and update the cash.

l. The Finance Manager will be the only one authorized to release the check to the

custodian, vendor, etc.

22

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

5. Recording of the said payments in the books is done after the checks has been released

and the check was cashed by the payee.

7.3 : ACCOUNTS RECEIVABLE COLLECTION AND BILLING

Accounts Receivable arises from the following:

a. Rental

b. Maintenance fee

c. Water Bill

d. Electric Bill

e. Other Fees/Charge stated in the contract

Purpose

1. To outline procedure to be used in billing charges to tenants for the rental fee,

maintenance fee and other charges.

2. To outline administrative and collection responsibilities of amount billed.

3. To discuss option for delinquent payments and tenants accounts.

4. To keep track of Tenants security deposits

5. Analyzing and processing monthly rents, invoices and customer statements or payments.

6. To consolidate cash receipts against relevant invoices or customer checks.

Policy

1. The Finance Officer is responsible for the follow-up and collection of unpaid items and

shall maintain customer accounts receivable records for all charges prepared in

accordance with this regulation.

2. Access to customer/tenant charges payment history and balances will be made available

to the originating department.

Procedure

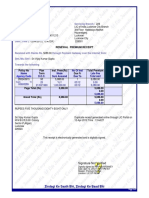

1. Finance Officer

i. Computation of the total amount of Rent, Water and Electric bill for the month

and the preparation of Billing Notice in three (3) copies.

23

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

2. Property Manager/Operations Manager

i. Checking of Billing Notice prepared by Finance Officer

3. Finance Manager

i. Approved the Billing Notice prepared by the Finance Officer

4. Administrative Assistant

i. Releasing of Billing Notice through Maintenance Personnel

5. Maintenance Personnel

i. Delivering the Notice to tenants and retains two (2) signed copies to be returned

to the Administrative Office

6. Administrative Assistant

i. Filing of the two (2) copies to tenants’ folder

7. Rental Fee is deposited by the tenants on the first (1st) day of the month the payment

pertains plus the Maintenance Fee stated in the contract.

8. BACIWA Bill, CENECO Bill and other charges are paid within five (5) days after the

Billing Notices are sent to the tenants.

9. See Cash Receipts above.

A. Delinquent Accounts

Collection of Penalty Payments for Delinquent Accounts (Rent, Ceneco, Baciwa and other

fees)

Accounts are considered delinquent if payment is not made until the 6th day of the month.

1. Finance Officer

i. Computation of the total amount of Rent, Baciwa and Ceneco plus penalty

ii. Preparation of Notice of Delinquent Payments in three (3) copies

2. Property Manager

i. Checking of Notice of Delinquent Payments.

ii. Notifies tenants

3. Administrative Assistant

i. Releasing of Notice of Delinquent Payments through Maintenance

Personnel

4. Maintenance

i. Delivering the Notice to tenants and retains two (2) signed copies to be

returned to the Administrative Office

24

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

5. Administrative Assistant

i. Filing of the two (2) copies to tenants’ folder

6. If tenants pay, see Cash Receipts Procedures.

In case TENANTS failed to pay in the lapse of the period given:

1. Finance Officer

i. Increases penalty of tenant for each day of non-payment

ii. Informed the Property Manager of the delinquency.

2. * Property Manager

i. Issuance of the 2nd Notice of Delinquency on the 12th day of delinquency

ii. Issuance of door notice on the 15th day of delinquency.

iii. Issuance of Notice for cutting off utilities on the 20th day of delinquency.

iv. On the 60th day of non-payment, tenant’s premise will be padlock and security

deposit shall be forfeited.

v. On the 61st day of default damages of tenant contract.

vi. Demand Letter under retained Counsel’s

* Or as instructed according to negotiated terms.

7.4 : PURCHASING

The purchasing cycle involves ordering, receiving and paying for goods and services required by

the organization.

Purpose

1. To establish and document uniform procedures for procurement of supplies and services.

2. To manage the purchasing and contracting process equitably, efficiently and effectively.

3. To provide basic orientation information for the operational activities of the Purchasing

Unit/Department.

Policy

1. Examining past purchasing records to determine which items are needed in large enough

numbers.

2. Prepare a description of the types and estimated quantities of items needed over a specified time

frame.

