Professional Documents

Culture Documents

Frequently Asked Questions About The Banking System in Panama

Frequently Asked Questions About The Banking System in Panama

Uploaded by

oldemar sotoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Frequently Asked Questions About The Banking System in Panama

Frequently Asked Questions About The Banking System in Panama

Uploaded by

oldemar sotoCopyright:

Available Formats

February 2023

10 Frequently Asked Questions About the

Banking System in Panama

1. Why open a bank account (or a brokerage account) in Panama?

• The agency Moody's has raised the credit rating of sovereigns in Panama's

debt to Baa3, which places it in the investment grade, thanks to the

improvement in fiscal and debt position of the country.

• The official currency of Panama is the US Dollar, which has been in circulation

without any exchange control since 1904.

• Panama has not suffered a financial crisis in its 115 years of life. In fact, only

one bank has gone bankrupt since the birth of the banking system, Banco

Disa.

• Panama is widely recognized as one of the best offshore banking jurisdictions

in the world, with one of the most reliable financial centers in the world.

• Panama has one of the most stable governments and economies in all Latin

America. Besides, the official Language is Spanish, although English is widely

spoken.

• Panama regulators are strong, but not dominant. And while

compliance with opening a bank account in Panama may not be easy

to navigate, but with the correct help and approach to arrive with

banks, this is not a problem.

2. Are the updated bank credit ratings posted on the website to keep the

public informed?

Based on the regulation, banks are obliged to have a rating issued by a Risk

Rating Agency, which has to be published by the bank in a newspaper with

national circulation, and a copy must be placed in a place accessible to the public

in all of the bank’s establishments for the entire year.

3. Is there Bank Secrecy in Panama?

Panama still has strict laws to keep bank secrecy in revealing who are the

shareholders and signatories of the accounts. On the other hand, it is important

to mention that Panama has signed agreements with foreign countries for the

exchange of tax information, FATCA and CRS. Although these agreements allow

the exchange of information, it will only be carried out under the strictest security

measures.

4. How long does it take to open a bank account in Panama?

Banks are open Monday through Friday from 8:30 am to 3 pm and on Saturday

8:30 am to Noon. The time required to open a bank account depends for the most

part on the bank, and it can take up to 30 business days, but usually around two

weeks if all the bank requirements are fulfilled. Time also depends on you to

deliver all the necessary documents and the type of account. Nonetheless, with

the correct assitance and advisory you could open an account even in a

couple of hours or maximum two days.

Document prepared by OLDEMAR SOTO LOMBARDO

February 2023

5. Is it difficult to open an account in Panama?

Banking in Panama can be harder or easier, depending on which of these

categories you fall into:

• Permanent resident with a Panama ID card (cedula)

• Expat (not an American) without a cedula

• American (with or without a cedula).

The first group will make the process the least complicated. A cedula simplifies

several bureaucratic tasks in Panama. Migrants or Expats who don’t have a cedula

are treated with more caution. However, being a member of the third category

often causes the entire procedure to become very difficult. In fact, a number of

local banks in Panama do not readily open accounts for Americans and some will

have special regulations in place for European customers too. However, US

citizens can of course open accounts, but not in every bank. Therefore, it is

preferable to have a person who takes you by the hand during the whole

process if you are not very familiar with the country, its practices and

the operation of the Panamanian financial system.

6. Which are the best banks to open an account in Panama?

That depends on the type of account you intend to open, and the use that will be

given to the account. There are banks that are focused exclusively on high-

networth individuals and others that are interested primarily in medium and small

clients. Besides, in order to ease the opening, it is better to investigate in the

bank its position regarding the source of income from your country of origin,

because the requirements and paperwork could vary. However, an adviser can

help you with that information. This person, who does not have to be a

lawyer, can assist you during the account opening procedure because he

is familiar with the requirements, and surely can help you with the

follow-up once the client complies with the bank interview and due

diligence requirements, expediting the whole process.

7. Is it necessary to come personally to a bank to open an account?

According to regulations, all bankers in Panama are required to know their clients

very well; for this reason, it would be advisable for the client (the bank account

signatory) to come personally for a brief interview with the bank and sign the

bank application forms. Nevertheless, some of the banks we can refer could

accept receiving the account application via email, wave the personal

meeting requirement and arrange a virtual meeting.

