Professional Documents

Culture Documents

9e1621df KM BUCKET DraftSummary

Uploaded by

Amarnath POriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

9e1621df KM BUCKET DraftSummary

Uploaded by

Amarnath PCopyright:

Available Formats

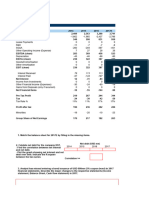

Taxable Income: 7,95,780 Tax Payable: 700

Name: PRABHASHANKAR Date of Birth: 18/04/1994 Residential Status: Resident

AMARNATH Aadhaar number: xxxxxxxx5090 Financial Year: 2022-2023

PAN: BCDPA6709C E-mail: amarjkm@gmail.com Assessment Year: 2023-2024

Address: SRI KRISHNA NILAYA Mobile Number: 8778264327 ITR Form: 1

#1723 1ST MAIN 5TH CROSS CK Return Type: Original Tax Regime: OLD

NAGAR HOSA ROAD Bangalore

South BANGALORE, 560100.

COMPUTATION OF INCOME

Particulars Rs. Rs. Rs.

1 Income from Salary (Refer annexure) 8,71,612

a Employer's Name: SOCIAL BEAT DIGITAL MARKETING LLP

Net Salary ( a) 7,31,600

b Employer's Name: VER SE INNOVATION PRIVATE LIMITED

Net Salary ( b) 1,40,012

Total Income from Salary 8,71,612

2 Income from House Property 0

3 Income from Business and Profession 0

Presumptive Business Income U/S 44AD 0

Presumptive Business Income U/S 44ADA 0

Speculative Business Income 0

Total Business and Profession Income 0

4 Income from Capital gains 0

Short Term Capital Gain @ slab rate 0

Short Term Capital Gain @ 15% 0

Long Term Capital gain @ 10% 0

Long Term Capital Gain @ 20% 0

Total Capital Gains 0

5 Income from Other sources 897

Interest income

Savings bank account 527

Dividend 370

Total Income from other sources 897

6 Total Headwise Income (1+2+3+4+5) 8,72,509

7 Losses of Current Year Setoff 0

House Property 0

8 Balance After Setoff of Current Year Losses 8,72,509

9 Brought Forward Losses Setoff 0

10 Gross Total Income 8,72,509

11 Income Chargeable to Tax at Special Rate U/S 111A, 112 etc. 0

12 Deductions Under Chapter VI-A 76,726

Investment Deduction 80CCE (80C + 80CCC + 80CCD1 subject to 1,50,000/-) 54,199

Interest on deposits in savings account 80TTA 527

Contribution to Pension Scheme 80CCD1B 22,000

Total Deductions 76,726

13 Total Income (10-12) 7,95,780

14 Income chargeable at Special Rates after adjusting BEL** 0

15 Net Agricultural Income 0

Created on: 17/07/2023 17:42:30 Page 1 of 4

16 Aggregate Income (13-14+15) 7,95,780

17 Losses To be Carried Forward (Refer Annexure) 0

18 Total Tax 71,656

Tax at normal rate - A 71,656

Tax at special rate - B 0

Rebate on agriculture income - C -0

Total Tax (A+B-C) 71,656

19 Rebate Under Section 87A 0

20 Tax After Rebate (18-19) 71,656

21 Surcharge 0

22 Health and Education Cess 2,866

23 Gross Tax Liability (20+21+22) 74,522

24 Tax Relief 0

Under 89 0

Under 90/ 90A 0

Under 91 0

Total Tax Relief 0

25 Net Tax Liability (23-24) 74,522

26 Interest and Fee Payable 0

Interest for late filing u/s 234A 0

Interest for non-payment of advance tax u/s 234B 0

Interest for delay in payment of advance tax u/s 234C 0

Penalty for late filling u/s 234F 0

Total Interest and Fee Payable 0

27 Aggregate Liability (25+26) 74,522

28 Taxes Paid 73,820

TDS on Salary (Refer Annexure) 73,820

Total Taxes paid 73,820

29 Net Tax Payable/ (Refund) 700

Created on: 17/07/2023 17:42:30 Page 2 of 4

ANNEXURES

Annexure: Bank details

Name of bank IFSC/Swift code Account number

HDFC BANK(if any Refund, will be credited in this bank) HDFC0001216 50100110079512

Annexure: Salary

Sr.no. Particulars Rs. Rs.