25

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

3. Solicit bids from qualified local suppliers if there is more than one accessible supplier.

4. Evaluate bids for price and conformance to quality standards set forth in the invitation to bid.

5. Select the most advantageous qualified bid considering both price and conformance.

6. Place the order with the selected vendor by issuing a pre-numbered purchase order.

Procedure

Office/Cleaning Supplies, Minimal Construction Supplies

Preparation and Approval of Requisition Slip

1. The Maintenance/Administrative Staff will fill up Requisition Slip for materials to be

purchase by completing the requisition form through entering the following data:

a. Department/Building

b. Requisition number

c. Date wanted

d. Current date

e. Quantity

f. Description

g. Unit price (if known)

h. Total price

i. Purpose of the order

j. Delivery point (if possible)

k. Approvals: Operations Manager

2. Send the requisition slip to the Administrative Assistant/ Purchasing Officer for the

canvass of the prices and for the preparation of purchase order.

3. The Operations Manager approves the Purchase Order after considering the following:

a. Review the purchase requisition:

i. Ensure that the requisition number is unique.

ii. Double check the mathematics for accuracy.

iii. Verify that the signature(s) of approval are authorized officials of the department

iv. Review that the other boxes of the form are complete.

26

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

b. If the purchase requisition is not accurate or complete, return the Requisition

Slip to the responsible staff

c. If the purchase requisition is accurate and complete, forward the second copy

of the requisition to accounting

4. The Finance Manager will determine the if the items needed are to be purchased

immediately or not

5. Once approved, it will be forwarded to the petty cash custodian for the amount to be

released to the Admin Assistant.

6. The Administrative Assistant order the items requested.

Construction Supplies

1. The Managing Director approves the list of materials to be purchased based on Bill of

Materials provided by the in-House Architect/Interior Designer.

2. The list will be forwarded to the Purchasing Officer for canvass. But prior to canvassing,

the Admin Assistant in charge of the warehouse items inventory will first check the

availability of the items needed.

3. If the items needed are available, the Admin Assistant will fill out the Pull-out form for

the items to be pulled from the warehouse.

4. If the items requested are not available in the warehouse, the Purchaser will then proceed

to look for at least two or three suppliers and asked for quotation.

5. Supplier’s quotation should include all Terms and Condition such as price, discount, etc.

6. Upon receiving the quotation, the Purchasing Officer will check if the quotation is in

accordance with the list of materials asked to be quote and send to Managing Director for

Approval.

7. If the Managing Director approves whether through stamp or signature or both, the

Purchasing Officer will go on ordering by preparing Purchase Order and send scanned

copy of signed Quotation and scanned Purchased Order or either to the suppliers.

8. If the company made a payment either partial or full through bank transfers

9. The Finance Officer will prepare the check and check voucher indicating the account

number and description of purchase.

27

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

10. The Finance Officer must ensure that the check voucher is signed by herself/himself,

Finance officer, Finance Manager, Managing Director and check signatory

11. Check Signatories required are delegated only by the Board of Director of Del Rio Realty

and Development of Bacolod, Inc.

12. The check and the check voucher will be sent to Finance Manager for safekeeping,

approval and update the cash.

13. The Finance Manager will be the only one to release the check and deposit it through

bank transfers.

14. The Purchasing Officers shall send the scanned copy of deposits slips to the suppliers.

Receiving of Purchased Items

Office/Cleaning Supplies, Minimal Construction Supplies

1. The Admin Assistant compare purchase order and delivery receipt from the goods

delivered to verify that items received is in accordance to what has been ordered.

2. Upon receiving the items, he/she will fill up Delivery Receipt Form in three (3) copies

completing the following:

a. Date

b. Delivery receipt number

c. Kind of Packaging (boxes, cartoons, crates, etc.)

d. Address

e. Quantity

f. Part number

g. Description of Items

h. Unit cost

i. Amount

j. Signatories required should be complete.

Construction Supplies

28

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

1. The Purchasing Officer proceeds to designated warehouse where the goods should be

delivered upon receiving notice that delivery is ready to be shipped.

2. Upon receiving the items, He/She will check the delivered items (quantity, kind, etc)

by comparing purchased order, approved suppliers’ quotation, sales Invoice, gate pass,

and delivery receipt to the actual items or materials received.

