Professional Documents

Culture Documents

Mutual Fund Holding Report - June23 - IDBI Cap - 110723 - EBR

Uploaded by

RPOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mutual Fund Holding Report - June23 - IDBI Cap - 110723 - EBR

Uploaded by

RPCopyright:

Available Formats

We welcome your support in Asiamoney Brokers Poll.

Please CLICK HERE to vote. 11 July 2023

Mutual Fund – Monthly Report

June 2023

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Mutual Fund Monthly Commentary

Mutual Fund Industry flows: In June’23 net outflow for the industry was at Rs2,022Cr as against net

inflow of Rs57,420Cr in May’23. Scheme wise, the flows were as follows:

Income/Debt Oriented Schemes : Net outflow in June’23 is Rs16,592Cr vs inflow of Rs44,107Cr in May’23.

Growth/Equity Oriented Schemes: Net inflow in June’23 is Rs8,245Cr vs inflow of Rs2,906Cr in May’23.

Flexi Cap Fund: Net outflow in June’23 is Rs17Cr vs outflow of Rs368Cr in May’23.

Hybrid Schemes: Net inflow in June’23 is Rs4,611Cr vs inflow of Rs6,093Cr in May’23.

Arbitrage Fund: Net inflow in June’23 is Rs3,366Ccr vs inflow of Rs6,640Cr in May’23.

Solution Oriented Schemes: Net outflow in June’23 is Rs1,249Cr vs outflow of Rs64Cr in May’23.

Gold ETF: Net inflow in June’23 is Rs70Cr vs inflow of Rs103Cr in May’23.

Other ETF: Net inflow in June’23 is Rs3,402Cr vs inflow of Rs4,524Cr in May’23.

FOF investing overseas: Net outflow in June’23 is Rs510Cr vs outflow of Rs248Cr in May’23.

Stocks specific action by mutual fund:

Major New addition: NIIT Learning Systems, IKIO Lighting, Ideaforge Tech, Cyient DLM, Kolte-Patil, PTC Ind,

Anup Eng, Transformers & Rectifiers, Indian Metals & Ferro, Anant Raj, Ambika Cotton Mills.

Major Exits: Nexus Select Mall, Sarda Energy & Minerals, Accelya Solutions, Lyka Labs, Aarti Surfactants,

Puravankara, TruCap Finance, Shipping Corporation Of India, Edelweiss Financial Services.

New NFO:

Growth/Equity Oriented Schemes: Funds mobilized from 6 newly launched Open-ended schemes (Value

Fund/Contra Fund, Focused Fund, Sectoral/Thematic Funds, ELSS & Flexi Cap Fund) were to the tune of

Rs 3,038Cr.

Hybrid Schemes: Funds mobilized from 1 newly launched Open-ended schemes (Multi Asset Allocation Fund)

were to the tune of Rs 112Cr.

Other Schemes: Funds mobilized from 4 newly launched Open-ended schemes (3 Index Fund & 1 Other ETFs)

were to the tune of Rs142Cr.

Equity Investments by Mutual Funds and FIIs

Domestic mutual funds were net equity buyer in June’23. Mutual Funds were net equity buyers to an amount of

Rs5,664Cr as against net buyer of Rs2,447Cr in May’23.

FIIs were net buyers in equity in June’23. FIIs were net equity buyers for an amount of Rs55,160Cr as against net

buyer of Rs41,207Cr in May’23.

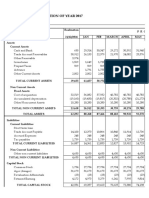

Month

Inflow / (Outflow) - Rs Crore

Jan-23 Feb-23 Mar-23 Apr-23 May-23 Jun-23

Income/Debt Oriented Schemes -9,733 -11,302 -54,472 105,704 44,107 -16,592

Liquid Fund -5,042 -11,304 -56,924 63,219 45,234 -28,545

Gilt Fund 6 588 6,366 988 -325 392

Growth/Equity Oriented Schemes 12,472 13,855 20,190 5,275 2,906 8,245

Multi Cap Fund 1,773 1,977 717 206 105 735

Large Cap Fund 716 354 911 53 -1,362 -2,050

Mid Cap Fund 1,628 1,817 2,129 1,791 1,196 1,749

Small Cap Fund 2,256 2,246 2,430 2,182 3,283 5,472

ELSS 1,391 952 2,657 36 -538 -510

Flexi Cap Fund 1,006 1,802 1,107 551 -368 -17

Hybrid Schemes 4,492 666 -12,372 3,317 6,093 4,611

Arbitrage Fund 2,055 65 -12,158 3,716 6,640 3,366

Solution Oriented Schemes 6,001 6,112 27,814 340 -64 -1,249

GOLD ETF -199 165 -267 125 103 70

Other ETFs -1,709 29 -331 6,790 4,524 3,402

Fund of funds investing overseas 50 50 173 -117 -248 -510

Total inflow/(Outflow) 11,373 9,575 -19,264 121,435 57,420 -2,022

Source: Accord Fintech,AMFI Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

SIP , Entry / Exits & Sector Trend

SIP Contribution (Rs Cr)

14,749

14,734

14,276

13,856

13,728

13,686

13,573

13,306

13,041

12,976

12,693

16,000

12,276

12,140

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

Nov-22

Feb-23

Sep-22

May-23

Oct-22

Aug-22

Jun-23

Jun-22

Jul-22

Apr-23

Mar-23

Dec-22

Jan-23

SIP Co ntribution (Rs Cr)

New Stock Added by Mutual Funds Jun-2023 (Based on Mkt Val) Exited by Mutual Funds Jun-2023 (Based on Market Value)

Market Value (Rs Cr) Market Value (Rs Cr)

Company Name Jun-23 Company Name Jun-23

NIIT Learning Systems Ltd. 373.83 Nexus Select Mall Management Pvt Ltd. 11.69

IKIO Lighting Ltd. 175.41 Sarda Energy & Minerals Ltd. 7.94

Ideaforge Technology Ltd. 127.94 Accelya Solutions India Ltd. 6.68

Cyient DLM Ltd. 100.01 Lyka Labs Ltd. 3.76

Kolte-Patil Developers Ltd. 18.63 Aarti Surfactants Ltd. 0.82

PTC Industries Ltd. 15.15 Puravankara Ltd. 0.62

The Anup Engineering Ltd. 12.17 TruCap Finance Ltd. 0.38

Transformers & Rectifiers (India) Ltd. 1.99 Shipping Corporation Of India Ltd. 0.04

Indian Metals & Ferro Alloys Ltd. 1.38 Edelweiss Financial Services Ltd. 0.03

Anant Raj Ltd. 1.33

Ambika Cotton Mills Ltd. 0.89

Sectoral Changes

Mkt Val (Rs Cr) Abs. change (Rs Cr) Change %

Industry

Jun-22 Mar-23 May-23 Jun-23 MoM QoQ YoY MoM QoQ YoY

Aviation 2,887 6,132 7,751 8,813 1,063 2,681 5,926 13.7 43.7 205.3

Retail 37,531 40,050 45,770 51,035 5,264 10,984 13,503 11.5 27.4 36.0

Metals & Mining 48,039 53,696 55,164 61,326 6,162 7,629 13,287 11.2 14.2 27.7

Plastic Products 9,998 12,492 14,472 15,979 1,507 3,488 5,981 10.4 27.9 59.8

Pharmaceuticals 138,255 153,350 165,002 178,836 13,834 25,486 40,581 8.4 16.6 29.4

Agri 6,910 7,485 8,382 9,062 679 1,577 2,151 8.1 21.1 31.1

Power 40,933 50,930 52,625 56,401 3,776 5,471 15,468 7.2 10.7 37.8

Auto & Auto Ancillaries 151,138 184,702 206,978 221,682 14,704 36,980 70,544 7.1 20.0 46.7

Infrastructure 50,181 67,276 71,458 76,413 4,955 9,136 26,231 6.9 13.6 52.3

Capital Goods 42,882 59,252 67,908 72,370 4,463 13,119 29,488 6.6 22.1 68.8

Diamond & Jewellery 9,466 13,147 14,752 15,673 922 2,526 6,207 6.3 19.2 65.6

Consumer Durables 33,165 35,311 39,555 41,713 2,159 6,403 8,548 5.5 18.1 25.8

Telecom 46,591 51,263 56,844 59,535 2,691 8,272 12,944 4.7 16.1 27.8

Realty 15,802 18,986 22,251 23,239 988 4,253 7,436 4.4 22.4 47.1

Banking & Finance 567,651 699,640 752,846 781,804 28,958 82,164 214,153 3.9 11.7 37.7

Oil & Gas 132,045 140,023 149,278 154,504 5,226 14,480 22,459 3.5 10.3 17.0

FMCG 98,702 123,602 137,842 142,222 4,380 18,620 43,520 3.2 15.1 44.1

Construction Materials 46,787 58,365 62,545 64,457 1,912 6,092 17,670 3.1 10.4 37.8

Chemicals & Fertilisers 68,636 76,377 81,645 84,005 2,360 7,628 15,369 2.9 10.0 22.4

Textile 14,987 16,270 18,533 19,038 505 2,768 4,051 2.7 17.0 27.0

Shipping & Logistics 20,198 19,299 21,537 22,044 507 2,745 1,846 2.4 14.2 9.1

IT-Services 222,634 230,330 238,305 242,647 4,343 12,317 20,013 1.8 5.4 9.0

Media & Entertainment 9,103 10,553 11,105 10,372 -733 -181 1,269 -6.6 -1.7 13.9

Paper 654 700 694 628 -66 -72 -26 -9.5 -10.3 -4.0

Source: Accord Fintech,AMFI

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Fund Performance

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Axis Asset Management Company Ltd.