1. Employer's Name: SOCIAL BEAT DIGITAL MARKETING LLP

Gross salary 8,71,000

Less: Exempt allowances 87,000

Less: Professional Tax 2,400

Less: Entertainment Tax 0

Less: Standard deduction 50,000

Net Salary ( 1) 7,31,600

2. Employer's Name: VER SE INNOVATION PRIVATE LIMITED

Gross salary 1,40,012

Less: Exempt allowances 0

Less: Professional Tax 0

Less: Entertainment Tax 0

Less: Standard deduction 0

Net Salary ( 2) 1,40,012

Total Income from Salary 8,71,612

Annexure: Tax Deducted at Sources

TDS on Salary

TAN of Income Chargeable under Total Tax

Sr.no. Name of Employer

Employer salaries Deducted

SOCIAL BEAT DIGITAL MARKETING

1. CHES41065D 8,71,000 73,820

LLP

Total 73,820

Notes:

* Income from house property will be first setoff against current years income and balance loss to be carried forward as per

income tax provisions.

** BEL stands for Basic Exemption Limit.

www.taxbuddy.com

Created on: 17/07/2023 17:42:30 Page 3 of 4

Created on: 17/07/2023 17:42:30 Page 4 of 4

You might also like

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Taxation For Construction IndustryDocument32 pagesTaxation For Construction IndustryFrances Marie TemporalNo ratings yet

- A Guide To Local SEO PDFDocument170 pagesA Guide To Local SEO PDFshiva shuklaNo ratings yet

- Payslip details for Mr. Abhilash EDocument1 pagePayslip details for Mr. Abhilash Eabhilash eNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDuttaNo ratings yet

- Latest Tax CalculatIor 3.3.2Document16 pagesLatest Tax CalculatIor 3.3.2Bijender Pal Choudhary100% (3)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- BSNL Payslip February 2019Document1 pageBSNL Payslip February 2019pankajNo ratings yet

- Vodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021Document1 pageVodafone India Services Pvt. LTD.: Pay Slip For The Month of March 2021sanket shah100% (1)

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Ageeta AY 2018-2019: Computation of Income (ITR4)Document50 pagesAgeeta AY 2018-2019: Computation of Income (ITR4)pmcmbharat264No ratings yet

- Indian Income Tax Return Acknowledgement 2022-23: Assessment YearDocument2 pagesIndian Income Tax Return Acknowledgement 2022-23: Assessment Yeardattam venkateswarluNo ratings yet

- Fiserv December SalaryDocument1 pageFiserv December SalarySiddharthNo ratings yet

- Slip PDFDocument1 pageSlip PDFPratikDutta0% (1)

- DV360 DSP Programmatic Campaign Best PracticesDocument6 pagesDV360 DSP Programmatic Campaign Best PracticesAmarnath PNo ratings yet

- Invoice Flipkart MobileDocument1 pageInvoice Flipkart MobileAmarnath PNo ratings yet

- Summary 1689086671Document4 pagesSummary 1689086671Akshay SharmaNo ratings yet

- N01887estax2007 09Document2 pagesN01887estax2007 09api-3747051100% (1)

- GAMDOORDocument2 pagesGAMDOORRashpreet PandiNo ratings yet

- IT Returns 2021-22Document3 pagesIT Returns 2021-22srinivas maguluriNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- Chapter 1 - Hightech Single Step vs. Multi-Step Income StatementDocument2 pagesChapter 1 - Hightech Single Step vs. Multi-Step Income StatementvarshithagangavarapuNo ratings yet

- Computation 21 22Document1 pageComputation 21 22aarushi singhNo ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument2 pagesIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNo ratings yet

- Ay2022 23 Ujjawal Dhawan Apypd6567j ComputationDocument2 pagesAy2022 23 Ujjawal Dhawan Apypd6567j ComputationAkshat MittalNo ratings yet

- Kamlesh AY 2021-2022: Computation of Income (ITR4)Document2 pagesKamlesh AY 2021-2022: Computation of Income (ITR4)Varun AgarwalNo ratings yet