3. If the items are inadequate, the Purchasing Officer inform the supplier and the supplier

deliver the remaining items.

4. If the supplier is unable to deliver, a credit memo from them is received to be used in

the next purchased.

A. Job Order Preparation

Purpose

1. Job/Work Order is prepared for works to be done by contractor or a service provider

entity for the company such as construction, repair and maintenance and related jobs.

Policy

1. Job Order must contain the following Information:

i. Project Title

ii. Property/Location

iii. Contractor

iv. Scope of Work

v. Materials to be used

vi. Total contract price

2. Job Order supporting documents are:

i. Itemized Quote

ii. Voucher

iii. Pictures of Project

iv. Others

Procedure

1. Operations Manager/Project Manager requests for quotation from supplier based on

project per building/unit or other area where property located.

2. Administrative Assistant receives the quotation from the supplier.

29

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

3. The Operations Manager verified and the Managing Director approved the quotation.

4. Admin Assistant prepares and fill ups the Job Order form in two (2) copies.

5. The Admin Assistant must ensure that the Job/Work Order is signed by herself, Property

Manager, Operations Manager.

7.4 : INVENTORY MANAGEMENT

Purpose

1. To ensures that the company always has the needed materials and products on hand while

keeping the cost as low as possible.

2. To avoid delay of construction, renovation and repairs in the buildings due to lack of

materials.

3. The Inventory management enable Staff to be aware of the following:

a. What supplies are being used by the company in the maintenance/renovation of

the buildings;

b. What supplies are on hand compared to the usual amounts used in the interval

between orders;

c. What office supplies have become surplus or shelf-worn stock; and

d. What will be required to replenish the stock of the company supplies.

A. Office/Cleaning Supplies

Policy

“Stocked office supplies” are items of which a quantity is kept at the field office because they are

continuously expended and need frequent replacement. Examples include pens, stationery, toner

cartridges, and cleaning supplies.

30

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

“Non-stocked office supplies” are items of which a quantity is not kept at the field office because

they do not often need to be replaced. Examples include small bulletin boards, wastebaskets, and

first aid kits.

1. When planning an order, the Administrative Assistant needs to take the following

considerations into account:

a. The current quantities of stocked items in the field office;

b. The rates at which the supply of stocked items is expended;

c. The amount of storage space available;

d. The various sources from which each needed item can be ordered, so that orders may be

efficiently coordinated; and

e. Any other staff needs or requests.

2. For any ordering schedule to be effective, this policy ensures that the items and quantities

ordered match the needs of the office. Information from staff members is critical in order to

avoid emergency procurement orders, as well as personal stockpiling, stock shortages, and

surplus stock of unnecessary items.

a. Each department determines which office supplies are most frequently needed by the

staff members in that office, and must therefore be kept in stock for ready access.

b. The need for non-stocked office supplies is determined on a more general basis (per

building, per floor, or per individual). Each staff member is responsible for adequate

notice and informing the Administrative Assistant when such items need to be

obtained or replaced.

3. Recording of Office Supplies and Cleaning Supplies in the books of accounts is expensed

immediately upon purchasing.

Procedure

Receiving:

1. Administrative Assistant

31

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

i. Receive the items ordered

ii. Compare Purchase Order from the items receives

iii. Fill up Delivery Receipt form.

iv. Record the items received

Releasing:

i. A log book is maintained in the Office Supplies Area where staff are required to

record/log the items they obtain subject to the supervision of Administrative

Assistant.

B. Warehouse Supplies

Warehouse Supplies and Inventory include all items related to the construction, repairs and

maintenance, etc. of the buildings operated by DRRDBI. These inventory Items should be stored

in a warehouse with proper supervision of Purchasing Officer.

Receiving:

1. Warehouse Staff

i. Receives the supplies from the supplier.

2. Administrative Assistant

i. Compare Purchase Order to the actual inventory receives

ii. Fill up Delivery Receipt in three (3) copies.

3. Purchasing Officer

i. Conducts physical count/inventory and inspection for damages or defects of the

supplies delivered.

ii. Prepares Inventory Master List

Releasing:

1. Head Maintenance

i. Fill up withdrawal slip for the supplies needed.