Fund House Details Investment Information Fund Statistics

AMC Name: Axis Asset Management Company Ltd. Fund Manager Jinesh Gopani Total Stocks: 328

Address: Axis House, 1st Floor, C-2, Wadia International Bench Mark NIFTY 50 Total Sectors: 27

Centre, Pandurang Budhkar Marg, Worli,Mumbai - Number of 42.0

P/E Ratio:

400 025 31

Schemes(Equity) P/B Ratio: 8.0

Website: www.axismf.com Avg. Market Cap (Rs. Cr.) 335,405 Div Yields (%) 1.1

Financial Details 5 Years History

Total AUM As On (Jun-23) 252,800 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 148,792 Total AUM (Rs Cr) 228,261 253,772 190,841 115,936 87,746

M-o-M % Total AUM Growth 0.5 Equity AUM (Rs Cr) * 130,593 144,273 101,996 52,309 43,457

M-o-M % Equity AUM Growth 4.9 Returns (%) -4.6 12.1 46.7 -10.6 6.5

YoY % Total AUM Growth 10.7 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 17.4 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.6

In 6 2022-2023 -10.7 10.0 1.5 -3.8

Out 5 2021-2022 8.7 10.6 1.1 -3.0

No Change %age 322 27 2020-2021 12.2 7.5 19.0 3.5

Top 10 New Addition 2019-2020 3.0 2.2 3.9 -17.6

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Solar Industries India Ltd. 0.12 171.02 457,237 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Timken India Ltd. 0.05 76.62 223,797 Bajaj Finance Ltd. 7.0 10,316 7159.3 44.4 9.0

Ideaforge Technology Ltd. 0.01 11.99 178,464 Avenue Supermarts Ltd. 5.5 8,051 3889.8 95.7 14.8

One97 Communications Ltd. 0.01 11.96 137,781 ICICI Bank Ltd. 4.5 6,669 934.4 20.8 3.4

Ajanta Pharma Ltd. 0.00 5.48 37,053 Tata Consultancy Services Ltd. 4.2 6,106 3300.5 30.6 16.1

Castrol India Ltd. 0.00 4.94 408,848 HDFC Bank Ltd. 3.7 5,381 1701.8 21.0 3.3

Cholamandalam Investment and Finance Company3.1

Ltd. 4,608 1141.8 35.5 6.6

Info Edge (India) Ltd. 2.6 3,843 4482.4 136.0 5.1

Kotak Mahindra Bank Ltd. 2.6 3,793 1847.2 33.9 4.5

Pidilite Industries Ltd. 2.6 3,745 2597.7 105.0 18.6

Top 10 Exits Nestle India Ltd. 2.5 3,599 22883.0 85.4 68.1

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Indian Bank 0.0 13.72 508,381 1 YR High 1 YR Low

Hindustan Zinc Ltd. 0.0 10.52 343,910 Banking & Finance 29.8 33.0 29.8

IT-Services 12.3

L&T Finance Holdings Ltd. 0.0 1.30 124,936 16.6 12.3

Auto & Auto… 9.5

Sun TV Network Ltd. 0.0 0.67 15,000 9.5 6.3

Chemicals &… 8.6

Apollo Tyres Ltd. 0.0 0.14 3,500 8.8 7.5

Pharmaceuticals 8.0

8.2 6.9

Retail 6.8

8.9 6.5

FMCG 4.1

4.1 3.1

Construction… 3.3

3.8 2.8

Oil & Gas 2.6

3.5 2.1

Capital Goods 2.1

Asset Allocation 2.1 0.8

Type Fund Category (Equity) Best Returns Worst Returns

Equity 58.9 92.9 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 32.6 0.6 Month 21-06-2023 5.3 3.6 26-06-2023 2.5 1.0

Cash 0.0 0.0 Quarter 28-06-2023 14.1 11.9 03-04-2023 -3.9 -4.6

Other 8.5 6.5 YTD 30-06-2023 8.6 6.0 28-03-2023 -5.7 -6.4

PE Ratio PB Ratio

45.6 8.8

8.3

40.6

7.8

35.6 7.3

6.8

30.6 6.3

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Baroda BNP Paribas Asset Management India Pvt. Ltd.

Fund House Details Investment Information Fund Statistics

AMC Name: Baroda BNP Paribas Asset Management India Pvt. Ltd. Fund Manager Sanjay Chawla Total Stocks: 209

Address: Crescenzo, 7th Floor,G-Block, Bandra Kurla Bench Mark NIFTY 50 Total Sectors: 27

Complex,Mumbai - 400051 Number of 35.9

P/E Ratio:

17

Schemes(Equity) P/B Ratio: 6.7

Website: https://www.barodabnpparibasmf.in Avg. Market Cap (Rs. Cr.) 380,930 Div Yields (%) 1.2

Financial Details 5 Years History

Total AUM As On (Jun-23) 27,932 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 14,220 Total AUM (Rs Cr) 22,999 19,636 16,706 11,679 13,201

M-o-M % Total AUM Growth 0.1 Equity AUM (Rs Cr) * 12,366 10,584 7,182 4,224 5,028

M-o-M % Equity AUM Growth 10.5 Returns (%) -0.3 13.6 48.8 -10.3 5.6

YoY % Total AUM Growth 39.0 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 43.5 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 10.1

In 23 2022-2023 -8.0 9.1 3.1 -2.5

Out 17 2021-2022 6.5 9.0 -0.2 -0.3

No Change %age 186 27 2020-2021 11.3 6.1 17.4 5.1

Top 10 New Addition 2019-2020 2.8 0.5 4.2 -16.4

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Birla Corporation Ltd. 0.52 73.30 591,000 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

JTEKT India Ltd. 0.22 31.70 2,220,383 HDFC Bank Ltd. 7.4 1,052 1701.8 21.0 3.3

SJVN Ltd. 0.22 30.68 7,500,000 Reliance Industries Ltd. 5.1 728 2550.7 41.9 3.7

Affle (India) Ltd. 0.17 24.17 220,500 ICICI Bank Ltd. 4.8 680 934.4 20.8 3.4

Bajaj Electricals Ltd. 0.12 16.53 130,000 ITC Ltd. 4.1 583 451.7 30.9 8.6

Tata Communications Ltd. 0.11 15.95 100,000 Larsen & Toubro Ltd. 3.4 487 2474.5 43.8 4.8

Jindal Steel & Power Ltd. 0.08 11.48 197,500 Tata Consultancy Services Ltd. 3.0 426 3300.5 30.6 16.1

Indus Towers Ltd. 0.07 10.16 618,800 Bharti Airtel Ltd. 1.9 266 878.2 0.0 6.6

Indian Railway Finance Corporation Ltd.

0.07 9.81 3,000,000 Infosys Ltd. 1.8 255 1335.2 23.7 8.2

Solar Industries India Ltd. 0.07 9.35 25,000 IndusInd Bank Ltd. 1.7 240 1375.1 14.4 2.0

Top 10 Exits Zydus Lifesciences Ltd. 1.7 236 582.8 38.5 4.3

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Multi Commodity Exchange Of India Ltd.

0.1 10.13 69,600 1 YR High 1 YR Low

Shree Cement Ltd. 0.0 5.03 2,000 Banking & Finance 26.4 32.3 25.6

Auto & Auto… 10.4

L&T Finance Holdings Ltd. 0.0 3.53 339,112 10.3 8.7

FMCG 9.2

Polycab India Ltd. 0.0 3.42 10,000 9.4 7.5

Oil & Gas 8.6

ACC Ltd. 0.0 2.00 11,250 8.6 6.2

IT-Services 8.2

Samvardhana Motherson International0.0

Ltd. 1.39 175,500 12.1 8.2

Pharmaceuticals 6.9

Aurobindo Pharma Ltd. 0.0 1.32 20,000 8.3 6.1

Capital Goods 4.7

LTIMindtree Ltd. 0.0 1.05 2,100 4.7 2.5

Power 3.9

Mahanagar Gas Ltd. 0.0 0.85 8,000 3.9 2.3

Infrastructure 3.5

Rain Industries Ltd. 0.0 0.53 35,000 3.5 2.2

Retail 2.2

Asset Allocation 3.6 1.5

Type Fund Category (Equity) Best Returns Worst Returns

Equity 50.9 90.4 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 42.4 0.8 Month 21-06-2023 4.3 3.6 12-06-2023 2.4 1.6

Cash 0.0 0.0 Quarter 28-06-2023 11.5 11.9 03-04-2023 -2.8 -4.6

Other 6.7 8.8 YTD 30-06-2023 7.0 6.0 28-03-2023 -4.4 -6.4

PE Ratio PB Ratio

40.8 6.9

6.4

35.8

5.9

30.8 5.4

25.8 4.9

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Aditya Birla Sun Life AMC Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Aditya Birla Sun Life AMC Limited Fund Manager Mahesh Patil Total Stocks: 450

Address: One World Center , Tower 1, 17th Floor, Jupiter Mill Bench Mark NIFTY 50 Total Sectors: 29

Compound,Senapati Bapat Marg, Elphinstone Number of 36.9

P/E Ratio:

Road,Mumbai - 400 013 44

Schemes(Equity) P/B Ratio: 6.5

Website: https://mutualfund.adityabirlacapital.com/ Avg. Market Cap (Rs. Cr.) 282,616 Div Yields (%) 1.3

Financial Details 5 Years History

Total AUM As On (Jun-23) 301,751 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 121,283 Total AUM (Rs Cr) 261,547 281,248 259,831 202,420 239,533

M-o-M % Total AUM Growth 1.1 Equity AUM (Rs Cr) * 109,611 112,332 91,636 60,339 85,928

M-o-M % Equity AUM Growth 3.7 Returns (%) -3.5 15.5 65.6 -22.4 2.7

YoY % Total AUM Growth 15.6 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 19.9 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 11.8

In 5 2022-2023 -10.3 9.2 3.5 -3.9

Out 7 2021-2022 9.7 9.3 0.0 -1.5

No Change %age 445 29 2020-2021 17.1 9.0 20.6 6.6

Top 10 New Addition 2019-2020 -0.1 -1.8 4.6 -24.4

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

TD Power Systems Ltd. 0.13 155.67 6,300,000 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Tanla Platforms Ltd. 0.03 39.91 390,206 ICICI Bank Ltd. 7.3 8,788 934.4 20.8 3.4

Cyient DLM Ltd. 0.02 20.00 754,768 HDFC Bank Ltd. 5.2 6,238 1701.8 21.0 3.3

Ideaforge Technology Ltd. 0.01 11.99 178,464 Infosys Ltd. 5.0 6,029 1335.2 23.7 8.2

Somany Ceramics Ltd. 0.01 6.36 89,610 Reliance Industries Ltd. 3.7 4,463 2550.7 41.9 3.7

Axis Bank Ltd. 3.2 3,856 987.8 31.0 2.4

State Bank Of India 2.9 3,450 572.8 10.5 1.8

Housing Development Finance Corporation Ltd. 2.8 3,378 2821.5 31.5 3.8

Bharti Airtel Ltd. 2.5 3,048 878.2 0.0 6.6

Larsen & Toubro Ltd. 2.2 2,676 2474.5 43.8 4.8

Top 10 Exits Sun Pharmaceutical Industries Ltd. 2.0 2,369 1051.4 148.4 10.6

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Symphony Ltd. 0.0 16.81 198,262 1 YR High 1 YR Low

