Professional Documents

Culture Documents

Openingbell

Uploaded by

gerak52526Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Openingbell

Uploaded by

gerak52526Copyright:

Available Formats

Opening Bell

July 7, 2023

Market Outlook Major economic events

Indian markets are likely to open negative today tracking Date Event Country Period Expected Previous

negative global cues. 07-Jul FX Reserves USE IN Jun - -

Market Yesterday Top Fundamental Picks

Domestic markets ended higher tracking gains in health Company Name Research Report CMP Target Price

care & real estate. Reliance Industries 2443 2850

PCBL 145 200

Key Developments Gujarat

3198 4000

▪ Titan in its Q1FY24 pre quarterly update reported yet Fluorochemicals

another impressive show with healthy double digit

revenue growth across all divisions. Daily Technical Calls

▪ The sales value at | 1465 crore was up ~28% YoY during ▪ Buy Hindustan Unilever in the range 2751-2755

Q1 with average price realisation (increased to | 10506/sq ▪ Buy Bharat Electronics in the range 124-124.40

ft, up 24.6% YoY) mainly due to project mix. ▪ All recommendations of June Future

▪ The Phoenix Mills (PML) continues to witness See Momentum Pick for more details

consumption across malls exceeding pre-covid levels,

albeit with moderate growth in Q1.

CNX Nifty Technical Picture

Bulk Deals Intraday Short term

Company Client Name Type No. of Price (|) Trend Range Bound Up

NSE Support 19420-19370 19100

Resistance 19500-19545 19700

GREENCHEF VIJIT GLOBAL SECURITIES BUY 3,20,000 109.2

20 day EMA 18960

200 day EMA 17953

Nifty Heat Map

1,549 Apollo 5,283 Power 263 Tata 601 Reliance 2,639

M&M

5.0% Hospitals 4.0% Grid 3.7% Motors 2.1% Ind. 2.1% Index Movement

Close Previous Chg (%) MTD(%) YTD(%) P/E (1yrfwd)

393 197 165 5,174 981

BPCL NTPC ONGC Britannia Axis Bank Sensex 65,786 65,446 0.5 1.6 8.1 24.1

1.7% 1.7% 1.6% 1.5% 1.5% Nifty 19,497 19,399 0.5 1.6 7.7 23.7

Coal 235 426 1,021 5,232 23,099

Hindalco Cipla Dr Reddy Nestle

India 1.4% 1.2% 1.0% 1.0% 0.9% Institutional Activity

Asian 3,399 2,489 Kotak 1,877 396 4,918 CY21 CY22 YTD CY23 Yesterday Last 5 Days

L&T Wipro Bajaj Auto FII (| cr) -95,085 -2,60,392 17,662 2,641 14,772

Paints 0.7% 0.7% Bank 0.7% 0.6% 0.6%

DII (| cr) 95,934 2,59,089 88,025 -2,352 -2,716

JSW 796 673 3,172 8,410 Bajaj 1,620

UPL Hero Moto Ultratech

Steel 0.5% 0.4% 0.4% 0.4% Finserv 0.4%

Markets Today

1,179 Bharti 870 593 3,106 2,403 Commodities Close Previous Chng (%) MTD(%) YTD(%)

TechM SBI Titan Adani Ent

0.4% Airtel 0.3% 0.3% 0.2% 0.2% Gold (|/10 gm) 58,514 58,473 0.1 0.5 6.4

ICICI 959 1,293 HDFC 1,675 3,323 2,757 Silver (|/kg) 71,370 71,357 0.0 3.5 2.8

SBI Life TCS HUL

Bank 0.1% 0.1% Bank 0.1% 0.1% 0.0% Crude ($/barrel) 76.5 76.7 -0.1 2.2 -10.9

Copper ($/tonne) 8,304.0 8,346.0 -0.5 -0.2 -0.7

HDFC 2,796 Tata 845 Sun 1,043 1,344 474

Infosys ITC Currency

Ltd 0.0% Consum -0.1% Pharma -0.2% -0.3% -0.3% USD/INR 82.5 82.8 -0.3 -0.6 0.3

Tata 113 3,737 Adani 740 Grasim 1,768 Indusind 1,390 EUR/USD 1.1 1.1 0.3 -0.2 1.7

Divis Lab

Steel -0.3% -0.3% Ports -0.4% Ind -0.6% Bank -0.7% USD/YEN 143.9 143.1 0.5 0.3 -8.9

Bajaj 7,766 1,181 9,859 661 3,222 ADRs

HCl Tech Maruti HDFC Life Eicher HDFC Bank 67.1 70.8 -5.3 -3.8 -2.0

Finance -0.9% -1.2% -1.3% -1.8% -2.6%

ICICI Bank 23.4 23.4 0.1 1.4 6.9

Infosys 16.3 16.1 0.7 1.2 -9.7

Advance/Decline Dr Reddys Labs 63.2 62.5 1.1 0.1 22.1

Advances Declines Unchanged Wipro 4.8 4.8 -0.4 1.1 2.4

BSE 2049 1401 146

NSE 1357 843 110

Opening Bell

July 7, 2023

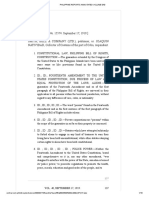

Key Data Points Exchange Cash Turnover (| crore)

Key Economic Indicator Period Latest Prior Values

RBI Cash Reserve Ratio N/A 4.50% 4.50%

RBI Repo Rate N/A 6.50% 6.25%

RBI Reverse Repo Rate N/A 3.35% 3.35%

CPI YY Apr 4.70% 5.66%

Current Account Balance Q4 -18.2bln $ -30.9bln $

Exports - USD Apr 34.66 bln$ 38.38 bln$

FX Reserves, USD Final Jun 595.07 bln$ 589.14 bln$

GDP Quarterly yy Q4 6.10% 4.40%

GDP Annual FY23 7.20% 6.80%

Imports - USD Apr 49.9 bln $ 58.11 bln $ NSE Derivative Turnover (| crore)

