Professional Documents

Culture Documents

Launching A Real Estate Fund - PELR

Uploaded by

alagendraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Launching A Real Estate Fund - PELR

Uploaded by

alagendraCopyright:

Available Formats

pelawreport.

com

May 5, 2020

REAL ESTATE

Launching a Real Estate Fund: Key Strategies,

Structures and Terms (Part One of Two)

By John D. Reiss and Nathaniel Marrs, DLA Piper

The structural, operational, legal and Distinct Statutory Considerations”

compliance considerations relevant to (Aug. 13, 2019); “Private REITs and Other

sponsoring and managing private real estate Potential Investment Vehicles” (Aug. 27, 2019);

funds may be generally familiar for many and “Unique Fund Terms and Notable Tax

experienced professionals in the PE or private Items” (Sep. 3, 2019).

credit sectors. There are, however, various

characteristics unique to the real estate asset Real Estate Fund Strategies

class that a fund manager needs to consider

before expanding into a real estate strategy and Asset Classes

or launching a new real estate investment

management business. Those differences Private real estate fund managers typically

manifest at all stages of the real estate fund market their products and describe their

lifecycle. investment strategies according to a risk-

return spectrum that includes four primary

This article describes key features of real categories: “core,” “core-plus,” “value-add” and

estate funds and necessary considerations “opportunistic.”

for fund managers considering pursuing the

strategy anew. This first article in a two- Core is viewed as the least-risky strategy with

part series delineates real estate strategies the lowest return target (e.g., fully leased, high-

along the risk-return spectrum; distinguishes quality office buildings in primary markets),

between operator and allocator funds; with opportunistic being the riskiest strategy

identifies appropriate fund structures for with the highest return target (e.g., ground-

the various strategies; and describes certain up development of a new residential complex

other considerations. The second article will in a secondary market). Core strategies focus

detail relevant securities law considerations primarily on current income with relatively low

and registration requirements; special tax leverage. Further along the spectrum toward

considerations, particularly for U.S. tax-exempt opportunistic strategies, the focus becomes

investors and non‑U.S. investors; and various more on future cash flow and the potential for

other regulatory considerations. capital appreciation from the improvement

or development of properties – often

See our three-part series on PE real estate accompanied by higher amounts of leverage.

funds: “Structuring by Investor Type and

©2020 Private Equity Law Report. All rights reserved. 1

pelawreport.com

In addition, real estate funds – and real estate A final distinction among real estate funds is

investing generally – are often categorized between investing in debt and equity. Debt

by reference to the targeted asset class. funds might originate or acquire interests in

Some of the major real estate asset classes performing or non-performing mortgages,

include multifamily, industrial, office, retail for example, or in residential or commercial

and hospitality. More specialized real estate, mortgage-backed securities.

such as senior and student housing, has also

attracted significant investor interest over the See “How Fund Managers Can Navigate

last decade or so. Industrial has also been a hot Establishing Parallel and Debt Funds in

sector in recent years, while retail is generally Luxembourg in the Shadow of Brexit and

viewed as being under significant market Proposed E.U. Delegation Rules” (Jun. 14, 2018).

pressure from technological and consumer

preference trends (e.g., the decline of brick-

and-mortar stores). That pressure is only Closed‑ or Open‑End?

becoming more pronounced with the impact of

the current coronavirus pandemic. Private real estate funds can employ a

closed- or open-end structure. Closed-end

For more on the coronavirus pandemic, funds follow the familiar PE model with a

see “Former OCIE Private Funds Examiner limited fundraising period; investor capital

Forecasts Potential SEC Response to Fund commitments that are drawn down over time;

Manager Efforts During the Coronavirus a defined investment period and fund term;

Pandemic (Part One of Two)” (Apr. 14, 2020); and no ongoing subscription or redemption

and “Withstanding the Coronavirus Pandemic: rights.

Business Continuity and Other Operational

Risks (Part Three of Three)” (Apr. 7, 2020). Conversely, open-end real estate funds

generally have an indefinite life with evergreen

Another way real estate funds are potential for subscriptions and redemptions

distinguished is between “operator” funds (i.e., akin to hedge funds). Unlike typical

and “allocator” funds. Operator real estate hedge funds that have full up-front funding of

funds are offered by sponsors that themselves investor subscriptions, an open-end real estate

provide local operating or development fund may maintain a capital commitment/

services and expertise. In contrast, sponsors draw-down mechanism that allows the

offering allocator funds invest alongside local manager to put investor money to work more

operators or developers, typically through gradually.

joint ventures. Although operator funds have

become quite popular with investors in recent For another context in which sponsors

years, numerous allocator funds continue to confront those decisions, see “What Must a PE

be offered by many prominent real estate fund Sponsor Consider Before Launching a Private

sponsors that benefit from a preference among Credit Strategy? (Part One of Two)”

larger institutional investors for large sponsors (Feb. 4, 2020).

with established track records.

©2020 Private Equity Law Report. All rights reserved. 2

pelawreport.com

Issues With Open‑End Funds See “Correcting Alpha: Fundamental Flaws of

IRR and How Sponsors Can Avoid Distorted

With any open-end structure, the liquidity of Calculations (Part One of Two)” (Nov. 12, 2019).

the underlying investments and available cash

flow are key considerations. Given the relatively Appeal of Hybrid and Closed‑End

illiquid nature of most real estate investments, Funds

open-end structures tend to fit only with core

or core-plus strategies that generate sufficient In recent years there has been an increasing

cash flow to pay redemptions, or real estate number of hybrid funds and other vehicles,

debt funds with steady interest income or which combine some features of open- and

that invest in more liquid, real-estate-related closed-end funds. One example is “build-

securities. Open-end real estate funds also to-core” vehicles or funds that provide for

often have robust lockups; early redemption fee the long-term acquisition, development and

mechanisms; or the ability to defer redemption operation of properties. That example often

requests to, among other reasons, avoid the contains a built-in conversion feature investors

requirement to sell or refinance properties to can use after a property is fully developed

meet redemptions. to either retain their interests – usually on

different economic terms – or to sell their

In addition, valuation takes on added interests in the property.

significance for open-end funds, as investors

typically subscribe for and redeem interests See “Operational and Tax Challenges of Hybrid

in funds based on their net asset value (NAV). Funds” (Nov. 5, 2019).

