Professional Documents

Culture Documents

5

5

Uploaded by

Lazy Leath0 ratings0% found this document useful (0 votes)

6 views2 pagesThe bank reconciliation for Ian Co.'s current account shows a December 31, 2018 balance of $585,284 per the bank statement. However, the balance per Ian Co.'s books is $541,714 once outstanding checks of $52,810, un deposited collections of $23,000, a rent check recording error of $900, an automatic mortgage payment of $18,000, bank charges of $740, an incorrect bank deposit of $35,000, and an NSF check of $3,400 are accounted for. The adjusted cash in bank balance is $520,474 after reconciling the books to the bank statement. The total cash and cash equivalents to report as current assets is $728,

Original Description:

some notes in accounting

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe bank reconciliation for Ian Co.'s current account shows a December 31, 2018 balance of $585,284 per the bank statement. However, the balance per Ian Co.'s books is $541,714 once outstanding checks of $52,810, un deposited collections of $23,000, a rent check recording error of $900, an automatic mortgage payment of $18,000, bank charges of $740, an incorrect bank deposit of $35,000, and an NSF check of $3,400 are accounted for. The adjusted cash in bank balance is $520,474 after reconciling the books to the bank statement. The total cash and cash equivalents to report as current assets is $728,

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views2 pages5

5

Uploaded by

Lazy LeathThe bank reconciliation for Ian Co.'s current account shows a December 31, 2018 balance of $585,284 per the bank statement. However, the balance per Ian Co.'s books is $541,714 once outstanding checks of $52,810, un deposited collections of $23,000, a rent check recording error of $900, an automatic mortgage payment of $18,000, bank charges of $740, an incorrect bank deposit of $35,000, and an NSF check of $3,400 are accounted for. The adjusted cash in bank balance is $520,474 after reconciling the books to the bank statement. The total cash and cash equivalents to report as current assets is $728,

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Bank Reconciliation

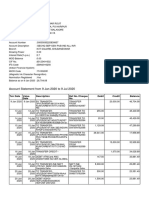

The bank statement for the current account of IAN Co. showed a December 31, 2018, balance of

P585,284. Information that might be useful in preparing a bank reconciliation is as follows:

a) Outstanding checks were P52,810.

b) b) The December 31, 2018, cash receipts of P23,000 were not deposited in the bank until

January 2,

c) 2019.

d) c) recorded One check by written the bank in but payment was recorded of rent by P8,940 Ian

Co. was

e) as a correctlyP9,840 disbursement.

f) d) In accordance with prior authorization, the bank withdrew P18,OOO directly from the current

g) account as payment on a mortgage note payable. The interest portion of that payment was

p14,OOO.

h) Ian Co. has made no entry to record the automatic payment.

i) e) Bank service charges of P 740 were listed on the bank statement.

j) f) A deposit of P35,000 was recorded by the bank on December 12, but it did not belong to Ian

Co.

k) g) The bank statement included a charge of P 3,400 for a notsufficient-fund check. The company

will

l) seek payment from the customer.

m) h) Ian Co. maintains an P8,000 petty cash fund that was appropriately reimbursed at the end of

n) December.

o) i) According to instructions from Ian Co. on December 301 the bank withdrew P40,000 from the

account

p) and purchased treasury bills for Ian Co. The company recorded the transaction in its books on

December

q) 31 when it received notice from the bank. Half of the treasury bills mature in three months and

the

r) other half in six months.

s) 1. What is the cash in bank balance per books on December 31, 2018?

t) A. P549,714 C. P534,914

u) B. P543,514 D. P541,714

v) 2. What is the adjusted cash in bank balance on December 31, 2018?

w) A. P520,474 C. P518,674

x) B. P527,274 D. P520,154

y) 3. What amount of cash and cash equivalents should be shown under current assets on

December 31,

z) 2018?