Industrial Output yy Mar 1.1% 5.6%

Manufacturing Output yy May 0.5% 5.6%

Trade Deficit Govt - USD Apr -15.24 bln $ -19.70 bln $

WPI Food yy Apr 3.5% 5.5%

WPI Fuel yy Apr 0.9% 9.0%

WPI Inflation yy May -0.9% 1.3%

WPI Manuf Inflation yy Apr -2.4% -0.8%

Corporate Action Tracker Sectoral Performance – Monthly Returns (%)

Security name Action Ex Date Record Date Status Price (|)

MOTILAL OSWAL FINANCIAL SERVICES LTD. Final Dividend 04-Jul-23 - - 3.0

PUNJAB & SIND BANK Final Dividend 04-Jul-23 - - 0.5

MPHASIS LTD. Final Dividend 05-Jul-23 - - 50.0

SUNDARAM FINANCE LTD. Final Dividend 05-Jul-23 - - 15.0

IDBI BANK LTD. Final Dividend 06-Jul-23 - - 1.0

ADANI ENTERPRISES LTD. Final Dividend 07-Jul-23 07-Jul-23 - 1.2

AMBUJA CEMENTS LTD. Final Dividend 07-Jul-23 07-Jul-23 - 2.5

ASHOK LEYLAND LTD. Final Dividend 07-Jul-23 - - 2.6

AXIS BANK LTD. Final Dividend 07-Jul-23 07-Jul-23 - 1.0

BHARAT FORGE LTD. Final Dividend 07-Jul-23 07-Jul-23 - 5.5

Crompton Greaves Final Dividend 07-Jul-23 - - 3.0

Key News for today

Company/ News View Impact

Industry

Titan Titan in its Q1FY24 pre quarterly update reported yet Titan has been a secular growth story with

another impressive show with healthy double digit consistent market share gains from the

revenue growth across all divisions. Revenue from unorganized players. Despite challenging

jewellery division grew by 21% YoY led by strong demand scenario, Tanishq through its strong

buyer growth. Despite significant volatility in gold brand patronage continued to deliver healthy

prices throughout the quarter, Akshaya Tritiya sales in

April and wedding purchases in June were robust.

results. Over a long term company aspires to

grow jewellery revenues by 2.5x by FY27

👍

Watches division reported 13% sales growth with (implied CAGR: 20% from FY22 base).

wearables increasing 84% YoY. CaratLane (72%

owned Subsidiary) continues to scale to new highs

with robust growth of 32% YoY

Indian Hotels Indian Hotels Company ( IHCL) continued to accelerate With IHCL’s current portfolio of 270 hotels it

portfolio expansion with signing of 11 hotels and remains well poised to achieve vision of

opening of 5 new hotels in Q1FY24. IHCL has 325+ hotels by FY25. Over the next four

achieved a balanced portfolio, enabling maximisation years ( till FY27) the company plans to

of operating leverage from its owned/leased hotels increase its room capacity from 21338 rooms

and enhancing margins from the fee-based managed in FY23 to 31483 rooms by FY27 entailing a

hotels portfolio. Currently 70% of pipeline is fees

based.

room capacity enhancement of 48%. The

management plans to focus on asset light

👍

expansion with majority of the room capacity

addition is expected to be done on

management contract basis which would

provide a positive momentum to the return

ratios going ahead.

Opening Bell ICICI Direct Research

Sobha The sales value at | 1465 crore was up ~28% YoY The overall demand seems to be steady. Key

during Q1 with average price realisation (increased to will leverage trend ahead, where company

| 10506/sq ft, up 24.6% YoY) mainly due to project has sharply reduced debt in FY23

mix. Sales volume remained healthy at 1.39 mn sq ft

(up 3% YoY). We highlight that sales volume growth ↔

for Q1 was driven by new launch in Kerala , while

Bengaluru at 0.84 million sq feet (forming 60% of

sales volume) was relatively muted.

The Phoneix The Phoenix Mills (PML) continues to witness Q1 overall performance is likely to remain

Mills consumption across malls exceeding pre-covid levels, decent for PML, albeit trend ahead will be key

albeit with moderate growth in Q1. With these, total . PML continues to be a key beneficiary of

consumption during Q1 stood at | 2575 crore, up 18% healthy consumption recovery at malls and

YoY. Excl. new malls contribution, like to like remains a quasi-play on India’s consumption

consumption was up 9% YoY (one off renovations story, given the quality of assets, healthy

impacted growth). Retail collections stood at | 621 balance sheet & strategic expansion plans. ↔

crore in Q1, showing a YoY growth of 18%. New malls such as Indore (started in

Occupancy level for St Regis, Marriott (Agra) stood at December) and Ahmedabad (began in

82%, 72% respectively. Commercial segment saw February, 2023), alongwith new malls in FY24

new leasing of 0.85 lakh square feet in Q1 vs. 1.3 lakh will boost the overall growth ahead.

square feet in Q4.

GM GM Q1FY24 net revenues grew 4% YoY to | 147 GM Breweries results indicate lowered

Breweries crore, while its PAT grew 23% to | 20 crore. EBITDA inflationary impact on COGS side (mainly

margins expanded 320 bps to 18.4%. The company includes rectified spirit and PET). For the

continued to disappoint on the dividend front (no liquor industry in general Q1 is expected to

dividend announced in Q1 inspite of expected higher witness QoQ flat to positive inflationary

cash surplus) impact (mainly due to continued higher ENA ↔

prices, while others such as paper and PET

will see softening, whereas glass on the other

side will gradually soften due to lowered

natural gas prices).

