Professional Documents

Culture Documents

Sap S4hana Financial Accounting Consultant

Uploaded by

Chijioke IhediohaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sap S4hana Financial Accounting Consultant

Uploaded by

Chijioke IhediohaCopyright:

Available Formats

SAP S4HANA FINANCIAL ACCOUNTING

Goals

Participants will gain an overview of the fundamental business processes and configuration of core

components of Financial Accounting with SAP S/4HANA.

This course will prepare you to configure and use core functions of Financial Accounting:

General Ledger Accounting

Accounts Receivable

Account Payable

Configure the Master Data Settings (G/L Accounts, Customer and Vendor Accounts) of

Financial Accounting with SAP S/4HANA

Configure the Document Control and Posting Control Settings of Financial Accounting with

SAP S/4HANA

Configure the Settings for Financial Document Clearing of Financial Accounting with SAP

S/4HANA

Become familiar with the configuration and usage of Asset Accounting and Closing

Operations.

Audience

Application Consultant

Business Process Owner / Team Lead / Power User

Prerequisites

Essential

Accounting Knowledge

Recommended

Business Processes in Financial Accounting in SAP ERP/S4HANA

Course based on software release

SAP S/4HANA 2020 SPS0

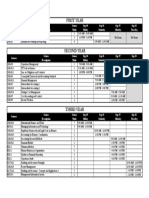

Content

Overview of SAP S/4HANA

Core Financial Accounting (FI) Configuration

Managing Organizational Units in Financial Accounting (FI)

Checking the Basic Settings in General Ledger (G/L)

Accounting

Outlining the Variant Principle

Managing Fiscal Year Variants

Master Data

Maintaining General Ledger (G/L) Accounts

Managing Customer and Vendor Accounts (BP)

Document Control

Configuring the Header and Line Items of Financial Accounting

Financial Document Postings

Managing Posting Periods

Managing Posting Authorizations

Posting Control

Analyzing Document Splitting

Maintaining Default Values

Configuring Change Control

Configuring Document Reversal

Configuring Payment Terms and Cash Discounts

Maintaining Taxes and Tax Codes

Posting Cross-Company Code Transactions

Financial Document Clearing

Performing Open Item Clearing

Managing Payment Differences

Automatic Payments

Dunning

Correspondence

Special G/L transactions and document parking

Validations and substitutions in Financial Accounting

Archiving in Financial Accounting

Organizational structures, master data, and business processes in Asset Accounting

Chart of depreciation, depreciation area, asset classes, master data, asset transactions,

valuation, periodic processing, investment support measures, information system, and

asset legacy data transfer

Overview of month and year-end accounting processes in Financial Accounting Balance

sheet and P&L

Preparatory closing postings in subledgers and the general ledger

Financial Closing Cockpit

Configuration of periodic closing in Financial Accounting

You might also like

- What is Financial Accounting and BookkeepingFrom EverandWhat is Financial Accounting and BookkeepingRating: 4 out of 5 stars4/5 (10)

- SAP FICO Course Contents - Advanced LevelDocument2 pagesSAP FICO Course Contents - Advanced LevelsureshNo ratings yet

- Financial Closing CDocument2 pagesFinancial Closing CJaved IqbalNo ratings yet

- SAP Finance & Introduction To Controlling (SAP FICO) : Duration: 12 Working Days or 6 WeekendsDocument5 pagesSAP Finance & Introduction To Controlling (SAP FICO) : Duration: 12 Working Days or 6 WeekendsCraig CraigNo ratings yet

- FICO OverviewDocument22 pagesFICO OverviewsarahsanadbaNo ratings yet

- 2.1. Sap Fico Intro 1Document12 pages2.1. Sap Fico Intro 1Sahana MNo ratings yet

- SAP FICO Syllabus PDFDocument11 pagesSAP FICO Syllabus PDFÅndraju DineshNo ratings yet

- Mysap Erp Financials: Sap Fi/Co Ebooks, Articles and Other Materials (Financial Accounting & Controlling)Document7 pagesMysap Erp Financials: Sap Fi/Co Ebooks, Articles and Other Materials (Financial Accounting & Controlling)yogesh_222No ratings yet