aa) A. P928,474 C. P720,474

bb) B. P728,474 D. P735,274

cc) SOLUTION 1-1 3

dd) 1. Balance per bank statement P585,284

ee) Outstanding checks (52,810)

ff) Undeposited collections 23,000

gg) Error in recording rent check (P9,840 -- P8,940) (900)

hh) Automatic mortgage payment 18,000

ii) Bank service charges 740

jj) Bank error — deposit incorrectly credited to Ian Co. (35,000)

kk) NSF check 3,400

ll) Balance per books P541,714

mm) Answer: D

nn) 2. Book Bank

oo) Unadjusted balances P541,714 P585,284

pp) Outstanding checks (52,810)

qq) Undeposited collections 23,000

rr) Error in recording rent check 900

ss) Automatic mortgage payment (18,000)

tt) Bank service charges (740)

uu) Bank error — deposit incorrectly credited

vv) to Ian Co. account (35,000)

ww) NSF check (3,400)

xx) Adjusted balances P520,474 P520,474

yy) Answer: A

zz) 3.

aaa) Current account balance P520,474

bbb) Petty cash 8,000

ccc)Treasury bills (P400,OOO x 1/2) 200,000

ddd) Total cash and cash equivalents P728,474

You might also like

- Types of SecuritiesDocument8 pagesTypes of SecuritiesA U R U M MDNo ratings yet

- Nubank: A Brazilian FinTech Worth $10 Billion - MEDICIDocument25 pagesNubank: A Brazilian FinTech Worth $10 Billion - MEDICIKay BarnesNo ratings yet

- Cash and Accounts ReceivableDocument11 pagesCash and Accounts ReceivablePat ClosaNo ratings yet

- Statement of Axis Account No:919010061861194 For The Period (From: 01-01-2019 To: 16-11-2021)Document4 pagesStatement of Axis Account No:919010061861194 For The Period (From: 01-01-2019 To: 16-11-2021)udi969No ratings yet

- Cash For SeatworkDocument3 pagesCash For SeatworkMika MolinaNo ratings yet

- PeerDocument8 pagesPeerronnelNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Using BVK To Transact BusinessDocument5 pagesUsing BVK To Transact BusinesswynvelNo ratings yet

- Practice Set: Page 5 of 7Document3 pagesPractice Set: Page 5 of 7darren sanchezNo ratings yet

- Auditing Quiz Audit of CashDocument4 pagesAuditing Quiz Audit of CashLoveli Breindaelyn Rivera0% (2)

- CASE 1: Petty Cash Fund Bank ReconciliationDocument50 pagesCASE 1: Petty Cash Fund Bank ReconciliationJohn Lloyd Yasto100% (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Quiz Bank Recon and Proof of CashDocument3 pagesQuiz Bank Recon and Proof of CashAlexander ONo ratings yet

- Bank Reconciliation ActivitiesDocument3 pagesBank Reconciliation ActivitiesRheu ReyesNo ratings yet

- Audit of Cash and Cash EquivalentsDocument9 pagesAudit of Cash and Cash Equivalentspatricia100% (1)

- Ap-5907q Cash PDFDocument5 pagesAp-5907q Cash PDFnikkaaaNo ratings yet

- FAR-Midterm ExamDocument19 pagesFAR-Midterm ExamTxos Vaj100% (1)

- Audit of CashDocument3 pagesAudit of CashCleopha Mae Torres100% (3)

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- Yes BankDocument30 pagesYes BankVivek PrakashNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Far: Mock Qualifying Quiz 2 (Cash and Cash Equivalents & Loans and Receivables)Document8 pagesFar: Mock Qualifying Quiz 2 (Cash and Cash Equivalents & Loans and Receivables)RodelLaborNo ratings yet

- Audit of Cash and Cash Equivalents 1Document9 pagesAudit of Cash and Cash Equivalents 1nena cabañesNo ratings yet

- Account Statement From 9 Jan 2020 To 9 Jul 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument10 pagesAccount Statement From 9 Jan 2020 To 9 Jul 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAnil Kumar RoutNo ratings yet

- 112 Seatwork1 ForStudentsDocument5 pages112 Seatwork1 ForStudentsJoventino NebresNo ratings yet

- 4 5958412768305481502Document3 pages4 5958412768305481502Misiker100% (2)

- Cash and CequizDocument5 pagesCash and CequizMaria Emarla Grace CanozaNo ratings yet