Key Developments (Continued…)

• Tata Steel reported steady sales volume for Q1FY24. For Tata Steel India crude steel production stood at

5.01 million tonne (up 2% YoY) with deliveries pegged at 4.8 million tonne (up 18% YoY). The planned

relining of Blast Furnace at Netherland operations of Tata Steel Europe led to muted volume overseas. Tata

Steel Europe reported crude steel production of 1.81 million tonne (down 26% YoY) and deliveries at 1.97

million tonne (down 8% YoY)

• JSW Steel reported healthy volume prints for Q1FY24. Indian operations reported crude steel production

of 6.2 million tonne (up 10% YoY) with total group combined volumes stood at 6.61 million tonne (up 12%

YoY)

• Tata Consultancy Services intends to train 25,000 engineers on generative artificial intelligence tools in its

partnership with Microsoft Corporation. It will also launch its new generative AI enterprise adoption offering

on Microsoft Cloud to help customers “jumpstart” their generative AI journey. In addition, TCS is enhancing

its own suite of products and platforms to take advantage of the new technology.

• Infosys has set up a new subsidiary in Canada under its US arm Infosys Public Services. IPS Canada will

help modernize public sector service delivery for new and existing federal, Ontario, and Manitoba

governments and crown corporation clients.

• JK Cement has acquired an additional 20% stake for ₹ 60.24 crore in Acro Paints, taking its overall

holding to 80%.

• As per media sources, SBI is undertaking restructuring its senior leadership wherein Amitava Chatterjee

will become Deputy MD in charge of overseas vertical catering to corporates. Rajay Sinha, currently in

charge of global operations, will become MD & CEO of SBI Capital Markets Ltd. Nand Kishore assumed as

deputy MD of global operations and Abhijit Chakravorty will become MD & CEO of SBI Cards.

• As per exchange filing, Reliance Industries has informed approval from NCLT for demerger and listing of

financial services undertaking - Jio Financial Services

• In its quarterly update, Dabur has informed that revenue growth is expected to exceed 10%, driven by

moderation in inflation and thus increase in demand. Operating profit is expected to grow at a faster pace

relative to top-line amid improvement in margins, however, amortization of acquisition expense is seen to

keep PAT growth lower than operating profit trajectory. For FY24, management expects improvement in

operating margin to sustain and to be utilised in higher advertising and promotion spends to drive further

business growth

• The board of Adani Green Energy (AGEL) cleared plans to raise up to Rs 12,300 crore by way of qualified

institutional placements (QIPs) of shares or any other share-sale instrument. The company will use the

ICICI Securities | Retail Research

Opening Bell ICICI Direct Research

proceeds to repay debt and expand capacity. Currently, the size of its renewable energy portfolio stands at

20.4 gigawatts (Gw) — 8.2 Gw operational and another 12.2 Gw under-construction and near-construction

projects. The company is targeting a 45-Gw portfolio by 2030

• To push China like infrastructure development and financial growth, India will n need Rs 845-880 lakh crore

investment between 2023 and 2047. It has recommended the roadmap for augmenting key infrastructures

to meet future need by setting the target to increase highway length by 1.6 times, port capacit by four times

and doubling the railway network, including the laying of 20,000 kms elevated tracks and 4,500 km bullet

train corridors in the next 24 years. There is also the plan to take the number of Vande Bharat trains to

4,500.

• GE Shipping has delivered its 2004 built crude carrier to its buyer. The vessel was sold in April 2023. Its

current fleet stands at 42 vessels, amid record shipping asset prices.

• IOC and Praj have signed a term agreement to strengthen biofuels capacity in India. Biofuels covered in the

MoU consists of Sustainable Aviation Fuel (SAF), Ethanol, compressed Bio-Gas, Biodiesel and Bio-

bitumen.

• AllCargo demerged entity - Transindia Real Estate Limited (TREL) had executed Business Transfer

Agreement with Premier Heavy Lift Private Limited (PHL) on April 27, 2023, for sale of crane division as a

going concern on a slump sale basis. TREL has completed the sale of crane division to PHL on a slump sale

basis on July 4, 2023.

• Aster DM has acquired additional 2.36% stake in Malabar Institute of Medical Scienc es Ltd (MIMS), a

material subsidiary of the Company from several minority shareholders as on July 05, 2023. Consequent

to the said acquisition, shareholding of the Company in MIMS has increased from 76.01% to 78.37%. MIMS

is a material a subsidiary of Aster DM Healthcare Limited and operates hospitals in Kerala.

• HCG has entered into a Share Purchase Agreement on July 06, 2023, with Dr Ajay Mehta, Dr Suchitra

Mehta, shareholders of Nagpur Cancer Hospital and Research Institute (NCHRI) for the acquisition of entire

equity share capital in NCHRI. The cost of acquisition would be | 14 crore and the sum payable to Dr. Ajay

Mehta would be | 17 crore (includes deferred consideration of |4 crore)

• As per media sources, Alkem labs has forayed into Opthalmology segment with the launch of extensive

portfolio of Eye care products

• As per media sources, the Cabo Delgado gasfield in Mozambique, in which Indian companies hold a 30%

stake, is expected to resume production this month after terror attacks threatened to derail it. ONGC Videsh

holds 16%, while BPRL Ventures Mozambique BV, a subsidiary of BPCL, and Oil India Ltd hold 10% and

4% respectively

• As per media sources, ONGC is preparing to map India's geothermal energy sources, which have a potential

capacity of 10 GW. Initial studies have indicated the presence of abundant geothermal sources in Ladakh,

Himachal Pradesh, Gujarat (Cambay Basin and Ankleshwar), Andhra Pradesh (Kowthalam), and

Chhattisgarh. The focus will primarily be on Ladakh, followed by Gujarat, and later on the southern regions.