2. Purchasing Officer

i. Approves the withdrawal slip

Inventory Count:

32

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

1. Purchasing Officer

i. Conduct physical count in the warehouse weekly with Warehouse Staff.

ii. Check the withdrawal slip if it coincides with the actual physical count.

iii. Prepare updated/final Master List of Inventory for filing.

2. Managing Director

i. Approve the Inventory Master List.

C. Office Equipment, Furnitures and other Movable Assets

Policy

1. All items of equipment to be brought under control shall be identified by a serial number

affixed to each item.

2. Equipment control records shall be maintained for each item of equipment identified by a

serial number.

3. Periodic physical inventories, at least once annually, shall be taken of all items of

equipment placed under serial number control.

4. Equipment utilization controls shall be maintained for significant items, whether they are

in the form of daily usage records or simple periodic observations to provide a safeguard

against loss and to facilitate effective utilization.

5. No item of equipment should be permitted to leave the premises without a pass signed by

the Operation Manager.

6. Items not included in the inventory are items permanently attached to buildings.

Examples of items would be light fixtures, built-in cabinets, permanently installed

carpeting.

7. Equipment Records Maintained by the Operation Manager/Administrative Assistant.

a. The tag number assigned to a piece of equipment serves as the central mechanism

for establishing a unit record in the inventory control system. The Operation

Manager/Administrative Assistant will be responsible to ensure that each record

contains information on the item including:

i. Asset No.

ii. Description

33

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

iii. Serial or manufacturer identification number

iv. Original cost

v. Purchase order number (if applicable)

vi. Acquisition date

vii. Disposition date

viii. Category

ix. Person responsible for equipment assigned

x. Location: Building and Department

8. Reporting Changes in Status of Equipment

a. Status changes are to be reported by the accountable person as they occur. The

Operation Manager/Administrative Assistant will update the inventory to reflect

the change.

b. Whenever an equipment item is temporarily (less than 6 months) transferred

between locations, the unit initiating the transfer must keep a record of its new

location.

c. Whenever an item of equipment is found missing or believed to be stolen, this

must be reported immediately to the Security Officers and the Operation Manager.

7.6 : PAYROLL

Purpose

The purpose of the Payroll Procedure is to establish criteria for the proper control and handling

of payments to employees.

Policy

i. Employees are paid bi-monthly with cut-off date every 10th and 25th of the month

ii. The company uses Payroll System that provide ATM cards for the employee for their

salary and wages.

iii. The company set up account in the bank for payroll purposes.

iv. The partner bank will be responsible for the distribution of salary in each employee

accounts.

Procedure

34

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

A. Administrative Employees

The DRRDBI operates a Biometrics System for its Administrative Staff and Maintenance

Personnel. Employees are paid bi-monthly.

1. Human Resource Personnel

i. Accesses the Biometrics System records.

ii. Records and summarizes the time records of employees.

iii. Prepares Summary Sheet of employee’s attendance.

iv. Computes gross pay and deduction such as SSS, Philhealth, Pag-ibig contribution,

payroll taxes, etc.

v. Prepares pay slips in three (2) copies, one copy for employee, one copy for employee

file.

vi. Create the list of amounts/salary per employee to be credited to employees’ atm payroll

account

2. Finance Manager

vii. Check the accuracy of the payroll sheet and verified if it is in consistent with their

computations.

viii. Once payroll is approved by the Finance Manager, the payroll summary will then

be forwarded to the Finance Officer in charge of making the payroll’s online transfer

for the approval of the Managing Director thru online.

3. Finance Officer

ix. Afterwards, the Finance Officer will print out the check voucher for that specific online

transaction.

x. The Finance Officer must ensure that the check voucher is signed by herself, the

Finance Manager, the Managing Director and the CFO.

xi. Check Signatories required are delegated only by the Board of Director of Del Rio

Realty and Development of Bacolod, Inc.

4. Finance Assistant

xii. Record salary and wages expense in the Book of Accounts.

35

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Overtime

Overtime pay refers to the additional compensation for work performed beyond eight (8) hours a

day.

1. The COLA shall not be included in the computation of overtime pay

2. The minimum overtime pay rates vary according to the day the overtime work is

performed.

3. Employee who work overtime should fill up the overtime sheet in the HR Department

the day after for it to be valid.