- 3.3 - Bank Reconciliation and Proof of CashDocument5 pages3.3 - Bank Reconciliation and Proof of CashxxxNo ratings yet

- IR1 CashcashEquivDocument4 pagesIR1 CashcashEquivMadielyn Santarin MirandaNo ratings yet

- Iii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)Document20 pagesIii-Ama: Bornasal Audit of Cash and Cash Equivalents (13 Feb 2021)nena cabañesNo ratings yet

- Problems - Cash & Cash Equivalents: Financial Accounting and ReportingDocument4 pagesProblems - Cash & Cash Equivalents: Financial Accounting and ReportingOlive Grace CaniedoNo ratings yet

- Cash and Cash EquivalentsDocument50 pagesCash and Cash EquivalentsAnne EstrellaNo ratings yet

- AudDocument46 pagesAudJane ConstantinoNo ratings yet

- Ap9208 Cash 1Document4 pagesAp9208 Cash 1Onids AbayaNo ratings yet

- Reviewees IntaccDocument6 pagesReviewees IntaccMarvic Cabangunay0% (2)

- Audit of CashDocument9 pagesAudit of CashRizzel SubaNo ratings yet

- ACC 140 1 Period - Quiz 2Document7 pagesACC 140 1 Period - Quiz 2Rica Mille MartinNo ratings yet

- Audit of Cash Bank ReconDocument8 pagesAudit of Cash Bank ReconPaul Mc AryNo ratings yet

- 6 Mock FAR Compre ExamDocument12 pages6 Mock FAR Compre ExamNatalia LimNo ratings yet

- Cce 3Document2 pagesCce 3Charish Jane Antonio CarreonNo ratings yet

- Quiz CCEDocument5 pagesQuiz CCEwesNo ratings yet

- Peer Mentoring PretestxxDocument7 pagesPeer Mentoring PretestxxronnelNo ratings yet

- Exercise ProjectDocument3 pagesExercise ProjectHassenNo ratings yet

- AP 001 A.1 Bank Reconciliation Prob 1Document2 pagesAP 001 A.1 Bank Reconciliation Prob 1Loid Gumera LenchicoNo ratings yet

- Audit of Cash and Cash Equivalent Problem 1 (Adapted)Document6 pagesAudit of Cash and Cash Equivalent Problem 1 (Adapted)Robelyn Asuna LegaraNo ratings yet

- Audit of Cash LecturesDocument3 pagesAudit of Cash Lecturespekka172No ratings yet

- A) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Document3 pagesA) B) C) D) E) A) B) C) D) E) A) B) C) D) E) A) B) C) D) E)Mharvie LorayaNo ratings yet

- BANK RECONCILIATION - Addtl ProbsDocument1 pageBANK RECONCILIATION - Addtl ProbsMercurio, Katrina EuniceNo ratings yet

- Bank Recon & Proof-Set ADocument2 pagesBank Recon & Proof-Set AJaypee BignoNo ratings yet

- Preliminary Exams-Aud 301A YmataDocument6 pagesPreliminary Exams-Aud 301A YmataMa Yra YmataNo ratings yet

- Auditing 1 AssessmentDocument15 pagesAuditing 1 AssessmentEmilou AustriacoNo ratings yet

- Audit of CashDocument7 pagesAudit of CashEvelynGonzalesNo ratings yet

- Quiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaDocument8 pagesQuiz 2 - Audit Cash - 5ae63b1cb41c4b23e6070f657ddaAlexNo ratings yet

- Audit of Cash ProblemsDocument23 pagesAudit of Cash ProblemsReign Ashley RamizaresNo ratings yet

- Cce ProblemDocument3 pagesCce ProblemCharish Jane Antonio CarreonNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- Long Examination Cash Set ADocument3 pagesLong Examination Cash Set AprechuteNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- N15 - Chapter3 Part 4Document3 pagesN15 - Chapter3 Part 4Lazy LeathNo ratings yet

- Kelp, Sea Lettuce (Green Nori), SquidsDocument3 pagesKelp, Sea Lettuce (Green Nori), SquidsLazy LeathNo ratings yet