Amber Enterprises India Ltd. 0.0 14.93 70,513 Banking & Finance 33.4 34.3 30.1

IT-Services 11.6

Rallis India Ltd. 0.0 7.31 385,398 13.0 11.2

Auto & Auto… 7.8

Rain Industries Ltd. 0.0 5.29 346,500 7.8 6.3

Pharmaceuticals 7.6

Tatva Chintan Pharma Chem Ltd. 0.0 4.87 29,368 9.2 7.4

FMCG 5.3

Intellect Design Arena Ltd. 0.0 0.70 12,000 5.3 4.9

Oil & Gas 4.3

Care Ratings Ltd. 0.0 0.35 5,512 6.4 4.2

Consumer… 3.1

4.0 3.0

Construction… 2.8

3.0 2.6

Telecom 2.7

3.0 2.5

Chemicals &… 2.7

Asset Allocation 4.0 2.7

Type Fund Category (Equity) Best Returns Worst Returns

Equity 40.2 97.2 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 53.7 0.0 Month 21-06-2023 5.1 3.6 26-06-2023 2.7 1.0

Cash 0.0 0.0 Quarter 28-06-2023 13.4 11.9 03-04-2023 -4.2 -4.6

Other 6.1 2.8 YTD 30-06-2023 7.4 6.0 28-03-2023 -6.0 -6.4

PE Ratio PB Ratio Chemic

7.1

36.9 6.6

6.1

31.9

5.6

26.9 5.1

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Bank of India Investment Managers Private Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Bank of India Investment Managers Private Limited Fund Manager Alok Singh Total Stocks: 202

Address: B/204, Tower 1, Peninsula Corporate Bench Mark NIFTY 50 Total Sectors: 27

Park,Ganpatrao Kadam Marg, Lower Parel,Mumbai - Number of 35.7

P/E Ratio:

400 013 11

Schemes(Equity) P/B Ratio: 5.7

Website: https://www.boimf.in/ Avg. Market Cap (Rs. Cr.) 253,607 Div Yields (%) 1.3

Financial Details 5 Years History

Total AUM As On (Jun-23) 4,248 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 2,822 Total AUM (Rs Cr) 3,769 2,964 2,102 1,927 3,180

M-o-M % Total AUM Growth -4.6 Equity AUM (Rs Cr) * 2,357 1,911 1,299 813 1,113

M-o-M % Equity AUM Growth 7.0 Returns (%) -1.2 23.0 60.2 -14.3 -4.0

YoY % Total AUM Growth 57.3 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 56.0 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 11.6

In 9 2022-2023 -9.5 11.5 2.1 -3.5

Out 11 2021-2022 12.8 8.7 3.1 -1.0

No Change %age 193 27 2020-2021 12.0 14.9 13.5 7.7

Top 10 New Addition 2019-2020 -2.6 -0.3 3.4 -14.2

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Radico Khaitan Ltd. 0.67 18.81 155,651 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

PCBL Ltd. 0.56 15.90 977,000 HDFC Bank Ltd. 4.1 115 1701.8 21.0 3.3

KPIT Technologies Ltd. 0.51 14.44 132,500 ICICI Bank Ltd. 3.6 101 934.4 20.8 3.4

Endurance Technologies Ltd. 0.27 7.57 47,900 State Bank Of India 2.9 82 572.8 10.5 1.8

Cyient Ltd. 0.27 7.50 50,000 Canara Bank 2.3 66 301.8 5.7 0.9

Can Fin Homes Ltd. 0.20 5.67 73,000 Reliance Industries Ltd. 2.3 65 2550.7 41.9 3.7

Ingersoll-Rand (India) Ltd. 0.17 4.70 16,429 NTPC Ltd. 2.2 63 189.2 10.4 1.3

Elecon Engineering Company Ltd. 0.09 2.57 44,000 Axis Bank Ltd. 2.0 57 987.8 31.0 2.4

Indian Oil Corporation Ltd. 0.02 0.53 58,500 Larsen & Toubro Ltd. 2.0 57 2474.5 43.8 4.8

Balrampur Chini Mills Ltd. 1.8 51 385.0 28.0 2.7

Top 10 Exits Power Finance Corporation Ltd. 1.7 48 215.8 5.1 0.9

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Harsha Engineers International Ltd. 0.2 6.24 146,500 1 YR High 1 YR Low

Multi Commodity Exchange Of India Ltd.

0.2 5.41 37,200 Banking & Finance 28.1 30.0 21.8

Auto & Auto… 11.3

City Union Bank Ltd. 0.2 4.94 394,800 13.6 10.1

Pharmaceuticals 8.3

Astec Lifesciences Ltd. 0.2 4.31 30,920 8.6 7.0

Capital Goods 6.2

Central Depository Services (India) Ltd.0.1 3.12 30,000 6.2 3.8

IT-Services 5.7

Galaxy Surfactants Ltd. 0.1 2.96 12,000 7.3 3.7

Chemicals &… 4.8

NMDC Ltd. 0.1 1.61 151,000 7.4 4.8

Oil & Gas 4.5

Hindustan Copper Ltd. 0.0 1.02 90,000 5.5 3.2

Construction… 4.0

Steel Authority Of India Ltd. 0.0 0.70 85,255 4.3 2.8

Agri 3.8

Bata India Ltd. 0.0 0.39 2,475 4.8 1.8

Power 3.5

Asset Allocation 3.8 2.4

Type Fund Category (Equity) Best Returns Worst Returns

Equity 66.4 96.9 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 27.8 0.1 Month 21-06-2023 5.5 3.6 30-05-2023 2.8 3.1

Cash 0.0 0.0 Quarter 28-06-2023 13.5 11.9 03-04-2023 -3.7 -4.6

Other 5.8 3.1 YTD 30-06-2023 7.9 6.0 28-03-2023 -5.3 -6.4

PE Ratio PB Ratio

7.6

45.3

40.3 6.6

35.3

5.6

30.3

25.3 4.6

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Canara Robeco Asset Management Company Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Canara Robeco Asset Management Company Limited Fund Manager Shridatta Bhandwaldar Total Stocks: 169

Address: Contruction House, 4th Floor,5 Walchand Hirachand Bench Mark NIFTY 50 Total Sectors: 28

Marg, Ballard Estate,Mumbai - 400 001 Number of 40.7

P/E Ratio:

13

Schemes(Equity) P/B Ratio: 6.8

Website: www.canararobeco.com Avg. Market Cap (Rs. Cr.) 342,342 Div Yields (%) 1.0

Financial Details 5 Years History

Total AUM As On (Jun-23) 70,849 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 59,632 Total AUM (Rs Cr) 62,438 49,771 29,876 15,774 15,481

M-o-M % Total AUM Growth 2.6 Equity AUM (Rs Cr) * 51,893 39,866 20,666 9,499 8,964

M-o-M % Equity AUM Growth 5.3 Returns (%) 0.9 19.8 69.5 -16.2 7.2

YoY % Total AUM Growth 44.6 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 51.0 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 11.9

In 4 2022-2023 -7.7 11.4 2.4 -2.9

Out 3 2021-2022 10.2 11.0 2.1 -1.7

No Change %age 165 28 2020-2021 15.7 11.0 18.1 8.2

Top 10 New Addition 2019-2020 1.0 -1.8 4.1 -19.0

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Bharat Dynamics Ltd. 0.13 78.42 700,000 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Dr. Lal Pathlabs Ltd. 0.12 73.66 326,000 HDFC Bank Ltd. 7.2 4,270 1701.8 21.0 3.3

Vijaya Diagnostic Centre Ltd. 0.08 45.62 965,000 ICICI Bank Ltd. 6.4 3,826 934.4 20.8 3.4

Coforge Ltd. 0.05 28.27 60,000 Reliance Industries Ltd. 4.7 2,789 2550.7 41.9 3.7

Infosys Ltd. 4.2 2,522 1335.2 23.7 8.2

Axis Bank Ltd. 2.8 1,694 987.8 31.0 2.4

Bajaj Finance Ltd. 2.8 1,661 7159.3 44.4 9.0

State Bank Of India 2.7 1,625 572.8 10.5 1.8

Bharti Airtel Ltd. 2.6 1,555 878.2 0.0 6.6

Larsen & Toubro Ltd. 2.6 1,542 2474.5 43.8 4.8

Top 10 Exits Ultratech Cement Ltd. 2.3 1,344 8292.9 49.0 4.6

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Gland Pharma Ltd. 0.1 36.20 391,709 1 YR High 1 YR Low

Indian Energy Exchange Ltd. 0.0 18.38 1,201,467 Banking & Finance 31.9 33.6 30.5

Auto & Auto… 9.9

Bank Of Baroda 0.0 2.78 150,000 9.9 8.5

IT-Services 7.7

10.9 7.6

Pharmaceuticals 7.4

8.7 7.4

Oil & Gas 5.3

7.5 4.9

FMCG 5.2

5.4 3.8

Chemicals &… 4.3

5.2 4.2

Capital Goods 4.2

4.2 3.2

Construction… 3.9

3.9 2.4

Infrastructure 3.1

Asset Allocation 3.1 2.6

Type Fund Category (Equity) Best Returns Worst Returns

Equity 84.2 96.1 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 10.9 0.0 Month 07-06-2023 5.2 3.6 26-06-2023 3.1 1.0

Cash 0.0 0.0 Quarter 28-06-2023 13.7 11.9 03-04-2023 -3.3 -4.6

Other 5.0 3.9 YTD 30-06-2023 8.7 6.0 28-03-2023 -5.1 -6.4

PE Ratio PB Ratio

50.0

7.1

45.0

6.6

40.0 6.1

35.0 5.6

30.0 5.1

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

DSP Investment Managers Private Limited

Fund House Details Investment Information Fund Statistics

AMC Name: DSP Investment Managers Private Limited Fund Manager Vinit Sambre Total Stocks: 330

Address: Mafatlal Centre,10th Floor, Nariman Point,Mumbai - Bench Mark NIFTY 50 Total Sectors: 28

400 021 Number of 35.0

P/E Ratio:

26

Schemes(Equity) P/B Ratio: 5.9

Website: https://www.dspim.com/ Avg. Market Cap (Rs. Cr.) 246,916 Div Yields (%) 1.3

Financial Details 5 Years History

Total AUM As On (Jun-23) 122,936 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 72,426 Total AUM (Rs Cr) 107,067 105,958 97,412 66,155 76,439

M-o-M % Total AUM Growth 2.9 Equity AUM (Rs Cr) * 64,827 65,695 51,487 29,566 38,061

M-o-M % Equity AUM Growth 4.5 Returns (%) -1.6 13.6 64.3 -18.8 2.9

YoY % Total AUM Growth 22.3 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 21.9 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 11.7

In 4 2022-2023 -8.9 10.1 2.5 -3.3

Out 6 2021-2022 10.4 8.2 -0.3 -1.7

No Change %age 326 28 2020-2021 18.1 8.6 18.7 6.7

Top 10 New Addition 2019-2020 0.4 -0.5 4.7 -22.2

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

IIFL Finance Ltd. 0.38 272.04 5,379,987 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Cyient DLM Ltd. 0.03 20.00 754,768 ICICI Bank Ltd. 4.3 3,080 934.4 20.8 3.4

