Professional Documents

Culture Documents

Notes

Uploaded by

SANG HOANG THANHOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notes

Uploaded by

SANG HOANG THANHCopyright:

Available Formats

“In the past few days, I have sought experts to handle the company's problems with the

bank, the opinions on this are as follows:

- Lowering the bad debt level from 5 to 1 is currently not possible because no one can do

it because The law stipulates that after 5 years (from the date of repayment of debt) ==>

Yes, it is SBV regulation and reflect on CIC data (5 years of historical loan).

- In order to help the company continue production and business and get a bank loan,

they suggested to me that there are two ways:

(one is) the company finds the way to raise capital at once, the warning level will be at

level 1 ==> Yes, VCB already advised us in the last meeting, but even we revert to level 1,

the ability to raise new loan from bank or even leasing is still difficult, because they have

policy to re-grant loan to just level 1 company (Previously, we discuss with previous

leasing company, but no one can provide us loan via leasing. We need at least 24 months

to re-start loan via leasing with them.

(two is) Gathering shareholders, restructuring the company (getting a new name) to open

new transactions will not affect anything production, business and bank capital. ==> Yes,

we already consider this. It means that we create new legal entity or company. Basically, it

is level 1, but normally, bank grant loan as a form of business support. So, to increase

loan successfully, we need transfer business activities and facilities to them as well. So it is

real company and become a replacement of Vina (in our case).

(third) experts note that there is a lot of cash in Vietnamese banks nowadays, banks are

having to find qualified customers to lend; if the company is restructured, it is required to

invite a lawyer in the field of finance and banking to participate.” ==> Yes, current bank’s

credit growth is low because of low demand for funding (due to economic down turn).

But bank’s challenges are high level of bad debt and quality of customer is slowing down.

And bank always follows SBV’s laws and regulations in lending activities, then bank lend

(1) qualified customer; (2) solid business foundation and plan; (3) mortgaged assets and

track record of repayment data to reduce their credit risk.

==> We need specialized lawyer in field of finance, especially having a lot of experience

and strong relationship with bank to assist us. Since our case is very special, then the

matter of expertise is very important.

You might also like

- Operational Exam Blueprints 2023 2024 Final For WebDocument29 pagesOperational Exam Blueprints 2023 2024 Final For WebSANG HOANG THANHNo ratings yet

- Risk and Risk ExposureDocument15 pagesRisk and Risk ExposureSANG HOANG THANH100% (1)

- Analysing and Managing CostsDocument30 pagesAnalysing and Managing CostsSANG HOANG THANHNo ratings yet

- Quotation Form YUJIN VINADocument2 pagesQuotation Form YUJIN VINASANG HOANG THANHNo ratings yet

- The Strategy ProcessDocument25 pagesThe Strategy ProcessSANG HOANG THANHNo ratings yet

- CFO TasksDocument11 pagesCFO TasksSANG HOANG THANHNo ratings yet

- Tinh Lai BIDVDocument8 pagesTinh Lai BIDVSANG HOANG THANHNo ratings yet

- T TRÌNH SMS Brand NameDocument2 pagesT TRÌNH SMS Brand NameSANG HOANG THANHNo ratings yet

- Strategic FrameworkDocument18 pagesStrategic FrameworkSANG HOANG THANHNo ratings yet

- 2 Sample SBLC 2023Document2 pages2 Sample SBLC 2023SANG HOANG THANH100% (1)

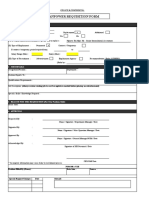

- Manpower Requisition Form: 1. Requirements 2. Job DetailsDocument1 pageManpower Requisition Form: 1. Requirements 2. Job DetailsSANG HOANG THANHNo ratings yet

- bBN1lVbjSkuTdZVW48pLvA - AI Strategy and Governance - Module 1 - v1.1Document66 pagesbBN1lVbjSkuTdZVW48pLvA - AI Strategy and Governance - Module 1 - v1.1SANG HOANG THANHNo ratings yet

- Customer Experience SOLUTIONSDocument39 pagesCustomer Experience SOLUTIONSSANG HOANG THANHNo ratings yet

- Pre-Seen - Intensive SummaryDocument13 pagesPre-Seen - Intensive SummarySANG HOANG THANHNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)