Professional Documents

Culture Documents

Jalea 3891099030000000 12312023

Jalea 3891099030000000 12312023

Uploaded by

Jemie JaleaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jalea 3891099030000000 12312023

Jalea 3891099030000000 12312023

Uploaded by

Jemie JaleaCopyright:

Available Formats

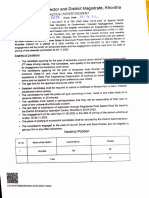

Republic of the Philippines

For BIR BC S/ Department of Finance

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Certificate of Compensation

2316

January 2018 (ENC S)

Payment/Tax Withheld

For C ompensation P ayment With or Without Tax Withheld 2316 01/18ENC S

Fill in all applicable spaces. Mark all appropriate boxes with an "X".

1 For the Year 2 For the P eriod

2 0 2 3 0 1 0 1 0 5 0 3

(YYYY) From (MM/DD) To (MM/DD)

Part I - Employee Information Part IV-B Details of Compensation Income & Tax Withheld from Present Employer

3 TIN

3 8 9 - 1 0 9 - 9 0 3 - 0 0 0 0 A. NON-TAXABLE/EXEMPT COMPENSATION INCOME Amount

4 Employee's Name (Last Name, First Name, Middle Name) 5 RDO C ode 27 Basic Salary (including the exempt P 250,000

& below)

Jalea, Jemie Rose Pauline, Pangantijon or the Statutory Minimum Wage of the MWE

28 Holiday P ay (MWE)

6 Registered Address 6A ZIP C ode

29 Overtime P ay (MWE)

6B Local Home Address 6C ZIP C ode

30 Night Shift Differential (MWE)

6D Foreign Address

31 Hazard P ay (MWE)

32 13th Month P ay and Other Benefits 2,879.66

7 Date of Birth (MM/DD/YYYY) 8 C ontact Number (maximum of P90,000)

0 9 2 9 1 9 9 6 33 De Minimis Benefits 4,821.84

9 Statutory Minimum Wage rate per day 34 SSS, GSIS, P HIC & P AG-IBIG C ontributions 4,882.31

and Union Dues (Employee share only)

10 Statutory Minimum Wage rate per month

35 Salaries and Other Forms of C ompensation 0.00

Minimum Wage Earner (MWE) whose compensation is exempt from

11

withholding tax and not subject to income tax 36 Total Non-Taxable/Exempt C ompensation 12,583.80

Part II - Employer Information (P resent) Income (Sum of Items 27 to 35)

12 TIN 2 0 5 - 3 6 6 - 9 2 1 - 0 0 0 0 B. TAXABLE COMPENSATION INCOME REGULAR

13 Employer's Name

37 Basic Salary 35,346.02

CONCENTRIX CVG PHILIPPINES, INC.

14 Registered Address 14A ZIP C ode 38 Representation

1 2 2 6

39 Transportation

15 Type of Employer X Main Employer Secondary Employer

40 C ost of Living Allowance (C OLA)

Part III - Employer Information (P revious)

16 TIN

- - - 41 Fixed Housing Allowance

17 Employer's Name 42 Others (specify)

42A

18 Registered Address 18A ZIP C ode

42B

GF 14th to 25th Flr 6798 Ayal

SUPPLEMENTA RY

Part IV A - Summary

43 C ommission

19 Gross C ompensation Income from P resent 55,493.04

Employer (Sum of Items 36 and 50)

44 P rofit Sharing

20 Less: Total Non-Taxable/Exempt C ompensation 12,583.80

Income from P resent Employer (From Item 36)

45 Fees Including Director's Fees

21 Taxable C ompensation Income from P resent 42,909.24

Employer (Item 19 Less Item 20) (From Item 50) 0.00

46 Taxable 13th Month Benefits

22 Add: Taxable C ompensation Income from

0.00

P revious Employer, if applicable

47 Hazard P ay

23 Gross Taxable C ompensation Income 42,909.24

(Sum of Items 21 and 22)

48 Overtime P ay

24 Tax Due 0.00

49 Others (specify)

25 Amount of Taxes Withheld 0.00 49A OTHER TAXABLE INCOME 7,563.22

25A P resent Employer

25B P revious Employer, if applicable 0.00 49B

26 Total Amount of Taxes Withheld as adjusted 50 Total Taxable C ompensation Income

0.00 42,909.24

(Sum of Items 25A and 25B) (Sum of Items 37 to 49B)

I/We declare, under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to

the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information

as contemplated under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes.

51 EDENREY RAMOS Date Signed

P resent Employer/Authorized Agent Signature over P rinted Name

CONFORME:

52 Jalea Jemie Rose Pauline Pangantijon Date Signed

Employee Signature over P rinted Name Amount paid, if CTC

C TC /Valid ID No. P lace of

Date Issued

of Employee Issue

To be accomplished under substituted filing

I declare, under the penalties of perjury that the information herein stated are I declare, under the penalties of perjury that I am qualified under substituted filing of Income Tax Return

reported under BIR Form No. 1604-C which has been filed with the Bureau of (BIR Form No. 1700), since I received purely compensation income from only one employer in the Philippines

Internal Revenue. for the calendar year; that taxes have been correctly withheld by my employer (tax due equals tax withheld); that

the BIR Form No. 1604-C filed by my employer to the BIR shall constitute as my income tax return; and that BIR

EDENREY RAMOS Form No. 2316 shall serve the same purpose as if BIR Form No. 1700 has been filed pursuant to the provisions

53 of Revenue Regulations (RR) No. 3-2002, as amended.

