Professional Documents

Culture Documents

Individual Assignment

Uploaded by

CHARITHAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Individual Assignment

Uploaded by

CHARITHACopyright:

Available Formats

Individual Assignment

Not less than 1500 words.

You are the Chief Risk Officer of The Bank of Homeland with an asset base of Rs. 100

billion. The financial statements as of 31.12.20xx and the following information has

collected by your unit to analyze and present a Board paper to the upcoming Board of

Directors Meeting.

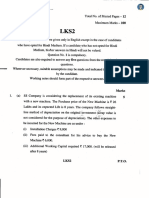

The Bank of Home Land

Income Statement for the period

ending 31.12.20xx Rs. Millions

Gross Income 6,000

Interest Income 4,500

Interest Expense (1,500)

Net Interest Income 3,000

Fee-Based Income 400

Other Operating Income 600

Total Income 4,000

Staff Related Expenses (600)

Other operating Expenses (200)

Profit before provisions 3,200

Provision for Bad & Doubtful debts (400)

Profit Before Tax 2,800

Provision for corporate Tax (800)

Profit After tax 2,000

The Bank of Home Land

Statement of financial position as 31.12.20xx

Assets Rs. Millions Rs. Millions

Current Assets

Cash + Account balance of 7,000

Central Bank

Investments –

Government securities 12,000

Quoted Company shares 1,000

Gold 2,000 15,000

Loans and Advances

Gross 70,400

Provisions (400) 70,000

Fixed Assets 8,000

Total Assets 100,000

Liabilities

Current Liabilities

Customer Deposits 80,000

Long term Liabilities

Debentures 6,000

Equity

Shareholder Capital 10,000

Reserves 4,000 14,000

Total Liabilities 100,000

The Bank of Home Land has incorporated six years ago and has its head office in the

capital and two other branches in two provincial capitals. They operate 10 ATM

machines in prominent shopping malls. The finance department has disclosed the

following information to the corporate management.

The Deposits placed by the top ten deposit customers amount to Rs. 40 billion whilst

the top ten borrowers have taken Rs. 30 billion.

The non-performing assets of the bank amount to a gross of Rs 1.5 billion and a net

NPA of Rs 1.1 billion respectively.

The credit portfolio has been tabulated as per industry and rating. Exposure to

Construction, Manufacturing, and Trading stood at Rs 21, 14, 14 billion respectively.

Asset quality of the bank based on rating is AAA-AA 50% and C the non-investment

category advances are amounted to Rs. 0.7 billion.

Despite recent RCSA exercise conducted on international department on lodgment of

collection documents stated that existing controls were sufficient, there had been

fraudulent bill of lading found in one set of documents. Internal Audit confirms that

customer had got hold of the original with the connivance of staff member and used

that document to clear the goods.

At the IT steering committee reveals that the hits on our firewall has increased and

close monitoring required.

As per the budget and the strategic plan Bank expected to record 20% growth in

deposits and advances however, what is recorded on the financial statement is only 10%

growth in advances and 15% in deposits.

As the economy was underperforming economist predicts rise in interest rates,

depreciation of rupee, and 10% drop in share prices, which is banks stop lost limit.

You are required to analyze the above information, using risk management techniques

to assess the existing and future risks to the bank, based on the results of analysis

prepare a board paper consisting of key risk indicators.

You might also like

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Solution Aman BHDDocument4 pagesSolution Aman BHDIZZAH ATHIRAH MOHD SALIMINo ratings yet

- Lecture No. 2 - Financial Statements & Illustrative ProblemDocument6 pagesLecture No. 2 - Financial Statements & Illustrative ProblemJA LAYUG100% (1)

- Problems Set On Ratio AnalysisDocument7 pagesProblems Set On Ratio AnalysispriyankaNo ratings yet

- Lecture No 2Document4 pagesLecture No 2Avia Chelsy DeangNo ratings yet

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Balance SheetDocument20 pagesBalance SheetMarie FeNo ratings yet

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- PDF 04Document7 pagesPDF 04Hiruni LakshaniNo ratings yet

- MBA AFM Probs on FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs on FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- Ma Internal Question BankDocument4 pagesMa Internal Question Bankvarmapriya712No ratings yet

- CSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Document8 pagesCSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Melokuhle MhlongoNo ratings yet

- JKN - Acc - 13 - Question Paper - 131020Document10 pagesJKN - Acc - 13 - Question Paper - 131020adityatiwari122006No ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- ACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2Document14 pagesACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2727822TPMB005 ARAVINTHAN.SNo ratings yet