That requires sponsors to maintain ongoing

calculations of the fair market value of Given all of the above, administering and

underlying investments through appraisals managing an open-end real estate fund is a

or other mark-to-market determinations. more complex undertaking that is generally

Similarly, open-end fund managers typically most attractive as a means to aggregate a large

earn management fees and any incentive fees number of assets over a significant period of

or carried interest based on a NAV calculation, time. As such, while the open-end structure

thereby resulting in the unrealized appreciation can be tempting and has some advantages,

of underlying investments playing a role in their the closed-end structure is often a better

determination. fit for smaller or emerging managers. Many

emerging fund managers also initially opt for

That approach to valuations is very different a deal-by-deal structure (i.e., single-asset joint

from a typical closed-end fund, where incentive ventures or managed accounts) to build a track

fees or carried interest are determined record and increase investor appetite for a first

based on the achievement of preferred commingled, discretionary fund.

returns calculated by reference to investor

distributions. Also, management fees in closed- See our three-part primer on deal-by-deal

end funds are calculated based on investor funds: “Structural Overview and Investor

commitments or invested capital, each of which Perceptions Affecting Adoption” (Feb. 18,

is determined without regard for any unrealized 2020); “Key Fundraising and Structural

appreciation of underlying investments. Considerations” (Feb. 25, 2020); and

©2020 Private Equity Law Report. All rights reserved. 3

pelawreport.com

“Balancing Deal Uncertainty Against Attractive are usually viewed by investors as part of a

Carry Opportunities” (Mar. 3, 2020). manager’s investment advisory function. Those

fees are normally subject to a management fee

Other Considerations offset of 50‑100%.

Fund Economics Affiliate Services

As with other types of private funds, a real Real estate fund managers, particularly

estate fund typically includes a management operator fund sponsors, often realize

fee and carried interest payable to the sponsor. additional revenue through the use of affiliates

to provide certain services for underlying

For closed-end funds, a common management real estate investments. Those services may

fee is 1.5% of capital commitments during the include property management; construction

investment period and 1.5% of invested capital and development management; and leasing or

thereafter. Carried interest or incentive fees brokerage services.

are typically 10‑20% of the fund’s profits, with

an average preferred return across all fund A key value proposition for vertically

types of 8‑9% and a GP catch-up (the GP/ integrated real estate fund sponsors that offer

LP split for which can also vary). European those types of affiliate services is that the

waterfalls – requiring a full return of capital services would otherwise need to be provided

plus preferred return before any carried by third parties but can be provided more

interest is paid to the sponsor – are relatively efficiently and effectively by those sponsor

customary, particularly for new sponsors. affiliates. As such, the fees are generally not

offset against the sponsor’s management fee.

See “How Different Waterfalls Affect GP

Receipt of Carried Interest (Part One of Two)” Despite potentially benefitting real

(Jun. 4, 2019). estate funds and their investors, affiliate

arrangements present a potential conflict

Management fees and carried interest of interest if a sponsor is incentivized to

vary widely for open-end funds, with the improperly maximize the additional revenue

management fee percentage typically starting streams for its own benefit and to the

lower than for closed-end funds and charged detriment of the fund. The SEC is also keenly

on the fund’s NAV. Also, open-end funds focused on the issue, and real estate managers

typically do not charge carried interest, or using affiliate service arrangements must

charge a rate – again, calculated on NAV ensure that specific and robust pre-investment

where applicable – that is lower than in the disclosure describing any affiliate services is

closed-end context. Like most private funds, included in fund marketing materials and their

fee discounts are often given to large or early Forms ADV, as applicable.

close investors.

See “Full Disclosure of Portfolio Company Fee

Finally, real estate funds may also have another and Payment Arrangements May Reduce Risk

category of fees (e.g., break-up, monitoring of Conflicts and Enforcement Action”

and director fees) relating to services that (Nov. 12, 2015).

©2020 Private Equity Law Report. All rights reserved. 4

pelawreport.com

In addition, it is advisable for sponsors to Leverage Opportunities

ensure – and have back-up data to support –

that fees paid by the fund to its affiliates are Finally, due largely to the production of

no less favorable to the fund than would be relatively durable cash flows, real estate

available from a third-party provider. investments can often be leveraged to a

greater extent than many other types of PE

Joint Venture Arrangements investments. Leverage may be incurred at the

asset level or at various levels above the asset

As noted above, the investment strategy for in a typical real estate investment’s capital

many real estate allocator funds often involves structure.

entering into joint ventures with third-party

operators or developers or, in the case of See “Five Obstacles When Negotiating NAV

operator funds, with third-party capital Facilities and Potential Ways to Overcome

providers (including allocator funds). Them (Part Two of Two)” (Mar. 24, 2020).

