Professional Documents

Culture Documents

BAM 127 Day 6 - TG

Uploaded by

Paulo BelenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BAM 127 Day 6 - TG

Uploaded by

Paulo BelenCopyright:

Available Formats

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Lesson title: Taxation for Individual Taxpayers Materials:

Lesson Objectives: Text book:

At the end of this module, I should be able to: Income Taxation by Rex

1. Enumerate the different classifications of taxpayers and Banggawan

discuss their taxability. References:

www.bir.gov.ph

Productivity Tip: Take breaks, there’s a limit to how long anybody can devote deep focus to a task.

A. LESSON PREVIEW/REVIEW

Give a brief recap of the topics from module 4. Call 2-3 students to recite and share his/her

takeaways from the latter. Also, ask if there are some questions or clarification from your previous

modules/topic.

Relate the Gross Income and the Situs of income to today’s lesson objectives.

One of the inherent limitations of the power to tax is territoriality. It means that Philippine tax

laws can only be enforced within the Philippine Territory. In today’s module, we will discuss the

different classes of taxpayers, as defined by NIRC, and identify who among them will be subjected

to Philippine Tax laws.

Activity 1- What I Know Chart (3 mins)

Try answering the questions below by writing your ideas under the first column What I Know. It’s

okay if you write keywords or phrases that you think are related to the questions.

What I Know Questions: What I Learned

1 What are the different types of

taxpayers?

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

2. Is Manny Pacquiao liable to

pay his income tax from his

earnings in his boxing matches

in Las Vegas, Nevada?

B. MAIN LESSON

Activity 2 – Content Notes

LO 1: ENUMERATE THE DIFFERENT TYPES OF TAXPAYERS AND DISCUSS THEIR TAXABILITY

INDIVIDUALS

a. Residents of the Philippines [Secs. 23 (A) and 24 (A)]

Citizens of the Philippines b. Not Residents of the Philippines [Secs. 23 (B) and 24 (A)]

c. OFW and Seaman [Sec. 23 (C) and 24 (A)]

a. Residents of the Philippines

Aliens b. Not Residents of the Philippines [Secs. 22 (G); 23 (D); 25 (A) and

(B)

c. Aliens employed by multinational companies, offshore banking

units, and petroleum contractors and subcontractors

An estate, in common law, is the net worth of a person at any point

in time alive or dead. It is the sum of a person's assets – legal rights,

interests, and entitlements to property of any kind – less all liabilities

Estates and Trusts at that time. The issue is of special legal significance on a question of

bankruptcy and the death of the person

A trust is a three-party fiduciary relationship in which the first party,

the trustor or settlor, transfers ("settles") a property (often but not

necessarily a sum of money) upon the second party (the trustee) for

the benefit of the third party, the beneficiary

CLASSIFICATION OF INDIVIDUALS

1. Resident Citizen – A Filipino citizen residing in the Philippines.

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

2. Non-resident Citizen - A Filipino citizen residing abroad.

3. Resident Alien – a person who resides in the Philippines but is not a citizen thereof. The

intention is material for the determination. An alien who stays in the Philippines for more than 1

year is considered a resident.

4. Non-resident Alien – a person who does not resides in the Philippines and not a citizen

thereof.

4.1 Non-resident Alien – ETB – Stays for more than 180 days during the taxable year.

4.2 Non-resident Alien – NETB - Stays 180 days at most during the taxable year.

CORPORATIONS

Domestic Corporations Domestic Corporations are liable to pay corporate income tax from

(Sec. 27) sources within or without.

a. Resident Corporations - foreign corporations engaged in trade

Foreign Corporations or business in the Philippines; Not Residents of the Philippines

[Secs. 22 (G); 23 (D); 25 (A) and (B)

b. Non-resident corporations - foreign corporations not engaged

in business or trade in the Philippines.