Fine Organic Industries Ltd. 0.00 2.99 6,123 HDFC Bank Ltd. 3.8 2,774 1701.8 21.0 3.3

Unichem Laboratories Ltd. 0.00 2.13 56,784 Bajaj Finance Ltd. 2.6 1,900 7159.3 44.4 9.0

Axis Bank Ltd. 2.4 1,734 987.8 31.0 2.4

Infosys Ltd. 2.0 1,462 1335.2 23.7 8.2

Alkem Laboratories Ltd. 1.9 1,342 3512.3 36.7 4.5

Ipca Laboratories Ltd. 1.7 1,254 742.2 37.9 3.3

State Bank Of India 1.6 1,133 572.8 10.5 1.8

Emami Ltd. 1.5 1,100 424.3 32.4 8.2

Top 10 Exits Supreme Industries Ltd. 1.4 1,012 3195.5 53.1 10.6

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

V-Mart Retail Ltd. 0.1 39.37 193,739 1 YR High 1 YR Low

L&T Finance Holdings Ltd. 0.0 26.77 2,570,112 Banking & Finance 25.6 27.5 25.6

Auto & Auto… 11.2

Himatsingka Seide Ltd. 0.0 15.61 1,660,187 11.2 9.7

Pharmaceuticals 10.1

Sanofi India Ltd. 0.0 3.77 5,548 10.1 8.2

Chemicals &… 7.1

Rain Industries Ltd. 0.0 1.12 73,500 8.0 7.1

IT-Services 7.0

Indiamart Intermesh Ltd. 0.0 0.59 2,100 8.9 7.0

FMCG 6.4

6.4 5.0

Capital Goods 5.3

5.3 2.3

Construction… 4.8

5.6 4.4

Oil & Gas 3.7

4.1 3.3

Consumer… 3.1

Asset Allocation 3.6 2.7

Type Fund Category (Equity) Best Returns Worst Returns

Equity 58.9 96.2 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 32.6 0.0 Month 21-06-2023 5.0 3.6 26-06-2023 2.8 1.0

Cash 0.0 0.0 Quarter 28-06-2023 13.0 11.9 03-04-2023 -3.7 -4.6

Other 8.5 3.8 YTD 30-06-2023 7.8 6.0 28-03-2023 -5.3 -6.4

PE Ratio PB Ratio Con

6.7

35.4

6.2

5.7

30.4

5.2

25.4 4.7

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

PGIM India Asset Management Private Limited

Fund House Details Investment Information Fund Statistics

AMC Name: PGIM India Asset Management Private Limited Fund Manager Vinay Paharia Total Stocks: 172

Address: 4th Floor, C Wing,Laxmi Towers, Bandra Kurla Bench Mark NIFTY 50 Total Sectors: 27

Complex, Bandra (East)Mumbai - 400 051 Number of 37.9

P/E Ratio:

9

Schemes(Equity) P/B Ratio: 6.9

Website: https://www.pgimindiamf.com Avg. Market Cap (Rs. Cr.) 354,633 Div Yields (%) 1.0

Financial Details 5 Years History

Total AUM As On (Jun-23) 23,447 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 18,626 Total AUM (Rs Cr) 21,437 17,477 7,109 3,765 5,968

M-o-M % Total AUM Growth 2.2 Equity AUM (Rs Cr) * 16,473 12,462 2,986 875 1,324

M-o-M % Equity AUM Growth 3.1 Returns (%) -0.7 15.5 56.5 -16.2 3.8

YoY % Total AUM Growth 38.0 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 50.3 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 8.6

In 8 2022-2023 -7.5 8.4 2.0 -2.0

Out 24 2021-2022 9.6 8.1 1.8 -2.4

No Change %age 164 27 2020-2021 16.2 9.8 16.5 6.0

Top 10 New Addition 2019-2020 1.4 -1.4 4.0 -19.2

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Divi's Laboratories Ltd. 0.34 63.25 176,500 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Aptus Value Housing Finance India Ltd.

0.29 53.99 2,175,000 ICICI Bank Ltd. 4.0 742 934.4 20.8 3.4

Go Fashion (India) Ltd. 0.15 27.68 243,500 Housing Development Finance Corporation Ltd. 3.9 732 2821.5 31.5 3.8

TeamLease Services Ltd. 0.12 22.97 92,124 Reliance Industries Ltd. 3.5 660 2550.7 41.9 3.7

Manappuram Finance Ltd. 0.01 2.38 180,000 Tube Investments of India Ltd. 2.9 539 3171.9 91.3 18.4

LIC Housing Finance Ltd. 0.01 1.26 32,000 Infosys Ltd. 2.9 537 1335.2 23.7 8.2

Jindal Steel & Power Ltd. 0.00 0.44 7,500 Max Healthcare Institute Ltd. 2.8 516 599.3 85.7 8.4

Tata Communications Ltd. 0.00 0.40 2,500 Indraprastha Gas Ltd. 2.5 468 473.1 23.4 4.8

Cholamandalam Investment and Finance Company2.3

Ltd. 429 1141.8 35.5 6.6

Jubilant FoodWorks Ltd. 2.2 410 501.1 89.1 14.8

Top 10 Exits Kotak Mahindra Bank Ltd. 2.1 399 1847.2 33.9 4.5

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

The Federal Bank Ltd. 0.9 168.82 13,479,021 1 YR High 1 YR Low

Indian Energy Exchange Ltd. 0.7 135.25 8,839,818 Banking & Finance 26.5 27.7 20.9

Auto & Auto… 16.4

Finolex Industries Ltd. 0.5 99.16 5,572,100 17.9 14.2

Pharmaceuticals 9.5

City Union Bank Ltd. 0.2 29.45 2,353,301 9.8 5.5

Oil & Gas 7.3

Coromandel International Ltd. 0.1 10.59 110,335 7.7 1.9

IT-Services 7.2

ACC Ltd. 0.1 9.29 52,250 11.2 6.4

Chemicals &… 6.3

IndusInd Bank Ltd. 0.0 5.67 44,100 6.3 3.5

FMCG 6.0

Rolex Rings Ltd 0.0 5.12 26,500 6.6 2.3

Consumer… 2.8

Voltas Ltd. 0.0 4.88 59,400 5.3 2.6

Construction… 2.7

Delta Corp Ltd. 0.0 4.08 168,000 5.6 2.0

Realty 2.2

Asset Allocation 3.5 1.5

Type Fund Category (Equity) Best Returns Worst Returns

Equity 79.4 95.4 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 8.4 0.2 Month 07-06-2023 4.1 3.6 26-06-2023 2.2 1.0

Cash 0.0 0.0 Quarter 28-06-2023 10.0 11.9 03-04-2023 -2.3 -4.6

Other 12.1 4.4 YTD 30-06-2023 6.4 6.0 28-03-2023 -3.6 -6.4

PE Ratio PB Ratio

43.1

7.1

6.6

38.1

6.1

33.1 5.6

5.1

28.1 4.6

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Edelweiss Asset Management Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Edelweiss Asset Management Limited Fund Manager Bhavesh Jain Total Stocks: 520

Address: Edelweiss HouseOff. C.S.T Road, Kalina,Mumbai - 400 Bench Mark NIFTY 50 Total Sectors: 29

098 Number of 38.3

P/E Ratio:

21

Schemes(Equity) P/B Ratio: 6.7

Website: www.edelweissmf.com Avg. Market Cap (Rs. Cr.) 290,159 Div Yields (%) 1.2

Financial Details 5 Years History

Total AUM As On (Jun-23) 130,198 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 22,195 Total AUM (Rs Cr) 125,221 92,212 56,142 24,047 11,555

M-o-M % Total AUM Growth 0.8 Equity AUM (Rs Cr) * 19,154 17,729 9,447 4,386 5,530

M-o-M % Equity AUM Growth 5.0 Returns (%) -1.5 13.1 61.5 -16.6 5.1

YoY % Total AUM Growth 34.5 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 34.3 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.6

In 2022-2023 -8.1 10.1 2.6 -3.4

Out 1 2021-2022 9.1 8.6 1.6 -2.1

No Change %age 520 29 2020-2021 13.5 9.7 19.4 7.6

Top 10 New Addition 2019-2020 1.5 -0.9 4.2 -20.3

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Reliance Industries Ltd. 4.3 945 2550.7 41.9 3.7

ICICI Bank Ltd. 4.2 924 934.4 20.8 3.4

Housing Development Finance Corporation Ltd. 4.0 892 2821.5 31.5 3.8

ITC Ltd. 2.6 572 451.7 30.9 8.6

HDFC Bank Ltd. 2.2 495 1701.8 21.0 3.3

Axis Bank Ltd. 2.2 482 987.8 31.0 2.4

State Bank Of India 2.0 441 572.8 10.5 1.8

Infosys Ltd. 1.7 382 1335.2 23.7 8.2

Larsen & Toubro Ltd. 1.7 381 2474.5 43.8 4.8

Top 10 Exits Cummins India Ltd. 1.7 367 1942.6 46.5 9.8

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Railtel Corporation Of India Ltd. 0.0 8.28 700,000 1 YR High 1 YR Low

Banking & Finance 29.5 31.0 28.0

Auto & Auto… 8.7

9.7 7.1

Pharmaceuticals 8.2

8.2 6.3

IT-Services 7.5

10.1 7.5

FMCG 6.3

6.3 4.6

Oil & Gas 5.0

6.9 4.9

Metals & Mining 4.5

4.9 3.6

Construction… 4.2

4.5 2.3

Chemicals &… 3.9

5.5 3.9

Capital Goods 3.7

Asset Allocation 4.9 3.2

Type Fund Category (Equity) Best Returns Worst Returns

Equity 17.0 97.2 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 59.3 0.1 Month 21-06-2023 5.4 3.6 26-06-2023 3.0 1.0

Cash 0.0 0.0 Quarter 28-06-2023 14.4 11.9 03-04-2023 -3.8 -4.6

Other 23.6 2.7 YTD 30-06-2023 8.3 6.0 28-03-2023 -5.6 -6.4

PE Ratio PB Ratio

42.5

7.4

37.5 6.9

6.4

32.5

5.9

27.5 5.4

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Navi AMC Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Navi AMC Limited Fund Manager Aditya Mulki Total Stocks: 276

Address: AMR Tech Park, Ground Floor,Municipal/ Khata No. Bench Mark NIFTY 50 Total Sectors: 29

826/792/46/23/1/24/1, Hongasandra Village Hosur Number of 36.5

P/E Ratio:

RoadBengaluru - 560068 11

Schemes(Equity) P/B Ratio: 6.1

Website: www.navimutualfund.com Avg. Market Cap (Rs. Cr.) 376,653 Div Yields (%) 1.2

Financial Details 5 Years History

Total AUM As On (Jun-23) 3,218 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 1,735 Total AUM (Rs Cr) 2,772 1,251 704 595 1,148

M-o-M % Total AUM Growth 2.6 Equity AUM (Rs Cr) * 1,497 922 542 438 695

M-o-M % Equity AUM Growth 2.1 Returns (%) -0.7 9.6 53.6 -20.2 6.5

YoY % Total AUM Growth 115.0 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 72.7 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.2

In 2022-2023 -8.6 11.2 3.2 -4.2

Out 2021-2022 7.2 9.6 1.2 -1.4

No Change %age 276 29 2020-2021 15.5 6.8 14.4 5.5

Top 10 New Addition 2019-2020 1.1 -0.4 3.5 -23.3

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

HDFC Bank Ltd. 8.0 138 1701.8 21.0 3.3

ICICI Bank Ltd. 7.6 131 934.4 20.8 3.4

Reliance Industries Ltd. 6.8 117 2550.7 41.9 3.7

Infosys Ltd. 4.0 70 1335.2 23.7 8.2

Housing Development Finance Corporation Ltd. 3.8 66 2821.5 31.5 3.8

Axis Bank Ltd. 3.7 65 987.8 31.0 2.4

Tata Consultancy Services Ltd. 2.6 45 3300.5 30.6 16.1

Kotak Mahindra Bank Ltd. 2.5 44 1847.2 33.9 4.5

State Bank Of India 2.5 44 572.8 10.5 1.8

Top 10 Exits ITC Ltd. 2.5 43 451.7 30.9 8.6

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

1 YR High 1 YR Low

Banking & Finance 38.4 38.4 32.6

IT-Services 9.8

14.6 9.8

Oil & Gas 7.8

12.5 7.8

Auto & Auto… 7.2

7.2 6.3

FMCG 6.2

6.5 5.3

Pharmaceuticals 6.1

7.4 6.0

Chemicals &… 3.6

3.8 2.5

Metals & Mining 2.7

3.1 2.6

Capital Goods 2.7

2.7 1.4

Infrastructure 2.2

Asset Allocation 2.5 1.8

Type Fund Category (Equity) Best Returns Worst Returns

Equity 53.9 99.9 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 3.5 0.1 Month 07-06-2023 5.3 3.6 26-06-2023 2.5 1.0

Cash 0.0 0.0 Quarter 28-06-2023 13.8 11.9 03-04-2023 -4.7 -4.6

Other 42.5 0.1 YTD 30-06-2023 8.0 6.0 28-03-2023 -5.8 -6.4

PE Ratio PB Ratio

42.1

7.4

37.1 6.9

6.4

32.1 5.9

5.4

27.1 4.9

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Franklin Templeton Asset Management (India) Private Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Franklin Templeton Asset Management (India) Private Limited

Fund Manager Anand Radhakrishnan Total Stocks: 239

Address: Indiabulls Finance Centre; Tower 2,12th and 13th Bench Mark NIFTY 50 Total Sectors: 28

Floor; Senapati Bapat Marg; Elphinstone Road Number of 34.6

P/E Ratio:

(W)Mumbai 400013 18

Schemes(Equity) P/B Ratio: 5.3

Website: www.franklintempletonindia.com Avg. Market Cap (Rs. Cr.) 315,462 Div Yields (%) 1.4

Financial Details 5 Years History

Total AUM As On (Jun-23) 71,657 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 56,888 Total AUM (Rs Cr) 64,421 65,152 79,465 87,154 121,459

M-o-M % Total AUM Growth 3.6 Equity AUM (Rs Cr) * 51,312 50,298 46,858 34,952 51,361

M-o-M % Equity AUM Growth 4.9 Returns (%) 1.8 16.1 79.0 -25.7 5.0

YoY % Total AUM Growth 21.7 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 25.0 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 10.1

In 8 2022-2023 -7.6 8.6 4.2 -1.3

Out 5 2021-2022 9.9 9.0 0.6 -2.7

No Change %age 231 28 2020-2021 18.2 8.4 24.1 9.0

Top 10 New Addition 2019-2020 -0.3 -3.7 4.3 -25.9

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

REC Ltd. 0.25 140.31 8,522,008 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

360 One Wam Ltd. 0.22 123.47 2,713,645 ICICI Bank Ltd. 6.9 3,890 934.4 20.8 3.4

Page Industries Ltd. 0.15 82.82 22,000 HDFC Bank Ltd. 6.5 3,635 1701.8 21.0 3.3

Ujjivan Small Finance Bank Ltd. 0.08 42.38 11,181,469 Infosys Ltd. 3.6 2,008 1335.2 23.7 8.2

CE Info Systems Ltd. 0.06 33.26 275,923 Larsen & Toubro Ltd. 3.5 1,983 2474.5 43.8 4.8

HDFC Asset Management Company Ltd.

0.04 23.71 103,281 Bharti Airtel Ltd. 2.8 1,590 878.2 0.0 6.6

NLC India Ltd. 0.03 17.35 1,600,000 Axis Bank Ltd. 2.8 1,569 987.8 31.0 2.4

SKF India Ltd. 0.00 0.27 552 Reliance Industries Ltd. 2.6 1,452 2550.7 41.9 3.7

State Bank Of India 2.3 1,277 572.8 10.5 1.8

HCL Technologies Ltd. 1.9 1,049 1187.9 26.6 7.4

Top 10 Exits Deepak Nitrite Ltd. 1.3 724 2173.5 57.7 10.3

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Zydus Lifesciences Ltd. 0.1 57.76 1,150,000 1 YR High 1 YR Low

Hindustan Oil Exploration Company Ltd.

0.0 18.16 1,000,000 Banking & Finance 29.3 30.2 28.9

IT-Services 10.2

Sundaram Finance Ltd. 0.0 14.00 55,023 11.5 9.5

Auto & Auto… 7.2

Tata Chemicals Ltd. 0.0 9.71 100,000 8.5 7.1

FMCG 6.2

Puravankara Ltd. 0.0 0.62 75,000 6.7 5.6

Pharmaceuticals 5.9

7.4 5.8

Oil & Gas 5.3

5.5 4.3

Infrastructure 4.1

4.5 3.7

Consumer… 4.1

4.1 3.5

Capital Goods 3.9

3.9 2.2

Chemicals &… 2.9

Asset Allocation 3.3 2.9

Type Fund Category (Equity) Best Returns Worst Returns

Equity 79.4 94.1 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 8.8 0.0 Month 07-06-2023 4.8 3.6 26-06-2023 2.8 1.0

Cash 0.0 0.0 Quarter 28-06-2023 11.7 11.9 03-04-2023 -1.8 -4.6

Other 11.8 5.9 YTD 30-06-2023 8.6 6.0 28-03-2023 -3.4 -6.4

PE Ratio PB Ratio Chemic

38.7 5.8

33.7 5.3

28.7 4.8

23.7 4.3

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Apr-23

Dec-22

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

HDFC Asset Management Company Limited

Fund House Details Investment Information Fund Statistics

AMC Name: HDFC Asset Management Company Limited Fund Manager Chirag Setalvad Total Stocks: 626

Address: HDFC House, 2nd floor, H.T. Parekh Marg,165-166 Bench Mark NIFTY 50 Total Sectors: 30

Backbay Reclamation, ChurchgateMumbai - 400 020 Number of 34.0

P/E Ratio:

47

Schemes(Equity) P/B Ratio: 6.2

Website: www.hdfcfund.com Avg. Market Cap (Rs. Cr.) 326,961 Div Yields (%) 1.5

Financial Details 5 Years History

Total AUM As On (Jun-23) 502,476 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 250,601 Total AUM (Rs Cr) 437,876 410,425 395,891 319,417 344,144

M-o-M % Total AUM Growth 1.8 Equity AUM (Rs Cr) * 219,197 190,137 155,480 109,788 148,532

M-o-M % Equity AUM Growth 5.2 Returns (%) 2.0 15.3 64.4 -26.1 7.0

YoY % Total AUM Growth 23.5 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 38.7 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.2

In 4 2022-2023 -6.8 10.9 5.0 -3.2

Out 5 2021-2022 9.5 9.8 -0.3 0.1

No Change %age 622 30 2020-2021 16.2 7.3 22.3 7.5

Top 10 New Addition 2019-2020 0.8 -4.6 3.9 -26.0

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

TD Power Systems Ltd. 0.06 140.14 5,671,260 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

IKIO Lighting Ltd. 0.02 38.01 869,621 ICICI Bank Ltd. 6.4 15,965 934.4 20.8 3.4

Cyient DLM Ltd. 0.01 20.00 754,768 HDFC Bank Ltd. 5.8 14,455 1701.8 21.0 3.3

Ideaforge Technology Ltd. 0.00 11.99 178,464 State Bank Of India 3.6 8,995 572.8 10.5 1.8

Infosys Ltd. 3.3 8,349 1335.2 23.7 8.2

Reliance Industries Ltd. 3.1 7,698 2550.7 41.9 3.7

Housing Development Finance Corporation Ltd. 3.0 7,481 2821.5 31.5 3.8

Axis Bank Ltd. 2.6 6,485 987.8 31.0 2.4

ITC Ltd. 2.5 6,361 451.7 30.9 8.6

Bharti Airtel Ltd. 2.5 6,236 878.2 0.0 6.6

Top 10 Exits Larsen & Toubro Ltd. 2.5 6,204 2474.5 43.8 4.8

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Thyrocare Technologies Ltd. 0.0 0.00 17 1 YR High 1 YR Low

Shilpa Medicare Ltd. 0.0 0.00 38 Banking & Finance 34.1 35.3 32.6

IT-Services 8.9

Edelweiss Financial Services Ltd. 0.0 0.00 629 10.0 8.9

Auto & Auto… 8.7

Greaves Cotton Ltd. 0.0 0.00 110 8.7 8.0

Pharmaceuticals 8.3

Wockhardt Ltd. 0.0 0.00 55 8.3 6.8

Oil & Gas 5.8

7.1 5.8

Capital Goods 5.0

5.0 4.2

Infrastructure 4.4

4.7 4.3

FMCG 4.0

4.5 3.8

Power 3.3

3.9 3.3

Telecom 3.3

Asset Allocation 3.3 2.4

Type Fund Category (Equity) Best Returns Worst Returns

Equity 49.9 93.2 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 43.5 0.0 Month 21-06-2023 5.3 3.6 26-06-2023 2.7 1.0