Last month, ONGC signed an agreement with Iceland GeoSurvey (ISOR) to collaborate on it

• IOCL, Chennai, has committed to invest | 54000 crore in various projects in Tamil Nadu in the next few

years, including a 9 MMTPA grass-root refinery at an estimated cost of | 35580 crore.

• As per media sources, RIL and Adani Total Gas (ATGL) are planning to set up 10 compressed biogas (CBG)

plants each, across the country. These plants will be of upto 30 tonnes per annum capacity. Five plants will

be set in the next five years. The rest would come up later. The companies would invest up to | 2500 crore

each in setting up these plants

• As per media sources, Promoters of Aster DM Healthcare led by Azad Moopen have initiated stake-sale

talks with private equity groups such as Blackstone and KKR among others. The promoters may even be

open to selling a controlling stake in their India-listed hospital chain to capitalise on the ongoing sectoral

consolidation.

ICICI Securities | Retail Research

Opening Bell ICICI Direct Research

Recovery to sustain!!!

A b out the stock: NRB was incorporated in 1965 as an Indo-French venture and

pioneered the production of needle and roller bearings in India.

• NRB is India’s largest needle and cylindrical roller bearings producer. Today

90% of vehicles on Indian roads run on NRB parts

• Domestic markets contribute ~75% of total revenues while exports

contribute the balance ~25%. In domestic markets, company cater to auto

Conviction Idea

Particulars

industry including 2W, PV, CV

Particular Amount

• Company exports its products to approx. 45 countries worldwide including Market Capitalization 1,980

France, Italy, the US, Mexico, Brazil, Thailand, Bangladesh etc Total Debt (FY23) 322

Cash and Investments (FY23) 83

Key I n vest men t T h esi s: EV 2,302

52 week H/L (|) (BSE) 212/ 115

• Do mestic and Exports to drive growth: We believe with strong traction with

Equity capital 19.4

export clients, we expect markets to deliver 15% YoY growth in FY24

Face value (|) 2.0

whereas domestic markets are expected to grow by 10% YoY led by

recovery in 2-Wheeler and CV segment. Hence, we expect revenues to grow Shareholding Pattern Key Fina

at a CAGR of 11% over FY23-FY25E to |1308 crore. Jun-22 Sep-22 Dec-22 Mar-23

Promoters 49.9 49.9 49.9 50.1

• Ma rgins improvement to boost P AT CAGR at 24% o ver FY23-FY25E: FY23 FII 21.5 21.5 21.3 21.3

was a tale of two half wherein H1FY23 saw margins falling to 10% given DII 11.6 11.6 11.5 11.5

sharp rise in prices of key input i.e., steel and the lag at which the same was Others 17.0 17.0 17.3 17.1

passed on to OEM’s. However, in Q4FY23, the price hikes got fully

implemeted the same reflected in significant improvement in margins which Risks to our call

rose to 20.5% in the same period. Going ahead, with no major volatility 1) Higher/lower than expected

expected in steel prices, double digit growth in export markets we expect growth in auto sector

margins to improve to 16.7% and 17.6% in FY24E and FY25E respectively. 2) Volatility in Raw material prices could

ICICI Securities – Retail Equity Research

Double digit topline growth coupled with margin expansion and controlled impact margins

finance costs will lead to PAT CAGR of 24% over FY23-FY25E

Price Performance

300 24000

Ra t i n g a n d T a rg et P ri c e

20000

• We believe with a visibility of 24% PAT CAGR over FY23-25E and a 200 16000

controlled leverage, NRB is highly undervalued across the bearings space 12000

(other players quoting at 40x-50x on 2 year forward EPS). Even discounting 100 8000

the fact that it has one segment exposure unlike other bearings companies 4000

still the stock remains undervalued and we expect a rerating to set in. 0 0

Jan-21

Jan-22

Jan-23

Jul-20

Jul-21

Jul-22

Jul-23

• We value NRB at | 270 per share (based on 18x FY25 P/E)

NRB Bearings Nifty Index

Research Analyst

Chirag Shah

Shah.chirag@icicisecurities.com

Vijay Goel

Vijay.goel@icicisecurities.com

Key Financial Summary

5 Year CAGR 2 Year CAGR

Financials FY21 FY22 FY23 FY24E FY25E

(FY18-23) (FY23-25E)

Net Sales 762.4 944.2 1,057.2 3.9% 1,175.6 1,307.9 11.2%

EBITDA 85.8 103.9 146.5 -2.7% 196.6 230.8 25.5%

EBITDA Margin (%)

Net Profit 55.7 75.6 94.9 0.4% 120.5 146.2 24.1%

EPS (|) 5.6 7.6 9.8 12.4 15.1

P/E (x) 36.9 27.2 21.0 16.6 13.7

EV/EBITDA (x) 20.6 15.2 13.0 11.2 9.4

RoCE (%) 11.8 13.7 15.4 17.3 19.3

s

Source: Company, ICICI Direct Research

ICICI Securities |Retail Research

Opening Bell ICICI Direct Research

Results/Events Calendar

19 June 20 June 21 June 22 June 23 June 24 June

Monday Tuesday Wednesday Thursday Friday Saturday

0 JP Industrial Production MoM UK CPI YoY US Existing Home Sales UK Retail Sales MoM 0

0 US Building Permits MoM 0 UK BoE Int Rate Decision EU Manufacturing PMI 0

0 0 0 0 EU Services PMI 0

0 0 0 0 0 0

0 0 0 0 0 0

26 June 27 June 28 June 29 June 30 June 01 July

Monday Tuesday Wednesday Thursday Friday Saturday

0 US New home sales EU M3 Money Supply US GDP Q3 UK GDP QoQ 0

0 0 US goods trade balance US Pending home sales EU CPI 0

0 0 0 CH Manufacturing CPI IN Federal Fiscal Deficit 0

0 0 0 CH Composite PMI IN Infrastructure Output 0

0 0 0 0 IN Foreign Debt 0

03 July 04 July 05 July 06 July 07 July 08 July

Monday Tuesday Wednesday Thursday Friday Saturday

IN Nikkei Manf PMI CH Caxin Service PMI IN Nikkei Service PMI US Services PMI US Unemployment Rate 0