8. Can I manage my bank account from abroad?

Managing your bank account in Panama from abroad is very simple, banks will

give you access to your online banking platform from which you can make any

movement of local or international funds you want and you can access your

information at any time. In addition to online banking, many of the Panamanian

banks offer free mobile App for both Android and Apple, where you can manage

everything from your cell phone. Finally, bigger Banks will have the option of

requesting a debit card with which you can withdraw money from ATMs almost

anywhere in the world.

Document prepared by OLDEMAR SOTO LOMBARDO

February 2023

9. Which are the basic Requirements to open a bank account?

Individual: Banks will ask for passport and official ID documentation (sometimes

even two forms of official identification with your photograph), personal bank

references (from your banking in any country), commercial references (example,

attorney, accountant, clients). A letter of reference from your current bank

addressed to the bank where you want to open an account; In some cases, a “To

Whom it May Concern” will not sufficient;

Corporate: Additionally to the standard corporate documents and signing the

account opening forms. Banks will ask for passport and official ID documentation

(sometimes even two forms of official identification with your photograph),

personal bank references (from your banking in any country), commercial

references (example, attorney, accountant, clients).

Additionally: banks would also ask for statements or documents to prove the

sources of the incoming funds, and/or proof of source of income thru your most

recent tax return. Secondly, if you are residing in Panama on an immigration visa,

you will need to provide copies of the immigration visa and immigration identity

card (carnet); and thirdly, they will also ask you to complete a W-9 form so they

have your U.S. social security number on file, for FATCA purposes. Most banks

require a minimum deposit ranging from $150 to $300.However, if you decide to

open an account in a premium segment this initial deposit could be as high as

$10,000.00. Once the account is opened you can make deposits with cash, local

or foreign checks, and bank wires.

Nonetheless, sometimes the bank’s compliance departments might

request additional information or documents if they consider it

necessary; in this case, if you are no longer present in Panama, your

advisor could assist you in filing the additional documents or information

to the bank if required.

10.What are the basic elements for considering an account inactive (or

dormant) in Panama?

• The holder has not made any deposits or withdrawals in the past five (5)

consecutive years, exclusive of the deposit of paid interest.

• The accounts belong to persons whose whereabouts are unknown.

• The bank has made verified, reasonable attempts to locate the beneficial

owners of the account.

Document prepared by OLDEMAR SOTO LOMBARDO

February 2023

Last Few Tips

1. Prepare your documents and funds well in advance: getting financial

institutions to process documents can take more time than expected.

2. Make sure your taxes are up to date: Panama is not a tax haven anymore

(FATCA); check with your accountant that you have no withstanding taxes, or

audits from your tax administrators.

3. Start building credit in Panama: This will give you lots of flexibility for small

business loans, mortgages, and automobile loans. You can start this process as

soon as your bank account is approved; whether you’re physically in the

country or not.

4. Pick the right bank: With over 100 different banks operating out of Panama,

finding the right one is not only important; it’s a bit of a challenge. Find a small

and reliable bank that offer great interest rates as an incentive to increase

business. Besides, they usually offer a better service.

5. If you make cash deposits or withdrawals greater than $ 10,000 the bank will

request additional information.

6. Invest in the local Security Market

7. And Get Advise

Oldemar Soto Lombardo

Email: oldemarsoto27@gmail.com

Cell: (507)-6618-9991

Advisory for loans, mortgages, bank and investment accounts.