The party acting as the operator or developer As such, most limited partnership agreements

for the underlying properties may serve for real estate funds will contain leverage

as managing member and hold a 5‑10% restrictions that “look through” an investment’s

equity interest in the joint venture entity, capital structure and consider all sources of

with the right to earn fees and performance leverage from the asset on up. The extent to

compensation or “promote.” Although joint which leverage is restricted varies by strategy,

venture partners are typically unaffiliated with some core funds having a 30‑50% loan-

with the fund sponsor, those relationships and to-value (LTV) leverage limitation and some

additional fees should be adequately disclosed opportunity funds allowing for up to an 85%

to investors. LTV leverage limitation. Sometimes lower

LTV levels are required for an overall fund

In addition to financial due diligence, fund limitation, while higher levels may be allowed

sponsors are advised to vet potential joint for individual investments.

venture partners for anti-money laundering

(AML) issues. In addition, if an operator fund Real estate loans also often contain other

itself is acting as local operator or developer terms that are atypical compared to loans

for joint ventures, the additional fees and entered into in connection with most other

carried interest payable by the joint venture types of PE investments. For example, loans

partner are typically shared in whole or in part for development projects will often require

with the operator fund itself (as opposed to the completion guarantees to be provided by the

fund sponsor). fund, and loans for other types of projects will

require the fund to enter into environmental

For more on AML compliance, see “Lessons indemnity agreements and non-recourse

Private Fund Managers Can Learn From U.S. carveout guarantees. Those bespoke terms

Bancorp’s Settlement of AML Violations” must be addressed when formulating

(Apr. 26, 2018); and “Survey Reveals Concerns appropriate leverage limitations and related

About and Shortcomings With AML restrictions in the fund documents.

Compliance” (Nov. 16, 2017).

©2020 Private Equity Law Report. All rights reserved. 5

pelawreport.com

John D. Reiss is a partner in the New York office

of DLA Piper. He advises investment managers

on all aspects of private fund formation and

the establishment of managed accounts, as

well as regulatory and compliance matters

(particularly the Investment Advisers Act of

1940); management company structuring;

and general governance issues. In addition, he

represents sophisticated investors in connection

with private investments across numerous

alternative asset classes. His experience spans

real estate, PE, private credit, venture capital

and hedge fund strategies. He has also worked

on real estate joint ventures, PE secondary

transactions, asset management M&A and

registered funds.

Nathaniel Marrs is a partner in the Chicago

office of DLA Piper. He represents domestic

and international real estate fund sponsors

and other real estate owners and operators in

a variety of corporate transactions, including

the formation and structuring of PE real

estate funds and management companies,

joint ventures and operating companies. His

transactional experience includes real estate

portfolio and single-asset acquisitions and

dispositions; multi-jurisdictional M&A involving

real estate investment trusts; and strategic

investments in real estate investment managers

and other real estate companies.

The authors would also like to add a note of

thanks for the contributions to this article

made by their colleagues Rich Ashley, Adrienne

Scerbak and Katie LaKoma.

©2020 Private Equity Law Report. All rights reserved. 6

pelawreport.com

May 12, 2020

REAL ESTATE

Launching a Real Estate Fund: Important Tax,

Regulatory and Securities Law Considerations

(Part Two of Two)

By John D. Reiss and Nathaniel Marrs, DLA Piper

Although many regulatory and tax issues See “Roundtable Explores PE Trends Related

apply across the private funds industry, it is to Emerging Managers and Real Estate

important for fund managers to be aware of Investing (Part One of Two)” (May 21, 2019); and

idiosyncratic issues related to each type of “Symposium Highlights Portfolio Management

underlying fund asset. A fund strategy focused and Global Trends for Private Equity and Real

on real estate can raise unique, material issues Estate Funds” (Jul. 2, 2015).

during the entire fund lifecycle, but particularly

during the formation and fundraising phase. Registration Considerations

That includes certain tax issues for non‑U.S.

and U.S. tax-exempt investors that are Securities Act

implicated by owning real estate, as well as

registration obligations under securities laws Similar to a typical PE fund or hedge fund,

and related structuring considerations. private real estate funds are generally offered

to investors pursuant to a private placement

This two-part series details critical of the fund’s securities (i.e., interests in the

considerations for any fund manager fund) conducted pursuant to Rule 506(b) of

considering a real estate strategy. This second Regulation D under the Securities Act of 1933

article summarizes relevant securities laws and (Securities Act).

the corresponding registration requirements;

notable tax considerations for U.S. tax-exempt Real estate fund sponsors are now permitted

investors and non‑U.S. investors; and other to employ general solicitation pursuant to Rule

relevant regulatory considerations. The first 506(c) under the Securities Act (introduced

article identified several real estate strategies as part of the JOBS Act in 2012). Most larger

along the risk-return spectrum and the suitable sponsors do not prefer that approach for a

corresponding fund structures; distinguished number of reasons, however, including the

between operator and allocator funds; and heightened obligation for sponsors to verify

highlighted various other considerations when (e.g., through supporting documentation) the

establishing real estate funds. accredited investor status of their investors

(as opposed to relying on self-certifications

and a “reasonable belief” as to that status under

Rule 506(b)).

©2020 Private Equity Law Report. All rights reserved. 7

pelawreport.com

See “Seminar Provides Fund Managers with a When Registration Is Required

Roadmap for JOBS Act Compliance”

(Nov. 8, 2013); and “SEC JOBS Act Rulemaking By definition, an investment adviser provides

Creates Opportunities and Potential Burdens advice on the purchase and sale of securities.

for Private Funds Contemplating General If the fund invests in securities, then the

Solicitation and Advertising” (Jul. 18, 2013). fund’s sponsor would in most cases be deemed

to be providing advice – to the fund as its

Advisers Act client – about the purchase and sale of those

securities. Also, if an adviser’s “securities

Impact of Registration portfolios” meet certain assets under

management (AUM) – i.e., generally over $100

In addition to the issues surrounding a fund million AUM, or $150 million AUM if managing

making a securities offering of its interests to only private funds – registration under

investors, a real estate fund sponsor must also the Advisers Act is required. If those AUM

examine whether its funds invest in underlying thresholds are not met, then a state investment

securities. The answer to that threshold adviser registration may still be required.