P resent Employer/Authorized Agent Signature over P rinted Name

(Head of Accounting/Human Resource or Authorized Representative) 54 Jalea Jemie Rose Pauline Pangantijon

Employee Signature over P rinted Name

*NOTE: The BIR Data P rivacy is in the BIR website (www.bir.gov.ph)

You might also like

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)From EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Rating: 3 out of 5 stars3/5 (1)

- The Full Gaps DietDocument9 pagesThe Full Gaps Dietalina4891100% (1)

- Fac Simile Richiesta Risarcimento DirettoDocument2 pagesFac Simile Richiesta Risarcimento Direttog1and3No ratings yet

- La Función de ReroducciónDocument11 pagesLa Función de ReroducciónMaruu KesslerNo ratings yet

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Temporary Shelters Revenues World Summary: Market Values & Financials by CountryFrom EverandTemporary Shelters Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryFrom EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Direct Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandDirect Property & Casualty Insurance Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 2021-12-21 MedicalCertificate Shergil-Abelita PDFDocument1 page2021-12-21 MedicalCertificate Shergil-Abelita PDFVincent FerrerNo ratings yet

- Med Cert CentDocument1 pageMed Cert CentVincent FerrerNo ratings yet

- 2022-15 02 MedicalCertificate VincentFerrer1.pdfDocument1 page2022-15 02 MedicalCertificate VincentFerrer1.pdfVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Infeccion Urinario Aparato Urinario Anatomia AcabadoDocument53 pagesInfeccion Urinario Aparato Urinario Anatomia AcabadoInna hassel ArteagaNo ratings yet

- Proyecto de Investigación TocoshDocument12 pagesProyecto de Investigación TocoshYhojam Collado Valenzuela67% (3)

- Proyecto Lacteos WordDocument46 pagesProyecto Lacteos WordCristina Fo Dianderas100% (2)

- IP Ref List-MOST RECENT-8-2-13Document30 pagesIP Ref List-MOST RECENT-8-2-13BlaireNo ratings yet

- Índice: Recopilación de TemasDocument90 pagesÍndice: Recopilación de TemasMiriam De la CruzNo ratings yet

- NEA's Ra Today, Issue 4, July 3, 2021Document31 pagesNEA's Ra Today, Issue 4, July 3, 2021Los Angeles Daily NewsNo ratings yet

- XMXMXMXDocument8 pagesXMXMXMXDanila DuarteNo ratings yet

- 16 Launch Driver Boat Khalasi Posts Advt Details Collector Office OdishaDocument2 pages16 Launch Driver Boat Khalasi Posts Advt Details Collector Office OdishaGudu PandaNo ratings yet

- Comprehensive of Combined BA and BS-MD Medical ProgramsDocument15 pagesComprehensive of Combined BA and BS-MD Medical Programssonnynguyen208682100% (1)

- Profilaxis AntibióticaDocument17 pagesProfilaxis AntibióticaKatherine Guamán100% (1)

- Psicología SocialDocument100 pagesPsicología SocialYesenia HernandezNo ratings yet

- Elementos y Fases Del Caso de Abuso Sexual InfantilDocument2 pagesElementos y Fases Del Caso de Abuso Sexual InfantilMaria Victoria Mauad100% (1)

- Otitis Media AgudaDocument5 pagesOtitis Media AgudaLeila TapiaNo ratings yet

- Noelito Dela CruzDocument2 pagesNoelito Dela CruzGrey Gap TVNo ratings yet

- Laboratorio de Densidad - Lucy HernandezDocument7 pagesLaboratorio de Densidad - Lucy Hernandezlucy hernandezNo ratings yet

- Edital-Echm - 2020 - Fanfarra Do 7º RC MecDocument24 pagesEdital-Echm - 2020 - Fanfarra Do 7º RC MecFábio FerreiraNo ratings yet

- Question 8Document31 pagesQuestion 8Ehsan KhanNo ratings yet

- WUSCHEL-related Homeobox Family Genes in Rice ContDocument9 pagesWUSCHEL-related Homeobox Family Genes in Rice ContErika MatiasNo ratings yet

- Practica 6 Oropeza Tapaia Raymundo JosueDocument15 pagesPractica 6 Oropeza Tapaia Raymundo JosueRaymundo Oropeza TapiaNo ratings yet

- La Estructura Del Deporte en El Ambito Internacional - Crespo - Valencia 2004 PDFDocument42 pagesLa Estructura Del Deporte en El Ambito Internacional - Crespo - Valencia 2004 PDFFredd6969No ratings yet

- Módulo 2 - Nutrición ParenteralDocument38 pagesMódulo 2 - Nutrición ParenteralalbertoNo ratings yet

- Reflexionamos Sobre El Uso de La Tecnología, Promoviendo La Innovación y CreatividadDocument58 pagesReflexionamos Sobre El Uso de La Tecnología, Promoviendo La Innovación y CreatividadAldair Pascual PaucarNo ratings yet

- Neu-Team Erkhes Und Max-DugongDocument5 pagesNeu-Team Erkhes Und Max-DugongerkhessuperNo ratings yet

- Pure Water SpecDocument2 pagesPure Water SpecRisma Berliana PanjaitanNo ratings yet

- Taller O.VDocument4 pagesTaller O.VVe SaNo ratings yet

- ZORTRAX Support Center Troubleshooting-Extrusion-ProblemsDocument18 pagesZORTRAX Support Center Troubleshooting-Extrusion-ProblemsLuis PalenzuelaNo ratings yet

- Hyderabadi CuisineDocument4 pagesHyderabadi CuisineponavnitNo ratings yet