EU Manf PMI 0 EU Service PMI JP Household Spending 0 0

UK Manf PMI 0 UK Service PMI 0 0 0

US Mang PMI 0 US Facory Orders 0 0 0

0 0 0 0 0 0

10 July 11 July 12 July 13 July 14 July 15 July

Monday Tuesday Wednesday Thursday Friday Saturday

0 UK Unemployment Rate IN CPI UK GDP IN WPI Food 0

0 JP PPI US CPI UK Industrial Prodn IN WPI Fuel 0

0 PCBL IN Cumulatine Industrial Prodn EU Industrial Production IN WPI Inflation 0

0 0 TCS US PPI IN WPI Manf Inflation 0

0 0 HCL Tech 0 0 0

17 July 18 July 19 July 20 July 21 July 22 July

Monday Tuesday Wednesday Thursday Friday Saturday

0 US Industrial Production UK CPI YoY US Existing Home Sales UK Retail Sales 0

0 CIE Automotive India UK PPI JP National CPI JSW Steel 0

0 0 EU CPI Infosys Ramkrishna Forging 0

0 0 US Building Permits Coforge 0 0

0 0 0 Persistent Technology 0 0

Major Economic Events this Week Recent Releases

Date Event Country Period Actual Expected Date Report

03-Jul Nikkei Manf PMI IN Jul 57.8 58.0 July 03, 2023 Shubh Nivesh– South Indian Bank

03-Jul Manufacturing PMI EU Jul 43.4 43.6 Jun 26, 2023 Shubh Nivesh– Steel Strips Wheels Ltd

03-Jul Manufacturing PMI UK Jul 46.5 46.2 Jun 19, 2023 Stock Tales– Hindustan Oil Exploration

03-Jul Manufacturing PMI US Jul 46.3 46.3 Jun 19, 2023 Company Update– Trent

04-Jul Caixin Service PMI CH Jul 53.9 56.2 Jun 19, 2023 Shubh Nivesh– Granules

05-Jul Nikkei Servie PMI IN Jul 58.5 60.2

05-Jul API Weekly Crude Oil Stock US Jul -4.382M -1.800M

06-Jul Initial Jobless Claims US Jul 248k 245k

06-Jul Crude Oil Inventories US Jul -1.508M -0.983M

Date Event Country Period Expected Previous

07-Jul FX Reserves USE IN Jun - -

ICICI Securities |Retail Research

Opening Bell ICICI Direct Research

Pan kaj Pan dey Head – Research

pan kaj. pan dey@icicisecu rities. com

IC IC I Direct Research Desk,

IC IC I S ecu rities Limited,

Third Floor,Brillanto House,

Road No 13, MIDC

Andheri (East)

Mumbai – 400 093

research @icicidirect. com

ICICI Securities |Retail Research

Opening Bell ICICI Direct Research

Disclaimer

AN ALY S T C ERTIFIC ATION

I/We, Pankaj Panday, Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this research report accurately reflect our views about

the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. It

is also confirmed that above mentioned Analysts of this report have not received any compensation from the companies mentioned in the report in the preceding twelve months and donot

serve as an officer, director or employee of the companies mentioned in the report.

Terms & conditions and other disclosures:

ICICI Securities Limited (ICICI Securities) is a full-service, integrated investment banking and is, inter alia, engaged in the business of stock brokering and distribution of financial products.

ICICI Securities is Sebi registered stock broker, merchant banker, investment adviser, portfolio manager and Research Analyst. ICICI Securities is registered with Insurance Regulatory

Development Authority of India Limited (IRDAI) as a composite corporate agent and with PFRDA as a Point of Presence. ICICI Securities Limited Research Analyst SEBI Registration Number –

INH000000990. ICICI Securities Limited SEBI Registration is INZ000183631 for stock broker. Registered Office Address: ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai -

400 025. CIN: L67120MH1995PLC086241, Tel: (91 22) 6807 7100. ICICI Securities is a subsidiary of ICICI Bank which is India’s largest private sector bank and has its various subsidiaries engaged

in businesses of housing finance, asset management, life insurance, general insurance, venture capital fund management, etc. (“associates”), the details in respect of which are available on

www.icicibank.com.

Investments in securities market are subject to market risks. Read all the related documents carefully before

investing.

Registration granted by Sebi and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. None of the research

recommendations promise or guarantee any assured, minimum or risk-free return to the investors.

Name of the Compliance officer (Research Analyst): Mr. Atul Agarwal Contact number: 022-40701000 E-mail Address: complianceofficer@icicisecurities.com

For any queries or grievances: Mr. Prabodh Avadhoot Email address: headservicequality@icicidirect.com Contact Number: 18601231122

ICICI Securities is one of the leading merchant bankers/ underwriters of securities and participate in virtually all securities trading markets in India. We and our associates might have investment

banking and other business relationship with a significant percentage of companies covered by our Investment Research Department. ICICI Securities and its analysts, persons reporting to

analysts and their relatives are generally prohibited from maintaining a financial interest in the securities or derivatives of any companies that the analysts cover.

Recommendation in reports based on technical and derivative analysis centre on studying charts of a stock's price movement, o utstanding positions, trading volume etc as opposed to focusing

on a company's fundamentals and, as such, may not match with the recommendation in fundamental reports. Investors may visit icicidirect.com to view the Fundamental and Technical

Research Reports.