- Final Account, Income Statement and Financial Analysis Practice QuestionsDocument36 pagesFinal Account, Income Statement and Financial Analysis Practice QuestionsMansi GoelNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- Statement of Financial Position: Quiz 1: Multiple ChoiceDocument6 pagesStatement of Financial Position: Quiz 1: Multiple Choicedanica dimaculanganNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- Interpretation of Public Sector Financial StatementsDocument4 pagesInterpretation of Public Sector Financial StatementsEsther AkpanNo ratings yet

- Lesson 4 Week 5 FABM 2Document21 pagesLesson 4 Week 5 FABM 2Mikel Nelson AmpoNo ratings yet

- Accounting AssignmentDocument2 pagesAccounting Assignmentsadif sayeed100% (2)

- ACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Document3 pagesACCO 30103 CORPLIQ-Statement of Affairs and Deficiency Statement 04-2022Zyrille Corrine GironNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Statement of Financial Position: Learning CompetenciesDocument9 pagesStatement of Financial Position: Learning CompetenciesJmaseNo ratings yet

- 2020 Acc 410 Test 1Document8 pages2020 Acc 410 Test 1Kesa Metsi100% (1)

- Financial Analysis RatiosDocument17 pagesFinancial Analysis RatiosRajesh PatilNo ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- Accounting 315 - Quiz Business CombinationDocument5 pagesAccounting 315 - Quiz Business CombinationAlexNo ratings yet

- Statement-Of-Financial-Position-Abm 12Document27 pagesStatement-Of-Financial-Position-Abm 12JerollNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- GPV & SCF (Assignment)Document16 pagesGPV & SCF (Assignment)Mica Moreen GuillermoNo ratings yet

- Module+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Document5 pagesModule+2+-+Assignment+on+SFP+and+Notes+to+FS Bettina+Flores 3A8Bettina Alec Francesca FloresNo ratings yet

- Cashflow Practice Solution-AdditionalDocument5 pagesCashflow Practice Solution-AdditionalNadjah JNo ratings yet

- Basic Elements of AccountingDocument10 pagesBasic Elements of AccountingMahmudul Hassan RohidNo ratings yet

- Addtional Cash Flow Problems and SolutionsDocument7 pagesAddtional Cash Flow Problems and SolutionsHossein ParvardehNo ratings yet

- L03 - Accounting Classification and EquationsDocument29 pagesL03 - Accounting Classification and EquationsmardhiahNo ratings yet

- Siddharth Education Services LTDDocument5 pagesSiddharth Education Services LTDBasanta K SahuNo ratings yet

- Chapter Four-Part I: Accounting For Governmental FundsDocument28 pagesChapter Four-Part I: Accounting For Governmental FundsabateNo ratings yet

- Ia3 Prelim Exam - Set ADocument11 pagesIa3 Prelim Exam - Set AClara MacallingNo ratings yet

- Accounts ProblemsDocument30 pagesAccounts ProblemsBalasaranyasiddhuNo ratings yet

- Class Problem: 2Document7 pagesClass Problem: 2Riad FaisalNo ratings yet

- IPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDocument6 pagesIPS Academy, IBMR Session Jan-June 2020 BBA II Semester: Assignment Of: Financial ManagementDrShailesh Singh ThakurNo ratings yet

- Financial StatementsDocument2 pagesFinancial StatementsMaria Teresa VillamayorNo ratings yet

- Test de Fusion (LAAYOUN)Document3 pagesTest de Fusion (LAAYOUN)Hamdi KritaNo ratings yet

- Financial Statement AnalysisDocument7 pagesFinancial Statement AnalysisWaqar HassanNo ratings yet

- Internal Question Bank MA 2022Document7 pagesInternal Question Bank MA 2022singhalsanchit321No ratings yet

- Net Company Statement of Financial Position As of December 31, 2017 Assets Current AssetsDocument13 pagesNet Company Statement of Financial Position As of December 31, 2017 Assets Current AssetsSarah Nelle PasaoNo ratings yet

- Activity 3.1Document13 pagesActivity 3.1kel dataNo ratings yet

- 19 - Ch4 Weekly QuestionsDocument10 pages19 - Ch4 Weekly QuestionsCamilo ToroNo ratings yet

- CONSOLIDATED STATEMENTDocument8 pagesCONSOLIDATED STATEMENTPrageeth Roshan WeerathungaNo ratings yet

- R22 Financial Statement Analysis IFT NotesDocument15 pagesR22 Financial Statement Analysis IFT NotesIndustrial Trainig EAGNo ratings yet

- Bank Financial Statements 2020 SDocument54 pagesBank Financial Statements 2020 SSuvajitLaikNo ratings yet

- CASH FLOW STATEMENT FOR IEDocument6 pagesCASH FLOW STATEMENT FOR IECATHERINE FRANCE LALUCISNo ratings yet

- ADVANCED ACCOUNTING 2BDocument4 pagesADVANCED ACCOUNTING 2BHarusiNo ratings yet