Document prepared by OLDEMAR SOTO LOMBARDO

You might also like

- Bank Account CreationDocument10 pagesBank Account CreationJustin Patenaude100% (14)

- Optimum NutritionDocument4 pagesOptimum Nutritionmanav67% (3)

- Abm Fabm2 Module 6 Lesson 1 Basic Bank Documents and TransactionsDocument20 pagesAbm Fabm2 Module 6 Lesson 1 Basic Bank Documents and TransactionsDark Slayer100% (5)

- Nomad Capitalist FREE Report Secrets of Offshore Banking PDFDocument5 pagesNomad Capitalist FREE Report Secrets of Offshore Banking PDFtacamp daNo ratings yet

- Basic Principles of Fiber Optic CommunicationDocument3 pagesBasic Principles of Fiber Optic CommunicationHumayra Anjumee100% (2)

- FM 202 Finals3Document34 pagesFM 202 Finals3sudariodaisyre19No ratings yet

- All About Banking: Amy FontinelleDocument24 pagesAll About Banking: Amy FontinelleSai Prasad Iyer JNo ratings yet

- How To Open A Bank AccountDocument10 pagesHow To Open A Bank AccountKabano CoNo ratings yet

- SCR Banking GJKJ - HJHDocument31 pagesSCR Banking GJKJ - HJHamitguptaujjNo ratings yet

- Bank Account For Australia 2024Document8 pagesBank Account For Australia 2024Thirumalai VasanNo ratings yet

- Opening A Bank Account Can Seem IntimidatingDocument9 pagesOpening A Bank Account Can Seem IntimidatingtriratnacomNo ratings yet

- Offshore: Offshore Banking - Deposit of Funds by A Company or An Individual in A Bank That Is Located Outside NationalDocument4 pagesOffshore: Offshore Banking - Deposit of Funds by A Company or An Individual in A Bank That Is Located Outside NationalChristine Joy LacsonNo ratings yet

- Banking ProjectDocument30 pagesBanking Projectdhanya2979No ratings yet

- Introduction To Offshore Banking: Types of Offshore Bank AccountsDocument6 pagesIntroduction To Offshore Banking: Types of Offshore Bank AccountsHamza Mubasher SheikhNo ratings yet

- Types of Bank AccountsDocument8 pagesTypes of Bank Accountschaitanya100% (1)

- File 1641790871 0004738 BLPDocument118 pagesFile 1641790871 0004738 BLPwww.ishusingh4420No ratings yet

- Financial Institution Financial IntermediaryDocument15 pagesFinancial Institution Financial IntermediarySayed Nadeem A. KazmiNo ratings yet

- Steps 4 Opening A.CDocument20 pagesSteps 4 Opening A.CBipinNo ratings yet

- International BankingDocument9 pagesInternational Bankingbharathi.sunagar5389No ratings yet

- Money and Banking ProjectDocument11 pagesMoney and Banking Projectshahroze ALINo ratings yet

- Function of HDFC BankDocument9 pagesFunction of HDFC BankRajesh Maharajan50% (2)

- Lession 3 OperationsDocument13 pagesLession 3 Operationssusma susmaNo ratings yet

- BCOM Financial LiteracyDocument11 pagesBCOM Financial LiteracyVivek GabbuerNo ratings yet

- UnlockedDocument229 pagesUnlockednathalytortoza100% (3)

- Opening A Saving AccountDocument2 pagesOpening A Saving AccountAnik SarkarNo ratings yet

- Bank Open ProcedureDocument3 pagesBank Open ProcedureNadirNo ratings yet

- Opening and Types of Bank Account: by Rushil Pandey 11hDocument11 pagesOpening and Types of Bank Account: by Rushil Pandey 11hRushil PandeyNo ratings yet

- Landbank RequirementsDocument3 pagesLandbank Requirementsgee gambol50% (4)

- Chapter 4: Money and Banking: Why Use A Bank?Document23 pagesChapter 4: Money and Banking: Why Use A Bank?Jojilyn DabloNo ratings yet

- Myusacorporation: How To Start Your Business in The Usa RemotelyDocument47 pagesMyusacorporation: How To Start Your Business in The Usa RemotelyJack DixonNo ratings yet

- Cbo 2Document21 pagesCbo 2Jabed MansuriNo ratings yet

- BIM - Unit-III: Unit-3 Management of Deposit and Advances. Opening of ADocument22 pagesBIM - Unit-III: Unit-3 Management of Deposit and Advances. Opening of AMehak ShineNo ratings yet

- Cash LoanDocument9 pagesCash Loanmaica_prudenteNo ratings yet

- Banks Other Bank TransactionsDocument35 pagesBanks Other Bank TransactionsBrenda PanyoNo ratings yet