question plays a critical role in determining

whether the fund’s sponsor or manager is A fee simple interest in real estate (e.g., 100%

required to register as an investment adviser ownership of an office building) is not deemed

under the Investment Advisers Act of 1940 to be a security. Other types of real-estate-

(Advisers Act) or with any states. related investments are likely to be considered

securities, however, such as:

Most PE sponsors are well aware that Advisers

Act registration is a meaningful undertaking • more passive minority stakes in real

in terms of time and resources. It requires the estate buildings or projects;

development of a comprehensive compliance • interests in publicly traded real estate

program and the appointment of a CCO, along operating companies or real estate

with public disclosure of a variety of aspects of investment trusts (REITs); and

the sponsor’s operations. It also subjects a fund • most debt investments.

sponsor to inspection by the SEC, and those

inspections can lead not only to deficiency Generally speaking, the lower the ownership

letters but also SEC enforcement actions. percentage and the less control an investor

has over a property, the more likely it is that

See “What Fund Managers Should Consider the investment would be deemed a security. As

When Hiring and Onboarding CCOs; such, the analysis of whether a real estate fund

Determining CCO Governance Structures (Part sponsor needs to register as an investment

Two of Three)” (Apr. 21, 2020); and “Benefits adviser under the Advisers Act centers on the

of Having a Dual‑Hatted GC/CCO, and nature of the sponsor’s targeted investments

Alternative Solutions for Fund Managers (Part and the degree of flexibility desired for future

One of Two)” (Apr. 30, 2019). investment in securities.

©2020 Private Equity Law Report. All rights reserved. 8

pelawreport.com

Whether the sponsor uses managed accounts and other liens on and interests in real estate.”

– as opposed to or in addition to commingled Historically, the SEC has interpreted that

funds – can also be an important consideration. provision to mean at least 55% of the fund’s

Another factor is whether registration would assets are in real estate investments, with at

be viewed as beneficial from a marketing least 25% of the remaining assets held in other

perspective. Notably, some investors (e.g., “real-estate related interests.”

public pension plans, particularly those

advised by larger consultants) have been The definition of “security” is co‑extensive

known to consider Advisers Act registration a under the Advisers Act and the Investment

prerequisite for investment. Company Act, and any real estate fund manager

should consider its Advisers Act status and that

See “Registration, Reporting, Disclosure and of its funds under the Investment Company

Operational Consequences for Fund Managers Act in tandem. For example, if the funds are

of the SEC’s New ‘Regulatory Assets Under relying on Section 3(c)(1) or 3(c)(7) under the

Management’ Calculation” (Mar. 1, 2012). Investment Company Act, it may be difficult

to also assert that the fund manager is not

Investment Company Act advising on the purchase and sale of securities

for purposes of the Advisers Act.

In all cases, private real estate fund sponsors

will want to avoid registration of the fund In addition, the interplay between the Advisers

itself as an investment company under the Act and the Investment Company Act may also

Investment Company Act of 1940 (Investment have practical implications for who can invest

Company Act), even if the sponsor is a in a manager’s funds. For example, investors in

registered investment adviser. any fund managed by a registered adviser that

charges a performance fee must be “qualified

If the fund invests only in real estate (i.e., clients,” which is generally a higher standard

non-securities), then Investment Company than the “accredited investor” requirement

Act registration would not be required under Regulation D of the Securities Act. The

because the fund would not fall within the qualified client requirement is no additional

definition of an investment company under burden, however, for funds that require

the Investment Company Act. If the fund does investors to be “qualified purchasers” pursuant

invest in securities, it could rely on Section 3(c) to Section 3(c)(7) under the Investment

(1) or 3(c)(7) to avoid Investment Company Act Company Act, as any qualified purchaser is by

registration, as is generally the case with PE definition also a qualified client.

and hedge funds.

See “The Accredited Investor Definition:

Section 3(c)(5) of the Investment Company Act Proposed Changes and SEC Commissioner

provides an additional avenue for certain real Perspectives (Part One of Two)” (Mar. 3,

estate funds to avoid Investment Company Act 2020); and “SEC Order Increasing the Dollar

registration. Specifically, it excludes any entity Threshold for ‘Qualified Client’ Status Further

from the definition of investment company Chips Away at the Utility of the 3(c)(1) Fund

that is primarily engaged in the business of Structure” (Aug. 19, 2011).

“purchasing or otherwise acquiring mortgages

©2020 Private Equity Law Report. All rights reserved. 9

pelawreport.com

Similarly, a real estate fund manager should For coverage of UBTI issues in the private

carefully consider where and how investments credit context, see “Four Common Fund

in its funds may be made by its principals and Structures to Mitigate ECI Risks When a PE

employees in light of those securities regimes Sponsor Launches a Private Credit Strategy

and the “knowledgeable employee” definition (Part Two of Two)” (Feb. 11, 2020); and “Direct

in Rule 3c‑5 under the Investment Company Lending Funds: Five Structures to Mitigate Tax

Act. Specifically, the definition permits certain Burdens for Various Investor Types (Part Two

employees to invest in a sponsor’s 3(c)(7) funds of Two)” (Dec. 10, 2019).

without being qualified purchasers, and in

3(c)(1) funds of the sponsor without being The fractions rule does not work for all U.S.

counted for purposes of the 100‑person limit. tax-exempt investors, however, and UBTI can

The Advisers Act also includes similar relief also be generated by a real estate fund investing

from the qualified client requirement for those in properties with a significant operational

employees. component (e.g., hotels or senior housing) or

in dealer properties (e.g., condominiums). In

See “Ways Fund Managers Can Compensate those instances, a fund may be able to avoid

and Incentivize Partners and Top Performers” or minimize UBTI by owning the underlying

(Dec. 14, 2017); and “SEC Clarifies Scope of investments through one or more corporations

the ‘Knowledgeable Employee’ Exception for or private REITs, provided the REIT is not

Section 3(c)(1) and 3(c)(7) Funds” (Feb. 28, 2014). “pension-held,” including REITs used in

conjunction with other entities and structures

Tax Considerations (e.g., taxable REIT subsidiaries and structures

for senior living under the REIT Investment

Tax structuring for real estate funds is often Diversification and Empowerment Act).

more complex than for a typical PE fund,

particularly if a fund has U.S. tax-exempt or In all cases, a real estate fund structured as a

non‑U.S. investors. partnership for tax purposes must be careful to

avoid or carefully manage any debt for which

UBTI Issues the fund or its subsidiaries acts as borrower,

including fund subscription facilities.