Our proprietary trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

ICICI Securities Limited has two independent equity research groups: Institutional Research and Retail Research. This report has been prepared by the Retail Research. The views and opinions

expressed in this document may or may not match or may be contrary with the views, estimates, rating, and target price of the Institutional Research.

The information and opinions in this report have been prepared by ICICI Securities and are subject to change without any noti ce. The report and information contained herein is strictly

confidential and meant solely for the selected recipient and may not be altered in any way, transmitted to, copied or distrib uted, in part or in whole, to any other person or to the media or

reproduced in any form, without prior written consent of ICICI Securities. While we would endeavour to update the information herein on a r easonable basis, ICICI Securities is under no

obligation to update or keep the information current. Also, there may be regulatory, compliance or other reasons that may prevent ICICI Securities from doing so. Non -rated securities indicate

that rating on a particular security has been suspended temporarily and such suspension is in compliance with applicable regulations and/or ICICI Securities policies, in circumstances where

ICICI Securities might be acting in an advisory capacity to this company, or in certain other circumstances.

This report is based on information obtained from public sources and sources believed to be reliable, bu t no independent verification has been made nor is its accuracy or completeness

guaranteed. This report and information herein is solely for informational purpose and shall not be used or considered as an offer document or solicitation of offer to buy or sell or subscribe

for securities or other financial instruments. Though disseminated to all the customers simultaneously, not all customers may receive this report at the same time. ICICI Securities will not treat

recipients as customers by virtue of their receiving this report. Nothing in this report constitutes investment, legal, accounting and tax advice or a representation that any investment or strategy

is suitable or appropriate to your specific circumstances. The securities discussed and opinions expr essed in this report may not be suitable for all investors, who must make their own

investment decisions, based on their own investment objectives, financial positions and needs of specific recipient. This may not be taken in substitution for the exercise of independent

judgment by any recipient. The recipient should independently evaluate the investment risks. The value and return on investment may vary because of changes in interest rates, foreign

exchange rates or any other reason. ICICI Securities accepts no liabilities whatsoever for any loss or damage of any kind arising out of the use of this report. Past performance is not necessarily

a guide to future performance. Investors are advised to see Risk Disclosure Document to understand the risks associated before investing in the securities markets. Actual results may differ

materially from those set forth in projections. Forward-looking statements are not predictions and may be subject to change without notice.

ICICI Securities or its associates might have managed or co-managed public offering of securities for the subject company or might have been mandated by the subject company for any other

assignment in the past twelve months.

ICICI Securities or its associates might have received any compensation from the companies mentioned in the report during the period preceding twelve months from the date of this report

for services in respect of managing or co-managing public offerings, corporate finance, investment banking or merchant banking, brokerage services or other advisory service in a mergeror

specific transaction.

ICICI Securities or its associates might have received any compensation for products or services other than investment bankin g or merchant banking or brokerage services from the companies

mentioned in the report in the past twelve months.

ICICI Securities encourages independence in research report preparation and strives to minimize conflict in preparation of research report. ICICI Securities or its associates or its analysts did

not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither ICICI

Securities nor Research Analysts and their relatives have any material conflict of interest at the time of publication of this report.

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

ICICI Securities or its subsidiaries collectively or Research Analysts or their relatives do not own 1% or more of the equity securities of the Company mentioned in the report as o f the last day

of the month preceding the publication of the research report.

Since associates of ICICI Securities and ICICI Securities as a entity are engaged in various financial service businesses, they might have financial interests or actual/ beneficial ownership of one

percent or more or other material conflict of interest various companies including the subject company/compani es mentioned in this report.

ICICI Securities may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report.

Neither the Research Analysts nor ICICI Securities have been engaged in market making activity for the companies mentioned in the report.

We submit that no material disciplinary action has been taken on ICICI Securities by any Regulatory Authority impacting Equit y Research Analysis activities.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such

distribution, publication, availability or use would be contrary to law, regulation or which would subject ICICI Securities and affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession this document may come

are required to inform themselves of and to observe such restriction.

ICICI Securities |Retail Research

You might also like

- Palacio VsDocument2 pagesPalacio VsRaymart SalamidaNo ratings yet

- Citroen C4 Picasso/Grand Picasso BilmetropolenDocument5 pagesCitroen C4 Picasso/Grand Picasso BilmetropolenAlberto Miglino100% (1)

- Lay Up ProcedureDocument21 pagesLay Up ProcedureAmir100% (1)

- Straight Through Processing for Financial Services: The Complete GuideFrom EverandStraight Through Processing for Financial Services: The Complete GuideNo ratings yet

- Integral Abutment Bridge Design (Modjeski and Masters) PDFDocument56 pagesIntegral Abutment Bridge Design (Modjeski and Masters) PDFAnderson UrreaNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Yaskawa Ac Servo Drives & Controllers PDFDocument40 pagesYaskawa Ac Servo Drives & Controllers PDFNur CholisNo ratings yet

- .Trashed 1691267349 OpeningbellDocument6 pages.Trashed 1691267349 Openingbellgerak52526No ratings yet

- OpeningbellDocument8 pagesOpeningbellPRASANNANo ratings yet

- Market Radiance 30th October 2023Document8 pagesMarket Radiance 30th October 2023SUNDAR PNo ratings yet

- Openingbell123 03 22Document8 pagesOpeningbell123 03 22Tirthankar DasNo ratings yet

- OpeningbellDocument9 pagesOpeningbellsmartboy4funNo ratings yet

- PPPPPTDocument41 pagesPPPPPTbikash ranaNo ratings yet

- CSEC Daily Market OverviewDocument3 pagesCSEC Daily Market OverviewSuresh kumar ChockalingamNo ratings yet