- Basics of Customizing For Financial Accounting GL AP Ar in Sap S4hanaDocument3 pagesBasics of Customizing For Financial Accounting GL AP Ar in Sap S4hanaaminab1No ratings yet

- Sap Fico SyllabusDocument7 pagesSap Fico SyllabusUsa IifcaNo ratings yet

- Pooja SAP Fico 3Document6 pagesPooja SAP Fico 3zidduNo ratings yet

- SAP FICO Course ContentsDocument10 pagesSAP FICO Course ContentsSagar Paul'gNo ratings yet

- Fico S/4 Hana: Igrow SoftDocument12 pagesFico S/4 Hana: Igrow SoftVenkat Ramireddy Basam100% (1)

- Sap Fico: Timings: Mode of Training: Course Duration: What We Offer: Class Duration: Server VersionDocument4 pagesSap Fico: Timings: Mode of Training: Course Duration: What We Offer: Class Duration: Server VersionNikhil AgarwalNo ratings yet

- SAP FinanceDocument94 pagesSAP FinanceAnkur SinghNo ratings yet

- CA FI IIBS Course OutlinesDocument2 pagesCA FI IIBS Course OutlinesBinny SharmaNo ratings yet

- 1 (2 Files Merged)Document2 pages1 (2 Files Merged)syed shabbirNo ratings yet

- SAP Training in Fico 01249917780Document3 pagesSAP Training in Fico 01249917780Carmen DiacNo ratings yet

- SAP Simple Finance Course Content: Overview of S/4 HANADocument3 pagesSAP Simple Finance Course Content: Overview of S/4 HANAVAIBHAV PARABNo ratings yet

- Hana Fi Course ContentDocument2 pagesHana Fi Course ContentRaju Raj RajNo ratings yet

- SAP - ECC 6.0 FICO ContentsDocument8 pagesSAP - ECC 6.0 FICO ContentsBhupesh DebnathNo ratings yet

- Pravin Sap Fico ResumeDocument16 pagesPravin Sap Fico ResumezidduNo ratings yet

- SAP S/4 HANA Simple Finance Course ContentDocument10 pagesSAP S/4 HANA Simple Finance Course ContentRakesh GuptaNo ratings yet

- SAP SyllabusDocument6 pagesSAP Syllabuspavan8412No ratings yet

- Senior Accountant in Charlotte NC Resume Karen GeorgeDocument2 pagesSenior Accountant in Charlotte NC Resume Karen GeorgeKarenGeorge1No ratings yet

- SAP Certified FI/CO & SAP S4 Hana Finance - Abrar JameelDocument4 pagesSAP Certified FI/CO & SAP S4 Hana Finance - Abrar JameelAbrar JameelNo ratings yet

- Fico Sudhakar Dharavath Fico A1Document7 pagesFico Sudhakar Dharavath Fico A1Dharavath SudhakarNo ratings yet

- SAP FI Associate Level Certification SyllabusDocument1 pageSAP FI Associate Level Certification SyllabusnaimdelhiNo ratings yet

- SAP FICO-Revised PDFDocument6 pagesSAP FICO-Revised PDFakhilesh chauhanNo ratings yet

- Sap - Financial Accounting and Controlling: Finance: FI - General Ledger Accounting: Organization StructureDocument4 pagesSap - Financial Accounting and Controlling: Finance: FI - General Ledger Accounting: Organization StructureManisha BhanushaliNo ratings yet

- Introduction To SAP RDocument5 pagesIntroduction To SAP Rmuneendra143No ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingRavi KondabalaNo ratings yet

- Seeking Assignments As SAP FIC0 Implementation With An Organisation of ReputeDocument4 pagesSeeking Assignments As SAP FIC0 Implementation With An Organisation of ReputeAlok KumarNo ratings yet

- Accounting Information System Chapter 8Document45 pagesAccounting Information System Chapter 8Cassie100% (4)