4. For work in excess of eight (8) hours performed on ordinary working days plus twenty

five percent (25%) of the hourly date = Hourly Rate x 125% x Number hours of OT

work

(e.g. 350/8 = 43.75* 1.25 = 54.69 * 3OT/hr).

= 164.06

5. For work in excess of eight (8) hours performed on a scheduled rest day or a special day

plus thirty percent (30%) of the hourly rate on the said days.

= Hourly Rate x 130% 130% x Number hours of OT work

(e.g. 350/8 = 43.75* 1.30 *1.30= 77.11 * 3OT/hr)

= 221.81

6. For work in excess of eight (8) hours performed on a special day which falls on as

scheduled rest day plus 30% of the hourly rate on said days.

= Hourly Rate x 150% 130% x Number hours of OT work

(e.g. 350/8 = 43.75*1.50% *1.30% * 3hours)

= 255.94

7. For work in excess of eight (8) hours performed on a regular holiday plus 30% of the

hourly rate on said days.

= Hourly Rate x 200% 130% x Number hours of OT work

(e.g 350/8 = 43.75 *2.00% * 1.30% * 3hours)

= 341.25

8. For work in excess of eight (8) hours performed on a regular holiday which falls on a

scheduled rest day plus 30% of the hourly rate on said days

= Hourly Rate x 260% 130% x Number hours of OT work

36

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

(e.g 350/8) = 43.75 *2.60% *1.30% * 3hours)

= 443.63

Night shift Differential

Night shift differential refers to the additional compensation of ten percent (10%) of an

employee’s regular wage for each of work performed between 10 p. m and 6 a.m.

1. The COLA shall not be included in the computation of night shift pay.

2. The minimum night shift pay rates vary accordingly to the day the night shift work is

performed. = hourly Rate x 110 x 110 x Number of Hours

(e.g. 350/8 = 43.75 * 1.10 *1.10= 55.21 * 3hours)

= 158.81

Undertime /Late

Undertime refers to a working time is less than full time or a required minimum.

1. Undertime a time less than time allotted for the performance of some task.

= Daily Rate / 8 hours / 60 minutes x number of minutes UT

(e.g 350/8 = 43.75 / 60min.* 12 min/UT)

= 8.75

Payroll Taxes

1. The Finance Officer shall secure BIR Form 2316. It is a Certificate of Compensation

Payment/Tax Withheld for Compensation Payment with or without Tax Withheld.

2. This is a certificate accomplished and issued to all employees by the employers reflecting

compensation received and taxes withheld and paid based on the compensation received

during the calendar year.

3. This certificate is used as an attachment to Annual ITR of employees either purely

compensation income or mixed income.

4. This certificate must be issued to the employee on or before January 31 of the following

year.

5. In case when employment is terminated within the calendar year, this certificate must be

issued on the same day last wages are paid.

37

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

SSS, Pag-ibig and Philhealth Contributions

1. The Payroll Officer compute all contributions.

2. The Payroll Officer process the fund for payment

Maternity Leave

1. Coverage

a. This Benefits applies to all employees, whether married or unmarried.

2. Entitlement

b. Every pregnant employee in the private sector, whether married or unmarried, is

entitled to maternity leave benefits of sixty (60) days in case of normal delivery or

miscarriage, or seventy-eight (78) days in case of Caesarian section delivery.

c. The benefits equivalent to one hundred percent (100%) of the average daily salary

credit of the employee as defined under the law.

d. To be entitled to the maternity leave benefits, a female employee should be an SSS

member employed at the time of her delivery.

Paternity Leave

Paternity Leave is granted to all married male employees in the private sector, regardless of their

employment status. (e.g. probationary, regular, contractual, project basis)

1. The purpose of this benefit is to allow the husband to lend support to his wife during her

period of recovery and/or in nursing her newborn child.

2. Paternity leave shall apply to the first four (4) deliveries of the employee’s lawful wife

with whom he is cohabiting. For purpose of “cohabiting” means the obligation of the

husband and wife to live together.

3. Paternity leave shall be for seven (7) calendars days, with full pay, consisting of basic

salary and mandatory allowances fixed by the Regional Wage Board, if any, that his pay

shall not be less than the mandated minimum wage.