- AE244 Intl Students 11 FINALDocument11 pagesAE244 Intl Students 11 FINALPmsakda HemthepNo ratings yet

- What Is An International Bank?: AnswerDocument22 pagesWhat Is An International Bank?: AnswerSonetAsrafulNo ratings yet

- Hands On Banking21-1Document3 pagesHands On Banking21-1chloeiskingNo ratings yet

- Summer 2012 ColorDocument8 pagesSummer 2012 Colorapi-309082881No ratings yet

- What Is A BankDocument5 pagesWhat Is A BankmanojdunnhumbyNo ratings yet

- Watch Your Savings GrowDocument14 pagesWatch Your Savings GrowpratikjaiNo ratings yet

- LAON Recovery-management-Of Andhra BankDocument87 pagesLAON Recovery-management-Of Andhra Banklakshmikanth100% (1)

- 1 Introduction To BankingDocument8 pages1 Introduction To BankingGurnihalNo ratings yet

- Computerised Account Saving SystemDocument17 pagesComputerised Account Saving SystemUgoStan100% (1)

- Banking BasicsDocument35 pagesBanking Basicsparkerroach21No ratings yet

- Solution Manual For Personal Finance 4 e 4th Edition 0136117007 Full DownloadDocument5 pagesSolution Manual For Personal Finance 4 e 4th Edition 0136117007 Full Downloaddorothyjohnson12061988omk100% (42)

- Las 8 Bank AccountsDocument8 pagesLas 8 Bank AccountsCharlyn CastroNo ratings yet

- Fundamentals of Accountancy Business and Management 2Document20 pagesFundamentals of Accountancy Business and Management 2MOST SUBSCRIBER WITHOUT A VIDEO43% (7)

- Chapter 6 BS 2 2PUCDocument20 pagesChapter 6 BS 2 2PUCVipin Mandyam KadubiNo ratings yet

- Commerce Topic 2Document16 pagesCommerce Topic 2Anonymous lVpFnX3No ratings yet

- Bank of The Philippine IslandsDocument23 pagesBank of The Philippine IslandsGianJoshuaDayrit0% (1)

- Types of Accounts BANKING LAWDocument99 pagesTypes of Accounts BANKING LAWTinashe MurindagomoNo ratings yet

- Oxford Bank Account Guide For European and International Students 2020 - 0Document6 pagesOxford Bank Account Guide For European and International Students 2020 - 0Gaurav SaharanNo ratings yet

- Oxford Bank Account Guide For European and International Students 2020 - 0Document6 pagesOxford Bank Account Guide For European and International Students 2020 - 0Gaurav SaharanNo ratings yet

- Agent BankingDocument5 pagesAgent BankingAnik SarkarNo ratings yet

- Myusacorporation: How To Start Your Business in The Usa RemotelyDocument44 pagesMyusacorporation: How To Start Your Business in The Usa RemotelysethNo ratings yet

- Offshore Banking ReportDocument10 pagesOffshore Banking ReportYaffah PenkavaNo ratings yet

- Offshore Accounts:: 1.-DefinitionDocument4 pagesOffshore Accounts:: 1.-DefinitionOlenka Sapallanay OjedaNo ratings yet

- Topic 2Document16 pagesTopic 2Anonymous lVpFnX3No ratings yet

- Repair Your CreditDocument13 pagesRepair Your Creditchris mcwilliamsNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Csir Net Dec 14Document24 pagesCsir Net Dec 14Aamer100% (1)

- Utilizes The Standards (Criteria or Checklist) in Evaluating Research Paper Peer/Group/Expert Evaluation)Document5 pagesUtilizes The Standards (Criteria or Checklist) in Evaluating Research Paper Peer/Group/Expert Evaluation)John Aeron Samson BiscoNo ratings yet

- Tugas Bahasa Inggris Incomplete SentencesDocument7 pagesTugas Bahasa Inggris Incomplete SentencesRivaldo Zamara100% (1)