- NMDC Results Update: Maintain Hold With Target Price Of ₹115Document10 pagesNMDC Results Update: Maintain Hold With Target Price Of ₹115Mani SeshadrinathanNo ratings yet

- Nuvama On Dabur, Polycab and Food DeliveryDocument6 pagesNuvama On Dabur, Polycab and Food Deliverytakemederato1No ratings yet

- ICICI Bank, Reliance Industries, Infosys among top large-cap stock picks for upside of up to 32Document25 pagesICICI Bank, Reliance Industries, Infosys among top large-cap stock picks for upside of up to 32Prachi PatwariNo ratings yet

- India sneak peek jul 21Document8 pagesIndia sneak peek jul 21nikhilNo ratings yet

- Top Story:: MON 14 JUN 2021Document4 pagesTop Story:: MON 14 JUN 2021JajahinaNo ratings yet

- GMR Infra: Robust Traffic GrowthDocument4 pagesGMR Infra: Robust Traffic GrowthRaunak MukherjeeNo ratings yet

- Top Picks - 2022Document14 pagesTop Picks - 2022Bineet KumarNo ratings yet

- Nokia Corporation (NOK)Document1 pageNokia Corporation (NOK)Raisul Islam NayanNo ratings yet

- Idea Cellular LTD: Key DataDocument7 pagesIdea Cellular LTD: Key Datayash_mulwani5815No ratings yet

- Opening BellDocument7 pagesOpening BellDarrenJohnsonNo ratings yet

- Larsen & Toubro Strong Operating Performance and Balance SheetDocument32 pagesLarsen & Toubro Strong Operating Performance and Balance SheetAshutosh PatidarNo ratings yet

- Buy Unitech - Target 51Document7 pagesBuy Unitech - Target 51Sovid GuptaNo ratings yet

- Itc LTD: Q3FY19: Healthy Quarter Driven by Strong Cigarette VolumesDocument8 pagesItc LTD: Q3FY19: Healthy Quarter Driven by Strong Cigarette Volumesvidrr1242No ratings yet

- 18january 2019 - India - DailyDocument52 pages18january 2019 - India - DailyAnuj MahajanNo ratings yet

- Buy Mayur Uniquoters - Aug'18Document6 pagesBuy Mayur Uniquoters - Aug'18Deepak GNo ratings yet

- Indian Stock Market Update - 02 Sep 2010Document7 pagesIndian Stock Market Update - 02 Sep 2010bhavnesh_muthaNo ratings yet

- Reliance Jio Infocomm audited financial results for FY19Document9 pagesReliance Jio Infocomm audited financial results for FY19Kajal Gupta0% (1)

- Tata Consultancy Services LTD.: Result UpdateDocument7 pagesTata Consultancy Services LTD.: Result UpdateanjugaduNo ratings yet

- 5_6231111529102575480Document15 pages5_6231111529102575480dinilaNo ratings yet

- Amara Raja Batteries LTD: 1Q FY11 ResultsDocument5 pagesAmara Raja Batteries LTD: 1Q FY11 ResultsveguruprasadNo ratings yet

- Q4FY22 Result Review: Margin performance commendable; upgrade to BUYDocument10 pagesQ4FY22 Result Review: Margin performance commendable; upgrade to BUYTai TranNo ratings yet

- IDBI Diwali Stock Picks 2019Document12 pagesIDBI Diwali Stock Picks 2019Akt ChariNo ratings yet

- ITC Analyst Meet Key TakeawaysDocument19 pagesITC Analyst Meet Key TakeawaysTatsam VipulNo ratings yet

- Q2FY19 Investor Update - PGCILDocument19 pagesQ2FY19 Investor Update - PGCILHemant SharmaNo ratings yet

- Top Stories:: FRI 06 AUG 2021Document14 pagesTop Stories:: FRI 06 AUG 2021jdalvaranNo ratings yet

- RIL SegmentsDocument47 pagesRIL Segmentsdeepsinghrawat06No ratings yet

- Top Story:: TUE 19 FEB 2019Document6 pagesTop Story:: TUE 19 FEB 2019MarcRayosNo ratings yet

- Tata MotorsDocument6 pagesTata MotorsNoman AgashiwalaNo ratings yet

- LIT FactsheetDocument2 pagesLIT FactsheetAlex MilarNo ratings yet

- Weekly Equity Market Report of Indian MarketDocument5 pagesWeekly Equity Market Report of Indian MarketRahul SolankiNo ratings yet

- Buy Tata ChemicalsDocument9 pagesBuy Tata ChemicalsSovid GuptaNo ratings yet

- CNVRG: Growth Opportunity in The Underpenetrated Fiber MarketDocument7 pagesCNVRG: Growth Opportunity in The Underpenetrated Fiber MarketJajahinaNo ratings yet

- Telecom: Nov'21 Tariff Hike-Led Sim Consolidation Not Yet Over?Document5 pagesTelecom: Nov'21 Tariff Hike-Led Sim Consolidation Not Yet Over?PranavPillaiNo ratings yet

- Reliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Document18 pagesReliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Abhiroop DasNo ratings yet

- Indian Stock Markets - 06 Sep 2010Document6 pagesIndian Stock Markets - 06 Sep 2010bhavnesh_muthaNo ratings yet

- PSE drops below 6,000 as investors take profitsDocument8 pagesPSE drops below 6,000 as investors take profitsJajahinaNo ratings yet

- Most Market Outlook: Morning UpdateDocument5 pagesMost Market Outlook: Morning UpdateVinayak ChennuriNo ratings yet

- TVS Motor Company: CMP: INR549 TP: INR548Document12 pagesTVS Motor Company: CMP: INR549 TP: INR548anujonwebNo ratings yet