Cash 0.0 0.0 Quarter 28-06-2023 13.6 11.9 03-04-2023 -3.6 -4.6

Other 6.7 6.8 YTD 30-06-2023 8.8 6.0 28-03-2023 -5.2 -6.4

PE Ratio PB Ratio

37.6

6.6

6.1

32.6

5.6

27.6 5.1

4.6

22.6 4.1

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

HSBC Global Asset Management (India) Private Limited

Fund House Details Investment Information Fund Statistics

AMC Name: HSBC Global Asset Management (India) Private Limited Fund Manager Venugopal Manghat Total Stocks: 319

Address: 9-11 Floors, NESCO IT Park, Building No.3,Western Bench Mark NIFTY 50 Total Sectors: 29

Exp Highway, Goregaon (E)Mumbai - 400 063 Number of 38.0

P/E Ratio:

19

Schemes(Equity) P/B Ratio: 6.7

Website: www.assetmanagement.hsbc.com/in Avg. Market Cap (Rs. Cr.) 264,938 Div Yields (%) 1.1

Financial Details 5 Years History

Total AUM As On (Jun-23) 91,041 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 47,745 Total AUM (Rs Cr) 81,312 72,711 65,442 48,217 58,934

M-o-M % Total AUM Growth 2.9 Equity AUM (Rs Cr) * 42,896 39,297 34,244 23,392 34,587

M-o-M % Equity AUM Growth 4.3 Returns (%) -0.2 18.2 60.4 -21.7 0.3

YoY % Total AUM Growth 37.9 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 38.7 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 11.3

In 5 2022-2023 -9.0 10.0 2.4 -1.8

Out 10 2021-2022 8.7 9.7 1.6 -1.6

No Change %age 314 29 2020-2021 16.0 8.7 17.6 6.7

Top 10 New Addition 2019-2020 0.1 -2.3 3.7 -22.7

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Shriram Finance Ltd. 0.41 196.22 1,130,800 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

One97 Communications Ltd. 0.19 90.08 1,038,000 HDFC Bank Ltd. 3.8 1,794 1701.8 21.0 3.3

Sundaram-Clayton Ltd. 0.05 23.32 50,000 ICICI Bank Ltd. 3.3 1,554 934.4 20.8 3.4

Ideaforge Technology Ltd. 0.03 11.99 178,464 Reliance Industries Ltd. 2.4 1,124 2550.7 41.9 3.7

Metropolis Healthcare Ltd. 0.01 3.11 20,800 Larsen & Toubro Ltd. 2.3 1,101 2474.5 43.8 4.8

NTPC Ltd. 1.8 844 189.2 10.4 1.3

Infosys Ltd. 1.6 761 1335.2 23.7 8.2

Sun Pharmaceutical Industries Ltd. 1.5 705 1051.4 148.4 10.6

State Bank Of India 1.4 674 572.8 10.5 1.8

ITC Ltd. 1.3 642 451.7 30.9 8.6

Top 10 Exits Ratnamani Metals & Tubes Ltd. 1.3 638 2272.3 32.4 6.2

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

L&T Finance Holdings Ltd. 0.1 23.98 2,302,392 1 YR High 1 YR Low

Aditya Birla Capital Ltd. 0.0 13.70 804,600 Banking & Finance 21.2 23.4 18.8

Auto & Auto… 8.7

VIP Industries Ltd. 0.0 6.07 100,000 10.4 8.2

IT-Services 8.2

Union Bank Of India 0.0 5.69 800,000 9.2 6.5

Pharmaceuticals 7.8

RBL Bank Ltd. 0.0 5.51 340,000 8.4 7.1

Capital Goods 7.0

Chalet Hotels Ltd. 0.0 3.25 75,000 7.0 2.7

Infrastructure 5.4

Kansai Nerolac Paints Ltd. 0.0 2.95 100,268 5.4 3.5

FMCG 5.3

Rain Industries Ltd. 0.0 2.67 175,000 5.9 3.0

Construction… 4.9

Hindustan Copper Ltd. 0.0 2.17 192,000 5.0 4.2

Metals & Mining 4.1

Astral Ltd. 0.0 0.07 367 4.4 4.0

Consumer… 4.0

Asset Allocation 4.0 2.6

Type Fund Category (Equity) Best Returns Worst Returns

Equity 52.4 98.3 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 40.7 0.0 Month 21-06-2023 4.9 3.6 26-06-2023 2.6 1.0

Cash 0.0 0.0 Quarter 28-06-2023 12.9 11.9 03-04-2023 -2.2 -4.6

Other 6.8 1.7 YTD 30-06-2023 9.4 6.0 28-03-2023 -3.8 -6.4

PE Ratio PB Ratio Con

42.7 7.6

7.1

37.7 6.6

6.1

32.7

5.6

27.7 5.1

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

ICICI Prudential Asset Management Company Limited

Fund House Details Investment Information Fund Statistics

AMC Name: ICICI Prudential Asset Management Company Limited Fund Manager Sankaran Naren Total Stocks: 593

Address: One BKC, A - Wing 13th Floor,Bandra Kurla Complex, Bench Mark NIFTY 50 Total Sectors: 29

Bandra (East)Mumbai - 400 051 Number of 35.7

P/E Ratio:

69

Schemes(Equity) P/B Ratio: 6.2

Website: www.icicipruamc.com Avg. Market Cap (Rs. Cr.) 309,023 Div Yields (%) 1.5

Financial Details 5 Years History

Total AUM As On (Jun-23) 572,099 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 277,206 Total AUM (Rs Cr) 509,896 475,392 405,216 301,163 314,123

M-o-M % Total AUM Growth 2.4 Equity AUM (Rs Cr) * 252,530 217,692 161,070 105,185 128,893

M-o-M % Equity AUM Growth 3.9 Returns (%) 1.5 17.7 70.9 -23.7 6.8

YoY % Total AUM Growth 21.9 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 29.9 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.5

In 7 2022-2023 -7.2 9.7 4.0 -2.6

Out 7 2021-2022 10.4 10.9 0.0 -0.6

No Change %age 586 29 2020-2021 18.9 9.0 21.8 7.9

Top 10 New Addition 2019-2020 0.6 -2.0 4.7 -25.6

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Sansera Engineering Ltd. 0.08 219.43 2,520,908 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

IKIO Lighting Ltd. 0.01 33.74 771,940 ICICI Bank Ltd. 7.3 19,901 934.4 20.8 3.4

NIIT Learning Systems Ltd. 0.01 29.65 960,725 Infosys Ltd. 5.2 14,158 1335.2 23.7 8.2

Orchid Pharma Ltd. 0.01 24.75 495,135 Reliance Industries Ltd. 5.1 13,707 2550.7 41.9 3.7

Ideaforge Technology Ltd. 0.00 11.99 178,464 Bharti Airtel Ltd. 3.9 10,697 878.2 0.0 6.6

Chennai Petroleum Corporation Ltd. 0.00 2.81 72,500 HDFC Bank Ltd. 3.9 10,519 1701.8 21.0 3.3

Healthcare Global Enterprises Ltd. 0.00 2.31 72,512 NTPC Ltd. 3.9 10,461 189.2 10.4 1.3

Larsen & Toubro Ltd. 3.5 9,519 2474.5 43.8 4.8

Axis Bank Ltd. 3.3 9,051 987.8 31.0 2.4

Sun Pharmaceutical Industries Ltd. 3.1 8,512 1051.4 148.4 10.6

Top 10 Exits Housing Development Finance Corporation Ltd. 3.1 8,316 2821.5 31.5 3.8

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Sarda Energy & Minerals Ltd. 0.0 7.94 67,902 1 YR High 1 YR Low

Railtel Corporation Of India Ltd. 0.0 7.26 614,370 Banking & Finance 29.7 32.3 29.7

IT-Services 10.7

Wockhardt Ltd. 0.0 0.01 364 14.1 10.7

Oil & Gas 9.8

Edelweiss Financial Services Ltd. 0.0 0.03 4,206 9.8 8.7

Auto & Auto… 9.4

Johnson Controls - Hitachi Air Conditioning

0.0 India Ltd.

0.01 52 9.7 7.8

Pharmaceuticals 7.5

Shilpa Medicare Ltd. 0.0 0.01 258 7.5 6.9

Power 4.9

Greaves Cotton Ltd. 0.0 0.01 757 4.9 4.2

FMCG 4.2

4.5 3.8

Infrastructure 4.2

4.2 3.6

Telecom 4.1

5.4 3.9

Metals & Mining 2.7

Asset Allocation 3.3 2.6

Type Fund Category (Equity) Best Returns Worst Returns

Equity 48.5 91.7 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 38.2 0.7 Month 21-06-2023 5.4 3.6 26-06-2023 2.8 1.0

Cash 0.0 0.0 Quarter 28-06-2023 14.0 11.9 03-04-2023 -2.8 -4.6

Other 13.4 7.6 YTD 30-06-2023 9.5 6.0 28-03-2023 -4.7 -6.4

PE Ratio PB Ratio

40.6

6.9

35.6 6.4

5.9

30.6

5.4

25.6 4.9

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

IDBI Asset Management Ltd.

Fund House Details Investment Information Fund Statistics

AMC Name: IDBI Asset Management Ltd. Fund Manager Alok Ranjan Total Stocks: 223

Address: 5th floor, Mafatlal Centre,Nariman Point Mumbai - Bench Mark NIFTY 50 Total Sectors: 27

400021 Number of 39.3

P/E Ratio:

14

Schemes(Equity) P/B Ratio: 6.7

Website: www.idbimutual.co.in Avg. Market Cap (Rs. Cr.) 337,585 Div Yields (%) 1.1

Financial Details 5 Years History

Total AUM As On (Jun-23) 3,635 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 2,674 Total AUM (Rs Cr) 3,479 4,205 4,231 3,395 6,238

M-o-M % Total AUM Growth -4.5 Equity AUM (Rs Cr) * 2,482 2,687 2,454 1,838 2,633

M-o-M % Equity AUM Growth 0.9 Returns (%) -3.2 18.3 65.9 -20.4 0.8

YoY % Total AUM Growth 1.3 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 12.0 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.0

In 2022-2023 -9.9 11.2 2.5 -4.7

Out 10 2021-2022 9.5 10.4 0.5 -1.7

No Change %age 223 27 2020-2021 17.5 9.4 19.3 5.4

Top 10 New Addition 2019-2020 -0.8 0.1 3.8 -22.7

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

HDFC Bank Ltd. 7.1 189 1701.8 21.0 3.3

ICICI Bank Ltd. 6.8 181 934.4 20.8 3.4

Reliance Industries Ltd. 4.7 126 2550.7 41.9 3.7

Infosys Ltd. 3.9 106 1335.2 23.7 8.2

State Bank Of India 3.7 98 572.8 10.5 1.8

Axis Bank Ltd. 3.5 93 987.8 31.0 2.4

Larsen & Toubro Ltd. 2.6 68 2474.5 43.8 4.8

ABB India Ltd. 2.5 66 4421.3 102.8 17.9

Housing Development Finance Corporation Ltd. 2.2 60 2821.5 31.5 3.8

Top 10 Exits Cholamandalam Investment and Finance Company2.1

Ltd. 57 1141.8 35.5 6.6

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Sunteck Realty Ltd. 0.2 5.41 192,285 1 YR High 1 YR Low

Indiamart Intermesh Ltd. 0.1 1.82 6,518 Banking & Finance 34.3 35.2 31.4

IT-Services 10.2

Rossari Biotech Ltd. 0.1 1.65 22,500 12.7 9.9

Auto & Auto… 8.5

Escorts Kubota Ltd. 0.0 0.91 4,192 8.4 7.2

Chemicals &… 6.0

Multi Commodity Exchange Of India Ltd.