One of the primary sources of “unrelated

taxable income” (UBTI) for U.S. tax-exempt See “Trends in the Use of Subscription

investors investing in a real estate fund is Credit Facilities: Structuring Considerations

taxable income generated by underlying Negotiated With Lenders and Important LPA

property investments subject to debt, known as and Side Letter Provisions (Part Two of Two)”

“debt-financed property.” One way for certain (Feb. 7, 2019).

types of qualified U.S. tax-exempt investors

(e.g., pension plans and college endowments) FIRPTA Regime

to avoid UBTI from debt-financed property

is by structuring the fund and its underlying Non‑U.S. investors investing in a real estate

investment vehicles to comply with a fund must pay careful attention to special tax

complicated set of tax allocation rules known as rules covered by the Foreign Investment in

the “fractions rule.” Real Property Tax Act of 1980 (FIRPTA). The

©2020 Private Equity Law Report. All rights reserved. 10

pelawreport.com

FIRPTA regime generally imposes U.S. federal controlled,” – i.e., less than 50% of the REIT’s

income tax on gains from the dispositions shares (by value) are directly or indirectly

of “U.S. real property interests” by certain owned by non-U.S. persons.

non‑U.S. investors, including on dispositions

of U.S. real property interests held directly or Finally, it is worth noting that a FIRPTA

through an entity treated as a partnership for exemption applies for “qualified foreign

tax purposes. Gains of non‑U.S. investors are pension funds,” which are entities wholly

taxed as though the investors were engaged in owned by qualified foreign pension funds

a trade or business and constitute income that and certain “qualified shareholders.” There

is effectively connected with the activity. are also special considerations for sovereign

government investors that qualify for certain

For more on FIRPTA, see “Tax Expert Provides beneficial treatment under Section 892 of the

Insight Into Recent U.S. Tax Court Decision Internal Revenue Code.

on Taxation of Foreign Investments in U.S.

Partnerships” (Dec. 7, 2017). See “PE Real Estate Funds: Structuring

by Investor Type and Distinct Statutory

The requirement to file a U.S. tax return and Considerations (Part One of Three)”

pay branch profits tax may also apply to certain (Aug. 13, 2019).

non‑U.S. corporate taxpayers. To avoid that

issue, a real estate fund may invest through Regulatory Considerations

one or more corporations, which may be

leveraged to effectively reduce the corporate A variety of regulatory considerations can apply

tax rate. Alternatively, the fund may invest to real estate funds depending on the fund’s

through private REITs, which are generally not specific strategy. For example, a fund focused

subject to U.S. federal income tax at the REIT on originating whole or mezzanine loans to be

level, provided the REIT distributes 100% of its made to U.S. borrowers will need to ensure it is

taxable income and certain other requirements complying with a variety of U.S. state-specific

are met. lender licensing regimes. There are, however,

two primary regulations that warrant particular

See “PE Real Estate Funds: Private REITs and attention from real estate fund managers.

Other Potential Investment Vehicles (Part Two

of Three)” (Aug. 27, 2019). ERISA

A distribution made by a REIT – to the extent The Employee Retirement Income Security Act

attributable to gains from dispositions of a of 1974 (ERISA) also bears on the structuring

U.S. real property interest (i.e., a capital gain of a real estate fund if at least 25% of the

dividend) – will generally be subject to FIRPTA, investors in any class of equity in the fund are

however, and considered effectively connected owned by “benefit plan investors” (as defined

income, subjecting non-U.S. investors to in ERISA). If the fund meets the 25% threshold,

U.S. federal income taxation and a U.S. filing the investment manager will be required to act

obligations. The sale of REIT shares is generally as a fiduciary of the benefit plan investors and

not taxable to non-U.S. investors under the could be prohibited from having the fund make

FIRPTA rules if the REIT is “domestically certain types of investments. As such, real

©2020 Private Equity Law Report. All rights reserved. 11

pelawreport.com

estate funds may limit investment by benefit invests in a fund structured to qualify as a

plan investors to avoid exceeding the 25% REOC. When this occurs, special ownership and

threshold. structuring rules need to be applied to both

vehicles.

See “Private Fund Industry Practice for Defining

‘Class of Equity Interests’ for Purposes of the 25 See “Happily Ever After? – Investment Funds

Percent Test Under ERISA” (Jul. 23, 2010). That Live With ERISA, for Better and for Worse

(Part One of Five)” (Sep. 4, 2014).