- Final Individual Assignment - 4 Nov 2022Document6 pagesFinal Individual Assignment - 4 Nov 2022Vernice CuffyNo ratings yet

- Chapter 2 ProblemDocument18 pagesChapter 2 ProblemJudielyn M GonzalesNo ratings yet

- Cash Flow Tutorial QnsDocument13 pagesCash Flow Tutorial QnsCristian Renatus100% (1)

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- DD / MC Dilna Form: Bank SealDocument1 pageDD / MC Dilna Form: Bank Sealwolf tanvirNo ratings yet

- Actex IFM Manual Fall 2019 SampleDocument35 pagesActex IFM Manual Fall 2019 SampleBrian NgNo ratings yet

- Profitability Ratios: Strategic Financial Management - SFM (S5) Topic: Financial Ratio AnalysisDocument8 pagesProfitability Ratios: Strategic Financial Management - SFM (S5) Topic: Financial Ratio AnalysisAhmed RazaNo ratings yet

- ACG 4803 Exam 3 Study GuideDocument11 pagesACG 4803 Exam 3 Study GuideMinh NguyễnNo ratings yet

- BMAccounting QualitiesDocument22 pagesBMAccounting QualitiesESTRADANo ratings yet

- My Student DataDocument30 pagesMy Student DataSarah Valetina Hernandez PeñaNo ratings yet

- IHM 3 Notes NewDocument10 pagesIHM 3 Notes NewSadik ShaikhNo ratings yet

- UGBA103 Final Fall 2016Document5 pagesUGBA103 Final Fall 2016Billy bobNo ratings yet

- Detecting Financial Statement Fraud: Best Known For Committing Accounting FraudDocument11 pagesDetecting Financial Statement Fraud: Best Known For Committing Accounting FraudKelvin LeongNo ratings yet

- Problem 3-5A: InstructionsDocument2 pagesProblem 3-5A: InstructionsJEERAPA KHANPHETNo ratings yet

- IAS-16 (Property, Plant & Equipment)Document20 pagesIAS-16 (Property, Plant & Equipment)Nazmul HaqueNo ratings yet

- Chapter Eleven: Bank Liquidity ManagementDocument53 pagesChapter Eleven: Bank Liquidity ManagementtusedoNo ratings yet

- Total Return Futures On Cac 40 PresentationDocument17 pagesTotal Return Futures On Cac 40 Presentationouattara dabilaNo ratings yet

- Mancon Quiz 6Document45 pagesMancon Quiz 6Quendrick SurbanNo ratings yet

- CHAPTER 8 - Noncurrent Asset Held For SaleDocument19 pagesCHAPTER 8 - Noncurrent Asset Held For SaleChristian GatchalianNo ratings yet

- Quiz BeeDocument2 pagesQuiz BeeMARIANo ratings yet

- Dr. Arti Singh Assistant Professor Kristu Jayanti College BengaluruDocument16 pagesDr. Arti Singh Assistant Professor Kristu Jayanti College BengaluruArti SinghNo ratings yet

- Fundamentals of Accounting Module Answer SheetDocument57 pagesFundamentals of Accounting Module Answer SheetMhae LopezNo ratings yet

- MoaDocument4 pagesMoaRaghvirNo ratings yet

- Hanlon (2010)Document31 pagesHanlon (2010)Bambang HarsonoNo ratings yet

- Merger and Demerger ProceduresDocument11 pagesMerger and Demerger ProceduresSujan GaneshNo ratings yet

- Valix Vol. 3 2014 edition problem analysisDocument10 pagesValix Vol. 3 2014 edition problem analysisJenyl Mae NobleNo ratings yet

- Equity Carve OutDocument32 pagesEquity Carve OutmuditsingNo ratings yet

- Analysis On The Financial Performance of The Musical MuseumDocument19 pagesAnalysis On The Financial Performance of The Musical MuseumDaniel AjanthanNo ratings yet

- SFM Paper May 2019 Old Syllabus FinAppDocument12 pagesSFM Paper May 2019 Old Syllabus FinAppAkshat TongiaNo ratings yet

- Unprofitable (Negative) Financial Leverage - This Type of Leverage Is Opposed To TheDocument2 pagesUnprofitable (Negative) Financial Leverage - This Type of Leverage Is Opposed To TheYashvi ShahNo ratings yet

- Financial Accounting: Semester - IvDocument63 pagesFinancial Accounting: Semester - IvKARANNo ratings yet

- Answers of The ProblemDocument11 pagesAnswers of The ProblemRavi KantNo ratings yet

- Corporate Restructuring For Value CreationDocument10 pagesCorporate Restructuring For Value CreationKrishna Vyas100% (4)

- Value InvestingDocument10 pagesValue InvestingAtul Divya SodhiNo ratings yet