- N11Document2 pagesN11Lazy LeathNo ratings yet

- NEITHER Importation From Abroad, Purchase of Goods From Economic Zones in The PhilDocument2 pagesNEITHER Importation From Abroad, Purchase of Goods From Economic Zones in The PhilLazy LeathNo ratings yet

- False 1. Marginal Income Earners Are Exempt From Both Business Tax and Income Tax. False 2. An Employed Professional Is Engaged in BusinessDocument3 pagesFalse 1. Marginal Income Earners Are Exempt From Both Business Tax and Income Tax. False 2. An Employed Professional Is Engaged in BusinessLazy LeathNo ratings yet

- False 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinDocument2 pagesFalse 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinLazy LeathNo ratings yet

- 6Document2 pages6Lazy LeathNo ratings yet

- 3Document3 pages3Lazy LeathNo ratings yet

- 4Document4 pages4Lazy LeathNo ratings yet

- 7Document3 pages7Lazy LeathNo ratings yet

- 1 Liquidity RiskDocument8 pages1 Liquidity RiskShreyanko GhosalNo ratings yet

- CRM at Capital OneDocument35 pagesCRM at Capital OneMOHIT KAVITKARNo ratings yet

- Legal Writing Case PoolDocument84 pagesLegal Writing Case PoolBuknoy PinedaNo ratings yet

- ZAM MOOELiquidation DVJEV TemplateDocument9 pagesZAM MOOELiquidation DVJEV TemplateEuchel Pauline Doble RamosNo ratings yet

- Chapter 17 Homework ProblemsDocument5 pagesChapter 17 Homework ProblemsAarti JNo ratings yet

- SecuritisationDocument43 pagesSecuritisationRonak KotichaNo ratings yet

- Secrecy of Bank Deposits and Unclaimed Balances LawDocument14 pagesSecrecy of Bank Deposits and Unclaimed Balances LawAllaiza Mhel Arcenal EusebioNo ratings yet

- Ghana CHRAJ Investigation Report On MP Car LoansDocument26 pagesGhana CHRAJ Investigation Report On MP Car LoansKwakuazarNo ratings yet

- Floirendo CaseDocument8 pagesFloirendo CaseAila AmpNo ratings yet

- Challan - Copy (1) - 1Document3 pagesChallan - Copy (1) - 1OshnicNo ratings yet

- Bank of ChinaDocument10 pagesBank of ChinaAnuj MongaNo ratings yet

- Statement 502xxxx68066 24052023 105256Document21 pagesStatement 502xxxx68066 24052023 105256Dhina KaranNo ratings yet

- Worksheet#1-MCQ-2018 Engineering EconomyDocument4 pagesWorksheet#1-MCQ-2018 Engineering EconomyOmar F'KassarNo ratings yet

- Financial Performance Analysis of EBL & IFIC BANKDocument21 pagesFinancial Performance Analysis of EBL & IFIC BANKShurovi UrmiNo ratings yet

- Sol Chap 29 Monetary System: PART 1: Multiple ChoicesDocument7 pagesSol Chap 29 Monetary System: PART 1: Multiple ChoicesChi NguyenNo ratings yet

- Dup Caf In30267932020369Document9 pagesDup Caf In30267932020369barnana jeevanraoNo ratings yet

- Atm DDDocument5 pagesAtm DDVrushali KhatpeNo ratings yet

- Canara BankDocument99 pagesCanara BankSharath Unnikrishnan Jyothi NairNo ratings yet

- ASU281512995 Auth Letter PDFDocument3 pagesASU281512995 Auth Letter PDFsenthiljayanthiNo ratings yet

- Dissertation Topic R193863ZDocument6 pagesDissertation Topic R193863ZMusariri TalentNo ratings yet

- Stress TestingDocument7 pagesStress TestingNabab ShirajuddoulaNo ratings yet

- FEB MAR Account StatementDocument2 pagesFEB MAR Account Statementhassanalisa2002No ratings yet

- Welcome To Vidya Lakshmi PortalDocument4 pagesWelcome To Vidya Lakshmi PortalAkash SahuNo ratings yet

- Tutorial 5 QuestionsDocument2 pagesTutorial 5 QuestionsNguyễn Ngọc ThôngNo ratings yet