Another approach used by real estate fund

managers to avoid ERISA is to rely on the “real CFIUS

estate operating company” (REOC) exemption,

which requires at least 50% of the investments Real estate fund sponsors also need to

of a real estate fund, valued at cost, to be in understand the potential impact of regulations

real estate that is managed or developed, and promulgated by the Committee on Foreign

in which the fund has the right to substantially Investment in the U.S. (CFIUS). New CFIUS

participate directly in those management or regulations became effective on February

development activities. In addition, the fund 13, 2020, which strengthen CFIUS’ authority

must be actively engaged in those activities in and broaden its jurisdiction to review a wider

the ordinary course of its business. variety of U.S. investments, including non-

controlling investments in U.S. businesses and

To rely on the REOC exemption, a real estate real estate transactions.

fund must have management or development

rights in its first investment. REOC qualification Although the regulations may present more

must be established at the time of the first challenges for funds making other types of U.S.

investment, and no capital should be funded PE investments, they can also create issues for

for other purposes (e.g., paying fees or other funds making U.S. real estate investments that

expenses) without establishing a qualified are sponsored by non‑U.S. managers or that

escrow account to pay those amounts or have a significant non-U.S. investor base. That

take other special steps. The requirement is particularly the case if one or more of the

to manage or develop the real estate in the investments are in or near facilities that may

ordinary course of business may be met raise national security sensitivities, such as

through direct exercise of the applicable rights military bases or airports.

or through properly structured management

arrangements. See “Impact of FIRRMA on PE Funds: Recent

CFIUS Developments and Upcoming Changes”

The REOC exemption is often used in (May 7, 2019); and our two-part series:

conjunction with the “venture capital operating “Understanding the CFIUS Review Process and

company” (VCOC) exemption, which may be How to Structure Investments to Minimize

more familiar to sponsors of other types of PE Regulatory Risk” (Apr. 2, 2019); and “FIRRMA

funds. Layered VCOC/REOC structures are Expands the Scope of Transactions Subject to

formed when a fund structured to qualify as a CFIUS and Lengthens the Target Acquisition

VCOC (because at least 25% of its investors in Timeline” (Apr. 9, 2019).

any class of equity are benefit plan investors)

©2020 Private Equity Law Report. All rights reserved. 12

pelawreport.com

John D. Reiss is a partner in the New York office

of DLA Piper. He advises investment managers

on all aspects of private fund formation and the

establishment of managed accounts, as well as

regulatory and compliance matters (particularly

the Advisers Act); management company

structuring; and general governance issues. In

addition, he represents sophisticated investors

in connection with private investments

across numerous alternative asset classes. His

experience spans real estate, PE, private credit,

venture capital and hedge fund strategies. He

has also worked on real estate joint ventures, PE

secondary transactions, asset management M&A

and registered funds.

Nathaniel Marrs is a partner in the Chicago

office of DLA Piper. He represents domestic

and international real estate fund sponsors

and other real estate owners and operators in

a variety of corporate transactions, including

the formation and structuring of PE real

estate funds and management companies,

joint ventures and operating companies. His

transactional experience includes real estate

portfolio and single-asset acquisitions and

dispositions; multi-jurisdictional M&A involving

real estate investment trusts; and strategic

investments in real estate investment managers

and other real estate companies.

The authors would also like to add a note of

thanks for the contributions to this article

made by their colleagues Rich Ashley, Adrienne

Scerbak and Katie LaKoma.

©2020 Private Equity Law Report. All rights reserved. 13

You might also like

- Portfolio Management - Part 2: Portfolio Management, #2From EverandPortfolio Management - Part 2: Portfolio Management, #2Rating: 5 out of 5 stars5/5 (9)

- RealestatefundsguideDocument24 pagesRealestatefundsguideNikitha JhawarNo ratings yet

- Chap 10Document37 pagesChap 10Yc OngNo ratings yet

- Asset and Wealth Management EssayDocument3 pagesAsset and Wealth Management Essay뿅아리No ratings yet

- TW EU 2012 25068 Hedge Fund Investing Opportunities and ChallengesDocument44 pagesTW EU 2012 25068 Hedge Fund Investing Opportunities and Challengesps4scribdNo ratings yet

- Starting A Hedge Fund GrantThornton Stonegate Capital Dec 2011Document24 pagesStarting A Hedge Fund GrantThornton Stonegate Capital Dec 2011Felipe LimaNo ratings yet

- FIN - 605 - Lecture NotesDocument195 pagesFIN - 605 - Lecture NotesDebendra Nath PanigrahiNo ratings yet

- Leveraged BuyoutsDocument12 pagesLeveraged BuyoutsLeonardo100% (1)

- Understanding Mutual Funds: Types, Benefits and OrganizationDocument68 pagesUnderstanding Mutual Funds: Types, Benefits and OrganizationvinaydineshNo ratings yet

- ch001Document36 pagesch001isuru anjanaNo ratings yet

- Capitulo 12Document20 pagesCapitulo 12Daniel Adrián Avilés VélezNo ratings yet

- PAPER Comparative Analysis of Mutual Funds in Geojit Financial Services LTD GulbargaDocument9 pagesPAPER Comparative Analysis of Mutual Funds in Geojit Financial Services LTD GulbargaDr Bhadrappa HaralayyaNo ratings yet

- PPTs Fund Management DAlviaDocument35 pagesPPTs Fund Management DAlviaashabaman98No ratings yet

- What are Institutional InvestmentDocument13 pagesWhat are Institutional Investmentdivyanshi sethiNo ratings yet

- Absolute returns in any marketDocument20 pagesAbsolute returns in any marketLudwig CaluweNo ratings yet

- Kanchan YadavDocument14 pagesKanchan YadavNandini JaganNo ratings yet

- Removal of A Long-Term Asset From A Company's Financial RecordsDocument26 pagesRemoval of A Long-Term Asset From A Company's Financial RecordsRABIRAJ K (RA1811201010073)No ratings yet

- Chapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductionDocument10 pagesChapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductiontemedebereNo ratings yet

- Ackman RandomDocument18 pagesAckman RandomscribdhankNo ratings yet

- Why Invest in Private Equity?Document6 pagesWhy Invest in Private Equity?dracode01No ratings yet