Partnerships a. Taxable Partnership

b. Exempt Partnership

- General Professional Partnership (GPP)

- Joint Venture or Consortium…

CLASSIFICATION OF CORPORATIONS

1. Domestic Corporation –a corporation created and organized under the law of the Philippines;

2. Foreign Corporations – are those which are created and organized under foreign laws:

a. Resident – having a permanent establishment/branch in the Philippines, acquiring residency for

tax purposes; b. Non-resident – no permanent establishment in the Philippines; not regularly

engaged in trade or business in the Philippines

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

General Principles of Taxation

SEC. 23. General Principles of Income Taxation in the Philippines. - Except when otherwise provided in this

Code:

(A) A citizen of the Philippines residing therein is taxable on all income derived from sources within and without

the Philippines;

(B) A nonresident citizen is taxable only on income derived from sources within the Philippines;

(C) An individual citizen of the Philippines who is working and deriving income from abroad as an overseas

contract worker is taxable only on income derived from sources within the Philippines: Provided, That a seaman

who is a citizen of the Philippines and who receives compensation for services rendered abroad as a member of

the complement of a vessel engaged exclusively in international trade shall be treated as an overseas contract

worker;

(D) An alien individual, whether a resident or not of the Philippines, is taxable only on income derived from

sources within the Philippines;

(E) A domestic corporation is taxable on all income derived from sources within and without the Philippines; and

(F) A foreign corporation, whether engaged or not in trade or business in the Philippines, is taxable only on

income derived from sources within the Philippines.

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Taxability of Individuals

Individual Taxpayers Earned within the Earned outside the

Philippines Philippines

Resident Citizens Taxable Taxable

Non-Resident Citizens Taxable Not Taxable

Resident Alien Taxable Not Taxable

Non-Resident Aliens Taxable Not Taxable

Note: For simplicity, resident citizens are taxable on their worldwide income, while all the rest (Non-

resident Citizens and Aliens [whether resident or non-resident) are taxable only on their income from

sources within the Philippines.

Taxability of Corporations

Corporate Taxpayers Earned within the Earned outside the

Philippines Philippines

Domestic Corporation Taxable Taxable

Resident Foreign Taxable Not Taxable

Corporation

Non-resident Taxable Not Taxable

Foreign Corporation

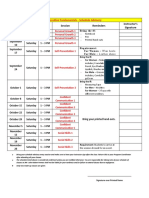

Activity 3: Skill-building Activities

Let’s practice! After completing each exercise, you may refer to the Key to Corrections for feedback.

Try to complete each exercise before looking at the feedback.

Exercise 1: General Income Tax Rule

Check the box that properly corresponds to the taxability of the following taxpayers:

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

N Taxpayer World Income Philippine Income

o

1 Non-resident citizen

2 Resident Alien

3 Non-resident alien engaged in trade or

business

4 Resident Foreign Corporation

5 Resident Citizen

6 Non-resident alien not engaged in trade

or business

7 Non-resident Foreign Corporation

8 Domestic Corporation

9 Taxable trust established by a Filipino

citizen in the Philippines

10 Taxable estate of a non-resident citizen

judicially administered abroad

ACTIVITY 4: What I Know Chart – Part 2 (3 mins)

It’s time to answer the “what I learned” column in the What I Know chart in Activity 1.

ACTIVITY 5: ‘Check for understanding’, Income Taxpayer Classification

Indicate the appropriate classification for each of the following taxpayers:

RC – Resident Citizen DC – Domestic Corporation

NRC – Non-resident Citizen RFC – Resident Foreign Corporation

RA – Resident Alien NRFC – Non-resident Foreign Corporation

NRA–ETB – Non-resident Alien Engaged in Trade or Business

NRA–NETB – Non-resident Alien NOT Engaged in Trade or Business

No Person or Entity Classificatio

. n

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

1 A fat Mexican tourist

2 A hardworking overseas Filipino worker

3 An expatriate employee

4 A Filipino who is privately employed in the Philippines

5 An unemployed Filipino residing in the Philippines

6 A Chinese businessman who has his domicile in the Philippines for 6

months

7 A Japanese who married a beautiful Filipina and residing in the

Philippines for 2 years

8 A 2nd year Korean college student studying in the Philippines

9 A Corporation incorporated under Philippine Law

10 A Foreign Corporation doing business in the Philippines

11 Trust Designated by the donor as irrevocable

12 Trust Designated by the donor as revocable

13 A business partnership

14 A joint venture organized under a foreign law and is not operating in the

Philippines

15 An estate of a Filipino Citizen judicially administered in Japan.

C. LESSON WRAP-UP

Congratulations for finishing day 3! Consistency is key, keep it up! Shade the number of the module that you

finished.

Did you have challenges learning the concepts in this module? If none, which parts of the module helped you

learn the concepts?

____________________________________________________________________________________________________________________

____________________________________________________________________________________________

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Some question/s I want to ask my teacher about this module is/are:

____________________________________________________________________________________________________________________

____________________________________________________________________________________________

FAQs

1. Who are citizens of the Philippines –Under Sec. 1, Art. IV of the 1987 Constitution, the

following are citizens of the Philippines.

(1) Those who are citizens of the Philippines at the time of the adoption of this Constitution;

(2) Those whose fathers or mothers are citizens of the Philippines;

(3) Those born before January 17, 1973, of Filipino Mothers, who elect Philippine citizenship

upon reaching the age of majority; and

(4) Those who are naturalized in accordance with law.

2. Who are Non-resident citizen

a. A citizen of the Philippines whose physical presence abroad is with a definite intention to reside

therein – to the satisfaction of the Commissioner of Internal Revenue.

b. A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad,

either as an immigrant or for employment on a permanent basis. A good example would be

Overseas Contract Workers (OCW) or Overseas Filipino Workers (OFW) who were issued an

overseas employment permit. For purposes of income tax, a seaman is considered an OCW.

c. A citizen of the Philippines who works and derives income from abroad and whose employment

thereat requires him to be physically present abroad most of the time during the taxable year.

“Most of the time” meaning at least 183 days. (Sec. 2 of RR No. 1-79)

d. A citizen who has been previously considered a non-resident citizen and who arrives in the

Philippines at any time during the taxable year to reside permanently in the Philippines shall

likewise be treated as a non-resident citizen for the taxable year with respect to his income

derived from sources abroad until the date of his arrival in the Philippines. (Sec. 22[E] of the Tax

Code)

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

3. Who are Resident Alien?

a. An alien who lives in the Philippines with no definite intention as to his stay (floating intention);

b. One who comes to the Philippines for a definite purpose which in its nature would require an

extended stay and to that end makes his home temporarily in the Philippines;

c. An alien who has acquired residence in the Philippines and retains his status as such until he

abandons the same and actually departs from the Philippines.

4. Who are Non-resident alien (NRA)

a. An alien who comes to the Philippines for a definite purpose which in its nature may be

promptly accomplished.

b. One who may either be a:

i. NRA engaged in trade or business (NRAETB) in the Philippines or

ii. NRA not engaged in trade or business (NRANETB) in the Philippines. An NRA who shall

come to the Philippines and stay for an aggregate of more than 180 days shall be deemed a

NRAETB.

This document is the property of PHINMA EDUCATION

BAM 127: Income Taxation for BA

Teachers’ Guide Module # 6

Name: _________________________________________________________________ Class number: _______

Section: ____________ Schedule: ________________________________________ Date: ________________

Key to Corrections:

Exercise 1

Exercise 2

This document is the property of PHINMA EDUCATION

You might also like

- Taxation ReviewerDocument19 pagesTaxation ReviewerjwualferosNo ratings yet

- Taxation of Individuals QuizzerDocument37 pagesTaxation of Individuals QuizzerCharry Ramos62% (13)