- RTRDocument4 pagesRTRDANIELNo ratings yet

- New Resume 4.5Document7 pagesNew Resume 4.5Dharavath SudhakarNo ratings yet

- List Sap Ac010Document1 pageList Sap Ac010Dia MutiaraNo ratings yet

- SAP FICO Online Training ContentDocument7 pagesSAP FICO Online Training ContentzidduNo ratings yet

- Business Processes in Financial: Mysap Erp FinancialsDocument35 pagesBusiness Processes in Financial: Mysap Erp Financialsjung jeyooNo ratings yet

- SAP S4 HANA Course ContentDocument2 pagesSAP S4 HANA Course ContentusasidharNo ratings yet

- Sap Fico CourseDocument12 pagesSap Fico CourseRajashekar ReddyNo ratings yet

- Finance (FI) IntroductionDocument7 pagesFinance (FI) Introductionbasheer110No ratings yet

- SAP FICO (We Cover Both Finance and Controlling In-Depth)Document3 pagesSAP FICO (We Cover Both Finance and Controlling In-Depth)HoNo ratings yet

- Sap Fico Imp PointsDocument3 pagesSap Fico Imp PointsmrugmanasiNo ratings yet

- Management Accounting in SAP S/4HANADocument1 pageManagement Accounting in SAP S/4HANAnabigcsNo ratings yet

- Benefits of S4 HANADocument13 pagesBenefits of S4 HANAramesh B100% (2)

- Yogesh Kadam (ABC)Document5 pagesYogesh Kadam (ABC)vipin HNo ratings yet

- Akhil Vayaliparambath - SAP FI CO - Masters Û Information Technology - 6 Yrs - North of BostonDocument4 pagesAkhil Vayaliparambath - SAP FI CO - Masters Û Information Technology - 6 Yrs - North of BostonPriya MadhuNo ratings yet

- Learning Hub: Course Content For SAP Finance and ControllingDocument3 pagesLearning Hub: Course Content For SAP Finance and ControllingBhushan DhandeNo ratings yet

- SAP FICO Config TrainingDocument6 pagesSAP FICO Config TrainingMd Mukul HossainNo ratings yet

- Senior Solution Architect & SAP FICO Competency Head: D V V N Narendra Kumar SAPDocument13 pagesSenior Solution Architect & SAP FICO Competency Head: D V V N Narendra Kumar SAPVishnu Vardhan YanamalaNo ratings yet

- SAP Finance For Business Development SAP Literacy WorkshopDocument17 pagesSAP Finance For Business Development SAP Literacy WorkshopOlawale KolapoNo ratings yet

- Atta-us-Samad Sabir: Objectiv eDocument8 pagesAtta-us-Samad Sabir: Objectiv eSam. GhouriNo ratings yet

- Sap Link BookDocument28 pagesSap Link Bookpamisetty ramNo ratings yet

- Sap Fico Online TrainingDocument4 pagesSap Fico Online TrainingVaishnavi MittalNo ratings yet

- SAP FI AND SAP CO CoursesDocument4 pagesSAP FI AND SAP CO CoursesNaseer SapNo ratings yet

- SAP Accounting Systems Manager in Dallas FT Worth TX Resume Don MooreDocument4 pagesSAP Accounting Systems Manager in Dallas FT Worth TX Resume Don MooreDonMooreNo ratings yet

- Accounts and Finance ProfessionalDocument3 pagesAccounts and Finance ProfessionalFahad Ahmad Khan100% (1)

- Sap-Fico Course Content: Erp Concepts General Ledger Accounting (GL)Document2 pagesSap-Fico Course Content: Erp Concepts General Ledger Accounting (GL)kumar_3233No ratings yet

- Penerapan PSAK 73 - MaterialDocument77 pagesPenerapan PSAK 73 - Materialni made safitriNo ratings yet

- Understanding Accruals R12 05012013Document58 pagesUnderstanding Accruals R12 05012013prasanthbab7128No ratings yet

- Amity Distance Learning Mba Finance Projects SynopsisDocument7 pagesAmity Distance Learning Mba Finance Projects Synopsissandesh2011No ratings yet