- ACL Practice Lab 2Document7 pagesACL Practice Lab 2LGBT Việt NamNo ratings yet

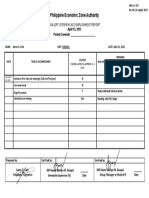

- Rmac Conducts Mock Random Manual Audit: What's in ?Document6 pagesRmac Conducts Mock Random Manual Audit: What's in ?Legal Network for Truthful ElectionsNo ratings yet

- NitricAcid PDFDocument2 pagesNitricAcid PDFmladen lakicNo ratings yet

- PHYSICS Project 30Document30 pagesPHYSICS Project 30SAHILNo ratings yet

- 'Just', 'Yet', 'Still' and 'Already' - LearnEnglishDocument3 pages'Just', 'Yet', 'Still' and 'Already' - LearnEnglishJUAN CARLOS BORJANo ratings yet

- Osundare PoemsDocument14 pagesOsundare PoemsLisha AggarwalNo ratings yet

- 6 Spouses Juico Vs China BankDocument10 pages6 Spouses Juico Vs China BankjunaNo ratings yet

- Questions & Answers On Useful Theorems in Circuit AnalysisDocument53 pagesQuestions & Answers On Useful Theorems in Circuit Analysiskibrom atsbha100% (1)

- Catalogo General HANNA Instruments Vol 27 (Ingles)Document670 pagesCatalogo General HANNA Instruments Vol 27 (Ingles)hannabolivia100% (1)

- Cars English PDFDocument4 pagesCars English PDFmorusNo ratings yet

- STG ArrangementDocument23 pagesSTG ArrangementAdel Klk100% (1)

- Caltrans (2019) Obras de Proteccion FluvialDocument32 pagesCaltrans (2019) Obras de Proteccion FluvialPablo CartesNo ratings yet

- Rtari: RemainDocument10 pagesRtari: RemainLucas KnightNo ratings yet

- Flowering PlantsDocument43 pagesFlowering Plantskingbanakon100% (1)

- BPI Investment Corp v. CADocument4 pagesBPI Investment Corp v. CAPaolo BrillantesNo ratings yet

- Spatial Ability: Mechanical Aptitude TestsDocument46 pagesSpatial Ability: Mechanical Aptitude Testsrofiq100% (1)

- FWA ACCOMPLISHMENT REPORT CafeDocument1 pageFWA ACCOMPLISHMENT REPORT CafeAaron O. CafeNo ratings yet

- CS Pipe Fab & Erect Costs..xls: DownloadDocument1 pageCS Pipe Fab & Erect Costs..xls: DownloadtunlinooNo ratings yet

- (Abstract) Factors Affecting Customers Satisfaction in Online Food Delivery Service During The COVID19 Pandemic in Iloilo CityDocument3 pages(Abstract) Factors Affecting Customers Satisfaction in Online Food Delivery Service During The COVID19 Pandemic in Iloilo CityRodel Lequip0% (1)

- Schematic Diagrams: AV32T25EKS AV32R25EKSDocument20 pagesSchematic Diagrams: AV32T25EKS AV32R25EKSRoosevelt Vega SanchezNo ratings yet

- Types of TestsDocument15 pagesTypes of TestsMuhammadNo ratings yet

- Descripción de Dos Nuevas Especies de Nostoc de China Basados en Un Enfoque PolifásicoDocument13 pagesDescripción de Dos Nuevas Especies de Nostoc de China Basados en Un Enfoque PolifásicoElvis Ponce AbarcaNo ratings yet

- Body Shop CSRDocument20 pagesBody Shop CSRSarah JinNo ratings yet

- #83/1, N.G.M.Plaza, Ground Floor, S.P.Road, Bangalore - 02 Ph:41492442,41765006 Enquiry No: 41765106 PH: 9739661248 PH: 9986487836Document56 pages#83/1, N.G.M.Plaza, Ground Floor, S.P.Road, Bangalore - 02 Ph:41492442,41765006 Enquiry No: 41765106 PH: 9739661248 PH: 9986487836Ajay KaundalNo ratings yet

- Myeloproliferative DisorderDocument36 pagesMyeloproliferative DisorderKalpana ShahNo ratings yet