- Real Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsFrom EverandReal Estate investing: 2 books in 1: Create Passive Income with Real Estate, Reits, Tax Lien Certificates and Residential and Commercial Apartment Rental Property InvestmentsNo ratings yet

- Long Quiz in Income Taxation FM 3Document2 pagesLong Quiz in Income Taxation FM 3Charmaine Shanina100% (1)

- Process Industry Practices Insulation: PIP INTG1000 Insulation Inspection ChecklistDocument7 pagesProcess Industry Practices Insulation: PIP INTG1000 Insulation Inspection ChecklistCristian Jhair PerezNo ratings yet

- Income Taxation Mamalateo NotesDocument19 pagesIncome Taxation Mamalateo Notesclandestine2684100% (1)

- Businessfinance12 q3 Mod1.2 Introduction To Financial ManagementDocument23 pagesBusinessfinance12 q3 Mod1.2 Introduction To Financial ManagementAsset Dy100% (2)

- (Cooperative) BOD and Secretary CertificateDocument3 pages(Cooperative) BOD and Secretary Certificateresh lee100% (1)

- Dan Fue Leung v. IACDocument2 pagesDan Fue Leung v. IACCedricNo ratings yet

- Individual Income TaxDocument6 pagesIndividual Income Taxira concepcionNo ratings yet

- Dealer Agreement InternationalDocument7 pagesDealer Agreement InternationalmanojNo ratings yet

- Applied Economic Quarter 1 Module 6 Week6Document10 pagesApplied Economic Quarter 1 Module 6 Week6Randy Magbudhi73% (11)

- Schenck V US Case DigestDocument2 pagesSchenck V US Case DigestLyleThereseNo ratings yet

- TAX 03 Fundamentals of Income Taxation PDFDocument9 pagesTAX 03 Fundamentals of Income Taxation PDFNita Costillas De MattaNo ratings yet

- Fundamentals of Income TaxationDocument11 pagesFundamentals of Income TaxationJane100% (1)

- Fabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueDocument21 pagesFabm 2: Quarter 4 - Module 5 Computing Gross Taxable Income and Tax DueFlordilyn DichonNo ratings yet

- Week 6 Applied EconomicsDocument14 pagesWeek 6 Applied EconomicsVincent Factor100% (2)

- Sworn Declaration of SalesDocument1 pageSworn Declaration of SalesPaulo BelenNo ratings yet

- The Rental Property Investment Bible: Budget Limited but Ambition Unlimited: The Reference Book for Investing Intelligently, Generating Passive Income and Achieving Financial IndependenceFrom EverandThe Rental Property Investment Bible: Budget Limited but Ambition Unlimited: The Reference Book for Investing Intelligently, Generating Passive Income and Achieving Financial IndependenceNo ratings yet

- Mortor Bike Helmet Regulations EngDocument2 pagesMortor Bike Helmet Regulations EngCharles AtmNo ratings yet

- Taxation of Individuals QuizzerDocument38 pagesTaxation of Individuals QuizzerCookie Pookie BallerShopNo ratings yet

- Chapter 3Document4 pagesChapter 3Frances Garrovillas100% (2)

- Fundamentals of Accountancy, Business and Management 1: Accounting Concepts and PrinciplesDocument24 pagesFundamentals of Accountancy, Business and Management 1: Accounting Concepts and PrinciplesGil Barry Nacario Ordoñez100% (3)

- Income Tax 2nd Quiz PrelimDocument5 pagesIncome Tax 2nd Quiz PrelimRenalyn ParasNo ratings yet

- Income and Business Taxation: GradeDocument9 pagesIncome and Business Taxation: GradeTinny Casana100% (1)

- Republic V CA and Heirs of Carag and TuringanDocument2 pagesRepublic V CA and Heirs of Carag and TuringanThalia SalvadorNo ratings yet