- Institutional investors' impact on financial market efficiency and stabilityDocument9 pagesInstitutional investors' impact on financial market efficiency and stabilityab2oNo ratings yet

- Comparitive Analysis of Portfolio Management in Different Sectors of The Financial Markets, Equity Portfolio Management ServicesDocument29 pagesComparitive Analysis of Portfolio Management in Different Sectors of The Financial Markets, Equity Portfolio Management ServicesKirann PatekarNo ratings yet

- Structured Products OverviewDocument7 pagesStructured Products OverviewAnkit GoelNo ratings yet

- TerminologyDocument7 pagesTerminologyarjemNo ratings yet

- 02a Creating - An - Investment - Policy - StatementDocument16 pages02a Creating - An - Investment - Policy - StatementBecky GonzagaNo ratings yet

- Financial Management Term PaperDocument29 pagesFinancial Management Term PaperOmar Faruk100% (1)

- Separate Accounts vs. Commingled Funds: Similarities and Differences in The Context of Credit FacilitiesDocument4 pagesSeparate Accounts vs. Commingled Funds: Similarities and Differences in The Context of Credit FacilitiesMoiz SaeedNo ratings yet

- Asset Securitization in Asia: Ian H. GiddyDocument30 pagesAsset Securitization in Asia: Ian H. Giddy111No ratings yet

- QFIP-159-F23 Private Debt Fund Returns, Persistence, and Market ConditionsDocument54 pagesQFIP-159-F23 Private Debt Fund Returns, Persistence, and Market ConditionsNoodles FSA100% (1)

- Sources of Finance: Topic ListDocument46 pagesSources of Finance: Topic Listnitu mdNo ratings yet

- Real Estate Fund Formation Guide Part IDocument7 pagesReal Estate Fund Formation Guide Part IRoad Ammons100% (2)

- Types of CDOsDocument9 pagesTypes of CDOsKeval ShahNo ratings yet

- Chapter No. Title Weights (%) : Fund SchemeDocument18 pagesChapter No. Title Weights (%) : Fund SchemeNidheesh BabuNo ratings yet

- Mutual FundDocument47 pagesMutual FundSubhendu GhoshNo ratings yet

- Tutorial 1 SolutionsDocument4 pagesTutorial 1 SolutionsnatashaNo ratings yet

- Practical Law Marketing Private Equity Funds July 2014Document5 pagesPractical Law Marketing Private Equity Funds July 2014Larry411No ratings yet

- Solution Manual For Investments An Introduction 10th Edition by MayoDocument13 pagesSolution Manual For Investments An Introduction 10th Edition by MayoChristianLeonardqgsm100% (37)

- Combine Slide JFP463EDocument333 pagesCombine Slide JFP463EZuhairy ZakariaNo ratings yet

- SecuritisationDocument43 pagesSecuritisationRonak KotichaNo ratings yet

- A Guide To Investing in Private Equity and Private Real Estate FundsDocument10 pagesA Guide To Investing in Private Equity and Private Real Estate FundsSaurabh GuptaNo ratings yet

- Capital Structure: Some Legal and Policy IssuesDocument11 pagesCapital Structure: Some Legal and Policy IssuesthetaungNo ratings yet

- Promoting Longer-Term Investment by Institutional Investors: Selected Issues and PoliciesDocument18 pagesPromoting Longer-Term Investment by Institutional Investors: Selected Issues and PoliciesJumahardi BsNo ratings yet

- Assignment PortifolioDocument6 pagesAssignment PortifolioANGELA MSELUNo ratings yet

- Asset Management Guide for Portfolio GrowthDocument7 pagesAsset Management Guide for Portfolio GrowthHuzaifa AshNo ratings yet

- Statement of Financial Position and Statement of Cash Flows - HandoutDocument8 pagesStatement of Financial Position and Statement of Cash Flows - HandoutdesyanggandaNo ratings yet

- Innovations in financial marketsDocument112 pagesInnovations in financial marketsDipesh JainNo ratings yet

- Student Notes Chap 5Document7 pagesStudent Notes Chap 5Bhoomi GoyalNo ratings yet

- Slate Finance Overview 3.0.2Document20 pagesSlate Finance Overview 3.0.2Jesse Barrett-MillsNo ratings yet

- Chapter 13 - Equity Investment AnalysisDocument22 pagesChapter 13 - Equity Investment AnalysisCharlie Li0% (1)

- Property Development FinanceDocument37 pagesProperty Development Financebabydarien100% (1)

- Investments Guide to Elements, Asset Classes & MarketsDocument50 pagesInvestments Guide to Elements, Asset Classes & MarketsTrisha Kaira RodriguezNo ratings yet

- Introduction to Mutual Funds and Their ClassificationDocument70 pagesIntroduction to Mutual Funds and Their ClassificationRajesh BathulaNo ratings yet

- Explain The Scope, Importance, Features, Advantages and Disadvantages of Securitization (Special Purpose Vehicle)Document6 pagesExplain The Scope, Importance, Features, Advantages and Disadvantages of Securitization (Special Purpose Vehicle)somilNo ratings yet

- Chapter 1: Introduction: 1.1 BackgroundDocument34 pagesChapter 1: Introduction: 1.1 Backgroundkritika agarwalNo ratings yet

- Hedge Funds - in Emerging MarketsDocument75 pagesHedge Funds - in Emerging MarketsDipesh JainNo ratings yet

- UNIT-IV-Financing of ProjectsDocument13 pagesUNIT-IV-Financing of ProjectsDivya ChilakapatiNo ratings yet

- CH 05Document16 pagesCH 05Hanif MusyaffaNo ratings yet

- Pif18 Chapter-2 AllenoveryllpDocument5 pagesPif18 Chapter-2 AllenoveryllpJose GoncalvesNo ratings yet