Service Incentive Leave

38

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

Every employee who has rendered at least one (1) year of service is entitled to Service Incentive

Leave (SIL) of five (5) days with pay.

1. One Year of Service of the employee means service with in twelve (12) months,

2. The service incentive leave may be used for sick and vacation leave purposes

3. Usage / Conversion to cash

4. The unused service incentive leave is convertible to monetary value.

Thirteenth – Month Pay

All employers are required to pay their rank and file employees thirteenth - month pay,

regardless of the nature of their employment and irrespective of the methods by which their

wages are paid, provided they worked for at least one (1) month during a calendar year.

1. The thirteenth-month pay should be given to the employees in every half year June &

December.

2. The thirteenth- month pay shall not be less than one twelfth (1/12) of the total basic

salary earned by an employee in a calendar year.

3. The basic salary of an employee for the purpose of computing the thirteenth-month pay

shall include all remunerations or earnings paid by his her employer for services

rendered.

4. It does not include allowances and monetary which are not considered or integrated as

part of the regular or basic salary, such as the cash equivalent of unused vacation leave

and sick leave credits, overtime, premium, night shift differential and holidays pay, and

cost living allowance (COLA).

Formula and Computation of 13th Month Pay

= Total basic salary earned during the year = proportionate

12 Months 13th month pay

(e.g. 122,977.72 = P10, 248.14 is the proportionate)

12monhts 13th month pay

Separation Pay

39

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

The Company follow the labor code of the Philippines, articles 283 and 284 state that an employee can

claim separation pay if his employment ended under authorized causes.

1. The following authorized causes

a. Retrenchment of person for loss prevention.

b. Cessation of operation of a branch not due to serious losses or financial difficulties.

c. If the employee has contracted a disease not curable within 6 months and that his

presence at work can be harmful to himself or his co-workers.

d. Installation of labor-saving devices

e. Redundancy • Retrenchment to prevent losses

2. The company has the right to terminate the contract of an employee following any of the

above authorized causes through a written notice to both the employee and the

Department of Labor and Employment of the Philippines at least one month before the

contract cessation date.

3. According to article 282 an employee terminated for just cause is generally not entitled to

separation pay.

a. Serious misconduct

b. Wilful disobedience

c. Gross and Habitual neglect of duty

d. Fraud or breach of trust

e. Commission of a crime or offense against the company, his family or representative

7.7 : FIXED ASSETS

Fixed Assets includes items such as:

1. Land

2. Office Equipment - Functional or mechanical items such as computer, flat screen TV,

projectors, aircons, water sprinkler, fire distinguisher, CCTV’s , camera, cellphones

and telephones, printer/scanners/copier, water dispenser, interactive whiteboards,

screens, Audio / visual equipment such as multimedia, televisions, DVD players, CD

players & recorders and overhead projectors etc.

3. Building

40

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

4. Building Improvements

5. Office furniture and Fixtures- Larger items of movable equipment that are used to

furnish an office and includes bookcases, chairs, desks, Wooden and Steel Cabinets,

white boards and fans etc.

6. Construction Tools & Equipment – includes welding Machine, tools for

construction, etc.

7. Generator Set

8. Construction in Progress

Purpose

1. Due to the high cost of fixed assets, this procedure aims to maintain accurate records and

inventory controls to avoid hidden costs due to mismanagement or lack of precise

information.

2. To set out policy and procedure in relation to the appropriate management, recording and

monitoring of all the company fixed assets.

3. To provide an organized and accountable method monitoring and controlling the

acquisition, custody and disposal of the company fixed assets

4. To ensure value for money in acquiring fixed assets and to maximize residual value in the

disposal of same, where applicable.

5. To protect the company from any conflict of interest, either potential or real, which may

arise between company departments in the acquisition or disposal of fixed assets and any

persons or groups purchasing such fixed assets from the company.