- BAM 127 Day 4 - TGDocument11 pagesBAM 127 Day 4 - TGPaulo BelenNo ratings yet

- BAM 127 Day 8 - TGDocument9 pagesBAM 127 Day 8 - TGPaulo BelenNo ratings yet

- BAM 127 Day 7 - TGDocument11 pagesBAM 127 Day 7 - TGPaulo BelenNo ratings yet

- BAM 127 Day 11 - TGDocument8 pagesBAM 127 Day 11 - TGPaulo BelenNo ratings yet

- BAM 127 Day 3 - TGDocument14 pagesBAM 127 Day 3 - TGPaulo BelenNo ratings yet

- BAM 127 Day 12 - TGDocument8 pagesBAM 127 Day 12 - TGPaulo BelenNo ratings yet

- BAM 127 Day 5 - TGDocument6 pagesBAM 127 Day 5 - TGPaulo BelenNo ratings yet

- BAM 127 Day 1 - TGDocument7 pagesBAM 127 Day 1 - TGPaulo BelenNo ratings yet

- Day 10 - BAM 213 - Banking LawsDocument8 pagesDay 10 - BAM 213 - Banking LawsSe ExamenNo ratings yet

- Applied Economics: Quarter 4 - Module 6Document11 pagesApplied Economics: Quarter 4 - Module 6Yannah LongalongNo ratings yet

- Income Tax 2nd Quiz PrelimDocument5 pagesIncome Tax 2nd Quiz PrelimRenalyn ParasNo ratings yet

- Fundamentals of Accountancy Business and Management II Module 1Document5 pagesFundamentals of Accountancy Business and Management II Module 1Rafael RetubisNo ratings yet

- Cities of Mandaluyong and Pasig: RizaltechnologicaluniversityDocument9 pagesCities of Mandaluyong and Pasig: RizaltechnologicaluniversitySampang, Jericho Michael E.No ratings yet

- Special Aliens Are Non-Resident Aliens WhoDocument8 pagesSpecial Aliens Are Non-Resident Aliens WhoMary Rose LacsamanaNo ratings yet

- Lesson Plan in Financial InstrumentsDocument4 pagesLesson Plan in Financial InstrumentsVanessa AngaraNo ratings yet

- Edited FABM2 Q2 MOD3 Income and Business TaxationDocument17 pagesEdited FABM2 Q2 MOD3 Income and Business Taxationleslie sabateNo ratings yet

- MODULE 1 - TAXATION Lesson 2Document9 pagesMODULE 1 - TAXATION Lesson 2Euviel ConsignaNo ratings yet

- Chapter 2Document9 pagesChapter 2Sheilamae Sernadilla GregorioNo ratings yet

- TaxssdakcnsaDocument164 pagesTaxssdakcnsaLouisse Marie CatipayNo ratings yet

- G12 ABM ACCOUNTING2 Week1Document10 pagesG12 ABM ACCOUNTING2 Week1Severus S PotterNo ratings yet

- Applied Economic Quarter 1 Module 6 Week6Document10 pagesApplied Economic Quarter 1 Module 6 Week6androgutlay55555No ratings yet

- Quiz Feb 22Document1 pageQuiz Feb 22dinooalii03No ratings yet

- Module 5: Contemporary Economic Issues Facing The Filipino EntreprenuersDocument5 pagesModule 5: Contemporary Economic Issues Facing The Filipino EntreprenuersMadelyn ArimadoNo ratings yet

- Week 3 Course Material For Income TaxationDocument11 pagesWeek 3 Course Material For Income TaxationAshly MateoNo ratings yet

- Module No 2 - INCOME TAXATION PART1ADocument11 pagesModule No 2 - INCOME TAXATION PART1APrinces S. RoqueNo ratings yet

- Module For TAX2 April 3 2020 THIRD QTR EXAMSDocument7 pagesModule For TAX2 April 3 2020 THIRD QTR EXAMSFranz Ana Marie CuaNo ratings yet

- Business Finance12 Q3 M1Document24 pagesBusiness Finance12 Q3 M1Chriztal TejadaNo ratings yet