- Capstone Project G-21Document23 pagesCapstone Project G-21Satpal SinghNo ratings yet

- Hedge Fund Leverage Counterparty NegotiationsDocument16 pagesHedge Fund Leverage Counterparty NegotiationsJason GoldenNo ratings yet

- Fund Structuring Beyond Just TheoriesDocument16 pagesFund Structuring Beyond Just TheoriesalagendraNo ratings yet

- PitchBook 2Q 2019 Analyst Note Blackstones C-Corp ConversionDocument4 pagesPitchBook 2Q 2019 Analyst Note Blackstones C-Corp ConversionalagendraNo ratings yet

- A Taxonomy of Digital AssetsDocument21 pagesA Taxonomy of Digital AssetsalagendraNo ratings yet

- BESS Schneider ElectricDocument4 pagesBESS Schneider ElectricalagendraNo ratings yet

- Smart Grids CaliforniaDocument47 pagesSmart Grids CaliforniaalagendraNo ratings yet

- Deal Structure NoteDocument15 pagesDeal Structure Notezohaib.patelNo ratings yet

- Masonry Brickwork 230 MMDocument1 pageMasonry Brickwork 230 MMrohanNo ratings yet

- Marijuana Grow Basics - Jorge CervantesDocument389 pagesMarijuana Grow Basics - Jorge CervantesHugo Herrera100% (1)

- LAC-Documentation-Tool Session 2Document4 pagesLAC-Documentation-Tool Session 2DenMark Tuazon-RañolaNo ratings yet

- COT EnglishDocument4 pagesCOT EnglishTypie ZapNo ratings yet

- Wika Type 111.11Document2 pagesWika Type 111.11warehouse cikalongNo ratings yet

- Tutorial 3Document2 pagesTutorial 3prasoon jhaNo ratings yet

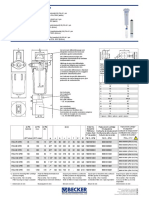

- Medical filter performance specificationsDocument1 pageMedical filter performance specificationsPT.Intidaya Dinamika SejatiNo ratings yet

- Lesson Plan 2018-2019 Term 1Document205 pagesLesson Plan 2018-2019 Term 1Athlyn DurandNo ratings yet

- Sheqxel Bbs Participation Dashboard TemplateDocument39 pagesSheqxel Bbs Participation Dashboard TemplateMuhammad Adytio DarmawanNo ratings yet

- MVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDocument4 pagesMVJUSTINIANI - BAFACR16 - INTERIM ASSESSMENT 1 - 3T - AY2022 23 With Answer KeysDe Gala ShailynNo ratings yet

- Electrocardiography - Wikipedia, The Free EncyclopediaDocument18 pagesElectrocardiography - Wikipedia, The Free Encyclopediapayments8543No ratings yet

- The Graduation Commencement Speech You Will Never HearDocument4 pagesThe Graduation Commencement Speech You Will Never HearBernie Lutchman Jr.No ratings yet

- Basic Calculus: Performance TaskDocument6 pagesBasic Calculus: Performance TasksammyNo ratings yet

- IT SyllabusDocument3 pagesIT SyllabusNeilKumarNo ratings yet

- JR Hydraulic Eng. Waterways Bed Protection Incomat BelfastDocument2 pagesJR Hydraulic Eng. Waterways Bed Protection Incomat Belfastpablopadawan1No ratings yet

- BSC6900 UMTS V900R011C00SPC700 Parameter ReferenceDocument1,010 pagesBSC6900 UMTS V900R011C00SPC700 Parameter Referenceronnie_smgNo ratings yet

- Mba Project GuidelinesDocument8 pagesMba Project GuidelinesKrishnamohan VaddadiNo ratings yet

- The Impact of Information Technology and Innovation To Improve Business Performance Through Marketing Capabilities in Online Businesses by Young GenerationsDocument10 pagesThe Impact of Information Technology and Innovation To Improve Business Performance Through Marketing Capabilities in Online Businesses by Young GenerationsLanta KhairunisaNo ratings yet

- Youth, Time and Social Movements ExploredDocument10 pagesYouth, Time and Social Movements Exploredviva_bourdieu100% (1)

- W1inse6220 PDFDocument11 pagesW1inse6220 PDFpicalaNo ratings yet

- SQL 1: Basic Statements: Yufei TaoDocument24 pagesSQL 1: Basic Statements: Yufei TaoHui Ka HoNo ratings yet

- Hardware Purchase and Sales System Project ProfileDocument43 pagesHardware Purchase and Sales System Project Profilesanjaykumarguptaa100% (2)

- E Learning: A Student Guide To MoodleDocument16 pagesE Learning: A Student Guide To MoodleHaytham Abdulla SalmanNo ratings yet

- PGP TutorialDocument21 pagesPGP TutorialSabri AllaniNo ratings yet

- Power Bi ProjectsDocument15 pagesPower Bi ProjectssandeshNo ratings yet

- Agricultural Sciences P1 Nov 2015 Memo EngDocument9 pagesAgricultural Sciences P1 Nov 2015 Memo EngAbubakr IsmailNo ratings yet

- Future Design of Accessibility in Games - A Design Vocabulary - ScienceDirectDocument16 pagesFuture Design of Accessibility in Games - A Design Vocabulary - ScienceDirectsulaNo ratings yet

- AJK Newslet-1Document28 pagesAJK Newslet-1Syed Raza Ali RazaNo ratings yet

- AC7114-2 Rev N Delta 1Document34 pagesAC7114-2 Rev N Delta 1Vijay YadavNo ratings yet

- Desarme Del ConvertidorpdfDocument7 pagesDesarme Del ConvertidorpdfDiego Orlando Santos BuitragoNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (34)

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)