Policy

5. All acquisitions of fixed assets require approval.

6. The company must maintain Fixed Asset Register (FAR) to provide a record of the

physical assets held by the company, which will:

2. Facilitate the physical control and security of these assets.

3. Assist the department in planning for future investment in fixed assets

7. All significant details required for recording and reporting monetary amount associated

with fixed asset transaction to be included in Fixed Asset Register are the following:

i. Name of Asset

41

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

ii. Asset Code/Model Number

iii. Asset Account Code

iv. Description/Class of the Asset

v. Quantity

vi. Cost

vii. Date Purchased

viii. Suppliers Name

ix. Invoice No.

x. Location/Department (where kept)

xi. Balance Quantity

xii. Useful Life of Asset

xiii. Depreciation (Accumulated Depreciation)

xiv. Details of transfer and Disposal

4. It is the organization’s policy to capitalize all items which have a unit cost greater

₱5,000.00. Items purchased with a value or cost less than ₱5,000.00 will be expensed in

the period purchased.

5. The company uses straight line method of recognizing Depreciation. Estimated useful

lives are the following:

A. Land Not Depreciated

B. Land Improvements 5 years

C. Building 50 years

D. Building Improvements 5 years

E. Office Furniture and Fixtures 5 years

F. Office Equipment 5 years

G. Construction Tools & Equipment 5 years

H. Generator Set 5 years

I. Capitalizable Repair and Maintenance

(e.g. Bldg. Imp, etc.) 5 years

* Useful life may be reviewed periodically after taking into consideration the expected

physical wear and tear, obsolescence and legal or other limits on the use of the asset. In case of

42

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

change in useful life, depreciation should be provided taking into consideration the revised useful

life over the remaining no. of years.

6. Immovable fixtures and fittings (i.e. those that are permanently or solidly fixed to the

physical structure of the building) are to be capitalized and depreciated as part of the

Freehold Buildings category.

7. All movable Fixed Assets required tagging & codification for physical verification and to

maintain identification system within the company. This is also to certify that all movable

and controlled Fixed Assets items have assigned asset numbers and properly tagged not

only for identification but also for inventory purpose. In addition, tagging and

codification

8. Annual control over assets is required, this is done through updating on a continuous

basis and annually the following:

i. Confirm that the list of Assets held is complete and can be physically accounted

for.

ii. Identify items not listed and provide all necessary details so that the asset can be

added to the Asset Register

iii. Supply details of any asset listed on the register that have scrapped, transferred to

other buildings or location, sold or lost.

iv. Check that all new items purchased have been added to the Asset Register.

9. Normal repair and maintenance will be charged to operating expenses as and when

incurred. However, major repairs and improvement will be capitalized as capital

expenditures.

10. The staff/employee to whose custody the asset is assigned will be responsible for the

security of the equipment under her/his use. This includes ensuring that equipment or

other assets is used only by the authorized persons for authorized purposes safeguards

against theft and damage, and only removed from the premises with proper authorization.

11.

Procedure

A. Acquisition of Movable Fixed Assets (Includes Office Furnitures and

Fixtures, Equipment, Construction Tools & Equipment. Etc.)

1. A Fixed Asset Log is maintained by the Administrative Assistant.

43

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

2. The Log will be reviewed by the:

i. Operations Manager if assets/ materials are inside the properties it manages.

ii. Managing Director for all company owned assets.

3. Annually, a physical inspection and inventory will be taken of all fixed assets and

reconciled to the general ledger balances.

4. The Operations Manager shall be informed in writing by the custodian of the specific

assets of any change in status or condition of any property or equipment.

5. Depreciation is recorded annually.

6. Depreciation is computed using the straight-line method over the estimated useful

lives of the related assets.

7. Any impaired assets discovered during the inventory will be written down to their

actual value.

B. Depreciation Procedure

1. Assign an asset class

a. Match the fixed asset to the company’s standard asset class descriptions. If you

are uncertain of the correct class to use, examine the assets already assigned to the

various classes, or consult with the controller.

2. Assign depreciation factors

a. Assign to the fixed asset the useful life and depreciation method (straight line)

that are standardized for the asset class of which it is a part.

3. Determine salvage value

a. Consult with the purchasing or industrial engineering staffs to determine

whether the asset is expected to have a salvage value at the end of its useful life. If

this salvage value exceeds the company’s policy for minimum salvage values, make

note of it in the depreciation calculation.

4. Create depreciation calculation

44

Downloaded by NAZRALIFF NAZRI (mht.arissa@gmail.com)

lOMoARcPSD|24621526

a. Create the depreciation calculation based on the useful life and depreciation

mandated for the asset class using the asset cost less any salvage value

5. Print depreciation report.