- Module 8.1Document21 pagesModule 8.1Yen AllejeNo ratings yet

- Chapter 1: Fundamental Principles of TaxationDocument22 pagesChapter 1: Fundamental Principles of TaxationChira Rose Fejedero NeriNo ratings yet

- Work Sheet in Accounting 1Document8 pagesWork Sheet in Accounting 1Nancy AtentarNo ratings yet

- Applied Economics ExaminationDocument2 pagesApplied Economics ExaminationAriel Clopino PiolNo ratings yet

- Lesson Title: Revenue Recognition - Consignment AccountingDocument8 pagesLesson Title: Revenue Recognition - Consignment AccountingFeedback Or BawiNo ratings yet

- Applied Economics: Box ADocument2 pagesApplied Economics: Box AHLeigh Nietes-GabutanNo ratings yet

- Module 3 TaxationDocument10 pagesModule 3 TaxationHinata UmazakiNo ratings yet

- Tax On Ind-QuizDocument34 pagesTax On Ind-QuizKathleen Jane Solmayor100% (2)

- Multiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationDocument34 pagesMultiple Choice Questions CPA Reviewer in Taxation Income Taxation of Individuals & CorporationAngel May L. LopezNo ratings yet

- 3 Sources: How Government Collects Taxes Under The Two LawsDocument3 pages3 Sources: How Government Collects Taxes Under The Two LawsmaeNo ratings yet

- Real Estate Income Genesis: Internet Business Genesis Series, #9From EverandReal Estate Income Genesis: Internet Business Genesis Series, #9No ratings yet

- A Blueprint for Prosperity: Market-based Alternatives to the Obama Blueprint for ChangeFrom EverandA Blueprint for Prosperity: Market-based Alternatives to the Obama Blueprint for ChangeNo ratings yet

- BAM 127 Day 1 - TGDocument7 pagesBAM 127 Day 1 - TGPaulo BelenNo ratings yet

- Sworn Declaration of SalesDocument4 pagesSworn Declaration of SalesPaulo BelenNo ratings yet

- MenuDocument7 pagesMenuPaulo BelenNo ratings yet

- Listofitems SaucemattersDocument1 pageListofitems SaucemattersPaulo BelenNo ratings yet

- APPLICATIONDocument2 pagesAPPLICATIONPaulo BelenNo ratings yet

- Details SiDocument1 pageDetails SiPaulo BelenNo ratings yet

- Cash Monitoring and Sales MonitoringDocument29 pagesCash Monitoring and Sales MonitoringPaulo BelenNo ratings yet

- 2 ND Finals TOSDocument4 pages2 ND Finals TOSPaulo BelenNo ratings yet

- Executive Fundamentals Schedule AdvisoryDocument1 pageExecutive Fundamentals Schedule AdvisoryPaulo BelenNo ratings yet

- Automatic ScoresheetDocument4 pagesAutomatic ScoresheetPaulo BelenNo ratings yet

- 2019 and 2020 Purchases SLSPDocument6 pages2019 and 2020 Purchases SLSPPaulo BelenNo ratings yet

- 2020 Sales SLSPDocument2 pages2020 Sales SLSPPaulo BelenNo ratings yet

- 2021 Income ComputationsDocument7 pages2021 Income ComputationsPaulo BelenNo ratings yet

- 2021 Income ComputationsDocument7 pages2021 Income ComputationsPaulo BelenNo ratings yet

- 2019 Sales SLSPDocument2 pages2019 Sales SLSPPaulo BelenNo ratings yet

- Details of Offer: Details of Offer:: Postgraduate - Admissions@swansea - Ac.uk Postgraduate - Admissions@swansea - Ac.ukDocument2 pagesDetails of Offer: Details of Offer:: Postgraduate - Admissions@swansea - Ac.uk Postgraduate - Admissions@swansea - Ac.ukAdetunji TaiwoNo ratings yet

- Competition Appellate TribunalDocument1 pageCompetition Appellate TribunalKunal SinghNo ratings yet