0.0 0.86 5,882 6.8 5.8

Pharmaceuticals 5.3

Aarti Surfactants Ltd. 0.0 0.82 13,275 6.5 5.1

Oil & Gas 5.3

Max Healthcare Institute Ltd. 0.0 0.81 14,800 6.0 5.1

Capital Goods 5.1

Indiabulls Real Estate Ltd. 0.0 0.61 90,000 5.1 3.5

FMCG 4.1

TruCap Finance Ltd. 0.0 0.38 80,000 4.4 3.9

Construction… 3.8

BEML Land Assets Ltd. 0.0 0.15 10,000 3.8 3.2

Infrastructure 3.0

Asset Allocation 3.2 2.4

Type Fund Category (Equity) Best Returns Worst Returns

Equity 73.6 97.1 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 15.3 0.0 Month 21-06-2023 4.9 3.6 26-06-2023 2.4 1.0

Cash 0.0 0.0 Quarter 30-06-2023 13.5 12.3 03-04-2023 -5.0 -4.6

Other 11.1 2.9 YTD 30-06-2023 6.7 6.0 28-03-2023 -6.8 -6.4

PE Ratio PB Ratio

43.7

7.2

38.7 6.7

6.2

33.7

5.7

28.7 5.2

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Bandhan AMC Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Bandhan AMC Limited Fund Manager Sachin Relekar Total Stocks: 325

Address: OneIndiaBulls Centre, 841, Jupiter Mills Compound, Bench Mark NIFTY 50 Total Sectors: 27

Senapati Bapat Marg, Elphinstone Road (West), Number of 37.5

P/E Ratio:

Mumbai - 400 013 23

Schemes(Equity) P/B Ratio: 6.4

Website: https://bandhanmutual.com/ Avg. Market Cap (Rs. Cr.) 317,227 Div Yields (%) 1.1

Financial Details 5 Years History

Total AUM As On (Jun-23) 120,740 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 31,489 Total AUM (Rs Cr) 111,592 115,499 121,349 90,163 71,714

M-o-M % Total AUM Growth 1.4 Equity AUM (Rs Cr) * 27,545 27,277 23,490 16,605 20,752

M-o-M % Equity AUM Growth 4.3 Returns (%) -0.8 15.9 67.1 -20.9 3.6

YoY % Total AUM Growth 4.4 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 28.1 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.0

In 15 2022-2023 -8.2 9.6 2.4 -2.7

Out 5 2021-2022 9.4 8.7 1.7 -1.5

No Change %age 310 27 2020-2021 16.4 10.2 17.0 7.3

Top 10 New Addition 2019-2020 1.0 -2.5 3.6 -23.1

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Kolte-Patil Developers Ltd. 0.06 18.63 550,000 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Kalyan Jewellers India Ltd. 0.04 12.06 820,000 ICICI Bank Ltd. 6.5 2,032 934.4 20.8 3.4

Sundaram Finance Ltd. 0.03 10.16 38,910 HDFC Bank Ltd. 5.4 1,712 1701.8 21.0 3.3

TeamLease Services Ltd. 0.03 8.52 34,181 Axis Bank Ltd. 3.5 1,100 987.8 31.0 2.4

Affle (India) Ltd. 0.02 7.67 70,000 Infosys Ltd. 3.0 933 1335.2 23.7 8.2

Ideaforge Technology Ltd. 0.02 7.00 104,164 Reliance Industries Ltd. 2.8 883 2550.7 41.9 3.7

Praj Industries Ltd. 0.02 6.50 172,012 Tata Motors Ltd. 2.1 668 595.5 75.3 9.2

Rainbow Children's Medicare Ltd. 0.02 5.00 52,000 Tata Consultancy Services Ltd. 1.7 537 3300.5 30.6 16.1

PCBL Ltd. 0.01 3.63 222,854 Housing Development Finance Corporation Ltd. 1.7 529 2821.5 31.5 3.8

Blue Dart Express Ltd. 0.01 3.62 5,000 ITC Ltd. 1.7 522 451.7 30.9 8.6

Top 10 Exits UNO Minda Ltd. 1.6 506 581.1 77.3 10.6

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Rain Industries Ltd. 0.0 3.95 259,000 1 YR High 1 YR Low

Intellect Design Arena Ltd. 0.0 2.11 36,000 Banking & Finance 28.8 29.5 25.8

Auto & Auto… 12.6

Atul Ltd. 0.0 1.29 1,917 12.6 11.2

IT-Services 8.0

Coforge Ltd. 0.0 1.16 2,550 11.2 8.0

Pharmaceuticals 7.3

Petronet LNG Ltd. 0.0 0.14 6,000 8.4 7.2

FMCG 5.2

5.4 4.3

Oil & Gas 4.3

4.9 3.6

Construction… 4.2

5.6 4.2

Capital Goods 4.0

4.0 2.8

Chemicals &… 3.5

5.8 3.4

Metals & Mining 3.1

Asset Allocation 3.1 2.1

Type Fund Category (Equity) Best Returns Worst Returns

Equity 26.1 95.7 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 69.2 0.0 Month 07-06-2023 5.1 3.6 26-06-2023 2.6 1.0

Cash 0.0 0.0 Quarter 28-06-2023 13.6 11.9 03-04-2023 -3.0 -4.6

Other 4.8 4.3 YTD 30-06-2023 8.9 6.0 28-03-2023 -4.7 -6.4

PE Ratio PB Ratio

42.0

6.9

37.0 6.4

5.9

32.0

5.4

27.0 4.9

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

360 ONE Asset Management Limited

Fund House Details Investment Information Fund Statistics

AMC Name: 360 ONE Asset Management Limited Fund Manager Mayur Patel Total Stocks: 96

Address: IIFL Centre, 3rd Floor Annex, Kamala City, Senapati Bench Mark NIFTY 50 Total Sectors: 21

Bapat Marg, Lower Parel,Mumbai - 400 013 Number of 38.8

P/E Ratio:

4

Schemes(Equity) P/B Ratio: 7.1

Website: www.iiflmf.com Avg. Market Cap (Rs. Cr.) 344,789 Div Yields (%) 1.3

Financial Details 5 Years History

Total AUM As On (Jun-23) 6,044 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 4,271 Total AUM (Rs Cr) 4,720 4,518 2,476 1,300 1,486

M-o-M % Total AUM Growth 8.4 Equity AUM (Rs Cr) * 3,387 2,786 1,564 614 622

M-o-M % Equity AUM Growth 13.4 Returns (%) -1.7 10.9 80.0 -14.5 11.3

YoY % Total AUM Growth 36.2 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 65.3 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 14.7

In 11 1 2022-2023 -12.7 14.6 3.5 -3.5

Out 3 2021-2022 10.3 12.7 3.6 -2.3

No Change %age 85 20 2020-2021 20.0 11.6 24.0 6.0

Top 10 New Addition 2019-2020 6.0 1.5 7.0 -25.4

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

CMS Info Systems Ltd. 2.15 91.81 2,495,111 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Aether Industries Ltd. 1.07 45.64 427,350 HDFC Bank Ltd. 9.8 416 1701.8 21.0 3.3

Jubilant FoodWorks Ltd. 0.10 4.44 88,650 ICICI Bank Ltd. 9.0 384 934.4 20.8 3.4

Dixon Technologies (India) Ltd. 0.10 4.39 10,000 Axis Bank Ltd. 6.4 272 987.8 31.0 2.4

Aditya Birla Capital Ltd. 0.09 4.05 206,070 Infosys Ltd. 5.6 240 1335.2 23.7 8.2

Dr. Lal Pathlabs Ltd. 0.09 4.02 17,800 Larsen & Toubro Ltd. 4.7 203 2474.5 43.8 4.8

Escorts Kubota Ltd. 0.09 4.00 17,776 Tata Motors Ltd. 4.7 200 595.5 75.3 9.2

Vedant Fashions Ltd. 0.09 3.98 32,100 Bharti Airtel Ltd. 4.4 187 878.2 0.0 6.6

Timken India Ltd. 0.07 2.98 8,700 NTPC Ltd. 3.3 140 189.2 10.4 1.3

Avalon Technologies Ltd. 0.07 2.97 54,000 Hindustan Unilever Ltd. 3.3 139 2678.4 62.7 12.4

Top 10 Exits Cyient Ltd. 3.2 135 1501.3 43.6 5.8

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

SRF Ltd. 2.1 80.81 320,704 1 YR High 1 YR Low

VIP Industries Ltd. 1.5 55.24 910,671 Banking & Finance 35.2 35.9 30.4

IT-Services 13.5

Sansera Engineering Ltd. 1.2 43.38 551,446 13.5 10.8

Auto & Auto… 11.0

12.9 8.1

Metals & Mining 6.9

9.4 6.9

Consumer… 5.0

5.8 4.7

Infrastructure 4.8

5.1 4.6

Telecom 4.4

5.2 4.4

Pharmaceuticals 3.8

6.6 3.8

FMCG 3.6

4.2 0.1

Chemicals &… 3.5

Asset Allocation 4.9 3.3

Type Fund Category (Equity) Best Returns Worst Returns

Equity 70.7 96.9 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 25.1 0.0 Month 21-06-2023 6.3 3.6 26-06-2023 3.4 1.0

Cash 0.0 0.0 Quarter 30-06-2023 16.2 12.3 03-04-2023 -3.9 -4.6

Other 4.3 3.1 YTD 28-06-2023 9.6 4.8 28-03-2023 -5.6 -6.4

PE Ratio PB Ratio Chemic

42.2 11.2

37.2 10.2

9.2

32.2

8.2

27.2 7.2

22.2 6.2

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Groww Asset Management Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Groww Asset Management Limited Fund Manager Anupam Tiwari Total Stocks: 73