- Financial Statement Model For The Clorox Company: Company Name Latest Fiscal YearDocument10 pagesFinancial Statement Model For The Clorox Company: Company Name Latest Fiscal YearArslan HafeezNo ratings yet

- Canada Job Opportunity ListDocument39 pagesCanada Job Opportunity ListVaibhav Gujrati VickyNo ratings yet

- 08 Identifying & Assessing The Risks of Material MisstatementDocument5 pages08 Identifying & Assessing The Risks of Material Misstatementrandomlungs121223No ratings yet

- Particulars: Rs. RsDocument7 pagesParticulars: Rs. RsAnmol ChawlaNo ratings yet

- Internal Audit in Practice Case StudiesDocument32 pagesInternal Audit in Practice Case StudiesJo Bats67% (3)

- CV Tataru Andrada en AA DA NEWDocument4 pagesCV Tataru Andrada en AA DA NEWChuck NorrisNo ratings yet

- UPDATED SCHEDULE Departmental Quiz 1Document1 pageUPDATED SCHEDULE Departmental Quiz 1Elaine AntonioNo ratings yet

- FA Study Text 2019 PDFDocument476 pagesFA Study Text 2019 PDFsmlingwa100% (1)

- Financial Statement 2020Document3 pagesFinancial Statement 2020Fuaad DodooNo ratings yet

- Liquidity Ratios - ShyamDocument10 pagesLiquidity Ratios - ShyamYaswanth MaripiNo ratings yet

- BA 99.1 Course OutlineDocument10 pagesBA 99.1 Course OutlineCharmaine Bernados BrucalNo ratings yet

- VIDYA SAGAR Analysis-CA Final AuditDocument15 pagesVIDYA SAGAR Analysis-CA Final AuditRUBY SHARMANo ratings yet

- Introduction To AccountancyDocument5 pagesIntroduction To AccountancyVipin Mandyam KadubiNo ratings yet

- Case Study 4Document4 pagesCase Study 4RoseanneNo ratings yet

- Accounting 102 TermsDocument3 pagesAccounting 102 TermsAlfred MartinNo ratings yet

- Aldersgate College Espinoza, Daenielle Audrey MDocument6 pagesAldersgate College Espinoza, Daenielle Audrey MddddddaaaaeeeeNo ratings yet

- Q 4 Results Intimation 240522Document29 pagesQ 4 Results Intimation 240522kumar sunnyNo ratings yet

- Accountancy ImpQ CH04 Admission of A Partner 01Document18 pagesAccountancy ImpQ CH04 Admission of A Partner 01praveentyagiNo ratings yet

- AE231Document6 pagesAE231Mae-shane SagayoNo ratings yet

- FM 6 Financial Statements Analysis MBADocument50 pagesFM 6 Financial Statements Analysis MBAMisganaw GishenNo ratings yet

- Musab Alwuthaynani - UpdatedDocument2 pagesMusab Alwuthaynani - UpdatedAnonymous xU32J0No ratings yet

- Ifrs 11: Joint Arrangements Joint Arrangement Joint ControlDocument4 pagesIfrs 11: Joint Arrangements Joint Arrangement Joint ControlMariette Alex Agbanlog100% (1)

- JSS 2016053009190527Document105 pagesJSS 2016053009190527ushaNo ratings yet

- BDO Unibank 2020 Annual Report Financial SupplementsDocument236 pagesBDO Unibank 2020 Annual Report Financial SupplementsDanNo ratings yet

- 15 Financial AccountsDocument111 pages15 Financial AccountsRenga Pandi100% (1)

- Group Assignment: AI LING ALIAS IRENE CHUNG (Student #: 108-388-158)Document9 pagesGroup Assignment: AI LING ALIAS IRENE CHUNG (Student #: 108-388-158)jaNo ratings yet

- Inspera Exam Question Set - Blank Without Solutions - 16-2-2023Document21 pagesInspera Exam Question Set - Blank Without Solutions - 16-2-2023МаринаNo ratings yet