- Regulation Crowdfunding - A Small Entity Compliance Guide For IssuersDocument7 pagesRegulation Crowdfunding - A Small Entity Compliance Guide For IssuersCrowdfundInsiderNo ratings yet

- Before The Hon'Ble Supreme Court of Aryavarta at Aryavarta Special Leave Petition No. - /2019Document20 pagesBefore The Hon'Ble Supreme Court of Aryavarta at Aryavarta Special Leave Petition No. - /2019Adv Shilpa Arun PawarNo ratings yet

- Remrev-2012 Remedial Law Reviewer (Post Judgment Remedies)Document71 pagesRemrev-2012 Remedial Law Reviewer (Post Judgment Remedies)Marife Tubilag ManejaNo ratings yet

- 2011 Waikato Raupatu Trustee Co LTDDocument1 page2011 Waikato Raupatu Trustee Co LTDkorero11No ratings yet

- Case Laws - SUPREME COURT JUDGEMENT IN SAHARA INDIA REAL ESTATE CORP LTD & Ors VS PDFDocument6 pagesCase Laws - SUPREME COURT JUDGEMENT IN SAHARA INDIA REAL ESTATE CORP LTD & Ors VS PDFkimmiahujaNo ratings yet

- Searches and SeizuresDocument11 pagesSearches and SeizuresHarkiran BrarNo ratings yet

- Ordinary Portland Cement, 33 Grade - Specification: Indian StandardDocument12 pagesOrdinary Portland Cement, 33 Grade - Specification: Indian StandardAmbrishNo ratings yet

- Simple ContractDocument2 pagesSimple ContractMark PierreNo ratings yet

- Ged Program Bulletin 20110408Document32 pagesGed Program Bulletin 20110408claugzaNo ratings yet

- Corporation Application For Tentative Refund: Sign HereDocument1 pageCorporation Application For Tentative Refund: Sign HereIRSNo ratings yet

- Educational Credential Assessment CDN Immigration Programs September 2015aDocument6 pagesEducational Credential Assessment CDN Immigration Programs September 2015aMaissa HassanNo ratings yet

- TAX - Chapter 1 Cases PDFDocument161 pagesTAX - Chapter 1 Cases PDFellen laigoNo ratings yet

- Meetings of CoMpanyDocument18 pagesMeetings of CoMpanyHeer ChaudharyNo ratings yet

- Erick's NegoDocument7 pagesErick's NegoSakuraCardCaptorNo ratings yet

- Baptiste LawsuitDocument42 pagesBaptiste LawsuitWTVCNo ratings yet

- Milton Parness v. United States, 415 F.2d 346, 3rd Cir. (1969)Document2 pagesMilton Parness v. United States, 415 F.2d 346, 3rd Cir. (1969)Scribd Government DocsNo ratings yet

- G. Capitol Wireless, Inc v. Provincial Treasurer of Batangas, G.R. No. 180110 May 30, 2016Document7 pagesG. Capitol Wireless, Inc v. Provincial Treasurer of Batangas, G.R. No. 180110 May 30, 2016Sharlie BayanNo ratings yet

- Rules For 15th NUJS-HSF National Moot Court Competition, 2023 PDFDocument21 pagesRules For 15th NUJS-HSF National Moot Court Competition, 2023 PDFRishi Raj MukherjeeNo ratings yet

- Municipal Best Practices - Preventing Fraud, Bribery and Corruption FINALDocument14 pagesMunicipal Best Practices - Preventing Fraud, Bribery and Corruption FINALHamza MuhammadNo ratings yet

- 2015 How The WTO Shapes Regulatory GovernanceDocument26 pages2015 How The WTO Shapes Regulatory GovernanceHazem SaadNo ratings yet

- Cannabis Business and Organization Sign On Letter To House JudiciaryDocument5 pagesCannabis Business and Organization Sign On Letter To House JudiciaryMikeLiszewskiNo ratings yet