- Rabichakra/Ridarc J.V. Balance Sheet and Financial StatementsDocument8 pagesRabichakra/Ridarc J.V. Balance Sheet and Financial StatementsNayan MallaNo ratings yet

- Oho Shop CoiDocument5 pagesOho Shop CoiJAY K SHAH & ASSOCIATESNo ratings yet

- Computation 22-23 AyDocument2 pagesComputation 22-23 AysonuNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Riddhi Siddhi Grain StoreDocument9 pagesRiddhi Siddhi Grain StoreRavi KarnaNo ratings yet

- Sridhar BojiniDocument3 pagesSridhar BojiniSridhar BojiniNo ratings yet

- SlipDocument1 pageSlipPratikDuttaNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- COMPUTATIONDocument2 pagesCOMPUTATIONjaredford913No ratings yet

- Computation of Income - Wajid 2021-22Document2 pagesComputation of Income - Wajid 2021-22casadegorrasfashionllp1No ratings yet

- Problem Set 1Document4 pagesProblem Set 1Eric CauilanNo ratings yet

- India Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableDocument4 pagesIndia Ratings Assigns Vishal Infraglobal IND BB-' Outlook StableKishan PatelNo ratings yet

- Viridian Development Managers Pvt. Limited: Pay Slip For The Month of August 2018Document1 pageViridian Development Managers Pvt. Limited: Pay Slip For The Month of August 2018userabazNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Direct Tax SolutionsDocument8 pagesDirect Tax SolutionsGaurav SoniNo ratings yet

- Zaki Abdul Basit: Gain/Loss Statement AMOUNT (RS.) CGT Rate Tax Liability (RS.)Document1 pageZaki Abdul Basit: Gain/Loss Statement AMOUNT (RS.) CGT Rate Tax Liability (RS.)zaki Abadul BasitNo ratings yet

- Apr 2022Document1 pageApr 2022Rohit AdnaikNo ratings yet

- $RN8C7G2Document3 pages$RN8C7G2akxerox47No ratings yet

- HSBC AchievementsDocument9 pagesHSBC AchievementsArsen AbdyldaevNo ratings yet

- Comp FY 2019-2020Document2 pagesComp FY 2019-2020Tayal SahabNo ratings yet

- Payslip March 2022Document1 pagePayslip March 2022sunanda singhNo ratings yet

- Computation 1Document1 pageComputation 1Vishnu VardhanNo ratings yet

- Heads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation StatementDocument2 pagesHeads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation Statementsunit pattanayakNo ratings yet

- Consolidated Balance Sheet For Hindustan Unilever LTDDocument11 pagesConsolidated Balance Sheet For Hindustan Unilever LTDMohit ChughNo ratings yet

- Rajat Gaur's Payslip for January 2021Document1 pageRajat Gaur's Payslip for January 2021Rahul GaurNo ratings yet

- Nov PayslipDocument1 pageNov Payslipsuresh1.somisettyNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- Vinod Singh Computation Revised-3Document4 pagesVinod Singh Computation Revised-3vinodNo ratings yet

- Updated Excel Case StudyDocument4 pagesUpdated Excel Case Studydheerajvish1995No ratings yet

- Etisalat Fact SheetDocument1 pageEtisalat Fact SheetAyaz Ahmed KhanNo ratings yet

- Comp 22-23Document1 pageComp 22-23Rohit IrkalNo ratings yet

- Profits and Gains of Business or ProfessionDocument3 pagesProfits and Gains of Business or ProfessionKumar GajulaNo ratings yet

- Tax - Osman Gani - 22-23Document1 pageTax - Osman Gani - 22-23M N Sharif MintuNo ratings yet

- Top Star Polymer (PVT) Ltd. Final ReportDocument2 pagesTop Star Polymer (PVT) Ltd. Final ReportMuhammad Amin Muhammad AminNo ratings yet

- Marketing Report SampleDocument13 pagesMarketing Report SampleAmarnath PNo ratings yet

- Card Surrender or Cancellation Application DetailsDocument1 pageCard Surrender or Cancellation Application DetailsAmarnath PNo ratings yet