- Motilal Oswal 2022 Stock PicksDocument13 pagesMotilal Oswal 2022 Stock Pickskp_05No ratings yet

- Delta Corp 1QFY20 Results Update | Sector: OthersDocument6 pagesDelta Corp 1QFY20 Results Update | Sector: OthersJatin SoniNo ratings yet

- AIA Engineering Feb 19Document6 pagesAIA Engineering Feb 19darshanmaldeNo ratings yet

- Top Stories:: TUE 17 AUG 2021Document14 pagesTop Stories:: TUE 17 AUG 2021Elcano MirandaNo ratings yet

- Stocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic TimesDocument4 pagesStocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic Timeserkant007No ratings yet

- Most Market Bytes 12 TH April 19Document7 pagesMost Market Bytes 12 TH April 19Sahil ModiNo ratings yet

- Trading Strategy: Morning NoteDocument6 pagesTrading Strategy: Morning Noteganesh chavanNo ratings yet

- Sharekhan Pre Market Insight (Morning Tiger) 03 August 2023Document10 pagesSharekhan Pre Market Insight (Morning Tiger) 03 August 2023Vivek BishtNo ratings yet

- Sharekhan Top Picks: April 01, 2011Document7 pagesSharekhan Top Picks: April 01, 2011Dinesh KumarNo ratings yet

- TelecomDocument8 pagesTelecomVaibhav JainNo ratings yet

- Emas Kiara Industries Berhad: 1QFY12/10 Net Profit Grows 23% YoY - 31/5/2010Document7 pagesEmas Kiara Industries Berhad: 1QFY12/10 Net Profit Grows 23% YoY - 31/5/2010Rhb InvestNo ratings yet

- Weekly Stock Market Trend and UpdatesDocument6 pagesWeekly Stock Market Trend and UpdatesRahul SolankiNo ratings yet

- India Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14Document5 pagesIndia Grid Q3FY18 - Result Update - Axis Direct - 22012018 - 22!01!2018 - 14saransh saranshNo ratings yet

- Data Analytics For Ioe: SyllabusDocument23 pagesData Analytics For Ioe: SyllabusTejal DeshpandeNo ratings yet

- Haslinda Mohd Anuar Senior Lecturer School of Law ColgisDocument24 pagesHaslinda Mohd Anuar Senior Lecturer School of Law ColgisSHAHEERANo ratings yet

- Selection of Materials For Cutting ToolsDocument21 pagesSelection of Materials For Cutting ToolsKarthick NNo ratings yet

- Saving Your Work in MATLAB: Saving Data and The Contents of The Command WindowDocument2 pagesSaving Your Work in MATLAB: Saving Data and The Contents of The Command WindowMakhdoom Ibad HashmiNo ratings yet

- Group 3 - Brand Architecture Assignment IDocument9 pagesGroup 3 - Brand Architecture Assignment IShijin SreekumarNo ratings yet

- The Ultimate Experience With AvatradeDocument3 pagesThe Ultimate Experience With AvatradeAnonymous wk2GeJ8ERQNo ratings yet

- State Board of Education Memo On Broward County (Oct. 4, 2021)Document40 pagesState Board of Education Memo On Broward County (Oct. 4, 2021)David SeligNo ratings yet

- Systematic Review of The Market Wide Herding Behavior in Asian RegionDocument9 pagesSystematic Review of The Market Wide Herding Behavior in Asian RegionIJAR JOURNALNo ratings yet

- Carbozinc 11Document4 pagesCarbozinc 11DuongthithuydungNo ratings yet

- Credit Risk ManagementDocument85 pagesCredit Risk ManagementDarpan GawadeNo ratings yet

- Ratio & Proportion - Important Maths For BankDocument9 pagesRatio & Proportion - Important Maths For BankXpired ZoneNo ratings yet

- Basic IT Tutorial 2 - No Answer, Candidates Are To Work Out The Answers ThemselveDocument3 pagesBasic IT Tutorial 2 - No Answer, Candidates Are To Work Out The Answers ThemselveTri Le MinhNo ratings yet

- User Manual Rish Insu 10Document10 pagesUser Manual Rish Insu 10Manoj TyagiNo ratings yet

- Measuring The Sustainability of Urban Water ServicesDocument10 pagesMeasuring The Sustainability of Urban Water ServicesWalter RodríguezNo ratings yet

- Tekla - DocumentDocument2,005 pagesTekla - DocumentTranタオNo ratings yet

- Mobile Scaffold Inspection ChecklistDocument3 pagesMobile Scaffold Inspection Checklistanthony murphyNo ratings yet

- RELAP5 Simulation of CANDU Station Blackout AccideDocument20 pagesRELAP5 Simulation of CANDU Station Blackout AccideWhite HeartNo ratings yet

- Sand Patch TestDocument5 pagesSand Patch TestgreatpicNo ratings yet

- 5442 - FVRDocument100 pages5442 - FVRKrishna Chaitanya DeepalaNo ratings yet

- (GR No. 15574) Smith, Bell & Co Vs NatividadDocument18 pages(GR No. 15574) Smith, Bell & Co Vs Natividadshopee onlineNo ratings yet

- Quy Trình AgencyDocument4 pagesQuy Trình Agencyson nguyenNo ratings yet

- QuizDocument5 pagesQuizReuven GunawanNo ratings yet

- Unit 1Document176 pagesUnit 1kassahun meseleNo ratings yet

- Bulk PricesDocument2 pagesBulk PricesMega Byte0% (1)

- If An Existing Amazon Account Exists For Your Work Email Address, Skip To Step 4Document3 pagesIf An Existing Amazon Account Exists For Your Work Email Address, Skip To Step 4ThaiNo ratings yet