Address: Floor 12 A, Tower 2 A, One World Centre,Jupiter Bench Mark NIFTY 50 Total Sectors: 21

Mills Compound, Senapati Bapat MargMumbai - 400 Number of 33.9

P/E Ratio:

013 7

Schemes(Equity) P/B Ratio: 5.9

Website: https://www.growwmf.in Avg. Market Cap (Rs. Cr.) 470,161 Div Yields (%) 1.1

Financial Details 5 Years History

Total AUM As On (Jun-23) 456 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 175 Total AUM (Rs Cr) 293 460 528 912 4,305

M-o-M % Total AUM Growth 37.0 Equity AUM (Rs Cr) * 152 193 228 207 464

M-o-M % Equity AUM Growth 7.8 Returns (%) -0.2 12.4 52.6 -18.3 1.1

YoY % Total AUM Growth -10.6 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 2.0 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 8.6

In 9 2 2022-2023 -6.8 7.1 4.7 -3.5

Out 1 2021-2022 5.6 8.6 -0.6 -0.8

No Change %age 64 19 2020-2021 12.8 7.3 17.9 3.4

Top 10 New Addition 2019-2020 1.8 -1.7 4.4 -21.5

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Interglobe Aviation Ltd. 1.39 2.43 9,238 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Bharat Electronics Ltd. 1.11 1.95 154,916 ICICI Bank Ltd. 9.0 16 934.4 20.8 3.4

Birlasoft Ltd. 1.10 1.93 53,853 HDFC Bank Ltd. 6.1 11 1701.8 21.0 3.3

Power Finance Corporation Ltd. 0.97 1.70 78,564 Reliance Industries Ltd. 5.7 10 2550.7 41.9 3.7

JK Lakshmi Cement Ltd. 0.84 1.47 20,427 Larsen & Toubro Ltd. 5.3 9 2474.5 43.8 4.8

Godrej Consumer Products Ltd. 0.83 1.45 13,454 Axis Bank Ltd. 5.0 9 987.8 31.0 2.4

Sansera Engineering Ltd. 0.68 1.18 13,593 ITC Ltd. 4.8 8 451.7 30.9 8.6

Cholamandalam Financial Holdings Ltd.

0.18 0.32 3,525 Infosys Ltd. 4.3 7 1335.2 23.7 8.2

NLC India Ltd. 0.06 0.11 9,874 Housing Development Finance Corporation Ltd. 4.1 7 2821.5 31.5 3.8

Bajaj Finance Ltd. 3.6 6 7159.3 44.4 9.0

Top 10 Exits Ultratech Cement Ltd. 3.4 6 8292.9 49.0 4.6

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Gujarat Gas Ltd. 0.1 0.21 4,200 1 YR High 1 YR Low

Banking & Finance 37.1 42.1 37.1

Auto & Auto… 12.4

12.4 5.3

FMCG 9.8

10.9 6.2

IT-Services 9.3

14.0 8.5

Oil & Gas 5.8

10.9 5.8

Construction… 5.4

5.4 1.5

Infrastructure 5.3

5.6 3.9

Telecom 3.4

4.2 2.5

Diamond &… 2.0

2.1 1.7

Pharmaceuticals 1.7

Asset Allocation 3.7 1.7

Type Fund Category (Equity) Best Returns Worst Returns

Equity 38.4 97.3 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 44.0 0.0 Month 07-06-2023 3.5 3.6 26-06-2023 1.1 1.0

Cash 0.0 0.0 Quarter 30-06-2023 9.7 12.3 03-04-2023 -3.7 -4.6

Other 17.6 2.7 YTD 30-06-2023 4.7 6.0 20-03-2023 -5.0 -6.2

PE Ratio PB Ratio

37.8 6.3

5.8

32.8

5.3

27.8

4.8

22.8 4.3

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Apr-23

Dec-22

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-4322 1169 dhartikumar.sahu@idbicapital.com

JM Financial Asset Management Private Limited

Fund House Details Investment Information Fund Statistics

AMC Name: JM Financial Asset Management Private Limited Fund Manager Asit Bhandarkar Total Stocks: 130

Address: 505, 5th Floor, Laxmi Towers,Bandra-Kurla Bench Mark NIFTY 50 Total Sectors: 25

Complex,Mumbai: 400 051 Number of 36.9

P/E Ratio:

8

Schemes(Equity) P/B Ratio: 5.3

Website: www.jmfinancialmf.com Avg. Market Cap (Rs. Cr.) 227,085 Div Yields (%) 1.5

Financial Details 5 Years History

Total AUM As On (Jun-23) 2,821 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 1,017 Total AUM (Rs Cr) 2,959 2,547 2,023 5,830 6,852

M-o-M % Total AUM Growth -5.5 Equity AUM (Rs Cr) * 740 544 483 1,648 2,920

M-o-M % Equity AUM Growth 15.5 Returns (%) 1.8 15.6 58.2 -18.3 5.9

YoY % Total AUM Growth 2.5 CNX Nifty Returns (%) -1.8 17.5 78.0 -26.3 13.8

YoY % Equity AUM Growth 109.8 Quarterly Performance Last % 5Years

Whats In Whats Out(From Pervious Month) Financial Year Q1 Q2 Q3 Q4

Company Sector 2023-2024 12.9

In 19 1 2022-2023 -8.0 8.9 5.8 -2.4

Out 11 1 2021-2022 6.2 10.8 -0.2 -0.7

No Change %age 111 24 2020-2021 12.4 7.0 21.0 5.3

Top 10 New Addition 2019-2020 -0.9 0.8 2.8 -20.5

Company Name % HoldingMkt Val(Cr) Shares Top Company Holding %

Star Health and Allied Insurance Company

1.70 Ltd. 17.27 295,199 Company Name % Holding Mkt Val(Cr) Price TTM PE (x) P/BV (x)

Indus Towers Ltd. 0.89 9.10 554,200 Larsen & Toubro Ltd. 3.8 39 2474.5 43.8 4.8

Timken India Ltd. 0.88 8.94 26,118 HDFC Bank Ltd. 3.8 38 1701.8 21.0 3.3

PB Fintech Ltd. 0.47 4.82 69,200 Infosys Ltd. 3.2 32 1335.2 23.7 8.2

Dr. Lal Pathlabs Ltd. 0.43 4.36 19,300 Ultratech Cement Ltd. 3.0 31 8292.9 49.0 4.6

Jindal Steel & Power Ltd. 0.43 4.36 75,000 REC Ltd. 3.0 30 164.6 4.0 0.8

Manappuram Finance Ltd. 0.41 4.21 318,000 Reliance Industries Ltd. 2.6 26 2550.7 41.9 3.7

Gokaldas Exports Ltd. 0.25 2.57 53,250 ICICI Bank Ltd. 2.3 23 934.4 20.8 3.4

Arvind Ltd. 0.17 1.73 130,000 One97 Communications Ltd. 2.1 21 868.1 0.0 4.3

Zee Entertainment Enterprises Ltd. 0.15 1.49 84,000 Poonawalla Fincorp Ltd. 2.1 21 340.9 47.7 4.4

Top 10 Exits Crompton Greaves Consumer Electricals Ltd. 2.1 21 289.3 39.1 6.8

Company Name % HoldingMkt Val(Cr) Shares Top Sector Holding (%)

Gujarat Gas Ltd. 0.7 6.29 124,100 1 YR High 1 YR Low

Balrampur Chini Mills Ltd. 0.3 2.60 66,250 Banking & Finance 26.1 30.2 25.4

Auto & Auto… 11.6

Tata Motors Ltd. 0.2 1.65 31,350 19.2 10.9

IT-Services 11.1

Siemens Ltd. 0.1 1.27 3,575 13.4 8.3

Pharmaceuticals 5.9

Pidilite Industries Ltd. 0.1 0.85 3,250 6.9 4.3

Consumer… 5.8

Bandhan Bank Ltd. 0.1 0.63 23,400 6.3 0.2

Infrastructure 5.3

Bajaj Finserv Ltd. 0.1 0.58 4,000 6.5 5.0

FMCG 4.8

ACC Ltd. 0.0 0.22 1,250 5.8 3.8

Realty 4.3

Asian Paints Ltd. 0.0 0.19 600 4.3 0.2

Capital Goods 3.7

Britannia Industries Ltd. 0.0 0.19 400 5.5 0.3

Construction… 3.7

Asset Allocation 5.3 2.8

Type Fund Category (Equity) Best Returns Worst Returns

Equity 36.1 97.7 Period Fund(%) B'Mark (%) Period Fund(%) B'Mark (%)

Debt 46.6 0.0 Month 21-06-2023 7.0 3.6 26-06-2023 3.8 1.0

Cash 0.0 0.0 Quarter 28-06-2023 14.1 11.9 03-04-2023 -2.6 -4.6

Other 17.3 2.3 YTD 30-06-2023 10.1 6.0 28-03-2023 -4.3 -6.4

PE Ratio PB Ratio Constru

7.2

40.5

6.2

35.5

30.5 5.2

25.5 4.2

Sep-22

Feb-23

Sep-22

Feb-23

Jul-22

Jul-22

Jan-23

Jan-23

Aug-22

Aug-22

Oct-22

Oct-22

Mar-23

Mar-23

Jun-22

Dec-22

Dec-22

Apr-23

Apr-23

May-23

Jun-22

May-23

Nov-22

Nov-22

PE PB

Source: Accord Fintech , * Cash & Cash Equivalents not included

Dhartikumar Sahu +91-22-2217 1770 dhartikumar.sahu@idbicapital.com

Kotak Mahindra Asset Management Company Limited

Fund House Details Investment Information Fund Statistics

AMC Name: Kotak Mahindra Asset Management Company Limited Fund Manager Harsha Upadhyaya Total Stocks: 354

Address: 27 BKC, C-27, G Block,Bandra Kurla Complex, Bandra Bench Mark NIFTY 50 Total Sectors: 28

(E),Mumbai - 400 051 Number of 35.1

P/E Ratio:

36

Schemes(Equity) P/B Ratio: 6.3

Website: http://assetmanagement.kotak.com/ Avg. Market Cap (Rs. Cr.) 299,743 Div Yields (%) 1.4

Financial Details 5 Years History

Total AUM As On (Jun-23) 314,731 Financial Year Mar-23 Mar-22 Mar-21 Mar-20 Mar-19

Equity AUM As On (Jun-23) * 157,262 Total AUM (Rs Cr) 284,284 280,962 234,215 153,849 150,315

M-o-M % Total AUM Growth -1.5 Equity AUM (Rs Cr) * 137,796 126,826 91,869 50,839 56,065

M-o-M % Equity AUM Growth 4.8 Returns (%) 0.7 15.6 64.6 -21.8 7.8