- Arun TNPSC Group 4Document2 pagesArun TNPSC Group 4Amarnath PNo ratings yet

- Distribute A231 - BKAT3033 - Tutorial 123 - QDocument7 pagesDistribute A231 - BKAT3033 - Tutorial 123 - QallyaNo ratings yet

- POI Submission GuidelinesDocument4 pagesPOI Submission Guidelinesswapna vijayNo ratings yet

- What Is BudgetDocument4 pagesWhat Is BudgetDhanvanthNo ratings yet

- I1040tt DFTDocument16 pagesI1040tt DFTVictor Hugo Padilla-VazquezNo ratings yet

- Introduction To Tax Ideology and PolicyDocument64 pagesIntroduction To Tax Ideology and PolicyfazrinbusirinNo ratings yet

- Problem 1 Communal PropertiesDocument11 pagesProblem 1 Communal PropertiesJuanaNo ratings yet

- Ucc Mock Board Exam 2021 Taxation 70Document15 pagesUcc Mock Board Exam 2021 Taxation 70Veronika BlairNo ratings yet

- Accounting Quiz BeeDocument83 pagesAccounting Quiz BeeMary Ingrid Arellano RabulanNo ratings yet

- Sandisk Storage Malaysia Sdn. BHDDocument1 pageSandisk Storage Malaysia Sdn. BHDJtech Connection EnterpriseNo ratings yet

- Vetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Document18 pagesVetan Deyak Praptra Vittiya Niyam Sangrah, Khand-5, Bhag-1 See Chapter 6 Para-108, Chapter 7 Para-131Arjun VermaNo ratings yet

- 49494898268471852-Invoice 9099156993Document1 page49494898268471852-Invoice 9099156993Hemant SharmaNo ratings yet

- Republic V RicarteDocument1 pageRepublic V RicarteReena MaNo ratings yet

- P00059591 InvoiceDocument2 pagesP00059591 InvoiceVijay SinghNo ratings yet

- Form 1040 SeniorDocument4 pagesForm 1040 SeniorStuti TiwariNo ratings yet

- Withholding Tax Statement Report Run On: Thursday, September 8, 2022 9:58:13 AMDocument1 pageWithholding Tax Statement Report Run On: Thursday, September 8, 2022 9:58:13 AMDDC&P INo ratings yet

- 3.concept of SupplyDocument3 pages3.concept of SupplyBhuvaneswari karuturiNo ratings yet

- Boat InvoiceDocument1 pageBoat Invoicelogeshkannan078No ratings yet

- Guide To Taxation of Employee Disability Benefits: Standard Insurance CompanyDocument26 pagesGuide To Taxation of Employee Disability Benefits: Standard Insurance CompanyJacen BondsNo ratings yet

- John Williams Age 42 Is A Single Taxpayer and He PDFDocument1 pageJohn Williams Age 42 Is A Single Taxpayer and He PDFhassan taimourNo ratings yet

- Report of Receipts and Disbursements: FEC Form 3Document371 pagesReport of Receipts and Disbursements: FEC Form 3Daniel StraussNo ratings yet

- Declaration for Remittance under Specified ListDocument1 pageDeclaration for Remittance under Specified ListSonu YadavNo ratings yet

- LectureDocument3 pagesLectureJimmy RecedeNo ratings yet

- Value-Added Tax (VAT) : Tan - Tandoc - Tubianosa - ReyesDocument19 pagesValue-Added Tax (VAT) : Tan - Tandoc - Tubianosa - ReyesJandrew TanNo ratings yet

- On July 1 2017 The Beginning of Its Fiscal YearDocument1 pageOn July 1 2017 The Beginning of Its Fiscal YearMuhammad ShahidNo ratings yet

- Steward Task EventsDocument40 pagesSteward Task EventsAeneas WoodNo ratings yet

- FX Income Worksheet For 2022: Generated: 2023-02-24, 04:31:42 ESTDocument1 pageFX Income Worksheet For 2022: Generated: 2023-02-24, 04:31:42 ESTGuillem Soler SuettaNo ratings yet

- Fiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order ToDocument2 pagesFiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order TominhaxxNo ratings yet

- Economics of Taxation 1Document13 pagesEconomics of Taxation 1Shivendra PrakashNo ratings yet